![]()

The Monthly Bill Tracker Excel Template for Homeowners helps efficiently organize and monitor all household expenses in one place. This template provides customizable categories, automated calculations, and visual charts to ensure timely payments and budget management. Using this tool reduces the risk of missed bills and improves financial planning for homeowners.

Monthly Bill Tracker Excel Template for Homeowners

The Monthly Bill Tracker Excel Template for homeowners is designed to help efficiently organize and monitor recurring expenses. It typically contains sections for bill categories, due dates, amounts, and payment statuses. This document aids in budgeting by providing clarity on monthly financial obligations.

Key features include automatic calculations, visual charts, and customizable fields for diverse utility and mortgage payments. Prioritizing accurate data entry and timely updates ensures optimal tracking and prevents late fees. Homeowners benefit by gaining control over their finances and identifying potential savings.

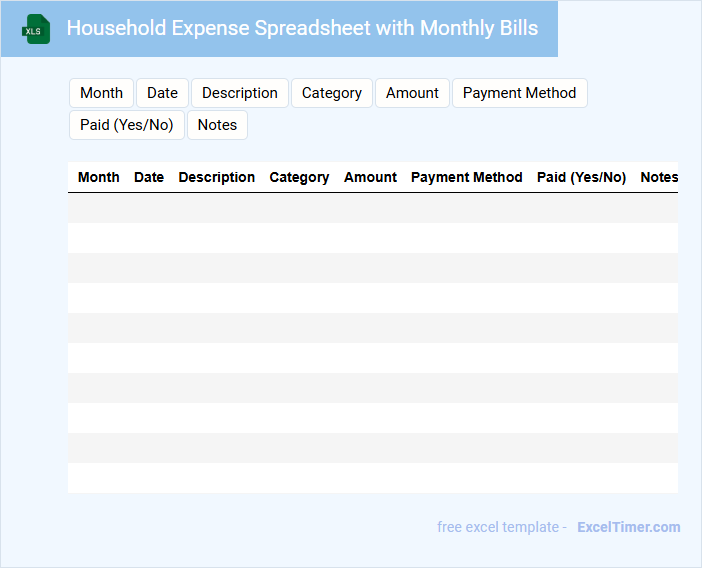

Household Expense Spreadsheet with Monthly Bills

A Household Expense Spreadsheet is typically a detailed document used to track monthly bills and various household expenses. It helps in organizing, budgeting, and managing finances efficiently by listing income, fixed costs, and variable expenses. The spreadsheet often includes categories like rent, utilities, groceries, and entertainment to provide a clear overview of monthly spending.

When using a Household Expense Spreadsheet, it is important to regularly update entries to maintain accuracy. Including payment due dates and categorizing expenses can enhance financial planning and avoid late fees. Additionally, reviewing and analyzing trends monthly can help identify areas to cut costs and improve savings.

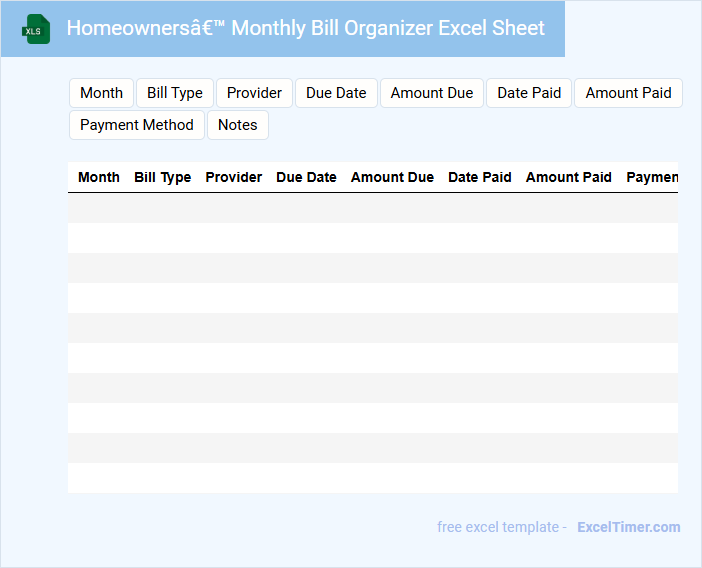

Homeowners’ Monthly Bill Organizer Excel Sheet

Homeowners' Monthly Bill Organizer Excel Sheet is a financial management tool designed to help users track and manage their monthly expenses efficiently. Typically, this document contains columns for bill types, due dates, amounts, and payment status to ensure timely payments. It is important to regularly update and review the sheet to avoid missed payments and maintain accurate budgeting.

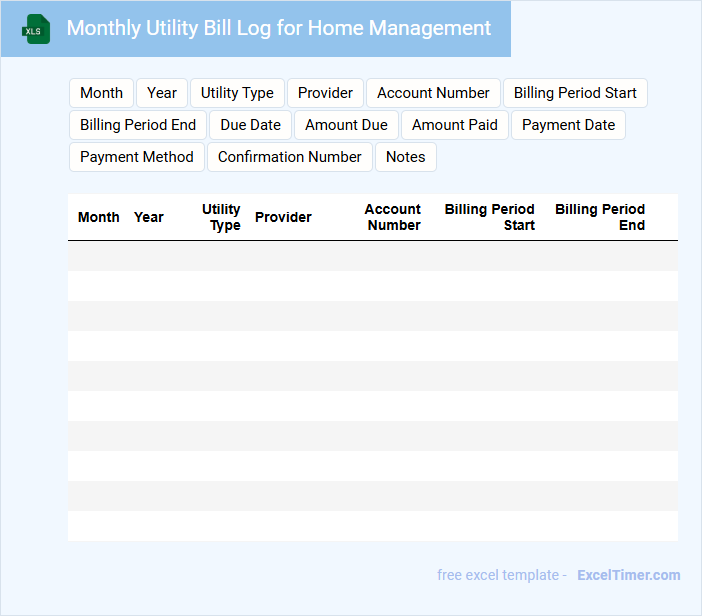

Monthly Utility Bill Log for Home Management

A Monthly Utility Bill Log for Home Management typically contains detailed records of expenses related to utilities such as electricity, water, gas, and internet. This document helps track consumption patterns and monthly costs, enabling better budget management. It is important to include accurate dates, payment statuses, and any overdue amounts to maintain financial organization.

Excel Template for Tracking Recurring Household Bills

An Excel Template for Tracking Recurring Household Bills is a structured spreadsheet designed to help users monitor their monthly expenses efficiently. It typically includes fields for bill names, due dates, amounts, and payment status.

This type of document enables organized financial management by providing a clear overview of all household bills in one place. Including reminders and summary charts enhances timely payments and better budgeting decisions.

For optimal use, regularly update the template with accurate data and review it monthly to avoid missed payments and track spending trends effectively.

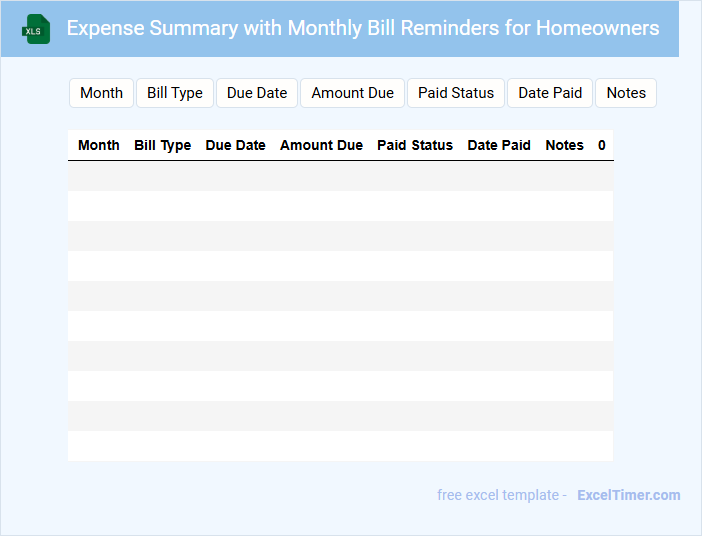

Expense Summary with Monthly Bill Reminders for Homeowners

An Expense Summary document typically contains a detailed breakdown of monthly expenditures and upcoming bill due dates, helping users keep track of their financial obligations. It is especially useful for homeowners to monitor utility bills, mortgage payments, and maintenance costs in one place. Including reminders ensures timely payments, avoiding late fees and maintaining good credit standing.

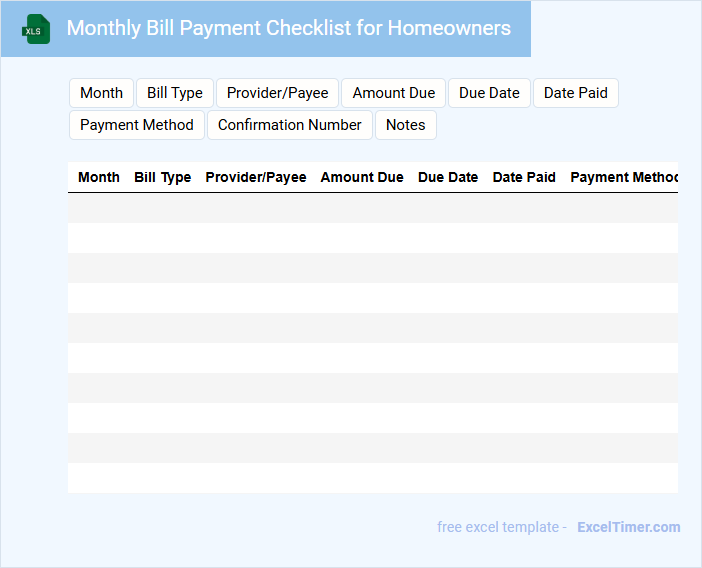

Monthly Bill Payment Checklist for Homeowners

A Monthly Bill Payment Checklist for homeowners is a document outlining all the regular expenses that need to be paid each month to maintain a household. It typically includes utility bills, mortgage or rent payments, insurance premiums, and maintenance fees. This checklist helps ensure timely payments, avoiding late fees and service interruptions.

Budget Planner with Monthly Bill Tracking for Home Use

A Budget Planner with Monthly Bill Tracking is an essential document for organizing household finances efficiently. It typically contains sections for recording income, monthly expenses, and due dates for bills to ensure timely payments. Using this planner helps users monitor spending habits, avoid late fees, and save money for future needs.

Important elements to include are clear categories for different expenses, reminders for upcoming bills, and a section to compare budgeted amounts against actual spending. Additionally, incorporating charts or graphs can visually track progress and identify areas for adjustment. Regularly updating the document promotes financial discipline and peace of mind in managing home finances.

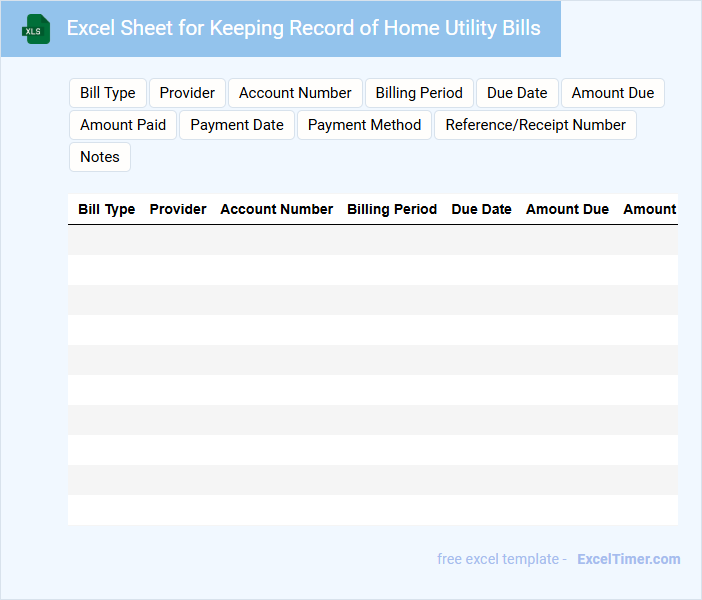

Excel Sheet for Keeping Record of Home Utility Bills

An Excel Sheet for keeping record of home utility bills serves as an organized digital ledger that tracks monthly expenses related to water, electricity, gas, and other utilities. It helps homeowners monitor their spending patterns and avoid missed or late payments.

Important features include clearly labeled columns for bill type, due date, amount, and payment status to ensure quick reference. Including a summary section for total monthly and yearly costs can provide valuable insights into budgeting and expense management.

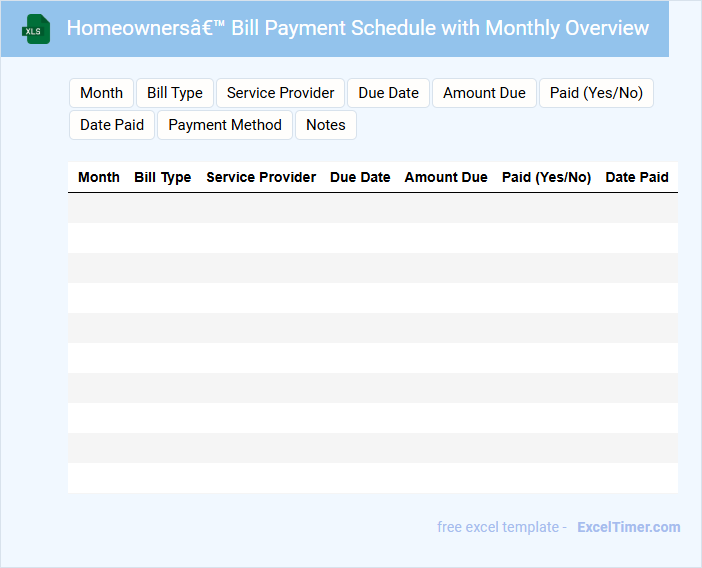

Homeowners’ Bill Payment Schedule with Monthly Overview

This document typically outlines the schedule for homeowners to pay their bills, providing a clear timeline and overview of monthly expenses. It helps in managing finances and ensuring timely payments to avoid penalties.

- Include all recurring home-related bills such as mortgage, utilities, and maintenance fees.

- Highlight due dates and payment methods for each bill to ensure clarity.

- Provide a monthly summary to help homeowners track total expenses and plan budgets effectively.

Monthly Home Expense Tracker with Bill Categories

What is typically included in a Monthly Home Expense Tracker with Bill Categories? This type of document usually contains detailed records of all household expenses categorized by bill types such as utilities, rent, groceries, and entertainment. It helps individuals monitor and manage their monthly spending effectively to stay within budget.

What important aspects should be considered when using this tracker? It is essential to regularly update the tracker with accurate amounts and due dates, and to review spending patterns monthly to identify areas for potential savings or adjustments. Organizing expenses by category ensures better financial control and clearer insights.

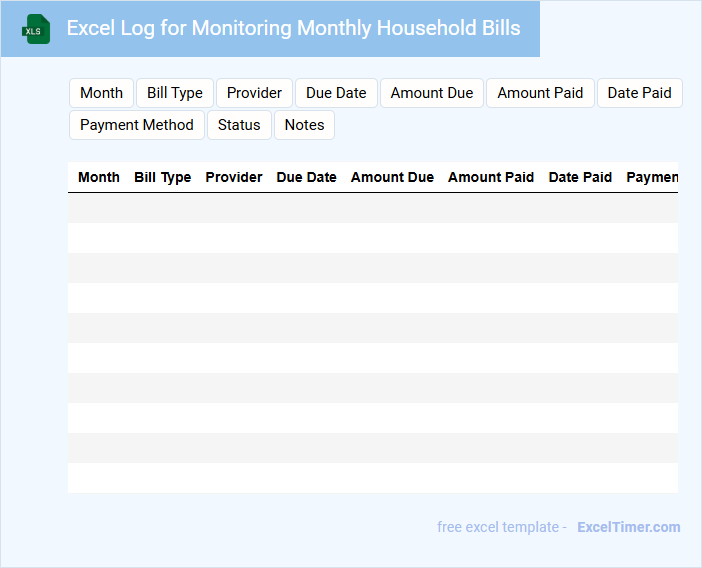

Excel Log for Monitoring Monthly Household Bills

What information is typically recorded in an Excel log for monitoring monthly household bills? This type of document usually contains detailed entries of various household expenses such as utilities, rent or mortgage payments, groceries, and other recurring costs. It helps users track spending patterns, manage budgets more effectively, and identify areas for potential savings.

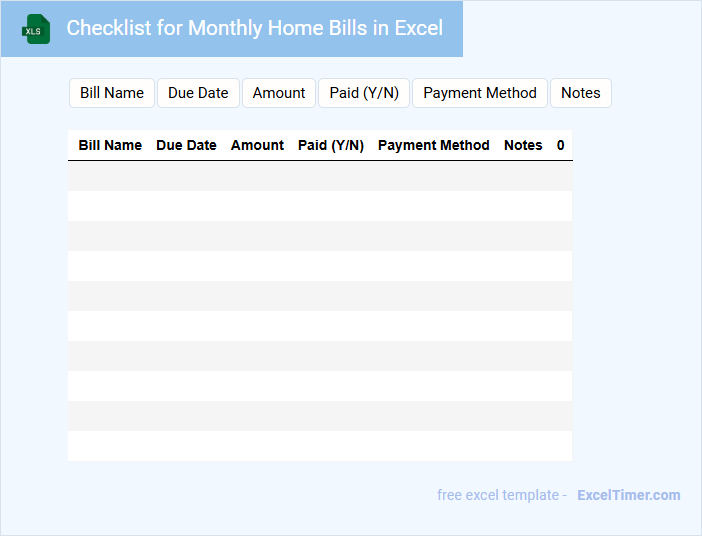

Checklist for Monthly Home Bills in Excel

A Checklist for Monthly Home Bills in Excel is a document designed to help individuals organize and track their recurring household expenses efficiently. It typically contains categories for various bills such as utilities, rent or mortgage, insurance, and subscriptions. This tool ensures timely payments and better financial management by providing an overview of due dates and amounts.

Important features to include are clear categorization of bills, columns for due dates, payment status, and amounts. Adding automatic reminders or conditional formatting can help highlight overdue bills. Maintaining an up-to-date checklist promotes budget control and reduces the risk of missed payments.

Personal Finance Tracker with Monthly Bills Section

What does a Personal Finance Tracker with Monthly Bills Section typically contain? This document usually includes a detailed record of income, expenses, savings, and tracking of monthly bill payments to help manage finances efficiently. It allows users to monitor due dates, bill amounts, and payment statuses to avoid late fees and maintain financial stability.

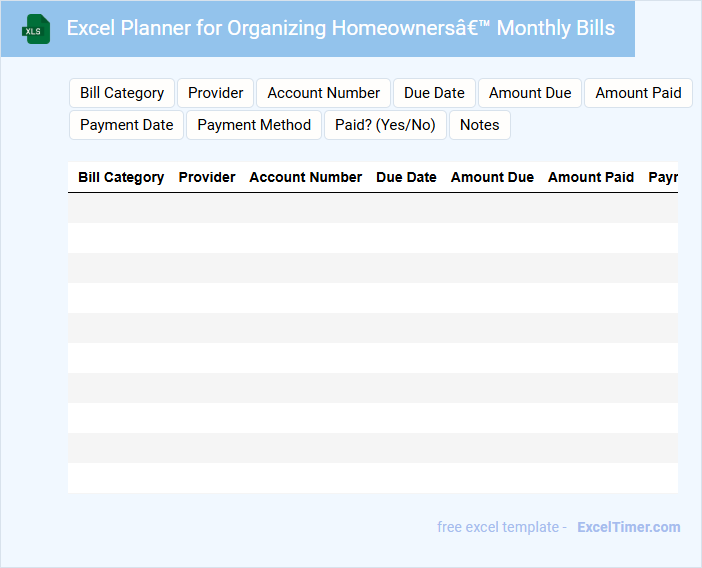

Excel Planner for Organizing Homeowners’ Monthly Bills

An Excel planner for organizing homeowners' monthly bills typically contains detailed records of each bill, including due dates, amounts, and payment status. It serves as a tool to track expenses accurately and ensure timely payments.

- Include categories for different types of bills such as utilities, mortgage, and insurance.

- Incorporate a clear, color-coded system for payment status to enhance readability.

- Add a monthly summary section to monitor total expenses and budget adherence.

What key expense categories should homeowners include in a Monthly Bill Tracker?

Homeowners should include key expense categories such as mortgage or rent payments, utilities (electricity, water, gas), property taxes, homeowners insurance, maintenance and repairs, and HOA fees in a Monthly Bill Tracker. Tracking these categories ensures comprehensive budget management and timely bill payments. Including additional expenses like internet, security systems, and landscaping helps maintain accurate financial oversight.

How can you use Excel formulas to automatically calculate total monthly bills?

Use Excel formulas like SUM to automatically calculate total monthly bills by adding values across specified cells representing each bill category. Implementing named ranges for your bill categories streamlines the process and reduces errors. Your Monthly Bill Tracker becomes efficient by leveraging these formulas to update totals whenever you input new data.

What methods can be used in Excel to flag overdue or unpaid bills?

Use Excel's Conditional Formatting to highlight overdue or unpaid bills based on due dates and payment status. Implement formulas like IF and TODAY to automatically flag bills past their due dates. Set up data validation to ensure consistency and enable easy identification of outstanding payments.

How do you structure a worksheet to compare monthly expenses over time?

Create a worksheet with columns labeled by month and rows for each expense category such as utilities, mortgage, and maintenance. Use a summary row to calculate total monthly expenses and another to display percentage changes compared to previous months. Incorporate conditional formatting to highlight expenses that exceed budget thresholds for clear visual comparison over time.

Which Excel features help visualize spending trends for better budgeting?

Excel features such as PivotTables, Conditional Formatting, and Sparklines help visualize spending trends effectively. Charts and graphs allow you to see monthly expense patterns at a glance. Using these tools in your Monthly Bill Tracker enhances budgeting accuracy and financial insight.