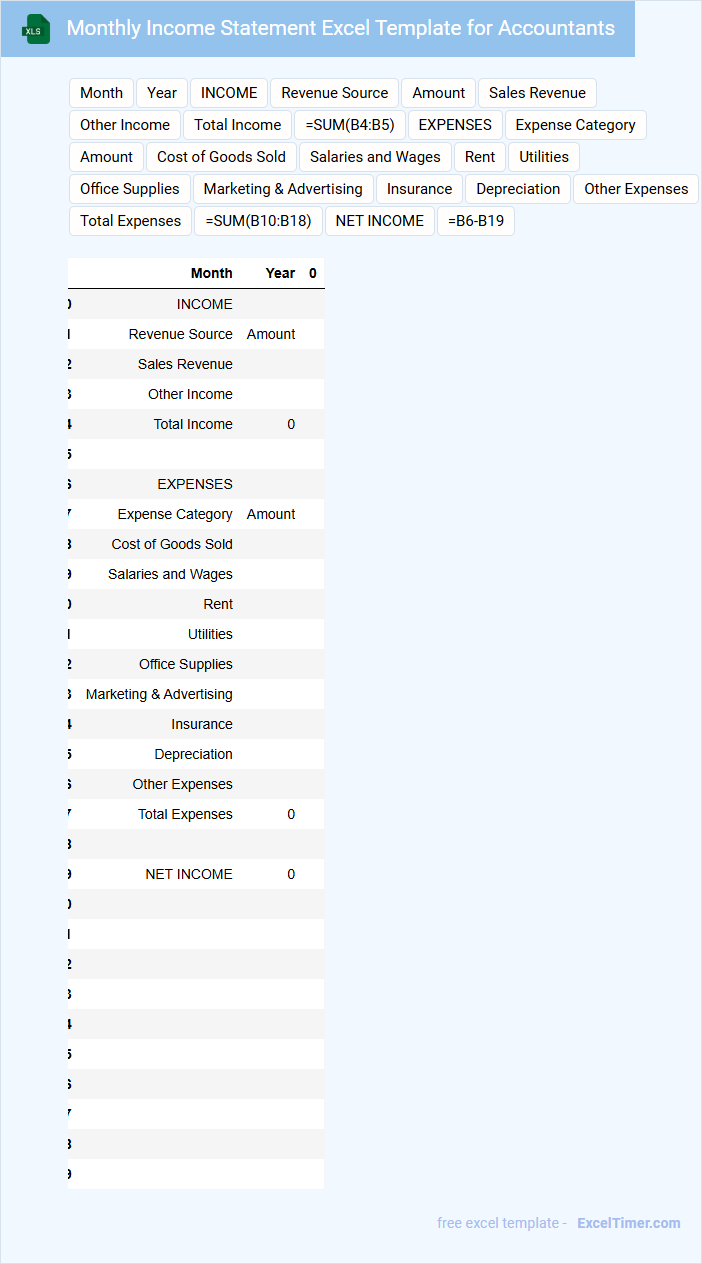

The Monthly Income Statement Excel Template for Accountants streamlines financial reporting by providing a structured format to track revenue, expenses, and net profit each month. It offers customizable categories, automated calculations, and visual charts to enhance accuracy and clarity in financial analysis. This template is essential for accountants aiming to improve efficiency and deliver precise monthly financial summaries.

Monthly Income Statement Excel Template for Accountants

The Monthly Income Statement Excel Template is a crucial financial document used by accountants to track revenues and expenses over a specific month. It typically contains detailed rows for income sources, cost of goods sold, operating expenses, and net profit or loss. Accurate categorization of these elements is essential for transparent financial analysis.

This template helps accountants monitor financial performance and identify trends that inform budgeting decisions. It also provides a clear summary for stakeholders, ensuring accountability. Including customizable formulas and up-to-date data validation enhances its efficiency and accuracy.

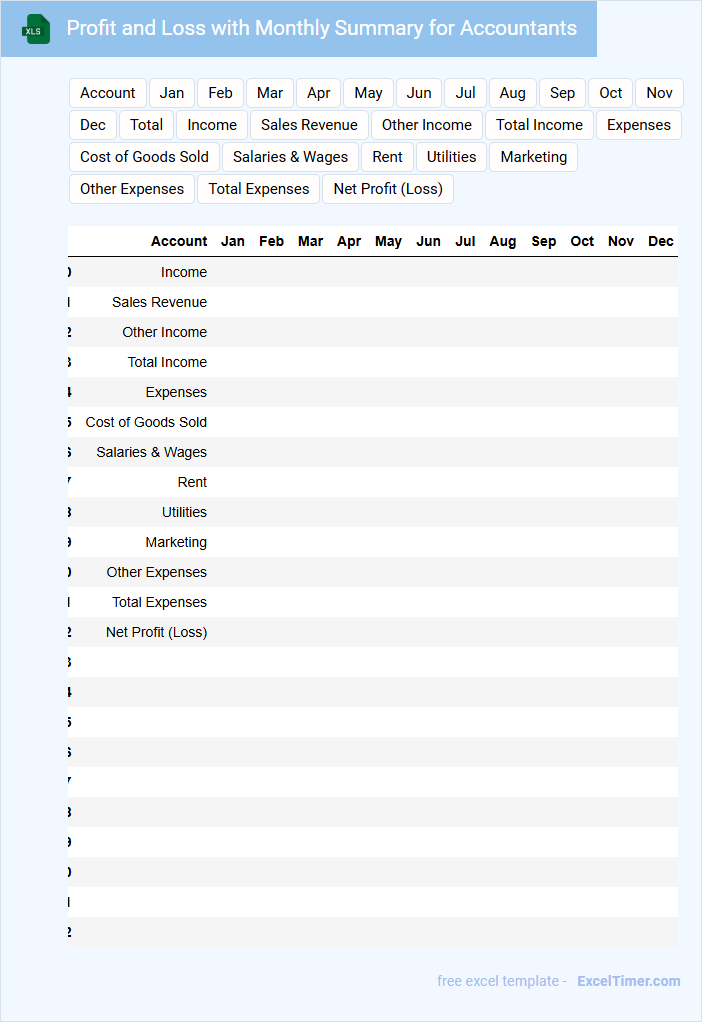

Profit and Loss with Monthly Summary for Accountants

What does a Profit and Loss statement with a Monthly Summary typically contain and why is it important for accountants? This document usually includes detailed monthly revenues, expenses, and net profit or loss that help track the financial performance of a business over time. It enables accountants to analyze trends, manage budgets effectively, and provide informed financial advice for strategic decision-making.

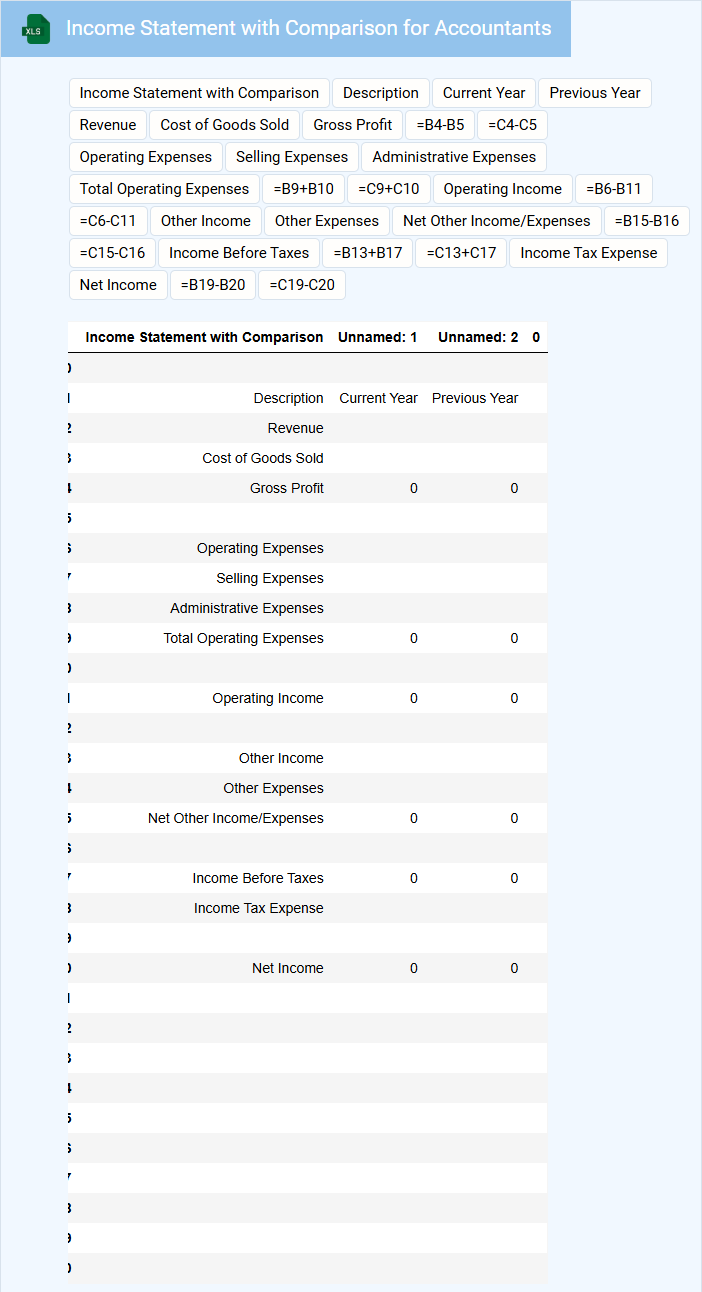

Income Statement with Comparison for Accountants

An Income Statement with Comparison is a financial document that summarizes revenues, expenses, and profits over specific periods. It allows accountants to analyze performance changes and trends effectively.

This document usually contains comparative figures for multiple periods, highlighting variances in key financial categories. Accurate data classification is crucial for meaningful analysis and reporting.

Ensure to include clearly labeled timeframes and consistent accounting methods for reliable comparisons.

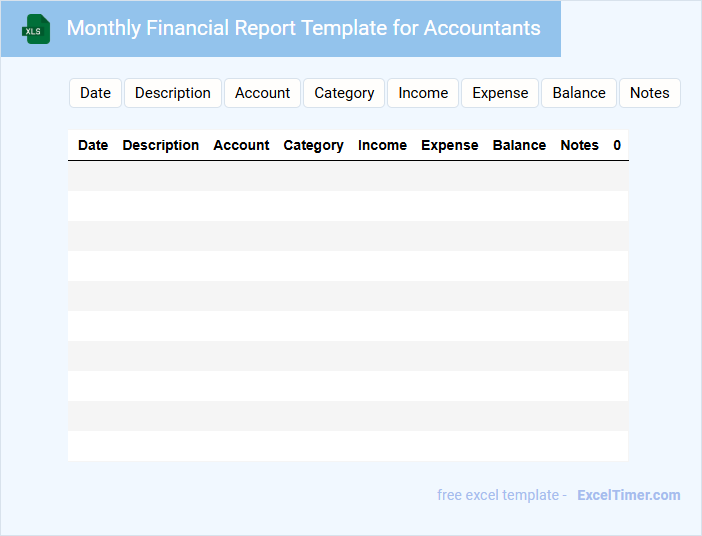

Monthly Financial Report Template for Accountants

Monthly Financial Report Template for Accountants typically contains a comprehensive overview of a company's financial performance over a specific period. It includes detailed sections such as income statements, balance sheets, and cash flow analysis. This document serves as a crucial tool for tracking financial health and making informed business decisions. Important suggestions for this report include ensuring data accuracy, including trend analysis, and highlighting any significant variances from budgets or prior periods.

Income and Expense Tracker with Monthly Overview for Accountants

An Income and Expense Tracker is a vital document that helps accountants monitor financial inflows and outflows systematically. It organizes data into categories like salaries, utilities, and miscellaneous expenses for clear financial analysis.

The Monthly Overview provides a summarized snapshot of financial health, highlighting trends and cash flow patterns. Including detailed charts and comparison tables enhances decision-making efficiency.

Ensure regular updates and maintain accuracy for reliable financial reporting and strategic planning.

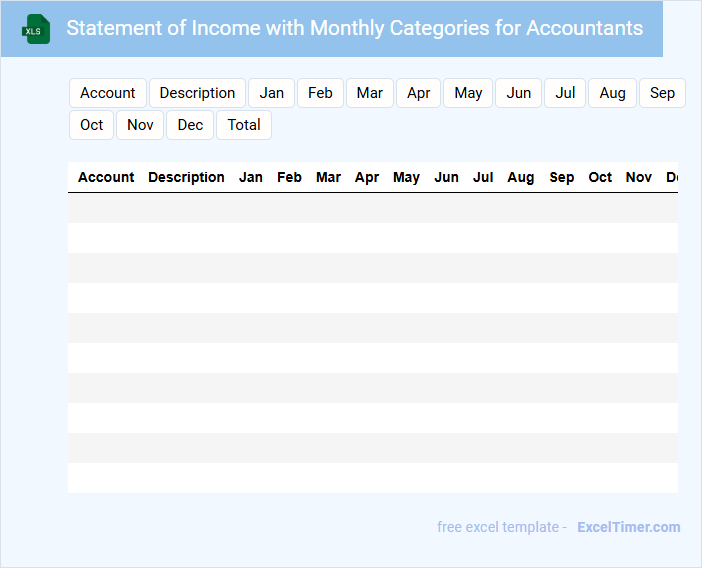

Statement of Income with Monthly Categories for Accountants

A Statement of Income with monthly categories is a financial document that details revenue and expenses over each month, providing a clear view of profitability trends. It typically includes income sources, operational costs, and net profit categorized by month to help accountants track financial performance. This structured breakdown aids in budgeting, forecasting, and identifying seasonal fluctuations in income and expenses.

Accountants should ensure data accuracy by regularly reconciling entries with bank statements to maintain reliable financial records. Including detailed notes for unusual transactions or significant variances each month can enhance clarity and support audits. Additionally, integrating this statement with other financial reports, such as balance sheets and cash flow statements, provides comprehensive insight into overall financial health.

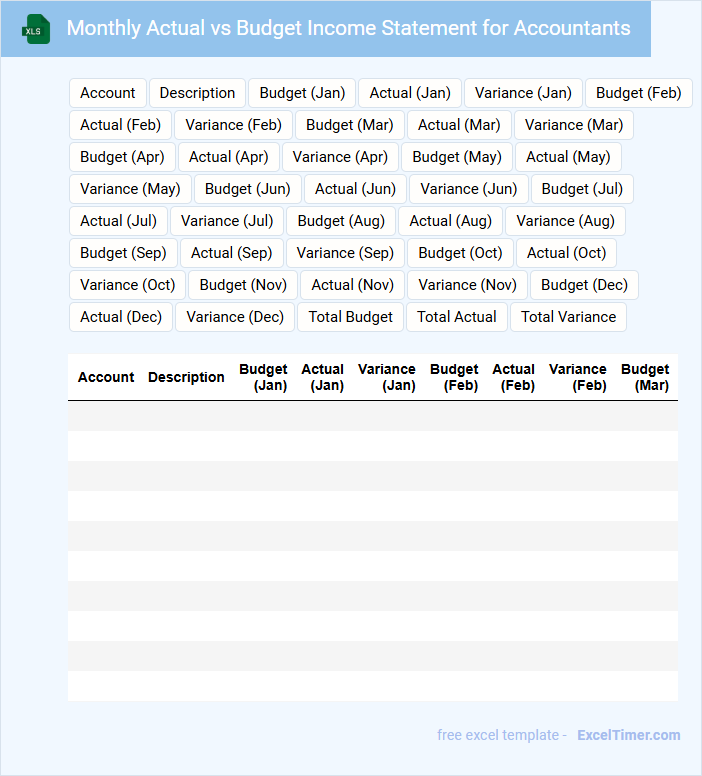

Monthly Actual vs Budget Income Statement for Accountants

The Monthly Actual vs Budget Income Statement is a financial report used to compare actual revenues and expenses against budgeted figures for a specific month. It helps accountants identify variances, analyze performance, and make informed decisions. This document usually contains income, expenses, gross profit, and net profit details for clear financial assessment.

Important elements to include are detailed line items for revenues and costs, clear variance calculations, and annotations explaining significant differences. Consistency in format and timely updates ensure accuracy and relevance. Additionally, highlighting trends and potential adjustment areas can improve budget planning.

For accountants, ensuring the report's clarity and accuracy is crucial for effective financial control and forecasting. Using this report enables better resource allocation and supports strategic business decisions. Thus, it acts as an essential tool in monthly financial management and accountability.

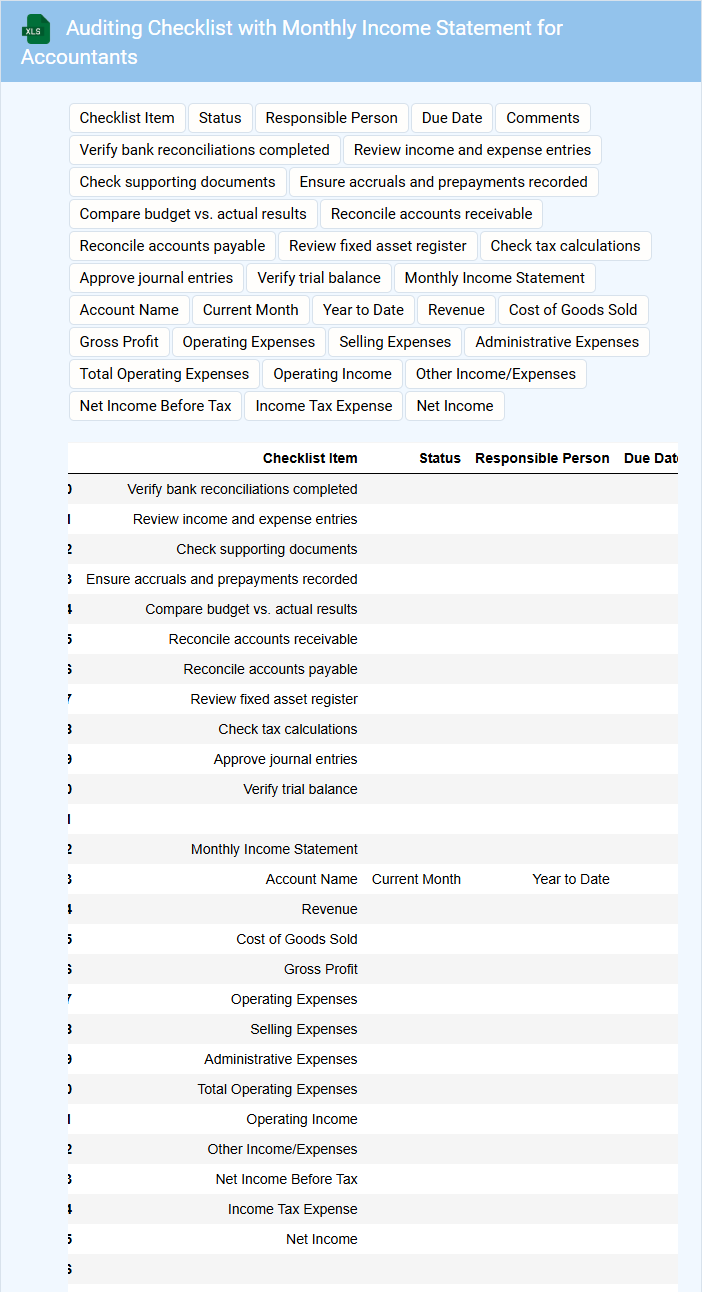

Auditing Checklist with Monthly Income Statement for Accountants

Auditing checklists with monthly income statements are essential documents that help accountants systematically verify financial accuracy and compliance. They ensure all revenue and expenses are thoroughly reviewed for proper reporting.

- Verify all income entries match supporting documents and bank statements.

- Check expense classifications to ensure they are correctly accounted for.

- Review reconciliations and adjustments to identify discrepancies or errors.

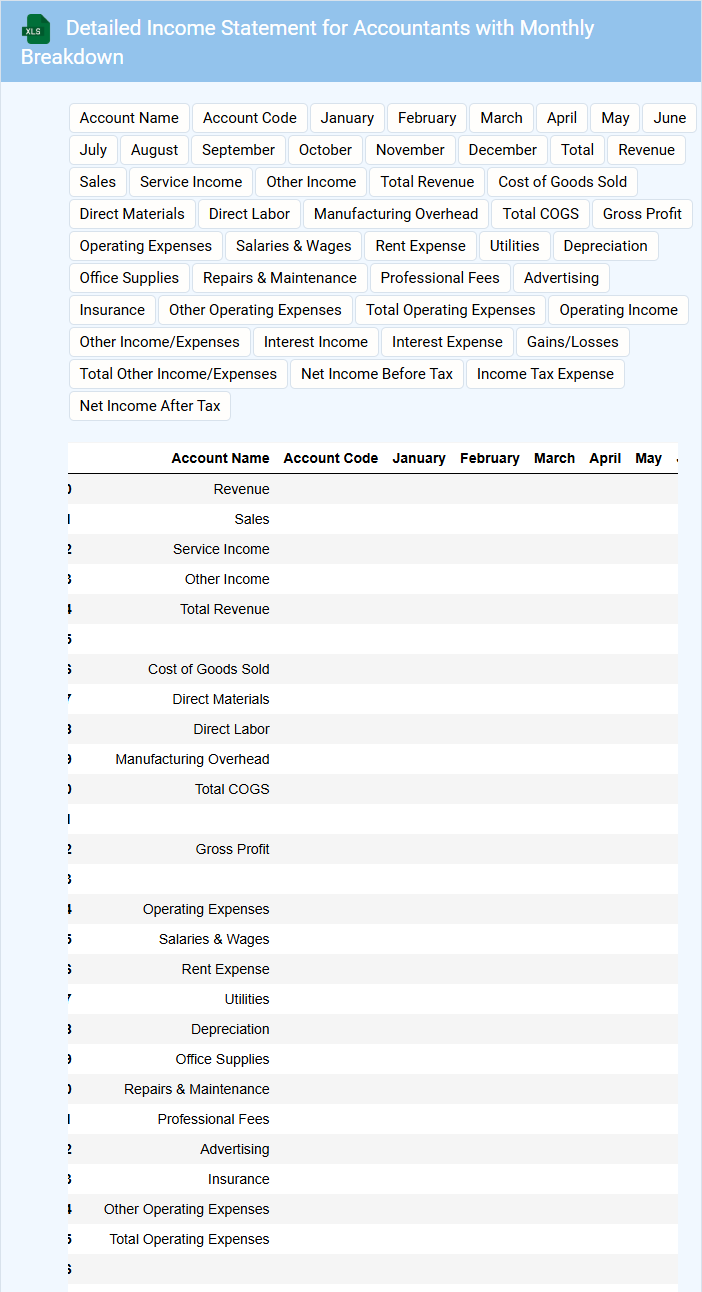

Detailed Income Statement for Accountants with Monthly Breakdown

A Detailed Income Statement for Accountants with Monthly Breakdown typically contains comprehensive revenue and expense data categorized month by month to facilitate precise financial analysis.

- Revenue Streams: Clearly itemized sources of income to identify trends and variations across months.

- Expense Categories: Detailed monthly expenses grouped by type to track cost behavior and control budgets effectively.

- Profitability Metrics: Monthly gross profit and net income figures essential for assessing financial performance and making informed decisions.

Monthly Revenue Analysis with Income Statement for Accountants

The Monthly Revenue Analysis report typically contains detailed financial insights including total income, expenses, and net profit for the month. It helps accountants track financial performance, identify trends, and make informed decisions. A comprehensive income statement is central to this document, summarizing revenue and costs systematically.

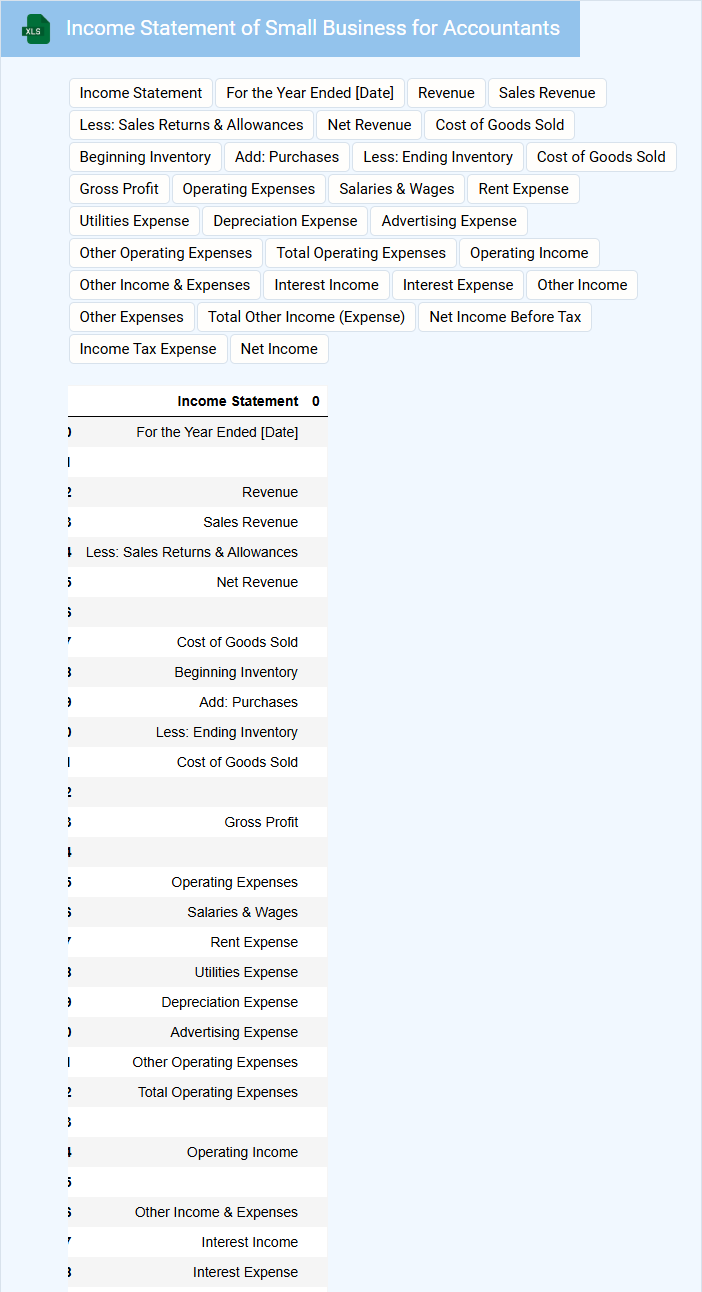

Income Statement of Small Business for Accountants

The Income Statement of a small business is a financial document that summarizes revenues, expenses, and profits over a specific period. It provides accountants with critical insights into the company's operational efficiency and profitability. Key components include total income, cost of goods sold, operating expenses, and net profit, essential for accurate financial analysis and reporting.

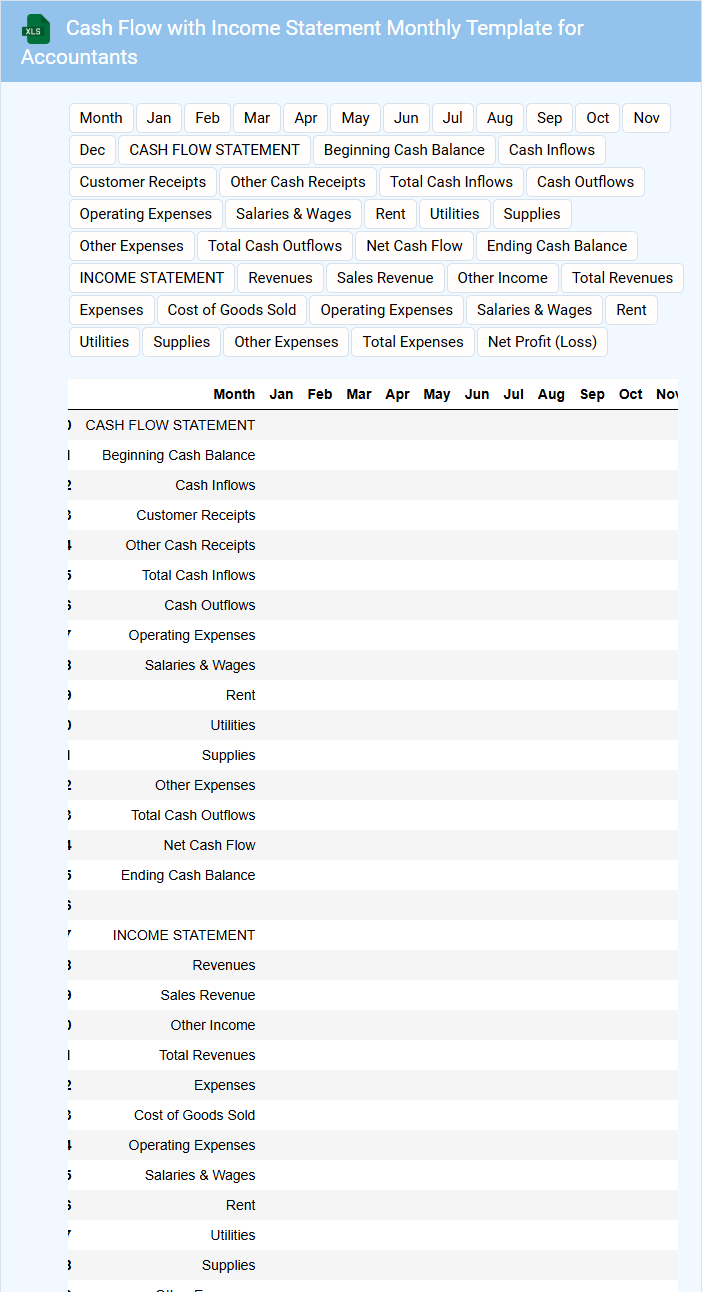

Cash Flow with Income Statement Monthly Template for Accountants

What information is typically contained in a Cash Flow with Income Statement Monthly Template for Accountants? This type of document usually includes detailed records of cash inflows and outflows alongside income and expenses for the month. It helps accountants track liquidity and profitability to ensure accurate financial management and reporting.

What important elements should be included in this template? Key components should involve categorizing cash receipts and payments, summarizing operating, investing, and financing activities, and integrating income statement data like revenues, costs, and net income for a comprehensive financial overview.

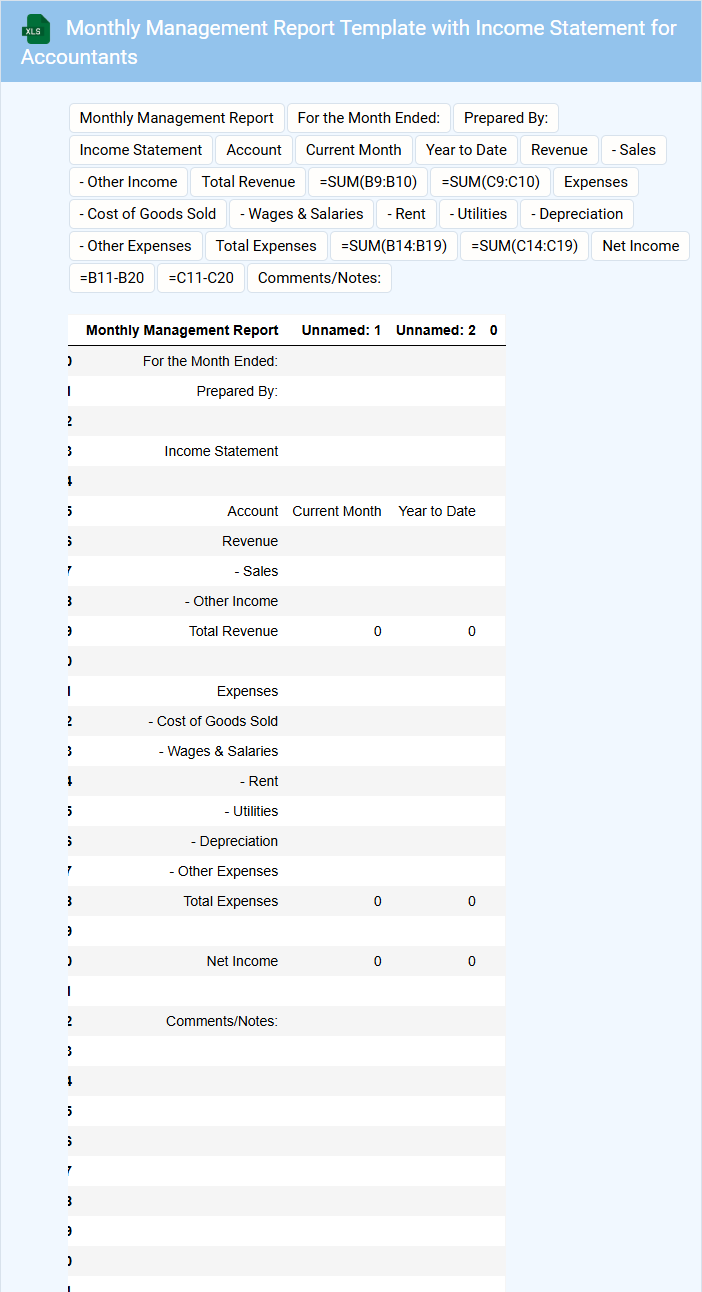

Monthly Management Report Template with Income Statement for Accountants

A Monthly Management Report Template containing an Income Statement serves as a comprehensive financial overview for accountants. It typically includes detailed revenue, expenses, and profit metrics to track business performance. Essential elements like variance analysis and key financial ratios are important for informed decision-making.

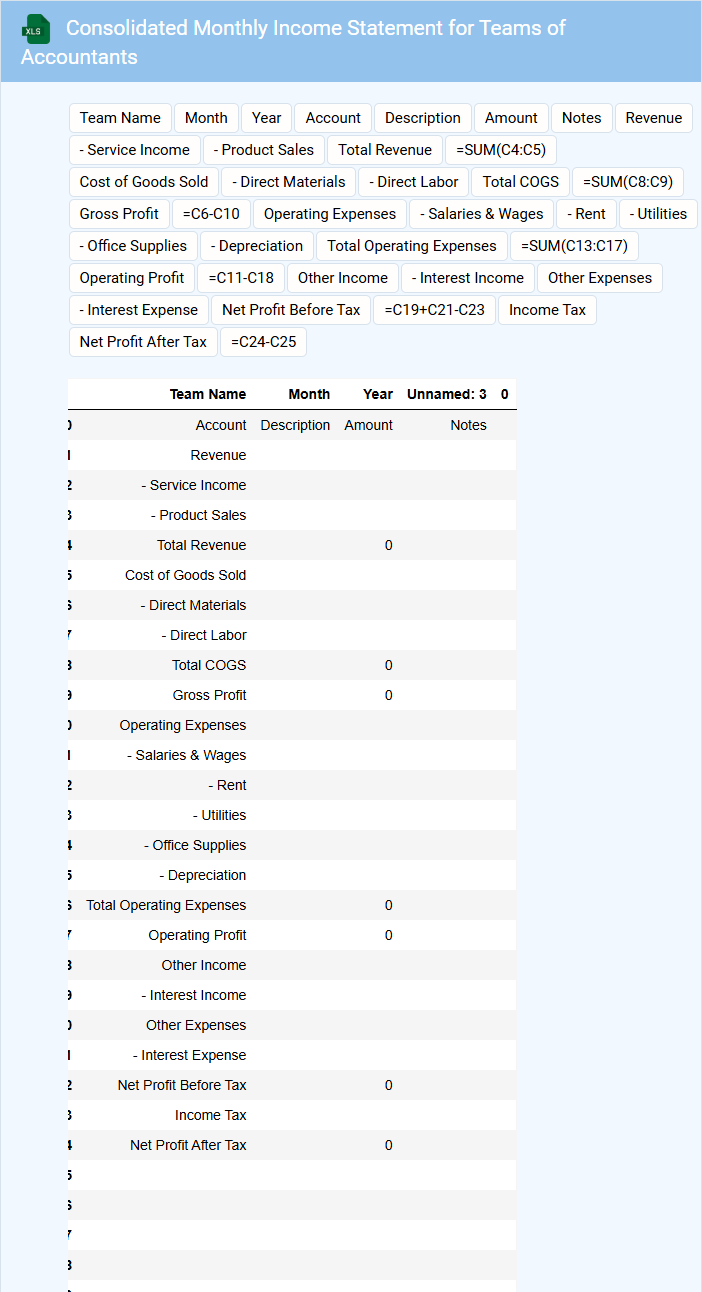

Consolidated Monthly Income Statement for Teams of Accountants

The Consolidated Monthly Income Statement is a financial document that summarizes the revenue, expenses, and net income of multiple accounting teams within an organization. It consolidates individual team performance into a comprehensive overview, enabling accurate financial analysis and decision making. Key components typically include total sales, operational costs, and profit margins for the reporting period. Important considerations include ensuring data accuracy, timely updates, and clear categorization of income and expenses to facilitate efficient financial review and planning.

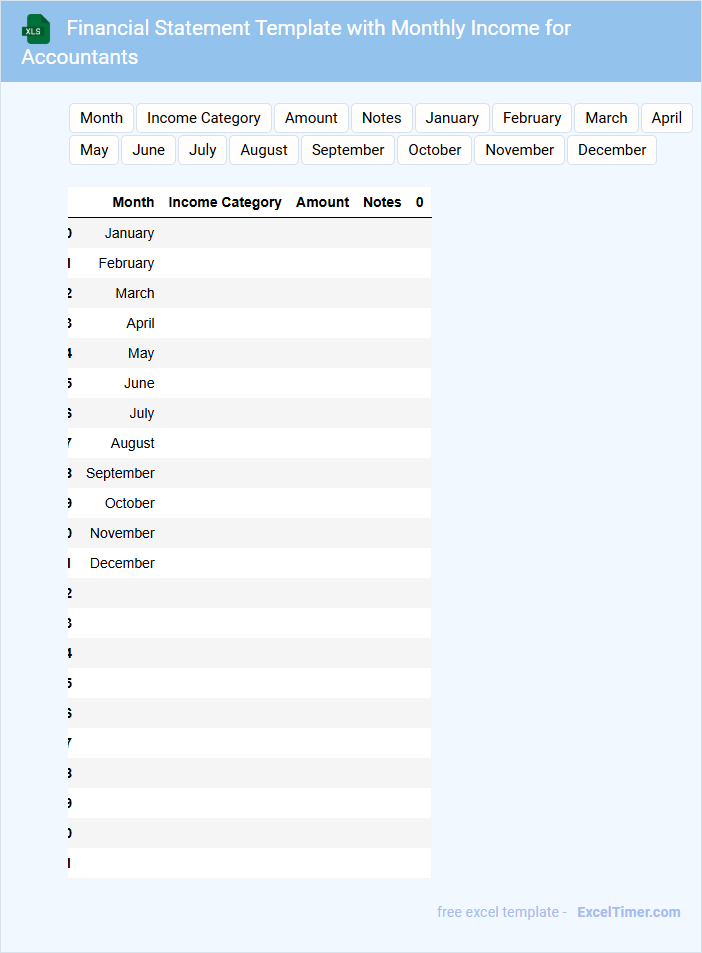

Financial Statement Template with Monthly Income for Accountants

The Financial Statement Template is a structured document used to record and summarize monthly income, expenses, and financial activities. It helps accountants to monitor cash flow and ensure accurate financial reporting.

This template typically contains sections for revenue, costs, net profit, and comparison against budget forecasts. For accuracy, it is important to regularly update and reconcile the figures with bank statements.

What are the key components included in a Monthly Income Statement in Excel?

A Monthly Income Statement in Excel includes key components such as Revenue, Cost of Goods Sold (COGS), and Gross Profit. It also details Operating Expenses, including salaries, rent, and utilities, to calculate Operating Income. The statement concludes with Net Income, factoring in taxes and interest expenses for accurate financial analysis.

How is revenue recognition handled in a Monthly Income Statement spreadsheet?

Revenue recognition in a Monthly Income Statement spreadsheet is recorded based on earned revenues within the reporting period, aligning with accounting principles like accrual basis. Entries reflect actual sales or services delivered, ensuring matching of income with related expenses. This approach provides accurate financial performance tracking for accountants each month.

What Excel formulas are commonly used to calculate gross and net profit in the statement?

In a Monthly Income Statement for Accountants, common Excel formulas to calculate gross profit include =SUM(Revenue)-SUM(Cost_of_Goods_Sold). Net profit is typically calculated using =Gross_Profit-SUM(Operating_Expenses)-SUM(Taxes). You can customize these formulas to accurately reflect your financial data and enhance reporting precision.

How should expenses be categorized and tracked monthly in an Excel income statement?

Expenses in a Monthly Income Statement should be categorized by type, such as fixed, variable, and periodic costs, and tracked in separate Excel columns for clarity. Use consistent labeling and formulas to automate the summation of each expense category, ensuring accuracy in monthly totals. Your organized tracking allows for streamlined financial analysis and better budget management.

What methods ensure the accuracy and consistency of financial data throughout the monthly reporting period?

Implementing automated data validation formulas and cross-referencing transactions with source documents ensures the accuracy of financial data in monthly income statements. Regular reconciliation processes align reported figures with bank statements and internal ledgers to maintain consistency. Utilizing standardized templates and version control in Excel minimizes errors and supports reliable financial reporting for accountants.