The Daily Income and Expense Excel Template for Freelancers is designed to help freelancers effortlessly track their daily earnings and expenditures, ensuring accurate financial management. This template includes categorized fields for income sources and expense types, enabling clear visibility of cash flow and budget control. Its user-friendly format supports effective tax preparation and financial decision-making for independent professionals.

Daily Income and Expense Tracker for Freelancers

A Daily Income and Expense Tracker for freelancers is a crucial document that helps monitor all financial transactions on a daily basis. It typically contains sections for recording incoming payments, outgoing expenses, and net daily profit or loss. Keeping this document updated promotes better budgeting, tax preparation, and financial decision-making.

Important elements to include are clear categories for income sources, expense types, dates of transactions, and notes for additional details. Incorporating a summary or total calculations at the end of each day or week enhances quick analysis. Consistent use ensures accurate financial tracking and improved business management.

Excel Sheet for Tracking Daily Earnings and Expenses

This document commonly contains detailed records of daily earnings and expenses, helping individuals or businesses monitor their financial health effectively. It typically includes categories for income sources, expenditure types, and dates to organize financial data systematically.

Maintaining accurate and up-to-date entries is crucial for reliable financial tracking and analysis. A suggested important feature is implementing automatic calculations and summary fields to quickly assess net income or spending trends.

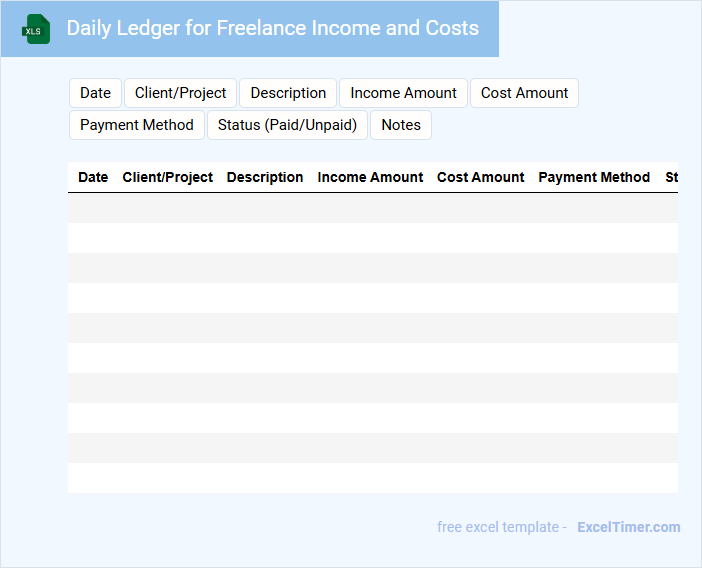

Daily Ledger for Freelance Income and Costs

A Daily Ledger for freelance income and costs is a financial record that tracks all earnings and expenses on a daily basis. It helps freelancers maintain organized and accurate accounts for tax purposes and budget management. Regular updates to this document ensure financial clarity and better decision-making.

Important elements to include are the date, description of income or expense, payment method, and the amount. Consistency in recording and categorizing transactions enhances the ledger's usefulness. Backing up the ledger data regularly is also essential to prevent data loss.

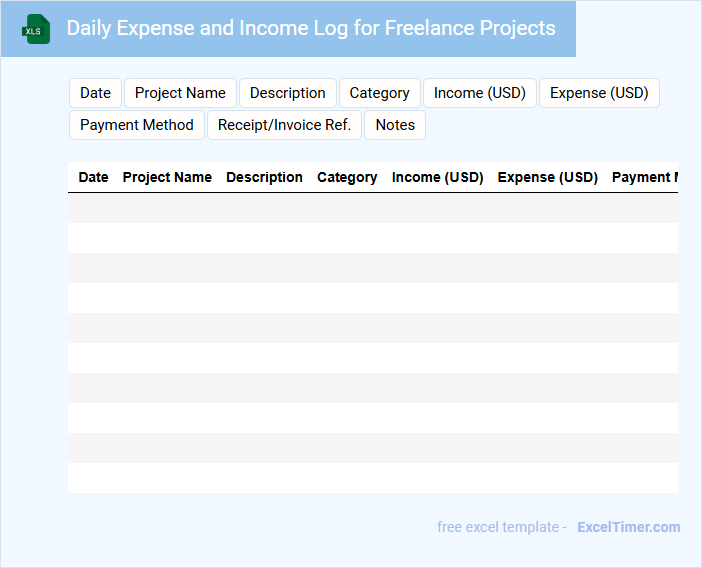

Daily Expense and Income Log for Freelance Projects

What information is typically recorded in a Daily Expense and Income Log for Freelance Projects? This type of document usually contains detailed records of daily earnings and expenditures related to freelance work, including project payments, materials purchased, and other relevant costs. It helps freelancers keep track of their financial flow, ensuring accurate budgeting and tax preparation.

What is an important element to include in such a log? Consistently updating entries with dates, descriptions, amounts, and payment methods is crucial for clarity and reliability. Including categories for different types of income and expenses also enhances organization and simplifies financial analysis.

Personal Finance Tracker with Daily Entry for Freelancers

What does a Personal Finance Tracker with Daily Entry for Freelancers typically contain? It usually includes sections for daily income, expenses, and savings details to help track financial flow accurately. This document helps freelancers manage irregular earnings and expenses systematically, ensuring better budgeting and financial planning.

What important aspects should be included to make it effective? It should feature categories for different income sources and expense types, automated calculations for totals and balances, and reminders for bill payments or tax deadlines. Including visual summaries like charts or graphs can also enhance financial insight and decision-making.

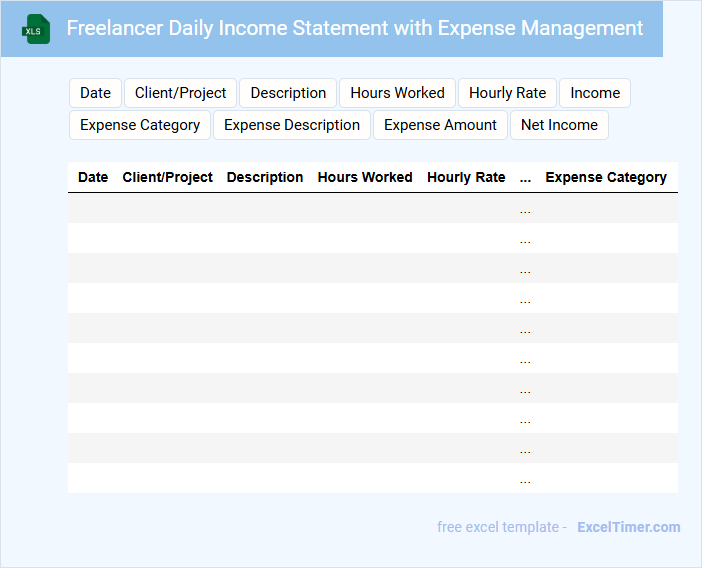

Freelancer Daily Income Statement with Expense Management

A Freelancer Daily Income Statement typically contains detailed records of daily earnings and related expenses to track net income accurately. It helps freelancers manage their cash flow, categorize sources of revenue, and monitor spending on business expenses. Maintaining this document regularly is crucial for effective financial management and tax preparation.

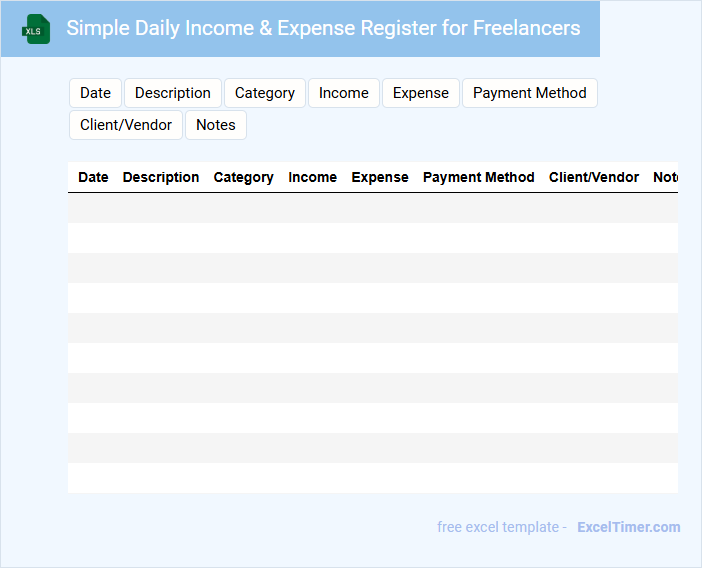

Simple Daily Income & Expense Register for Freelancers

A Simple Daily Income & Expense Register for freelancers is a crucial document designed to track daily financial transactions. It typically contains entries for income received, expenses incurred, and the running balance.

This register helps freelancers monitor cash flow effectively and maintain organized financial records. Ensuring accuracy and consistency in logging transactions is an important key for successful financial management.

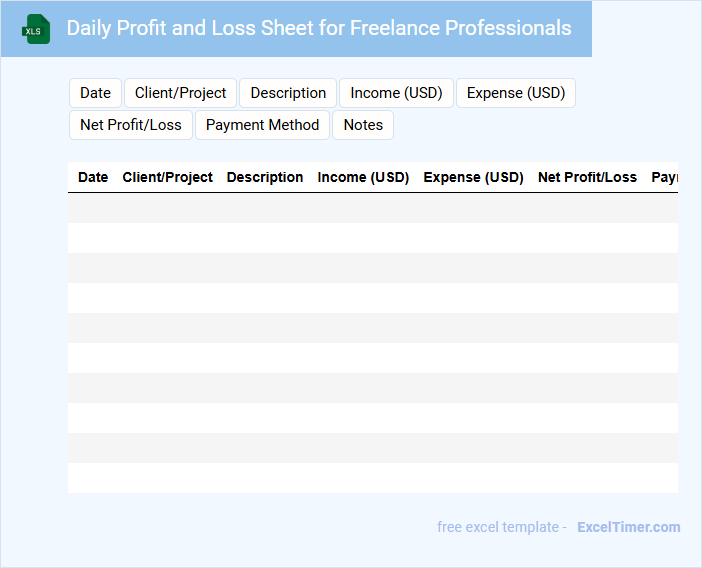

Daily Profit and Loss Sheet for Freelance Professionals

Daily Profit and Loss Sheet is a critical financial document that tracks income and expenses on a daily basis. It provides freelance professionals with a clear view of their daily earnings versus costs.

This sheet typically contains revenue sources, categorized expenses, and net profit or loss for the day. Freelancers should ensure accurate entry and regular updates to reflect true financial performance.

Keeping a detailed and organized sheet helps in budgeting, tax preparation, and identifying profitable projects or cost-saving opportunities.

Daily Work Income and Expense Tracker for Freelancers

What is usually contained in a Daily Work Income and Expense Tracker for Freelancers? This type of document typically includes detailed records of daily earnings from various projects alongside expenses incurred related to freelance work. It helps freelancers monitor their financial flow efficiently and prepare for tax obligations.

What important elements should be included in this tracker? Key components are date of transaction, client or project name, income received, expense type, amount spent, and a running balance. Additionally, including notes for specific details or irregular transactions enhances clarity and financial analysis.

Excel Template of Daily Financial Records for Freelancers

This Excel template for daily financial records helps freelancers systematically track income, expenses, and payment details.

- Income Tracking: Records daily earnings from different sources for accurate financial summaries.

- Expense Management: Logs all daily costs categorized by type to monitor spending habits.

- Payment Status: Tracks invoice statuses to ensure timely client payments and cash flow control.

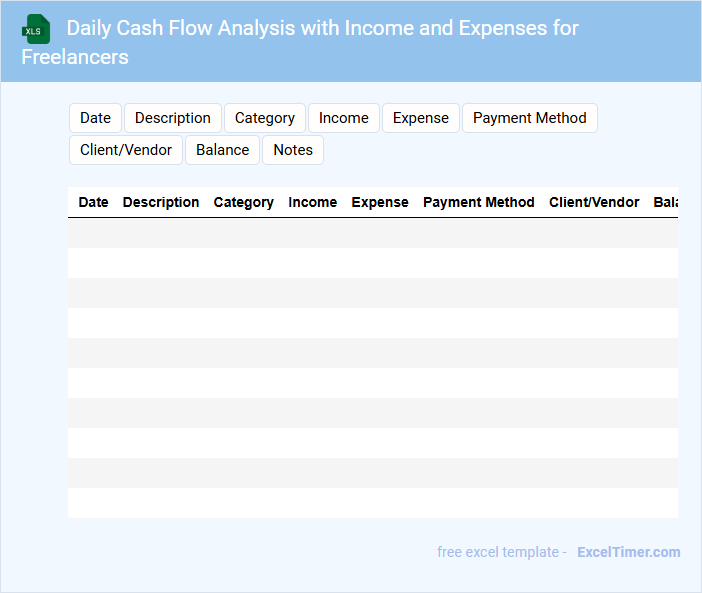

Daily Cash Flow Analysis with Income and Expenses for Freelancers

A Daily Cash Flow Analysis document for freelancers typically contains a detailed account of daily income and expenses, providing a clear view of financial health. It helps to track money flow and make informed decisions about budgeting and spending.

- Include categorized entries of all income sources and expense types for accurate tracking.

- Update the document daily to maintain an up-to-date financial overview.

- Use summaries and charts to visualize cash flow trends and identify potential issues.

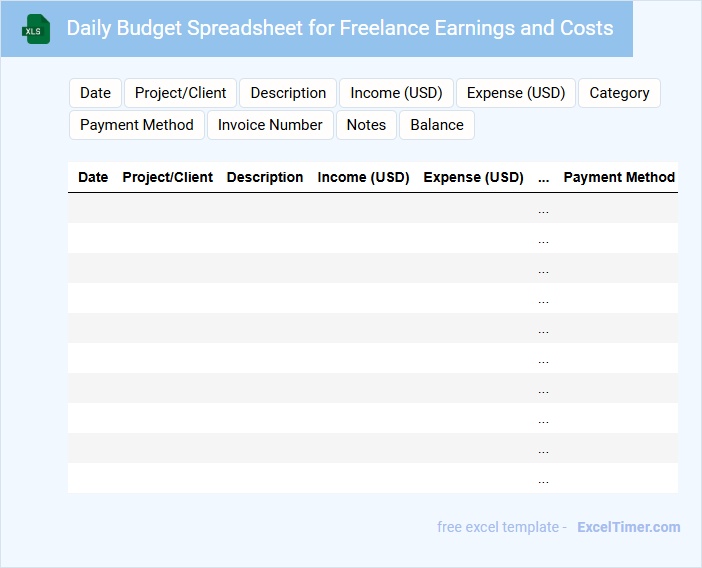

Daily Budget Spreadsheet for Freelance Earnings and Costs

A Daily Budget Spreadsheet for freelance earnings and costs is a vital tool for tracking income and expenses on a daily basis. It typically contains columns for date, description, earnings, expenses, and net profit or loss to help freelancers manage their finances effectively. Ensuring accuracy and consistency in data entry is crucial for gaining clear insights into daily financial performance and improving budget planning.

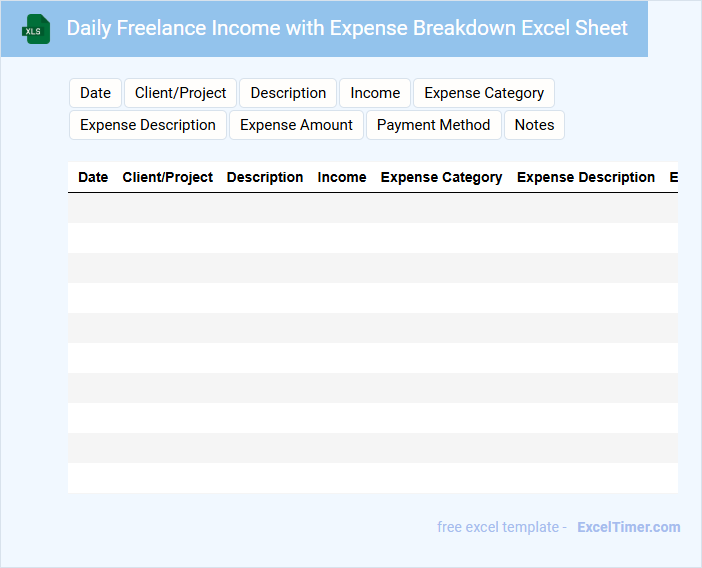

Daily Freelance Income with Expense Breakdown Excel Sheet

A Daily Freelance Income with Expense Breakdown Excel Sheet typically contains detailed records of daily earnings and associated costs. It helps freelancers track their financial performance on a day-to-day basis. This document also includes categories for different income sources and expense types.

Using this sheet allows for clear budget management and financial forecasting. It provides insights into profitability by comparing income against expenses regularly. To maximize its usefulness, ensure accurate and consistent data entry every day.

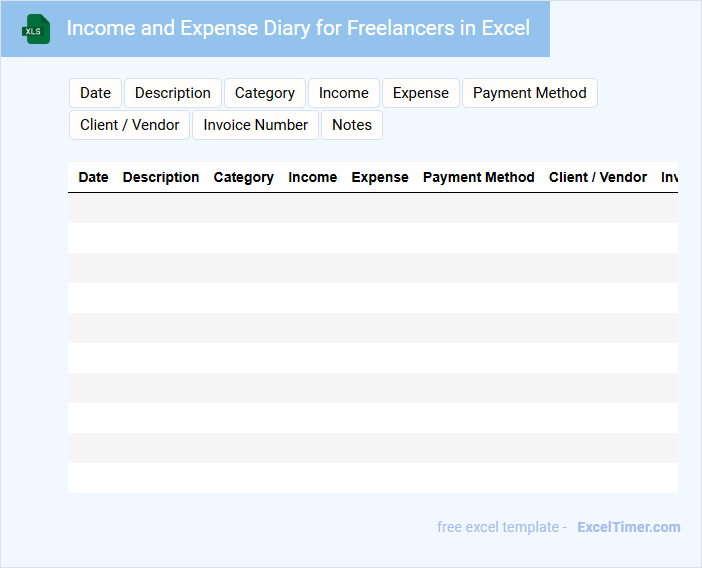

Income and Expense Diary for Freelancers in Excel

An Income and Expense Diary for freelancers is a financial record-keeping document that tracks all earnings and expenditures over a specific period. It helps freelancers monitor cash flow, manage budgets, and prepare for tax filings efficiently.

Typically created in Excel, this diary includes detailed entries for each transaction, categorized by income sources and expense types. An important tip is to regularly update the diary and reconcile it with bank statements to ensure accuracy.

Excel Journal of Daily Earnings and Expenses for Freelancers

What information is typically included in an Excel Journal of Daily Earnings and Expenses for Freelancers? This document usually contains detailed daily records of income received and expenses paid, allowing freelancers to monitor their financial activities effectively. It helps in maintaining accurate cash flow tracking and simplifies tax preparation by organizing all monetary transactions systematically.

What are the key columns needed to accurately track daily income and expense for freelancers in Excel?

Key columns to accurately track daily income and expenses for freelancers in Excel include Date, Description, Category, Income Amount, Expense Amount, Payment Method, and Client Name. Including a Running Balance column helps you monitor your financial status in real-time. Detailed categorization ensures precise reporting and tax preparation.

How can Excel formulas be used to automatically calculate daily, weekly, and monthly totals?

Excel formulas like SUMIF and SUMPRODUCT can automatically calculate daily, weekly, and monthly totals by referencing your income and expense dates. Using date criteria within these formulas allows precise aggregation of data, ensuring accurate financial tracking. Set up dynamic ranges or structured tables to streamline your daily income and expense management effectively.

What methods can freelancers use in Excel to categorize different sources of income and types of expenses?

You can use Excel's built-in Data Validation feature to create drop-down lists for categorizing various income sources and expense types. Employ PivotTables to quickly summarize and analyze categorized data by client, project, or expense category. Applying conditional formatting helps visually differentiate between income and expense entries, enhancing clarity and tracking.

How can conditional formatting in Excel help visualize spending patterns and income trends for freelancers?

Conditional formatting in Excel highlights key spending patterns and income trends for freelancers by automatically applying color scales, data bars, or icon sets based on transaction values. This visual layering enables quick identification of high or low expenses and fluctuating income streams within daily records. Freelancers can use these insights to manage budgets efficiently and make informed financial decisions.

What is the importance of regularly updating and backing up an Excel document for managing freelance finances?

Regularly updating your Daily Income and Expense Excel document ensures accurate tracking of your freelance finances, enabling timely decision-making and budgeting. Backing up the file protects your financial data from loss due to system failures or accidental deletions. Consistent maintenance of this document provides a reliable overview of your earnings and expenses, supporting tax preparation and financial planning.