The Semi-annually Excel Template for Cash Flow Management is designed to help businesses track and forecast cash inflows and outflows every six months, providing a clear overview of financial health over extended periods. It simplifies the monitoring of payments, expenses, and income, enabling more informed budgeting and financial planning. Using this template ensures consistent financial assessment, improving decision-making and liquidity management.

Semi-Annual Cash Flow Management with Projections

What does a Semi-Annual Cash Flow Management with Projections document typically contain? This document usually includes detailed records of cash inflows and outflows over a six-month period, along with projected cash flow for the upcoming months. It helps organizations anticipate financial challenges and plan accordingly to maintain liquidity.

What is an important aspect to focus on in this type of document? Ensuring accuracy in both historical cash flow data and future projections is crucial, as it directly impacts budgeting and financial decision-making. Additionally, regularly updating the projections based on actual performance allows for better cash management and risk mitigation.

Excel Template for Semi-Annual Cash Flow Tracking

Excel templates for semi-annual cash flow tracking are designed to monitor and manage the inflows and outflows of cash over a six-month period. They help businesses ensure liquidity and plan for financial obligations effectively.

- Include clear categories for income and expenses to maintain accurate records.

- Incorporate summary sections to highlight net cash flow and trends.

- Use formulas to automate calculations and reduce manual errors.

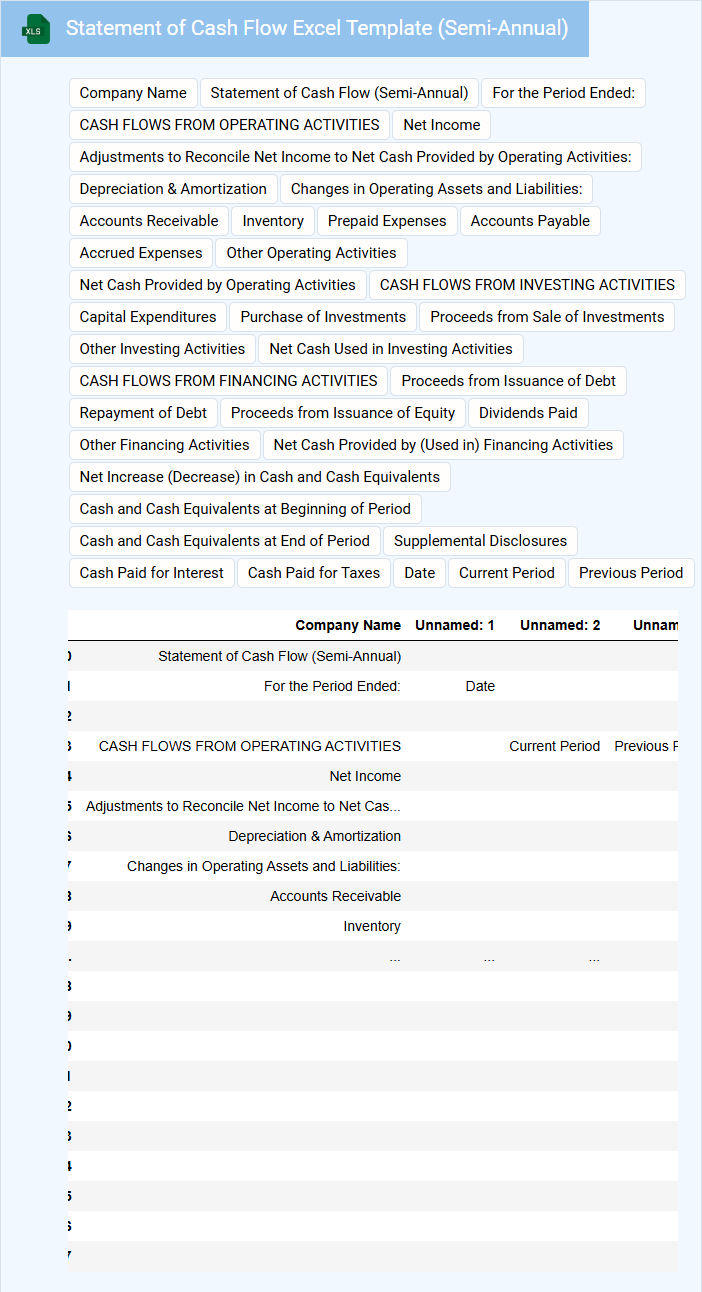

Statement of Cash Flow Excel Template (Semi-Annual)

What is typically contained in a Statement of Cash Flow Excel Template (Semi-Annual)? This document usually includes detailed records of cash inflows and outflows over a six-month period, categorized into operating, investing, and financing activities. It helps businesses or individuals track liquidity and financial health by presenting how cash is generated and used.

Why is it important to pay attention to accuracy and categorization in a semi-annual cash flow statement? Ensuring precise data entry and proper classification of cash movements is crucial for reliable financial analysis and decision-making. This allows users to better forecast cash needs, manage resources, and comply with accounting standards.

Cash Flow Analysis with Semi-Annual Review Period

A Cash Flow Analysis with a Semi-Annual Review Period typically contains detailed records of cash inflows and outflows over six months. It helps businesses track liquidity and forecast future financial positions accurately. This document is essential for monitoring operational efficiency and financial health.

Important aspects to focus on include consistent tracking of all cash transactions and identifying any irregularities or trends in spending and income. Regularly updating assumptions based on the semi-annual data ensures more accurate financial planning. Utilizing this analysis helps in making informed strategic decisions and maintaining solid cash management.

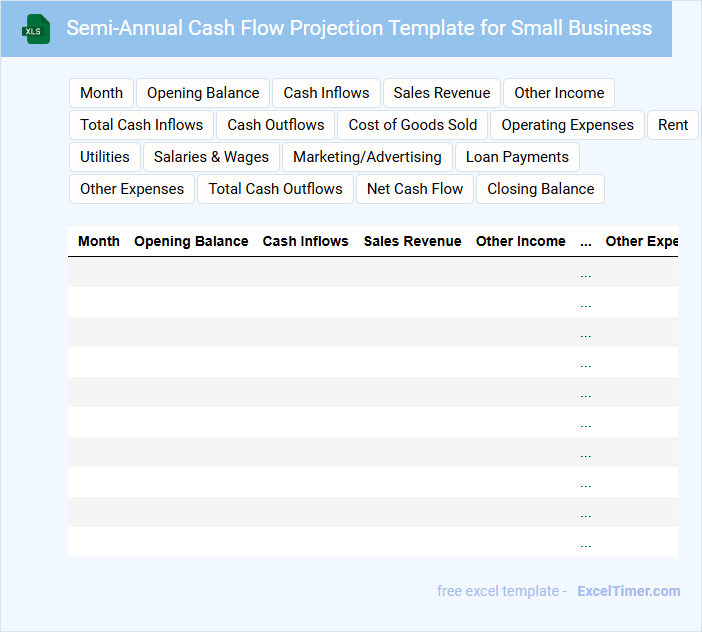

Semi-Annual Cash Flow Projection Template for Small Business

A Semi-Annual Cash Flow Projection Template for small businesses typically contains detailed forecasts of expected cash inflows and outflows over a six-month period. It helps in planning and managing liquidity to ensure the business can meet its financial obligations. Using this template assists in identifying potential cash shortages ahead of time. Important elements to include are accurate sales projections, fixed and variable expenses, and anticipated loan payments. This template serves as a financial roadmap and supports better decision-making. Businesses should update projections regularly to reflect actual performance and market changes.

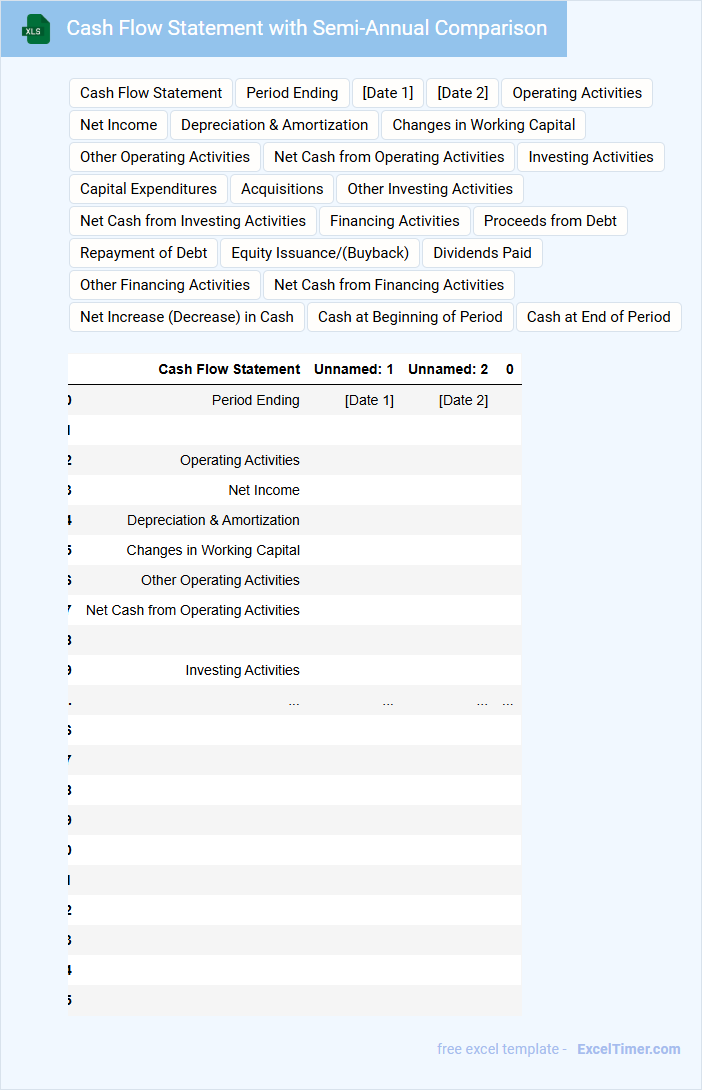

Cash Flow Statement with Semi-Annual Comparison

A Cash Flow Statement with Semi-Annual Comparison provides a detailed overview of cash inflows and outflows over two consecutive six-month periods, helping stakeholders assess financial health and liquidity trends. It highlights the sources and uses of cash, making it essential for evaluating operational efficiency and investment activities.

- Compare operating, investing, and financing cash flows between the two periods for significant changes.

- Highlight any unusual cash movements or one-time transactions affecting comparison accuracy.

- Ensure consistency in accounting methods to maintain reliable semi-annual comparisons.

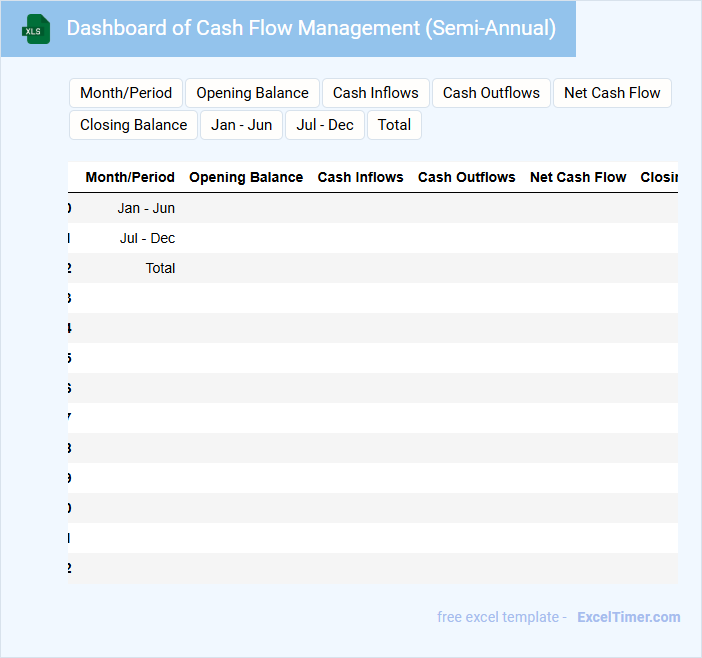

Dashboard of Cash Flow Management (Semi-Annual)

What information is typically included in a Dashboard of Cash Flow Management (Semi-Annual)? This type of document usually contains key financial metrics such as cash inflows, outflows, net cash position, and projections over a six-month period. It visually summarizes the organization's liquidity status and helps track financial performance to ensure stability and informed decision-making.

What important elements should be highlighted in a semi-annual cash flow management dashboard? It is crucial to include trend analysis, budget comparisons, and variance explanations to identify potential cash shortages or surpluses. Additionally, incorporating actionable insights and alerts for critical cash flow issues can enhance effective financial planning and control.

Template for Tracking Semi-Annual Operating Cash Flow

What information is typically included in a Template for Tracking Semi-Annual Operating Cash Flow? This document usually contains detailed records of cash receipts and payments related to the core operations of a business over a six-month period. It helps in monitoring liquidity, ensuring sufficient cash flow for operational needs, and facilitates informed financial decision-making.

An important consideration when using this template is to ensure accurate and timely data entry for all operating activities, including revenues and expenses. Additionally, including comparative metrics or trends within the semi-annual periods can provide valuable insights for forecasting and budget adjustments.

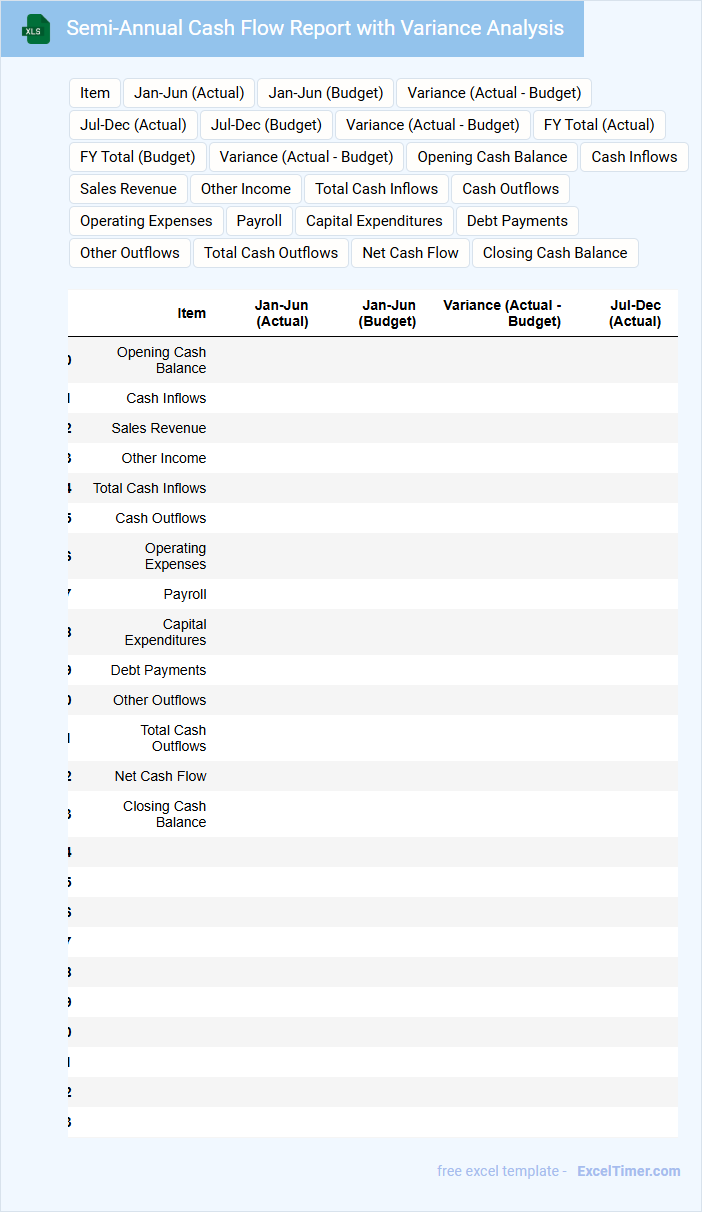

Semi-Annual Cash Flow Report with Variance Analysis

The Semi-Annual Cash Flow Report usually contains detailed summaries of cash inflows and outflows over a six-month period, highlighting operational, investing, and financing activities. It includes variance analysis comparing actual cash flows against budgeted figures to identify discrepancies. This report is essential for financial planning and decision-making in organizations.

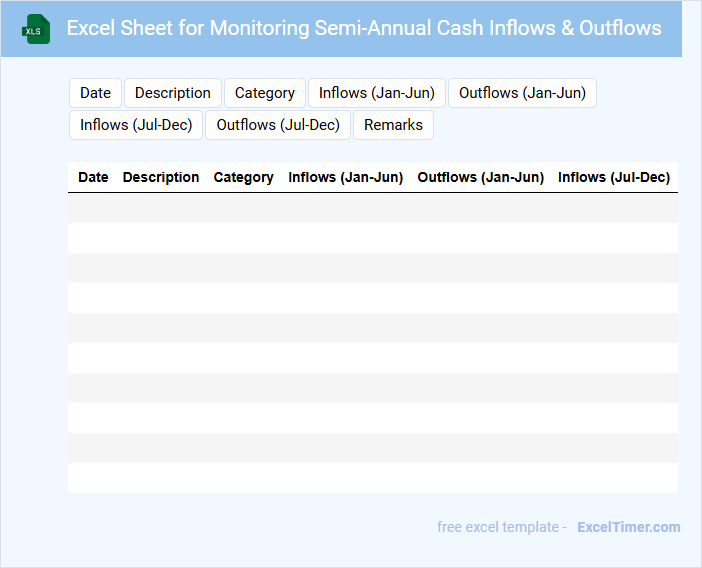

Excel Sheet for Monitoring Semi-Annual Cash Inflows & Outflows

What information is typically contained in an Excel sheet for monitoring semi-annual cash inflows and outflows? This document generally includes detailed records of all cash receipts and payments over a six-month period, categorized by sources and uses. It helps track financial performance, identify trends, and manage liquidity effectively.

What are important aspects to consider when creating this Excel sheet? It is crucial to ensure accuracy in data entry, use clear categorization and consistent formatting, and incorporate formulas to automate calculations for real-time updates. Additionally, including visual aids like charts can enhance understanding and support better decision-making.

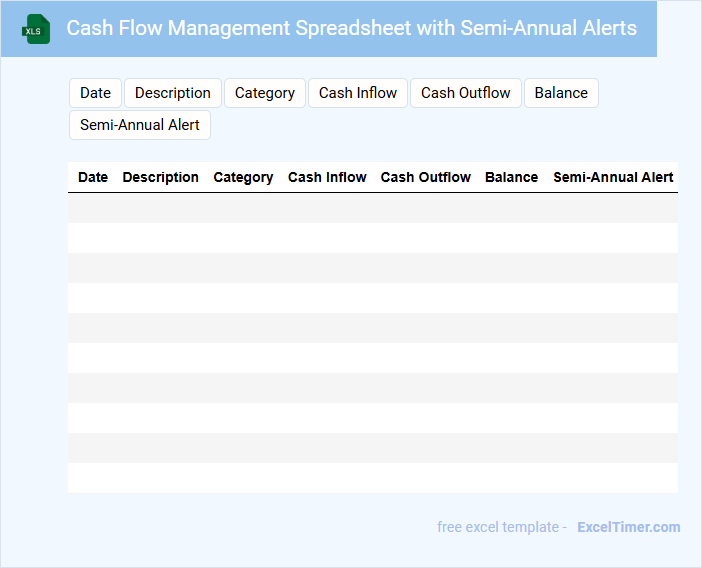

Cash Flow Management Spreadsheet with Semi-Annual Alerts

A Cash Flow Management Spreadsheet is a crucial tool for tracking income and expenses over a set period, typically used by individuals and businesses to maintain financial stability. This type of document usually contains detailed entries of cash inflows, outflows, and projected balances, helping users anticipate shortages or surpluses. Incorporating semi-annual alerts ensures timely reviews and adjustments, preventing cash flow problems before they arise.

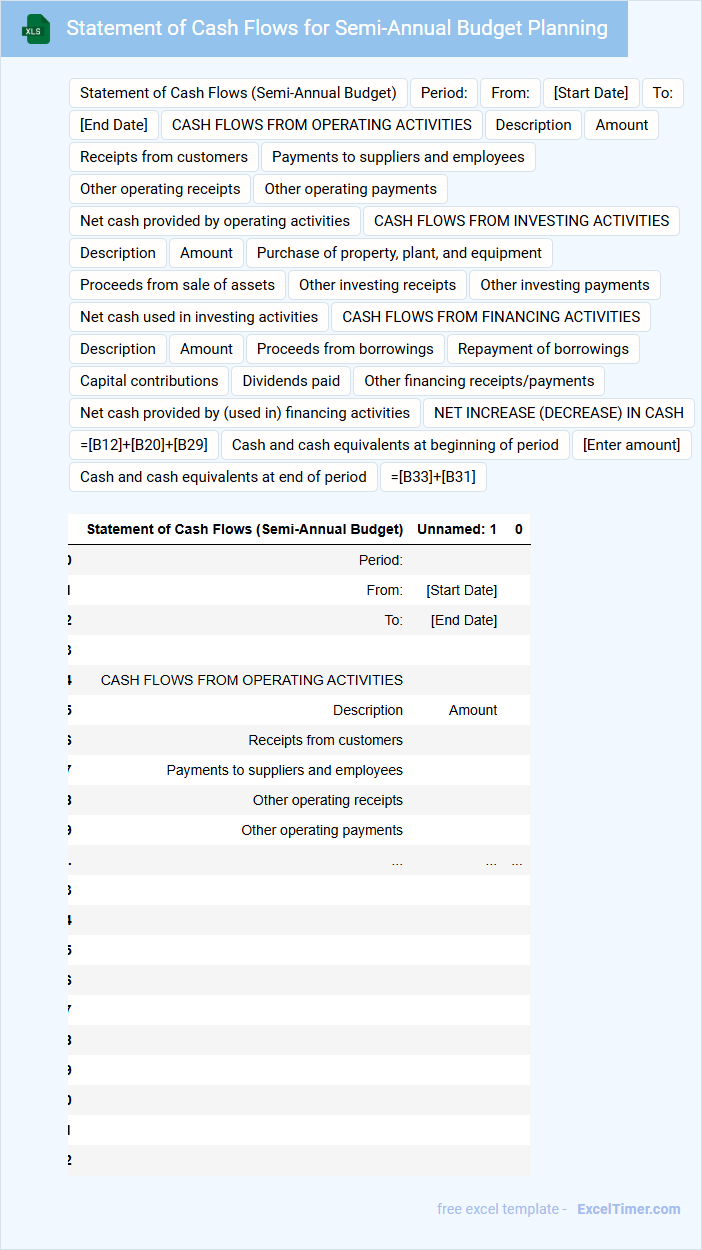

Statement of Cash Flows for Semi-Annual Budget Planning

The Statement of Cash Flows is a financial document that outlines the inflows and outflows of cash within a specific period, typically categorized into operating, investing, and financing activities. For semi-annual budget planning, it provides crucial insights into liquidity and cash management over six months. Key information includes net cash from operations, investment expenditures, and financing cash flows to ensure accurate forecasting and effective allocation of resources.

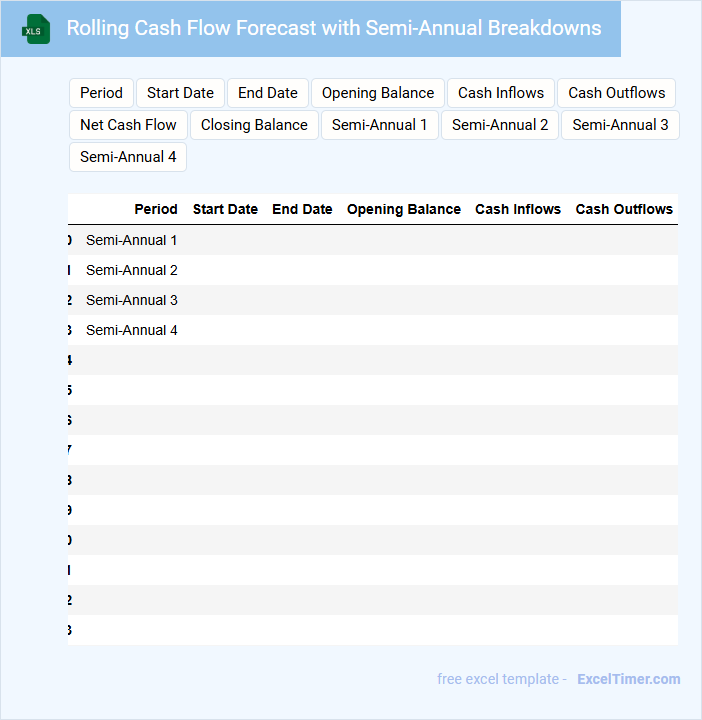

Rolling Cash Flow Forecast with Semi-Annual Breakdowns

A Rolling Cash Flow Forecast typically contains projections of cash inflows and outflows over a continuous period, updated regularly to reflect the latest financial data. This document helps businesses anticipate liquidity needs and manage working capital efficiently. For those utilizing semi-annual breakdowns, it is important to ensure accuracy in timing and amounts of cash movements within each six-month segment to maintain reliable forecasting.

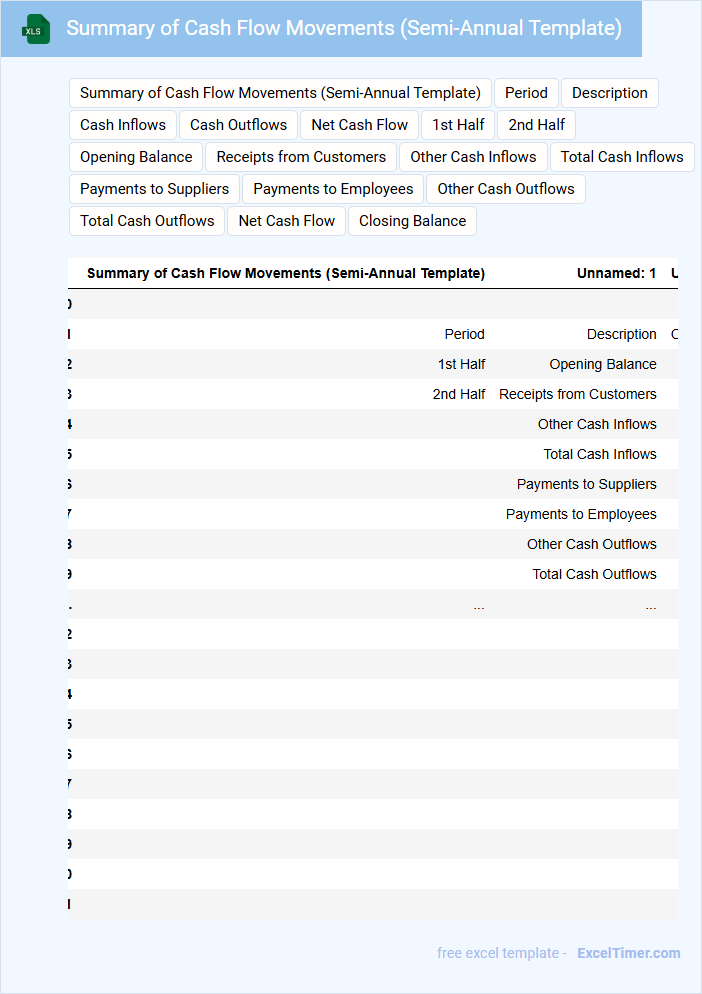

Summary of Cash Flow Movements (Semi-Annual Template)

What information is typically included in a Summary of Cash Flow Movements (Semi-Annual Template)? This document usually contains detailed records of cash inflows and outflows over a six-month period, highlighting the operational, investing, and financing activities. It helps stakeholders understand the liquidity and financial health of an organization within that timeframe.

What is an important consideration when preparing this summary? Ensuring accuracy in categorizing cash movements and aligning with accounting standards is crucial to provide a clear and reliable financial overview. Additionally, including comparative data from previous periods can enhance the analysis of cash flow trends.

Excel Template for Semi-Annual Cash Flow Statement with Charts

An Excel Template for a Semi-Annual Cash Flow Statement is designed to help users systematically record and analyze cash inflows and outflows over six months. This document typically includes detailed sections for operating, investing, and financing activities, allowing for comprehensive financial tracking. Incorporating charts enhances the visualization of cash flow trends and aids in better financial decision-making.

When using this template, it is important to ensure accurate data entry to maintain the reliability of financial insights. Users should customize the template to fit their specific business model and financial processes. Regular updates and reviews of cash flow trends through the embedded charts can improve forecasting and liquidity management.

How does semi-annual cash flow impact overall liquidity planning in Excel?

Semi-annual cash flow provides a clear biannual snapshot of cash inflows and outflows, enabling precise liquidity forecasting in Excel. Tracking these cash movements helps identify periods of surplus or deficit, optimizing working capital management. Excel's data analysis tools and financial functions support scenario planning for effective semi-annual liquidity strategies.

What formulas are essential for tracking semi-annual inflow and outflow schedules?

You should use the SUMIF formula to aggregate semi-annual inflows and outflows based on dates within six-month periods. The EOMONTH function helps define precise period-end dates for each semi-annual cycle. Combining these formulas ensures accurate cash flow management and forecasting in your Excel document.

How can you visualize semi-annual cash flow cycles using Excel charts?

You can visualize semi-annual cash flow cycles in Excel by creating line or bar charts that display cash inflows and outflows every six months. Use date-based data grouping and pivot tables to summarize transactions within each semi-annual period for clearer trends. Excel's built-in chart tools enable dynamic tracking and comparison of semi-annual cash flow patterns effectively.

What are the key considerations when forecasting semi-annual cash surpluses or deficits?

Forecasting semi-annual cash surpluses or deficits requires accurate projection of inflows and outflows over six-month periods, emphasizing seasonal trends and payment cycles. Incorporating historical cash flow data and adjusting for expected changes in revenue or expenses enhances forecasting precision. Maintaining a buffer for unexpected costs and timely tracking of receivables and payables supports effective cash flow management.

How do interest calculations differ for semi-annual cash flows in Excel financial models?

Semi-annual cash flow interest calculations in Excel financial models apply a 6-month period rate, dividing the annual interest rate by two for accurate compounding. Excel functions like RATE or NPV adjust to reflect these semi-annual intervals, ensuring precise cash flow valuation. Your model benefits from enhanced accuracy in forecasting and managing cash flow timing with this approach.