The Weekly Payroll Excel Template for Contractors simplifies managing weekly payment calculations by automatically tracking hours worked, rates, and deductions. This template ensures accurate and timely compensation, reducing errors and saving time for contractors and employers. Customizable fields allow seamless adaptation to various contract terms and payment structures.

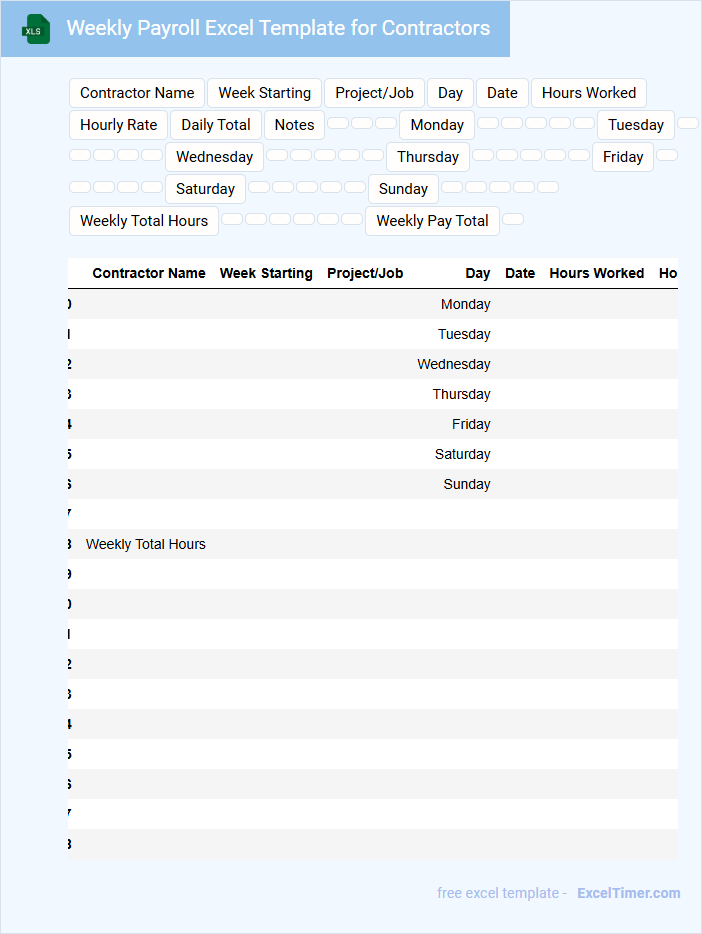

Weekly Payroll Excel Template for Contractors

A Weekly Payroll Excel Template for Contractors typically contains fields for employee names, hourly rates, hours worked, and total earnings. It often includes sections for deductions, taxes, and net pay to ensure accurate payment calculations. This document helps streamline the payroll process for businesses managing contractor payments. Key elements to focus on in the template are accuracy in data entry and proper formatting to prevent errors. Ensuring that tax rates and deduction rules are up to date is essential for compliance. Using automated formulas within the template can save time and reduce manual errors.

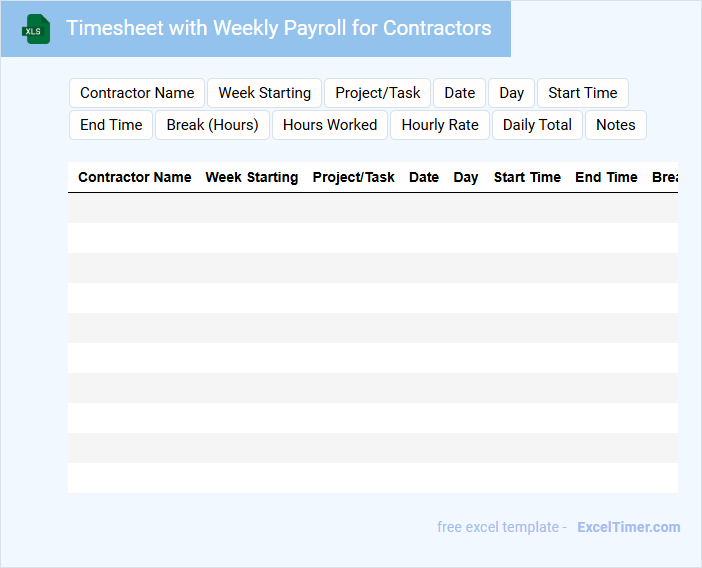

Timesheet with Weekly Payroll for Contractors

A Timesheet with Weekly Payroll for Contractors is a document that tracks the hours worked by contractors on a weekly basis. It usually contains detailed logs of daily start and end times, breaks, and total hours worked.

The document also includes payment calculations based on hourly rates and any applicable deductions or bonuses. Ensuring accuracy and timely submission of this timesheet is critical for proper payroll processing.

It is important to consistently verify contractor details and approval from supervisors to avoid payment delays or disputes.

Weekly Payment Tracker for Contractor Payroll

The Weekly Payment Tracker for contractor payroll is a document used to monitor and record payments made to contractors on a weekly basis. It typically contains details such as payment dates, amounts, contractor names, and hours worked.

This tracker helps ensure accuracy and timely payments while maintaining clear financial records. It is important to include a reliable system for updating entries and verifying payment approvals.

Payroll Management Excel Sheet for Weekly Contractors

A Payroll Management Excel Sheet for weekly contractors typically contains detailed records of hours worked, payment rates, and total wages. It helps ensure accurate and timely compensation by tracking weekly attendance and calculations. Important elements include contractor names, payment dates, tax deductions, and overtime calculations.

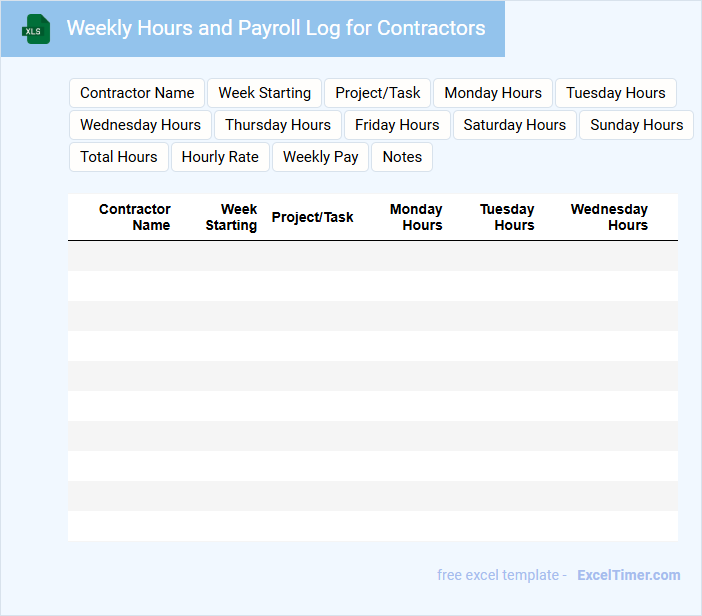

Weekly Hours and Payroll Log for Contractors

The Weekly Hours and Payroll Log for Contractors is a crucial document used to track the hours worked by contractors on a weekly basis. It typically contains details such as dates, hours worked each day, total hours, and payroll calculations. This log ensures accurate payment processing and compliance with labor regulations.

Earnings Report with Weekly Payroll for Contractors

An Earnings Report with Weekly Payroll for Contractors typically details the income and payment schedules for contract workers within a specific week. This document is essential for tracking financial transactions and ensuring accurate compensation.

- Include the total hours worked by each contractor.

- List individual earnings along with tax deductions and benefits.

- Ensure timely submission and verification of payroll information.

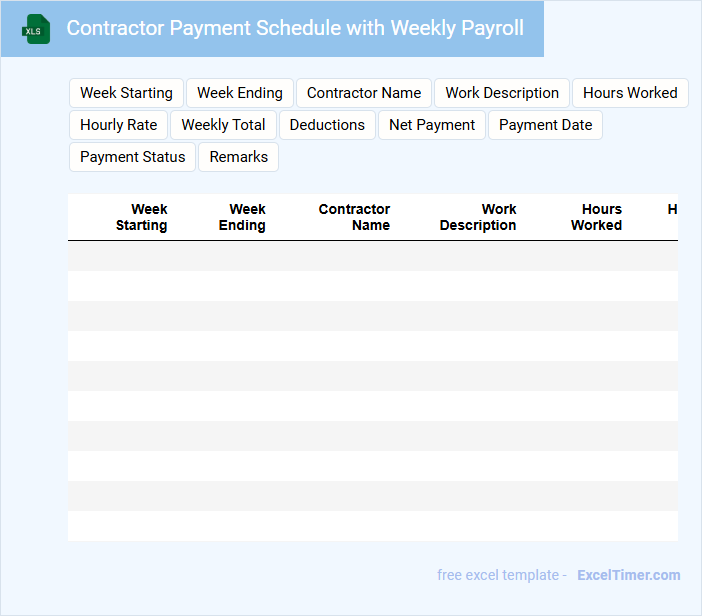

Contractor Payment Schedule with Weekly Payroll

A Contractor Payment Schedule with Weekly Payroll is a document that outlines the specific dates and amounts contractors will be paid on a weekly basis. It helps ensure timely and organized compensation for work completed during the project timeline.

This document typically contains detailed payment due dates, the amount to be paid each week, and any necessary approval signatures. For accuracy, it is important to include clear invoice submission guidelines and track hours or deliverables consistently.

Weekly Wage Sheet for Contractor Payroll

A Weekly Wage Sheet for Contractor Payroll typically contains detailed records of hours worked, rates, and total wages due to contractors. It serves as a crucial document for accurate and timely payment processing.

- Ensure all hours worked are accurately recorded and verified.

- Include clear contractor identification and job details.

- Review payroll calculations for compliance with contracts and labor laws.

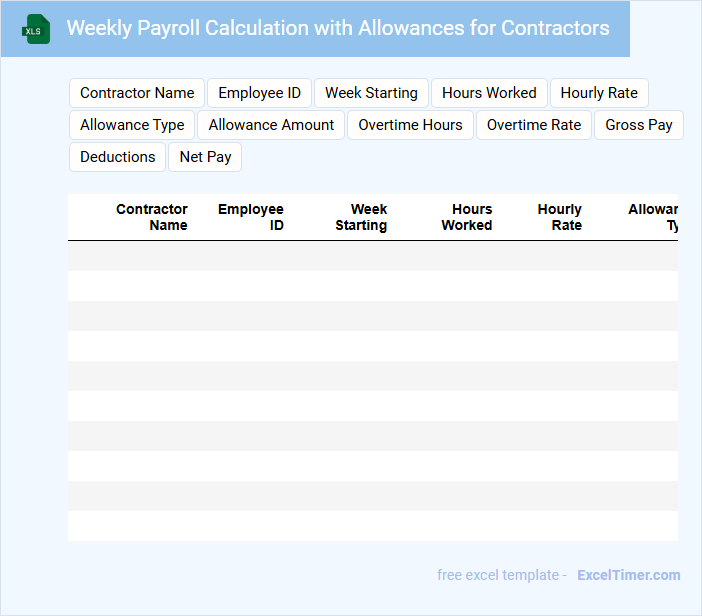

Weekly Payroll Calculation with Allowances for Contractors

What information is typically included in a weekly payroll calculation with allowances for contractors? This document usually contains detailed records of hours worked by contractors, their base pay rates, and any additional allowances such as travel or meal expenses. It also ensures accurate calculation of total weekly earnings, deductions, and final payable amounts to maintain transparency and compliance.

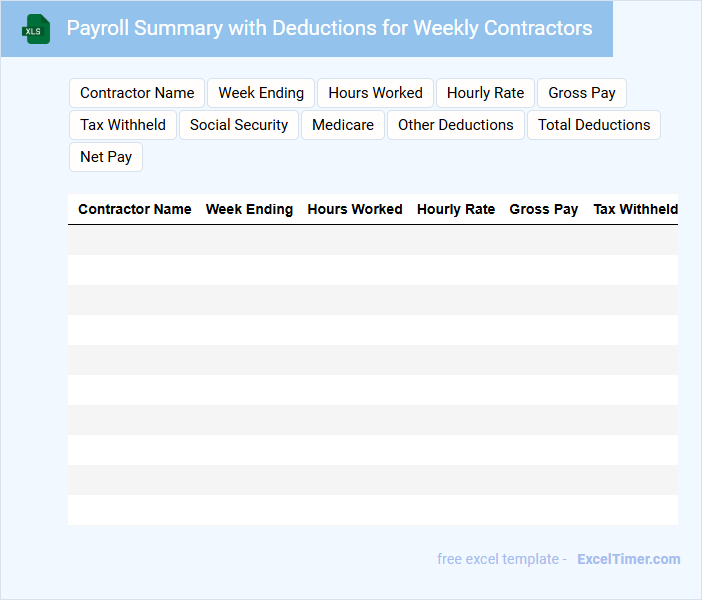

Payroll Summary with Deductions for Weekly Contractors

What information is typically included in a Payroll Summary with Deductions for Weekly Contractors? This document usually contains a detailed breakdown of each contractor's earnings for the week, including hours worked and pay rates. It also itemizes all applicable deductions such as taxes, insurance, and any other withholdings to provide a clear net payment figure.

Timesheet and Payroll Tracker for Weekly Contractors

What information does a Timesheet and Payroll Tracker for Weekly Contractors typically contain? This document usually includes detailed records of hours worked by contractors each day, along with payment rates and total earnings calculated for each pay period. It helps in accurately tracking labor costs and ensuring timely compensation for services rendered.

Why is maintaining a Timesheet and Payroll Tracker important for weekly contractors? Keeping an updated and precise tracker promotes transparency, facilitates compliance with labor regulations, and aids in budgeting for project expenses. Including clear fields for date, hours worked, pay rate, and total amount due is essential for effective management and auditing purposes.

Weekly Earnings Statement for Contractor Payroll

A Weekly Earnings Statement for Contractor Payroll typically contains detailed information about the hours worked, rates of pay, and total earnings for each contractor within a specific week. It serves as a transparent record ensuring accurate payment reconciliation and compliance with contractual agreements.

This document often includes deductions, taxes withheld, and net payment due to the contractor, providing clarity on compensation. For effective management, it is important to verify all entries for accuracy and maintain records for auditing purposes.

Payroll Register with Overtime for Weekly Contractors

A Payroll Register with Overtime for Weekly Contractors is a detailed document that tracks the total earnings, including overtime, of contractors paid on a weekly basis. It usually contains contractor names, hours worked, regular pay rates, overtime hours, and total compensation. Ensuring accuracy and compliance with labor laws is critical to prevent payroll disputes and maintain proper records.

Weekly Payroll Ledger for Independent Contractors

A Weekly Payroll Ledger for Independent Contractors is a detailed record that tracks payments made to contractors on a weekly basis. This document typically contains contractor names, hours worked, payment rates, and total amounts paid. Maintaining accurate records is essential for compliance, tax reporting, and financial management.

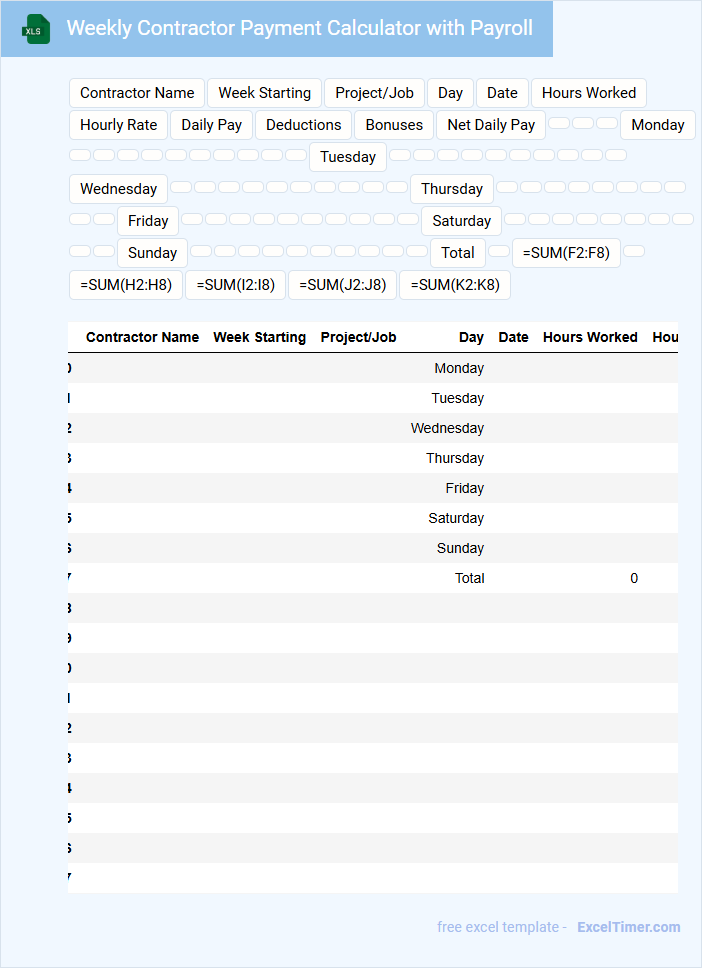

Weekly Contractor Payment Calculator with Payroll

The Weekly Contractor Payment Calculator with Payroll is a document that typically contains detailed records of contractor work hours, payment rates, and deductions for payroll processing. It helps ensure accurate and timely compensation based on weekly performance and contractual terms. Important aspects include verifying hours worked, calculating taxes and benefits, and maintaining clear records for compliance and auditing.

What key columns are necessary in an Excel document to accurately track weekly payroll for contractors?

Essential columns for accurately tracking weekly payroll for contractors include Contractor Name, Contractor ID, Week Ending Date, Hours Worked, Hourly Rate, Overtime Hours, Overtime Rate, Total Regular Pay, Total Overtime Pay, Gross Pay, Tax Deductions, Other Deductions, and Net Pay. Including Project or Job Code helps allocate labor costs effectively. Payment Status and Payment Date columns assist in managing and verifying compensation timelines.

How should you structure formulas to automatically calculate total pay based on hourly rate and hours worked?

Structure formulas by multiplying the hourly rate cell by the hours worked cell for each contractor to calculate total pay. Use a formula like =B2*C2, where B2 is the hourly rate and C2 is hours worked. Apply this formula across all rows to automate weekly payroll calculations efficiently.

Which Excel functions can you use to summarize total weekly payouts for all contractors?

You can use the SUM function in Excel to calculate the total weekly payouts for all contractors efficiently. The SUMIF function helps to summarize payouts based on specific criteria, such as individual contractor names or project codes. Employing PivotTables allows for dynamic aggregation and detailed analysis of your contractors' payroll data.

What methods ensure correct date entries and period alignment for each week's payroll records?

Implement data validation rules to restrict date entries to the correct week range, ensuring consistency in payroll periods. Use Excel functions like WEEKNUM and MATCH to align dates with predefined pay periods accurately. Employ conditional formatting to highlight any date mismatches for immediate correction within the payroll records.

How can you use data validation and protection features to minimize errors in payroll data entry?

Use data validation in your Excel Weekly Payroll for Contractors to restrict entries to valid ranges, such as hours worked between 0 and 60, and predefined job codes. Employ protection features to lock formula cells and prevent unauthorized changes, ensuring accurate calculations and consistent payroll data. These tools minimize errors and maintain data integrity in your payroll process.