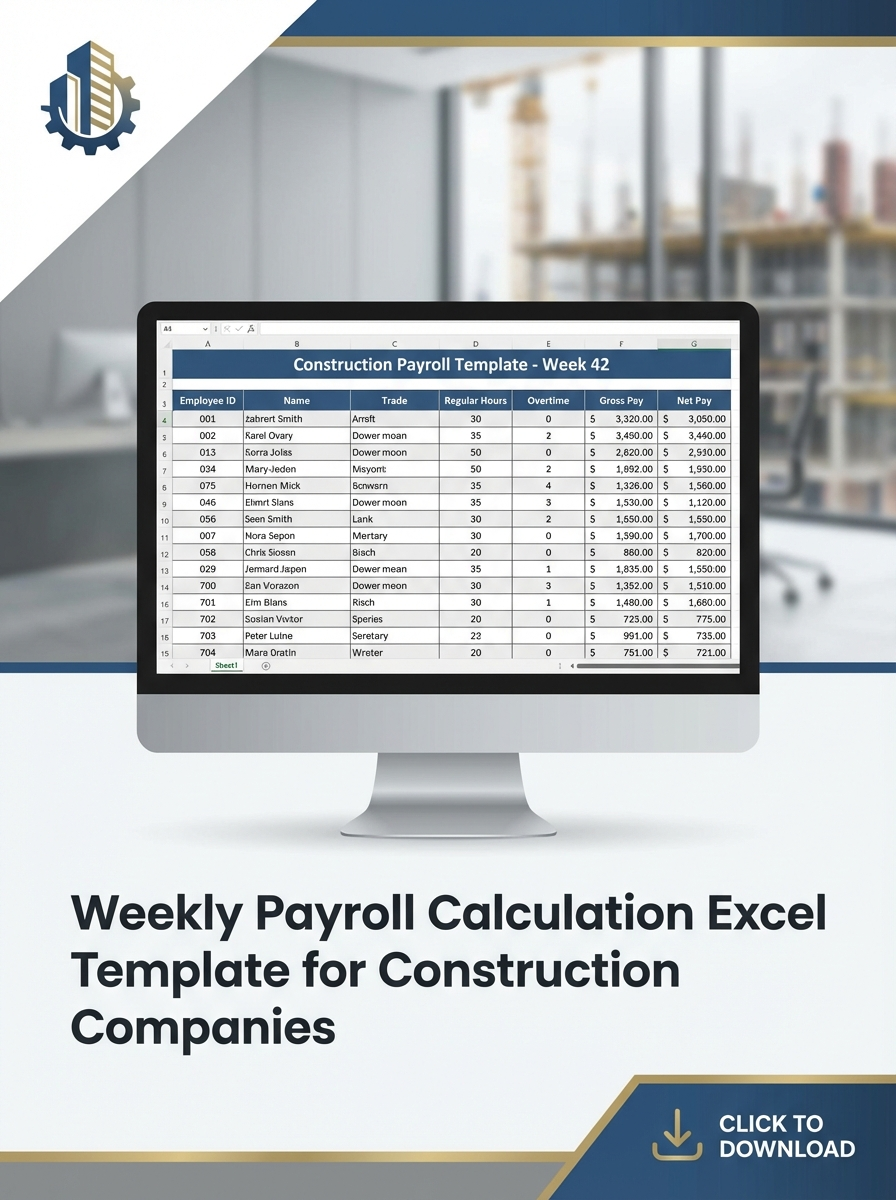

The Weekly Payroll Calculation Excel Template for Construction Companies streamlines the process of calculating worker wages, ensuring accuracy and saving time. This template includes fields for hours worked, overtime, deductions, and bonuses tailored specifically for construction labor needs. Its ease of use and customization options help maintain compliance with labor laws while improving payroll management efficiency.

Weekly Payroll Calculation Sheet for Construction Companies

A Weekly Payroll Calculation Sheet for Construction Companies typically contains detailed records of employee work hours, wage rates, and deductions to ensure accurate and timely payment.

- Employee Information: Ensure all worker names and job titles are clearly listed for proper identification.

- Hours Worked: Accurately record daily hours, including overtime, for precise wage calculations.

- Deduction Details: Include all relevant tax, insurance, and benefit deductions to maintain legal compliance.

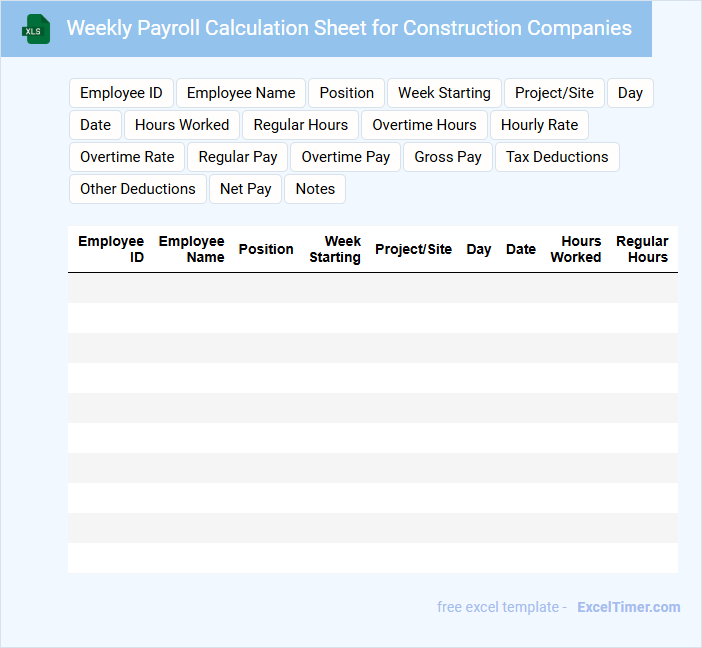

Employee Timesheet with Payroll Calculation for Construction Projects

What information is typically included in an Employee Timesheet with Payroll Calculation for Construction Projects? This document usually contains detailed records of employees' work hours, tasks performed, and project-specific labor allocation. It also includes payroll calculations such as wages, overtime, and deductions, ensuring accurate and transparent compensation for construction workers.

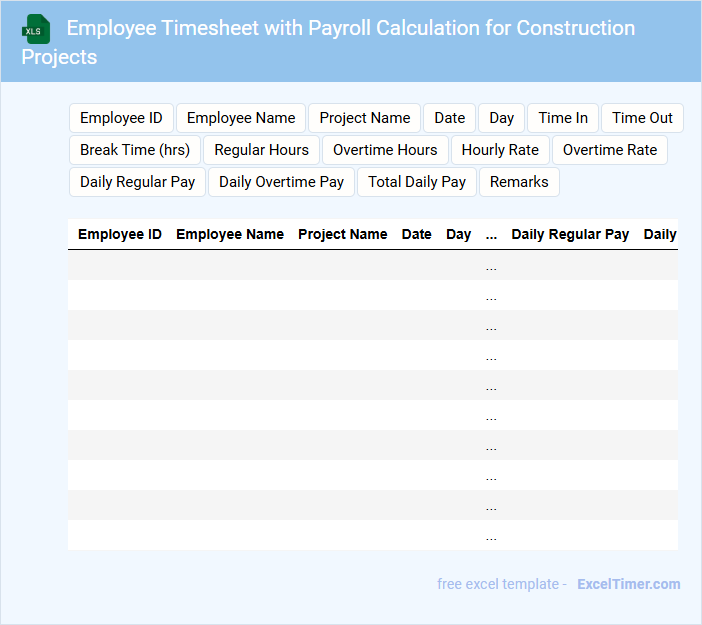

Weekly Wage Calculator Template for Construction Firm Staff

Weekly Wage Calculator Template for Construction Firm Staff is a document designed to accurately compute and track employee earnings based on hours worked and project specifics.

- Employee Details: Include comprehensive data such as names, job roles, and work hours for precise wage calculation.

- Wage Rates: Clearly specify hourly rates, overtime pay, and any bonuses applicable to ensure transparency.

- Project Tracking: Incorporate project codes or descriptions to link wages to specific tasks or contracts effectively.

Overtime Tracking with Payroll Summary for Construction Workers

What information is typically included in an Overtime Tracking with Payroll Summary for Construction Workers? This document usually contains detailed records of employees' regular and overtime hours worked, along with corresponding pay rates and total earnings. It helps ensure accurate compensation and compliance with labor laws, making it essential for payroll processing and auditing.

What important elements should be included to optimize the document's effectiveness? It should feature clear identification of each worker, date and time stamps for work periods, calculated overtime hours, pay summaries, and notes on applicable labor regulations. Including these details ensures transparency, simplifies payroll calculations, and supports dispute resolution if needed.

Weekly Labor Cost Calculation Excel for Construction Sites

The Weekly Labor Cost Calculation Excel document is essential for tracking and managing labor expenses on construction sites. It typically contains detailed records of hours worked, labor rates, and total wages for each worker. This helps in maintaining budget control and ensuring accurate payroll processing.

Important elements to include are employee names, job roles, hours worked per day, hourly rates, overtime calculations, and total weekly costs. Additionally, incorporating formulas for automatic calculations and summary sections aids in quick data analysis. Regular updates and validation are crucial to avoid discrepancies and improve project cost management.

Payroll Register with Hours and Rates for Construction Teams

A Payroll Register with hours and rates for construction teams is a detailed document that tracks employee hours worked, hourly pay rates, and total wages for each payroll period. It ensures accurate compensation for labor and helps maintain compliance with labor laws and company policies. Including overtime hours and differentiating pay rates for various roles within the construction team is essential for precise payroll management.

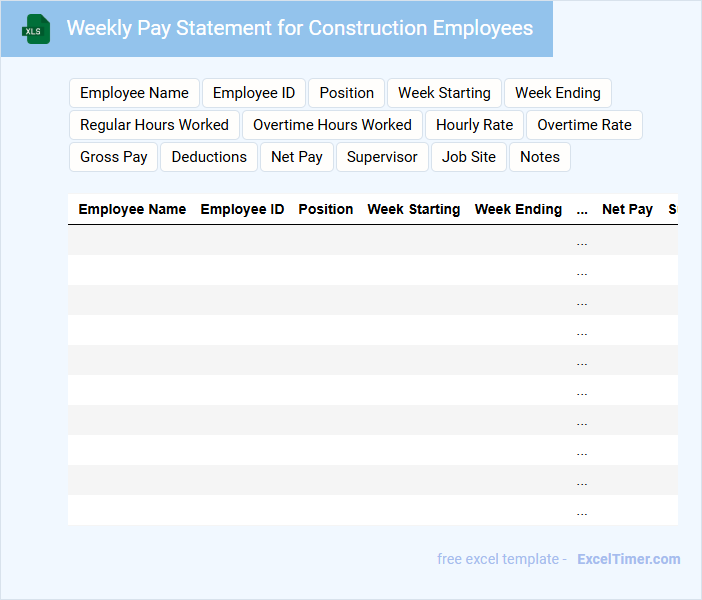

Weekly Pay Statement for Construction Employees

Weekly Pay Statements for Construction Employees typically include detailed information about hours worked, wages earned, and deductions. These documents serve as a transparent record for both employers and employees regarding weekly compensation.

- Ensure the statement clearly itemizes regular and overtime hours separately.

- Include a breakdown of gross pay, taxes, and other deductions.

- Provide contact information for payroll inquiries or dispute resolution.

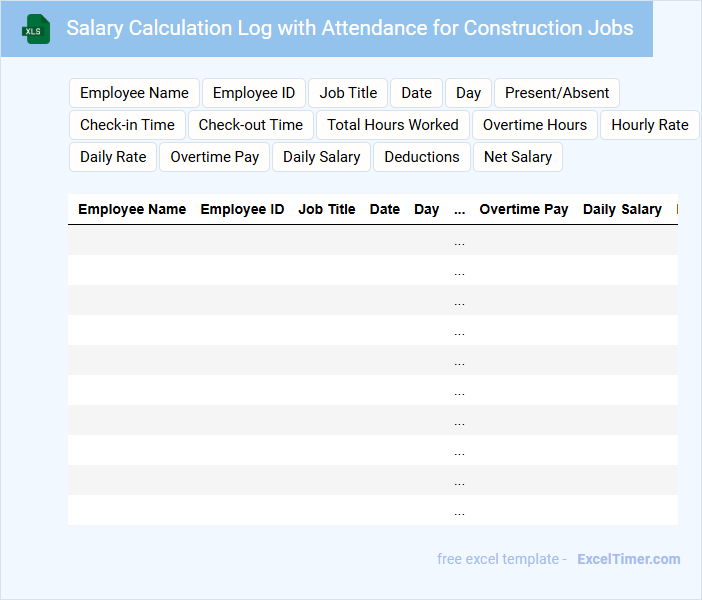

Salary Calculation Log with Attendance for Construction Jobs

What information is typically included in a Salary Calculation Log with Attendance for Construction Jobs? This document usually contains detailed records of daily attendance, hours worked, and corresponding wage calculations for each construction worker. It helps ensure accurate payroll processing and transparent tracking of labor costs on projects.

Why is it important to maintain a Salary Calculation Log with Attendance for Construction Jobs? Keeping precise attendance and salary records helps prevent payroll disputes and supports compliance with labor laws and contractual agreements. It is essential to regularly update the log and verify attendance data to guarantee accurate salary payments.

Wage and Deduction Tracker for Weekly Payroll of Construction Crews

This document typically contains detailed records of wages and deductions for each construction crew member on a weekly basis, ensuring accurate payroll management. It helps track hours worked, hourly rates, and any applicable deductions to guarantee transparent and compliant payments.

- Include employee names, roles, and total hours worked each week.

- Record all deductions such as taxes, insurance, and equipment fees clearly.

- Ensure accuracy by cross-verifying hours with job site records or timesheets.

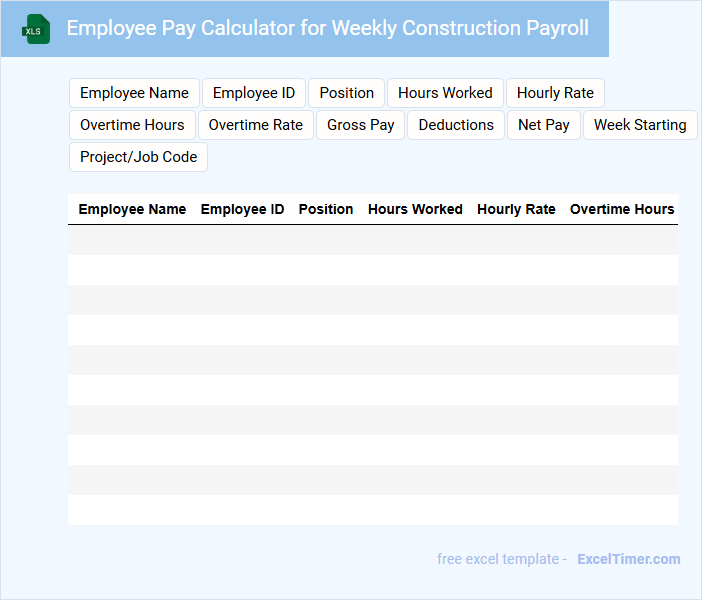

Employee Pay Calculator for Weekly Construction Payroll

An Employee Pay Calculator for weekly construction payroll is designed to accurately compute wages based on hours worked, overtime, and applicable deductions. It typically includes inputs for employee details, hourly rates, and work hours, ensuring compliance with labor laws. For best results, it should also factor in tax withholdings and benefits to provide a clear net pay figure.

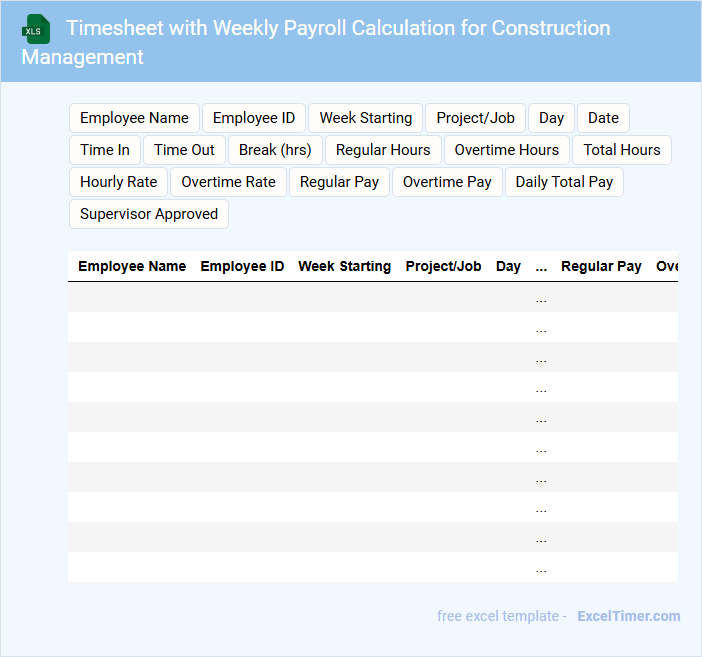

Timesheet with Weekly Payroll Calculation for Construction Management

Timesheets with weekly payroll calculations in construction management document employee work hours and calculate earnings accurately to ensure timely payments. This type of document is essential for tracking labor costs and managing project budgets effectively.

- Include daily work hours and overtime details for each employee.

- Incorporate hourly rates, job codes, and total weekly earnings.

- Ensure clear validation fields for supervisor approval and employee signatures.

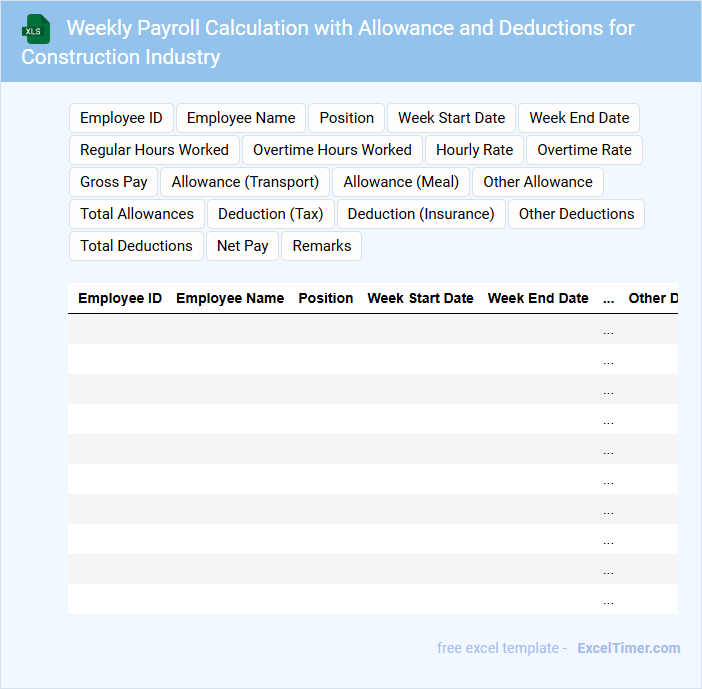

Weekly Payroll Calculation with Allowance and Deductions for Construction Industry

The Weekly Payroll Calculation document typically contains detailed records of employees' working hours, including regular and overtime hours, allowances, and deductions applicable for that pay period. It also includes calculations of gross pay, net pay, and any statutory contributions or taxes specific to the construction industry. Ensuring accuracy in allowances like hazard pay and deductions such as union dues is crucial for compliance and employee satisfaction.

Payroll Summary for Weekly Wages of Construction Laborers

Payroll Summary for Weekly Wages of Construction Laborers typically contains detailed records of hours worked, wages earned, deductions, and net pay for each laborer within a specified week.

- Employee details: Includes the names, job titles, and identification numbers of the laborers.

- Work hours and wages: Lists the total hours worked, pay rates, and gross wages for accurate compensation.

- Deductions and net pay: Summarizes tax withholdings, benefits, and the final amount payable to each laborer.

Tracking Sheet for Overtime and Weekly Pay of Construction Workers

This document is typically used to monitor and record the overtime hours and weekly pay for construction workers. It ensures accurate payroll management and compliance with labor regulations.

- Include worker names, dates, and total hours worked each day.

- Record overtime hours separately to calculate additional pay accurately.

- Summarize weekly earnings with clear breakdowns of regular and overtime payments.

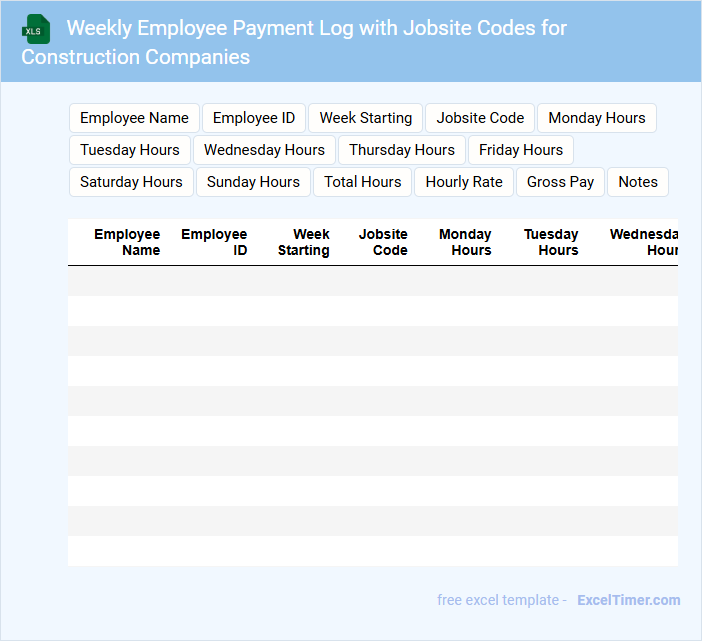

Weekly Employee Payment Log with Jobsite Codes for Construction Companies

What information does a Weekly Employee Payment Log with Jobsite Codes for Construction Companies typically contain? This document usually includes detailed records of employee work hours, payment amounts, and specific jobsite codes associated with each task. It helps construction companies accurately track labor costs and project expenses while ensuring proper payroll management.

What important factors should be considered when maintaining this log? It is crucial to ensure accuracy in recording hours and jobsite codes to avoid payroll errors and billing discrepancies. Additionally, regularly updating the log and cross-checking entries with timesheets enhances transparency and supports compliance with labor regulations.

What key data fields are essential in an Excel weekly payroll calculation sheet for construction employees (e.g., hours worked, pay rate, job code)?

Essential data fields in a weekly payroll calculation sheet for construction employees include Employee Name, Hours Worked, Pay Rate, Overtime Hours, Job Code, and Total Earnings. Accurate tracking of Hours Worked and Overtime Hours ensures proper wage computation based on Pay Rate and job-specific rates using Job Code. Including Deductions and Tax Withholdings fields aids in precise net pay calculation for each employee.

How should overtime hours and different pay rates (regular vs. overtime) be calculated using Excel formulas?

Calculate overtime hours by subtracting the standard work hours (e.g., 40) from total hours worked using the formula =MAX(0, TotalHours - 40). Use =MIN(TotalHours, 40) to compute regular hours. Multiply regular hours by the standard pay rate and overtime hours by the overtime pay rate, then sum both to determine total pay in your weekly payroll Excel sheet.

What methods can be used in Excel to track and allocate payroll costs by specific job or project?

Excel offers methods such as pivot tables, VLOOKUP, and SUMIFS functions to track and allocate payroll costs by specific job or project efficiently. You can create job-specific cost centers within your payroll sheet and use drop-down lists or data validation to assign employee hours and wages to each task. These features enable precise payroll cost monitoring and help optimize budgeting for construction projects.

How can Excel automate payroll deductions (taxes, insurance, union dues) within the weekly payroll calculation?

Excel automates payroll deductions in weekly payroll calculations by using formulas to apply tax rates, insurance premiums, and union dues based on employee earnings data. Functions like VLOOKUP or INDEX-MATCH retrieve deduction rates from separate tables, while conditional formulas adjust deductions according to employee status or hours worked. This ensures accurate, real-time calculation of net pay tailored to construction company payroll requirements.

What Excel features (such as data validation or conditional formatting) are most useful for minimizing errors and ensuring compliance in weekly payroll for construction companies?

Data validation ensures accurate input of hours and rates by restricting entries to predefined ranges and formats. Conditional formatting highlights inconsistencies like overtime or missing data, enabling quick error detection. Pivot tables and formulas automate calculations and generate compliance reports, streamlining payroll accuracy for construction companies.