The Weekly Cash Flow Excel Template for Nonprofits helps organizations track and manage their income and expenses on a weekly basis, ensuring financial stability. This template provides clear visualizations of cash inflows and outflows, enabling efficient budgeting and forecasting. Nonprofits can use it to maintain transparency and make informed decisions about resource allocation.

Weekly Cash Flow Tracker for Nonprofits

What information does a Weekly Cash Flow Tracker for Nonprofits typically contain? This document records the inflows and outflows of cash within a nonprofit organization on a weekly basis, helping to monitor financial health. It usually includes sections for tracking donations, grants, expenses, and other cash transactions to ensure accurate budgeting and planning.

Why is it important to include detailed categories and regularly update this tracker? Detailed categorization allows nonprofits to identify specific sources of income and areas of expenditure, improving financial transparency and accountability. Regular updates ensure timely detection of cash shortages or surpluses, aiding in making informed operational decisions and maintaining fiscal responsibility.

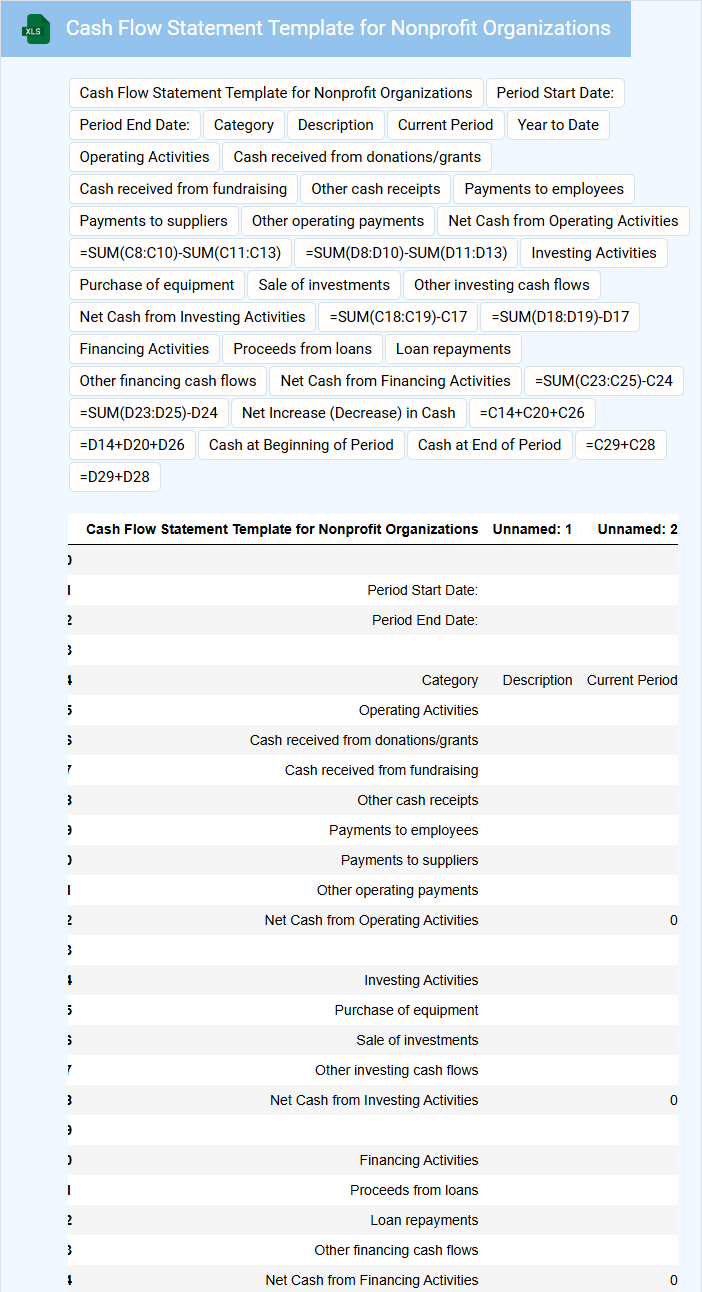

Cash Flow Statement Template for Nonprofit Organizations

The Cash Flow Statement Template for nonprofit organizations typically contains sections detailing cash inflows, outflows, and net cash changes over a specific period. It helps track operational, financing, and investing activities to maintain financial transparency.

Including accurate categorization of funding sources and expenses is a critical aspect of the template. Ensure the template facilitates clear monitoring of unrestricted and restricted funds to support strategic financial planning.

Weekly Cash Flow Projection Excel for Nonprofits

A Weekly Cash Flow Projection Excel document for nonprofits typically contains detailed records of expected income and expenses on a weekly basis. It helps organizations anticipate cash shortages and surpluses, ensuring financial stability throughout the month. Key components often include grant disbursements, donation forecasts, operational costs, and timing of payments.

To optimize its usefulness, it is important to regularly update actual cash flows against projections to identify and address discrepancies promptly. Including separate categories for restricted and unrestricted funds can improve accuracy in budget planning and reporting. Additionally, incorporating visual charts can enhance clarity for stakeholders reviewing financial health.

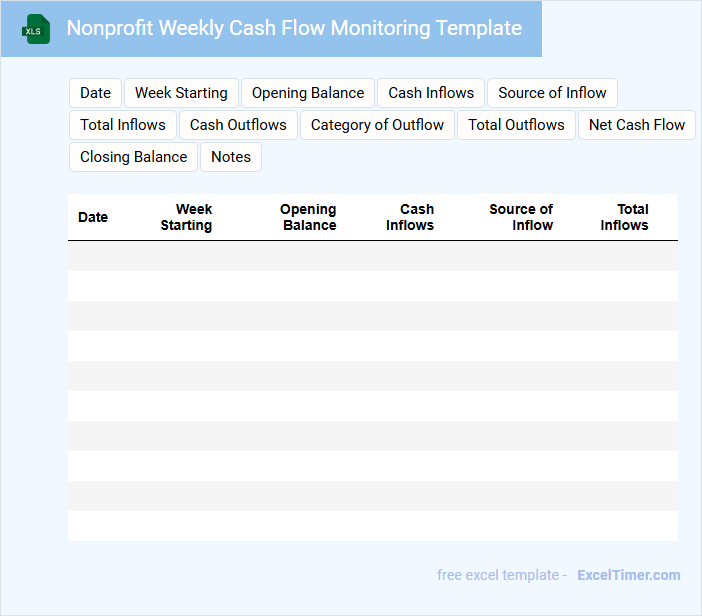

Nonprofit Weekly Cash Flow Monitoring Template

What information is typically included in a Nonprofit Weekly Cash Flow Monitoring Template? This document usually contains detailed tracking of incoming funds, outgoing expenses, and the resulting cash balance on a weekly basis. It helps nonprofits maintain financial stability by providing a clear view of cash flow trends and upcoming financial obligations.

What is an important aspect to consider when using this template? Ensuring accurate and timely data entry is crucial to reflect the true financial health of the organization. Additionally, regularly reviewing the template can help identify potential cash shortages early and support informed decision-making.

Excel Budget and Cash Flow Sheet for Nonprofits

An Excel Budget and Cash Flow Sheet for nonprofits typically contains detailed financial data including projected income, expenses, and cash inflows and outflows. It helps organizations monitor their financial health and ensure funds are allocated efficiently.

Important elements include tracking funding sources, categorizing expenses, and forecasting future cash flow to maintain sustainability. Regular updates and accuracy are crucial for effective financial planning and reporting.

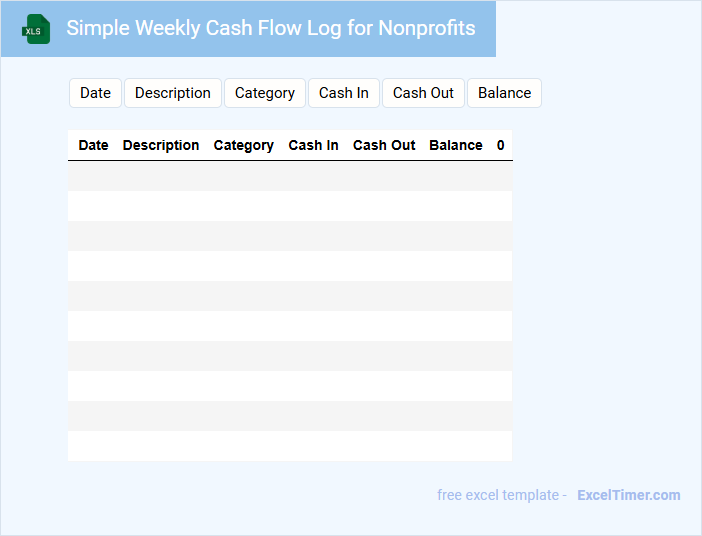

Simple Weekly Cash Flow Log for Nonprofits

A Simple Weekly Cash Flow Log for nonprofits typically contains records of all income and expenses within a week, tracking the organization's financial health. It includes dates, descriptions, amounts received, and amounts paid out, providing a clear snapshot of cash inflows and outflows. Maintaining this log helps ensure transparency and timely financial decision-making within the nonprofit.

Essential elements to include are accurate date entries, clear categorization of transactions, and a running balance to monitor liquidity throughout the week. It's important to regularly update the log to avoid errors and facilitate quick budget adjustments. Ensuring this log is straightforward yet comprehensive supports effective financial management and accountability for nonprofit organizations.

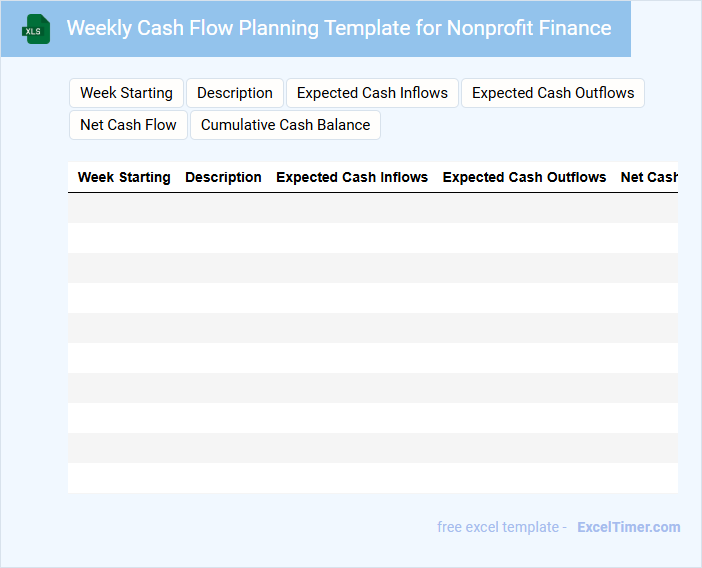

Weekly Cash Flow Planning Template for Nonprofit Finance

What information is typically included in a Weekly Cash Flow Planning Template for Nonprofit Finance? This document usually contains detailed projections of expected cash inflows and outflows over a one-week period, helping nonprofits manage their liquidity effectively. It tracks income from donations, grants, and other sources, as well as expenses like payroll, rent, and program costs.

What are the important considerations when using this template? It is crucial to update it regularly to reflect actual cash movements and forecasted changes, ensuring accurate financial planning. Additionally, incorporating contingency plans for unexpected expenses can help maintain financial stability and support sustainable nonprofit operations.

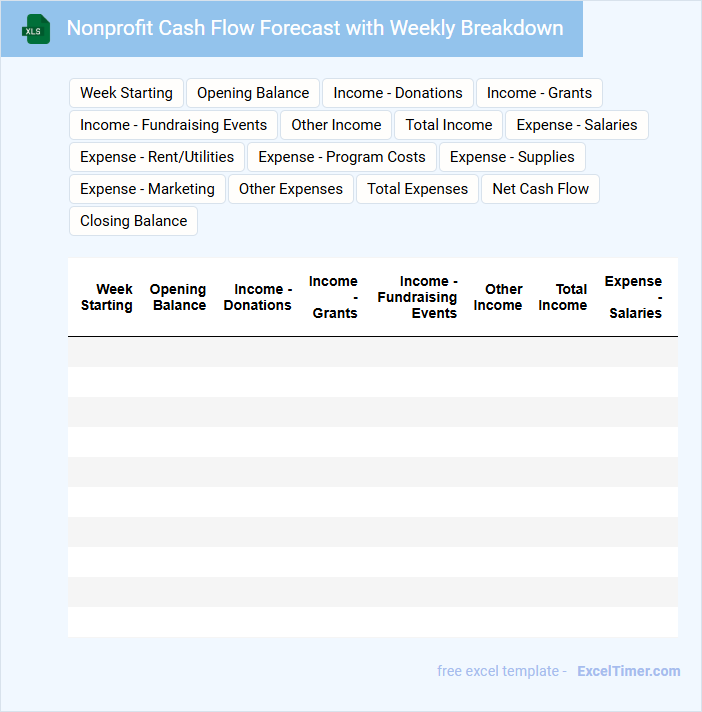

Nonprofit Cash Flow Forecast with Weekly Breakdown

What information does a Nonprofit Cash Flow Forecast with Weekly Breakdown typically contain? This document usually includes detailed projections of weekly incoming funds and outgoing expenses, which help nonprofits monitor their financial health closely. It provides a clear timeline of cash availability to ensure operational stability and timely decisions for fundraising and expenditures.

What is an important consideration when creating this forecast? Accurately estimating irregular income sources such as donations and grants on a week-by-week basis is crucial, as it directly impacts sustainability planning. Additionally, keeping track of recurring expenses and potential fluctuations in cash flow allows the organization to prepare for lean periods effectively.

Excel Cash Flow Register for Nonprofit Operations

An Excel Cash Flow Register for Nonprofit Operations typically contains detailed records of all income and expenses to track the organization's financial health. It includes categories such as donations, grants, operational costs, and program expenses, allowing for transparency and accountability. Key features often involve date, description, amount, and running balance to manage cash flows efficiently.

For nonprofits, it is essential to regularly update this register to ensure accurate budgeting and financial planning. Including separate columns for restricted and unrestricted funds helps maintain clarity on fund usage. Additionally, integrating clear notes or memos for each transaction aids in audit readiness and donor reporting.

Weekly Income and Expense Tracker for Nonprofits

A Weekly Income and Expense Tracker for nonprofits is designed to monitor financial inflows and outflows on a weekly basis, ensuring transparent and accurate accounting. It helps organizations maintain a clear overview of their financial health by categorizing donations, grants, and other income sources alongside operational expenses.

Such a document is essential for nonprofit budgeting and financial planning, aiding in cash flow management and fund allocation. Consistently updating this tracker supports compliance with financial reporting requirements and improves stakeholder trust.

Important elements to include are date, income source, expense category, amounts, and running balances to facilitate detailed analysis and decision-making.

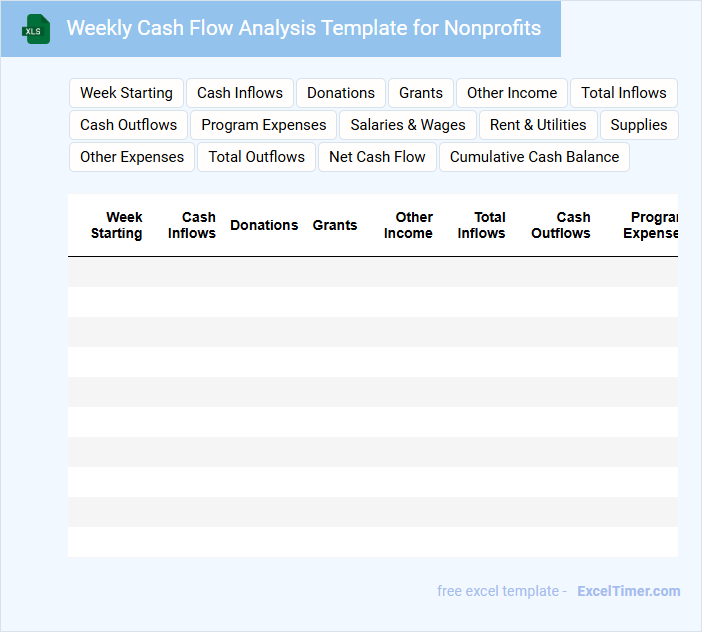

Weekly Cash Flow Analysis Template for Nonprofits

The Weekly Cash Flow Analysis Template for nonprofits is designed to track the inflow and outflow of cash on a weekly basis, helping organizations maintain financial stability. It typically includes sections for recording donations, grants, operational expenses, and other income sources.

Accurate cash flow forecasting allows nonprofits to anticipate shortfalls and plan for upcoming expenditures effectively. It is important to regularly update the template to ensure timely decisions and maintain transparency with stakeholders.

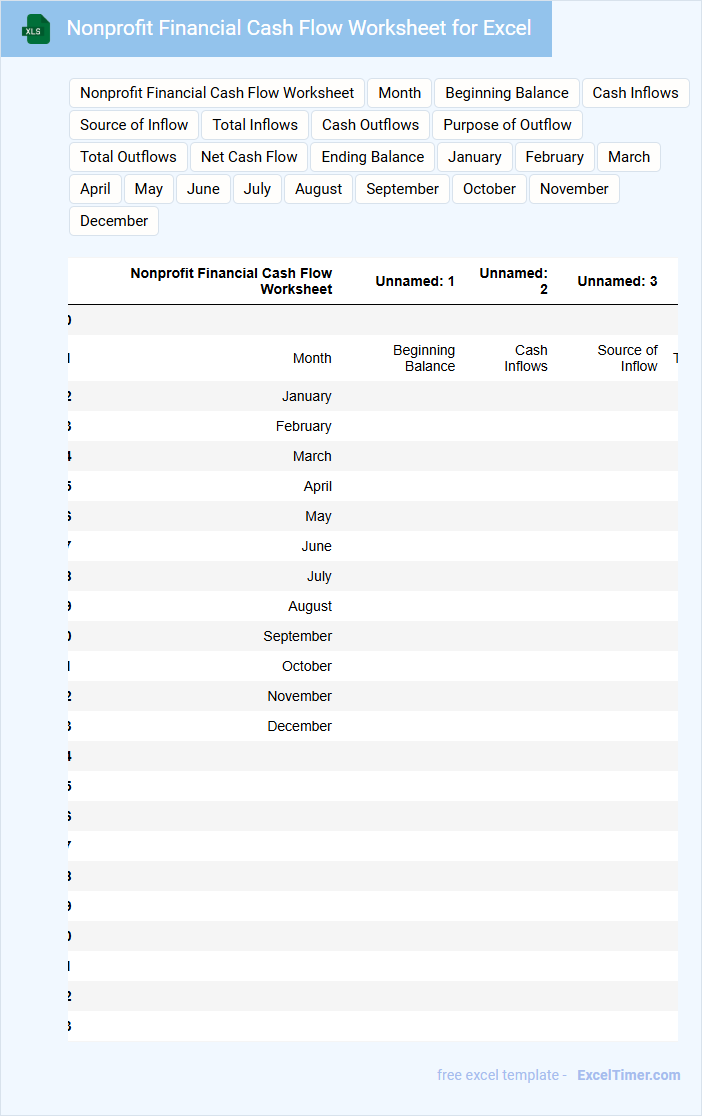

Nonprofit Financial Cash Flow Worksheet for Excel

A Nonprofit Financial Cash Flow Worksheet in Excel is a vital tool used to track the inflow and outflow of cash within a nonprofit organization. This document typically contains detailed records of income sources, expenses, and net cash flow to ensure financial stability. Proper use of this worksheet helps nonprofits maintain transparency and support effective budgeting.

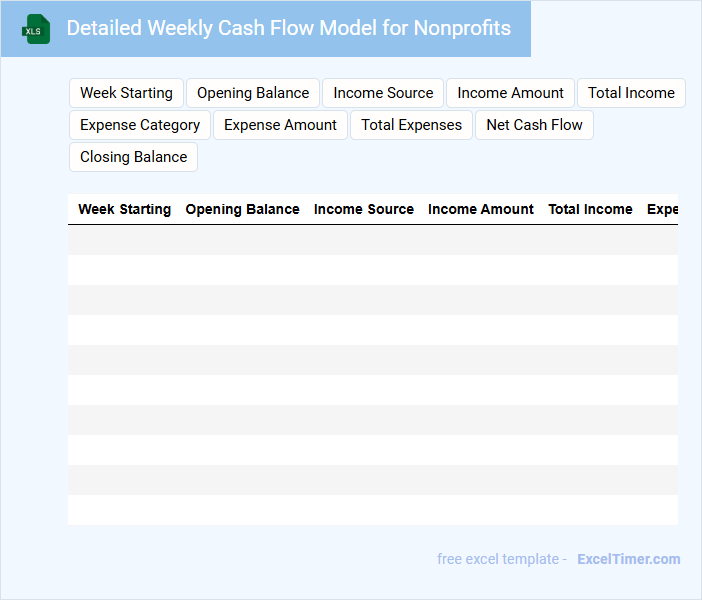

Detailed Weekly Cash Flow Model for Nonprofits

What does a Detailed Weekly Cash Flow Model for Nonprofits typically contain? This document usually includes weekly projections of cash inflows and outflows, tracking donations, grants, operational expenses, and program costs to ensure financial stability. It helps nonprofit organizations forecast liquidity, plan resource allocation, and identify potential funding gaps early in the planning cycle.

What is an important consideration when creating this model? Ensuring accuracy in estimating both predictable and variable income streams, as well as timely updating of actual cash movements against projections, is critical to maintaining the model's relevance and usefulness for decision-making. Additionally, incorporating scenario analysis can help nonprofits prepare for unexpected financial challenges.

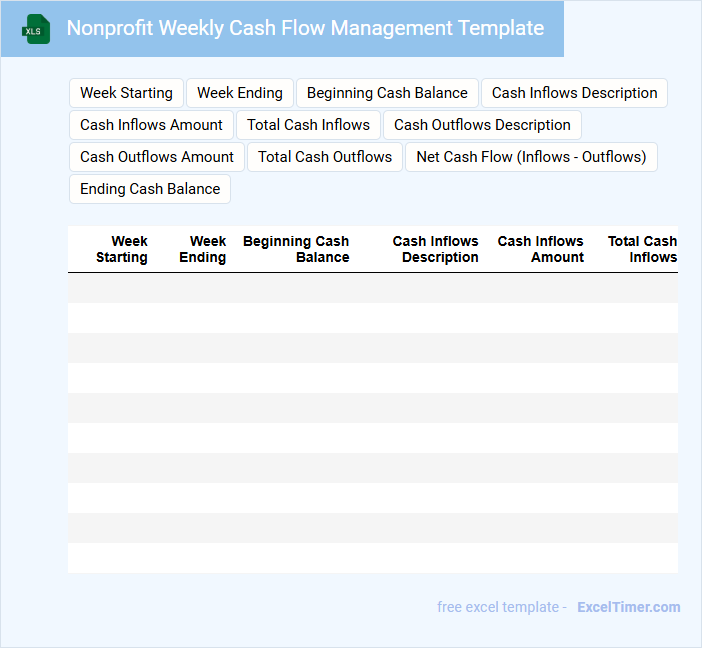

Nonprofit Weekly Cash Flow Management Template

A Nonprofit Weekly Cash Flow Management Template typically contains sections for tracking incoming funds, outgoing expenses, and the net cash balance on a weekly basis. It helps organizations monitor financial liquidity and ensure they have sufficient cash to meet operational needs. Regular use of this template supports timely decision-making and effective budget control.

Key elements to include are anticipated donations, grant disbursements, payroll costs, and any recurring expenses. It is important to update the template consistently and reconcile it with bank statements. Additionally, highlighting any cash shortfalls early can help proactive financial planning.

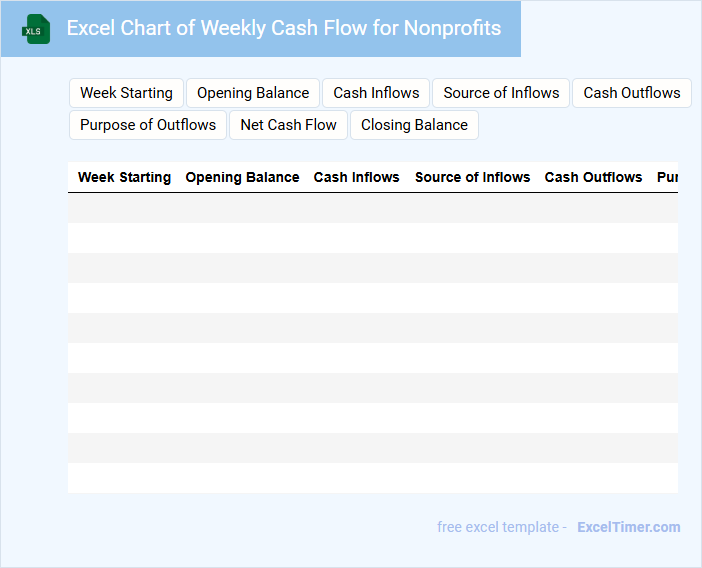

Excel Chart of Weekly Cash Flow for Nonprofits

An Excel Chart of Weekly Cash Flow for nonprofits typically contains detailed financial data that tracks income and expenditures on a weekly basis. It helps organizations monitor their liquidity and ensures they have sufficient funds to support their ongoing projects. Including clear labels, consistent time intervals, and a summary of key figures is essential for better understanding and decision-making.

What are the key income sources and expense categories tracked in a nonprofit's weekly cash flow document?

Your Weekly Cash Flow for Nonprofits document primarily tracks key income sources such as grants, donations, fundraising events, and program service revenue. Expense categories commonly monitored include salaries and wages, office supplies, rent, utilities, and program expenses. Accurate tracking of these items helps ensure sustainable financial management and supports strategic decision-making.

How does an Excel-based weekly cash flow report help forecast cash surpluses or shortages?

An Excel-based weekly cash flow report enables nonprofits to track incoming and outgoing funds in real-time, highlighting trends and variances in cash balances. By analyzing historical data and projecting future receipts and disbursements, it accurately forecasts cash surpluses or shortages. This proactive financial insight supports informed budgeting and timely decision-making for sustainable operations.

What is the importance of classifying restricted versus unrestricted funds within weekly cash flow tracking?

Classifying restricted versus unrestricted funds in weekly cash flow tracking ensures accurate allocation and compliance with donor-imposed limitations. It enables nonprofits to manage liquidity effectively by distinguishing funds available for general operations from those earmarked for specific projects. Proper classification supports transparent financial reporting and informed decision-making.

How can historical cash flow trends in Excel inform future budgeting decisions for nonprofits?

Analyzing historical cash flow trends in Excel enables nonprofits to identify income patterns and expenditure fluctuations, providing data-driven insights for accurate forecasting. This analysis helps allocate resources efficiently, ensuring financial stability during low-revenue periods. Leveraging Excel's visualization tools enhances understanding of cash flow cycles, supporting strategic budgeting and effective fund management.

Which essential Excel formulas or functions enhance the accuracy of a nonprofit's weekly cash flow projection?

Excel formulas like SUM, IF, and VLOOKUP significantly enhance the accuracy of a nonprofit's weekly cash flow projection by automating calculations and conditional analyses. The SUM function totals inflows and outflows, while IF statements track conditional cash movements based on criteria such as grant disbursements or scheduled expenses. Using VLOOKUP enables you to efficiently reference transaction details from separate sheets, ensuring comprehensive and precise financial tracking.