The Weekly Budget Planner Excel Template for Students helps manage expenses and track income efficiently, ensuring financial discipline throughout the week. Its user-friendly design allows students to categorize expenses, set spending limits, and monitor savings goals effectively. This template is essential for maintaining control over personal finances and avoiding unnecessary debt.

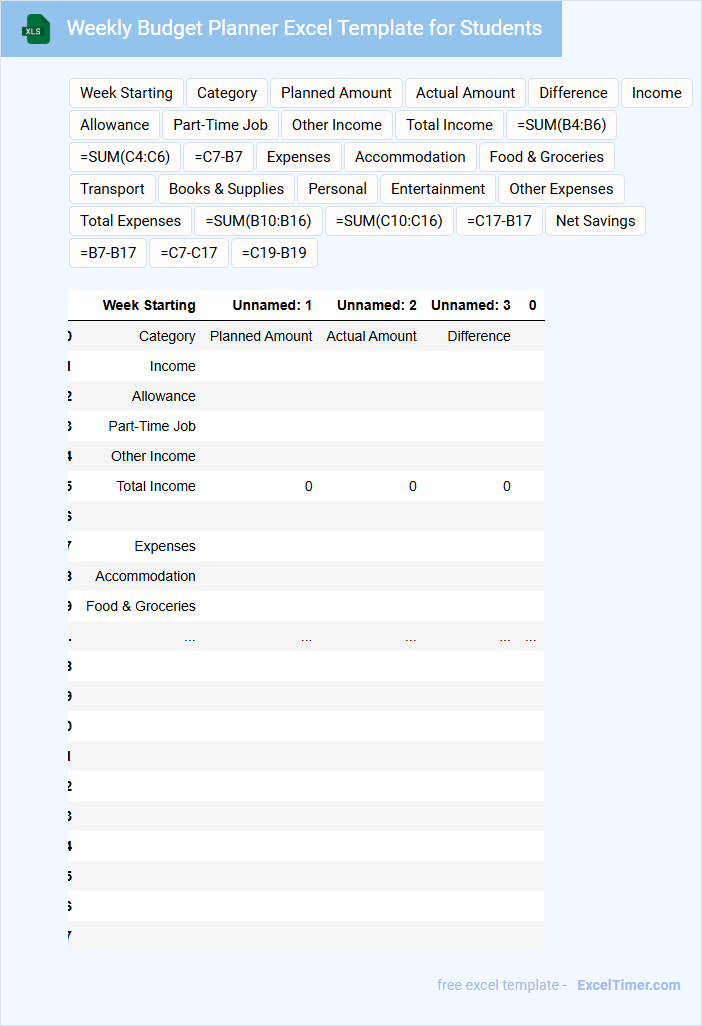

Weekly Budget Planner Excel Template for Students

A Weekly Budget Planner Excel Template for Students is a document designed to help manage and track weekly income and expenses efficiently.

- Income tracking: Record all sources of weekly income such as allowances, part-time job earnings, or scholarships.

- Expense categorization: Organize spending into categories like food, transportation, and supplies to identify areas to save.

- Savings goals: Set specific weekly savings targets to build financial discipline and prepare for future needs.

Simple Weekly Budget Tracker for College Students

A Simple Weekly Budget Tracker for College Students typically contains an organized overview of income, expenses, and savings to help manage finances effectively.

- Income sources: Record all streams of money received during the week, such as part-time jobs or allowances.

- Expense categories: Track spending on essentials like food, transportation, and school supplies.

- Savings goals: Set clear targets for saving money to build financial discipline and handle emergencies.

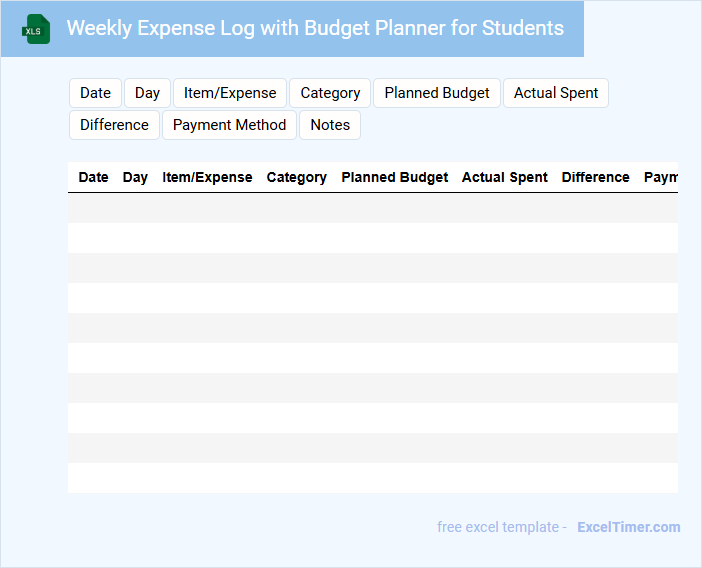

Weekly Expense Log with Budget Planner for Students

What is typically included in a Weekly Expense Log with Budget Planner for Students? This type of document usually contains categories for tracking daily expenses, income sources, and allocated budgets for different needs such as food, transportation, and entertainment. It also includes summary sections to compare actual spending versus planned budgets, helping students manage their finances effectively and avoid overspending.

Why is it important for students to maintain a Weekly Expense Log with Budget Planner? Keeping a detailed record encourages mindful spending habits and aids in identifying unnecessary expenses. Additionally, it promotes financial discipline, enabling students to plan for future expenses and save money more efficiently.

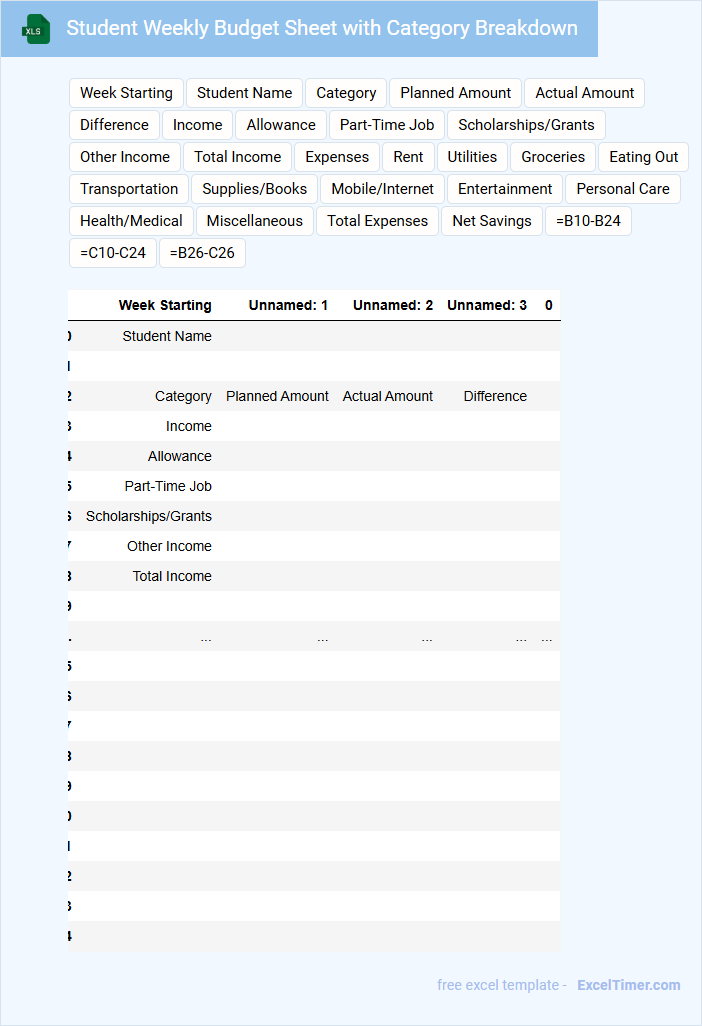

Student Weekly Budget Sheet with Category Breakdown

Student Weekly Budget Sheets with Category Breakdown typically contain an organized record of income and expenses categorized to help students manage their finances effectively.

- Income Tracking: Documenting all sources of weekly income to maintain an accurate overview of available funds.

- Expense Categorization: Breaking down expenses into categories such as food, transportation, and entertainment for detailed analysis.

- Budget Comparison: Comparing planned budgets against actual spending to identify areas for improvement and savings.

Weekly Budget Tracker for University Students

A Weekly Budget Tracker for University Students is a document designed to help students monitor and manage their weekly expenses effectively. It typically includes categories for income, spending, and savings to promote financial responsibility.

- Track all sources of income including scholarships, part-time jobs, and allowances.

- Record daily expenses such as food, transportation, and entertainment.

- Set weekly savings goals to build financial discipline and emergency funds.

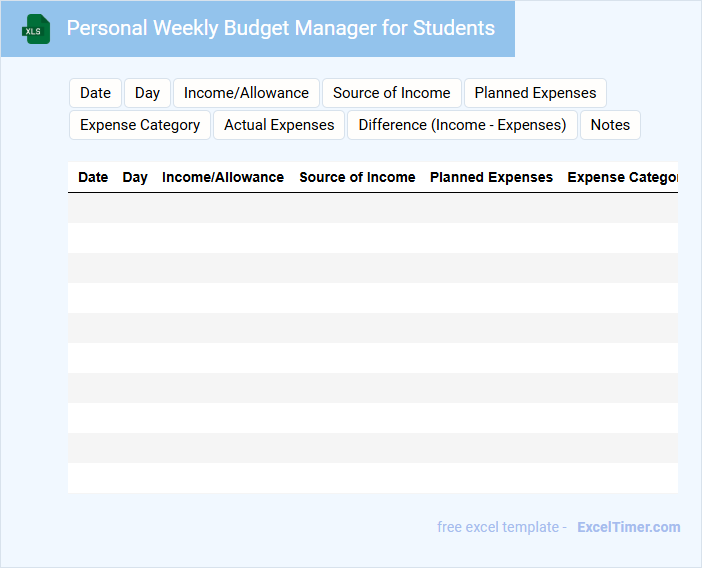

Personal Weekly Budget Manager for Students

A Personal Weekly Budget Manager for Students is a document designed to track and manage weekly income and expenses efficiently. It helps students maintain financial discipline and plan their spending wisely.

- Include categories for income, fixed expenses, and variable expenses to organize finances clearly.

- Track weekly spending to identify patterns and adjust budget allocations accordingly.

- Set financial goals and savings targets to encourage responsible money management.

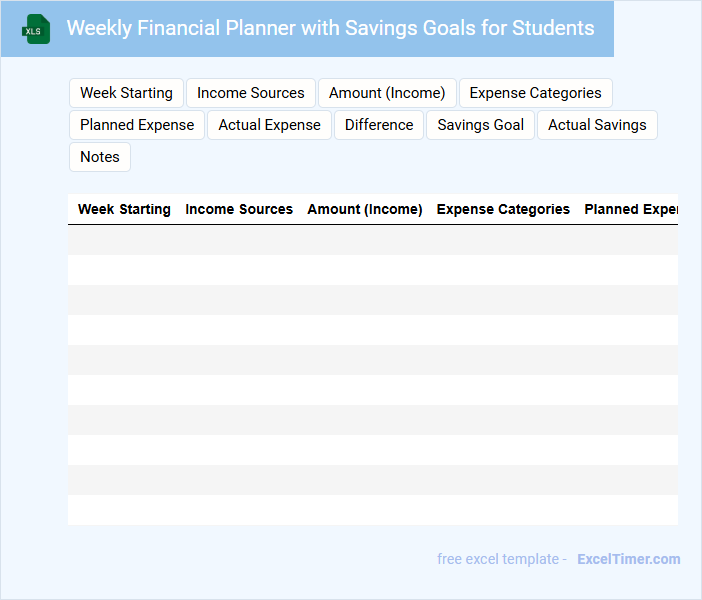

Weekly Financial Planner with Savings Goals for Students

A Weekly Financial Planner with savings goals for students typically contains a detailed breakdown of income, expenses, and saving targets for each week. It helps students monitor their spending habits and allocate funds towards essential needs and future savings effectively. Including sections for tracking weekly progress and adjusting goals is crucial for maintaining financial discipline.

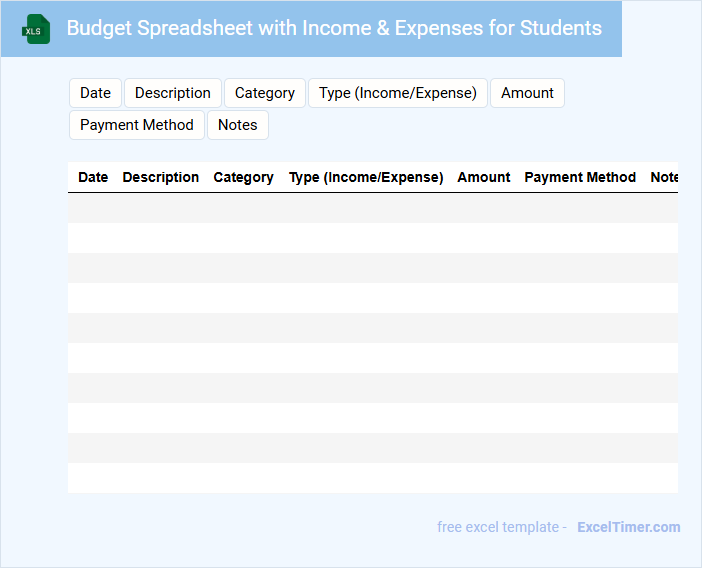

Budget Spreadsheet with Income & Expenses for Students

A Budget Spreadsheet with Income & Expenses for Students typically contains detailed tracking of earnings and expenditures to help manage finances effectively. It allows students to monitor their financial inflows and outflows to avoid overspending and save money.

- Include columns for income sources such as scholarships, part-time jobs, and allowances.

- List expense categories like tuition, books, food, transportation, and entertainment.

- Use formulas to automatically calculate totals and remaining balances for better budget control.

Weekly Allowance Tracker for Students with Charts

What information does a Weekly Allowance Tracker for Students with Charts usually contain? This type of document typically includes detailed records of weekly allowance amounts received and spent by students, accompanied by visual charts that illustrate spending patterns and savings over time. It helps students understand their financial habits by providing an organized and clear summary of their income and expenditures.

What important features should be included in this tracker? Key elements to consider are accurate date entries, categories for different spending types, and easy-to-read charts such as bar graphs or pie charts to show allowance distribution. Including tips for budgeting and goals for saving can further encourage responsible money management for students.

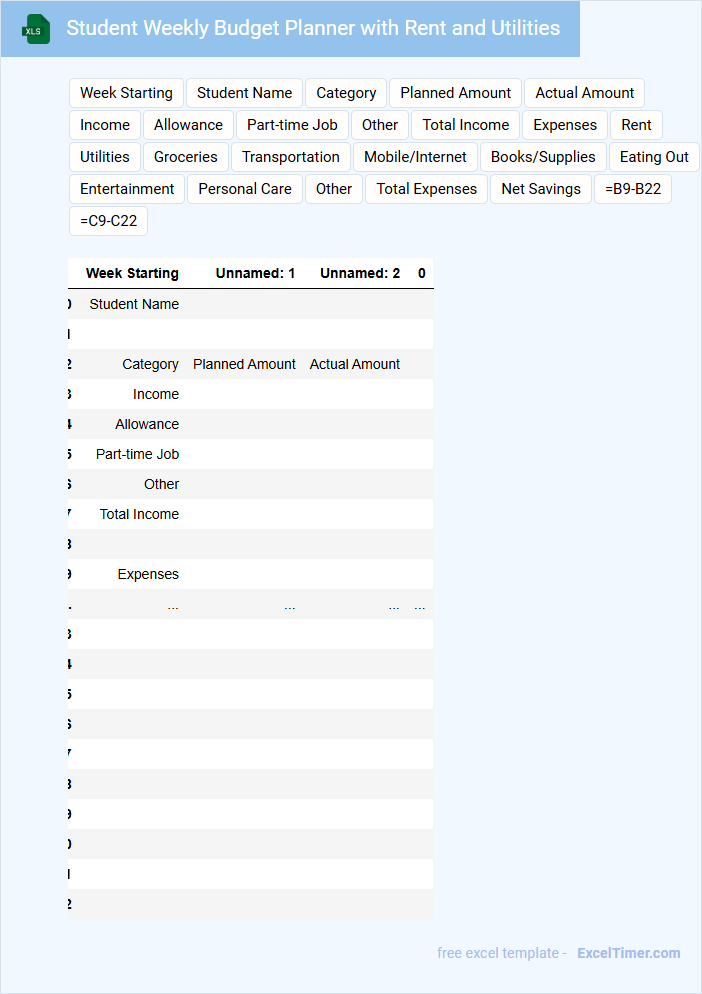

Student Weekly Budget Planner with Rent and Utilities

A Student Weekly Budget Planner is a document designed to help students manage their finances efficiently by tracking income and expenses on a weekly basis. It typically contains sections for rent, utilities, groceries, transportation, and personal expenses. Including these categories ensures students stay within their budget while covering essential living costs.

Weekly Spending Tracker with Comparison for Students

A Weekly Spending Tracker for students typically contains detailed records of daily expenses, categorized by types such as food, transportation, and entertainment. It also includes a weekly summary that helps visualize spending patterns and manage budgets effectively.

This document often features a comparison section, allowing students to evaluate their current week's spending against previous weeks to identify trends or areas for improvement. Including tips on setting financial goals and reminders to review spending habits can enhance its usefulness.

Budgeting Worksheet for Weekly Student Expenses

What is typically included in a Budgeting Worksheet for Weekly Student Expenses? This document usually contains categories of common student expenses such as food, transportation, study materials, and entertainment. It helps students track their spending and plan their budget effectively to avoid overspending.

Why is it important to use a Budgeting Worksheet for Weekly Student Expenses? Keeping a detailed record allows students to identify spending patterns and adjust their habits accordingly. Prioritizing essential expenses and setting limits on discretionary spending are key steps to maintaining financial stability.

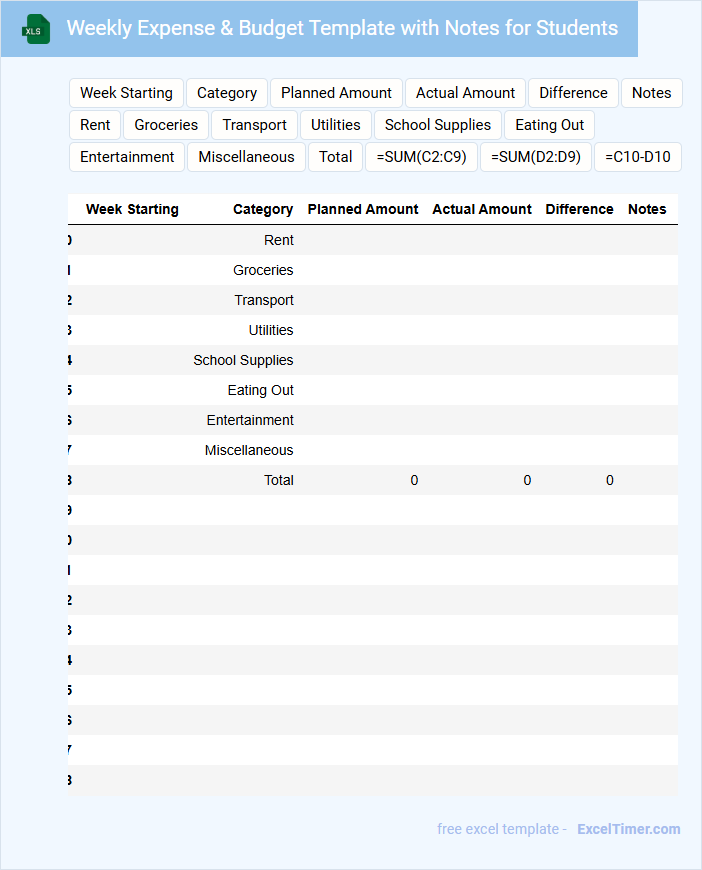

Weekly Expense & Budget Template with Notes for Students

The Weekly Expense & Budget Template for students is designed to track daily spending and manage finances efficiently. This document typically contains sections for income sources, categorized expenses, and savings goals to help students maintain a balanced budget. Including a notes area allows for additional reminders or financial observations throughout the week.

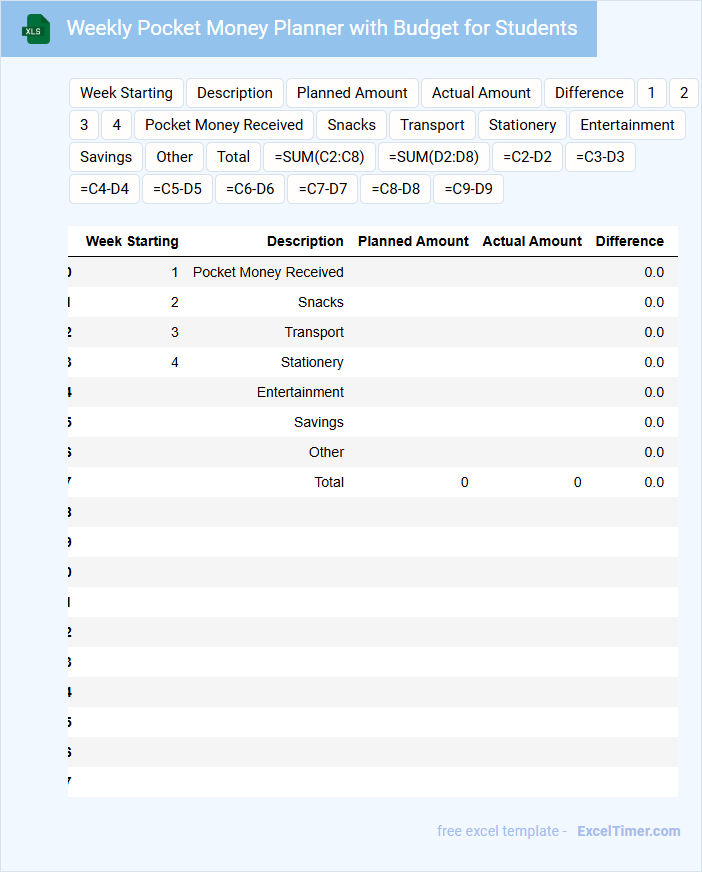

Weekly Pocket Money Planner with Budget for Students

What does a Weekly Pocket Money Planner with Budget for Students typically contain? This type of document usually includes sections for tracking income, categorizing expenses, and setting weekly spending limits. It is designed to help students manage their finances effectively by promoting budgeting skills and financial awareness.

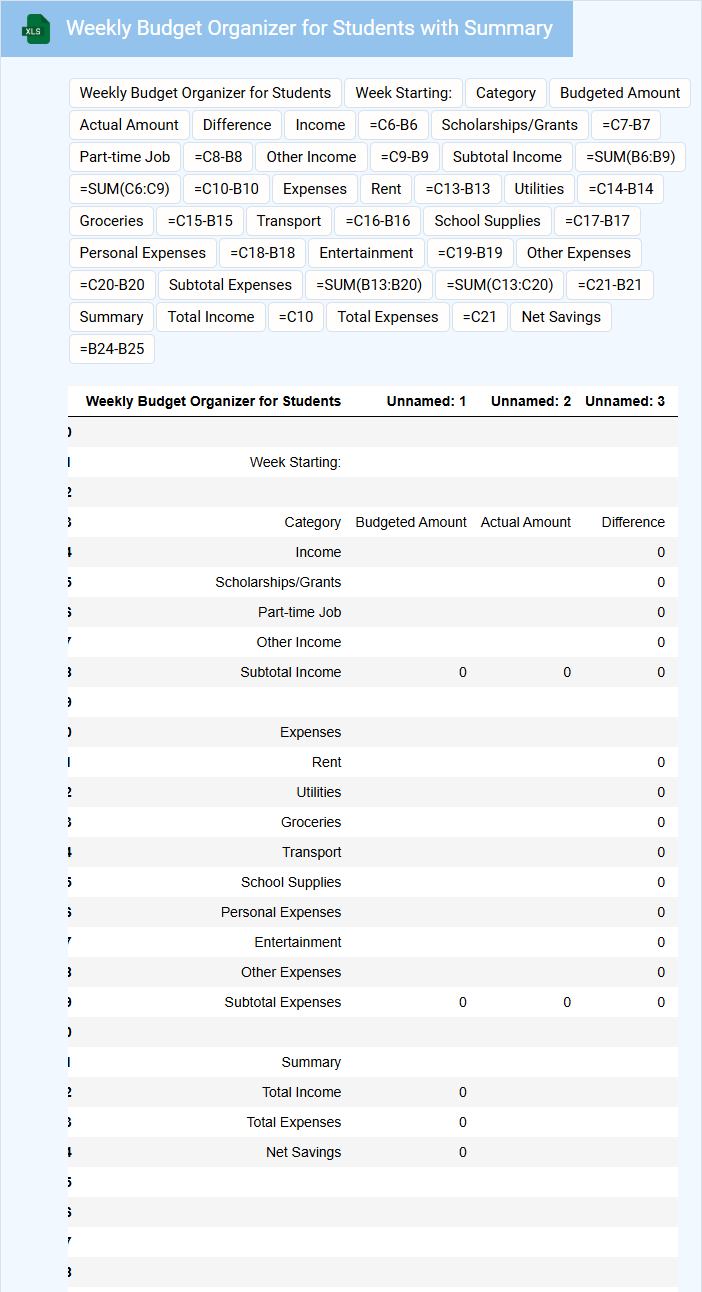

Weekly Budget Organizer for Students with Summary

A Weekly Budget Organizer for Students with Summary is a document designed to track weekly income and expenses, helping students manage their finances effectively. It typically summarizes spending patterns to provide clear insights into financial habits.

- Include sections for income sources, fixed expenses, and variable expenses.

- Add a summary area highlighting total spending, savings, and budget variances.

- Incorporate space for notes or financial goals to encourage mindful money management.

What essential categories should be included in a student's weekly budget planner (e.g., food, transport, study materials, entertainment)?

A student's weekly budget planner should include essential categories such as food, transport, study materials, accommodation, utilities, and entertainment. Tracking expenses under these categories helps manage finances effectively and avoid overspending. Including savings or emergency funds in the planner supports financial stability and future preparedness.

How can students effectively track and update their actual versus planned expenses in Excel?

You can effectively track and update your actual versus planned expenses in Excel by setting up separate columns for budgeted amounts and actual expenditures. Use formulas like SUM and IF to automatically calculate differences and highlight overspending with conditional formatting. Regularly updating these fields allows clear, real-time monitoring of your weekly budget performance.

What formulas or functions can automate the calculation of weekly balances and highlight overspending?

Use the SUM function to total weekly expenses and subtract this from the allocated budget for automatic balance calculation. Apply the IF function to compare expenses against the budget, highlighting overspending by returning alert text or conditional formatting triggers. Employ Conditional Formatting to dynamically color-code cells when expenses exceed the set budget limit, providing clear visual alerts for overspending.

How should recurring income sources and irregular expenses be handled in the weekly budget layout?

In the Weekly Budget Planner for Students, recurring income sources should be entered as fixed amounts in the income section to ensure consistent tracking. Irregular expenses must be estimated based on past data and allocated within specific weeks to maintain accurate cash flow management. Your planner will help you balance steady income with variable costs, promoting better financial control.

What visual tools (e.g., conditional formatting, charts) can help students quickly analyze their spending habits in Excel?

Conditional formatting highlights overspending by marking budget categories in red, helping you easily identify areas to improve. Interactive pie charts visually break down expenses by category, offering clear insights into spending distribution. Data bars provide a quick comparison of weekly expenses, making it simple to track trends over time.