The Semi-annually Excel Template for Expense Reimbursement streamlines tracking and managing employee expenses every six months, ensuring accurate financial reporting. This template includes pre-built formulas and organized categories to simplify data entry and expense verification. Efficient use of this tool reduces errors and accelerates the reimbursement process.

Semi-Annually Expense Reimbursement Tracker with Summary

The Semi-Annually Expense Reimbursement Tracker is a document designed to record and monitor expenses submitted for reimbursement every six months. It typically contains detailed entries of individual expenses, dates, categories, and amounts to ensure accurate tracking. A summary section is essential for providing an overview of total reimbursements and identifying patterns or discrepancies.

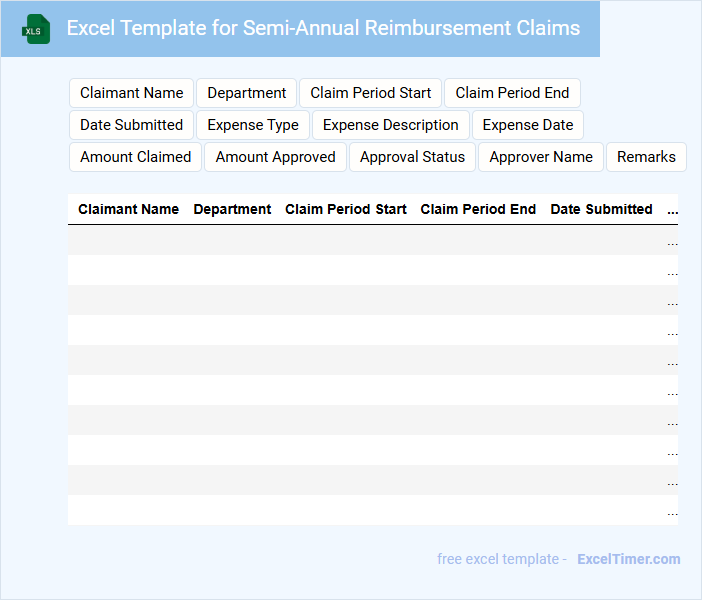

Excel Template for Semi-Annual Reimbursement Claims

An Excel Template for Semi-Annual Reimbursement Claims is designed to systematically capture and calculate expenses eligible for reimbursement over a six-month period. This document typically contains sections for inputting dates, expense categories, amounts, and supporting documentation references. It ensures accuracy and consistency in financial reporting, facilitating timely claim submissions.

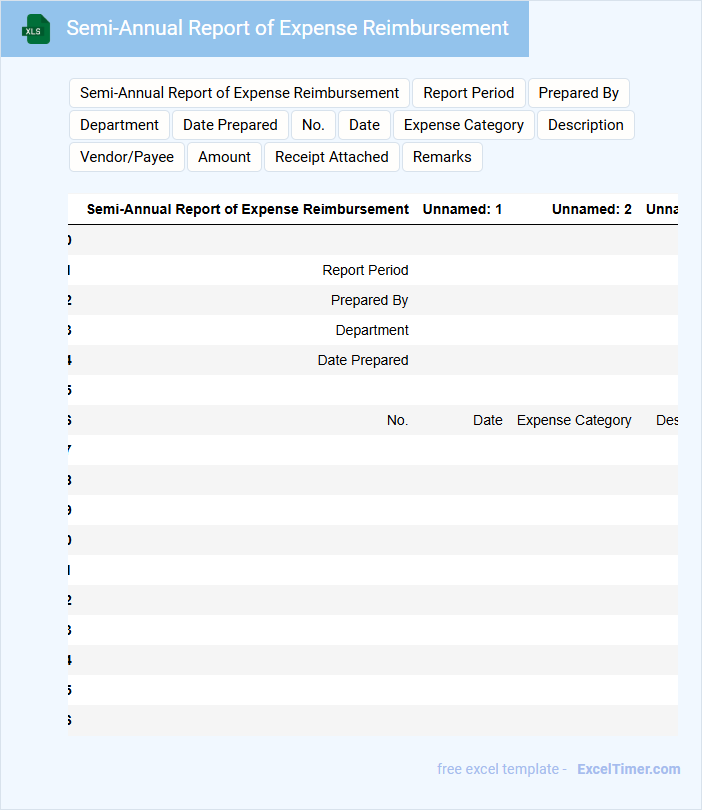

Semi-Annual Report of Expense Reimbursement

A Semi-Annual Report of Expense Reimbursement typically contains detailed records of all expenses submitted for reimbursement within a six-month period. It includes itemized receipts, approval statuses, and total reimbursed amounts to ensure transparency. This document helps organizations monitor and control spending, while ensuring compliance with financial policies. Suggested important elements to include are clear categorization of expenses, dates of transactions, and verification signatures for accountability.

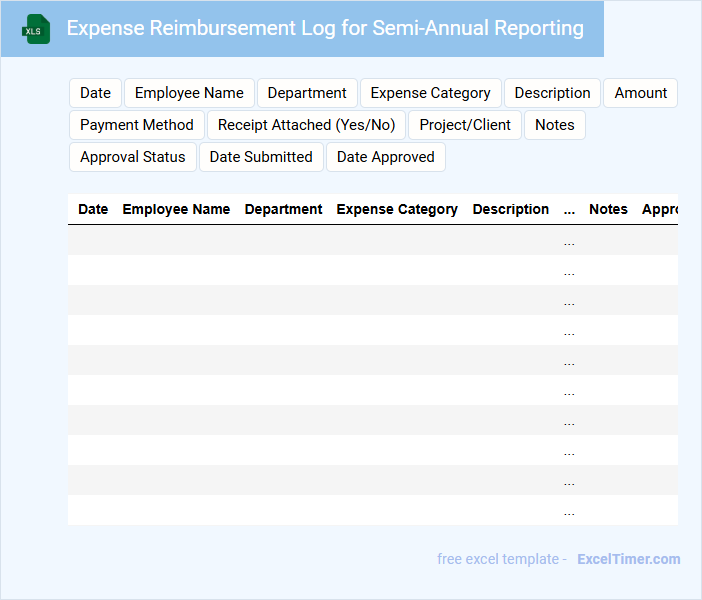

Expense Reimbursement Log for Semi-Annual Reporting

An Expense Reimbursement Log typically contains detailed records of all expenses incurred by employees or departments, submitted for repayment within a specified period. It includes dates, descriptions, amounts, and approval statuses to ensure transparency and accuracy. For semi-annual reporting, maintaining organized and timely logs is crucial to streamline financial audits and budget analysis.

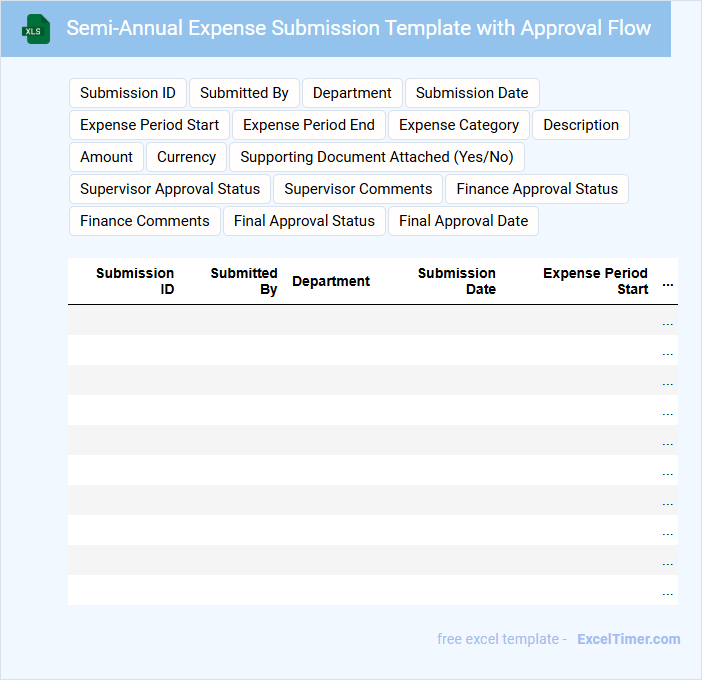

Semi-Annual Expense Submission Template with Approval Flow

A Semi-Annual Expense Submission Template with Approval Flow is a structured document used to report and track expenses incurred over a six-month period. It facilitates transparent expense management and ensures that all submissions undergo appropriate review and authorization.

- The document typically contains detailed expense categories, submission dates, and the submitter's information.

- It includes an approval section for managers or finance teams to review and authorize expenses.

- Important suggestions include clear guidelines for expense eligibility, required receipt attachments, and timely submission deadlines.

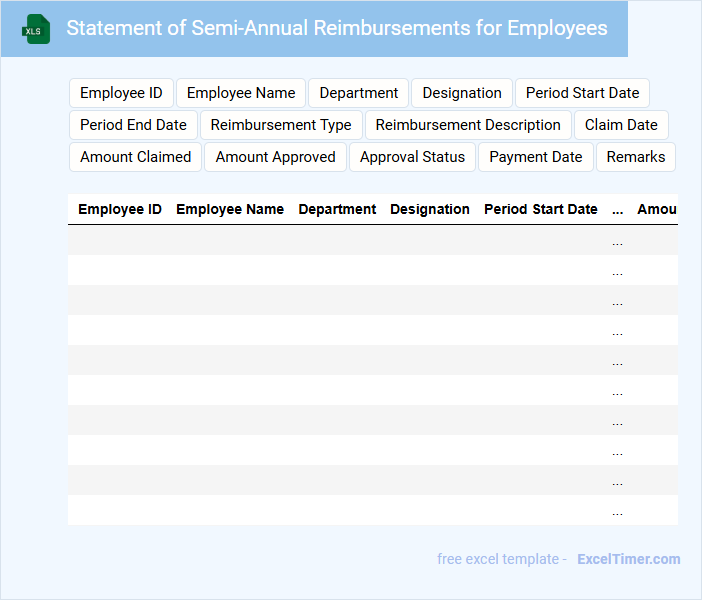

Statement of Semi-Annual Reimbursements for Employees

A Statement of Semi-Annual Reimbursements for Employees typically outlines the expenses reimbursed to employees over a six-month period, ensuring transparency and accurate financial reporting.

- Detailed Expense Records: Include itemized receipts and dates to validate reimbursement claims.

- Clear Employee Identification: Specify names and employee IDs to ensure correct attribution of expenses.

- Compliance with Company Policy: Ensure all reimbursed expenses align with organizational guidelines and limits.

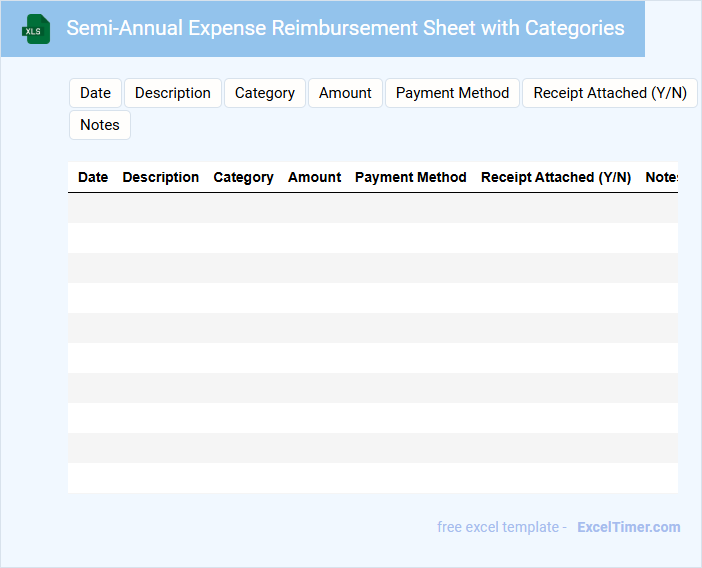

Semi-Annual Expense Reimbursement Sheet with Categories

The Semi-Annual Expense Reimbursement Sheet is a financial document that tracks and categorizes expenses incurred by employees over a six-month period. It organizes costs clearly to ensure accurate reimbursement and facilitates budget monitoring.

Categories typically include travel, meals, office supplies, and other business-related expenditures to improve clarity and accountability. It is important to include detailed receipts and dates for each expense to support verification and compliance.

Expense Tracker for Semi-Annual Reimbursements

An Expense Tracker for Semi-Annual Reimbursements is a document designed to record and organize expenses incurred over a six-month period. It typically contains detailed entries including dates, categories, amounts, and receipts or proof of payment. Ensuring accuracy and completeness in these records is crucial for smooth reimbursement processing and financial accountability.

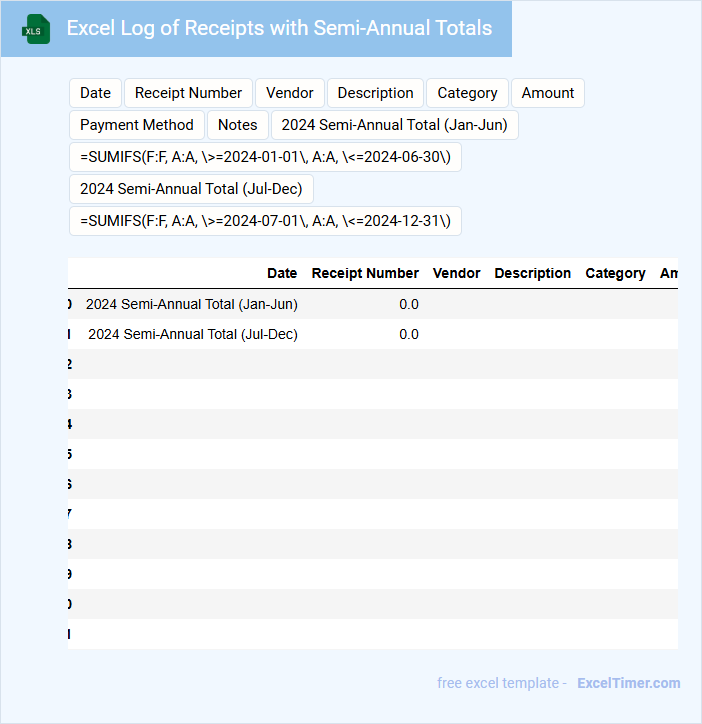

Excel Log of Receipts with Semi-Annual Totals

An Excel Log of Receipts is typically a spreadsheet document used to systematically record and track incoming payments over a specified period. It contains detailed entries of transaction dates, amounts, payer information, and categories to ensure accurate financial monitoring. For better analysis, semi-annual totals are calculated to summarize the receipt trends and cash flow within each six-month period.

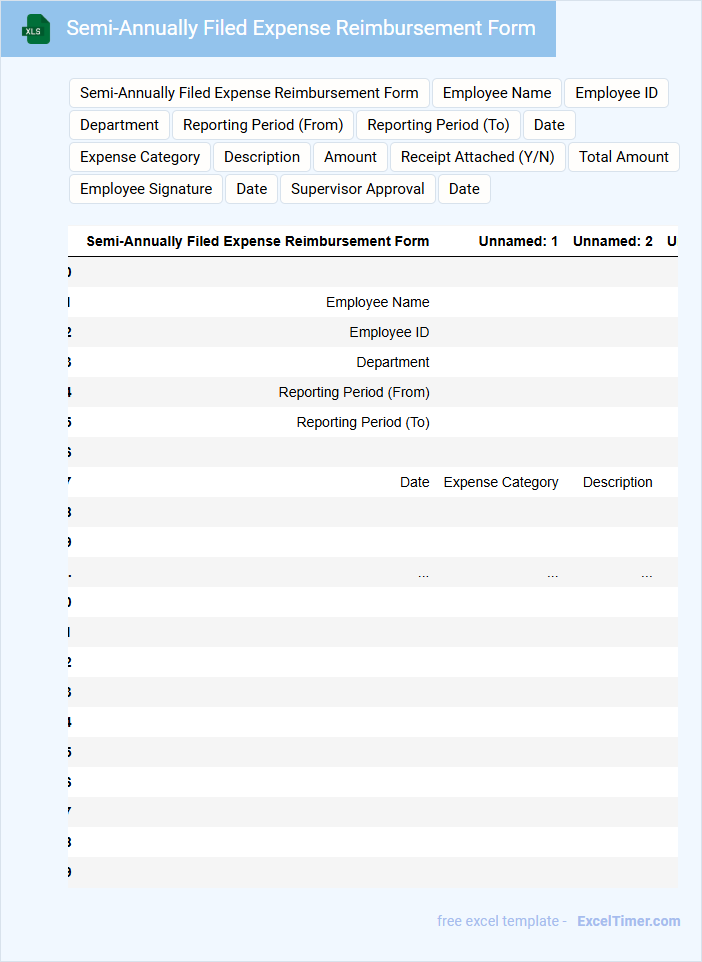

Semi-Annually Filed Expense Reimbursement Form

The Semi-Annually Filed Expense Reimbursement Form typically contains detailed records of incurred expenses submitted for reimbursement every six months. It includes fields for date, description, amount, and supporting receipts to ensure accurate financial tracking. Important considerations involve verifying expense eligibility and adhering to submission deadlines to avoid claim delays.

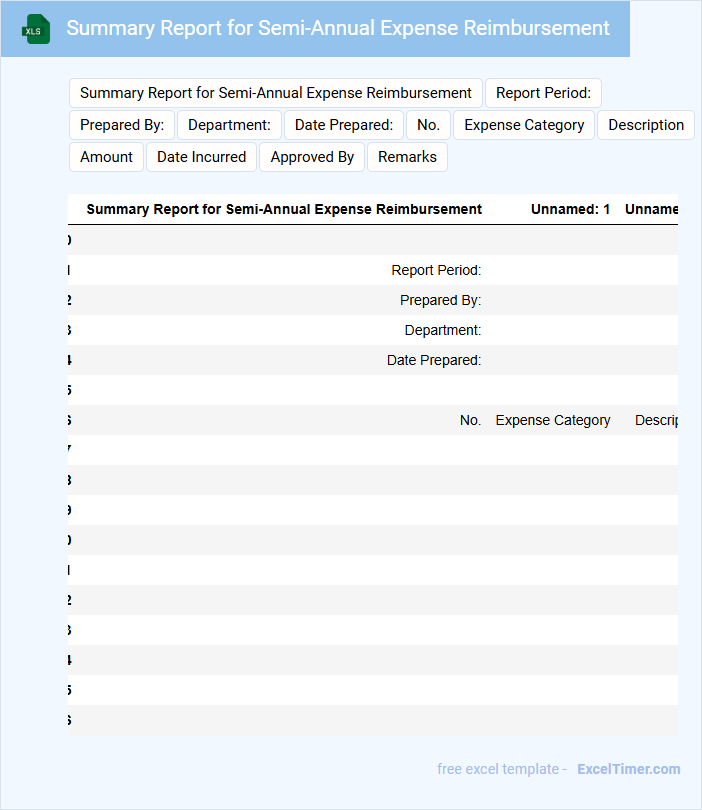

Summary Report for Semi-Annual Expense Reimbursement

A Summary Report for Semi-Annual Expense Reimbursement typically contains an overview of all reimbursed expenses submitted over a six-month period. It details transaction dates, amounts, categories, and approval statuses to ensure transparency and accuracy. Including clear documentation and organized receipts is crucial for efficient verification and auditing processes.

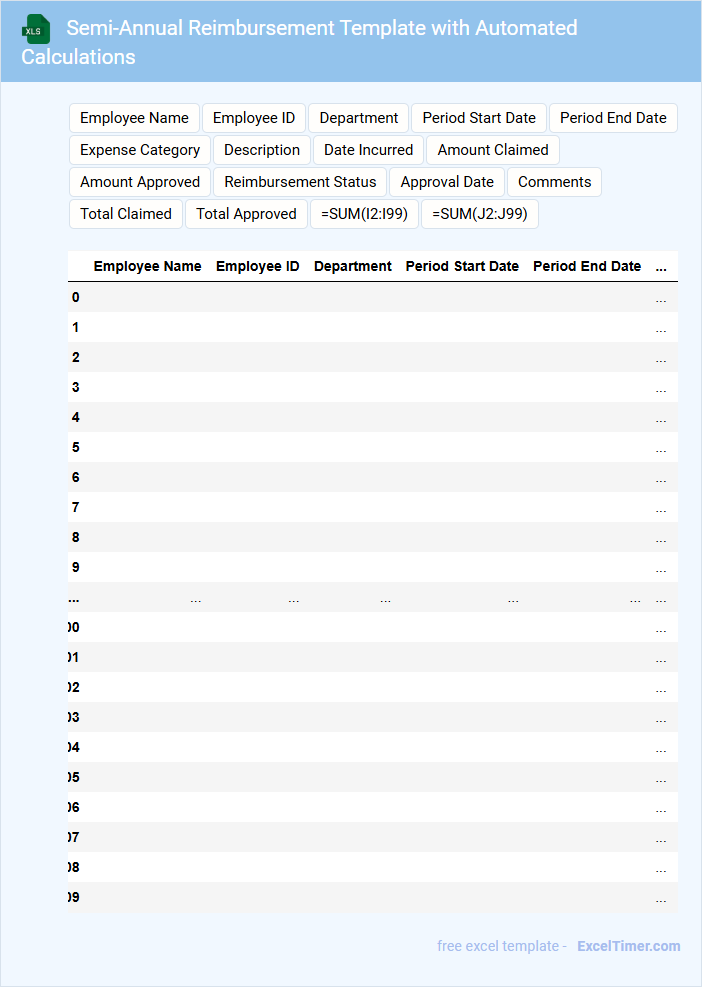

Semi-Annual Reimbursement Template with Automated Calculations

What does a Semi-Annual Reimbursement Template with Automated Calculations usually contain? This type of document typically includes detailed expense categories, dates of expenditures, and calculated reimbursement amounts. It is designed to ensure accuracy and efficiency in tracking and processing semi-annual reimbursements for employees or vendors.

What is an important consideration when using this template? Ensuring that automated formulas are correctly set up to reflect current reimbursement policies is crucial. Additionally, regular updates and validations help maintain accuracy and compliance with financial guidelines.

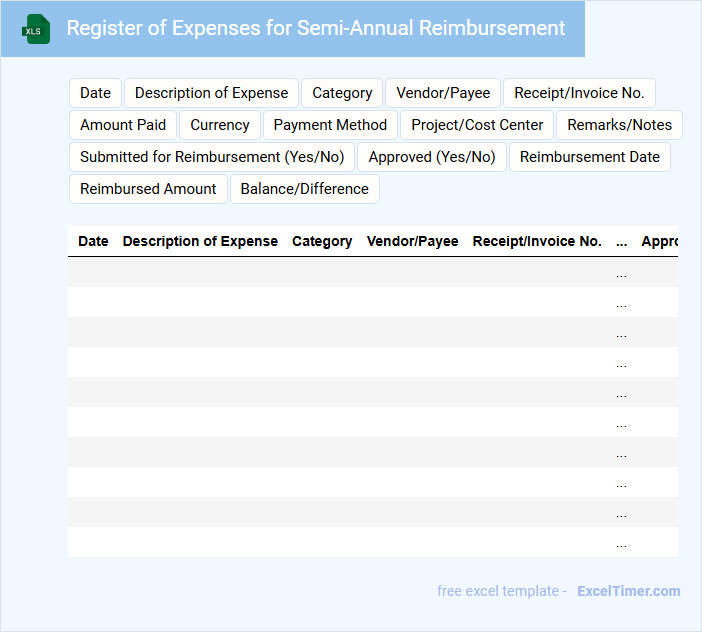

Register of Expenses for Semi-Annual Reimbursement

A Register of Expenses for Semi-Annual Reimbursement is a document that tracks and records all expenses incurred over a six-month period for reimbursement purposes. It ensures transparent financial management and facilitates accurate reimbursement processing.

- Include detailed descriptions and dates for each expense item.

- Attach all relevant receipts and proof of payment.

- Maintain a clear categorization of expenses for easy review.

Template for Tracking Semi-Annual Expense Reimbursements

What information is typically included in a Template for Tracking Semi-Annual Expense Reimbursements? This document usually contains detailed records of expenses incurred, dates of transactions, reimbursement amounts, and approval statuses. It helps streamline financial tracking and ensures accurate and timely reimbursements for employees or contractors.

What is an important consideration when using this template? It is crucial to maintain up-to-date and accurate entries with appropriate documentation such as receipts to avoid discrepancies. Additionally, implementing clear categories for expense types can enhance organization and simplify review processes.

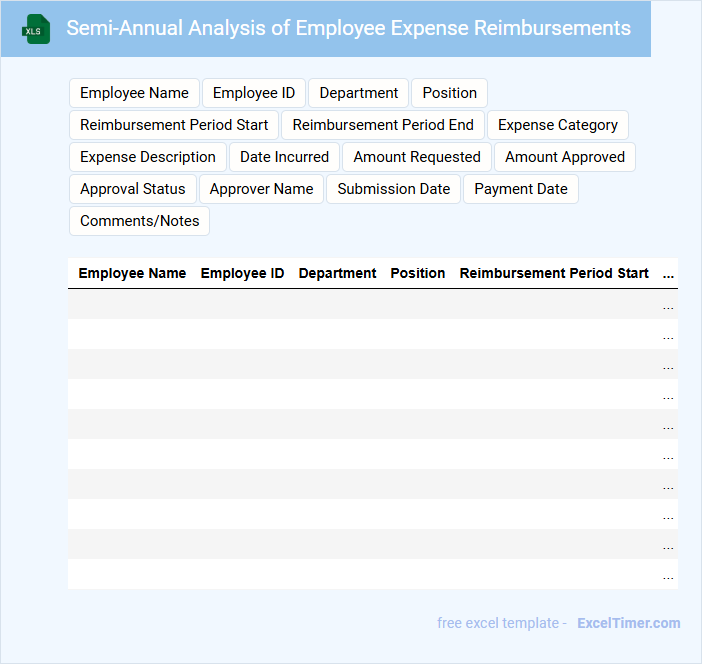

Semi-Annual Analysis of Employee Expense Reimbursements

This document typically contains a detailed review of employee expense reimbursements to ensure accuracy, compliance, and budget adherence over a six-month period.

- Accuracy Validation: Verify all submitted expenses are supported with proper receipts and align with company policies.

- Compliance Check: Ensure reimbursements comply with tax regulations and internal spending guidelines.

- Budget Analysis: Compare reimbursements against budget forecasts to identify any discrepancies or trends.

How is "semi-annually" defined within the context of expense reimbursement on an Excel document?

Semi-annually" in the context of expense reimbursement on an Excel document refers to a payment or reimbursement schedule occurring twice a year, typically every six months. This frequency ensures expenses are reviewed and reimbursed at two fixed intervals annually. The Excel sheet likely includes dates or periods marking these biannual reimbursement cycles.

What columns or fields are necessary to accurately track semi-annual reimbursement periods?

To accurately track semi-annual reimbursement periods in your Excel document, include columns for Employee Name, Expense Description, Amount, Date Incurred, Submission Date, and Reimbursement Period (e.g., H1 or H2). A field specifying Approval Status ensures monitoring of reimbursement progress. Incorporate a column for Payment Date to confirm when expenses are reimbursed within each semi-annual cycle.

How can formulas be used to automate the calculation of eligible expenses for each semi-annual period?

Excel formulas can automate the calculation of eligible expenses for each semi-annual period by using date functions like EDATE or YEARFRAC to identify expense dates within each six-month interval. SUMIFS can then total expenses that fall into these specified periods based on date criteria. You can set up dynamic ranges and criteria to ensure your expense reimbursement is calculated accurately and efficiently every semi-annually.

What methods can be implemented in Excel to flag or highlight expenses that fall outside the semi-annual reimbursement window?

Use Excel's Conditional Formatting with a formula comparing expense dates against the semi-annual reimbursement period start and end dates. Implement formulas like =OR(A2

How should supporting documentation for each semi-annual reimbursement claim be organized or referenced in the Excel file?

Supporting documentation for each semi-annual expense reimbursement claim should be organized in the Excel file using a dedicated column for document reference numbers or file paths linked to scanned receipts and invoices. Each entry must include the date, amount, and description of the expense, ensuring easy cross-referencing with the uploaded or attached support files. Utilizing consistent naming conventions and hyperlinks within the Excel sheet enhances traceability and audit compliance.