The Annually Financial Statement Excel Template for Property Managers streamlines the process of tracking income, expenses, and profitability throughout the year. It offers customizable categories tailored to property management needs, ensuring accurate financial reporting and easy budget analysis. Using this template helps property managers maintain organized records and make informed decisions to optimize property performance.

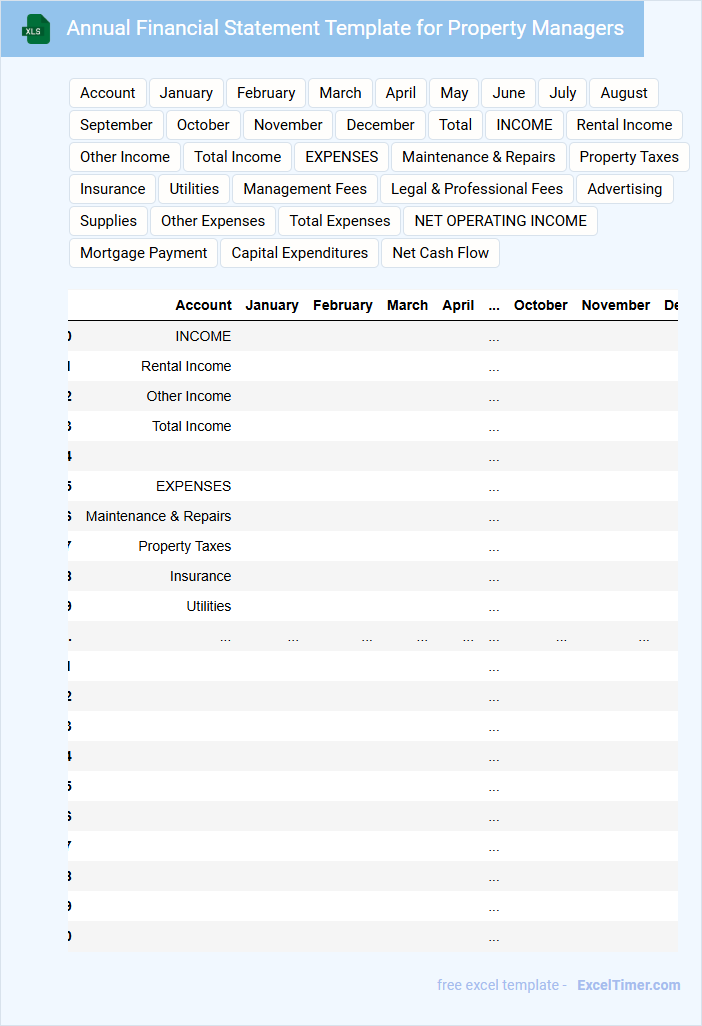

Annual Financial Statement Template for Property Managers

An Annual Financial Statement Template for Property Managers is a structured document used to compile and present the financial performance of properties under management over a year. It ensures clear communication of financial status to stakeholders.

This template typically includes key financial data, expense tracking, and income analysis to aid in property management decisions.

- Include detailed income and expense reports for transparency.

- Incorporate a summary of net operating income and cash flow.

- Present comparisons with previous years to identify trends.

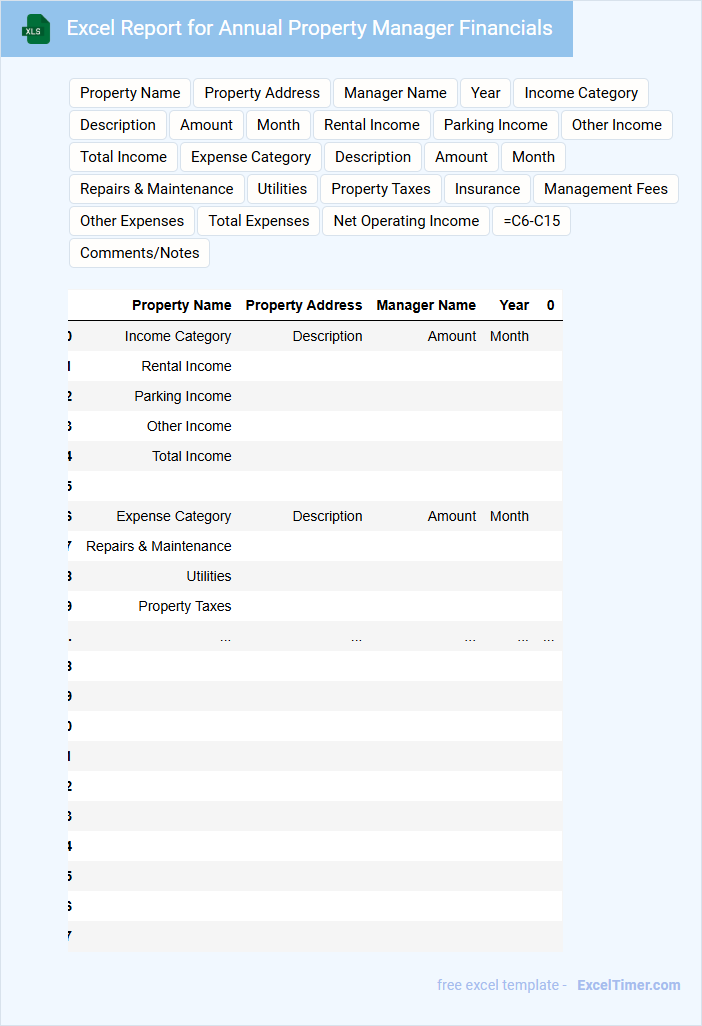

Excel Report for Annual Property Manager Financials

The Excel Report for Annual Property Manager Financials typically contains detailed income and expense statements, budget comparisons, and cash flow summaries. It is designed to provide a clear overview of the financial performance of properties managed throughout the year. Accurate data entry and formula validation are crucial to ensure reliable results.

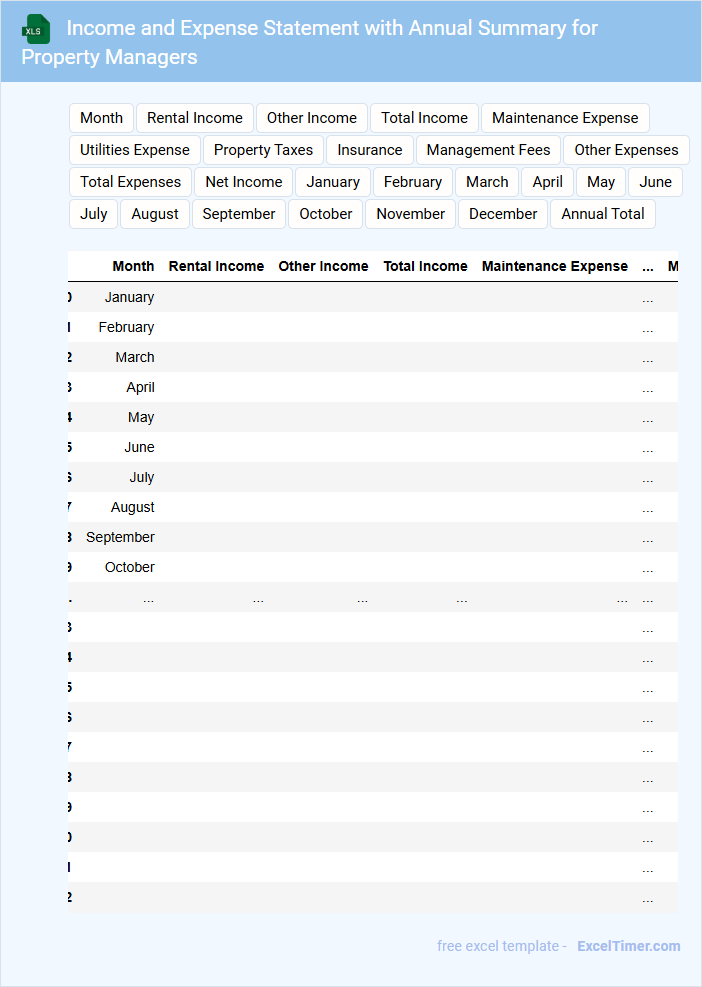

Income and Expense Statement with Annual Summary for Property Managers

An Income and Expense Statement is a financial document that summarizes the revenue and costs associated with property management over a specific period. It helps property managers track profitability and monitor financial performance.

The statement typically includes detailed categories of income such as rent and fees, alongside expense areas like maintenance, utilities, and taxes. For clarity and accuracy, it is important to ensure consistent categorization and timely updates throughout the year.

Including an annual summary provides a comprehensive overview that supports budgeting decisions and financial planning for future property management activities.

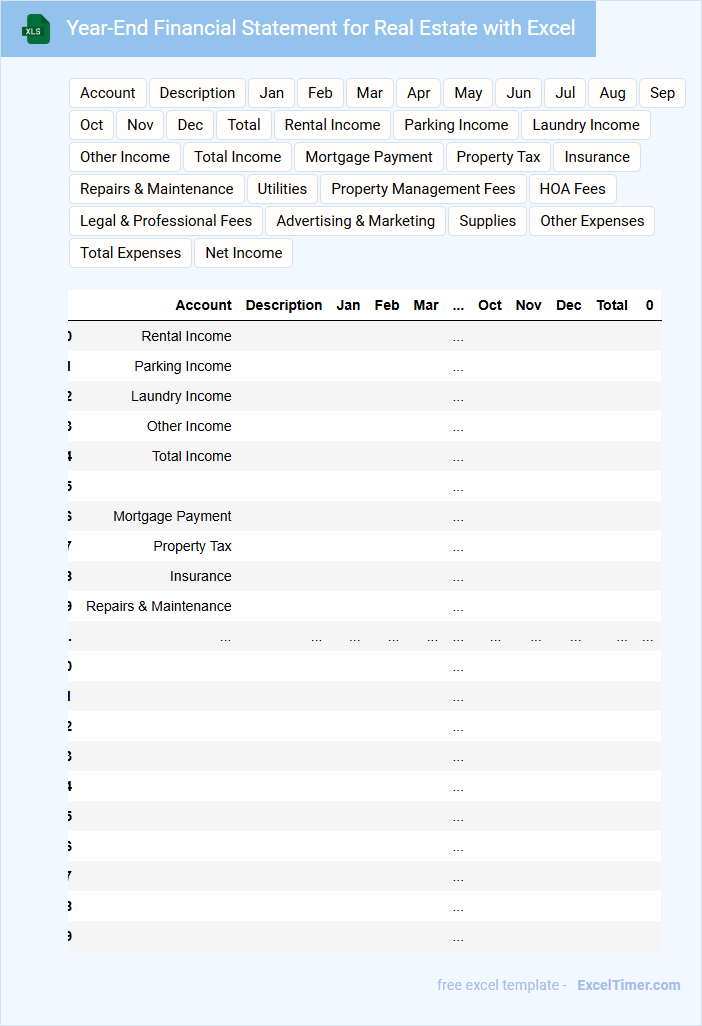

Year-End Financial Statement for Real Estate with Excel

The Year-End Financial Statement for real estate is a crucial document that summarizes the financial performance of property investments over the fiscal year. It typically includes income statements, expense reports, and asset valuations to provide a clear overview of profitability and cash flow. Using Excel for this statement allows for detailed data analysis, accurate calculations, and customizable reporting tailored to real estate specifics.

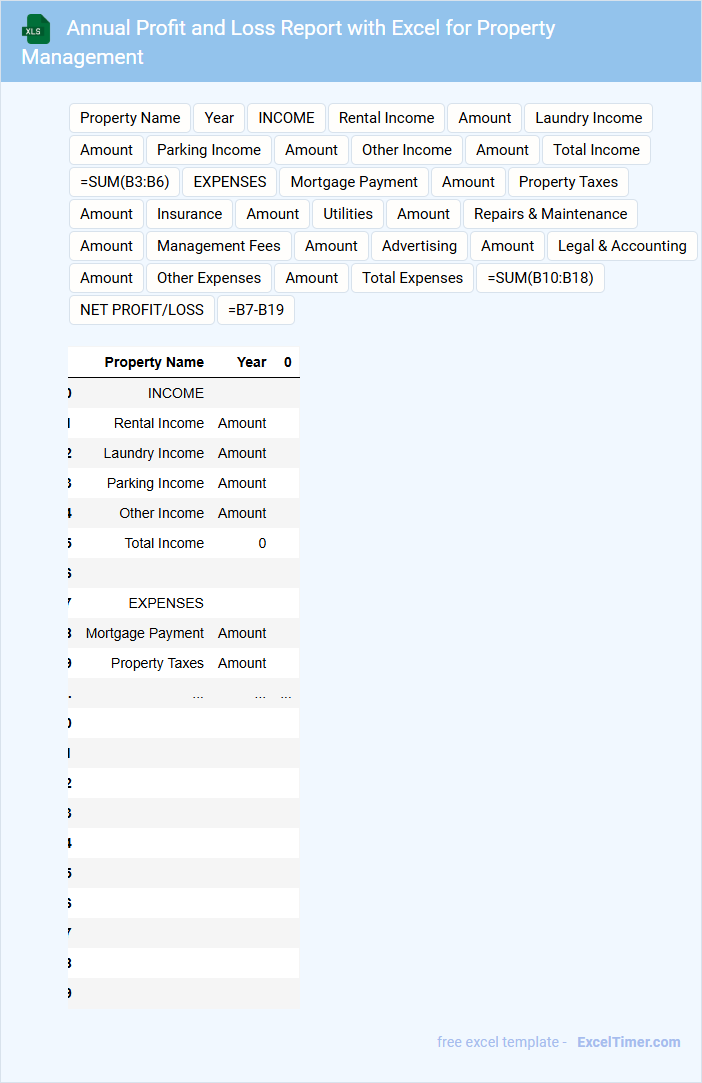

Annual Profit and Loss Report with Excel for Property Management

The Annual Profit and Loss Report is a critical financial document that summarizes the revenues, costs, and expenses incurred during a specific fiscal year. It provides property managers with a clear overview of the profitability and financial health of their properties. Using Excel to create this report enhances accuracy and allows for detailed data analysis and customization.

Important elements to include are gross rental income, operating expenses, net operating income, and any non-operating revenues or expenses. Ensure that the Excel sheet includes formulas for automatic calculations to reduce errors and facilitate quick updates. Additionally, incorporating visual charts can help stakeholders better understand financial trends and make informed decisions.

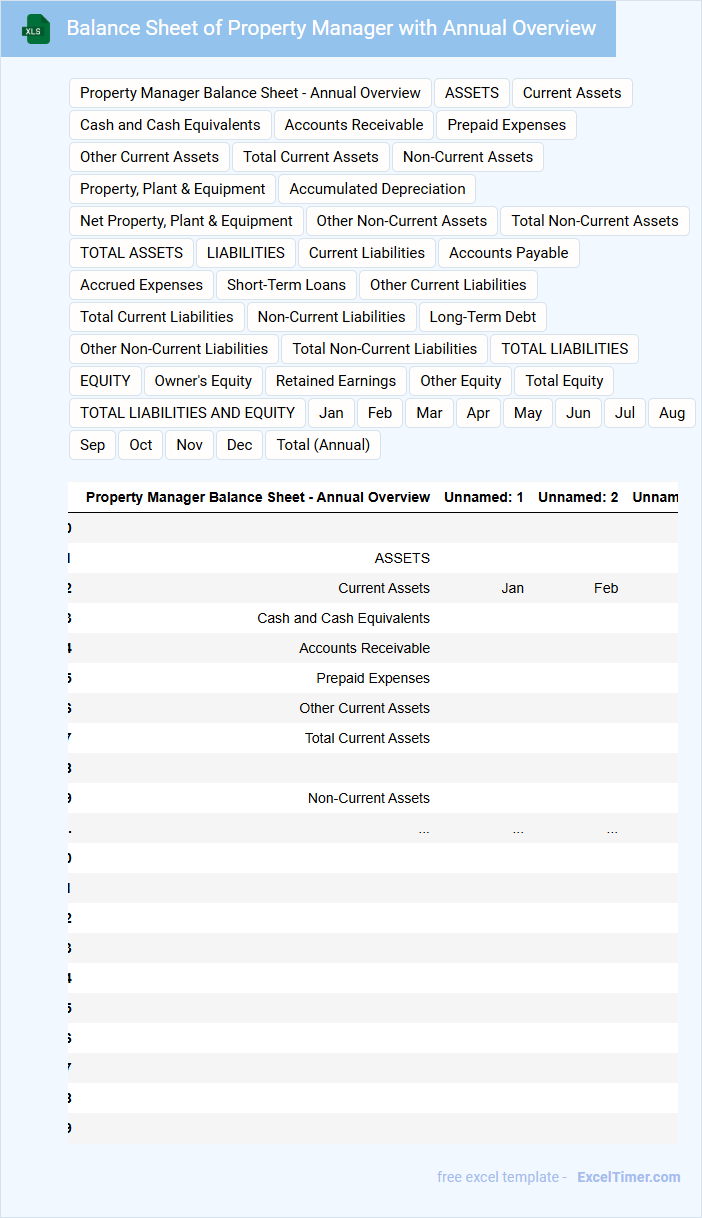

Balance Sheet of Property Manager with Annual Overview

The Balance Sheet of a Property Manager typically contains a detailed summary of assets, liabilities, and equity related to property management activities. It provides a snapshot of the financial position at a specific point in time, essential for evaluating financial health.

This document often includes property values, rental income, maintenance costs, and outstanding debts. For an annual overview, it is important to highlight changes in asset values and key financial ratios to support strategic decision-making.

Annual Budget Tracking for Property Managers in Excel

Annual Budget Tracking for Property Managers in Excel is a document typically containing detailed financial data that helps in monitoring income, expenses, and overall budget adherence for multiple properties throughout the fiscal year.

- Income Tracking: Record rental income and other revenue streams to compare against budgeted amounts.

- Expense Monitoring: Document all operational and maintenance costs to ensure spending stays within limits.

- Variance Analysis: Identify discrepancies between actual and budgeted figures to make informed financial decisions.

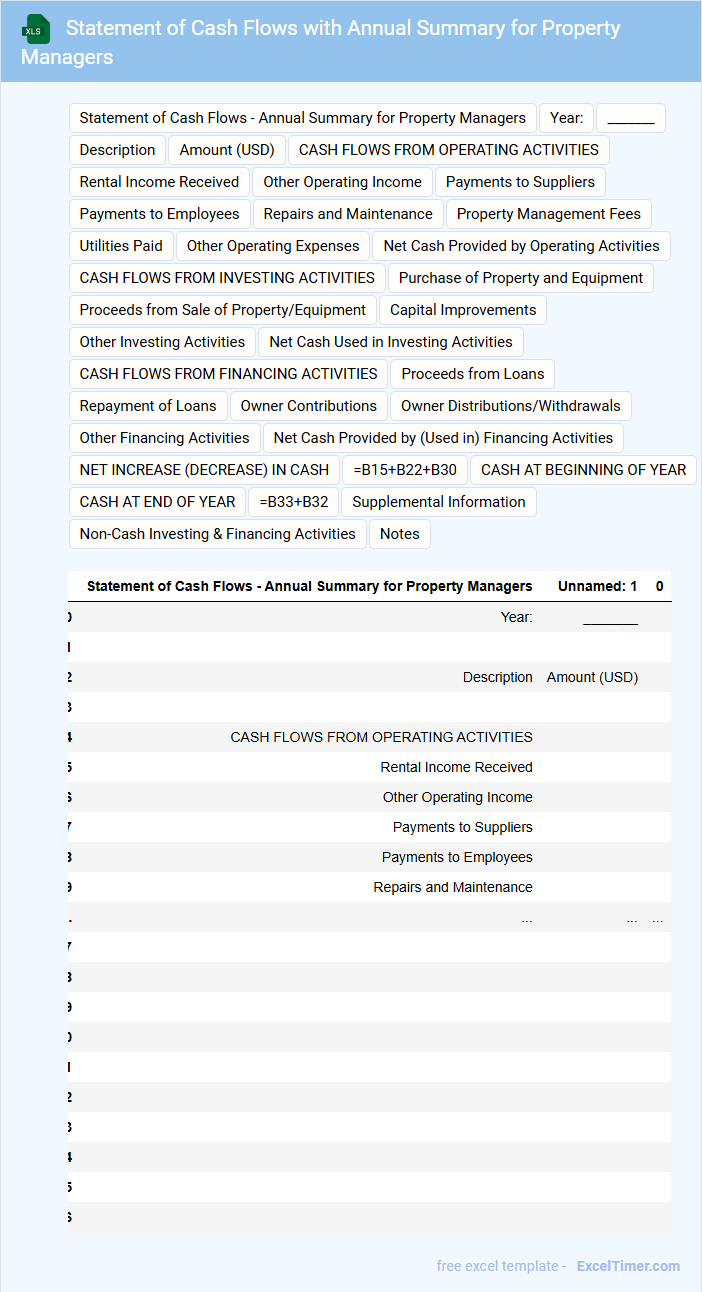

Statement of Cash Flows with Annual Summary for Property Managers

The Statement of Cash Flows provides a detailed overview of how cash is generated and used within a property management business over a specific period. It typically includes operating, investing, and financing activities, helping managers understand liquidity and cash position. For property managers, an annual summary highlights cash inflows from rents and outflows such as maintenance and loan payments, ensuring accurate financial planning and decision-making.

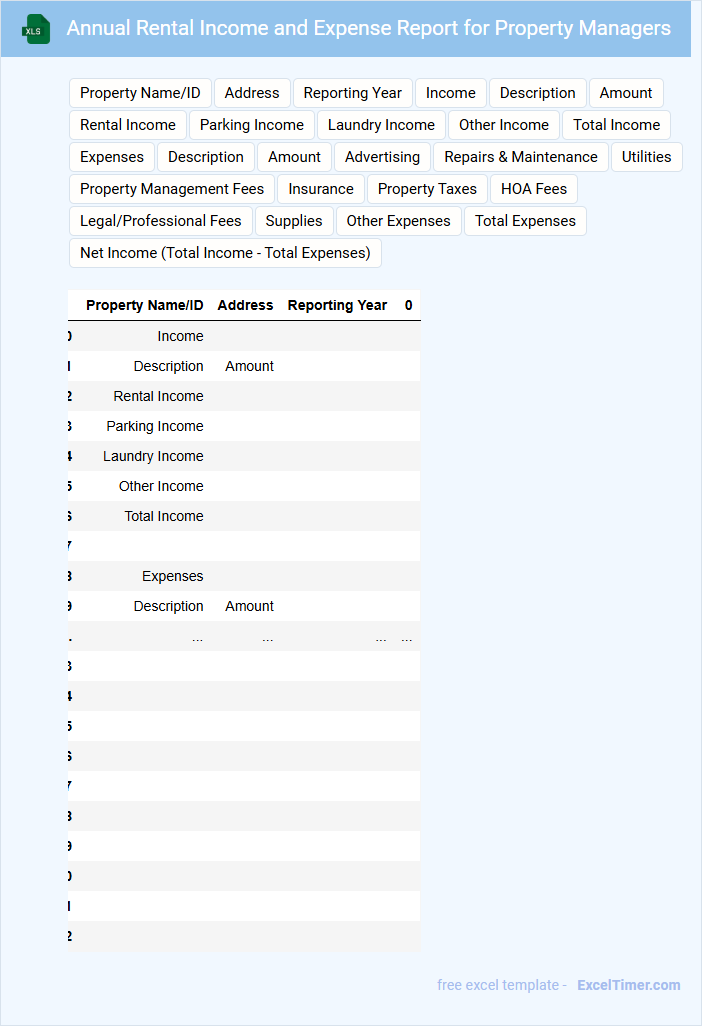

Annual Rental Income and Expense Report for Property Managers

The Annual Rental Income and Expense Report typically contains detailed financial data regarding rental properties, including total income generated and all related expenses incurred over the year. This document helps property managers track profitability and identify trends.

An important suggestion is to ensure accuracy and completeness in recording all income sources and expenses to provide a clear financial picture. Regular updates and thorough documentation aid in effective property management and tax preparation.

Yearly Asset and Liability Statement with Excel for Properties

A Yearly Asset and Liability Statement with Excel for Properties is a financial document that summarizes the assets and liabilities related to property holdings over the year. It is used to assess the net worth and financial health of real estate investments.

- Ensure all property values and loan balances are up-to-date and accurately reflected in the Excel sheet.

- Include detailed schedules for each property to track depreciation, maintenance costs, and income generated.

- Review formulas and data entries regularly to avoid errors and ensure reliable financial analysis.

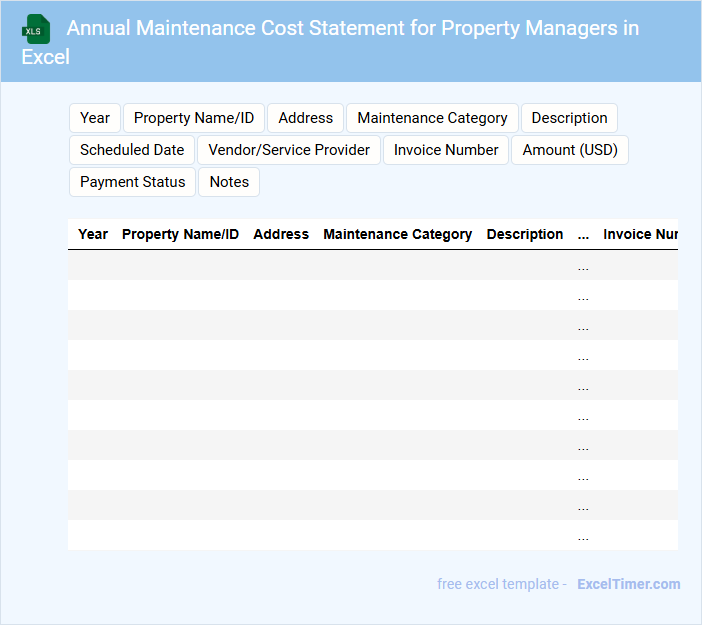

Annual Maintenance Cost Statement for Property Managers in Excel

An Annual Maintenance Cost Statement is a detailed financial document used by property managers to track and report maintenance expenses over a year. It typically includes categories such as repair costs, labor charges, and material expenses.

This document helps in budgeting and financial planning by providing a clear overview of property upkeep costs. For effective management, ensure the statement includes accurate date ranges and itemized entries for transparency.

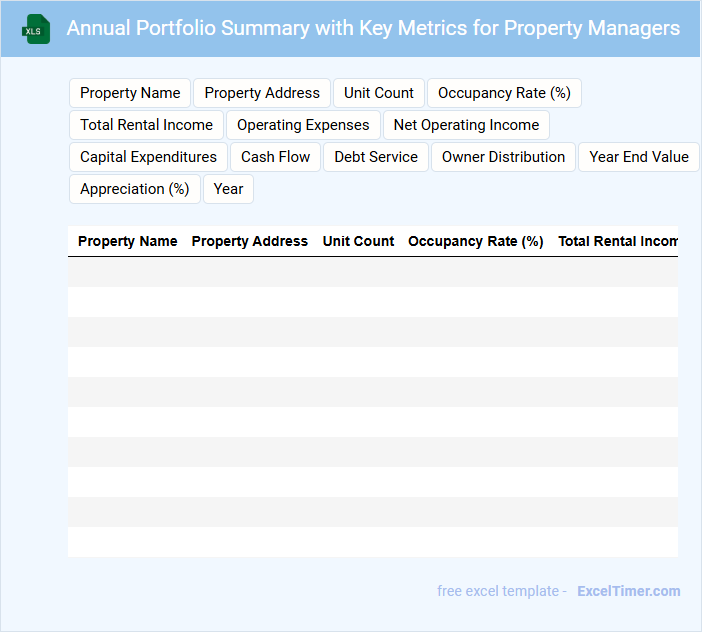

Annual Portfolio Summary with Key Metrics for Property Managers

The Annual Portfolio Summary typically contains an overview of property performance, including financial metrics such as income, expenses, and net operating income. It also highlights occupancy rates, tenant turnovers, and maintenance activities to provide a comprehensive snapshot of the portfolio's health. Property managers rely on this document to make data-driven decisions and optimize asset management strategies.

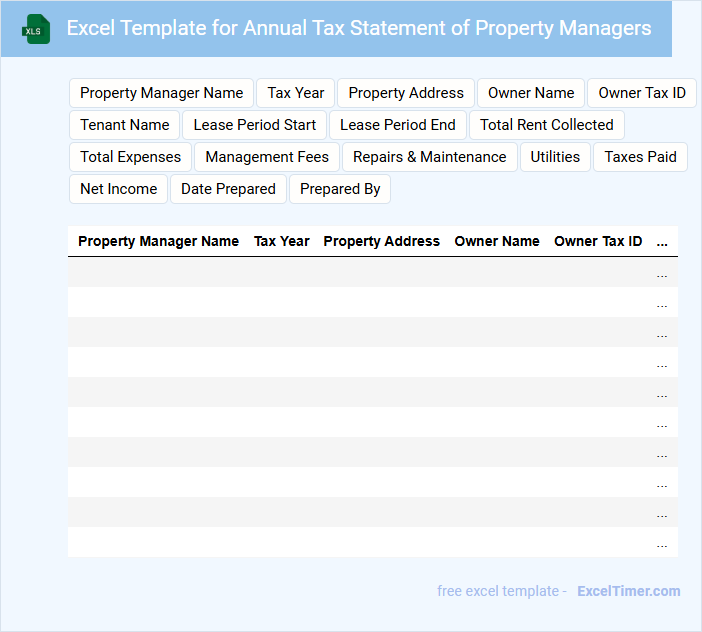

Excel Template for Annual Tax Statement of Property Managers

An Excel Template for Annual Tax Statements is designed to streamline the organization and calculation of financial data related to property management. It typically contains sections for income details, expense tracking, and tax deduction summaries. Including accurate and up-to-date property and tenant information is crucial for ensuring tax compliance and efficiency.

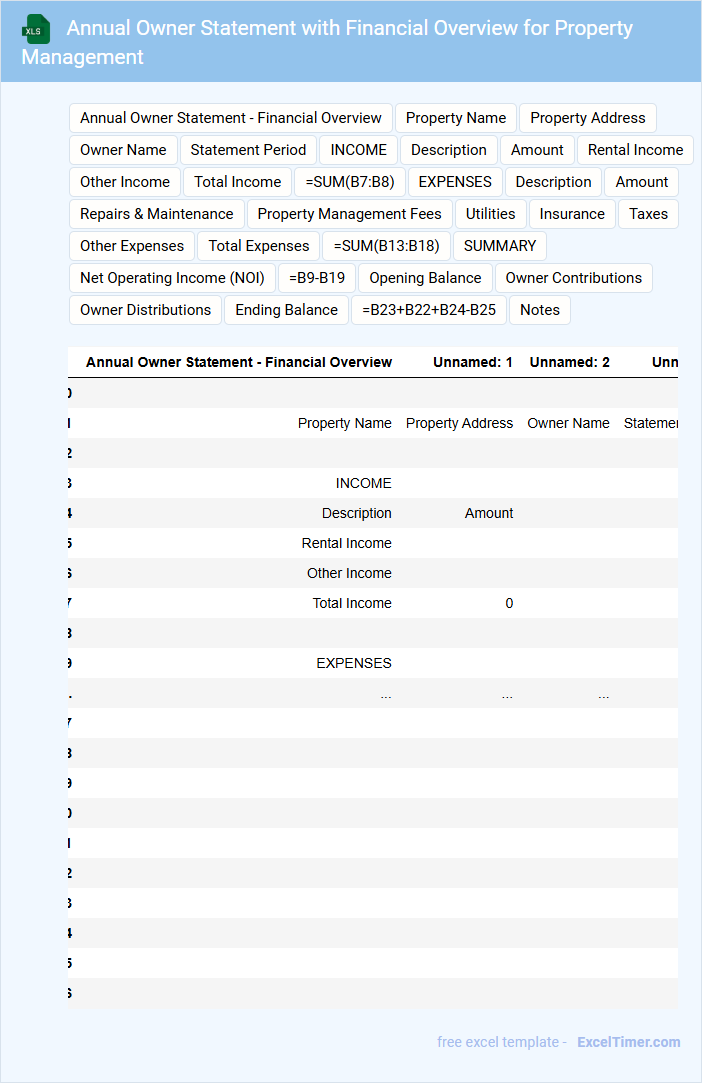

Annual Owner Statement with Financial Overview for Property Management

The Annual Owner Statement is a comprehensive document that provides property owners with a detailed summary of their property's financial performance over the past year. It typically includes income, expenses, and net operating income to give a clear overview of profitability. For effective property management, it is important to ensure accuracy in financial reporting and transparency in expense documentation.

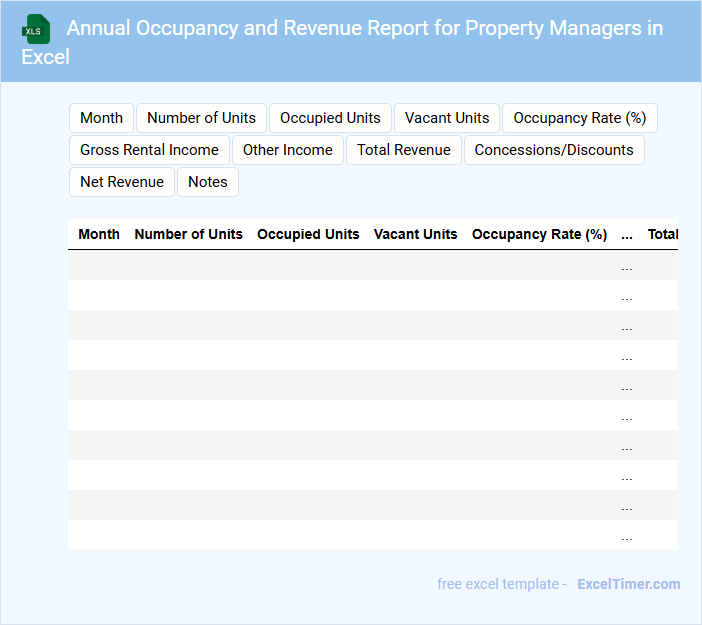

Annual Occupancy and Revenue Report for Property Managers in Excel

What information is typically included in an Annual Occupancy and Revenue Report for Property Managers in Excel? This document usually contains detailed data on property occupancy rates, rental income, and revenue trends over the year. It helps property managers track performance, identify seasonal patterns, and make informed financial decisions.

What important aspect should property managers focus on when creating this report? Accuracy in data entry and consistency in categorizing income and occupancy metrics are crucial. Including visual charts such as occupancy rate graphs and monthly revenue trends enhances clarity and aids in effective decision-making.

What key financial statements should be included in an annual financial statement for property management?

An annual financial statement for property managers should include the Income Statement, Balance Sheet, and Cash Flow Statement to provide a comprehensive overview of financial performance, position, and liquidity. The Income Statement details rental income, operating expenses, and net operating income. The Balance Sheet displays assets like properties and equipment, liabilities such as mortgages and accounts payable, and owner's equity.

How should income and expenses be categorized to accurately reflect property performance?

Income and expenses should be categorized into distinct groups such as rental income, maintenance costs, property taxes, and management fees to accurately reflect property performance. Your financial statement must separate operating income from non-operating income and classify expenses into fixed and variable costs for clear analysis. Proper categorization enables precise tracking of profitability and informed decision-making for property management.

What methods ensure accurate reconciliation of bank statements with property accounts annually?

Your annual financial statement for property managers requires accurate reconciliation of bank statements using automated matching software, detailed transaction audits, and regular cross-verification with property accounts. Employing real-time data integration and discrepancy reporting enhances precision and minimizes errors. Consistent documentation and adherence to standardized reconciliation protocols ensure compliance and financial transparency.

How are capital expenditures and reserve funds documented and reported in the annual statement?

Capital expenditures and reserve funds are documented in the annual financial statement through detailed line items and categorized expense reports, highlighting your property's long-term investments and savings. The statement includes summaries of amounts spent, allocated reserves, and projections for future capital needs. This transparent reporting ensures clear tracking and accountability of financial resources dedicated to property maintenance and improvement.

Which compliance requirements and deadlines are essential for annual financial reporting for property managers?

Property managers must comply with the Generally Accepted Accounting Principles (GAAP) and specific local real estate financial regulations when preparing annual financial statements. Deadlines for submission vary by jurisdiction but commonly fall within 90 days after the fiscal year-end to ensure timely reporting. Maintaining adherence to these compliance requirements helps avoid penalties and ensures transparent financial management for property owners.