The Daily Cash Flow Excel Template for Home Businesses is designed to help track daily income and expenses efficiently, ensuring accurate financial monitoring. It provides a clear overview of cash inflows and outflows, facilitating better budgeting and financial planning. This template is essential for maintaining organized records and making informed business decisions.

Daily Cash Flow Tracker for Home Businesses

The Daily Cash Flow Tracker for home businesses is a document designed to monitor the daily inflow and outflow of cash. It helps entrepreneurs maintain a clear record of their financial transactions.

This document typically contains sections for recording sales, expenses, and cash balances each day. Keeping it updated ensures better financial planning and avoids cash shortages.

It is important to include detailed descriptions of each transaction and regularly review the data to identify trends and improve business decisions.

Simple Daily Cash Flow Log for Home Use

What information is typically recorded in a Simple Daily Cash Flow Log for Home Use? This document usually contains daily records of all cash inflows and outflows within a household. It helps track spending habits and manage budget effectively.

Why is it important to include detailed descriptions and dates in this log? Detailed descriptions and accurate dates ensure clarity and accountability when reviewing transactions. This allows for better financial planning and identifying areas to reduce expenses.

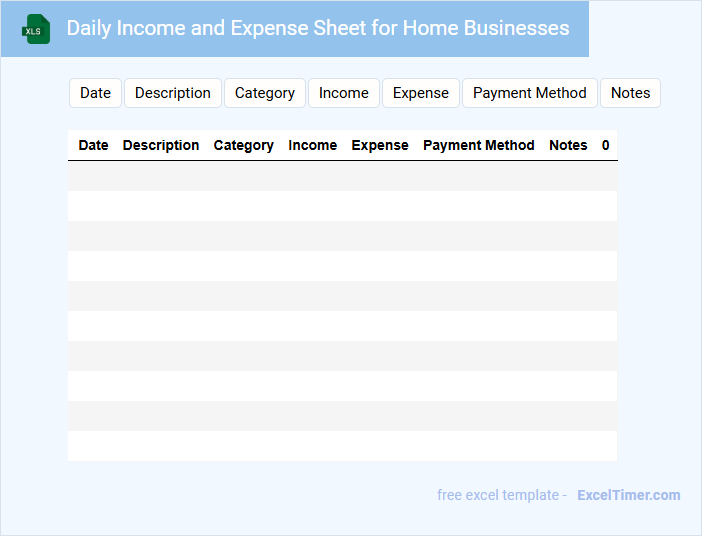

Daily Income and Expense Sheet for Home Businesses

A Daily Income and Expense Sheet for home businesses is a crucial document that tracks all financial transactions on a day-to-day basis. It helps in monitoring cash flow and maintaining accurate records for tax purposes.

This type of sheet typically contains details such as date, description of income or expense, category, and amount. Including a summary section for total daily income, expenses, and net profit is highly recommended to easily assess financial health.

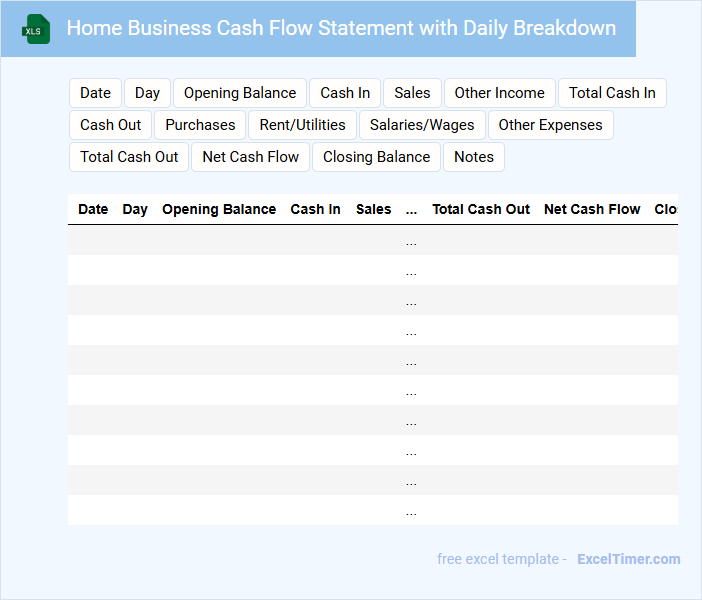

Home Business Cash Flow Statement with Daily Breakdown

The Home Business Cash Flow Statement with daily breakdown typically contains detailed records of all cash inflows and outflows on a daily basis. This document helps in tracking the liquidity and operational efficiency of a home-based business efficiently.

It includes sections for daily sales, expenses, incoming payments, and outgoing costs to provide a clear financial snapshot each day. Maintaining accuracy and consistency in this statement is crucial for effective financial planning and cash management.

Important suggestions include regularly updating the statement, categorizing transactions clearly, and reviewing trends to anticipate cash shortages or surpluses promptly.

Daily Cash Flow Analysis for Small Home Offices

What information is typically included in a Daily Cash Flow Analysis for Small Home Offices? This document usually contains detailed records of daily income and expenses to track the financial health of a small home office. It helps identify spending patterns and ensures positive cash flow management crucial for small-scale operations.

Why is daily monitoring of cash flow important for small home offices? Consistent tracking allows for early detection of potential cash shortages and supports better budgeting decisions. Maintaining accurate daily records is essential for managing liquidity and sustaining business growth.

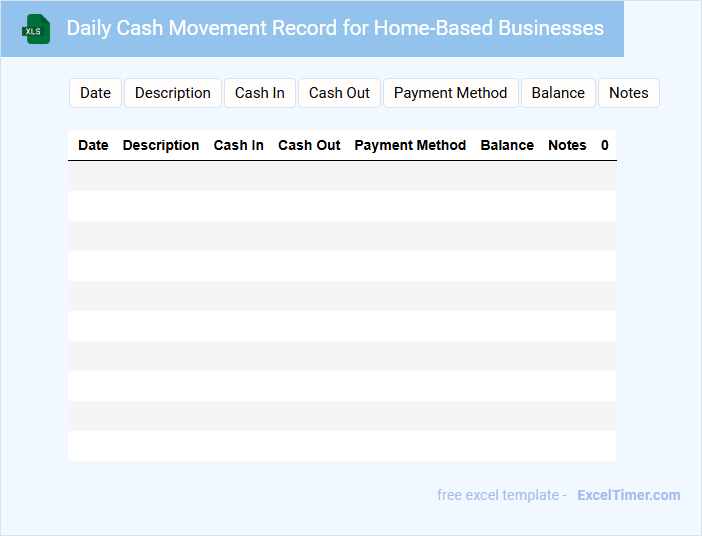

Daily Cash Movement Record for Home-Based Businesses

A Daily Cash Movement Record for Home-Based Businesses is a document used to track all cash transactions on a daily basis, ensuring accurate financial monitoring. It helps business owners maintain transparency and manage cash flow effectively.

- Record all cash inflows and outflows with exact dates and amounts.

- Include detailed descriptions for each transaction to avoid confusion.

- Review and reconcile the record daily to detect discrepancies early.

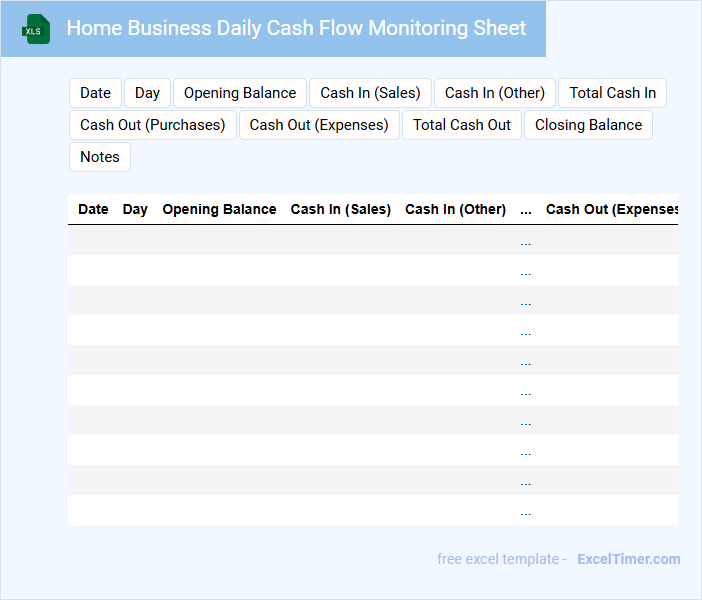

Home Business Daily Cash Flow Monitoring Sheet

Home Business Daily Cash Flow Monitoring Sheet is a document used to track daily financial transactions to ensure accurate cash management. It helps business owners monitor inflows and outflows to maintain liquidity and make informed decisions.

- Record all daily cash receipts and payments promptly.

- Update the balance regularly to avoid discrepancies.

- Review the sheet daily to identify cash flow trends and issues.

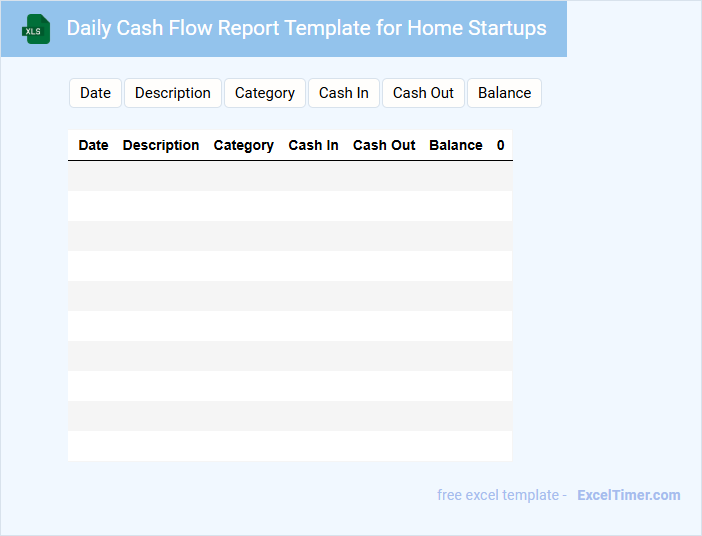

Daily Cash Flow Report Template for Home Startups

A Daily Cash Flow Report Template for Home Startups typically contains detailed records of daily income and expenses to help manage financial health.

- Income Tracking: It records all sources of daily revenue to monitor earnings accurately.

- Expense Monitoring: It lists daily expenditures to control and reduce unnecessary costs.

- Cash Position Summary: It provides a clear snapshot of available cash at the end of each day.

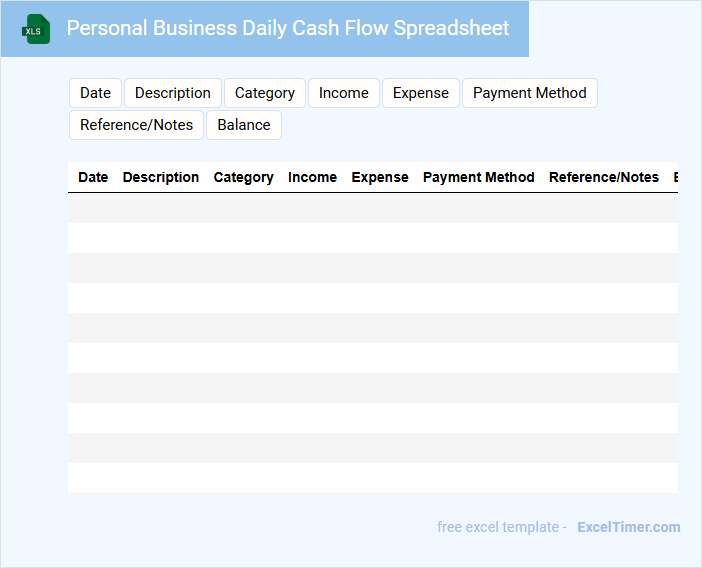

Personal Business Daily Cash Flow Spreadsheet

A Personal Business Daily Cash Flow Spreadsheet typically contains detailed records of daily income and expenses related to individual business activities. It tracks cash inflows and outflows to help maintain an accurate understanding of financial health. This type of document is essential for managing liquidity and making informed financial decisions.

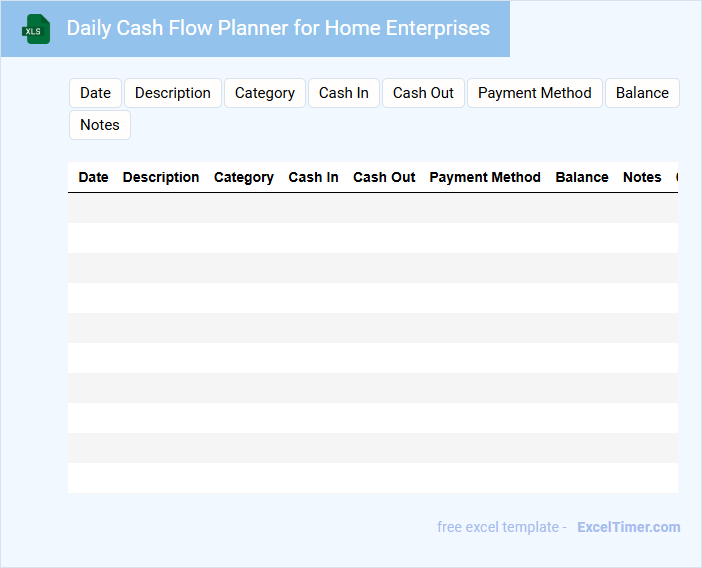

Daily Cash Flow Planner for Home Enterprises

A Daily Cash Flow Planner for home enterprises typically contains records of daily income and expenses to help monitor financial health. It usually includes sections for tracking sales, payments made, and outstanding receivables. Maintaining accuracy and consistency in entries is crucial for effective cash management.

Important suggestions include regularly updating the planner, categorizing expenses clearly, and reviewing the cash flow trends to make informed business decisions. Using this planner can help prevent cash shortages and improve budgeting strategies. Additionally, integrating digital tools can enhance accuracy and ease of access.

Cash Flow Tracking Sheet for Home Business Owners

A Cash Flow Tracking Sheet for home business owners usually contains detailed records of all income and expenses, helping to monitor financial health. It includes sections for sales revenue, operating costs, and cash inflows and outflows to provide a clear financial overview.

Keeping this document updated regularly is crucial for making informed budgeting and investment decisions. An important suggestion is to categorize transactions accurately to identify spending trends and optimize cash management.

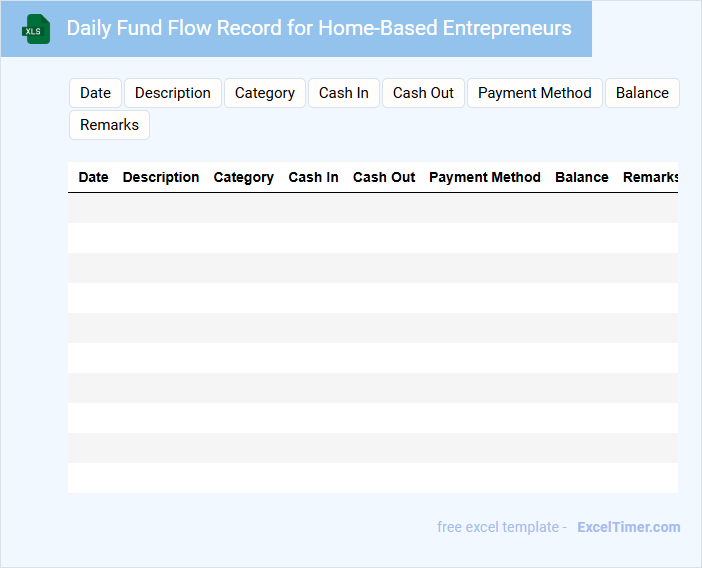

Daily Fund Flow Record for Home-Based Entrepreneurs

A Daily Fund Flow Record is a crucial financial document that tracks the daily income and expenses of home-based entrepreneurs, ensuring effective money management. It typically contains detailed entries of all cash inflows and outflows, helping to maintain accurate financial oversight. Consistent use of this record aids in budgeting, identifying spending patterns, and improving financial decision-making.

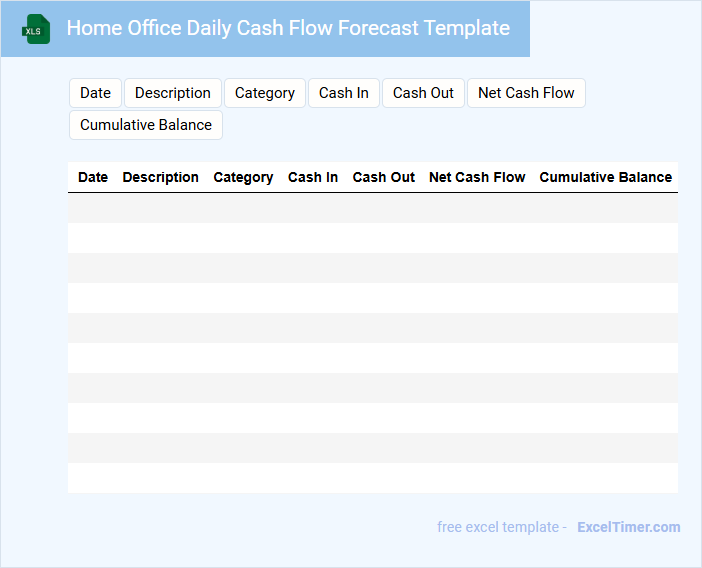

Home Office Daily Cash Flow Forecast Template

The Home Office Daily Cash Flow Forecast Template typically contains detailed records of expected daily income and expenses to help manage short-term financial liquidity. It includes sections for cash inflows, outflows, and the resulting daily net cash position. This template is essential for anticipating cash shortages or surpluses and making informed financial decisions.

Key elements to include are accurate daily transaction entries, clear categorization of income and expenses, and a running balance to track cash availability. It is important to update the template regularly and review forecast assumptions to maintain accuracy. Ensuring it reflects real-time data helps prevent cash flow disruptions in the home office environment.

Daily Transaction Log with Cash Flow Summary for Home Businesses

A Daily Transaction Log with Cash Flow Summary for Home Businesses is a document that tracks all financial transactions and summarizes cash inflows and outflows on a daily basis to maintain accurate records. It helps small business owners manage their finances effectively and ensures transparency in cash handling.

- Record each transaction with date, description, amount, and payment method.

- Summarize daily cash inflows and outflows to monitor liquidity.

- Regularly reconcile the log with actual cash on hand to identify discrepancies promptly.

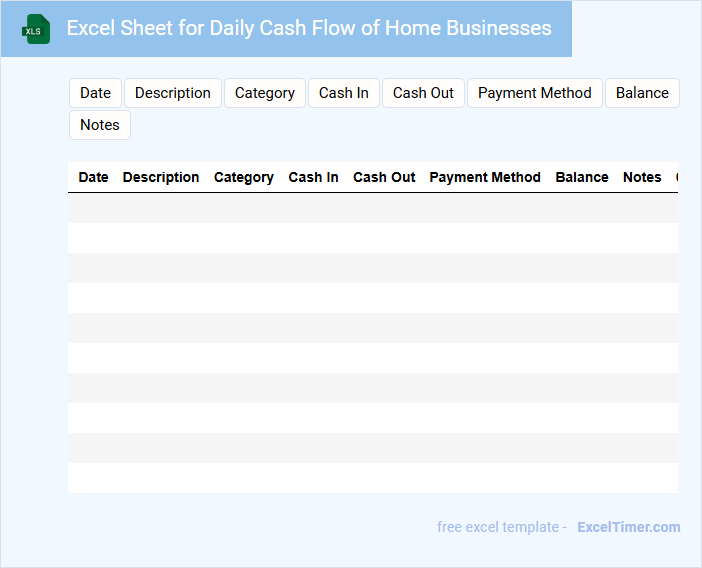

Excel Sheet for Daily Cash Flow of Home Businesses

An Excel Sheet for Daily Cash Flow of home businesses typically contains records of daily income and expenses to track financial health. It helps in monitoring cash inflows and outflows to ensure the business remains solvent and profitable. Important elements include columns for date, description, amount received, amount paid, and running balance to maintain clear, organized data.

What are the key components to include in a daily cash flow Excel sheet for a home business?

A daily cash flow Excel sheet for a home business should include key components such as opening cash balance, daily cash inflows from sales or services, and cash outflows for expenses like supplies and utilities. Tracking net cash flow daily helps monitor your liquidity and ensure your business remains financially healthy. Accurate categorization and date-wise entries optimize cash management and forecasting.

How can you categorize daily income and expenses efficiently in your cash flow document?

Categorize your daily income and expenses by creating distinct sections for revenue streams, fixed costs, and variable expenses in your cash flow document. Use clear labels such as sales, utilities, supplies, and marketing to track each category accurately. Implementing consistent date entries and summaries helps you monitor financial trends and maintain organized records.

What formulas or functions in Excel help track running balances and cash shortages?

Excel functions like SUM and SUMIF efficiently calculate running balances by totaling daily inflows and outflows, offering real-time cash position updates. The IF function highlights cash shortages by flagging negative balances, enabling proactive management. Combining these with conditional formatting visually emphasizes critical cash flow issues for home businesses.

How frequently should you update and review your daily cash flow data to maintain accuracy?

Updating and reviewing your daily cash flow data every business day ensures precise tracking of income and expenses for home businesses. Consistent daily monitoring helps identify trends and potential cash shortages early. Maintaining this routine supports accurate financial decision-making and business growth.

Which Excel visualization tools best highlight cash flow trends and problem areas for home businesses?

Excel's line charts effectively highlight daily cash flow trends for home businesses, revealing fluctuations over time. Heat maps provide intuitive visualization of problem areas by color-coding negative or low cash flows. Your use of pivot tables and conditional formatting further enhances analysis by organizing data and emphasizing critical financial insights.