The Daily Expense Report Excel Template for Freelancers offers a streamlined way to track daily income and expenses with ease. This template helps freelancers maintain accurate financial records, ensuring better budget management and tax preparation. Customizable categories and automatic calculations make it an essential tool for independent professionals.

Daily Expense Tracker Excel Template for Freelancers

The Daily Expense Tracker Excel Template for freelancers is designed to help individuals manage their daily financial transactions efficiently. It typically contains sections for recording income, expenses, and categorizing them for better financial oversight. This tool is essential for freelancers to maintain clear and organized records of their earnings and spendings.

Important elements to include are date entries, expense categories, payment methods, and a summary of totals to track cash flow effectively. Adding a notes section can help freelancers remember specific details about transactions. Ensuring the template has simple formulas for automatic calculations enhances accuracy and saves time.

Personal Daily Expense Log with Category Breakdown

A Personal Daily Expense Log typically contains detailed records of an individual's daily expenditures, categorized by type such as food, transportation, and entertainment. This documentation helps in tracking spending habits and identifying areas for budgeting improvements.

Including a Category Breakdown allows for more precise analysis of where money is going, enhancing financial awareness. It is important to ensure entries are updated consistently and accurately to maintain the log's usefulness.

Simple Daily Expense Report for Freelancers in Excel

A Simple Daily Expense Report for freelancers in Excel is typically a document used to track daily spending related to work activities. It usually contains details such as the date, description of the expense, category, payment method, and amount spent. This type of report helps freelancers manage their finances, monitor cash flow, and prepare accurate tax records.

For optimization, it's important to include clear categories that reflect common freelance expenses, such as software subscriptions, travel, and office supplies. Using Excel's built-in formulas to automatically sum totals and generate summaries enhances usability. Additionally, maintaining consistency in data entry and backing up reports regularly are essential best practices for effective expense tracking.

Daily Income and Expense Sheet for Freelancers

A Daily Income and Expense Sheet for freelancers is a detailed record of all earnings and expenditures made within a single day. It typically contains entries such as client payments, miscellaneous expenses, and any other financial transactions related to work. Maintaining this sheet helps freelancers track their financial health and make informed budgeting decisions.

Excel Template for Tracking Daily Expenses of Freelancers

An Excel Template for Tracking Daily Expenses of Freelancers is designed to help independent workers monitor their financial transactions efficiently. It usually contains columns for date, description, category, payment method, and amount spent. This document is essential for maintaining accurate records and simplifying tax filing processes.

Important features to include are customizable categories to reflect diverse freelancing activities, automatic calculations for totals and balances, and a clear layout that enhances readability. Additionally, incorporating a summary sheet for monthly expense reviews can provide valuable insights into spending patterns. Ensuring data validation and protection helps maintain accuracy and prevents accidental alterations.

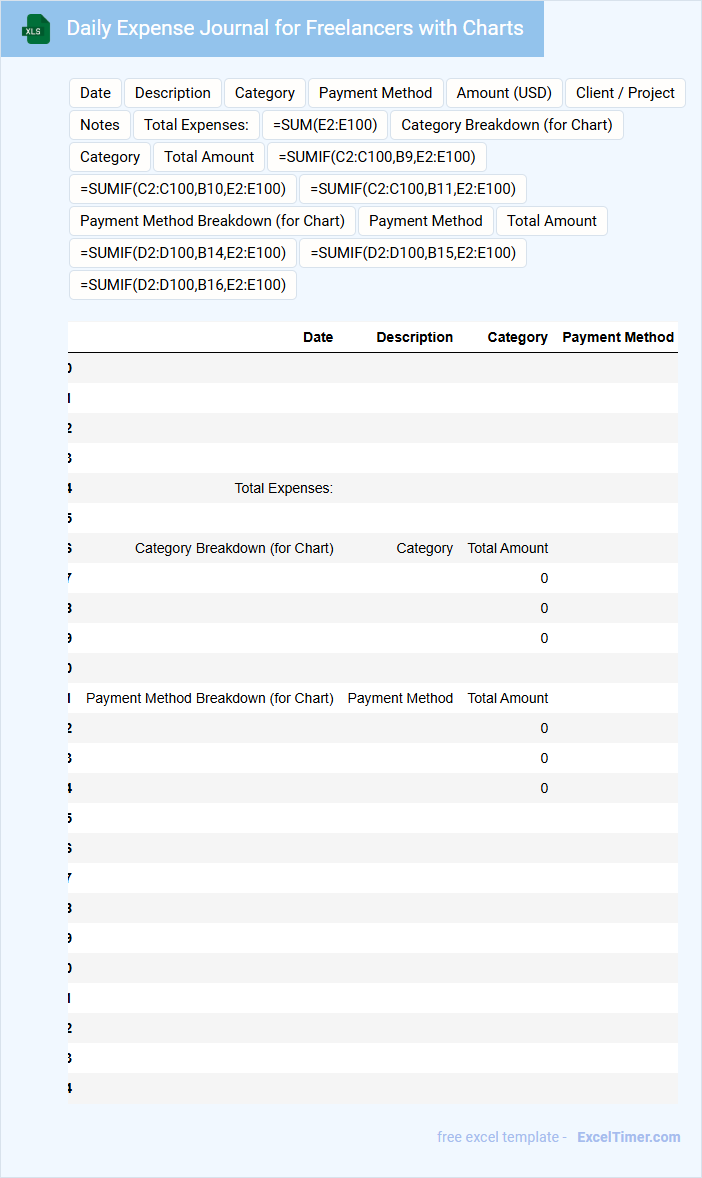

Daily Expense Journal for Freelancers with Charts

A Daily Expense Journal for Freelancers is a document used to meticulously track daily income and expenditures, allowing freelancers to maintain financial clarity and manage budgets effectively. Typically, this journal includes categorized expense entries, dates, payment methods, and notes for reference. Integrating visual charts enhances the understanding of spending patterns and financial trends over time.

Important elements to include are detailed expense categories, timestamps, and payment modes for accuracy. Automated chart generation aids in visual analysis, so consistency in data entry is crucial. Additionally, including a section for notes or remarks helps capture contextual details that impact financial decisions.

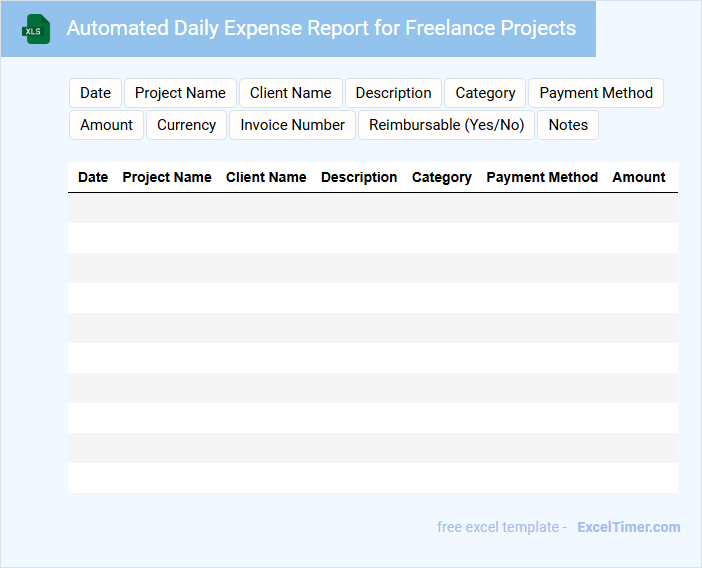

Automated Daily Expense Report for Freelance Projects

This document typically contains a detailed record of daily expenses incurred during freelance projects, including dates, categories, and payment amounts. It helps freelancers keep track of costs and manage budget effectively.

- Include clear descriptions and receipts for each expense.

- Summarize total daily and cumulative costs for easy review.

- Ensure categorization aligns with project budgets and client requirements.

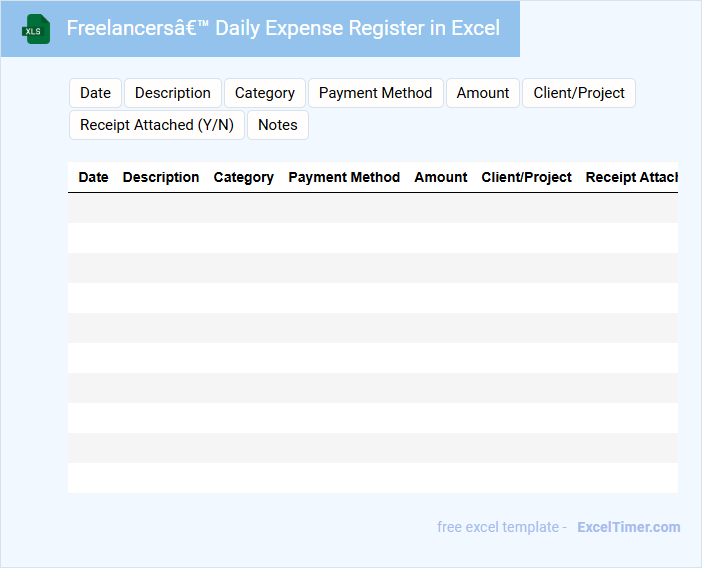

Freelancers’ Daily Expense Register in Excel

Freelancers' Daily Expense Register in Excel is a vital financial tracking tool designed to help independent workers monitor their daily expenses with accuracy and ease. This type of document typically contains columns for date, description, category, and amount spent, allowing for clear organization and easy review. Keeping a well-maintained expense register is crucial for budgeting, tax preparation, and understanding spending habits.

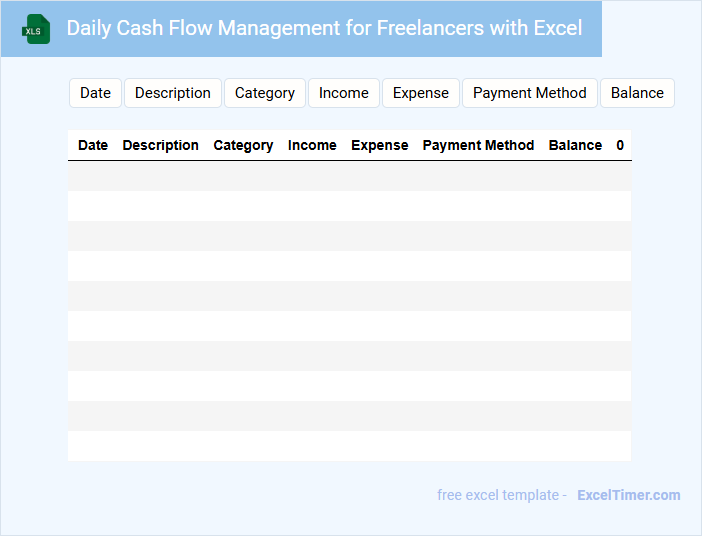

Daily Cash Flow Management for Freelancers with Excel

Daily Cash Flow Management documents typically contain detailed records of income and expenses, enabling freelancers to track their financial health on a daily basis. They include sections for listing various income sources, expense categories, and calculations to monitor net cash flow. Such documents help freelancers maintain financial stability by providing a clear overview of their daily transactions.

A well-structured Excel template for cash flow management offers automated calculations, easy data entry, and visual charts for better understanding. It often features customizable categories and periodic summaries to enhance financial analysis. Ensuring accuracy and consistency in data input is crucial for effective daily cash flow tracking.

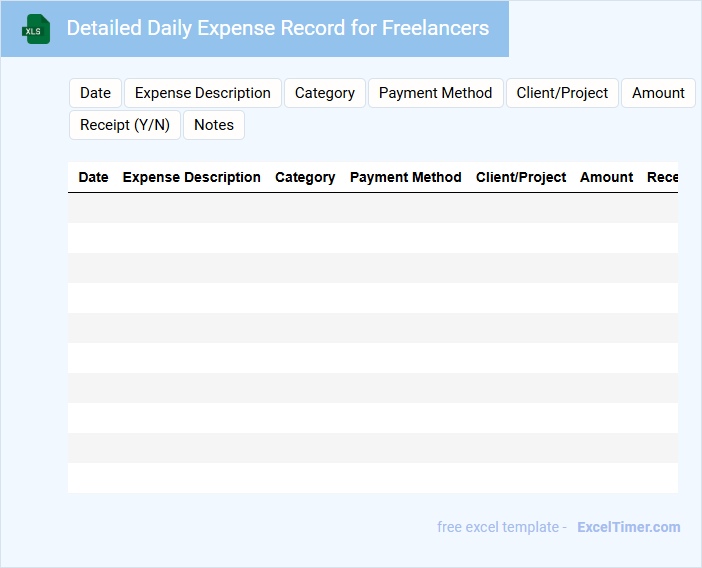

Detailed Daily Expense Record for Freelancers

A Detailed Daily Expense Record for Freelancers is a document that tracks all the daily financial transactions related to their work activities. It helps in managing cash flow and preparing accurate tax filings.

- Include all expenses with dates and categories for better organization.

- Keep receipts or digital copies to validate each recorded expense.

- Summarize weekly or monthly to monitor budgeting and optimize spending.

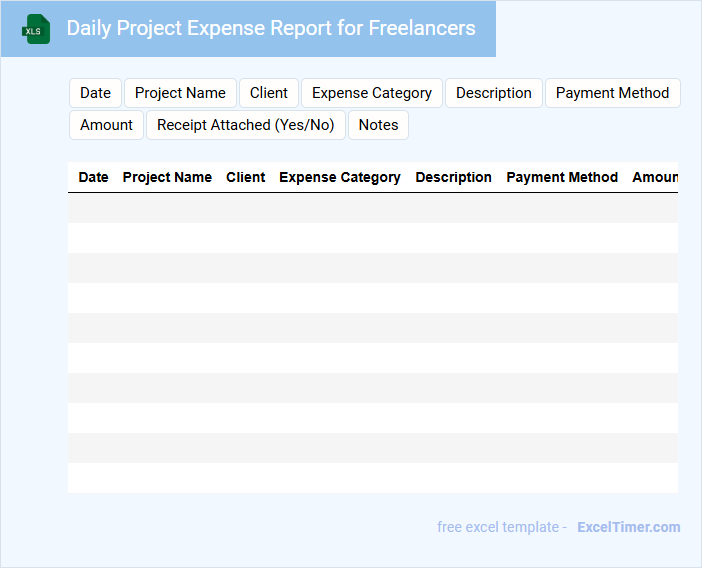

Daily Project Expense Report for Freelancers

A Daily Project Expense Report for Freelancers typically documents all costs incurred related to a specific project on a daily basis, ensuring accurate tracking of expenditures. This report helps freelancers manage their budgets and provides transparency for clients.

- Include detailed descriptions of each expense with associated receipts or proof of payment.

- Record the date and purpose of each expense to maintain clarity and accuracy.

- Summarize total daily expenses to monitor budget adherence and facilitate invoicing.

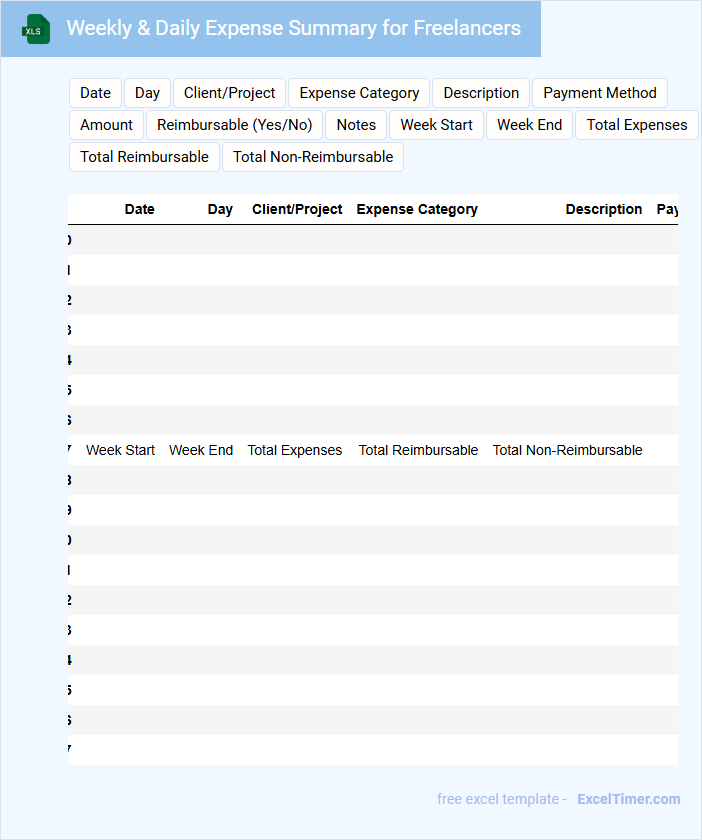

Weekly & Daily Expense Summary for Freelancers

Weekly & Daily Expense Summary for Freelancers typically contains a detailed breakdown of income and expenditures to help manage cash flow efficiently.

- Accurate Tracking: Ensure all expenses are recorded promptly for reliable financial overview.

- Category Organization: Group expenses into clear categories like supplies, subscriptions, and meals.

- Regular Review: Frequently analyze summaries to identify saving opportunities and adjust budgets.

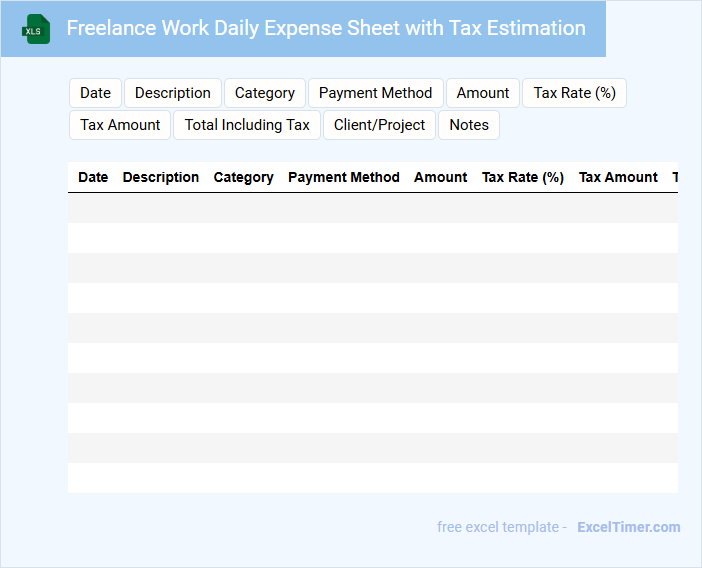

Freelance Work Daily Expense Sheet with Tax Estimation

What information is typically included in a Freelance Work Daily Expense Sheet with Tax Estimation? This document usually contains details of daily expenses related to freelance projects, such as materials purchased, transportation costs, and client meals. It also includes estimated tax calculations based on income and deductible expenses to help freelancers manage finances efficiently.

What important aspects should be considered when creating this sheet? Accuracy in recording each expense and a clear breakdown of taxable and non-taxable items are essential. Keeping consistent updates and including reminders for tax deadlines will ensure effective financial planning and compliance.

Daily Receipts and Payments Tracker for Freelancers

A Daily Receipts and Payments Tracker is a crucial document for freelancers to systematically record all incoming payments and outgoing expenses each day. It helps maintain clear financial records, ensuring better budgeting and tax preparation. To maximize its effectiveness, include detailed descriptions, dates, and payment methods for each transaction.

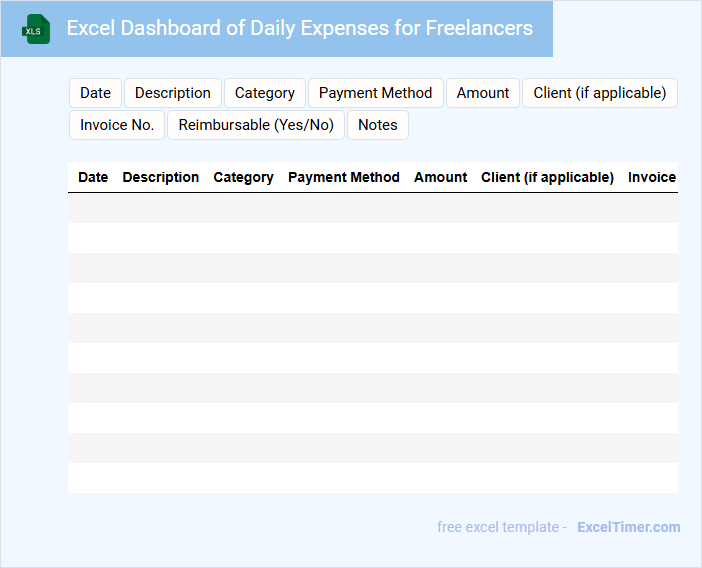

Excel Dashboard of Daily Expenses for Freelancers

An Excel Dashboard of Daily Expenses for Freelancers typically contains detailed entries of income, expenses, and categorized spending. It provides a clear visual summary through charts and graphs for easy tracking.

The main goal is to help freelancers manage cash flow and monitor budget adherence effectively. Including automated expense categorization and real-time data updates is highly recommended.

What essential columns should be included for tracking income and expenses in a daily expense report for freelancers?

Your daily expense report for freelancers should include essential columns such as Date, Description, Category, Income, Expense, and Payment Method. Tracking these details ensures accurate monitoring of cash flow and simplifies tax preparation. Including a Notes column helps capture additional information related to each transaction.

How can formulas be used to automate daily and monthly total calculations in an Excel expense report?

Formulas such as SUM can automate daily totals by adding expenses within each day's row, while monthly totals can be calculated by summing daily totals across the corresponding date range. Using Excel functions like SUMIF or SUMPRODUCT enables dynamic aggregation based on specific dates or categories. Incorporating these formulas reduces manual entry errors and enhances accuracy in freelancer expense tracking.

Which Excel features help categorize and filter expenses efficiently for a freelancer's reporting needs?

Excel features like PivotTables, filters, and conditional formatting help categorize and filter expenses efficiently for a freelancer's reporting needs. You can use Data Validation to create drop-down lists for consistent expense categories, ensuring accuracy in your Daily Expense Report. Sorting and slicers further enhance data analysis by allowing quick filtering and visualization of expense trends.

What methods ensure data accuracy and minimize duplication in an Excel-based daily expense report?

Using data validation rules and drop-down lists in Excel helps ensure accurate and consistent expense entries for freelancers. Implementing conditional formatting highlights duplicate entries, minimizing data redundancy. Leveraging Excel's unique function combined with pivot tables can effectively detect and manage duplicate records in daily expense reports.

How can charts and pivot tables be utilized to visualize expense trends and financial summaries for freelancers?

Charts in an Excel Daily Expense Report can visually represent expense trends by highlighting spending patterns over time, categorized by project or expense type. Pivot tables summarize financial data by dynamically grouping expenses, enabling freelancers to quickly analyze totals, averages, and variances across different periods or categories. Combining charts with pivot tables enhances data interpretation, making it easier to monitor budgets and identify cost-saving opportunities.