The Monthly Cash Flow Excel Template for Sole Proprietors helps track income and expenses efficiently, ensuring accurate financial management. It allows sole proprietors to monitor cash inflows and outflows monthly, aiding in maintaining positive cash flow and budgeting effectively. Customizable categories and automatic calculations simplify financial analysis and decision-making.

Monthly Cash Flow Tracker for Sole Proprietors

A Monthly Cash Flow Tracker for sole proprietors is a crucial financial document that records all income and expenses over a month. It helps in monitoring the inflow and outflow of cash to ensure positive cash management. This tracker enables proprietors to make informed business decisions and maintain financial stability.

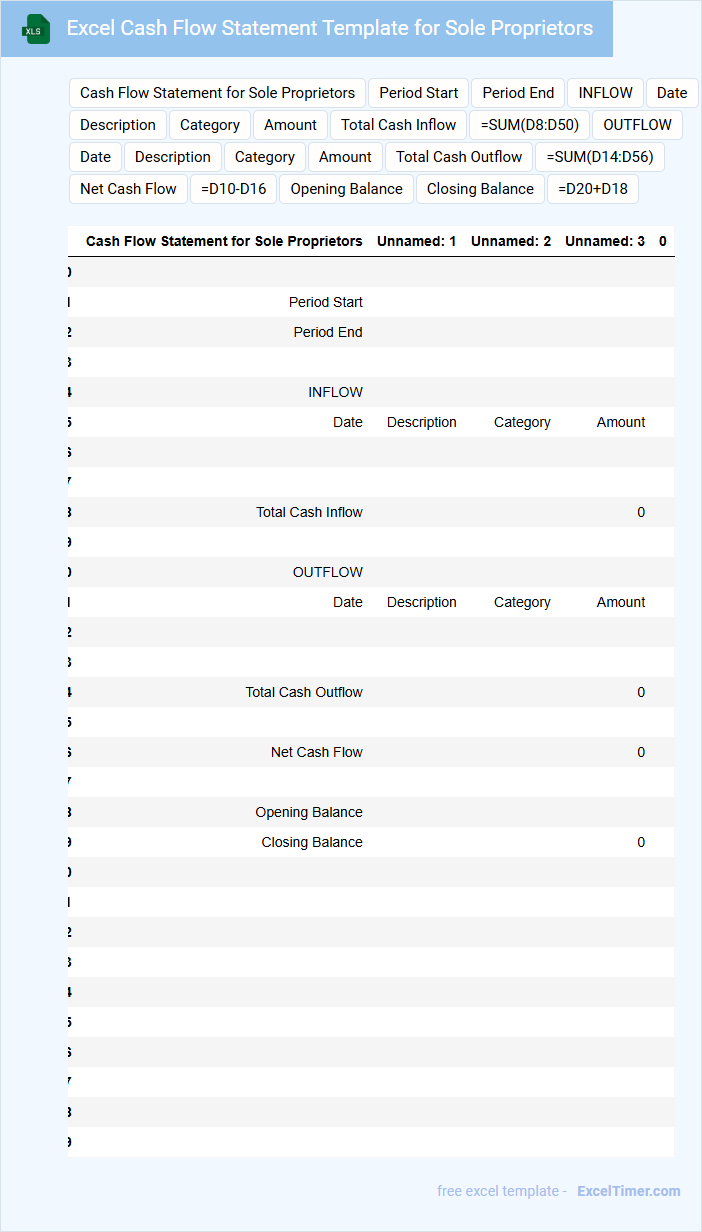

Excel Cash Flow Statement Template for Sole Proprietors

What information does an Excel Cash Flow Statement Template for Sole Proprietors typically include? This document usually contains sections for tracking cash inflows such as sales revenue, loans, and investments, along with outflows like expenses, salaries, and loan repayments. It helps sole proprietors monitor their liquidity by detailing the timing and amounts of cash transactions over a specific period.

What important aspects should a sole proprietor consider when using this template? It is crucial to ensure accurate and timely data entry to reflect real financial status, and to regularly review the cash flow projections to plan for upcoming expenses and avoid potential cash shortages. Additionally, customizing the template to include relevant income and expense categories specific to their business enhances financial clarity.

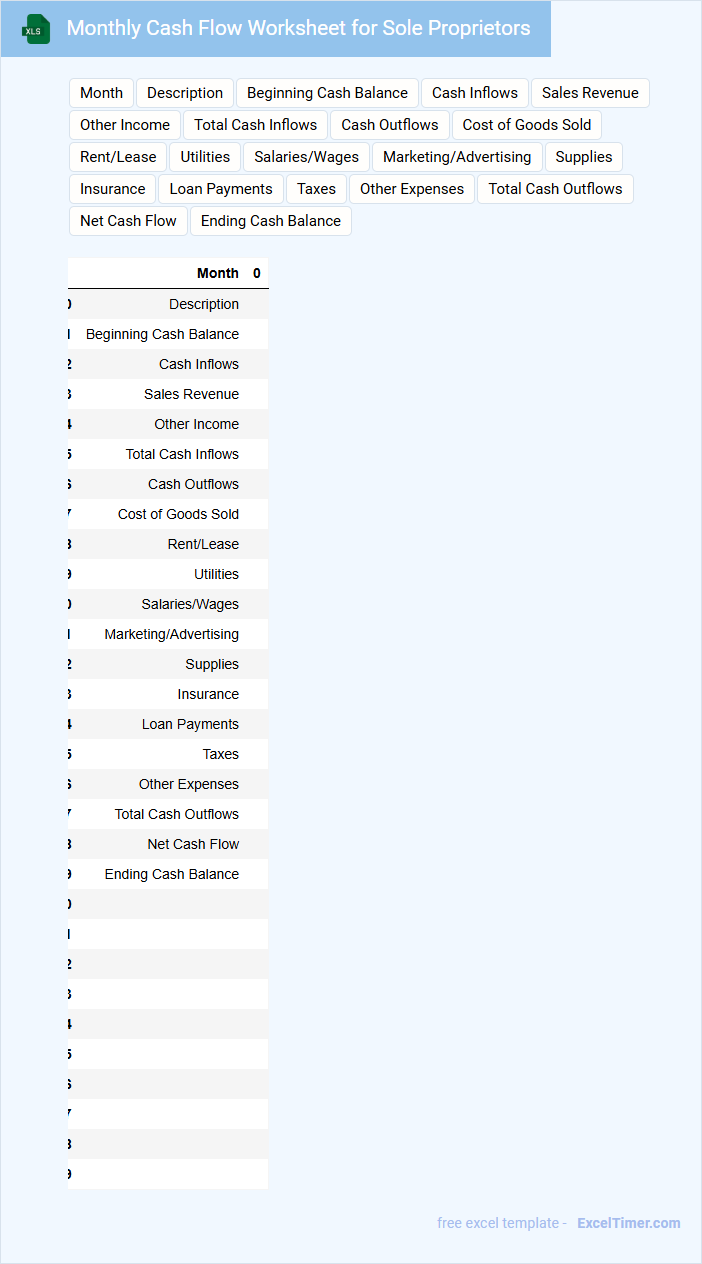

Monthly Cash Flow Worksheet for Sole Proprietors

The Monthly Cash Flow Worksheet for sole proprietors is a vital financial document that helps track income and expenses over a given month. It typically includes detailed entries of revenue sources, operational costs, and any other cash inflows or outflows. This worksheet ensures better financial management by providing a clear overview of the business's liquidity each month.

Important aspects to include are accurate and timely recording of all cash transactions, categorization of expenses, and a comparison against budgeted figures. Sole proprietors should regularly update this worksheet to monitor financial health and make informed decisions. Consistent use of the worksheet aids in forecasting future cash needs and maintaining solvency.

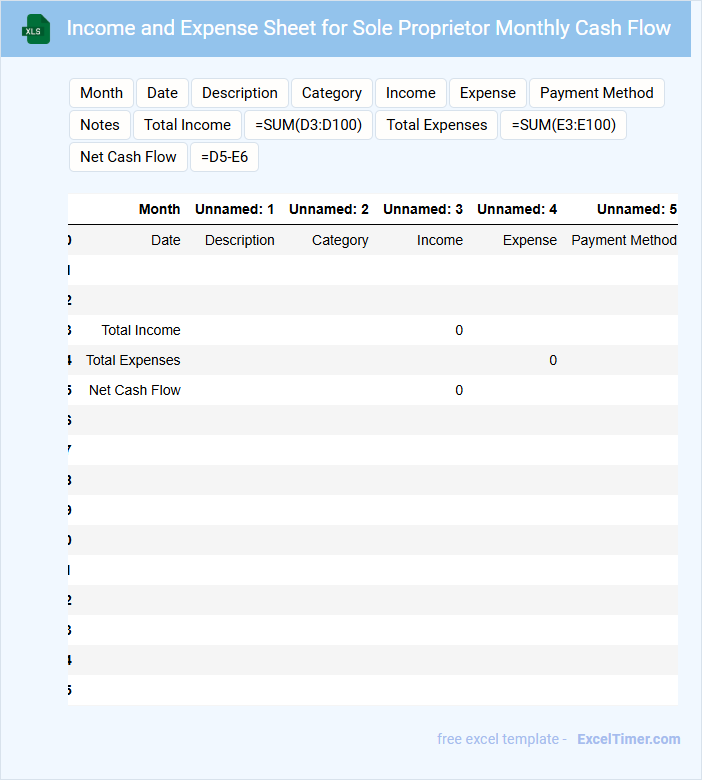

Income and Expense Sheet for Sole Proprietor Monthly Cash Flow

An Income and Expense Sheet for a Sole Proprietor is a financial document that tracks all monetary inflows and outflows on a monthly basis. It typically contains detailed records of revenue earned and expenses incurred, helping in assessing the business's cash flow health. This document is essential for accurate budgeting and financial planning.

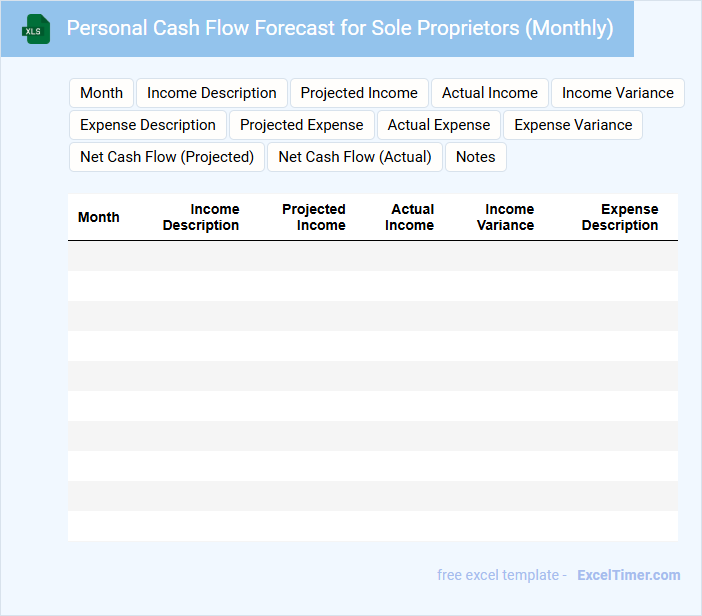

Personal Cash Flow Forecast for Sole Proprietors (Monthly)

A Personal Cash Flow Forecast for Sole Proprietors (Monthly) typically contains projected income and expenses to help manage personal and business finances effectively.

- Income sources: Detailed expected monthly earnings from all personal and business-related activities.

- Expense categories: Comprehensive listing of fixed and variable personal expenses, including business costs.

- Cash balance tracking: Regular monitoring of cash inflows and outflows to ensure sufficient liquidity throughout the month.

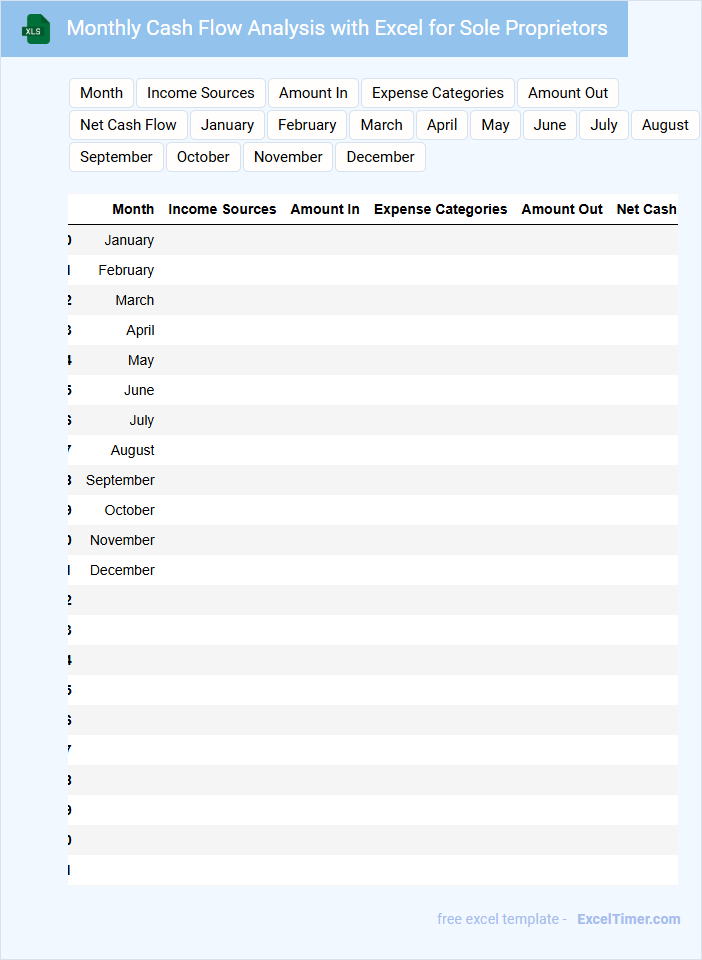

Monthly Cash Flow Analysis with Excel for Sole Proprietors

A Monthly Cash Flow Analysis document typically includes detailed records of all cash inflows and outflows within a specific month, providing a clear picture of a business's liquidity. For sole proprietors, this document helps track income from sales and expenses such as rent, utilities, and supplies. Maintaining accuracy and regularly updating the analysis ensures better financial decision-making and sustainability.

Important considerations for this document include categorizing cash transactions clearly, forecasting future cash flows based on historical data, and using Excel tools like formulas and charts to visualize financial trends effectively.

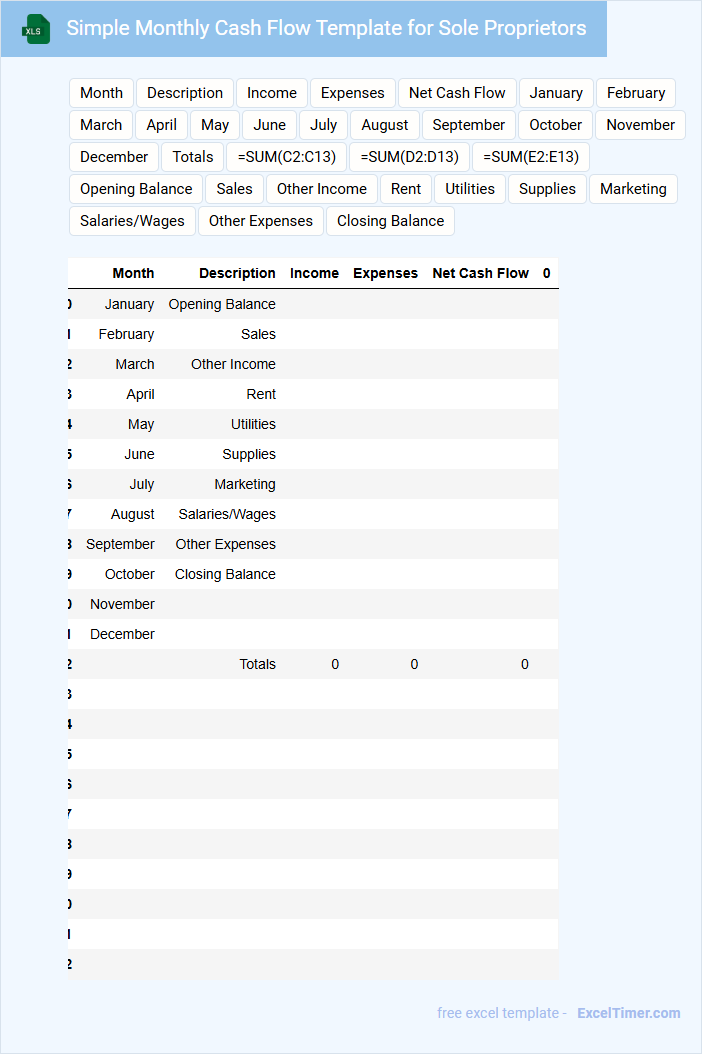

Simple Monthly Cash Flow Template for Sole Proprietors

This document is a Simple Monthly Cash Flow Template designed for sole proprietors to efficiently track their inflows and outflows each month. It typically contains sections for income sources, expenses, and net cash flow calculations.

Using this template helps in maintaining clear financial visibility and ensuring steady business operations. It's important to regularly update and review the entries to make informed financial decisions.

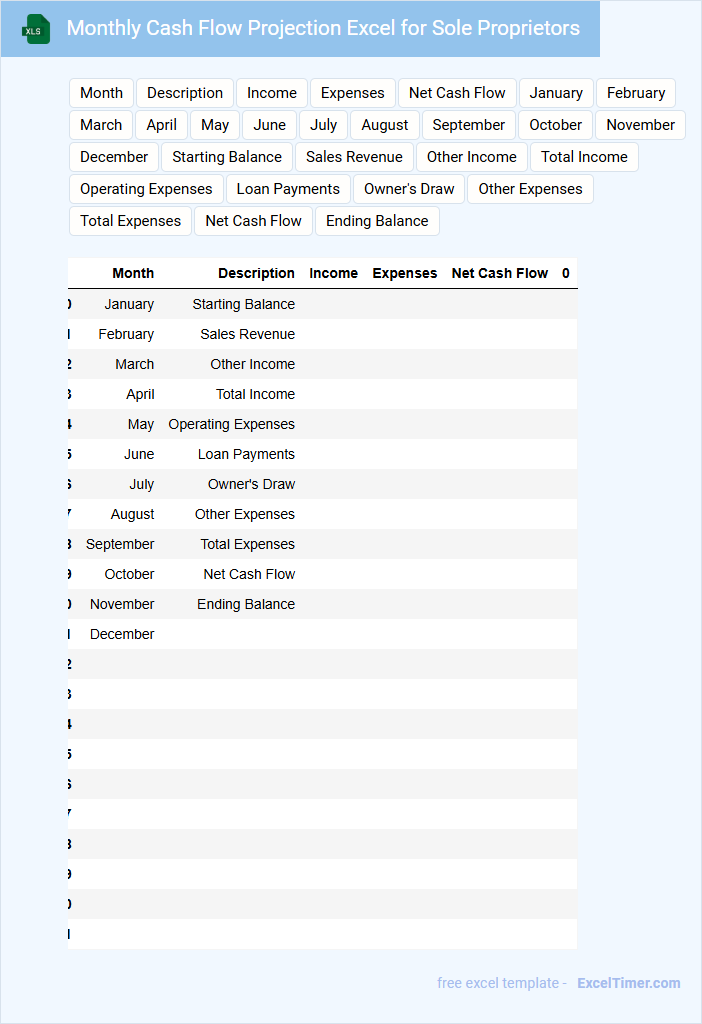

Monthly Cash Flow Projection Excel for Sole Proprietors

A Monthly Cash Flow Projection Excel for Sole Proprietors typically contains detailed estimates of incoming and outgoing cash over a month. It helps in forecasting the liquidity to ensure that the business can meet its financial obligations on time.

Key elements often included are expected sales revenue, operating expenses, and any additional cash inflows or outflows such as loans or investments. Keeping this document updated regularly is essential for effective financial planning and avoiding cash shortages.

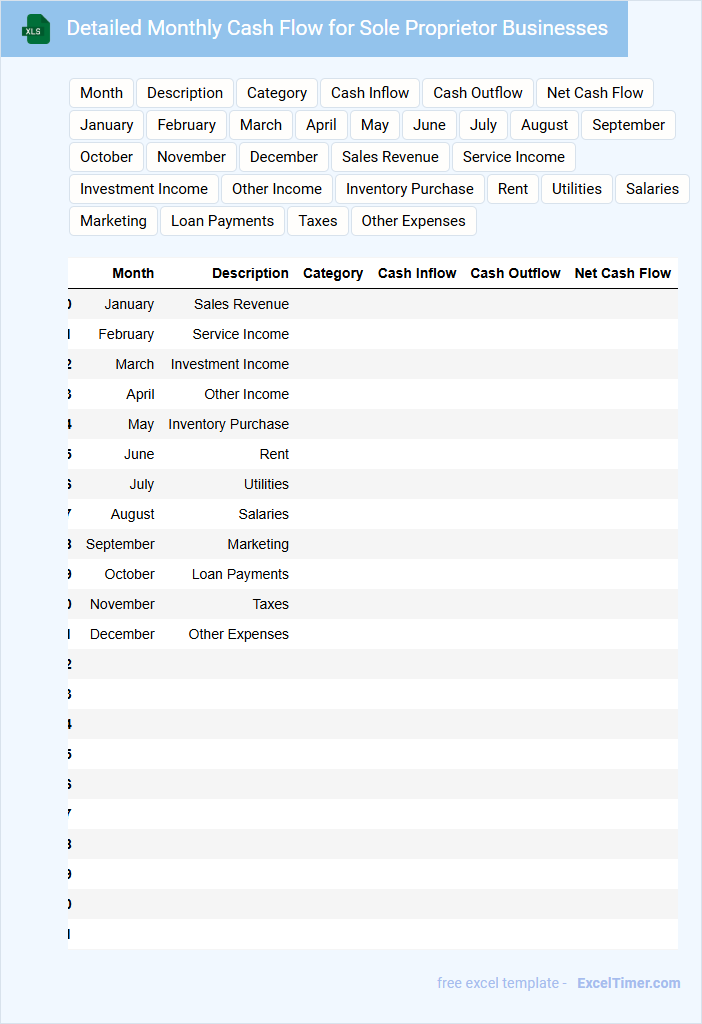

Detailed Monthly Cash Flow for Sole Proprietor Businesses

What information is typically included in a Detailed Monthly Cash Flow for Sole Proprietor Businesses? This document usually contains a comprehensive record of all cash inflows and outflows within a month, highlighting income sources, operating expenses, taxes, and loan payments. It offers a clear view of the business's liquidity and financial health, essential for effective cash management and planning.

What important aspects should be considered when preparing this document? It is crucial to ensure accuracy in tracking all transactions, categorize expenses properly, and regularly update the cash flow to detect trends or issues early. Including projections and comparing actual versus anticipated cash flow helps in making informed decisions to maintain profitability and avoid cash shortages.

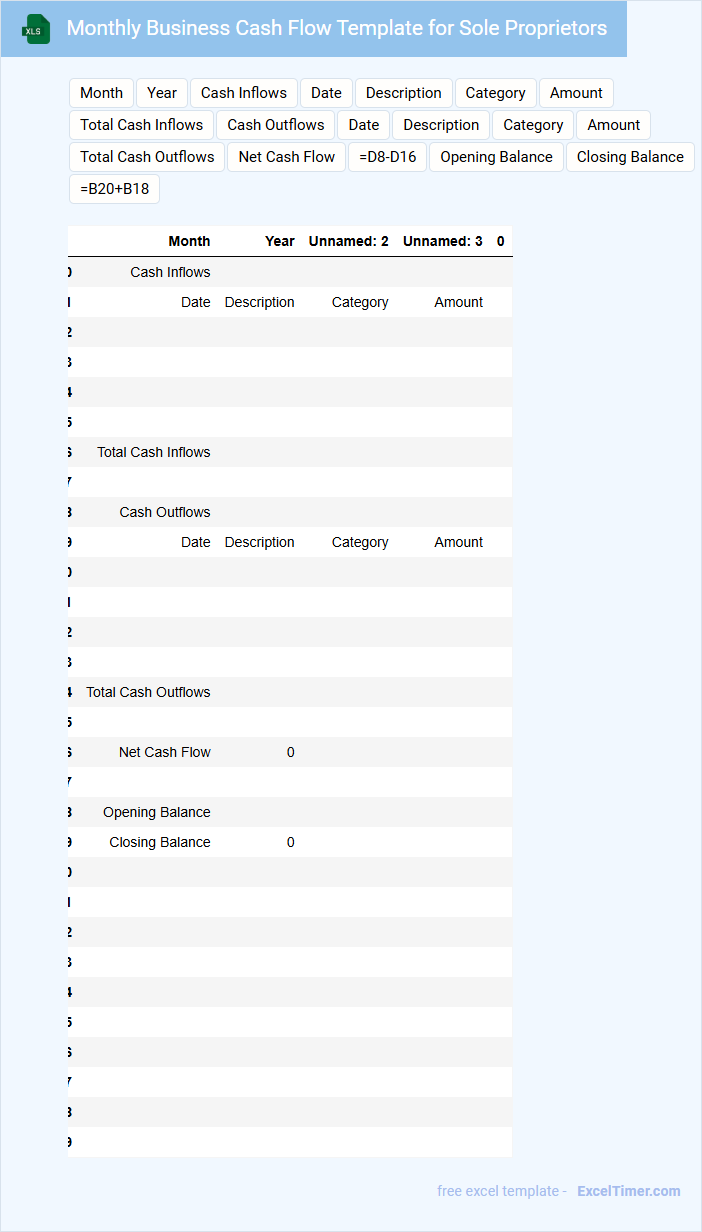

Monthly Business Cash Flow Template for Sole Proprietors

A Monthly Business Cash Flow Template for Sole Proprietors is designed to track the inflow and outflow of cash within a business over a specific month. It helps in maintaining accurate financial records and ensures that the business remains solvent.

This document typically contains sections for income, expenses, and net cash flow, allowing owners to forecast and manage their finances efficiently. It's important to regularly update the template to reflect real-time financial changes and support informed decision-making.

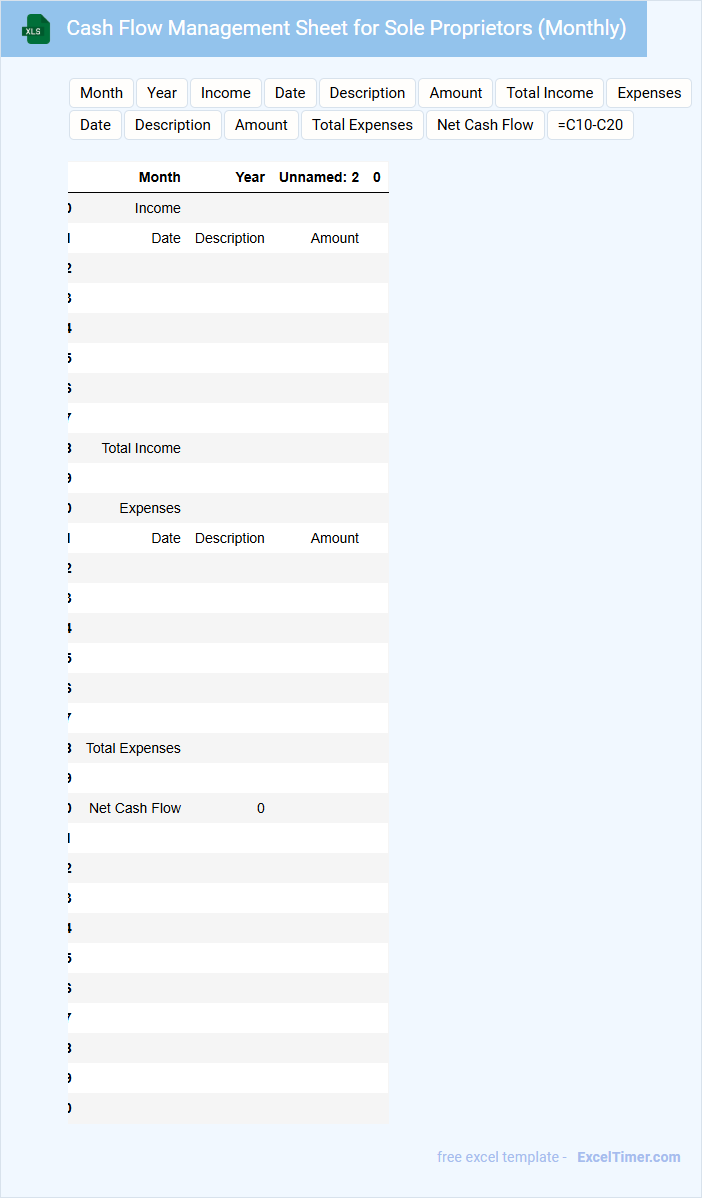

Cash Flow Management Sheet for Sole Proprietors (Monthly)

A Cash Flow Management Sheet for sole proprietors typically contains detailed records of all incoming and outgoing cash transactions on a monthly basis. It helps track the timing and amount of cash inflows and outflows to ensure the business remains solvent. Essential components usually include projections, actual cash received, and disbursements categorized by type.

Important suggestions for maintaining this document include regularly updating it to reflect real-time cash movements, separating personal and business expenses clearly, and setting aside a contingency fund to manage unexpected costs. Consistent monitoring promotes better budgeting and financial planning, which safeguards the owner's liquidity. Utilizing clear headings and actionable notes enhances usability and decision-making efficiency.

Monthly Financial Cash Flow Template for Sole Proprietors

What information does a Monthly Financial Cash Flow Template for Sole Proprietors typically contain? This document usually includes details of income, expenses, and net cash flow for each month, helping sole proprietors track their business's financial health. It provides a clear overview of cash inflows and outflows, enabling better budgeting and financial planning.

What is an important consideration when using this template? It is crucial to regularly update the template with accurate income and expense data to ensure reliable financial insights. Additionally, including categories for fixed and variable expenses helps in identifying areas to optimize cash flow effectively.

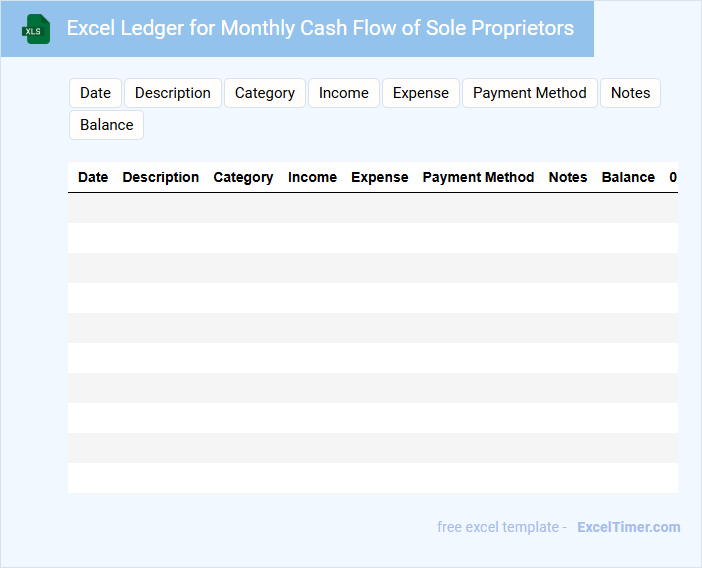

Excel Ledger for Monthly Cash Flow of Sole Proprietors

An Excel Ledger for Monthly Cash Flow is a document used by sole proprietors to track income and expenses meticulously. It typically contains detailed records of daily transactions, categorized by type, to provide a clear financial overview. This helps in monitoring business performance and planning for future expenses effectively.

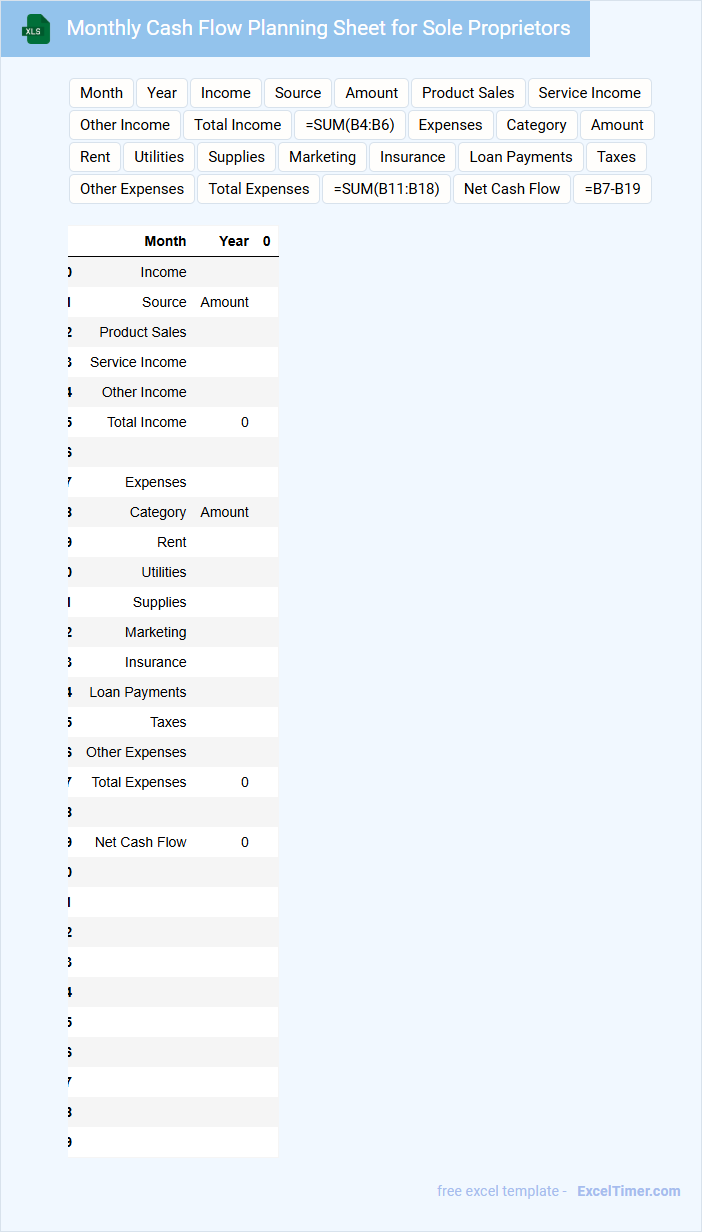

Monthly Cash Flow Planning Sheet for Sole Proprietors

What information is typically included in a Monthly Cash Flow Planning Sheet for Sole Proprietors? This document usually contains detailed records of expected income and expenses for the upcoming month, helping to project cash inflows and outflows. It is designed to assist sole proprietors in managing their finances efficiently by anticipating cash shortages and surpluses.

What are the most important aspects to focus on when creating this sheet? It is crucial to accurately estimate all sources of revenue and categorize expenses into fixed and variable costs. Additionally, regularly updating the sheet with actual figures helps to improve financial decision-making and ensures the business remains solvent throughout the month.

Operating Cash Flow Summary for Sole Proprietor (Monthly)

What information does an Operating Cash Flow Summary for a Sole Proprietor (Monthly) typically contain? This document usually includes detailed records of cash inflows and outflows from the primary business operations over a month. It helps track the actual cash generated or used, providing insight into the business's liquidity and operational efficiency.

What important elements should be carefully reviewed in this summary? Key components to focus on include cash received from customers, payments for operating expenses, and net cash flow to ensure positive cash management. Monitoring these helps the sole proprietor make informed decisions to maintain solvency and plan for future expenses.

What are the key components of a monthly cash flow statement for sole proprietors?

A monthly cash flow statement for sole proprietors includes cash inflows from sales, accounts receivable, and other income sources, along with cash outflows such as operating expenses, loan payments, and taxes. Tracking beginning and ending cash balances ensures accurate cash position monitoring. Your accurate record-keeping helps manage liquidity and supports financial decision-making.

How does tracking monthly cash inflows and outflows help in managing business sustainability?

Tracking monthly cash inflows and outflows provides sole proprietors with detailed insights into their liquidity, enabling effective budgeting and expense control. Accurate cash flow monitoring helps identify periods of surplus or shortfall, ensuring timely decisions to maintain operational stability. Consistent cash flow analysis supports long-term business sustainability by preventing cash shortages and optimizing financial planning.

Which Excel functions are essential for automating monthly cash flow calculations?

Key Excel functions for automating monthly cash flow calculations include SUM to total income and expenses, IF to create conditional cash flow scenarios, and PMT for loan payment computations. VLOOKUP or XLOOKUP help retrieve transaction details across sheets, while DATE and EOMONTH assist in organizing cash flows by month. Using these functions streamlines accurate forecasting and real-time cash management for sole proprietors.

How can a sole proprietor use monthly cash flow analysis to identify potential financial issues early?

A sole proprietor can use monthly cash flow analysis to track income versus expenses, highlighting periods of negative cash flow that signal potential financial issues. Monitoring cash flow trends helps pinpoint irregular payments or unexpected costs before they escalate. This proactive approach enables timely adjustments to budgeting, ensuring business stability and sustained liquidity.

What is the significance of categorizing expenses accurately in a monthly cash flow Excel document?

Accurately categorizing expenses in a monthly cash flow Excel document allows sole proprietors to identify spending patterns and optimize budget allocation. This precision enhances financial forecasting and cash management, reducing the risk of cash shortfalls. Clear expense categories also simplify tax preparation and compliance with financial regulations.