The Monthly Invoice Excel Template for Consultants streamlines billing processes by providing a customizable format to track hours worked, rates, and total payments. It ensures accurate invoicing, helping consultants maintain professional records and prompt client payments. Easy-to-use formulas within the template minimize errors and save time on financial documentation.

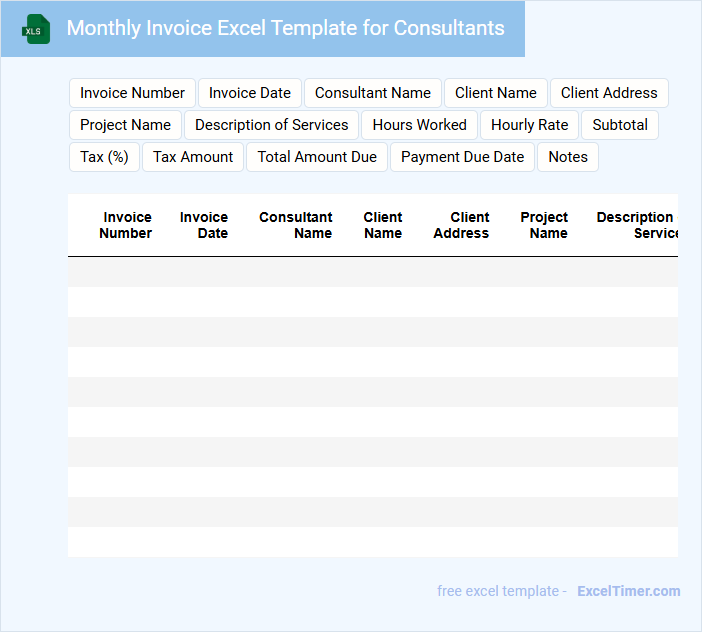

Monthly Invoice Excel Template for Consultants

A Monthly Invoice Excel Template for Consultants is a structured document designed to record and summarize billing details for consulting services provided within a month. It helps in tracking payments, managing client information, and ensuring accurate financial records.

- Include sections for client details, service descriptions, hours worked, and rates.

- Incorporate formulas to automatically calculate totals and taxes.

- Ensure space for payment terms and notes to clarify billing conditions.

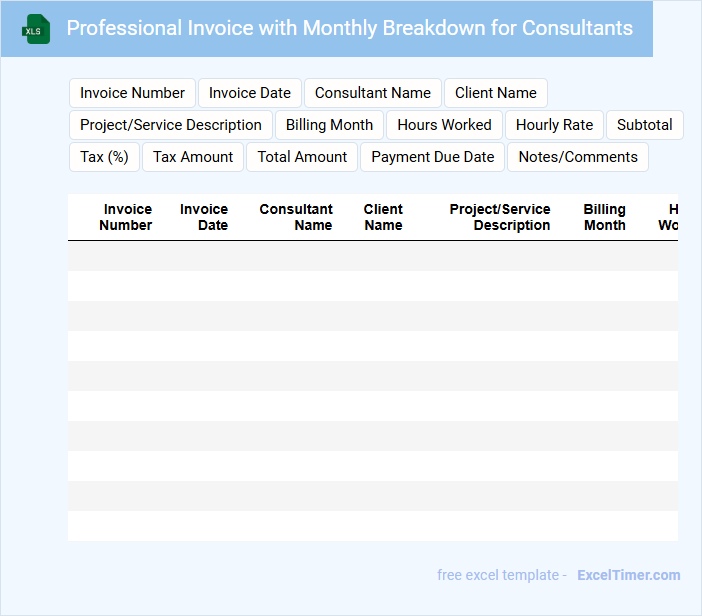

Professional Invoice with Monthly Breakdown for Consultants

A Professional Invoice with Monthly Breakdown for Consultants typically details the services provided each month along with corresponding charges, ensuring clear financial communication. It serves as an official request for payment and a record for both parties.

- Include a detailed description of services rendered each month.

- Clearly specify payment terms and due dates.

- Incorporate contact information for both the consultant and client.

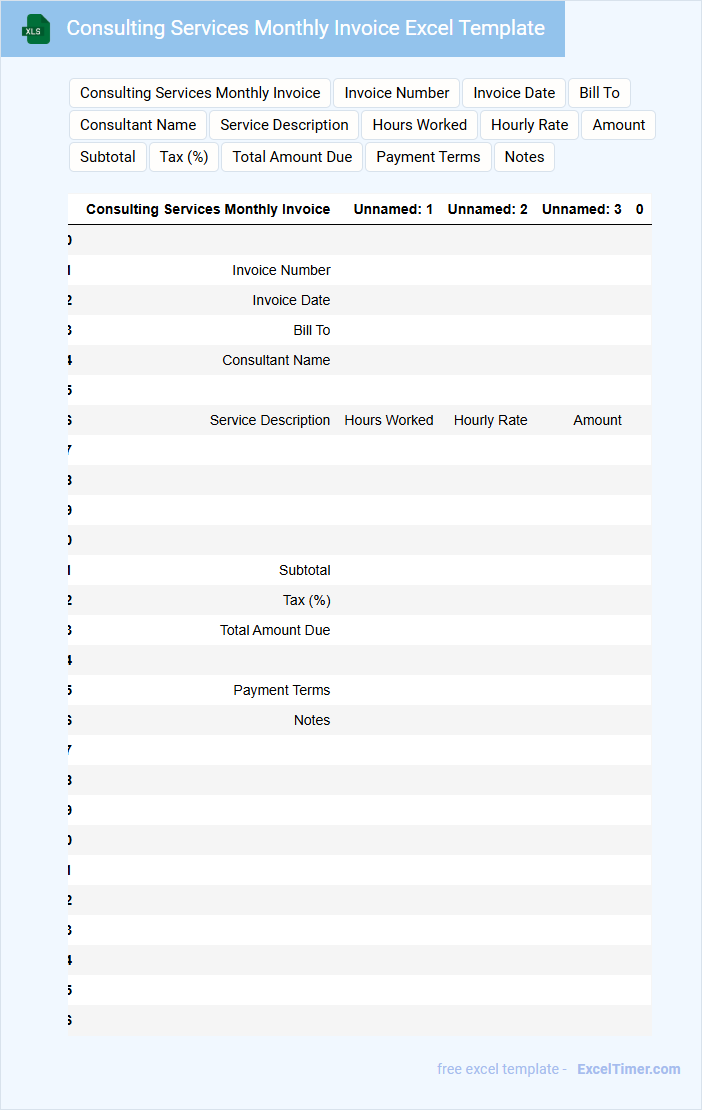

Consulting Services Monthly Invoice Excel Template

What information is typically included in a Consulting Services Monthly Invoice Excel Template? This document usually contains detailed billing information such as client details, services rendered, hours worked, rates, and total amounts due. It helps consultants maintain clear financial records and ensures accurate and timely payments.

What are some important features to include in this template? It is essential to have customizable fields for client information, service descriptions, and payment terms, as well as automatic calculations for totals and taxes to reduce errors and save time.

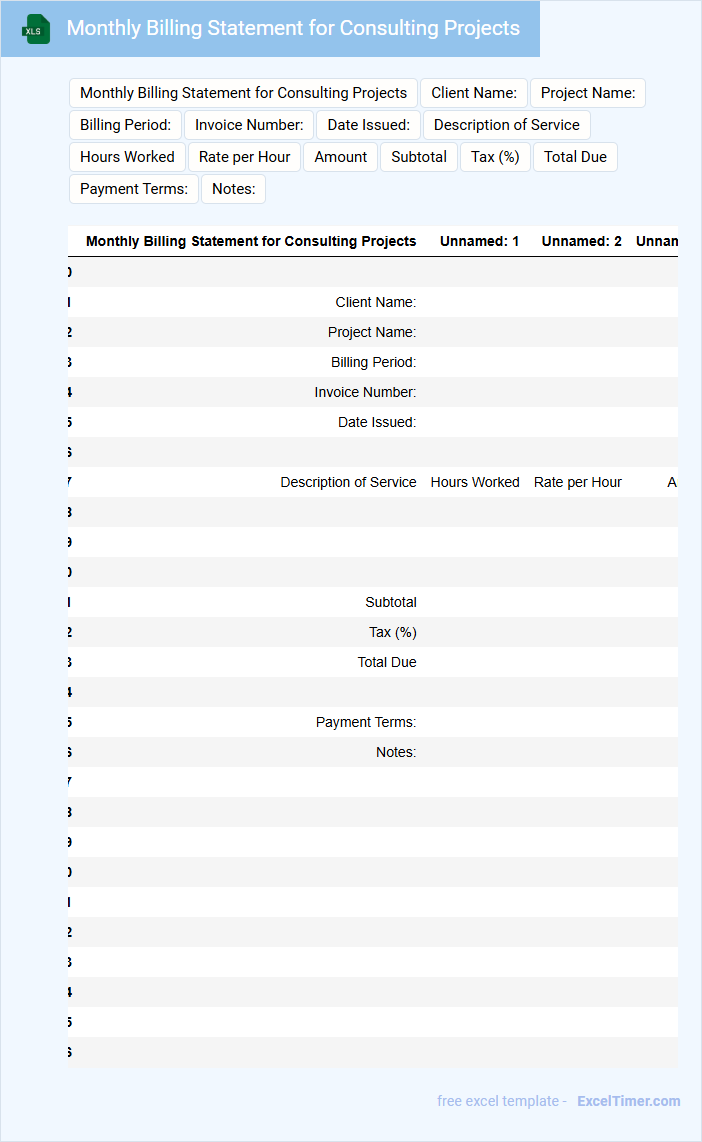

Monthly Billing Statement for Consulting Projects

A Monthly Billing Statement for Consulting Projects typically contains a detailed summary of services rendered during the billing period. It includes itemized charges, hours worked, and any additional expenses incurred. This document serves as a formal request for payment, ensuring transparency and accuracy in financial transactions.

Important elements to include are the project name, consultant's contact information, billing period dates, and clearly itemized fees. Ensuring clarity in task descriptions and providing payment terms can prevent disputes. Including a summary of previous payments and outstanding balances enhances understanding for both parties.

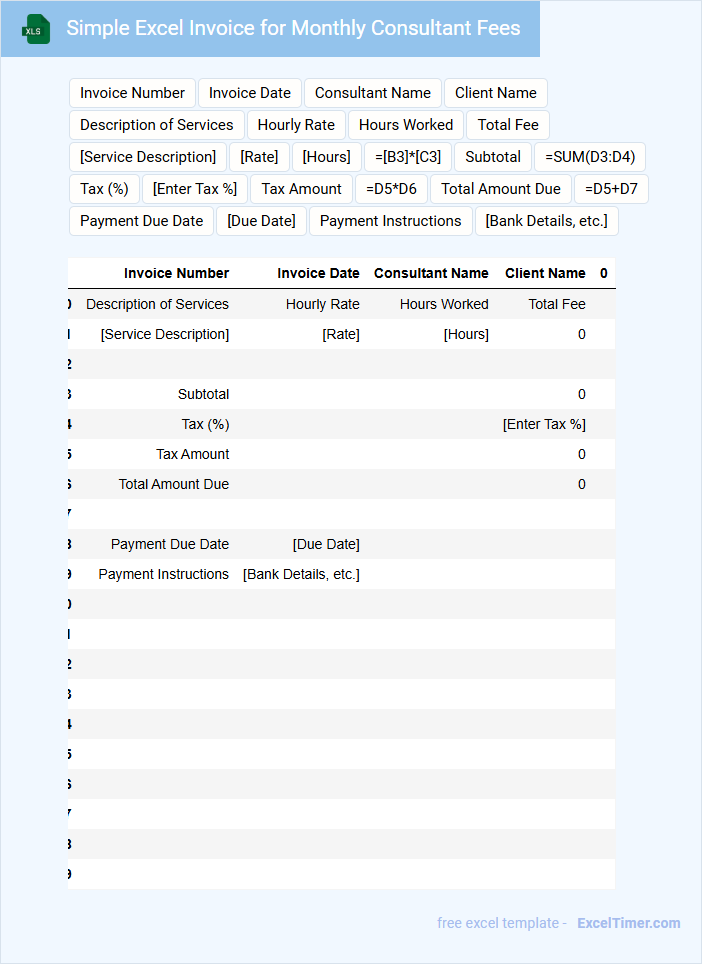

Simple Excel Invoice for Monthly Consultant Fees

What information does a Simple Excel Invoice for Monthly Consultant Fees typically contain? This type of document usually includes details such as the consultant's name, the billing period, and a breakdown of fees charged for services rendered. It also specifies payment terms, invoice number, and contact information to ensure clarity and prompt payment.

What important elements should be included to optimize this invoice? It is crucial to include a clear description of services provided, the exact dates for the billing period, and calculation of total fees to avoid confusion. Additionally, having a professional layout with company branding and a unique invoice reference helps maintain organization and facilitates smooth financial tracking.

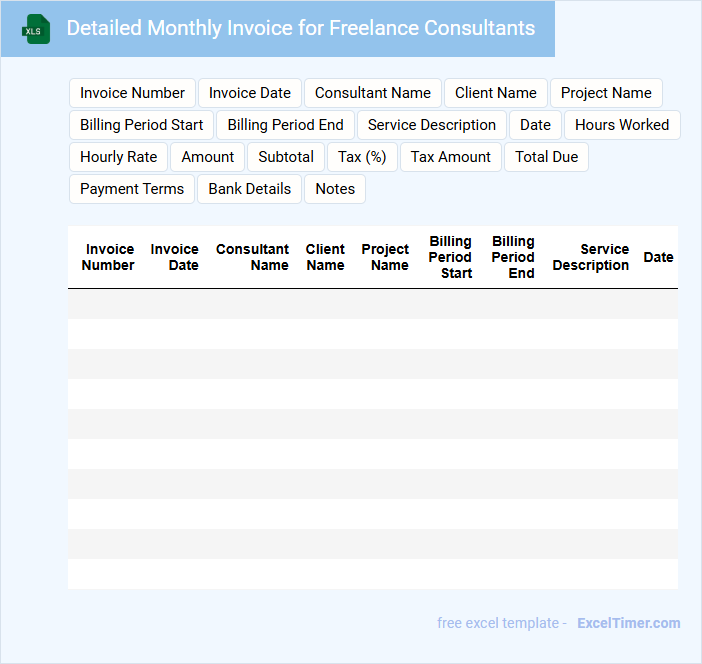

Detailed Monthly Invoice for Freelance Consultants

A Detailed Monthly Invoice for Freelance Consultants typically contains itemized descriptions of services rendered, hours worked, and corresponding rates. It includes client information, payment terms, and invoice dates to ensure clarity and professionalism. Ensuring accuracy and completeness in this document helps facilitate timely payments and maintains transparent communication between consultant and client.

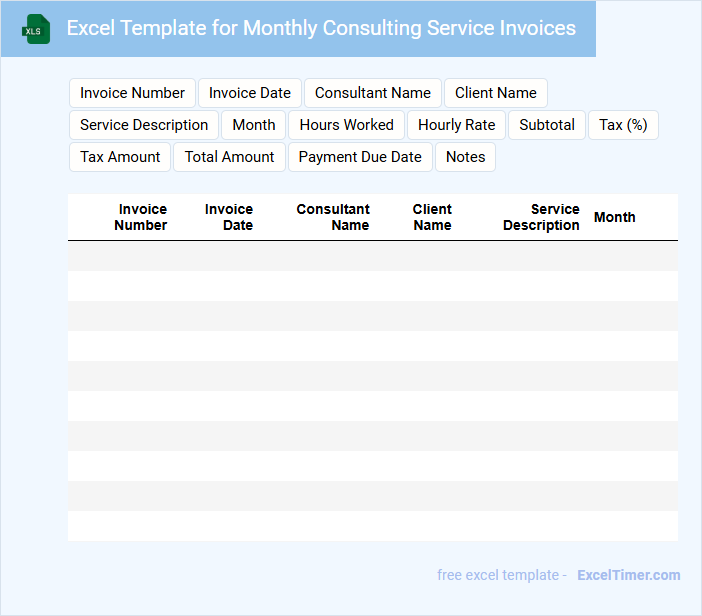

Excel Template for Monthly Consulting Service Invoices

An Excel template for monthly consulting service invoices typically contains essential elements such as client details, service descriptions, billing rates, hours worked, and total payment due. It is designed to streamline the invoicing process and ensure accuracy in financial documentation.

This template often includes preformatted formulas for automatic calculations, payment terms, and spaces for signatures or notes. It is important to regularly update client information and review billing details to maintain professionalism and avoid payment delays.

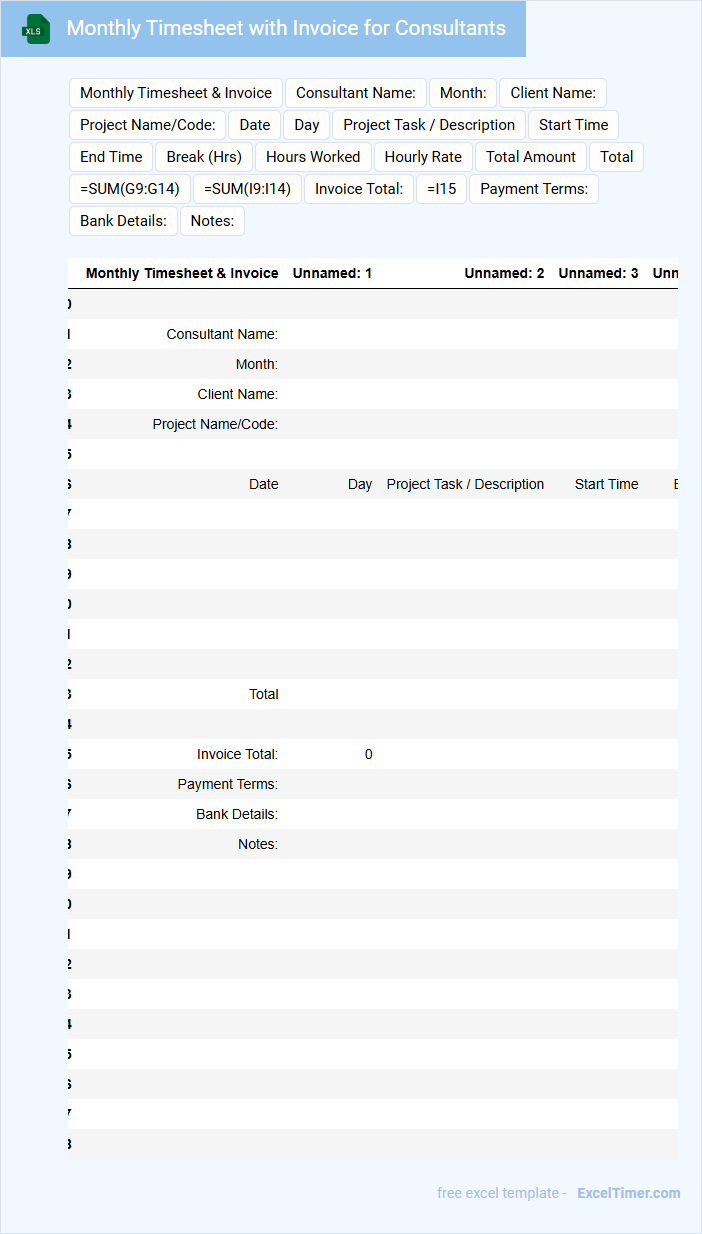

Monthly Timesheet with Invoice for Consultants

What information is typically included in a Monthly Timesheet with Invoice for Consultants? This document usually contains detailed records of hours worked by consultants, tasks performed, and the corresponding rates applied. It also includes a summary invoice for billing purposes, ensuring accurate payment and clear communication between consultants and clients.

Why is accuracy important in a Monthly Timesheet with Invoice for Consultants? Precise documentation helps prevent disputes, streamlines the approval process, and supports transparent financial tracking. Consultants should ensure all entries are verified, include clear task descriptions, and itemize expenses to maintain professionalism and facilitate timely payments.

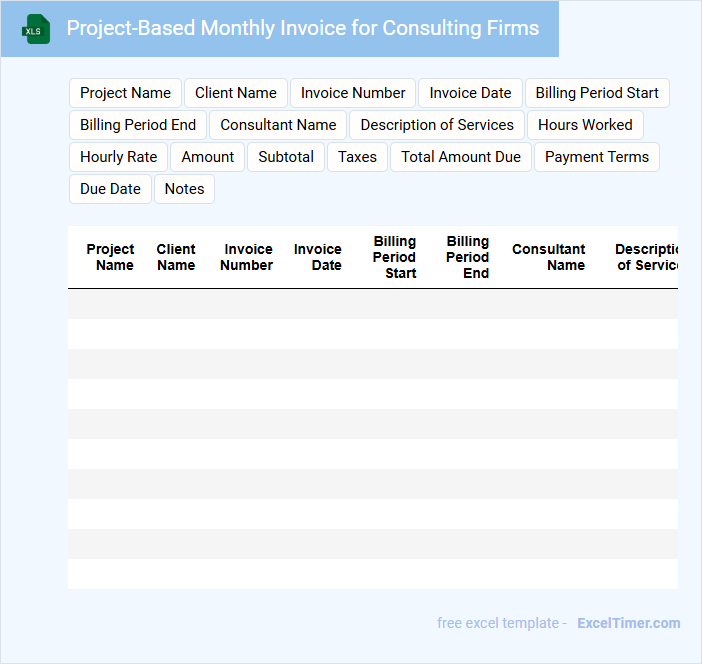

Project-Based Monthly Invoice for Consulting Firms

A Project-Based Monthly Invoice for consulting firms typically contains detailed billing information related to specific projects completed within the month. It includes hours worked, tasks performed, and agreed-upon rates to ensure transparent financial communication between consultants and clients.

This document also usually features client details, invoice date, payment terms, and total amount due to streamline the payment process. Maintaining clear descriptions and itemization is crucial for avoiding disputes and facilitating timely payments.

Ensure accuracy in project codes and task descriptions and always double-check the calculations before sending the invoice.

Consulting Retainer Invoice Template for Monthly Services

A Consulting Retainer Invoice Template for Monthly Services typically contains detailed information about the consulting services provided, billing terms, and payment details for ongoing monthly engagements.

- Client Information: Clearly list the client's name, contact details, and project reference to avoid confusion.

- Service Description: Provide a concise summary of the consulting services covered under the retainer for transparent billing.

- Payment Terms: Specify the retainer fee, payment schedule, and accepted payment methods to ensure timely payment.

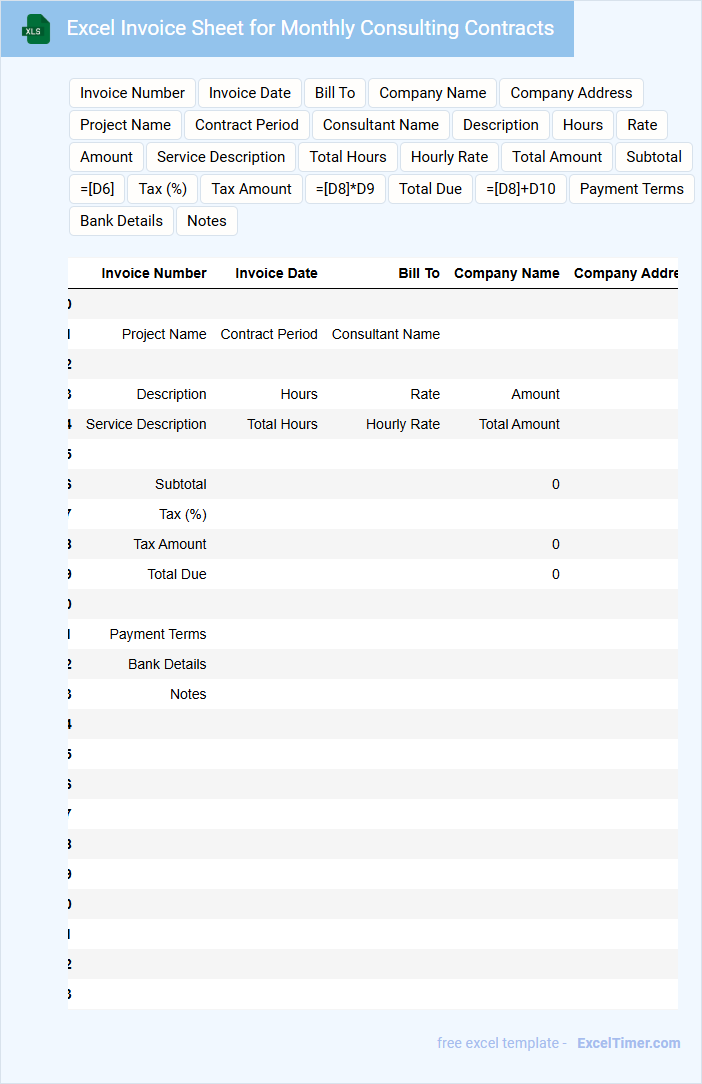

Excel Invoice Sheet for Monthly Consulting Contracts

This document typically contains detailed billing information for monthly consulting services rendered.

- Client Details: Includes the client's name, contact information, and contract specifics.

- Service Breakdown: Lists each consulting task or service provided with corresponding dates and hours.

- Payment Terms: Specifies the invoice total, payment due date, and accepted payment methods.

Payment Tracker with Monthly Invoice for Consultants

This document typically contains detailed records of payments made to consultants along with monthly invoices for tracking financial transactions.

- Payment Records: Detailed entries of payment dates, amounts, and methods for accuracy.

- Invoice Details: Clear monthly breakdowns of services provided and corresponding charges.

- Consultant Information: Contact data and contractual terms to maintain clarity and accountability.

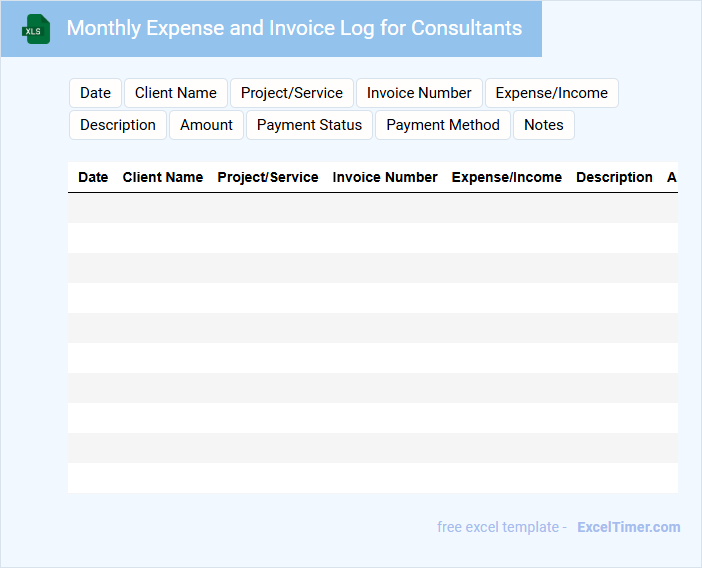

Monthly Expense and Invoice Log for Consultants

What does a Monthly Expense and Invoice Log for Consultants usually contain? This document typically includes detailed records of all expenses incurred and invoices issued by consultants within a month. It helps in tracking financial transactions, ensuring accurate billing, and simplifying account reconciliation.

What is an important aspect to consider when maintaining this log? Consistency and clarity are crucial; each entry should clearly specify dates, descriptions, amounts, and payment statuses to avoid discrepancies and support efficient financial management.

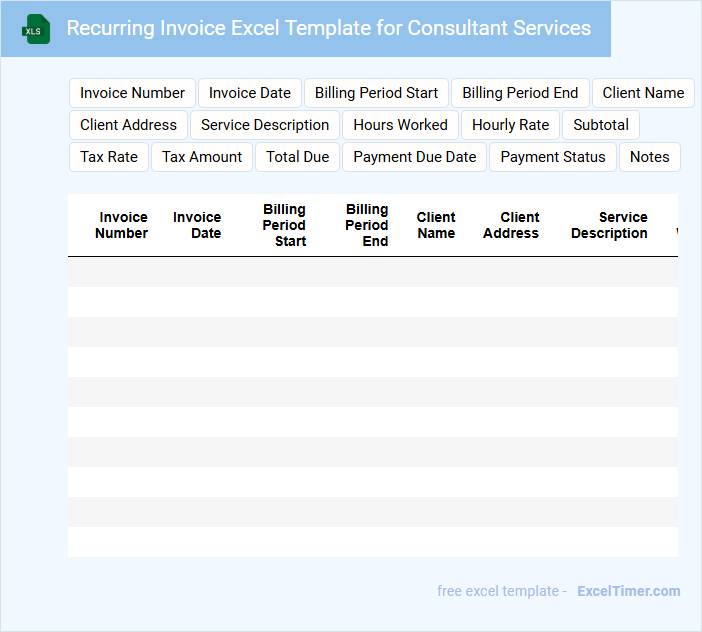

Recurring Invoice Excel Template for Consultant Services

The Recurring Invoice Excel Template for Consultant Services is designed to streamline the billing process by automating regular invoice generation. It usually contains client details, service descriptions, rates, billing cycles, and payment terms, ensuring clarity and consistency. This template helps avoid manual errors and saves time while maintaining professional financial records.

It is important to ensure the template includes customizable fields for consulting hours, expense tracking, and tax calculations to reflect accurate charges. Incorporating automated reminders for upcoming payments and easily adjustable billing periods can enhance efficiency. Additionally, maintaining a clear summary section for total amounts due and payment status aids in effective financial management.

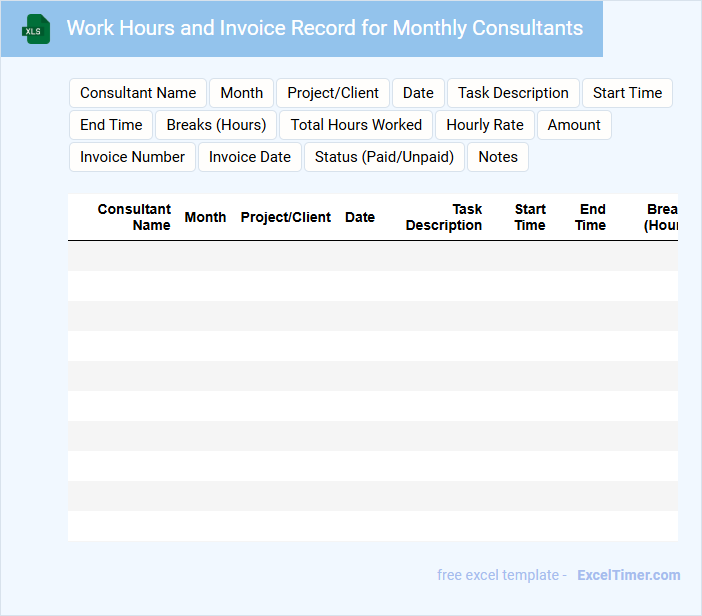

Work Hours and Invoice Record for Monthly Consultants

The Work Hours and Invoice Record for Monthly Consultants typically contains detailed logs of the hours worked each day and the corresponding invoices generated for billing purposes. This document ensures accurate tracking of consultant productivity and financial transactions. Maintaining precise records helps in resolving payment discrepancies and facilitates transparent communication between consultants and clients.

What are the essential data fields required in a monthly invoice for consultants in Excel?

A monthly invoice for consultants in Excel should include essential data fields such as Invoice Number, Invoice Date, Consultant Name, Client Name, Service Description, Hours Worked, Hourly Rate, Total Amount, Payment Terms, and Due Date. Your invoice must clearly display these details to ensure accurate billing and timely payment. Including Contact Information and Tax Identification Numbers adds professionalism and compliance.

How do you automate invoice number generation and date tracking in an Excel invoice template?

Automate invoice number generation in your Excel template by using a formula like =MAX(InvoiceNumbers)+1 to increment numbers automatically. Implement date tracking with =TODAY() to display the current date each time the invoice is opened. This setup ensures accuracy and efficiency in managing monthly invoices for consultants.

What formulas or functions can be used for calculating subtotals, taxes, and total amounts on a consultant's invoice?

Use the SUM function to calculate subtotals by adding individual service charges in the invoice. Apply the formula =Subtotal*Tax_Rate to compute taxes based on the subtotal amount. Calculate the total amount by combining the subtotal and tax using =Subtotal+Tax, ensuring accurate invoice totals for consultants.

How do you ensure consistent formatting and data validation across multiple monthly invoices in Excel?

Use Excel's predefined cell styles and custom templates to maintain consistent formatting across monthly consultant invoices. Implement data validation rules for critical fields like dates, invoice numbers, and payment terms to reduce entry errors. Employ structured tables and dynamic named ranges to streamline updates and ensure uniformity across all invoice sheets.

What methods can be implemented in Excel to track payment status and due dates for consulting invoices?

Excel can track payment status and due dates for consulting invoices using conditional formatting to highlight overdue payments and data validation lists for updating payment statuses. Formulas such as IF and TODAY help calculate days past due and alert you when invoices require attention. Setting up a pivot table can also summarize unpaid invoices by consultant or month for efficient monitoring.