Daily Cash Flow Excel Template for Small Shops offers an efficient way to track daily income and expenses, helping small business owners maintain accurate financial records. It simplifies cash management by providing clear visualization of cash inflows and outflows, enabling timely decision-making. Using this template improves budgeting accuracy, supports financial planning, and enhances overall business profitability.

Daily Cash Flow Tracker with Expense Categories

What information is typically included in a Daily Cash Flow Tracker with Expense Categories? This type of document usually contains daily records of all cash inflows and outflows, categorized by expense types such as rent, utilities, groceries, and entertainment. It helps individuals or businesses monitor their financial habits, control spending, and ensure accurate budgeting by clearly tracking where money is coming from and going to.

An important suggestion for using this document effectively is to consistently update it every day to avoid missing transactions and to categorize expenses precisely. This ensures accurate analysis of cash flow patterns and aids in making informed financial decisions.

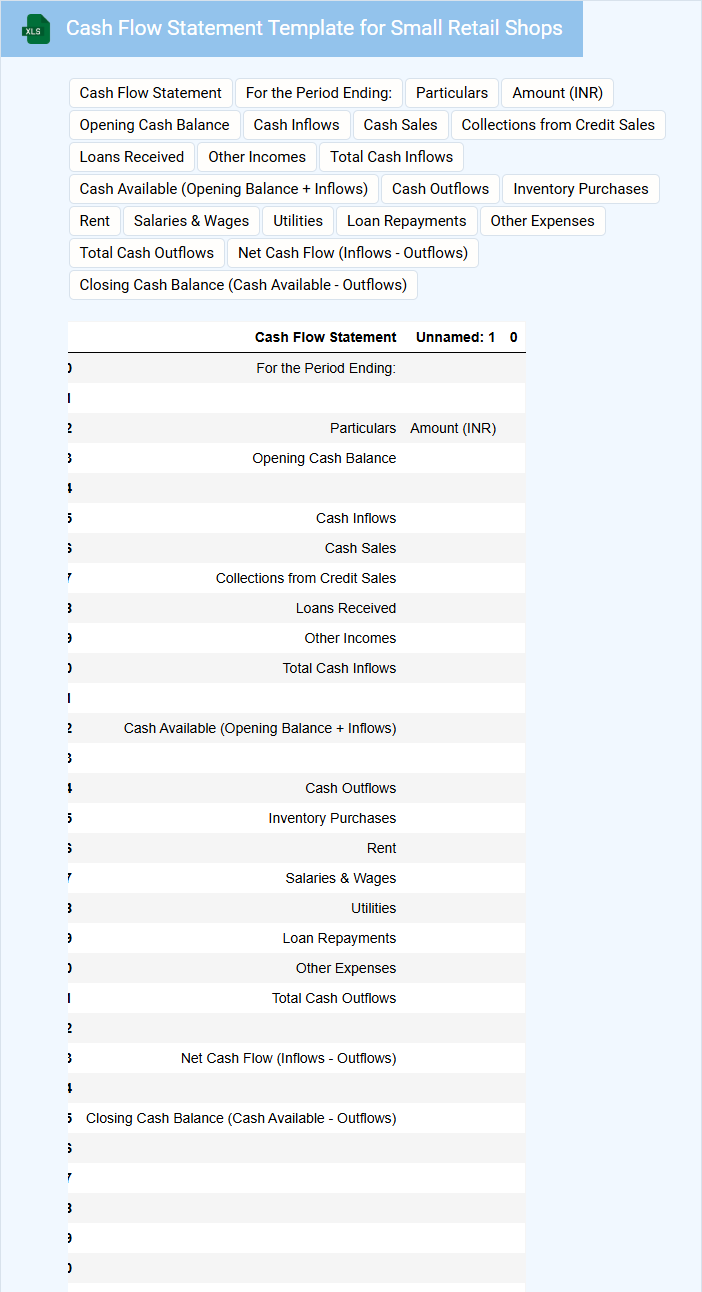

Cash Flow Statement Template for Small Retail Shops

The Cash Flow Statement Template is a crucial financial document that tracks the inflow and outflow of cash within a small retail shop. It typically includes sections for operating, investing, and financing activities to provide a clear picture of the business's liquidity. This template helps owners manage cash efficiently, ensuring the shop maintains enough funds to cover daily expenses and future growth.

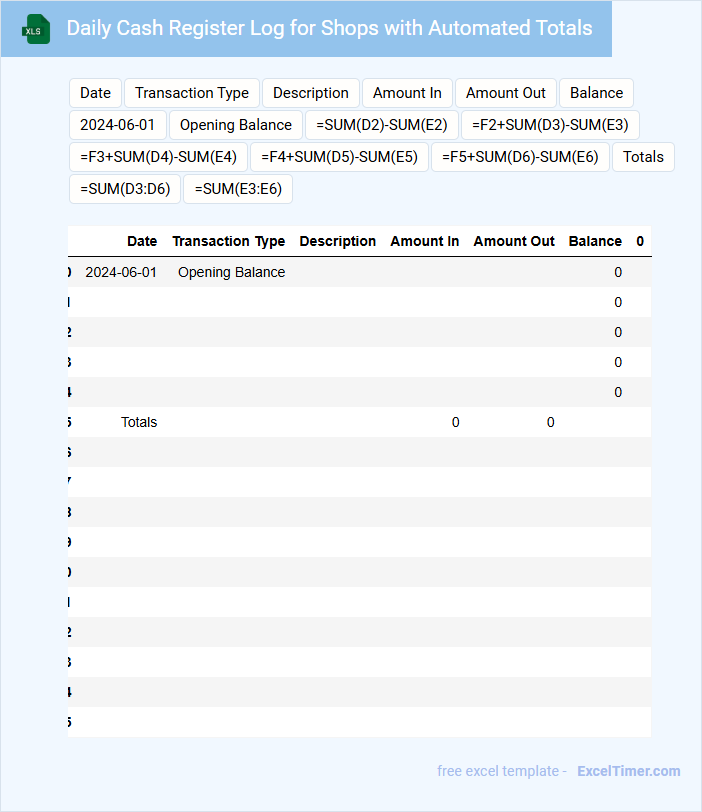

Daily Cash Register Log for Shops with Automated Totals

The Daily Cash Register Log for shops with automated totals is a crucial document that records all cash transactions made throughout the day. It helps in tracking sales, managing cash flow, and detecting discrepancies quickly. This log usually includes date, time, transaction details, opening and closing balances, and automated total calculations.

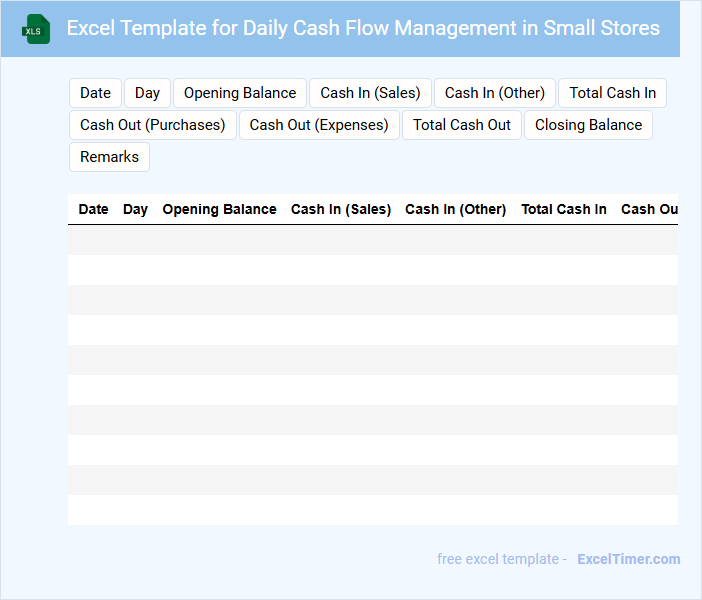

Excel Template for Daily Cash Flow Management in Small Stores

Excel templates for daily cash flow management in small stores typically contain financial data tracking tools to help monitor income and expenses efficiently.

- Daily Income and Expense Logs: These provide an organized record of all cash inflows and outflows each day.

- Cash Flow Summary: A consolidated view that highlights net cash position to support quick decision-making.

- Budget Comparison: Tools to compare actual cash flow against projected budgets to control spending.

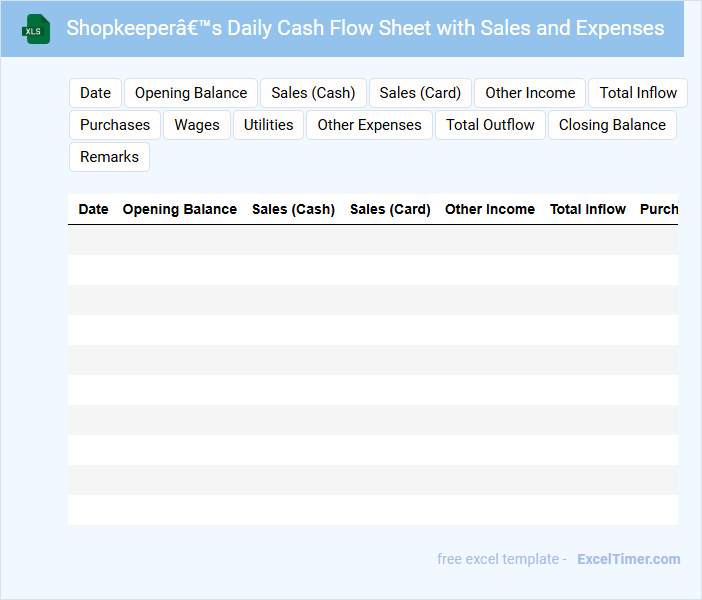

Shopkeeper’s Daily Cash Flow Sheet with Sales and Expenses

What information is typically included in a Shopkeeper's Daily Cash Flow Sheet with Sales and Expenses? This document usually records daily sales revenue, cash inflows, and all expenses incurred throughout the day to monitor financial performance. It helps shopkeepers track cash movements, manage budgets, and identify discrepancies promptly for better financial control.

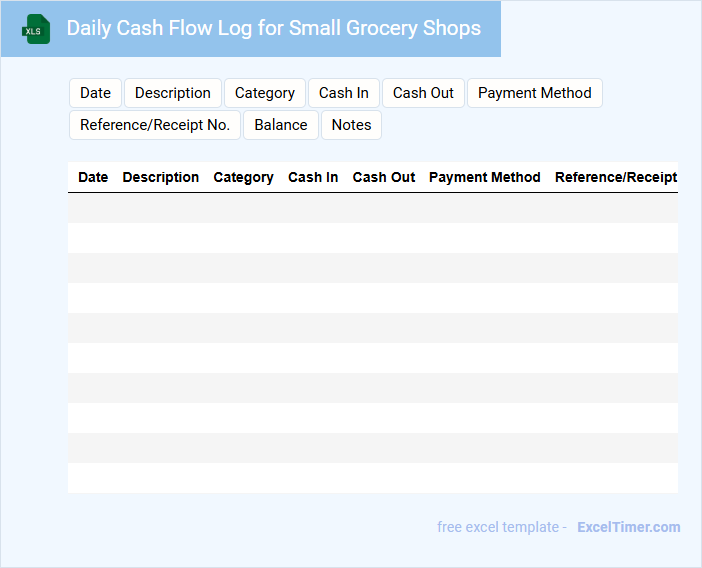

Daily Cash Flow Log for Small Grocery Shops

A Daily Cash Flow Log for small grocery shops is a vital document that records all daily cash inflows and outflows to maintain accurate financial tracking. It typically contains details such as sales revenue, expenses, and cash-on-hand balances. This log helps shop owners monitor liquidity and make informed business decisions. Important elements to include are opening cash balance, total sales, cash expenses, and closing cash balance to ensure precise cash management.

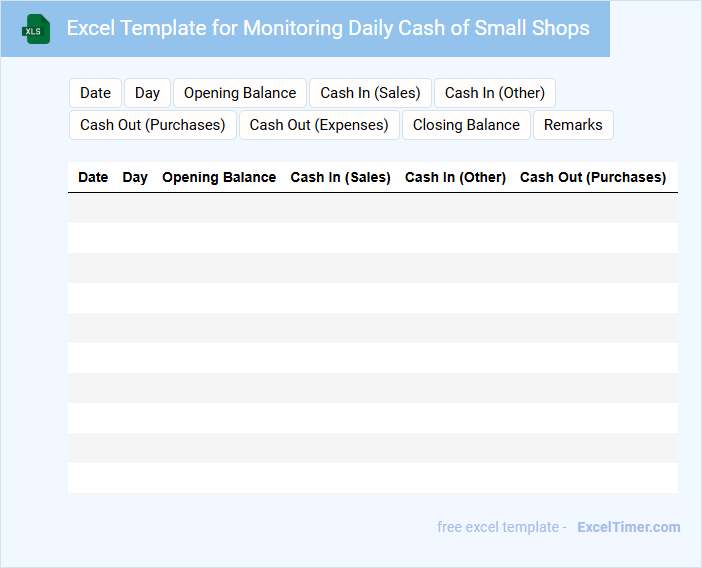

Excel Template for Monitoring Daily Cash of Small Shops

This document typically contains structured tables and formulas to record and track daily cash transactions for small shops. It is designed to help shop owners monitor their cash flow effectively and identify discrepancies promptly.

- Include columns for date, opening cash, sales, expenses, and closing cash.

- Incorporate automatic calculations to summarize daily totals and cash balances.

- Add a section for notes to record any unusual transactions or observations.

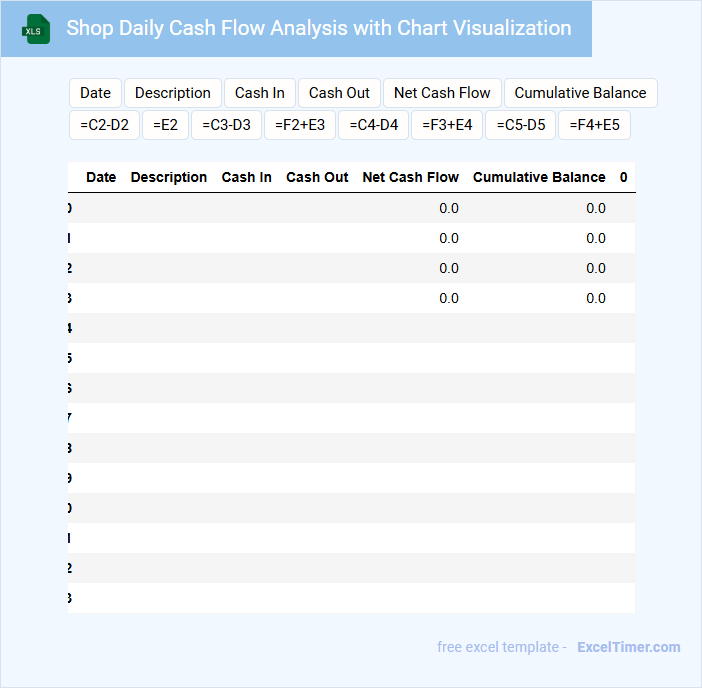

Shop Daily Cash Flow Analysis with Chart Visualization

The Shop Daily Cash Flow Analysis document typically contains detailed records of daily cash inflows and outflows. It helps shop owners monitor financial health by tracking sales, expenses, and net cash position. This document often includes a breakdown of revenue sources and expense categories.

A chart visualization enhances understanding by presenting daily cash trends and patterns graphically. It allows for quick identification of cash surpluses or shortages. Including a comparison against budgeted or target cash flow is an important suggestion for effective monitoring.

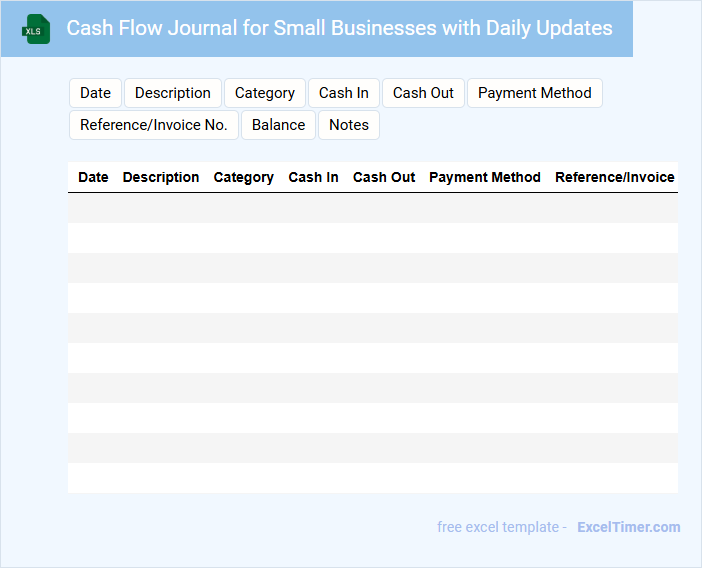

Cash Flow Journal for Small Businesses with Daily Updates

A Cash Flow Journal for Small Businesses with Daily Updates typically contains detailed daily records of all cash inflows and outflows to help track financial health.

- Accurate daily entries: Ensure all cash transactions are recorded promptly and precisely.

- Categorization of cash flows: Separate income and expenses by categories for better financial analysis.

- Regular reconciliation: Compare journal entries with bank statements to identify discrepancies early.

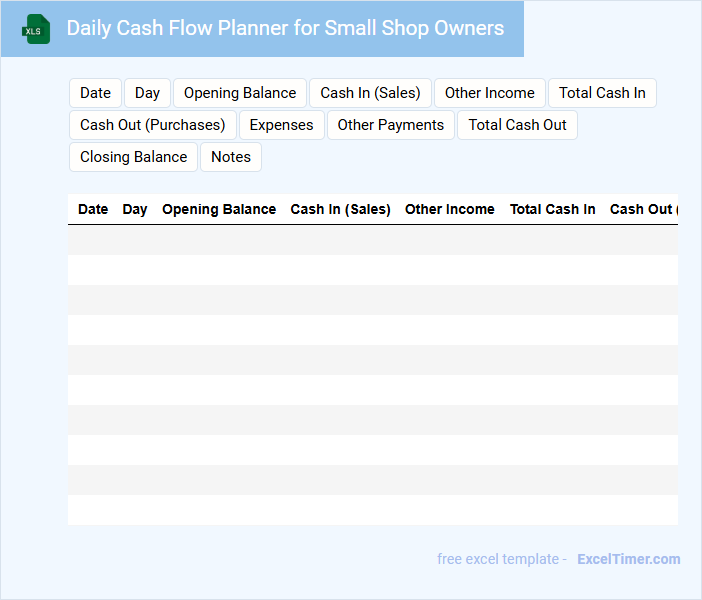

Daily Cash Flow Planner for Small Shop Owners

A Daily Cash Flow Planner for Small Shop Owners typically records all cash inflows and outflows to manage daily finances efficiently. It helps track the liquidity position and ensures operational expenses are covered.

- Include daily sales revenue and any other cash income entries.

- Record all cash expenses such as purchases, salaries, and utility bills.

- Monitor opening and closing cash balances for each day.

Retail Cash Tracker for Daily Income and Outflow

What information is typically contained in a Retail Cash Tracker for Daily Income and Outflow? This document usually records daily cash transactions including sales income and expenses to maintain accurate financial tracking. It helps retailers monitor cash flow, detect discrepancies, and plan for future expenses effectively.

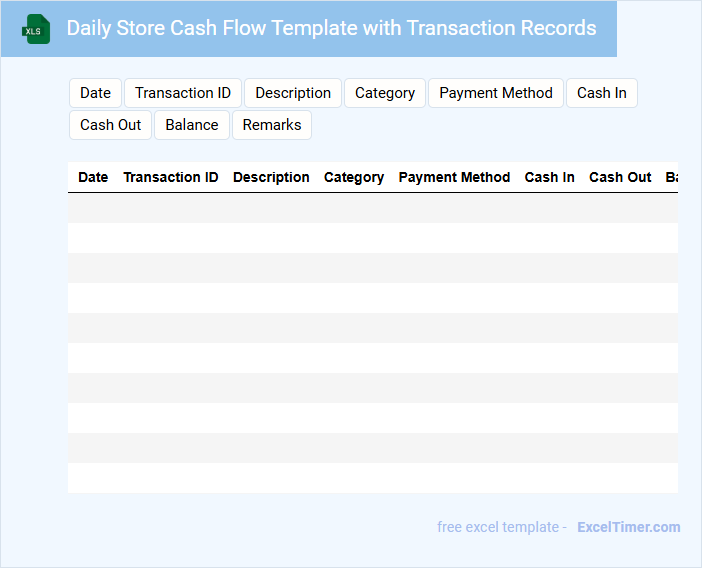

Daily Store Cash Flow Template with Transaction Records

The Daily Store Cash Flow Template is a vital document used to track all financial transactions within a store on a daily basis. It ensures accurate recording of cash inflows and outflows to maintain proper financial oversight.

This template typically contains sections for recording sales, expenses, cash on hand, and transaction details. Regularly updating and reviewing this document helps prevent discrepancies and supports effective cash management.

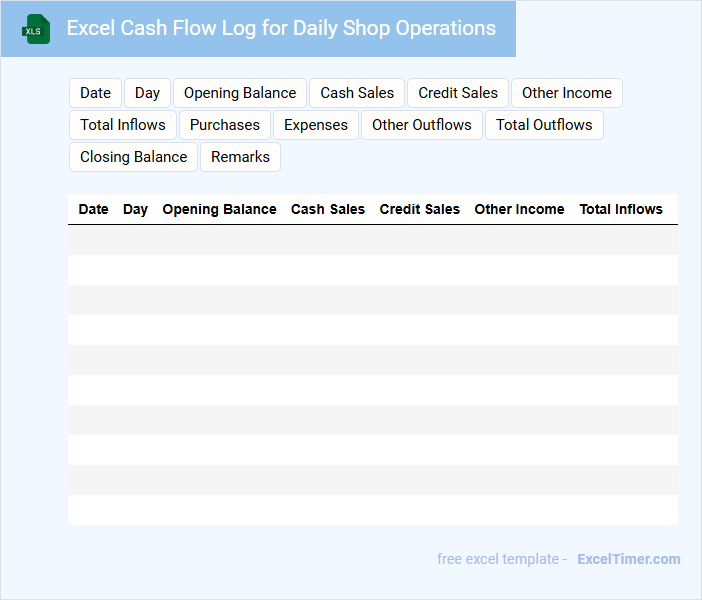

Excel Cash Flow Log for Daily Shop Operations

An Excel Cash Flow Log for Daily Shop Operations is a document used to record and monitor daily financial transactions, ensuring accurate tracking of cash inflows and outflows. It helps businesses maintain liquidity and manage their operational expenses efficiently.

- Include columns for date, description, cash inflow, cash outflow, and balance to keep information organized.

- Regularly update the log to promptly identify discrepancies and maintain accurate financial records.

- Use formulas to automate balance calculations and generate summaries for better cash management.

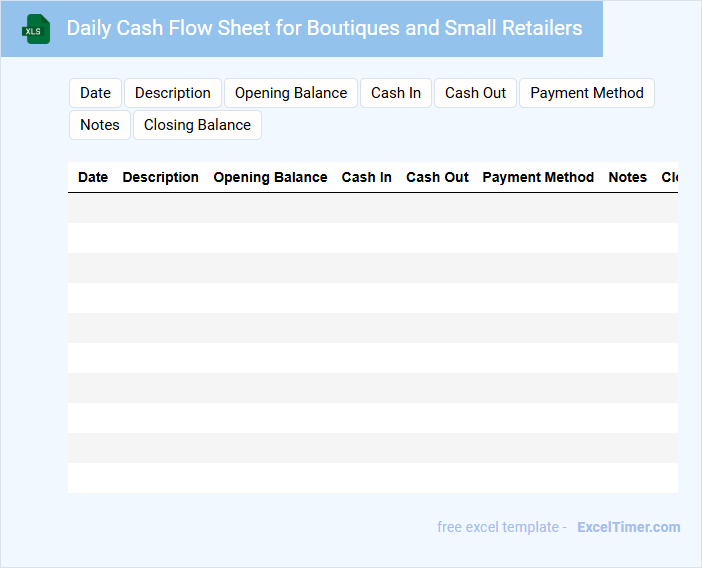

Daily Cash Flow Sheet for Boutiques and Small Retailers

What information is typically included in a Daily Cash Flow Sheet for Boutiques and Small Retailers? This document usually contains detailed records of daily cash receipts, disbursements, and the resulting cash balance to track the store's liquidity. It helps owners monitor their cash inflow and outflow, ensuring financial stability and effective management of working capital.

Daily Shop Cash Flow Monitor with Expense Tracking

A Daily Shop Cash Flow Monitor is a document designed to track the daily inflow and outflow of cash within a retail or service business. It typically contains sections for recording sales revenue, expenses, and cash balances to provide a clear snapshot of financial health. This tool is essential for identifying spending patterns and ensuring positive cash management.

Important elements to include are detailed expense categories, daily sales totals, and a summary of net cash flow to help in making informed financial decisions. Including a section for notes can aid in explaining any discrepancies or unusual transactions. Consistent daily updates and reviewing this document can prevent cash shortages and improve budgeting accuracy.

What essential data columns should be included to track daily cash inflows and outflows in an Excel cash flow document for small shops?

Include essential columns such as Date, Description, Cash Inflow, Cash Outflow, Payment Method, Category, and Running Balance to effectively track daily cash movements. Date logs each transaction, while Description details the source or use of funds. Running Balance dynamically updates to reflect the shop's current cash position, enabling precise financial monitoring.

How can Excel formulas help automatically calculate daily cash balances and highlight discrepancies?

Excel formulas like SUM and IF enable automatic calculation of daily cash balances by totaling daily inflows and outflows. Conditional formatting flags discrepancies in cash records by highlighting negative balances or unexpected variances. PivotTables summarize cash flow trends, helping small shops maintain accurate financial oversight effortlessly.

What best practices ensure accurate recording of both cash sales and expenses in the daily cash flow sheet?

Accurate recording of cash sales and expenses in a daily cash flow sheet requires establishing standardized entry categories and using real-time data input to minimize errors. Implementing regular reconciliation with physical cash counts and receipts enhances data reliability. Utilizing built-in Excel functions like SUMIF and data validation improves accuracy and consistency in tracking daily transactions.

How frequently should cash flow entries be updated to maintain real-time financial visibility for the shop?

Daily cash flow entries should be updated at the end of each business day to maintain accurate and real-time financial visibility for your small shop. Consistent daily tracking helps identify cash shortages or surpluses promptly, allowing better financial decision-making. Leveraging Excel for this process ensures organized, up-to-date records that support effective cash management.

What Excel tools or features (e.g., conditional formatting, charts) are most effective for visualizing cash flow trends and identifying potential cash shortages?

Excel tools like conditional formatting highlight low cash balances by applying color scales to daily cash flow figures, enabling quick identification of potential shortages. Line charts and sparkline graphs visualize cash flow trends over time, illustrating patterns and fluctuations in revenue and expenses. PivotTables summarize cash inflows and outflows across different dates or categories, supporting detailed analysis and decision-making.