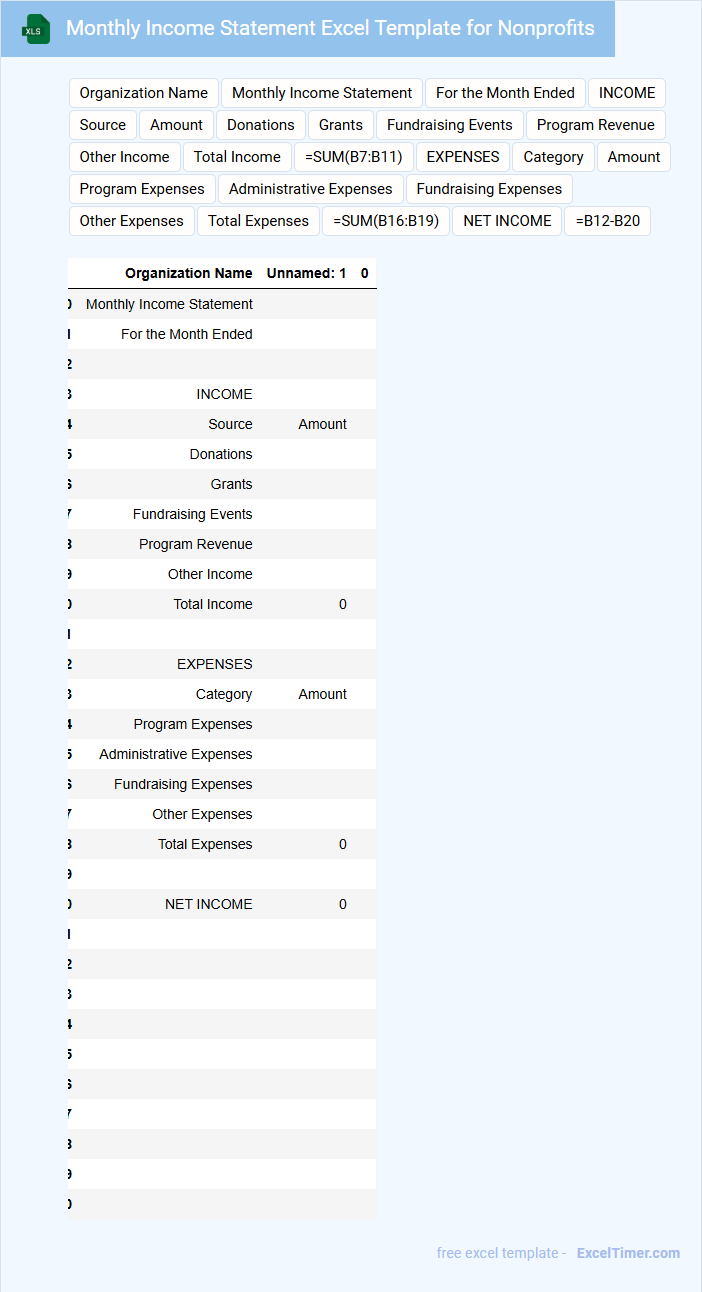

The Monthly Income Statement Excel Template for Nonprofits provides a streamlined way to track revenue and expenses, ensuring accurate financial management. It simplifies budgeting by categorizing income sources and expense types, making it easier to monitor monthly performance. Nonprofit organizations can use this template to maintain transparency and support grant reporting requirements efficiently.

Monthly Income Statement Excel Template for Nonprofits

A Monthly Income Statement Excel Template for Nonprofits typically contains detailed records of revenue, expenses, and net income for each month. It helps organizations track financial performance and maintain transparency in their accounting practices.

Important elements to include are donation tracking, grant income, operational costs, and program expenses. Consistent categorization and accurate data entry ensure reliable financial reporting and aid in budgeting decisions.

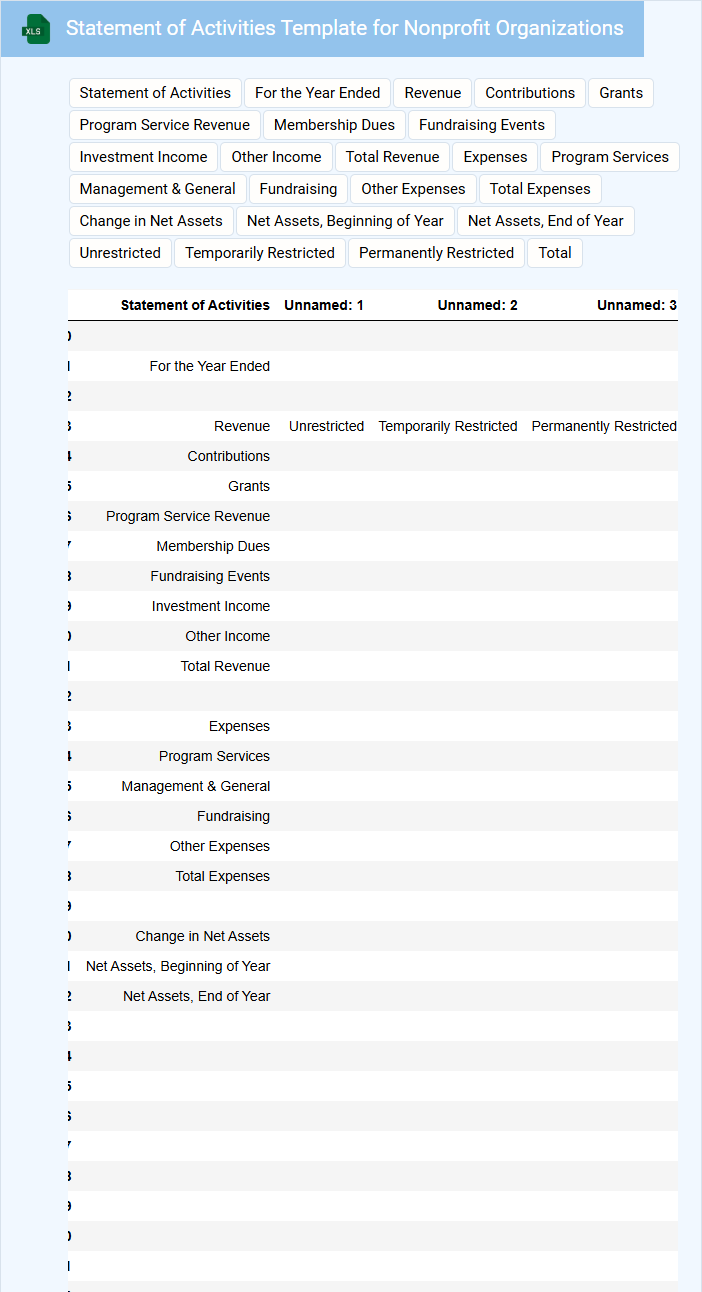

Statement of Activities Template for Nonprofit Organizations

A Statement of Activities template for nonprofit organizations typically contains a detailed summary of the organization's revenues, expenses, and changes in net assets over a specific period. It helps track financial performance and ensure transparency for stakeholders.

- Include clear categories for program services, management, and fundraising expenses.

- Ensure all revenue sources such as donations, grants, and fundraising events are accurately documented.

- Provide a comparison to budgeted figures to highlight financial management effectiveness.

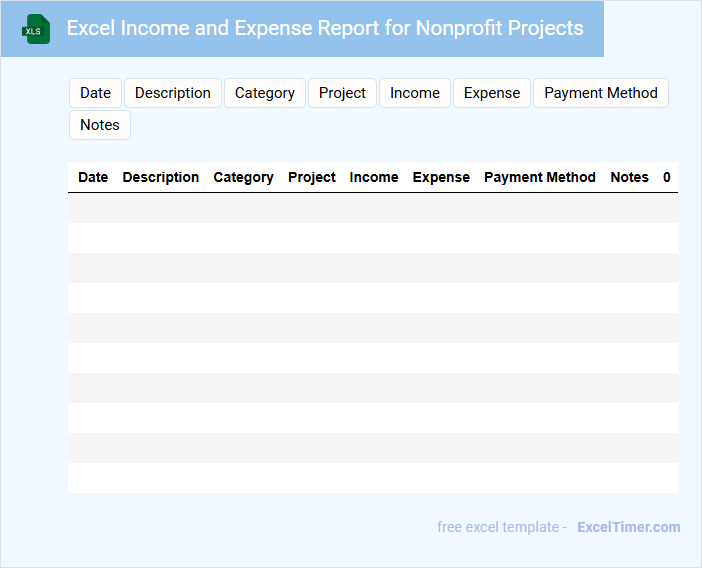

Excel Income and Expense Report for Nonprofit Projects

What information is typically included in an Excel Income and Expense Report for Nonprofit Projects? This type of document usually contains detailed records of all income sources and expenditures related to specific nonprofit projects, organized in a clear and systematic manner. It helps stakeholders track financial performance, ensure accountability, and make informed decisions regarding budget management and project funding.

What are important considerations when preparing this report? It is crucial to ensure data accuracy and consistency by regularly updating entries and categorizing income and expenses properly. Including clear labels, dates, and summaries enhances understanding, while linking to supporting documents or receipts strengthens transparency and audit readiness.

Budget Tracking Template for Nonprofit Monthly Income

A Budget Tracking Template for Nonprofit Monthly Income is designed to help organizations monitor and manage their monthly revenue sources efficiently. It typically includes detailed sections for different income streams and supports financial planning.

- Accurately record all sources of donations, grants, and fundraising income.

- Track monthly income trends to identify potential funding gaps or surpluses.

- Regularly update the template to compare actual income against budgeted projections.

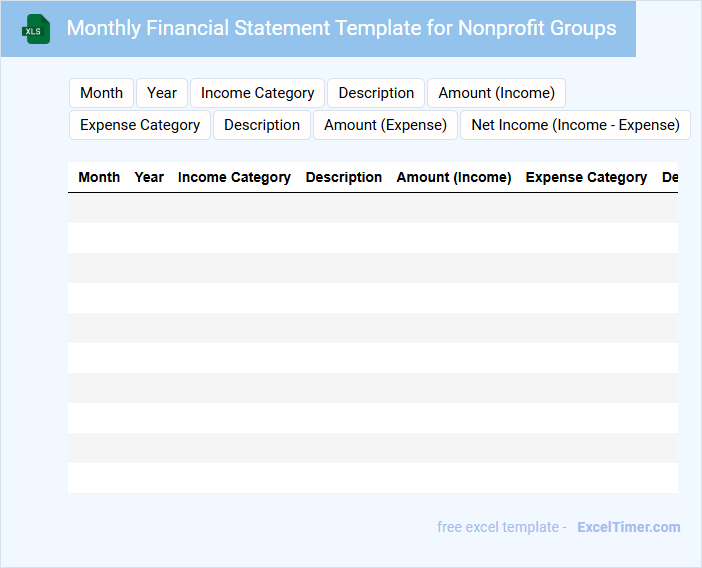

Monthly Financial Statement Template for Nonprofit Groups

A Monthly Financial Statement Template for Nonprofit Groups typically contains a summary of the organization's financial activities and status for the month. It helps in tracking income, expenses, and overall financial health to ensure transparency and accountability.

- Include detailed revenue sources and expense categories to accurately reflect financial performance.

- Update the statement monthly to monitor cash flow and budget adherence effectively.

- Incorporate notes on any significant financial events or changes for clarity and future reference.

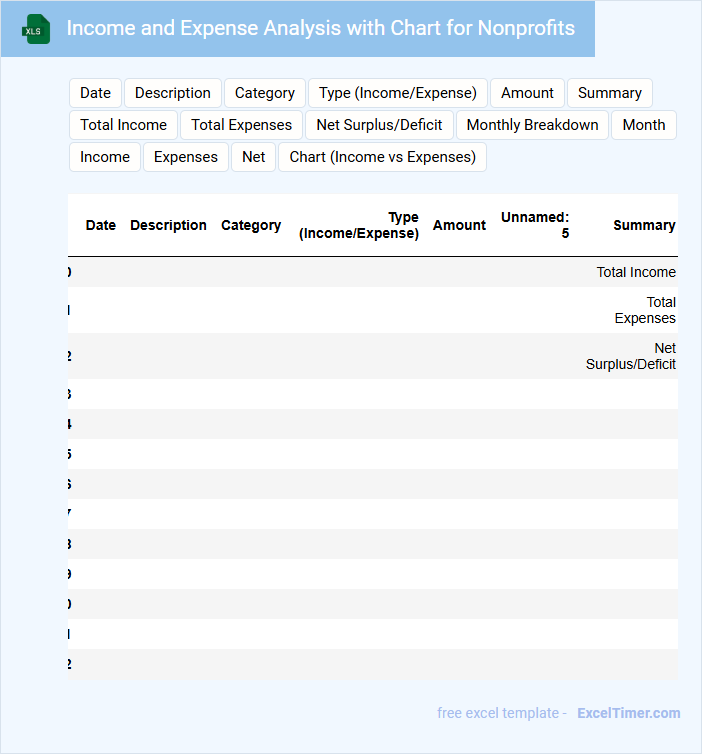

Income and Expense Analysis with Chart for Nonprofits

This document typically contains a detailed breakdown of income and expenses to help nonprofits understand their financial health and optimize resource allocation.

- Income Sources: Identification and categorization of all revenue streams including donations, grants, and fundraising events.

- Expense Tracking: Detailed records of operational costs, program expenses, and administrative fees to ensure transparency and budget control.

- Visual Analysis: Charts and graphs that highlight financial trends and comparisons for better decision-making and reporting.

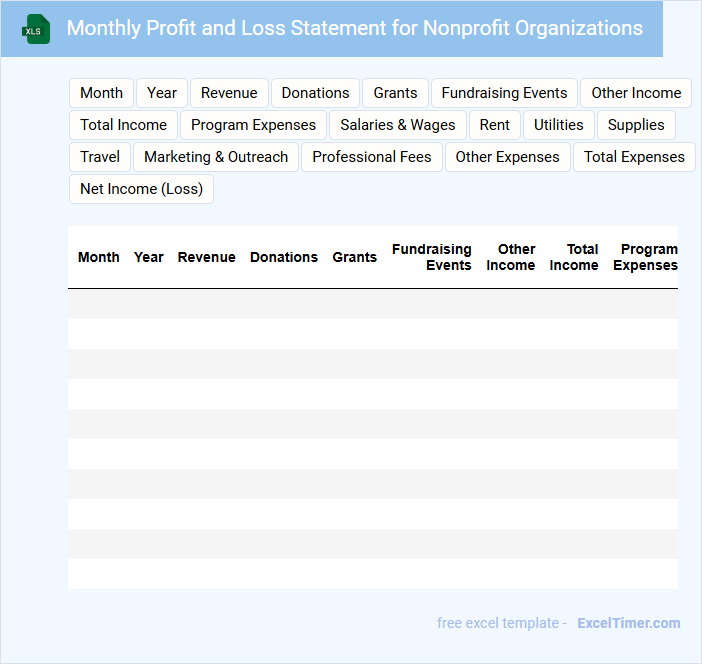

Monthly Profit and Loss Statement for Nonprofit Organizations

A Monthly Profit and Loss Statement for Nonprofit Organizations typically contains a financial summary outlining income, expenses, and net results for the specified month.

- Revenue Tracking: Detailed records of all income sources including donations, grants, and fundraising events are essential.

- Expense Categorization: Clear classification of operational, program, and administrative expenses ensures transparent financial reporting.

- Net Income Analysis: Calculating the difference between total income and expenses helps assess overall financial health and sustainability.

Grant Income Tracking Template for Nonprofits

Grant Income Tracking Templates for Nonprofits typically contain detailed financial records to monitor and manage the receipt and allocation of grant funds efficiently.

- Grant source identification: Clearly list all funding organizations and grant amounts awarded.

- Income categorization: Organize grant funds by project or program to ensure accurate tracking.

- Reporting deadlines: Highlight important dates for financial reports and compliance submissions.

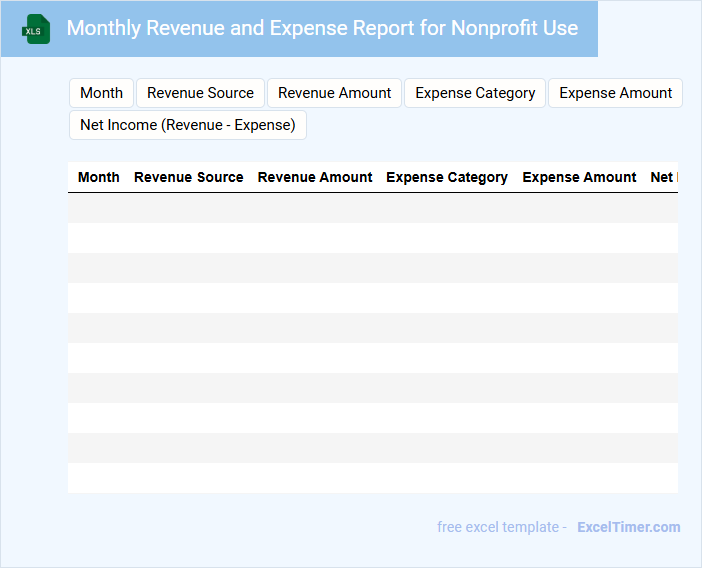

Monthly Revenue and Expense Report for Nonprofit Use

The Monthly Revenue and Expense Report is a critical document for nonprofits, summarizing all income and expenditures within a specific month. It typically contains detailed entries of donations, grants, fundraising income, operational costs, and program expenses. This report aids organizations in monitoring financial health and making informed budgeting decisions.

Important elements to include are clear categorization of revenue sources, accurate tracking of expenses, and a comparison to previous months or budget forecasts. Transparency and consistency in reporting ensure trustworthiness and regulatory compliance. Including notes on any unusual transactions or financial challenges can also be beneficial for stakeholders.

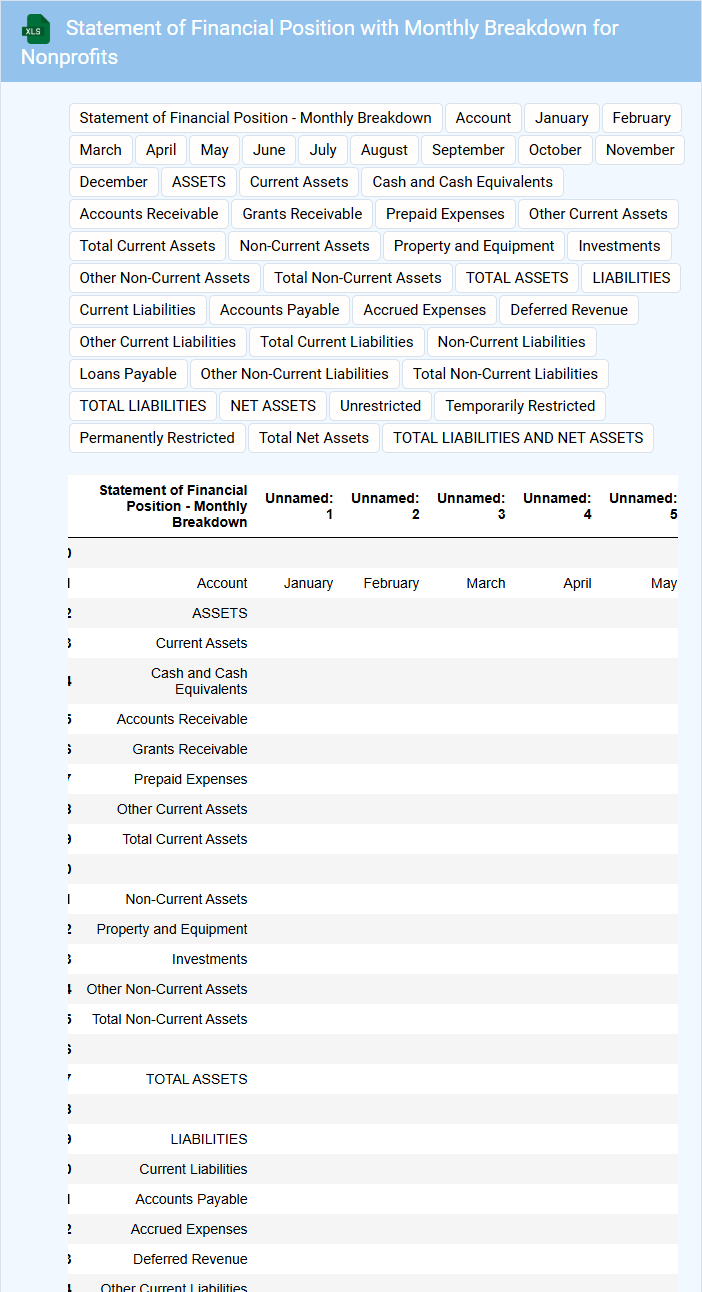

Statement of Financial Position with Monthly Breakdown for Nonprofits

The Statement of Financial Position is a crucial financial document for nonprofits, outlining assets, liabilities, and net assets at a specific point in time. It provides transparency and insight into the organization's financial health and stability.

Including a Monthly Breakdown allows for detailed tracking of changes over time, helping to identify trends and manage cash flow effectively. This level of detail supports strategic planning and donor reporting with accuracy.

Ensuring consistency and clarity in categorizing financial data is essential for generating meaningful analysis and maintaining trust with stakeholders.

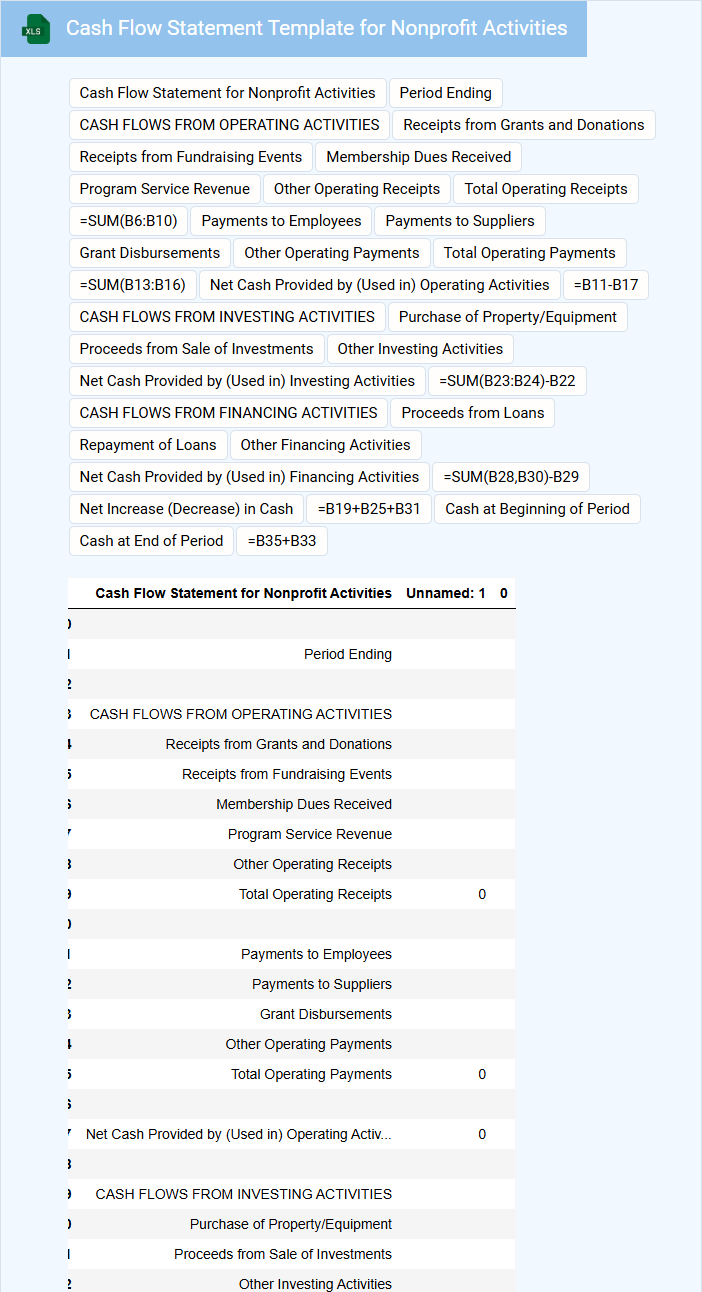

Cash Flow Statement Template for Nonprofit Activities

What information is typically included in a Cash Flow Statement Template for Nonprofit Activities? This document usually contains detailed records of cash inflows and outflows related to nonprofit operations, such as donations, grants, program expenses, and fundraising costs. It helps track liquidity and ensures the organization maintains financial stability to support its mission.

What is an important element to consider when using this template? It is crucial to categorize cash flows accurately between operating, investing, and financing activities specific to nonprofit contexts. This ensures transparency, aids in financial planning, and enhances accountability to donors and stakeholders.

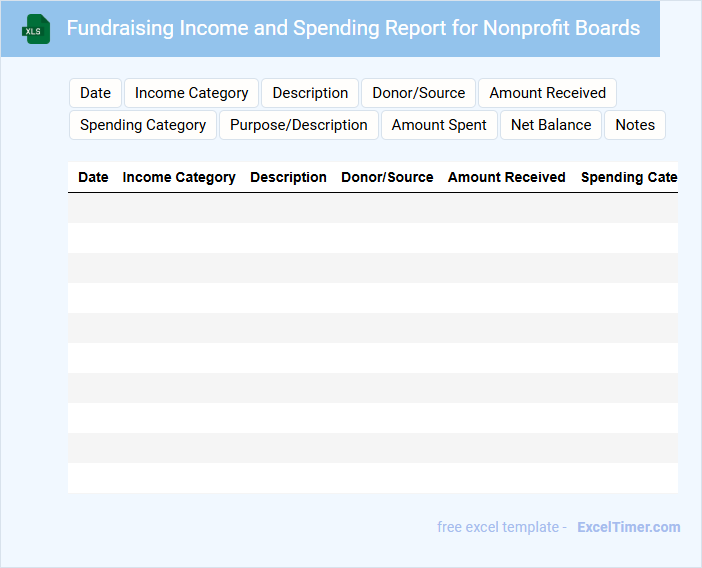

Fundraising Income and Spending Report for Nonprofit Boards

The Fundraising Income and Spending Report for nonprofit boards typically contains detailed records of all donations received and expenses incurred during a specific period. It provides transparency and accountability by summarizing financial activities related to fundraising efforts. This document helps board members evaluate the effectiveness of fundraising strategies and ensure proper allocation of resources.

Important elements to include are a clear breakdown of income sources, categorized expenditures, and comparisons against the budget. Highlighting trends in donor contributions and identifying any discrepancies are crucial for informed decision-making. Accurate and timely reporting supports regulatory compliance and builds donor trust.

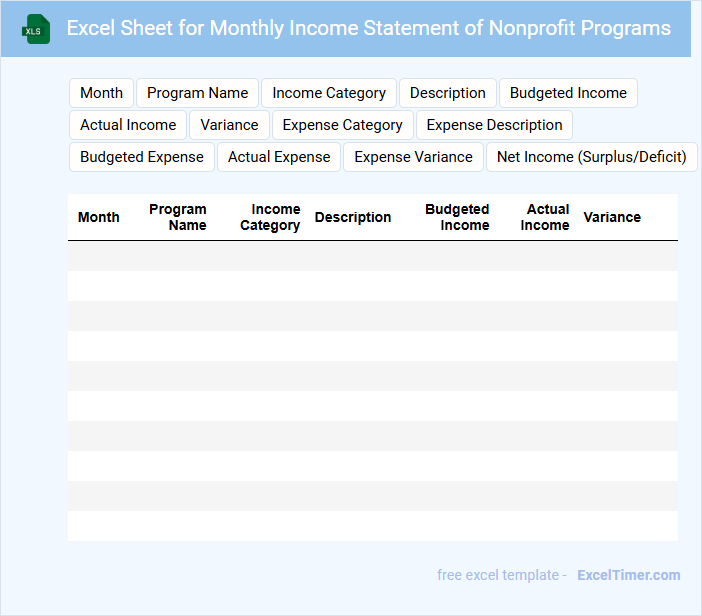

Excel Sheet for Monthly Income Statement of Nonprofit Programs

What information does an Excel Sheet for Monthly Income Statement of Nonprofit Programs usually contain? It typically includes detailed records of income and expenses related to various nonprofit programs for a specific month. This allows organizations to track financial performance and ensure funds are used effectively. What is an important consideration when creating this document? Ensuring accurate categorization of revenue sources and expenses is crucial for transparent financial reporting and informed decision-making.

Donation Tracking Template with Monthly Statement for Nonprofits

A Donation Tracking Template with a monthly statement is an essential document used by nonprofits to systematically record and monitor contributions over time. It typically contains donor details, donation amounts, and dates of contributions. Ensuring accuracy and transparency in this document helps maintain trust and accountability with supporters.

Important aspects to include are clear donor identification, categorization of donation types, and a summary statement for each month. Incorporating automated calculations for totals and generating monthly reports can enhance efficiency. Additionally, maintaining confidentiality and data security is crucial for handling sensitive donor information.

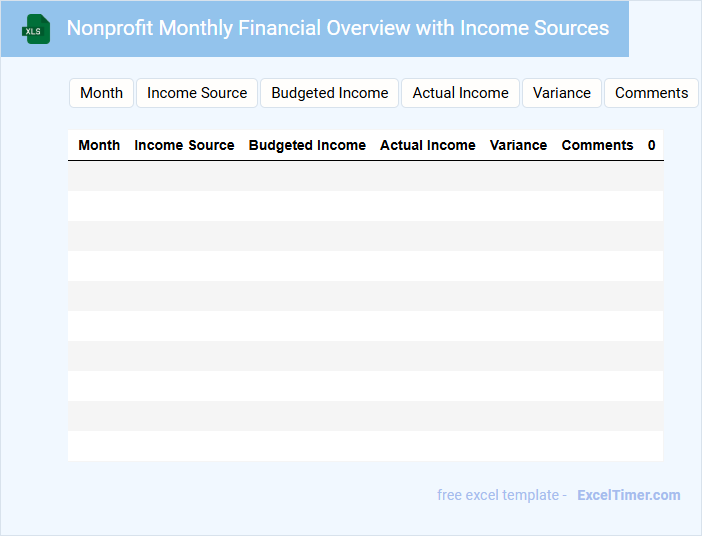

Nonprofit Monthly Financial Overview with Income Sources

A Nonprofit Monthly Financial Overview typically contains detailed summaries of income, expenses, and fund allocations to provide transparency and accountability. It highlights various income sources such as donations, grants, and fundraising events to track financial health over time.

Key elements include budget comparisons, cash flow statements, and variance analyses for informed decision-making. Regularly reviewing this document helps ensure proper resource management and supports strategic planning.

What are the key revenue sources included in a nonprofit's monthly income statement?

A nonprofit's monthly income statement typically includes key revenue sources such as donations, grants, fundraising events, and program service fees. Your statement also reflects income from membership dues and investment earnings. Tracking these revenue streams helps ensure accurate financial management and organizational transparency.

How does the statement differentiate between restricted and unrestricted funds?

The Monthly Income Statement for Nonprofits distinguishes restricted funds as those allocated for specific purposes, reflected separately from unrestricted funds available for general use. Restricted funds are tracked with designated categories to ensure compliance with donor-imposed limitations. Unrestricted funds provide flexibility for operational expenses and organizational needs.

What essential expense categories should be tracked monthly in nonprofit accounting?

Your Monthly Income Statement for nonprofits should track essential expense categories including Program Services, Management and General, and Fundraising costs. Monitoring Salaries, Grants, Office Supplies, and Marketing Expenses ensures accurate financial oversight. Detailed tracking supports transparency and informed decision-making for sustainable nonprofit operations.

How does the income statement reflect grant and donation income over time?

Your Monthly Income Statement for Nonprofits tracks grant and donation income by recording these funds as revenue in the month received, allowing you to monitor financial support trends over time. Detailed monthly entries highlight fluctuations in donor contributions and grant disbursements, providing clear visibility into funding cycles. This consistent reporting aids in budgeting and assessing the sustainability of your nonprofit's income streams.

What indicators on the monthly income statement reveal the organization's financial health?

Key indicators on a Monthly Income Statement for Nonprofits that reveal financial health include total revenue, total expenses, and net income or loss. Monitoring program service expenses as a percentage of total expenses highlights operational efficiency and mission focus. Tracking changes in unrestricted net assets provides insight into financial sustainability and the ability to support future programs.