The Monthly Debt Repayment Excel Template for Graduates helps users efficiently track loan payments and manage debt schedules. It features customizable fields to input different loan amounts, interest rates, and payment timelines tailored to individual financial situations. This template simplifies budgeting by providing clear visual summaries of outstanding balances and repayment progress.

Monthly Debt Repayment Tracker for Graduates

A Monthly Debt Repayment Tracker for graduates is a financial tool designed to monitor and manage debt payments systematically. It typically contains details of all outstanding debts, due dates, payment amounts, and progress over time. This document helps graduates maintain awareness of their financial obligations and avoid missed payments.

Important features to include are a clear breakdown of each loan or credit account and a summary of total monthly payments. Tracking interest rates and payment deadlines is also crucial for effective debt management. Regularly updating this tracker encourages responsible financial habits and supports timely repayment.

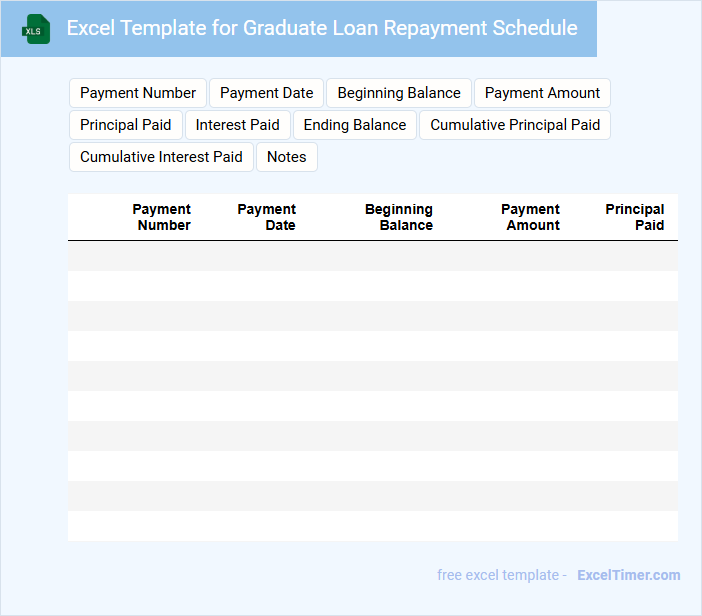

Excel Template for Graduate Loan Repayment Schedule

What information does an Excel Template for Graduate Loan Repayment Schedule usually contain? This type of document typically includes details such as loan amounts, interest rates, repayment terms, and monthly payment schedules. It is designed to help graduates track and manage their loan repayments efficiently.

What is an important consideration when using this template? Ensuring that the interest rate and repayment period are accurate is crucial, as these directly impact the total amount to be repaid. Additionally, including a clear summary of remaining balance and payment milestones can help borrowers stay organized and motivated.

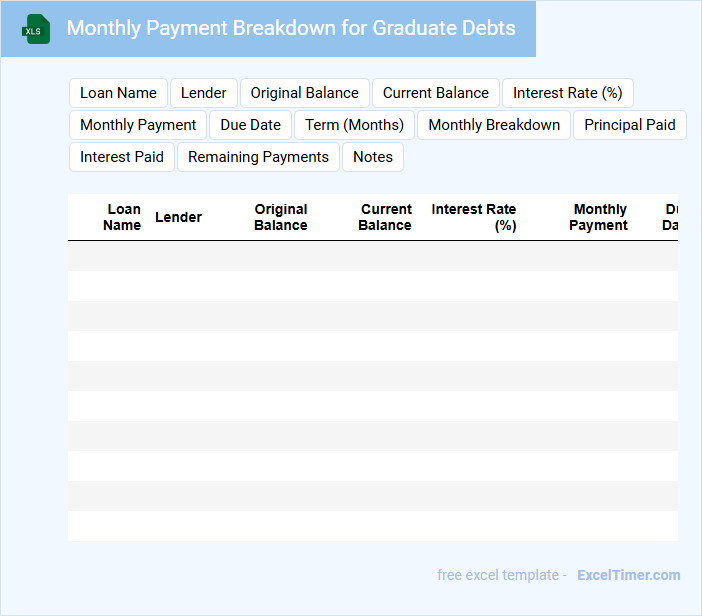

Monthly Payment Breakdown for Graduate Debts

A Monthly Payment Breakdown for Graduate Debts typically outlines the details of loan repayments, interest accrued, and outstanding balances for graduates managing their educational debt.

- Loan Amount: The original principal amount borrowed for graduate studies.

- Monthly Payment: The fixed or variable amount due each month toward the loan.

- Interest Rate: The percentage applied to the outstanding balance that affects the total cost of the loan.

Graduate Debt Payoff Progress Tracker in Excel

A Graduate Debt Payoff Progress Tracker in Excel is a document designed to monitor and manage student loan repayments systematically. It typically contains loan balances, interest rates, monthly payments, and amortization schedules to visualize progress over time. This tool helps graduates stay organized and motivated by clearly outlining their debt reduction journey. For optimal use, regularly update the tracker with actual payments to maintain accurate progress and adjust strategies as needed. Incorporating a summary section with key metrics such as total interest paid and estimated payoff date can provide insightful motivation and financial awareness. Prioritize setting realistic payment goals within the tracker to ensure steady advancement towards debt freedom.

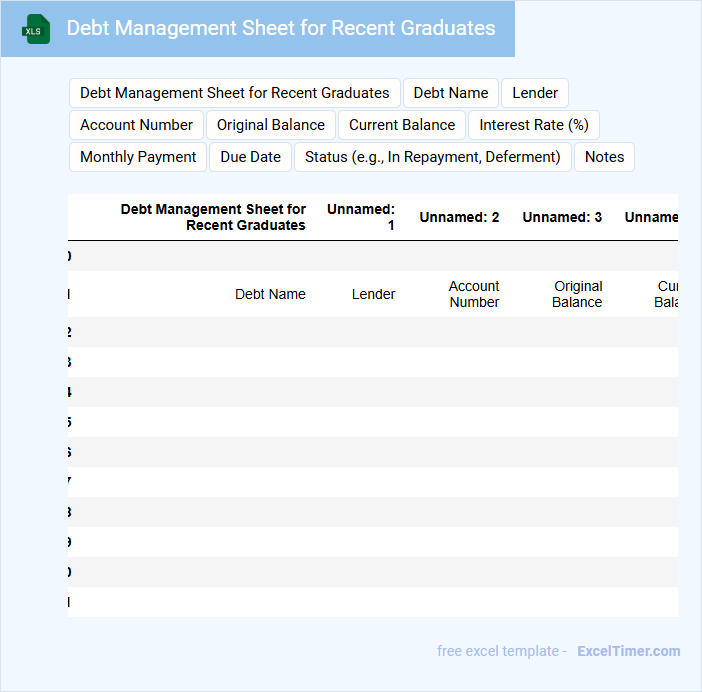

Debt Management Sheet for Recent Graduates

What typically is included in a Debt Management Sheet for Recent Graduates? This document usually contains a detailed list of all outstanding debts such as student loans, credit card balances, and personal loans. It helps recent graduates organize their debt, track payment due dates, and plan monthly budgets effectively.

What important elements should be highlighted in this Debt Management Sheet? Key components should include interest rates, minimum monthly payments, total balances, and payment priority to avoid missed deadlines and reduce overall debt efficiently. Tracking progress regularly ensures better financial control and goal achievement.

Excel Log for Monthly Graduate Debt Reduction

An Excel Log for Monthly Graduate Debt Reduction typically contains detailed records of monthly payments, outstanding balances, and interest calculations. It helps individuals track their progress in paying off student loans effectively. Ensuring accurate input of payment dates and amounts is crucial for maintaining a clear financial overview.

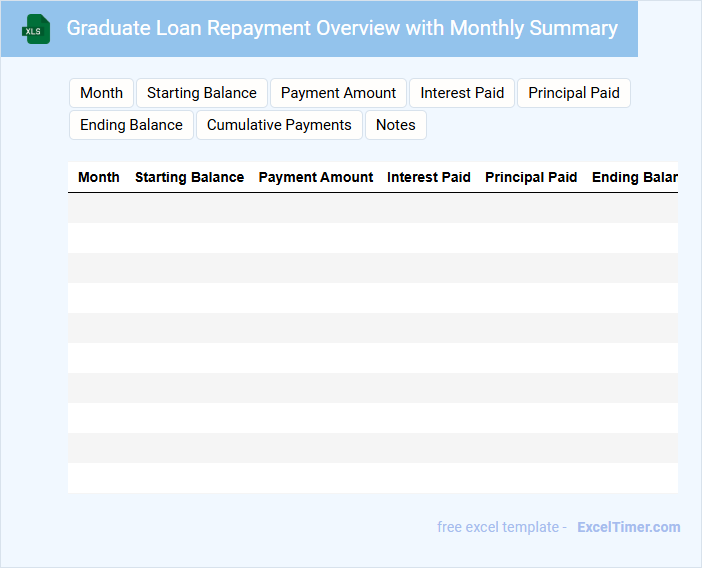

Graduate Loan Repayment Overview with Monthly Summary

A Graduate Loan Repayment Overview typically contains detailed information about the total loan amount, interest rates, and repayment terms tailored for graduates. It provides a clear outline of monthly payment amounts and schedules to help manage financial obligations. This document serves as a financial roadmap for graduates to stay on track with their loans.

The Monthly Summary section highlights the payment made each month, outstanding balance, and accrued interest, ensuring transparency and accountability. This summary helps borrowers monitor their progress and adjust budgets accordingly. Regularly reviewing this information is crucial for effective loan management and avoiding defaults.

Debt Snowball Tracker for Graduates in Excel

What information does a Debt Snowball Tracker for Graduates in Excel typically contain? This document usually includes a detailed list of all debts with their balances, minimum payments, and interest rates organized in order of smallest to largest balance. It helps graduates monitor their progress in paying off debts efficiently by focusing on one debt at a time while making minimum payments on others, creating a clear visual representation of debt reduction over time.

What important features should be included in this tracker? Important elements include columns for debt name, total balance, minimum payment, extra payment amount, payoff date projections, and progress graphs. Adding conditional formatting to highlight paid-off debts and a summary section showing total debt remaining can motivate users to stay committed to their repayment goals.

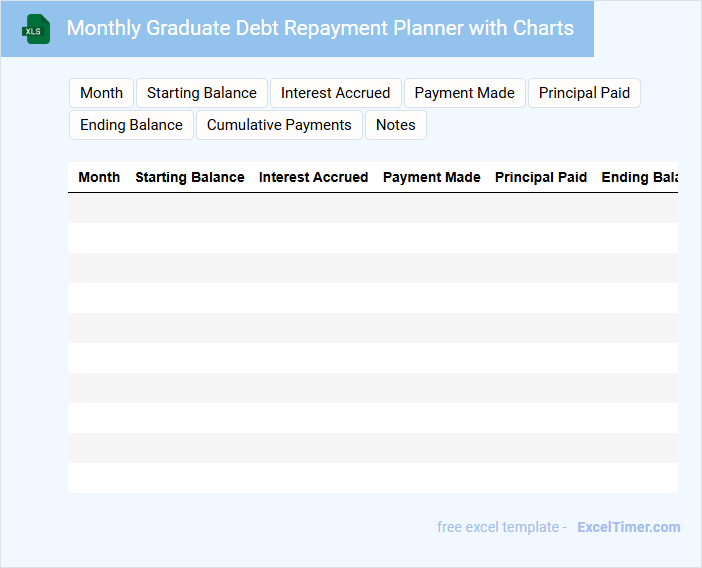

Monthly Graduate Debt Repayment Planner with Charts

This document typically contains an overview of outstanding graduate debts, repayment schedules, and visual charts to track payment progress.

- Debt Summary: A detailed list of all graduate loans including outstanding balances and interest rates.

- Repayment Plan: Suggested monthly payment amounts and timelines to ensure timely debt clearance.

- Visual Charts: Graphs and pie charts to visualize payment progress and remaining debt.

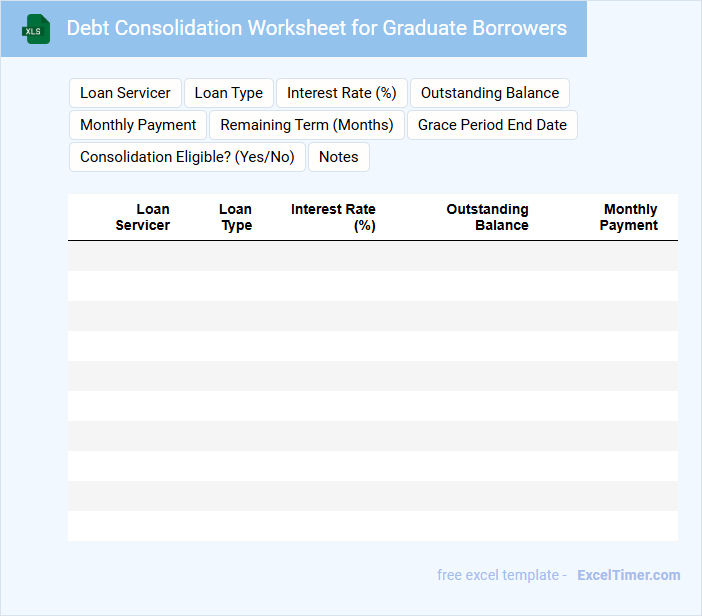

Debt Consolidation Worksheet for Graduate Borrowers

A Debt Consolidation Worksheet for Graduate Borrowers typically includes detailed information about existing loans, interest rates, and monthly payments. It helps borrowers organize and evaluate their debt to determine the best consolidation strategy. This document is essential for understanding overall financial obligations and planning repayment.

Important aspects to consider are accurate loan balances, current interest rates, and potential savings from consolidation. Tracking these details ensures informed decisions about refinancing or repayment plans. Including a budget overview can also aid in managing future expenses effectively.

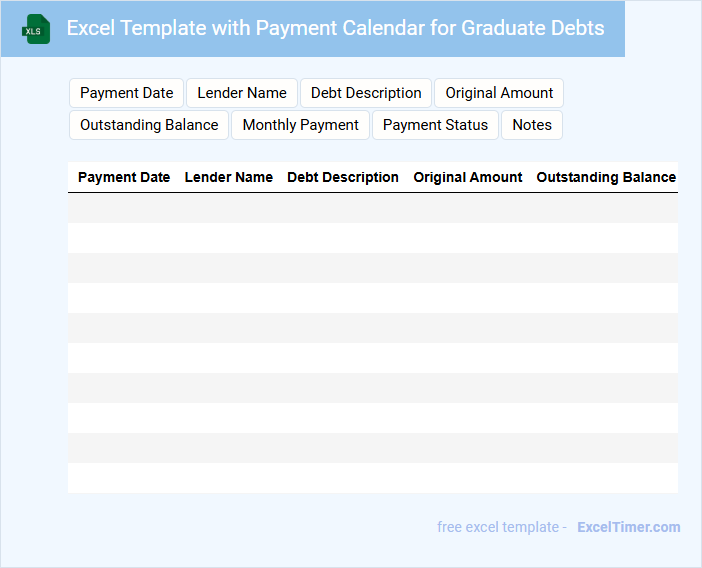

Excel Template with Payment Calendar for Graduate Debts

An Excel Template with a Payment Calendar typically contains structured spreadsheets designed to help users track and manage debt repayments over time. It includes columns for payment dates, amounts, interest rates, and outstanding balances to maintain clear and organized financial records.

This type of document is crucial for graduates managing their student loans, ensuring they stay on top of deadlines and avoid missed payments. For effective use, it is important to regularly update the template and set reminders aligned with the calendar to maintain timely payments.

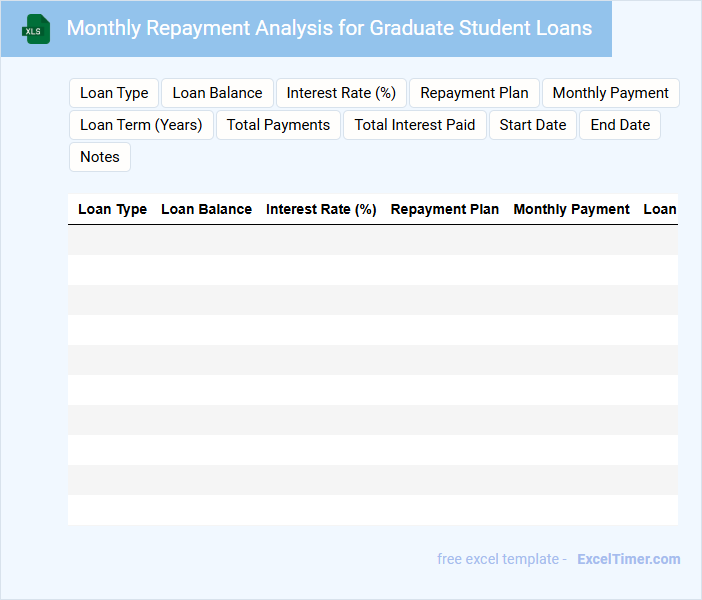

Monthly Repayment Analysis for Graduate Student Loans

The Monthly Repayment Analysis document typically contains detailed information on the amount a graduate student is expected to pay towards their student loans each month. It breaks down principal, interest, and any applicable fees to give a clear financial outlook.

For graduate student loans, it is important to include a comparison of repayment plans based on income levels and loan forgiveness options. This helps borrowers make informed decisions on managing their debt efficiently.

Debt Comparison Tool for Graduate Loan Options

A Debt Comparison Tool for Graduate Loan Options typically contains detailed information about various loan products, including interest rates, repayment terms, and total repayment costs. It helps users evaluate and compare different loan offers to make informed financial decisions. Key features often include customizable scenarios, eligibility criteria, and calculators for estimating monthly payments.

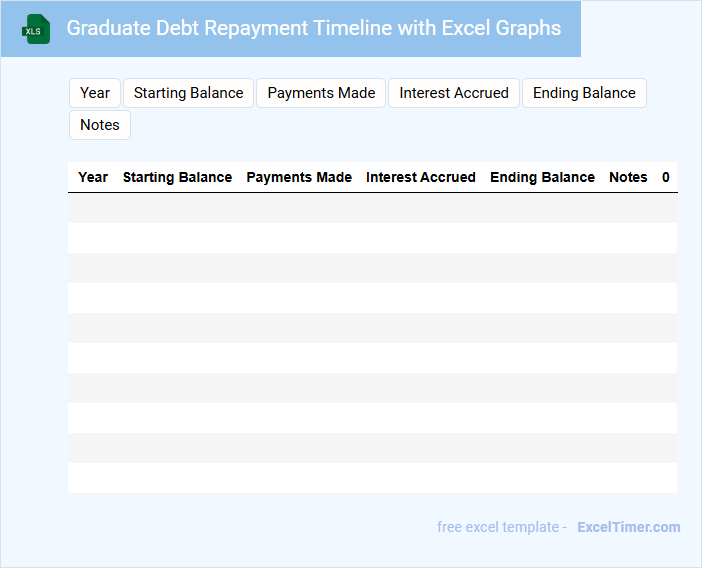

Graduate Debt Repayment Timeline with Excel Graphs

This document typically contains a structured timeline outlining the schedule for repaying graduate debt accompanied by visual representations using Excel graphs to enhance understanding.

- Debt Breakdown: Detailed description of different types of graduate debts, including interest rates and principal amounts.

- Repayment Schedule: Clear timeline of payment dates, amounts, and milestones to track debt reduction progress.

- Visual Data Representation: Excel graphs illustrating repayment trends, projections, and comparisons for better financial planning.

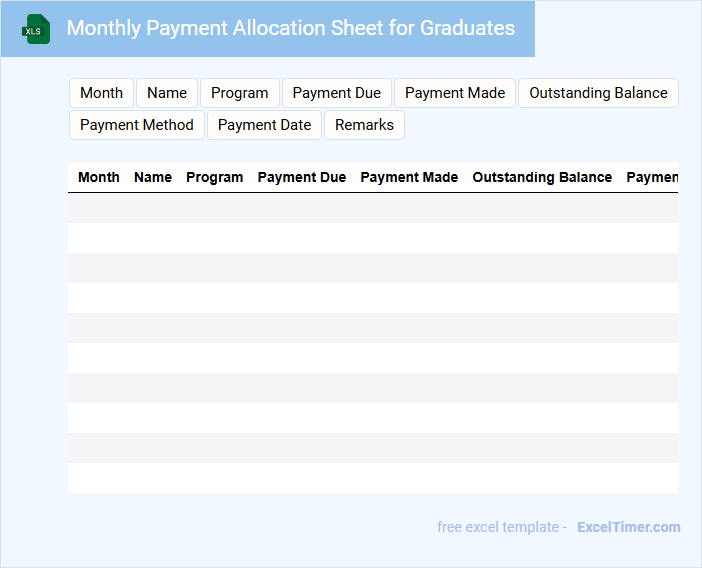

Monthly Payment Allocation Sheet for Graduates

A Monthly Payment Allocation Sheet for Graduates is a financial document that tracks and organizes payments made to graduates over a specific month. It helps ensure accuracy and transparency in distributing funds.

- Record each graduate's payment details, including amount and date received.

- Include categories for different payment types like scholarships, stipends, or reimbursements.

- Review and reconcile totals regularly to avoid discrepancies and ensure accountability.

What formulas can be used to calculate total monthly debt repayment in Excel for graduates with multiple loans?

To calculate Your total monthly debt repayment in Excel for graduates with multiple loans, use the SUM function to add individual monthly payments. For detailed loan repayment, apply the PMT formula: =PMT(rate, nper, pv), where rate is the interest rate per period, nper the number of periods, and pv the loan amount. Combining these formulas ensures accurate tracking of total debt repayment across all loans.

How can you track and visualize debt repayment progress over time using Excel charts or graphs?

You can track and visualize your monthly debt repayment progress by creating line charts or bar graphs in Excel, which display payment amounts and remaining balances over time. Use Excel's data table to input monthly payments, interest rates, and outstanding loan balances to generate dynamic visuals. These charts help identify trends and motivate consistent repayment toward graduate loans.

Which Excel functions help estimate how long it will take to pay off student loans based on current payment amounts?

Excel functions PMT, NPER, and RATE help estimate student loan payoff duration by calculating payment amounts, number of periods, and interest rates. Using NPER with loan balance, interest rate, and monthly payment estimates the months needed to repay student loans. Combining these functions in a debt repayment model provides accurate timelines for graduates' loan payoff.

How can you organize and categorize different loan types and interest rates in an Excel spreadsheet for better repayment planning?

Organize your loan types by creating separate columns for each category, such as student loans, credit cards, and personal loans. Input corresponding interest rates and monthly repayment amounts in adjacent columns to enable easy comparison and tracking. Use Excel's sorting and filtering features to prioritize high-interest debts for efficient repayment planning.

What conditional formatting rules in Excel can highlight high-interest loans or missed payments in a monthly debt repayment tracker?

Use conditional formatting rules in Excel to highlight high-interest loans by setting a rule where the interest rate column exceeds a specified threshold, such as 10%. Apply a separate rule to mark missed payments by highlighting cells in the payment status column that contain keywords like "Missed" or dates past due without payment. Color codes like red for high-interest rates and yellow for missed payments improve visibility in a monthly debt repayment tracker for graduates.