The Semi-annually Excel Template for Financial Statements streamlines the process of preparing accurate financial reports every six months. This template ensures consistent data entry and automatic calculations, helping businesses track financial performance efficiently. Key features include customizable fields, pre-built formulas, and easy-to-understand layouts that enhance financial analysis and decision-making.

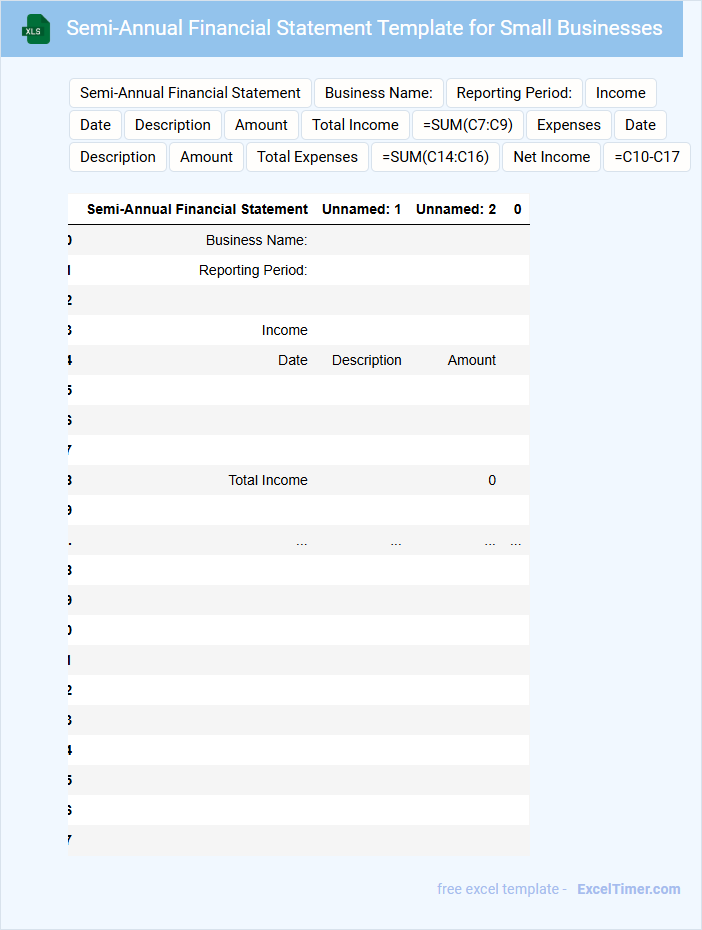

Semi-Annual Financial Statement Template for Small Businesses

A Semi-Annual Financial Statement Template for Small Businesses typically contains a summarized report of financial activities over a six-month period. It helps businesses track performance and make informed decisions.

- Include accurate income and expense records to reflect financial health.

- Ensure clear presentation of assets, liabilities, and equity.

- Use concise notes to explain significant changes or anomalies.

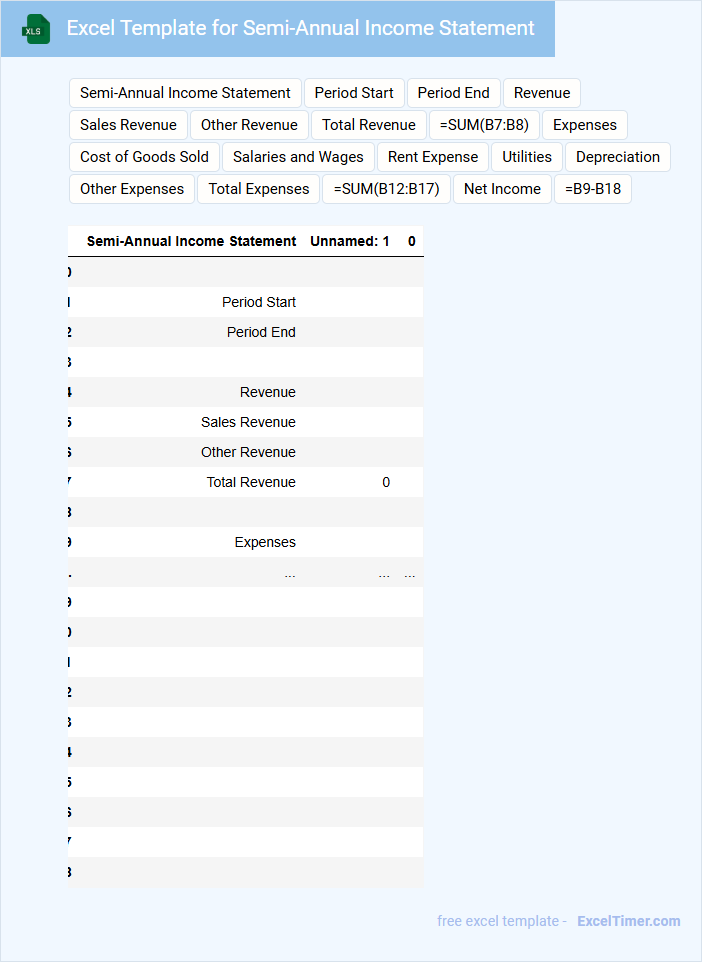

Excel Template for Semi-Annual Income Statement

An Excel Template for a Semi-Annual Income Statement is a structured document used to record and analyze revenue and expenses over a six-month period. It typically contains sections for sales, cost of goods sold, operating expenses, and net income. Important suggestions include ensuring accurate data entry, updating formulas for tax calculations, and providing clear labels for each financial category.

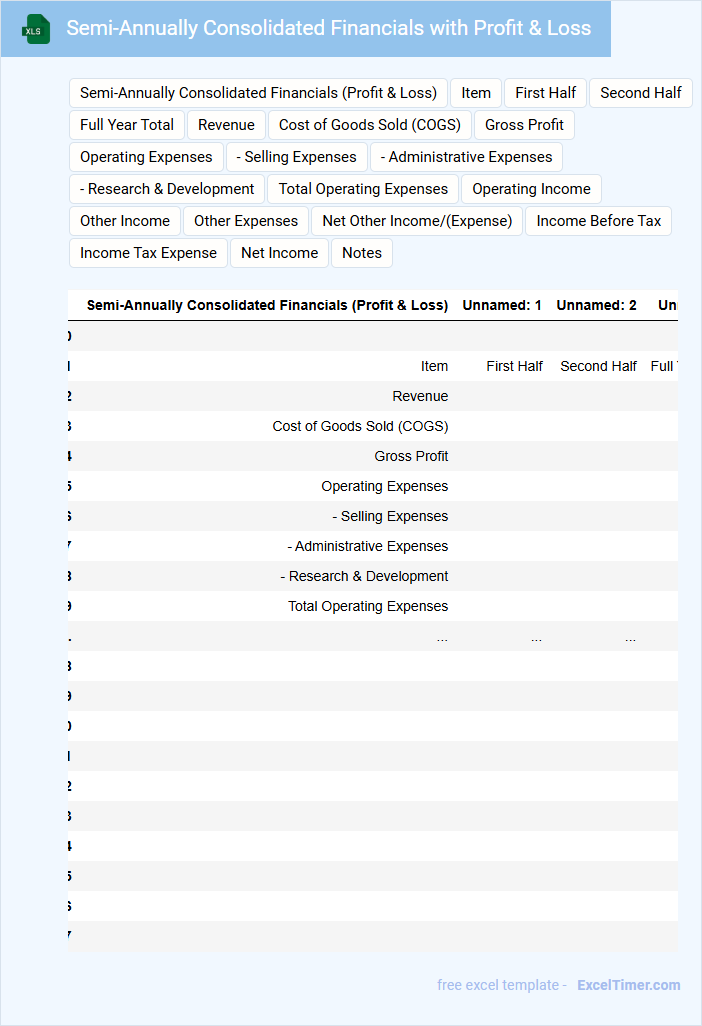

Semi-Annually Consolidated Financials with Profit & Loss

A Semi-Annually Consolidated Financial document typically includes combined financial statements from multiple subsidiaries of a parent company for a six-month period. It provides a summarized view of the overall financial position and performance, including the Profit & Loss statement, balance sheet, and cash flow. This document is crucial for stakeholders to assess operational efficiency and make informed decisions.

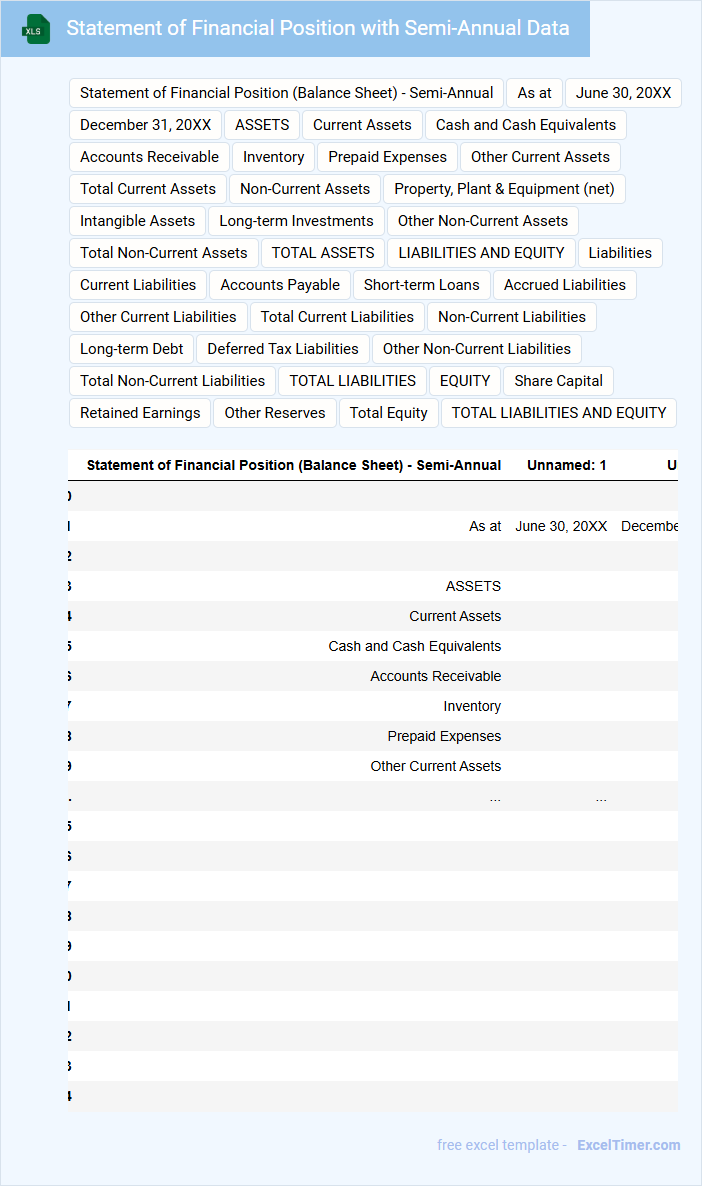

Statement of Financial Position with Semi-Annual Data

The Statement of Financial Position provides a snapshot of an entity's financial health by listing its assets, liabilities, and equity at a specific point in time. This type of document is crucial for understanding the net worth and liquidity of a business.

When prepared with Semi-Annual Data, it reflects the financial status at two points within the fiscal year, allowing for improved trend analysis and decision-making. It is important to ensure accuracy and consistency in reporting periods to maintain comparability.

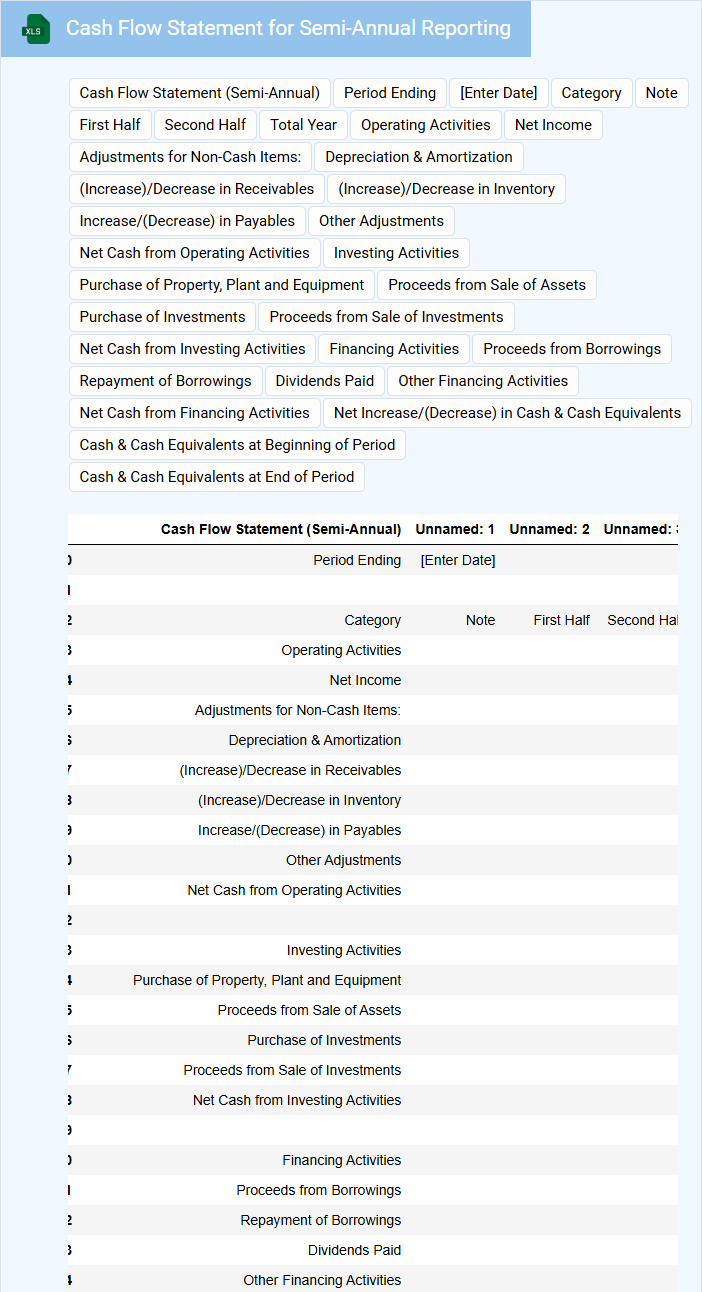

Cash Flow Statement for Semi-Annual Reporting

The Cash Flow Statement for semi-annual reporting provides a detailed summary of cash inflows and outflows over six months, highlighting the company's liquidity position. It typically includes operating, investing, and financing activities to give stakeholders a clear view of cash movements. Key elements to emphasize are accurate cash management, investment impact, and financing strategies to ensure financial stability.

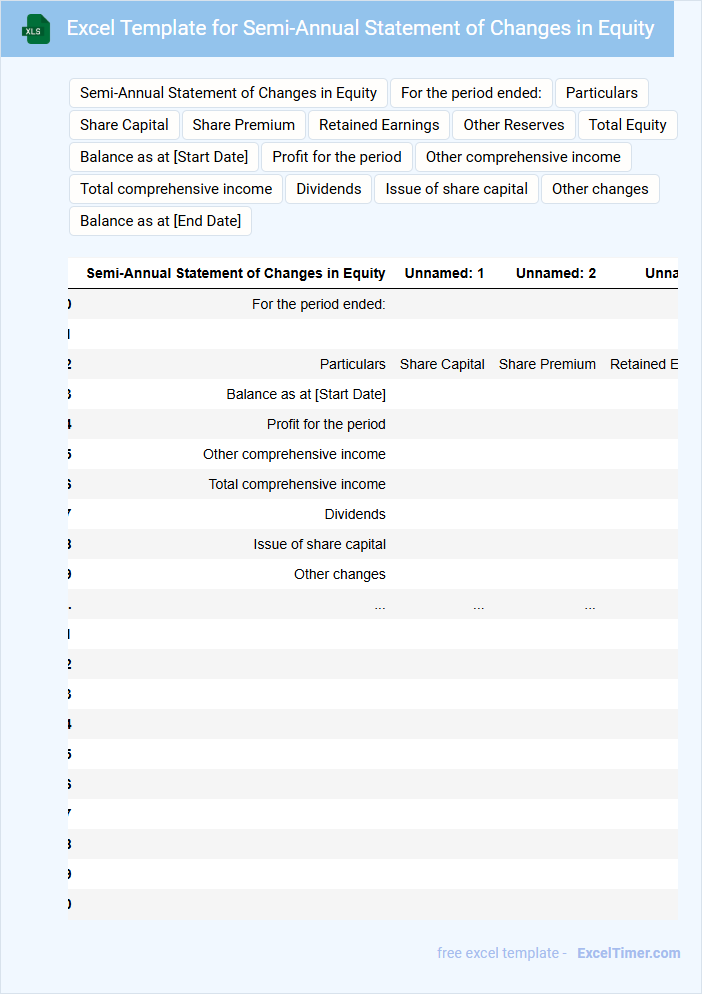

Excel Template for Semi-Annual Statement of Changes in Equity

An Excel Template for a Semi-Annual Statement of Changes in Equity typically contains detailed records of equity movements such as capital injections, dividend payments, and retained earnings adjustments within a six-month period. This document is essential for tracking shareholder equity and providing stakeholders with transparent financial insights. It often includes sections for opening balances, transactions, and closing balances to ensure accuracy and completeness.

When using this template, it is important to ensure all equity components are categorized correctly and updated promptly to reflect any changes in ownership or equity structure. Including clear labels and comments can enhance usability and reduce errors during data entry. Additionally, integrating formulas to auto-calculate totals and subtotals improves efficiency and accuracy.

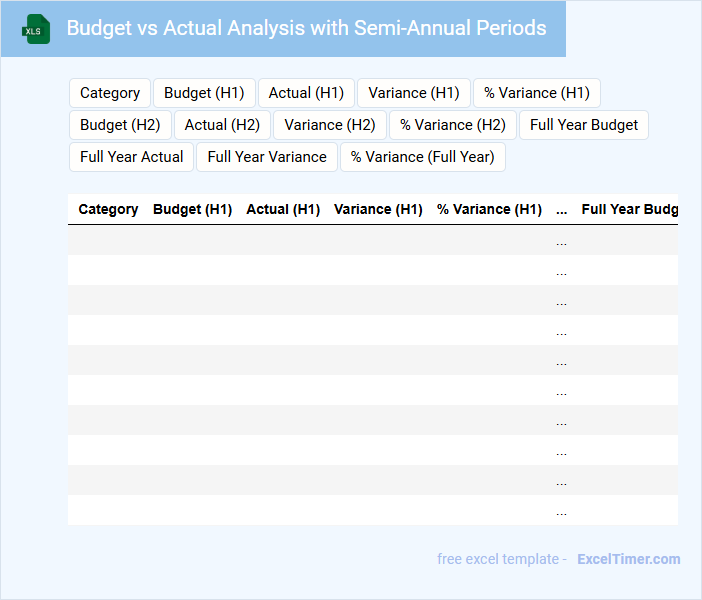

Budget vs Actual Analysis with Semi-Annual Periods

A Budget vs Actual Analysis document typically contains a detailed comparison between the planned budget and the actual financial performance over semi-annual periods. It highlights variances to identify areas of overspending or underspending. This analysis helps organizations make informed decisions to improve financial management and control costs.

For an effective Budget vs Actual Analysis with semi-annual periods, it is important to ensure accurate data collection for both budgeted and actual figures. Including clear variance explanations and graphical visualizations enhances understanding. Regular updates and reviews will support timely adjustments and strategic planning.

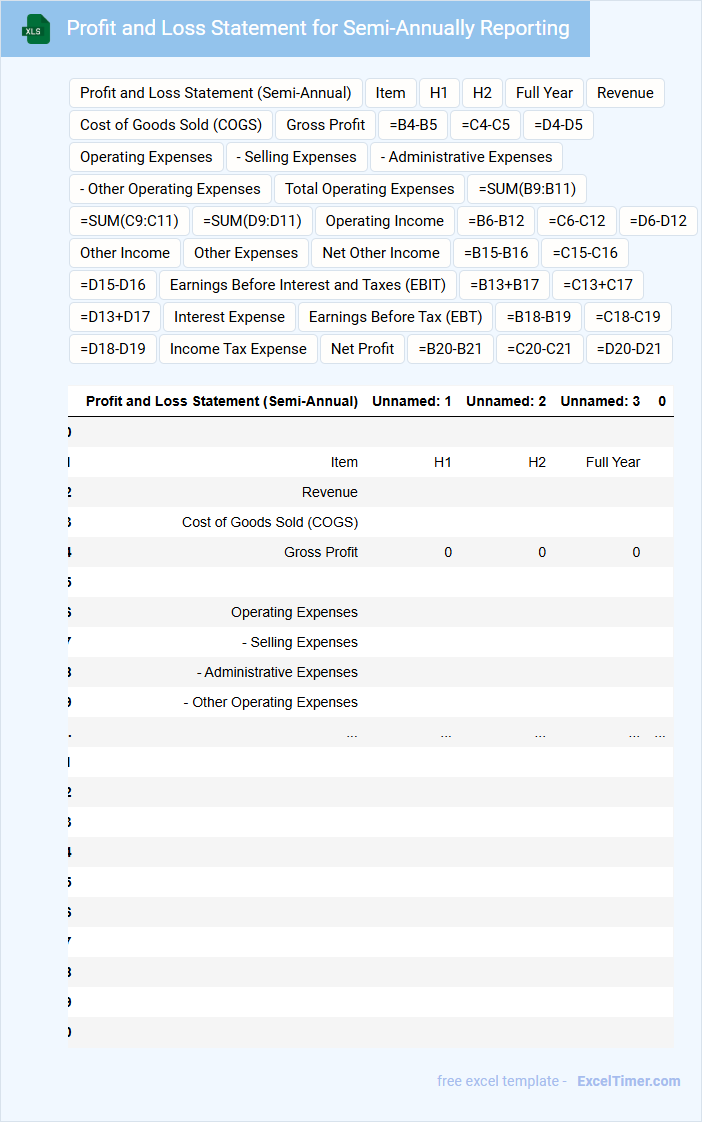

Profit and Loss Statement for Semi-Annually Reporting

A Profit and Loss Statement for Semi-Annually Reporting summarizes the revenues, costs, and expenses incurred over a six-month period to assess financial performance. It provides insights into the company's profitability and operational efficiency for that reporting period.

- Include accurate revenue and expense details to reflect true financial outcomes.

- Compare results against previous periods to identify trends and anomalies.

- Highlight significant changes in costs or income for better decision-making.

Financial Overview Dashboard with Semi-Annual Updates

This document is a Financial Overview Dashboard that provides a comprehensive summary of key financial metrics and trends. It typically includes revenue, expenses, profit margins, and cash flow data updated semi-annually to track performance over six-month periods.

Important elements to include are clear visualizations like charts and graphs for quick analysis and comparative figures from previous periods. Ensuring the accuracy and timeliness of data is crucial for effective decision-making and strategic planning.

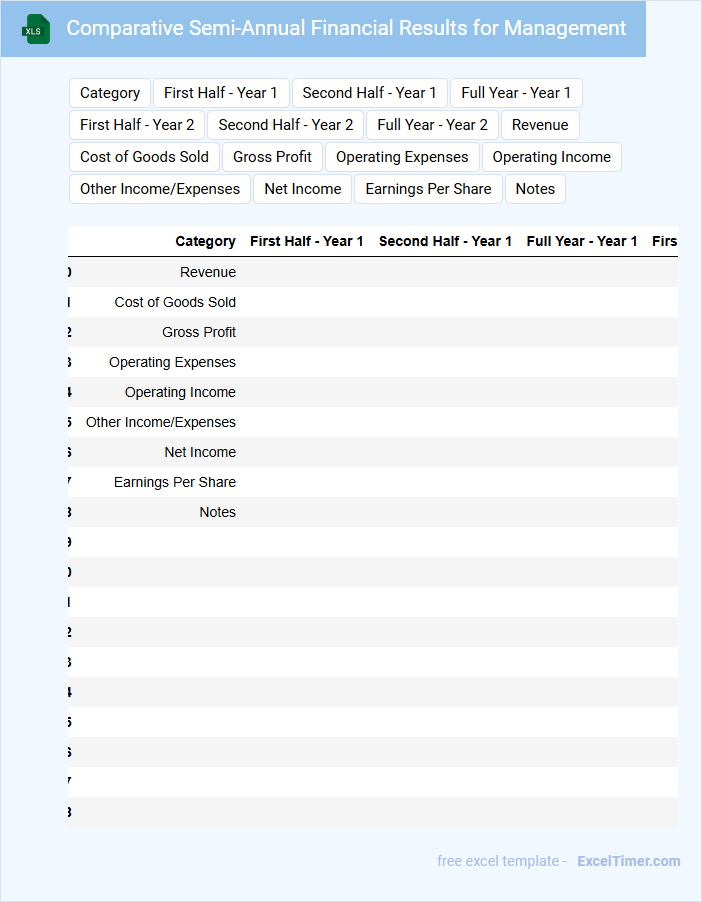

Comparative Semi-Annual Financial Results for Management

This type of document, titled Comparative Semi-Annual Financial Results, typically contains detailed financial data comparing two consecutive six-month periods. It focuses on key metrics such as revenue, expenses, profit margins, and cash flow to provide clear insights into the company's performance trends. Management uses this analysis to make informed strategic decisions and adjust operational plans accordingly.

Important aspects to highlight include consistent presentation of data for easy period-over-period comparison, clear explanations of significant variances or anomalies, and inclusion of forward-looking statements or recommendations based on the financial performance observed. Additionally, ensuring compliance with relevant accounting standards and including graphical representations can enhance clarity for management review.

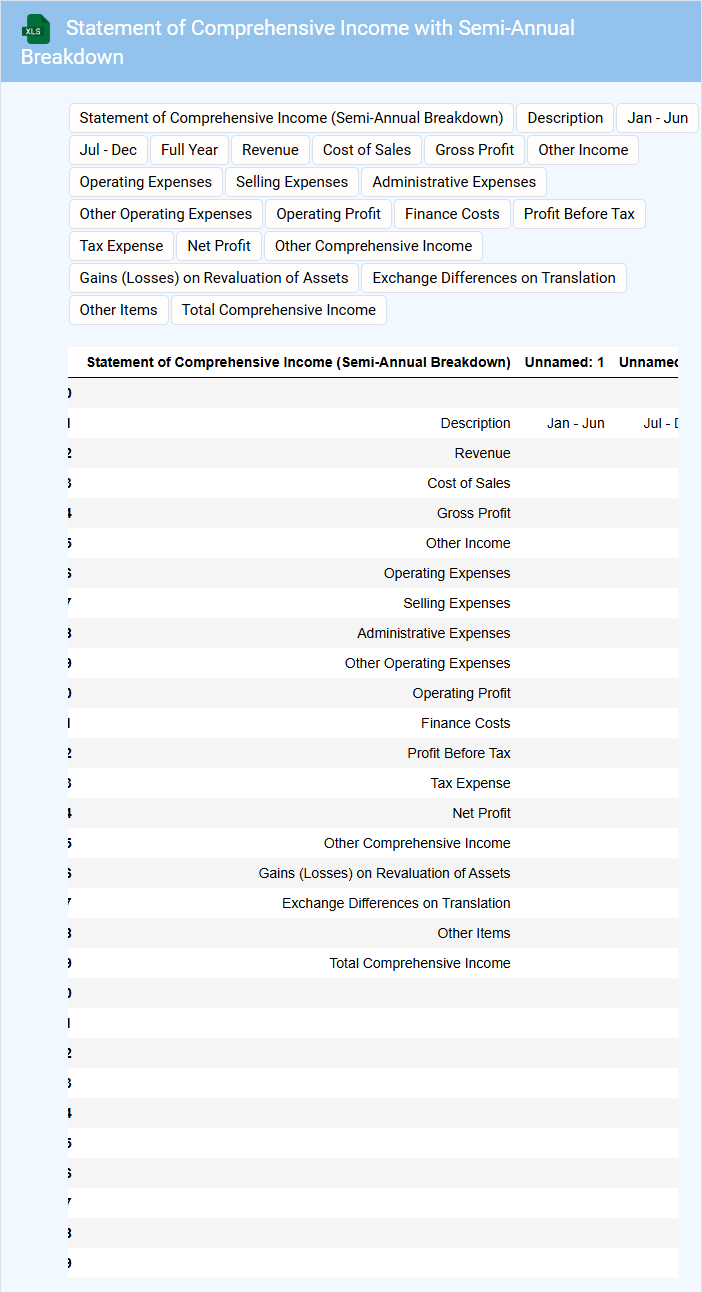

Statement of Comprehensive Income with Semi-Annual Breakdown

The Statement of Comprehensive Income provides an overview of a company's financial performance over a specific period, detailing revenues, expenses, gains, and losses. It typically includes breakdowns of net income and other comprehensive income items that affect equity but are not recorded in the profit and loss statement. For a Semi-Annual Breakdown, it's important to clearly separate and compare the results over the two six-month periods to identify trends and seasonal variances.

Expense Tracker with Semi-Annual Totals in Excel

An Expense Tracker with Semi-Annual Totals in Excel is a spreadsheet designed to monitor and categorize expenses over six-month periods. It typically includes columns for dates, descriptions, categories, and amounts spent, facilitating detailed financial analysis. Using semi-annual totals helps users identify spending trends and make informed budgeting decisions efficiently.

Important aspects to consider are setting up accurate category labels, ensuring formulas for semi-annual summations are correct, and maintaining consistent data entry. Including visual charts can enhance understanding of spending patterns, and protecting the sheet prevents accidental alterations. Regularly updating the tracker ensures precise financial management and goal tracking.

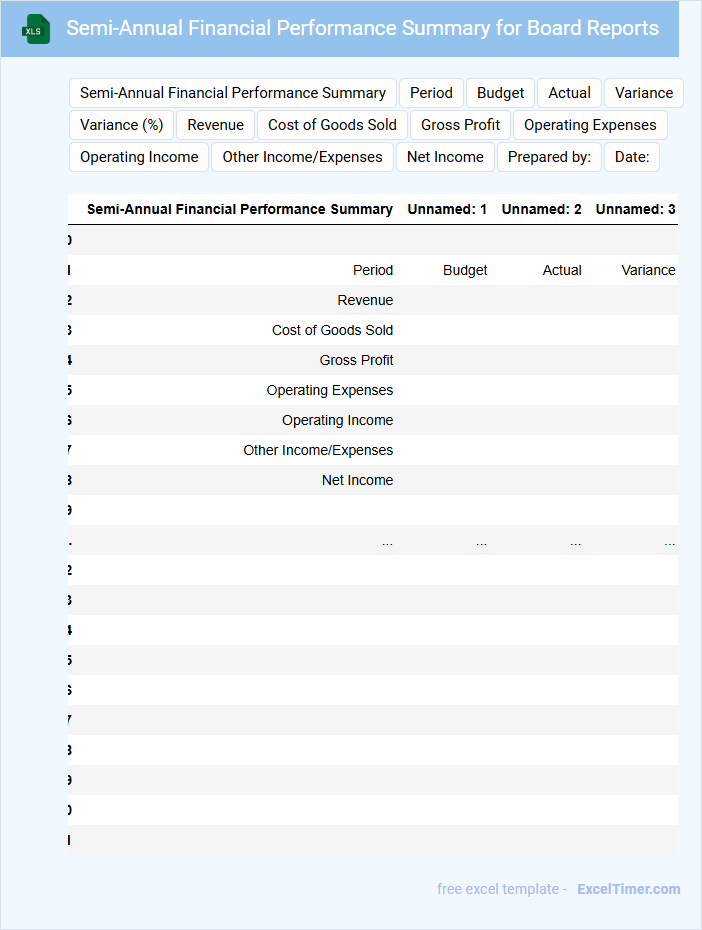

Semi-Annual Financial Performance Summary for Board Reports

A Semi-Annual Financial Performance Summary for Board Reports typically contains key financial data and analysis for the first half of the fiscal year, providing insight into the company's economic health. It highlights revenue, expenses, profits, and major financial trends to assist board members in strategic decision-making.

- Include clear comparisons against previous periods and budget forecasts to show performance trends.

- Summarize significant variances and underlying reasons to offer context and transparency.

- Highlight key financial metrics such as EBITDA, cash flow, and return on investment for comprehensive evaluation.

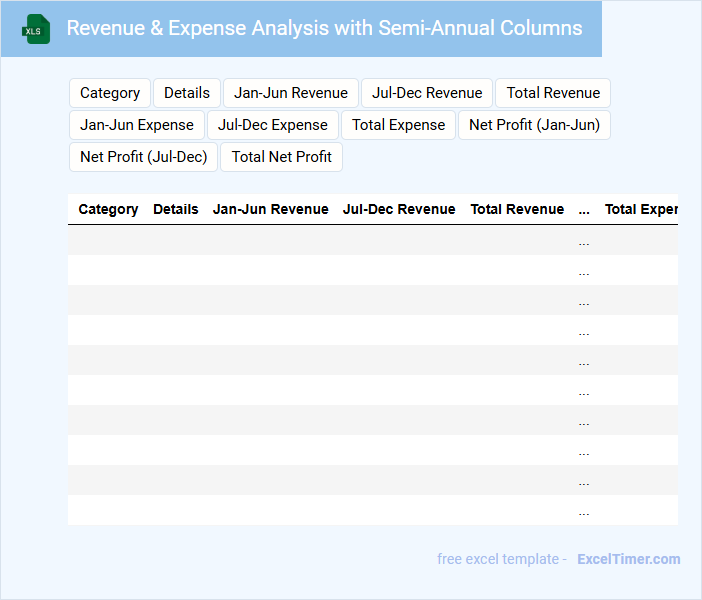

Revenue & Expense Analysis with Semi-Annual Columns

A Revenue & Expense Analysis document typically contains detailed financial data, categorizing income and expenditures over a specific period. It is organized in a tabular format allowing for clear comparison, such as semi-annual columns to track trends over the two halves of the year. This enables stakeholders to assess financial performance effectively and make informed budgetary decisions.

Important elements to include are accurate revenue sources, itemized expenses, and concise summaries for each semi-annual period. Highlighting variances between periods helps identify growth areas and cost-saving opportunities. Additionally, incorporating visual aids like charts can enhance clarity and engagement.

Ratio Analysis Template for Semi-Annually Financial Statements

Ratio Analysis Templates for Semi-Annually Financial Statements typically contain key financial ratios calculated from interim financial data to assess company performance and financial health.

- Liquidity Ratios: Measure the company's ability to meet short-term obligations using current and quick ratios.

- Profitability Ratios: Evaluate earnings efficiency and margins such as net profit margin and return on assets.

- Leverage Ratios: Assess the level of debt and financial risk with debt-to-equity and interest coverage ratios.

How are semi-annual periods defined and recorded in Excel-based financial statements?

Semi-annual periods in Excel-based financial statements are defined as two six-month intervals within a fiscal year, commonly labeled as H1 and H2 or Period 1 and Period 2. These periods are recorded by setting date ranges and grouping financial data accordingly using Excel functions like SUMIFS or PivotTables to summarize revenue, expenses, and other key metrics. Proper labeling and consistent date formatting ensure accurate period comparison and reporting in financial analysis.

Which Excel formulas best automate semi-annual revenue or expense aggregations?

To automate semi-annual revenue or expense aggregations in Excel, use the SUMIFS formula with date criteria to sum values within specific six-month periods. Employ functions like EOMONTH combined with SUMIFS to dynamically define semi-annual date ranges based on your data. You can streamline your financial statements by structuring these formulas to reference your transaction dates and amounts accurately.

How should semi-annual comparative columns be structured for financial statement clarity?

Semi-annual comparative columns in financial statements should present data for two consecutive periods side-by-side to enable clear period-over-period analysis. Each column must be labeled with the specific semi-annual dates or fiscal half-year to enhance clarity and avoid confusion. Including variance or percentage change columns further improves the readability and financial insight of the comparative analysis.

What date functions in Excel facilitate accurate semi-annual reporting periods?

Excel's DATE, EDATE, and EOMONTH functions facilitate accurate semi-annual reporting periods by calculating exact start and end dates for each half-year interval. EDATE helps shift dates by six months, ensuring precise semi-annual intervals, while EOMONTH determines month-end dates for reporting accuracy. You can automate financial statement timelines and reduce manual errors using these date functions effectively.

How to ensure consistency in semi-annual closing balances using s?

Use standardized Excel templates with locked formulas and dropdown data validation to ensure consistent semi-annual closing balances. Regularly update linked financial statements and perform reconciliations using pivot tables for accurate data aggregation. Implement cell protection and structured references to minimize manual errors during data entry.