The Semi-annually Cash Flow Statement Excel Template for Nonprofits provides a clear and organized method to track cash inflows and outflows every six months. It helps nonprofit organizations manage budgeting, monitor financial stability, and ensure transparency in fund allocation. Customizable features allow for easy adaptation to various nonprofit financial reporting requirements.

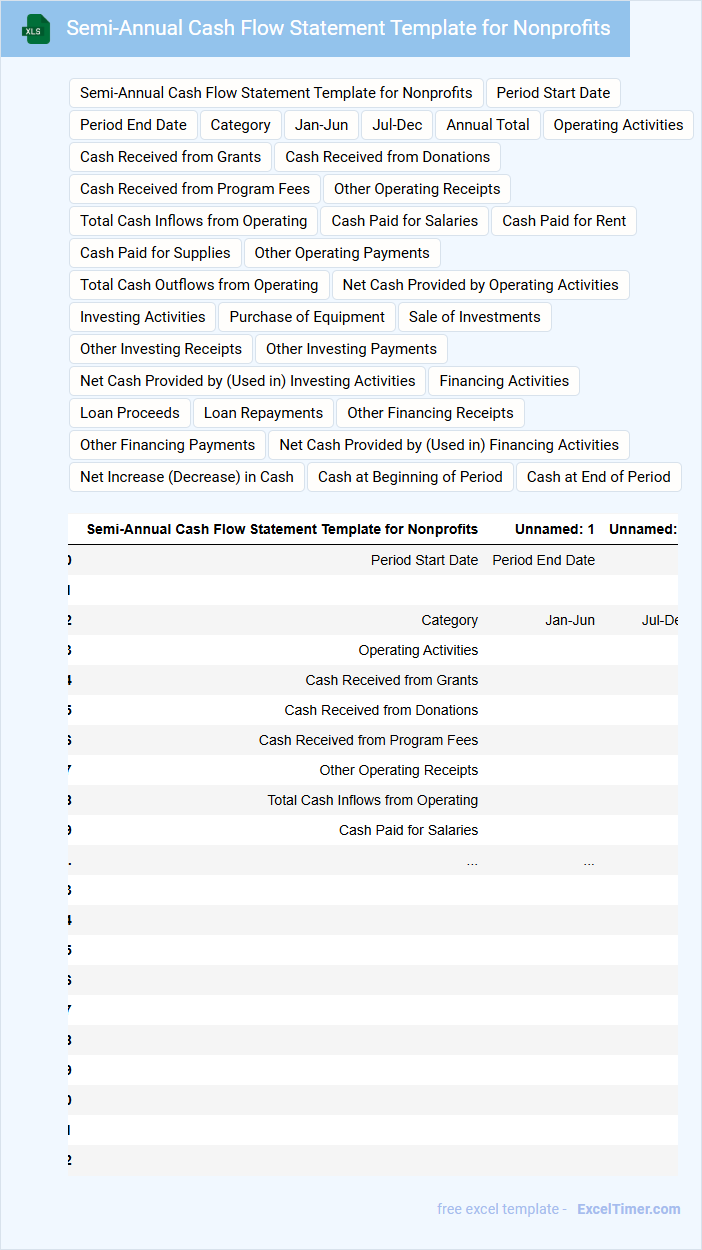

Semi-Annual Cash Flow Statement Template for Nonprofits

The Semi-Annual Cash Flow Statement Template for nonprofits is a crucial financial document that tracks the inflow and outflow of cash over a six-month period. It helps organizations monitor their liquidity and ensure they have sufficient funds to meet their operational needs. This template typically includes sections for operating, investing, and financing activities, providing a clear overview of the organization's financial health.

Important elements to include are detailed cash receipts and payments categorized by source and purpose, a comparison of actual versus projected cash flow, and notes explaining significant variances. Ensuring accuracy and timeliness in updating the template supports transparency and informed decision-making. Regular use of this template enables nonprofits to maintain fiscal responsibility and plan for future financial sustainability.

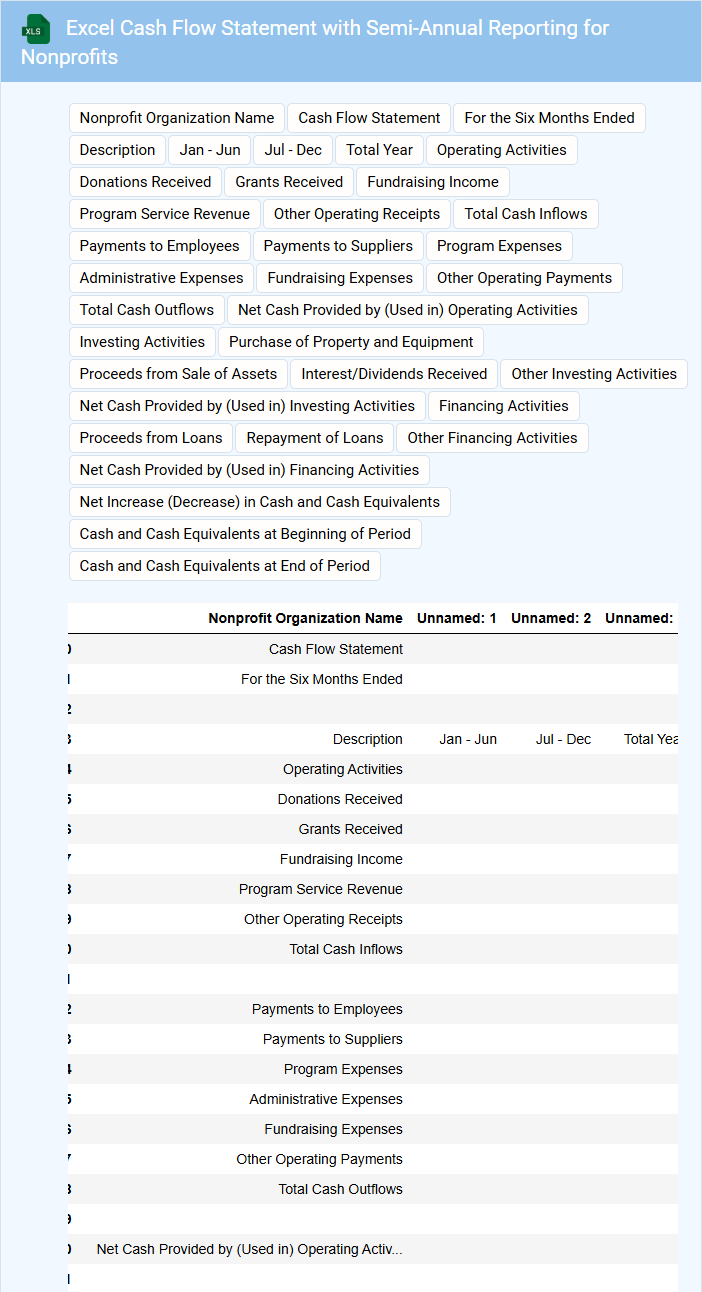

Excel Cash Flow Statement with Semi-Annual Reporting for Nonprofits

An Excel Cash Flow Statement for nonprofits provides a detailed record of all cash inflows and outflows over a specified period, typically structured for semi-annual reporting. This type of document helps organizations monitor financial health by tracking funds received and spent, ensuring transparency and accountability. It is essential for nonprofit managers to include detailed categories for donations, grants, operational expenses, and capital expenditures.

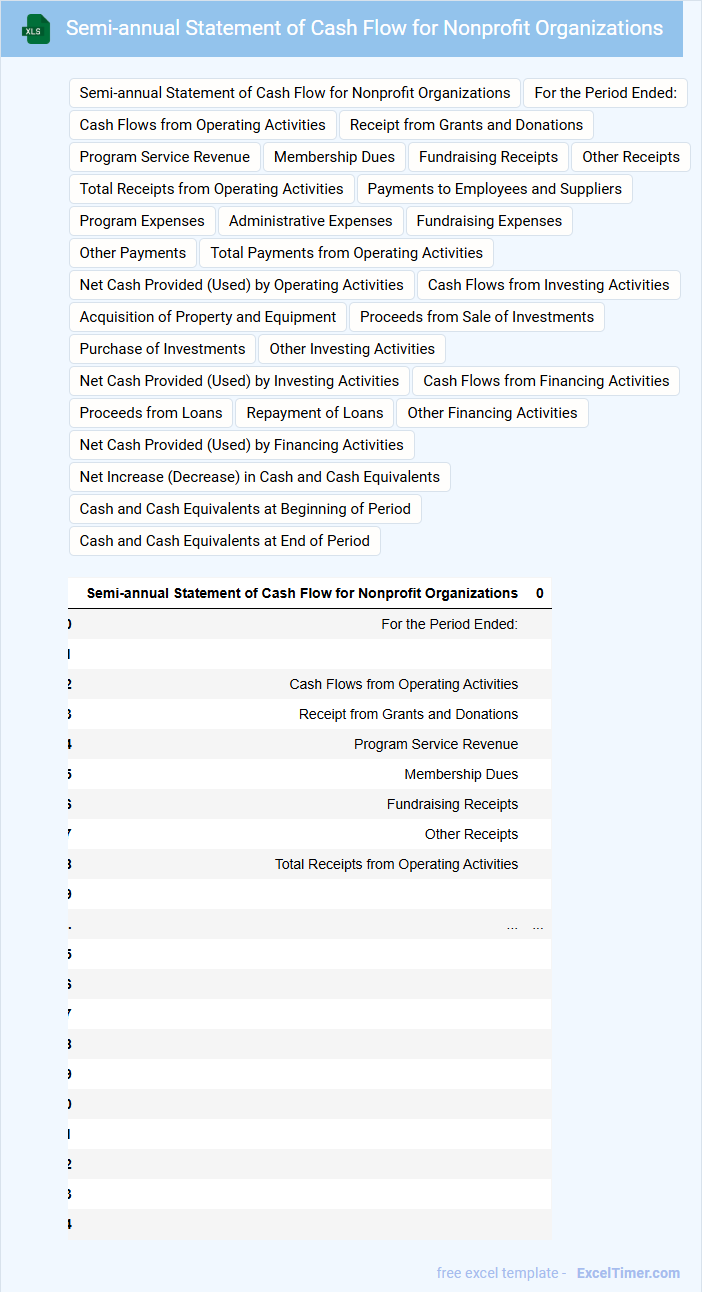

Semi-annual Statement of Cash Flow for Nonprofit Organizations

A Semi-annual Statement of Cash Flow for Nonprofit Organizations details the cash inflows and outflows over a six-month period to provide transparency on financial health. This document is essential for stakeholders to understand how cash is generated and spent during the period.

- Include clear categorization of operating, investing, and financing activities.

- Ensure reconciliation of beginning and ending cash balances for accuracy.

- Highlight significant changes in cash flow compared to previous periods.

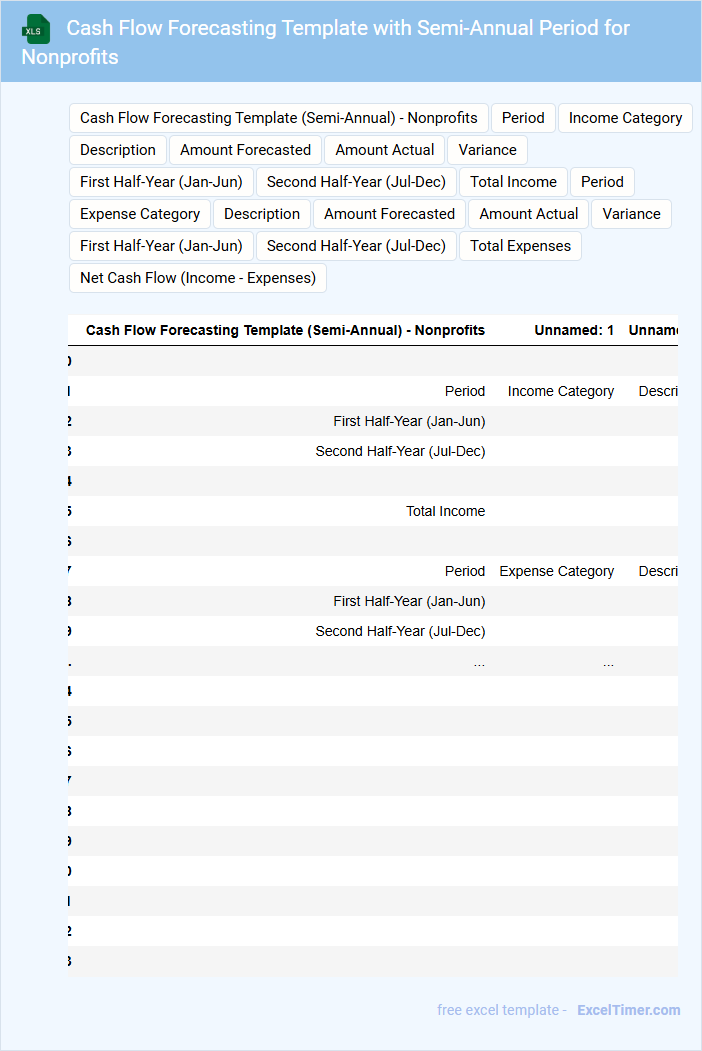

Cash Flow Forecasting Template with Semi-Annual Period for Nonprofits

A Cash Flow Forecasting Template with a semi-annual period for nonprofits typically contains projected income and expenditures broken down every six months. It helps organizations anticipate their financial position to ensure sustainability and plan for future activities. Key components often include donations, grants, program costs, and operational expenses tailored to the unique nonprofit funding cycles.

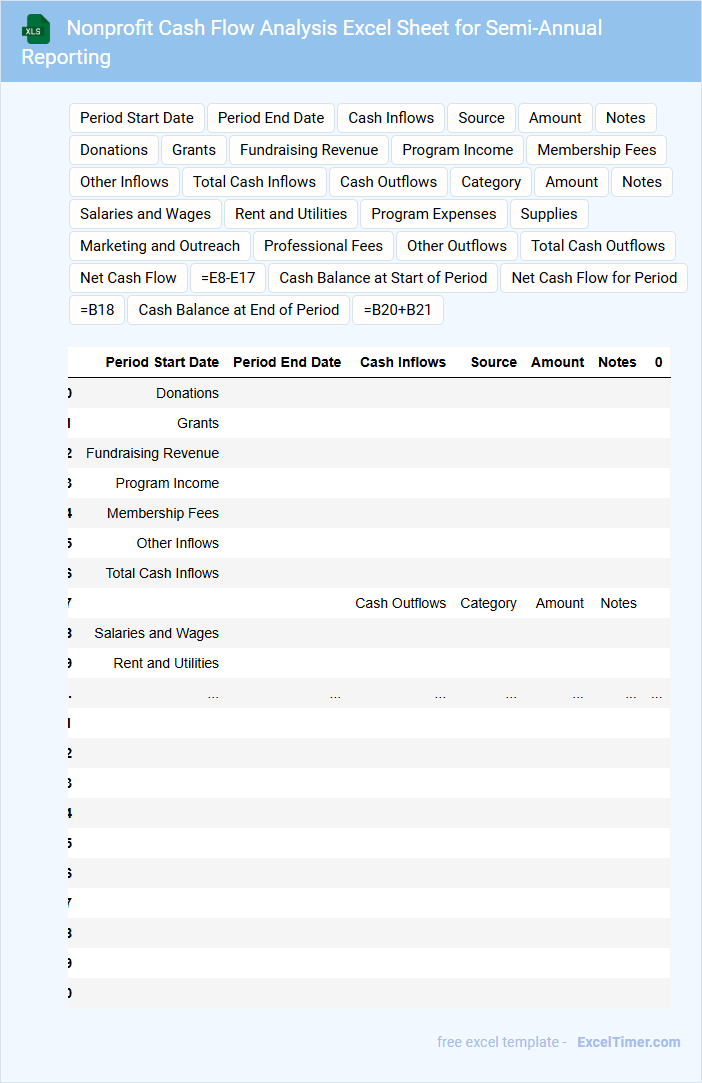

Nonprofit Cash Flow Analysis Excel Sheet for Semi-Annual Reporting

What information is typically included in a nonprofit cash flow analysis Excel sheet for semi-annual reporting? This document usually contains detailed records of cash inflows and outflows over a six-month period to help monitor the organization's financial health. It is designed to provide insights into liquidity, ensuring that the nonprofit can meet its operational needs and plan for future expenses.

What are important aspects to consider when preparing this type of report? Accuracy in categorizing income and expenses is essential, as is updating the sheet regularly to reflect real-time financial activity. Additionally, including projections and notes on significant variances can enhance transparency and support strategic decision-making.

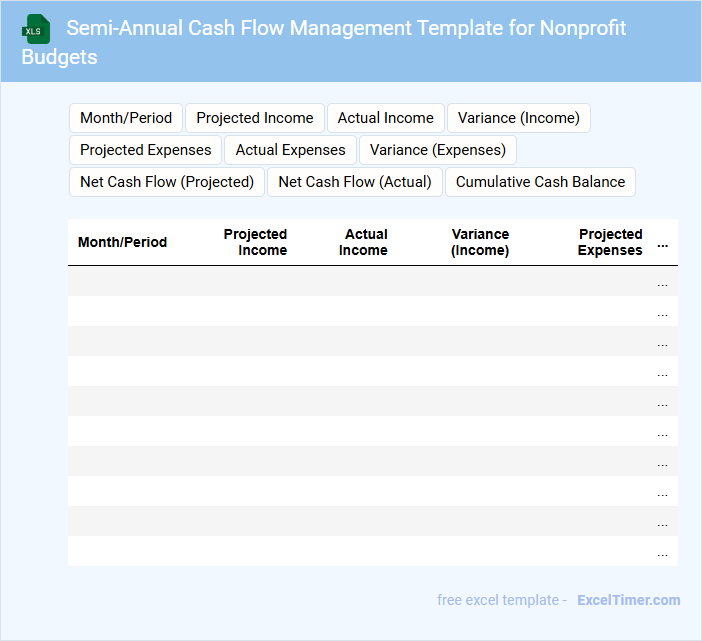

Semi-Annual Cash Flow Management Template for Nonprofit Budgets

What does a Semi-Annual Cash Flow Management Template for Nonprofit Budgets typically contain?

This type of document usually includes detailed records of incoming and outgoing cash flows over a six-month period, helping organizations track financial health and ensure liquidity. It often presents categorized income streams, expense forecasts, and cash balance projections to facilitate effective budget planning and monitoring.

What is an important consideration when using this template?

Accurately updating cash inflows and outflows in a timely manner is crucial to avoid budget shortfalls and maintain operational stability. Additionally, incorporating contingency plans for unexpected expenses can greatly enhance financial resilience within the nonprofit.

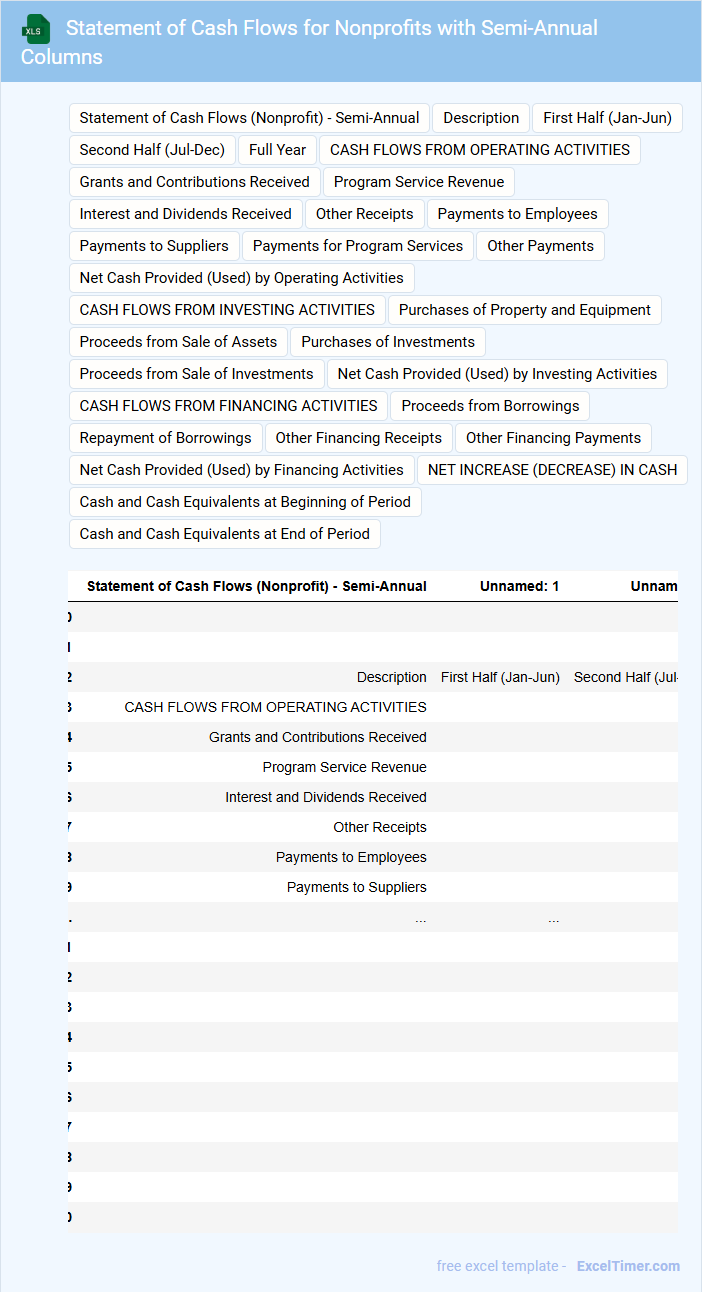

Statement of Cash Flows for Nonprofits with Semi-Annual Columns

What information is typically included in a Statement of Cash Flows for Nonprofits with Semi-Annual Columns? This document usually contains detailed records of cash inflows and outflows categorized by operating, investing, and financing activities over two six-month periods. It helps nonprofits track their cash position and ensure financial sustainability across different parts of the fiscal year.

What is an important consideration when preparing this statement? It is essential to provide clear column labels for each semi-annual period and to reconcile changes in cash with supportive notes explaining significant cash movements. This improves transparency and aids stakeholders in understanding the nonprofit's financial health throughout the year.

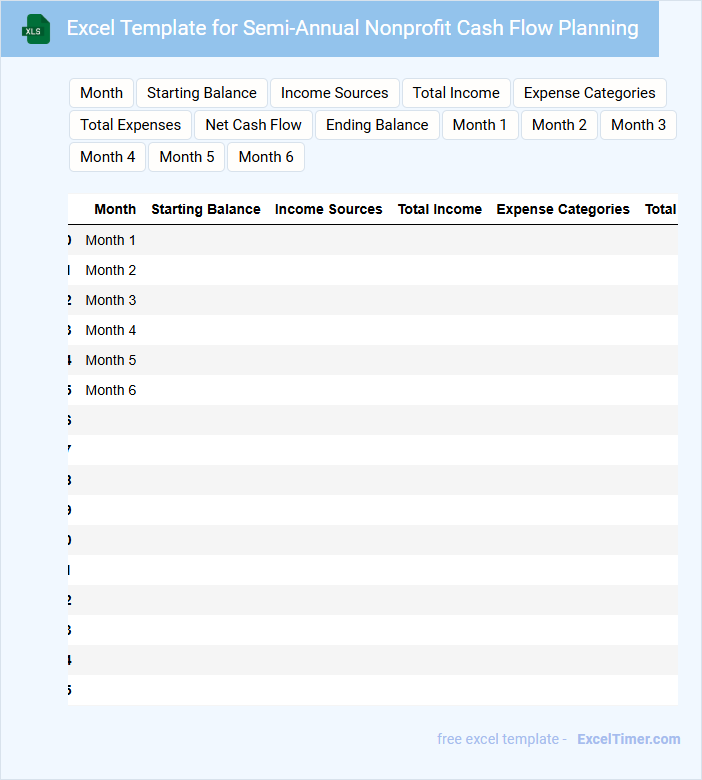

Excel Template for Semi-Annual Nonprofit Cash Flow Planning

An Excel Template for Semi-Annual Nonprofit Cash Flow Planning typically contains detailed sections for income sources, expenses, and timing of cash inflows and outflows over a six-month period. It helps organizations monitor financial health by projecting revenues and expenditures to ensure sufficient liquidity. Key components often include donation forecasts, grant schedules, and planned operational costs.

Important considerations include regularly updating assumptions to reflect actual cash movements, categorizing expenses accurately for transparency, and integrating contingency plans for unexpected financial challenges. Using formulas to automate calculations and visualize data trends can enhance decision-making. Ultimately, this template supports strategic financial management to sustain nonprofit activities effectively.

Nonprofit Semi-Annual Cash Flow Statement with Expense Tracking

A Nonprofit Semi-Annual Cash Flow Statement with Expense Tracking typically contains a detailed report of cash inflows and outflows over six months, emphasizing expense management and financial health.

- Cash Inflows: Documentation of all sources of revenue including donations, grants, and fundraising events.

- Cash Outflows: Detailed tracking of expenses categorized by program, administrative, and fundraising costs.

- Expense Tracking: Continuous monitoring and comparison of actual expenses against budgeted figures to ensure financial accountability.

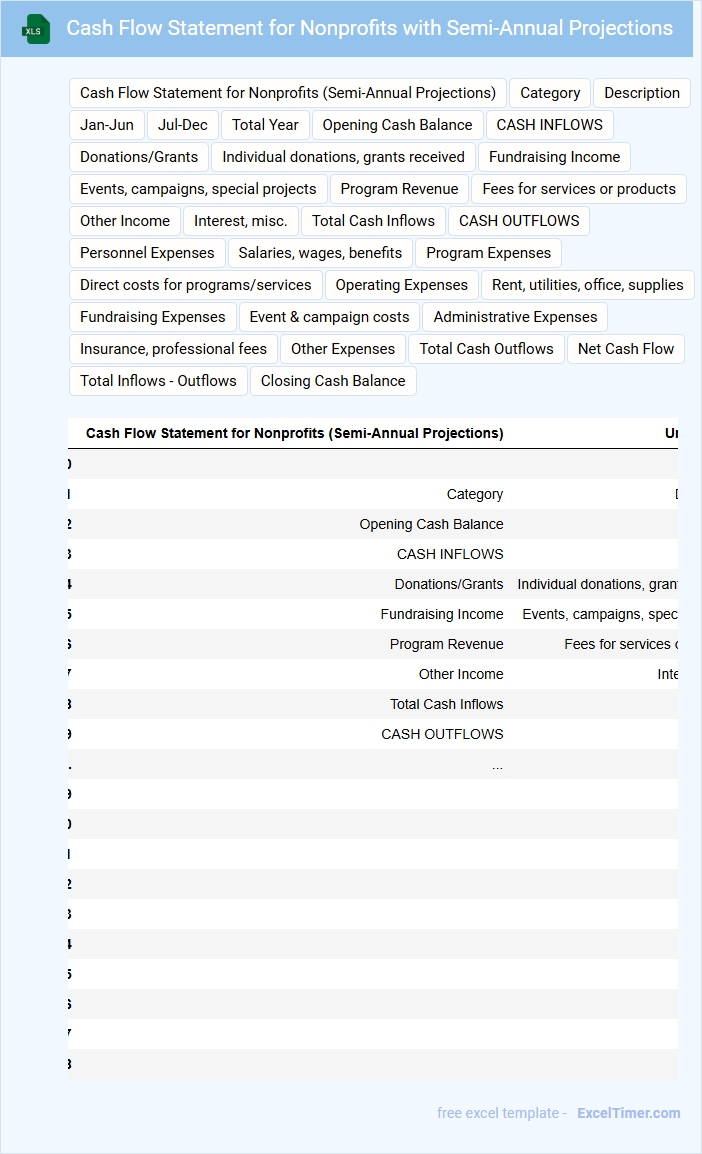

Cash Flow Statement for Nonprofits with Semi-Annual Projections

The Cash Flow Statement for nonprofits provides a detailed overview of how cash is generated and spent within the organization, ensuring transparency and fiscal responsibility. It typically includes actual cash inflows and outflows, as well as semi-annual projections to anticipate future liquidity needs. This document helps stakeholders gauge the nonprofit's financial health and plan for sustainable operations.

Semi-Annual Statement of Cash Flow for Grants and Donations

The Semi-Annual Statement of Cash Flow for Grants and Donations typically details the cash inflows and outflows associated with these funds over a six-month period. It provides transparency on how received grants and donations are spent, ensuring accountability.

Key components include tracking receipts, expenditures, and any balance rollovers. An important suggestion is maintaining clear documentation to support each transaction and ensure compliance with grant conditions.

Excel Cash Flow Tracker with Semi-Annual Tabs for Nonprofits

An Excel Cash Flow Tracker for nonprofits is a financial document designed to monitor inflows and outflows over specified periods, often organized into semi-annual tabs for clarity. It typically contains detailed sections for income sources, expenses, and net cash flow to ensure accurate fiscal management. For effective use, it's important to regularly update the tracker and reconcile it with bank statements to maintain transparency and accountability.

Nonprofit Operating Cash Flow Statement for Semi-Annual Reporting

A Nonprofit Operating Cash Flow Statement for Semi-Annual Reporting summarizes the cash inflows and outflows related to the organization's core operational activities over a six-month period. It provides stakeholders with clear insights into the organization's liquidity and financial health during that timeframe.

- Include detailed breakdowns of cash received from donations, grants, and program service revenues.

- Clearly report cash payments for operational expenses such as salaries, utilities, and program costs.

- Ensure reconciliation with the organization's overall financial statements for accuracy and transparency.

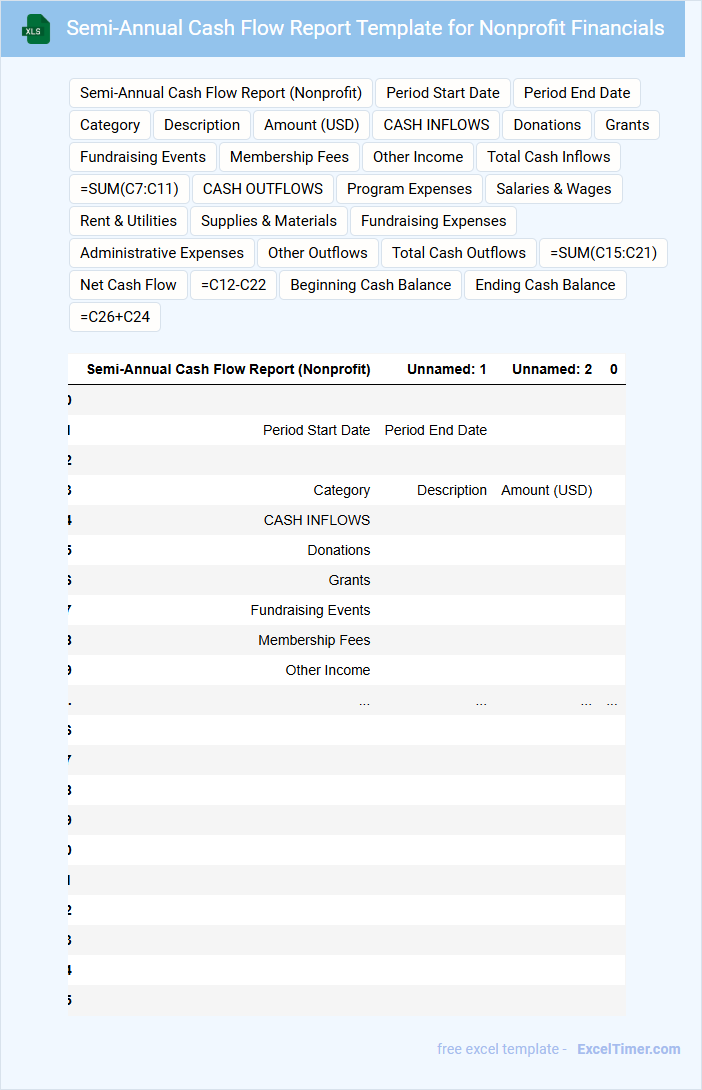

Semi-Annual Cash Flow Report Template for Nonprofit Financials

The Semi-Annual Cash Flow Report Template for nonprofit financials is designed to provide a clear overview of the organization's cash inflows and outflows over a six-month period. It typically contains sections for operating activities, investing activities, and financing activities, reflecting the organization's financial health. Including important details like a summary of major donations, grant receipts, and significant expenses ensures transparency and aids in strategic planning.

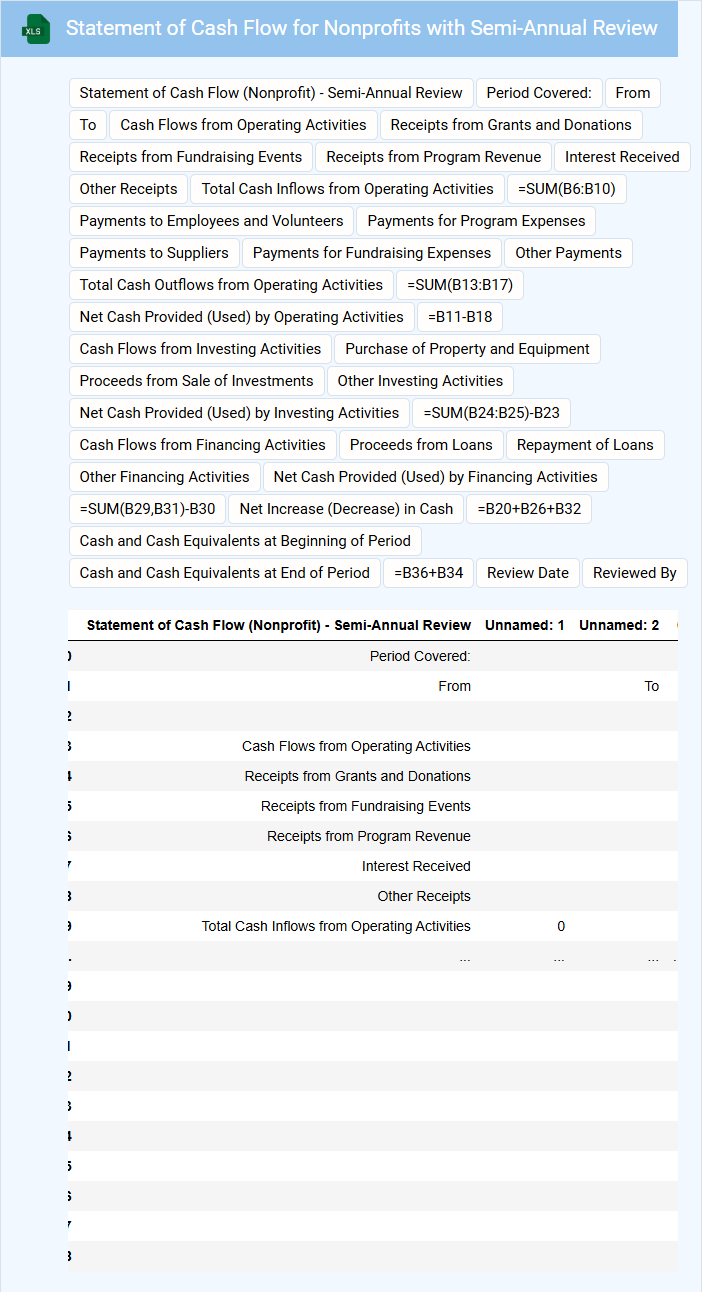

Statement of Cash Flow for Nonprofits with Semi-Annual Review

The Statement of Cash Flow for Nonprofits with Semi-Annual Review typically contains an overview of cash inflows and outflows to ensure financial transparency and sustainability.

- Cash Operating Activities: Details the cash generated or used in the core nonprofit operations.

- Investing Activities: Outlines cash spent on or received from long-term assets and investments.

- Financing Activities: Shows cash flow related to loans, grants, and fundraising efforts.

What are the key components included in a semi-annual cash flow statement for nonprofits?

A semi-annual cash flow statement for nonprofits includes cash inflows from donations, grants, and fundraising activities, alongside cash outflows related to program expenses, administrative costs, and capital expenditures. It captures operating, investing, and financing activities over a six-month period to provide a clear picture of liquidity and financial health. Accurate tracking of restricted and unrestricted funds ensures compliance with donor requirements and effective resource allocation.

How are restricted and unrestricted funds reported in a semi-annual nonprofit cash flow statement?

In a semi-annual nonprofit cash flow statement, restricted funds are reported separately from unrestricted funds to highlight donor-imposed limitations. Restricted cash flows detail transactions related to specific purposes or timeframes, while unrestricted funds represent resources available for general operations. This distinction ensures transparency and accurate tracking of fund usage within the reporting period.

What methods can be used to categorize cash inflows and outflows (e.g., operating, investing, financing) in a nonprofit context?

Your Semi-annually Cash Flow Statement for Nonprofits categorizes cash inflows and outflows into operating, investing, and financing activities based on nonprofit financial standards. Operating activities include donations, grants, and program service revenue, while investing activities cover asset purchases and sales. Financing activities reflect loans, capital contributions, and repayments specific to nonprofit funding sources.

How does a semi-annual cash flow statement support strategic planning and budgeting for nonprofit organizations?

A semi-annual cash flow statement provides nonprofit organizations with timely insights into their financial inflows and outflows over six-month periods, enabling accurate tracking of funding and expenses. This data supports strategic planning by highlighting cash availability for program investments and operational costs. It also enhances budgeting precision by identifying trends and anticipating resource needs, ensuring financial sustainability and effective mission delivery.

What are common challenges in preparing accurate semi-annual cash flow statements for nonprofits?

Common challenges in preparing accurate semi-annual cash flow statements for nonprofits include tracking irregular donation schedules, managing restricted funds, and timing discrepancies between income and expenses. Ensuring compliance with accounting standards for nonprofit organizations is crucial to maintain transparency and accountability. Your cash flow statement must accurately reflect these factors to support effective financial planning and reporting.