The Weekly Expense Report Excel Template for Small Businesses helps track and manage weekly expenses efficiently, ensuring accurate financial records. It includes customizable categories and automated calculations to simplify budgeting and cost analysis. Small businesses benefit from improved expense visibility and better decision-making with this user-friendly tool.

Weekly Expense Tracking Sheet for Small Businesses

What information is typically contained in a Weekly Expense Tracking Sheet for Small Businesses? This document usually includes detailed records of all business-related expenditures categorized by type, date, and amount. It helps small business owners maintain financial control and monitor cash flow effectively.

What important aspects should be considered when using this type of sheet? Accuracy in recording each expense and regularly updating the sheet are crucial to ensure reliable financial data. Additionally, categorizing expenses properly allows for better budgeting and tax preparation.

Weekly Expense Report Template for Small Business Owners

A Weekly Expense Report Template for small business owners typically contains detailed records of all expenditures made throughout the week, including categories such as office supplies, utilities, and employee reimbursements. This document helps track cash flow and monitor spending habits effectively.

It is important to include clear dates, expense descriptions, and amounts to ensure accuracy and accountability. Regularly reviewing this report can help identify cost-saving opportunities and maintain financial health.

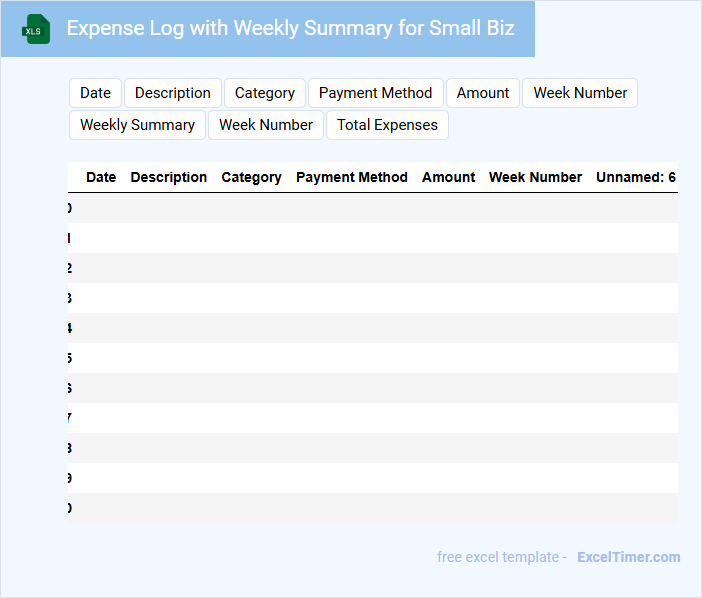

Expense Log with Weekly Summary for Small Biz

An Expense Log with Weekly Summary for Small Biz typically contains detailed records of daily expenses categorized by type, followed by a weekly summary highlighting total costs to help monitor cash flow efficiently.

- Accurate Entries: Ensure every expense is recorded promptly with date, amount, and description for precise tracking.

- Clear Categorization: Group expenses into meaningful categories like supplies, utilities, and payroll for better analysis.

- Consistent Weekly Review: Summarize expenses weekly to identify trends, control spending, and support budgeting.

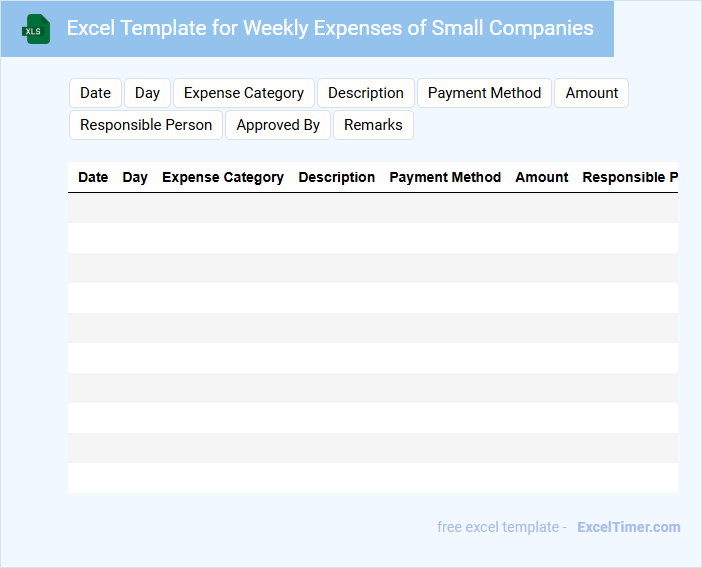

Excel Template for Weekly Expenses of Small Companies

An Excel Template for Weekly Expenses is designed to help small companies efficiently track and manage their expenditures on a weekly basis. It typically contains sections for categorizing expenses, inputting amounts, and summarizing total costs to maintain a clear overview of financial outflows. This document is crucial for budgeting, financial planning, and ensuring transparency in company spending.

For optimal use, ensure the template includes customizable categories relevant to the company's operations, automated calculations for accuracy, and visual charts to highlight spending trends. Including notes or comments sections can also enhance clarity for future reference. Regular updates and consistent data entry are essential to maximize the template's effectiveness.

Small Business Weekly Expense Report with Category Breakdown

What information is typically included in a Small Business Weekly Expense Report with Category Breakdown? This type of document usually contains a detailed record of all expenses incurred by the business within a week, categorized into sections such as utilities, supplies, payroll, and marketing. It helps business owners track spending patterns, identify cost-saving opportunities, and maintain financial accuracy for effective budgeting and reporting.

Weekly Operating Expense Report for Small Enterprises

A Weekly Operating Expense Report for Small Enterprises typically contains detailed records of all expenditures made during the week, helping businesses track their cash flow efficiently. This document is essential for budgeting and financial planning, providing insight into operational costs.

- Include all categories of expenses such as rent, utilities, and supplies for accurate tracking.

- Ensure dates and amounts are clearly documented to maintain transparency and accountability.

- Summarize weekly totals to quickly assess spending trends and budget adherence.

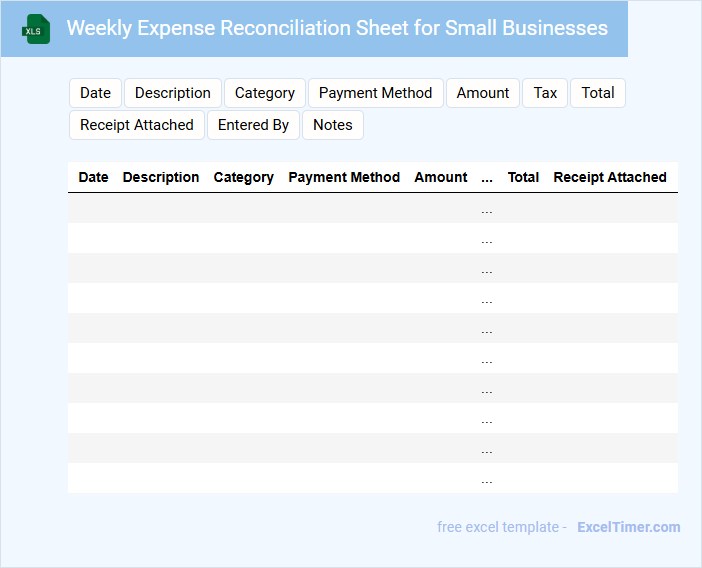

Weekly Expense Reconciliation Sheet for Small Businesses

A Weekly Expense Reconciliation Sheet for small businesses is a financial document used to track and verify expenses on a weekly basis. It typically contains detailed entries of all expenditures, categorized by type and date, along with corresponding receipts or invoices. This document helps ensure accuracy in accounting and aids in identifying discrepancies early.

Key elements to include are clear categories for different expense types, accurate date entries, and a summary section for total weekly expenses. Additionally, it is important to regularly review and update the sheet to maintain financial integrity. Implementing a consistent format and using digital tools can greatly enhance efficiency and accuracy.

This sheet serves as a crucial tool for budgeting, financial planning, and auditing, enabling small businesses to manage their cash flow more effectively. Keeping it organized and up-to-date helps avoid overspending and ensures compliance with accounting standards. Ultimately, it supports better decision-making and financial transparency.

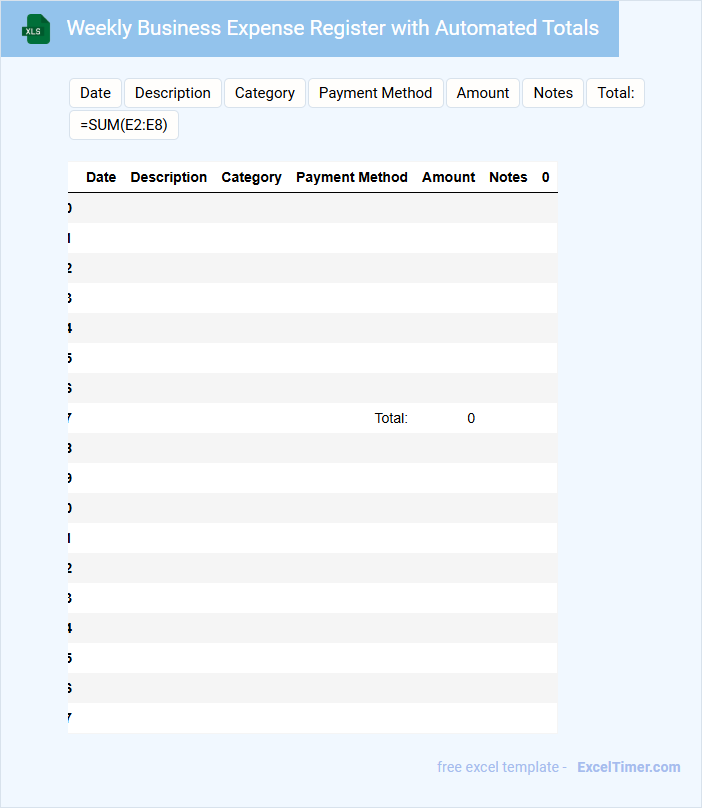

Weekly Business Expense Register with Automated Totals

A Weekly Business Expense Register is a detailed document used to record all expenses a business incurs during the week. It typically contains entries for various cost categories, dates, payment methods, and vendor details. Automated totals help streamline financial tracking and ensure accuracy in expense management.

Important elements to include are clear categorization of expenses, automated calculations for weekly totals and subtotals, and space for notes or receipts references. Ensuring the register is easy to update and review supports better budget control and financial analysis. Additionally, including fields for approval or verification can enhance accountability and record integrity.

Excel Template for Tracking Weekly Expenses of Startups

This Excel template is designed to help startups monitor and manage their weekly expenses efficiently. It provides a structured format to record, categorize, and analyze spending patterns over time.

- Include columns for date, expense category, amount, and payment method to ensure comprehensive tracking.

- Incorporate formulas to automatically calculate weekly totals and highlight discrepancies.

- Add a summary section that visualizes spending trends to aid in budgeting decisions.

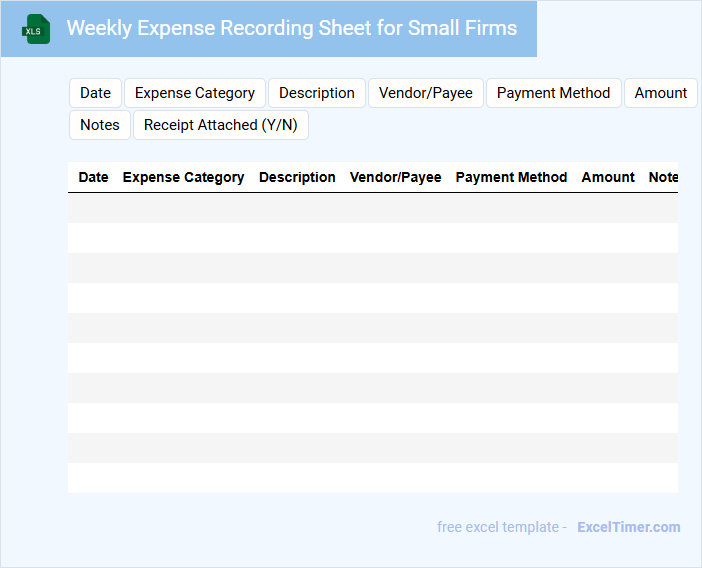

Weekly Expense Recording Sheet for Small Firms

A Weekly Expense Recording Sheet typically contains detailed entries of all expenditures made within a specific week. It helps small firms track their cash flow and monitor spending patterns effectively.

Important components include date, description, category, amount, and payment method. Ensuring accuracy and timely updates is crucial for reliable financial oversight.

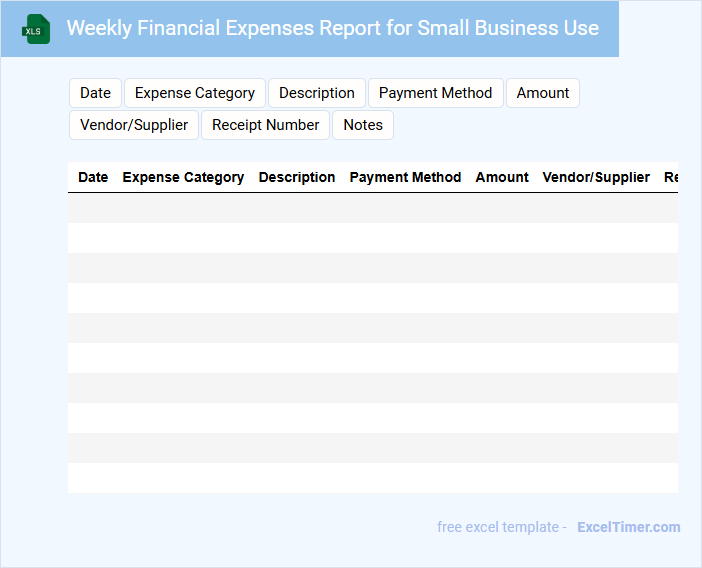

Weekly Financial Expenses Report for Small Business Use

A Weekly Financial Expenses Report typically contains a detailed summary of all expenditures incurred by a small business over the course of a week. This document helps track spending patterns and identify areas where costs can be optimized. For effective use, it is important to ensure accuracy, categorize expenses clearly, and update the report consistently.

Cash Flow and Expense Report for Small Companies Weekly

A Cash Flow and Expense Report for small companies on a weekly basis typically contains detailed records of all incoming and outgoing funds to ensure accurate financial tracking. It includes categories such as operational expenses, revenue streams, and cash reserves to help maintain liquidity. Regular monitoring of this report enables better budget management and financial decision-making.

Important elements to focus on in these reports are timely and accurate data entry, categorization of expenses, and trend analysis to identify potential cash shortages. Including a summary section with key financial indicators like net cash flow and outstanding payments is also essential. Additionally, integrating automated alerts for unusual transactions can enhance oversight and prevent errors.

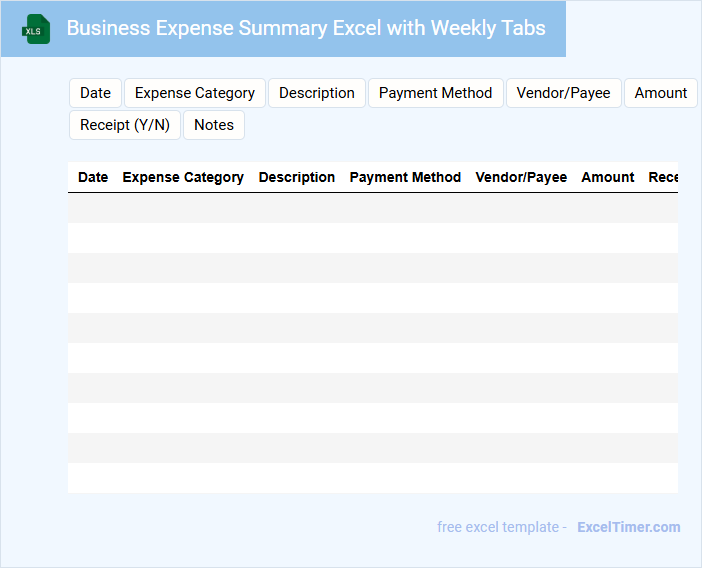

Business Expense Summary Excel with Weekly Tabs

A Business Expense Summary Excel with weekly tabs is typically a detailed document used to track and organize expenses incurred throughout each week. It contains categorized expense entries, dates, and totals to provide clarity on cash outflows. This structure helps businesses monitor spending trends and manage budgets effectively. To optimize its use, include clear category headers, maintain consistent data entry formats across tabs, and incorporate summary formulas for quick insights. Additionally, linking weekly totals to a master summary sheet enhances overall financial visibility. Implementing data validation and conditional formatting can also reduce errors and highlight important expense patterns.

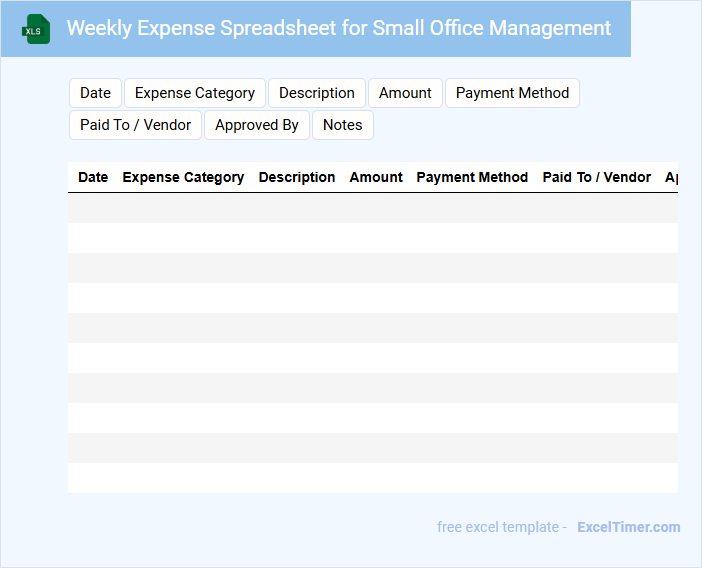

Weekly Expense Spreadsheet for Small Office Management

A Weekly Expense Spreadsheet for small office management typically contains detailed records of daily purchases, bill payments, and miscellaneous office expenses. It helps in tracking cash flow, ensuring budget adherence, and identifying spending patterns. Maintaining accurate and up-to-date data in this document is crucial for effective financial oversight and decision-making.

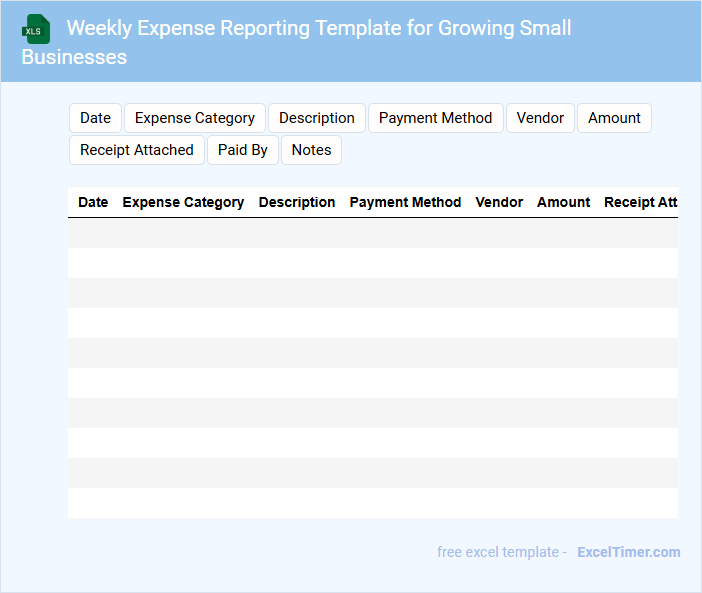

Weekly Expense Reporting Template for Growing Small Businesses

A Weekly Expense Reporting Template for Growing Small Businesses is a document used to track and manage weekly expenditures efficiently. It helps in maintaining clear financial records and assists in budgeting for future expenses.

- Include categories for different types of expenses such as supplies, utilities, and payroll.

- Ensure there is a section to note the date and description of each expense for clarity.

- Add a summary area to calculate total weekly expenses and compare them against the budget.

What are the essential columns to include in a Weekly Expense Report for small businesses?

Essential columns for a Weekly Expense Report for small businesses include Date, Expense Category, Description, Amount, Payment Method, and Vendor. These categories help you track spending accurately, monitor cash flow, and identify cost-saving opportunities. Including a column for Receipts or Notes ensures completeness and easy reference during audits or tax filing.

How can you categorize and track recurring vs. one-time expenses in an Excel Weekly Expense Report?

You can categorize recurring and one-time expenses in an Excel Weekly Expense Report by creating separate columns or tabs labeled "Recurring" and "One-Time" expenses. Use consistent tags or dropdown lists to classify each transaction, enabling precise tracking and analysis. Employ Excel functions like SUMIFS to calculate totals for each category, enhancing your financial management and budgeting accuracy.

What Excel formulas or functions help automate expense totaling and detect discrepancies?

Excel functions such as SUM automate weekly expense totaling by calculating the sum of expense entries. The IF and ISERROR functions help detect discrepancies by identifying incorrect or missing data in expense fields. Conditional formatting can highlight anomalies, ensuring accurate and efficient expense tracking for small businesses.

How do you use data validation to ensure accurate expense entry in your weekly report?

Data validation in a Weekly Expense Report for Small Businesses restricts entries to predefined categories or formats, such as date ranges or numerical values, ensuring accuracy. Implement dropdown lists for expense types and set rules for allowed expense amounts to prevent incorrect data input. This reduces errors and maintains consistent, reliable expense tracking.

What methods can enhance visual analysis, like conditional formatting or charts, in an Excel Weekly Expense Report?

Using conditional formatting in an Excel Weekly Expense Report highlights expense trends and variances by color-coding cells based on predefined rules. Incorporating charts like bar graphs or pie charts visually represents expense categories and weekly spending patterns, enabling quick insights. Sparklines provide compact, cell-sized visuals to track expense changes over time within the report.