The Daily Expense Log Excel Template for Freelancers is a practical tool designed to help freelancers track their daily expenses accurately and efficiently. It simplifies budgeting by categorizing costs and providing a clear overview of spending patterns. Using this template ensures better financial management and helps identify opportunities for saving money.

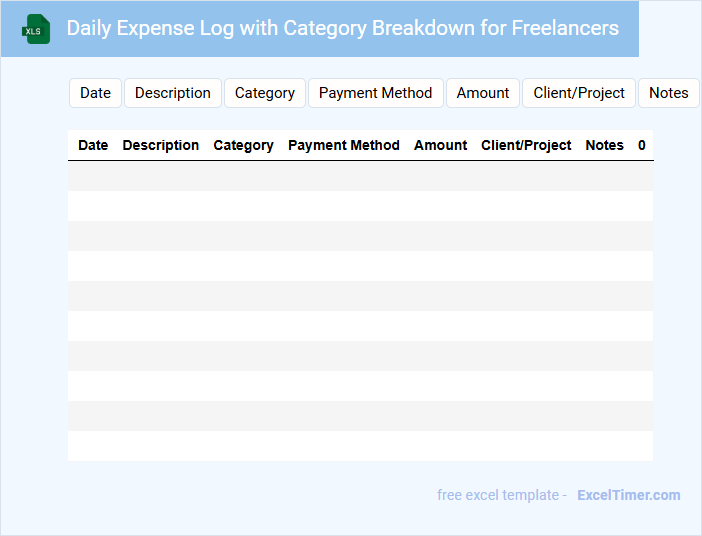

Daily Expense Log with Category Breakdown for Freelancers

A Daily Expense Log with category breakdown is a document that helps freelancers track their daily spending by organizing expenses into specific categories such as supplies, travel, and meals. This detailed tracking allows for better budget management and financial clarity.

Such a log typically contains date entries, expense amounts, payment methods, and categorized descriptions to provide a comprehensive overview of daily expenditures. Including accurate category labels and timestamps is crucial for effective expense analysis and tax preparation.

Freelancers’ Daily Expense Tracker Excel Template

Freelancers' Daily Expense Tracker Excel Template is designed to help independent professionals monitor and manage their daily spending efficiently. It simplifies financial tracking by organizing expenses in a clear, accessible format.

- Include categories such as meals, transportation, and office supplies for detailed tracking.

- Incorporate date and payment method columns to better analyze spending habits.

- Use formulas to automatically calculate daily and total expenses for accuracy and convenience.

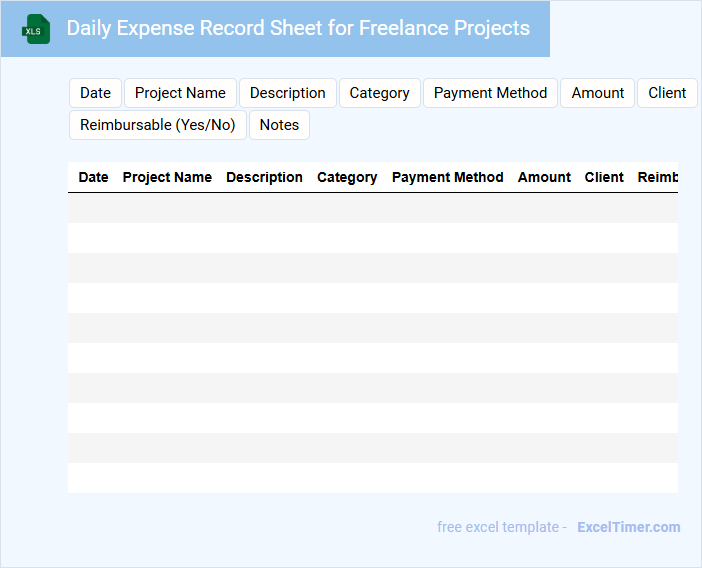

Daily Expense Record Sheet for Freelance Projects

A Daily Expense Record Sheet for Freelance Projects is a document that tracks all daily expenditures related to freelance work, helping to manage project budgets efficiently. It typically includes detailed entries of costs, dates, and purposes to ensure accurate financial tracking.

- Record every expense immediately to avoid missing any details.

- Include categories such as materials, transportation, and communication expenses.

- Review and reconcile the sheet regularly to maintain accurate financial records.

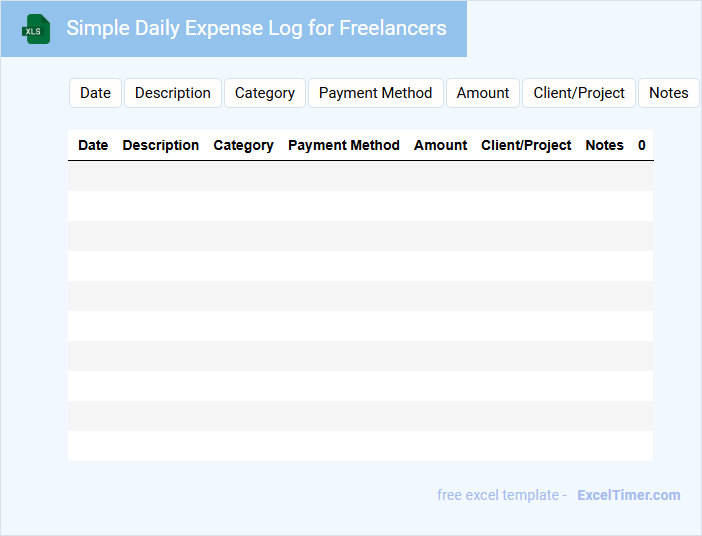

Simple Daily Expense Log for Freelancers

A Simple Daily Expense Log for freelancers is a straightforward document designed to track daily spending related to work activities. It typically contains fields for date, description of the expense, category, and amount spent. Keeping this log helps freelancers maintain accurate financial records and manage budgets effectively.

Important elements to include are clear categorization of expenses, regular updates to ensure accuracy, and summary sections for weekly or monthly totals. Using this document can also aid in tax preparation by providing detailed proof of deductible expenses. Consistency and simplicity are key to maximizing the utility of the expense log.

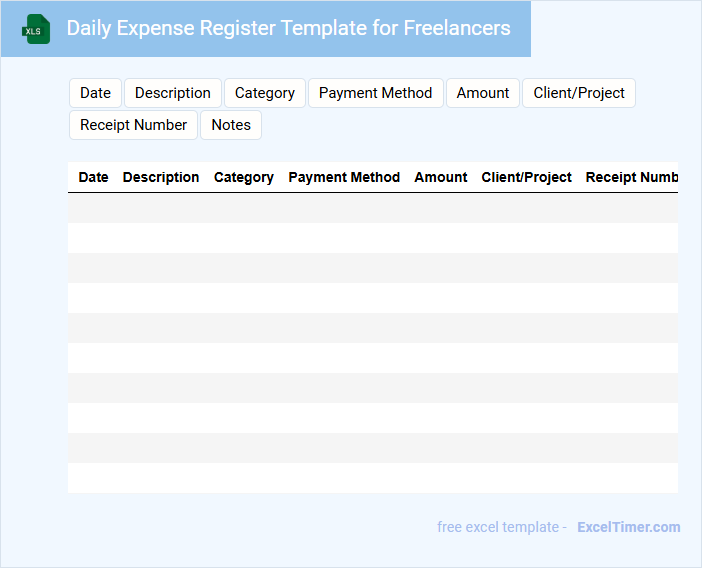

Daily Expense Register Template for Freelancers

A Daily Expense Register Template for freelancers is designed to track and organize daily spending efficiently. It helps in maintaining a clear record of all business-related expenditures to streamline financial management.

Typically, this document contains fields for date, description, amount, payment method, and category of expense. Ensuring accuracy and consistency in entering data is crucial for effective budgeting and tax preparation.

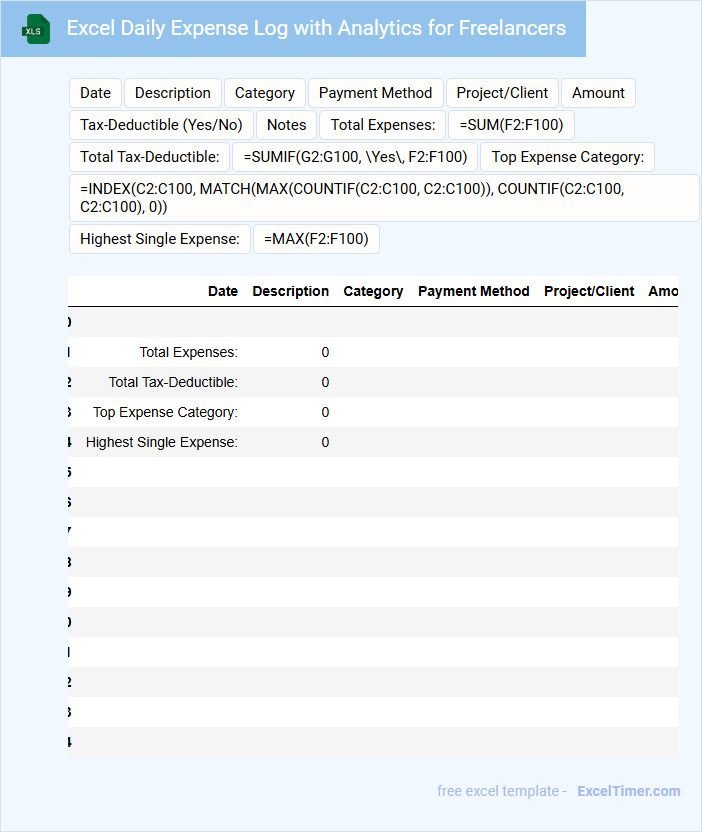

Excel Daily Expense Log with Analytics for Freelancers

This type of document typically contains detailed daily financial entries and visual data summaries to help freelancers manage their finances efficiently.

- Expense Tracking: It records daily expenses to provide clear insight into spending habits.

- Financial Analytics: It includes charts and summaries for analyzing spending patterns and budgeting.

- Freelancer Focus: It tailors categories and reports to the unique income and expense streams common to freelancers.

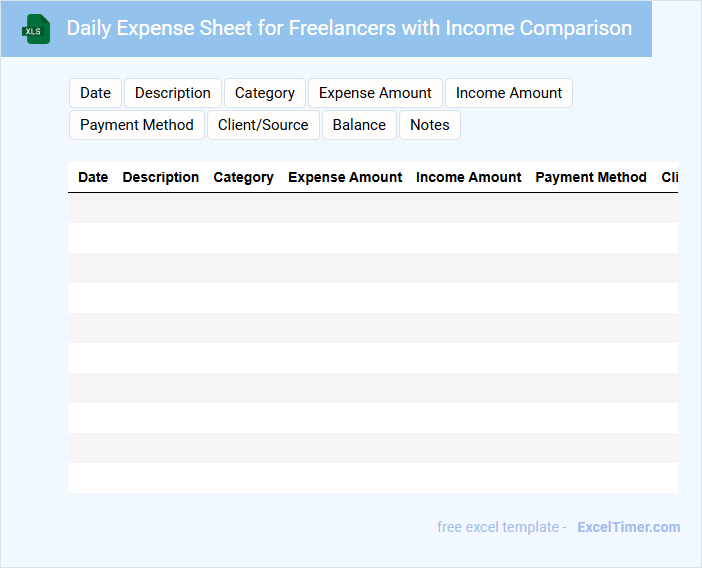

Daily Expense Sheet for Freelancers with Income Comparison

The Daily Expense Sheet for freelancers is typically a detailed record of daily expenditures related to work activities. It helps in tracking where money is spent and managing the freelance budget effectively.

This document often includes columns for date, expense category, amount spent, and description, as well as a section comparing daily income to expenses. Including income comparison allows freelancers to evaluate profitability on a daily basis.

To optimize its use, ensure all entries are accurate and categorize expenses clearly to identify saving opportunities and improve financial planning.

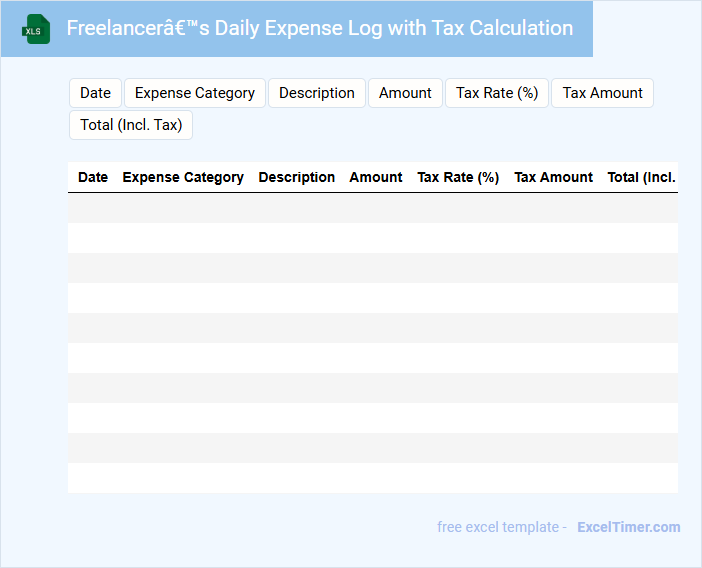

Freelancer’s Daily Expense Log with Tax Calculation

Freelancer's Daily Expense Log with Tax Calculation typically contains detailed records of daily expenditures alongside automated tax computations to help manage finances efficiently.

- Expense Tracking: It includes categorization and recording of all daily business-related expenses.

- Tax Calculation: Automated or manual computation of applicable taxes on each expense.

- Summary and Reports: Aggregated data for easy review and tax filing purposes.

Daily Log of Expenses for Freelancers

A Daily Log of Expenses for freelancers is a document that tracks all financial outflows related to daily business activities. It helps in maintaining accurate records for budgeting and tax purposes. Freelancers should regularly update this log to ensure no expense is overlooked.

Typically, this log contains details such as date, description of the expense, amount, and payment method. Clear categorization of expenses can simplify end-of-year financial analysis and reporting. Consistency and punctuality in recording expenses are crucial for effective financial management.

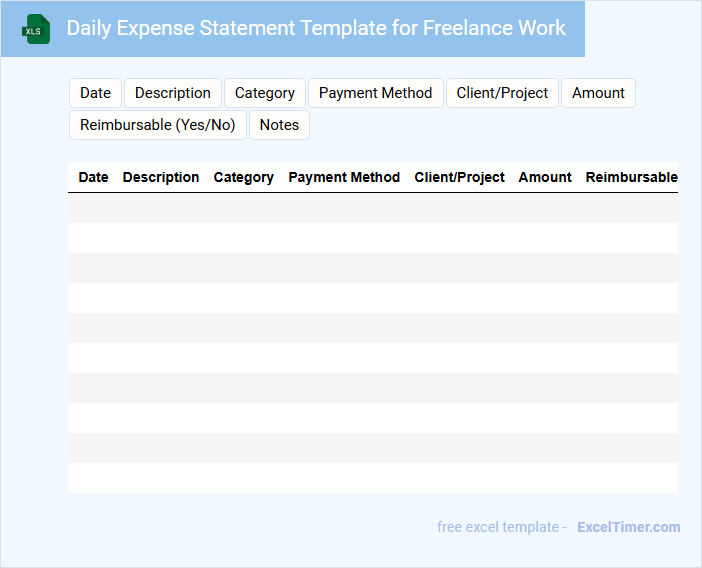

Daily Expense Statement Template for Freelance Work

A Daily Expense Statement Template for Freelance Work typically contains detailed records of daily costs incurred during freelance projects to maintain accurate financial tracking.

- Itemized Expenses: Clearly list each expense with date and purpose for transparency.

- Payment Method: Specify how each expense was paid, such as cash, credit card, or digital payment.

- Receipts Attachment: Include scanned receipts or proof of payment to support expense claims.

Daily Expense Tracker for Freelancers with Invoice Linking

What information does a Daily Expense Tracker for Freelancers with Invoice Linking typically contain? It usually includes detailed records of daily expenditures, categorized by type and project, helping freelancers maintain accurate financial oversight. Additionally, it links these expenses directly to corresponding invoices, streamlining the billing process and ensuring precise reimbursement or client charges.

Excel Template for Daily Tracking of Freelance Expenses

An Excel template for daily tracking of freelance expenses is designed to help individuals monitor their day-to-day financial outflows efficiently. It typically contains sections for date, expense category, description, amount, and payment method, making it simple to record and categorize expenses. Using such a template ensures accurate budget management and prepares freelancers for tax reporting and financial analysis.

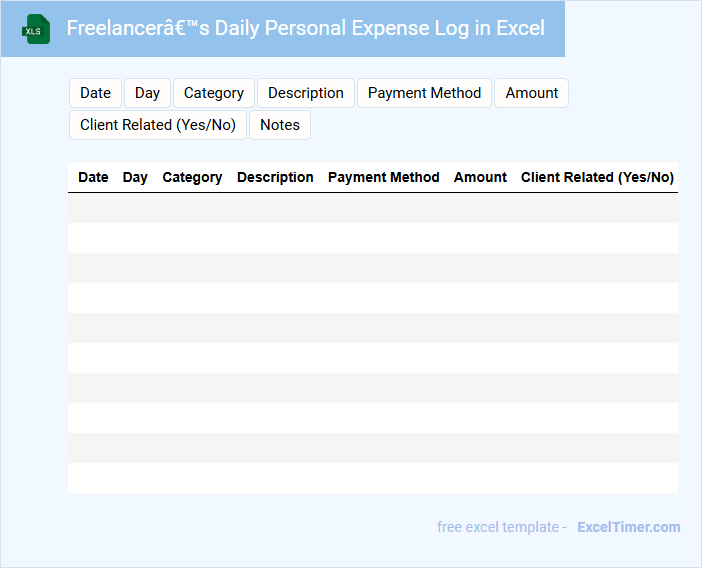

Freelancer’s Daily Personal Expense Log in Excel

Freelancer's Daily Personal Expense Log in Excel is a structured document used to track daily expenses related to freelancing activities. It helps manage finances by recording costs, ensuring accurate budgeting, and simplifying tax preparation.

- Include date, expense category, and amount spent for each entry.

- Regularly update the log to maintain accurate financial records.

- Use formulas to automatically calculate totals and summaries.

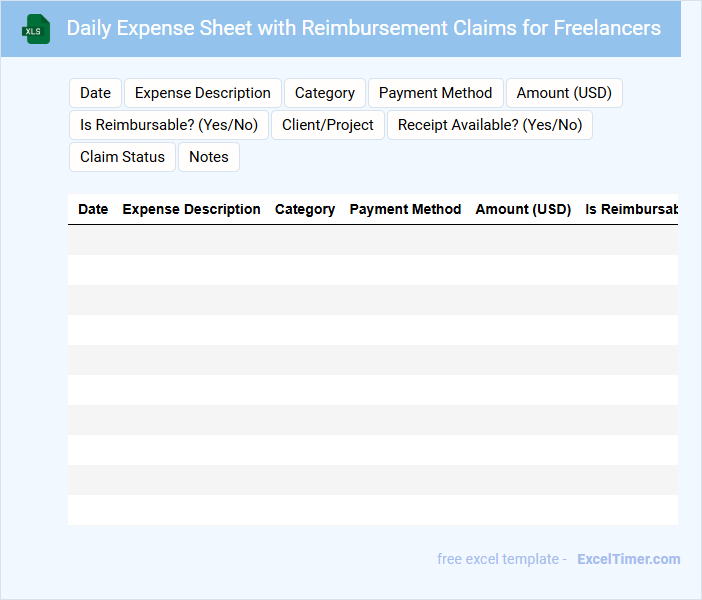

Daily Expense Sheet with Reimbursement Claims for Freelancers

A Daily Expense Sheet for freelancers typically contains detailed records of daily expenditures including dates, description of expenses, amounts, and payment methods. It serves as a crucial document for tracking and managing financial outflows effectively. When combined with Reimbursement Claims, the sheet facilitates transparent requests for repayment of work-related costs from clients or employers. It's important to include clear receipts and supporting documentation to ensure claims are approved smoothly.

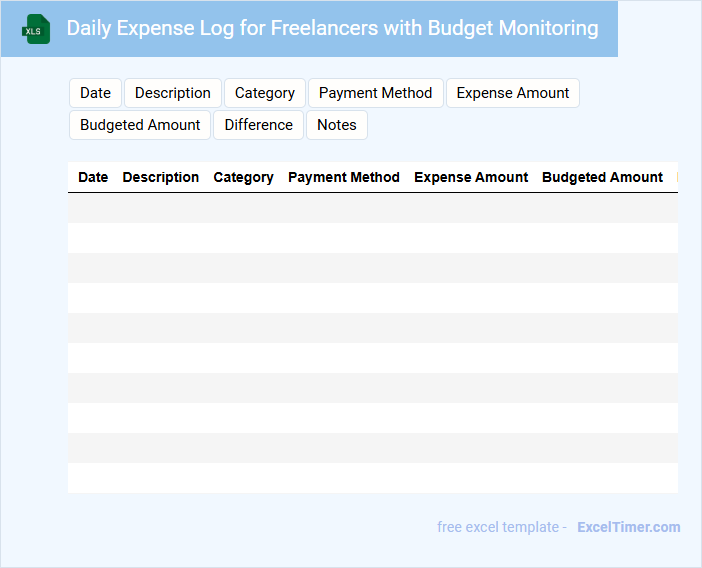

Daily Expense Log for Freelancers with Budget Monitoring

A Daily Expense Log for freelancers typically contains detailed records of daily spending, categorized by type and project. It helps track financial outflows systematically to maintain control over personal and business expenses.

Budget monitoring is an essential aspect, allowing freelancers to compare actual expenses against planned budgets. This practice ensures they stay within financial limits and optimize resource allocation for better financial health.

It is important to regularly update the log and review budget variances to make informed adjustments in spending habits.

What key expense categories should be included in a daily expense log for freelancers?

Key expense categories for a freelancer's daily expense log include software subscriptions, office supplies, internet and utilities, travel costs, client meals, marketing and advertising, and professional development. Tracking these categories helps maintain accurate financial records and simplifies tax preparation. Including payment dates and receipts enhances expense verification and accountability.

How can you use Excel formulas to automatically calculate total daily and monthly expenses?

Use the SUM formula to calculate total daily expenses by summing amounts in the daily expense column, for example, =SUM(B2:B10). For monthly expenses, apply the SUMIFS formula with date criteria, such as =SUMIFS(B2:B100, A2:A100, ">=2024-05-01", A2:A100, "<=2024-05-31") to sum expenses within May 2024. Implementing these formulas automates tracking and ensures accurate financial records for freelancers.

What essential data columns (e.g., date, item, amount, payment method, project) optimize tracking in a freelancer's expense log?

Essential data columns for a freelancer's daily expense log include Date to track when expenses occur, Item or Description to specify the purchase, Amount to record the cost, Payment Method to identify how the expense was paid, and Project to link costs directly to client work. Including Category for expense type and Notes for additional details enhances data organization and analysis. These columns optimize expense tracking, budgeting, and tax reporting for freelancers.

How can conditional formatting in Excel help highlight overspending or unusual expenses?

Conditional formatting in Excel can automatically highlight daily expenses exceeding set budget limits or unusual spending patterns in a freelancer's expense log. Color scales, icon sets, or custom rules visually flag overspending, making it easier to identify cost anomalies. This feature enhances financial tracking accuracy and supports better budget management for freelancers.

What methods can be used to link specific expenses to client projects for accurate billing and tax reporting?

Use Excel features like data validation drop-down lists to link expenses to specific client projects, ensuring consistent project names. Employ VLOOKUP or INDEX-MATCH formulas to automatically pull project details from a master client list for accurate billing. Create pivot tables to summarize expenses by client project, facilitating precise tax reporting and financial analysis.