The Quarterly Client Billing Excel Template for Consultants streamlines invoicing by organizing billable hours, expenses, and rates into a clear, professional format. It ensures accurate financial tracking and timely client payments through automated calculations and customizable entries. This template is essential for consultants aiming to enhance billing efficiency and maintain precise financial records.

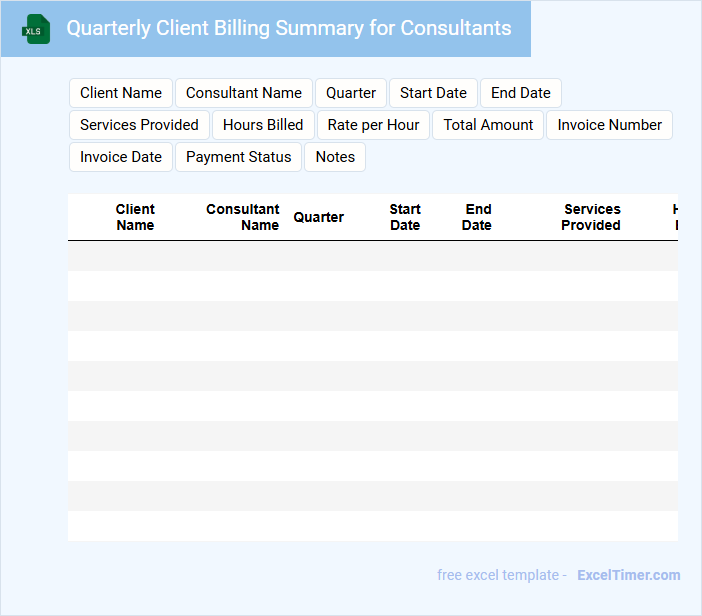

Quarterly Client Billing Summary for Consultants

The Quarterly Client Billing Summary for consultants typically contains detailed records of all billable hours worked, expenses incurred, and payments received within the quarter. It serves as a transparent communication tool between consultants and clients, ensuring clarity on financial transactions. Accurate documentation of this summary is essential for both invoicing and maintaining strong client relationships.

Excel Invoice Tracker with Quarterly Billing

An Excel Invoice Tracker with Quarterly Billing is a document designed to systematically record and manage invoices generated over three-month periods. It typically contains columns for invoice numbers, client details, billing amounts, payment status, and due dates to enhance financial accuracy. The primary use is to streamline the tracking process, ensuring timely payments and efficient quarterly financial reporting.

Important elements to include are clear categorization of invoices by quarter, automated calculations for totals and outstanding balances, and reminders for upcoming payment deadlines. Incorporating filters and pivot tables can optimize data analysis and provide quick insights into billing trends. Consistent updates and backups are essential to maintain accuracy and prevent data loss.

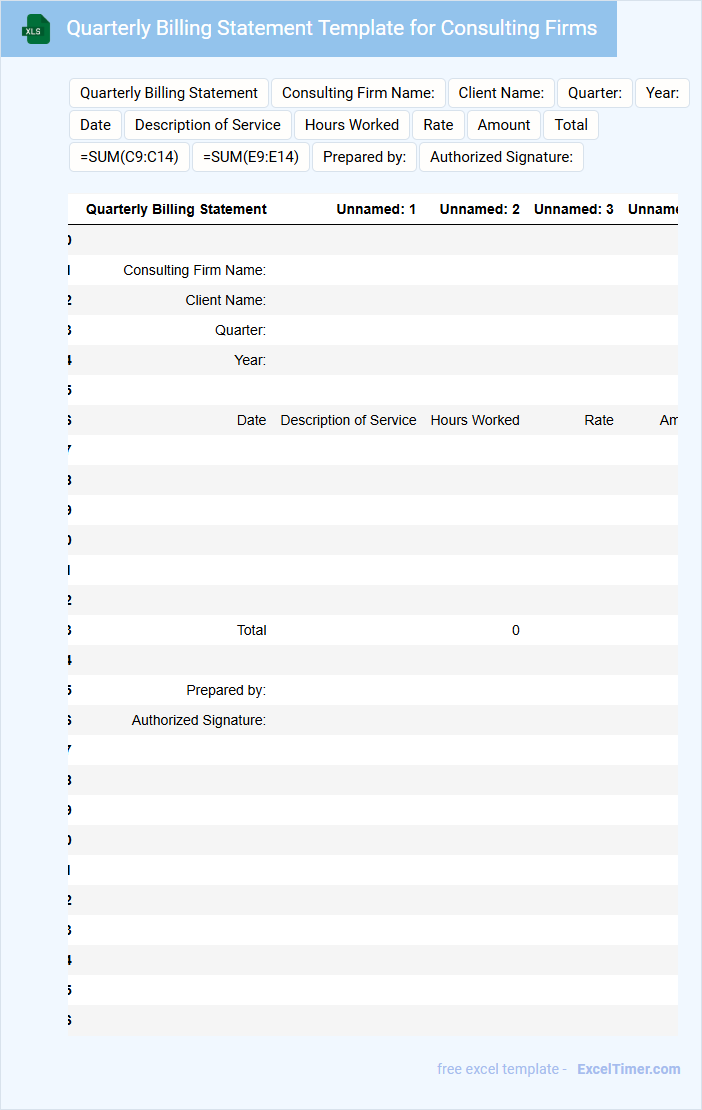

Quarterly Billing Statement Template for Consulting Firms

A Quarterly Billing Statement Template for Consulting Firms is a structured document that summarizes the consulting services provided and the corresponding fees for a three-month period.

- Client Information: Clearly list the client's name, contact details, and billing address to ensure accurate invoicing.

- Service Details: Provide a detailed breakdown of consulting hours, tasks completed, and hourly rates or fees applied.

- Payment Terms: Include the payment due date, accepted payment methods, and any late fee policies to facilitate timely payment.

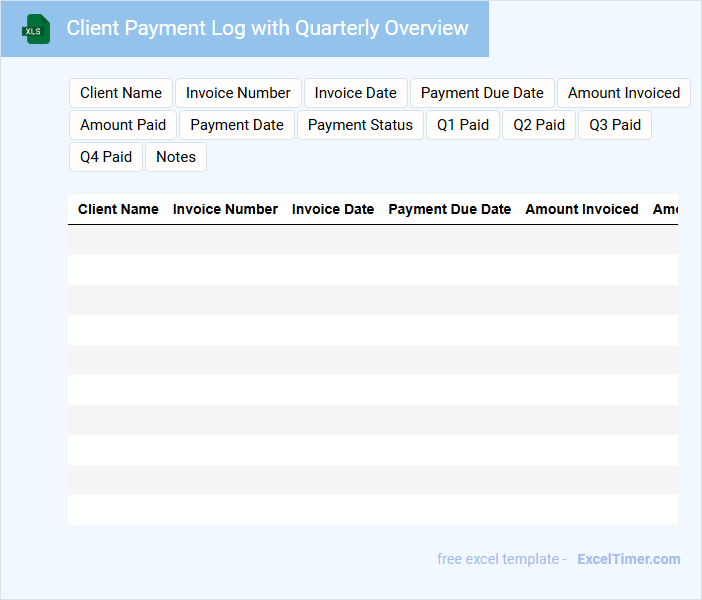

Client Payment Log with Quarterly Overview

A Client Payment Log typically contains detailed records of all payments made by clients. It includes payment dates, amounts, methods, and outstanding balances for accurate tracking.

The addition of a Quarterly Overview summarizes payment trends and overall financial performance every three months. This helps in analyzing cash flow and forecasting future revenue.

Ensure timely updates and accuracy to maintain clear financial records and improve client relationship management.

Consultant Fee Tracking Sheet for Quarterly Clients

The Consultant Fee Tracking Sheet is a vital document used to monitor and record the fees charged by consultants over a specific time frame. It typically includes details such as client names, fee amounts, payment dates, and services provided.

For Quarterly Clients, this sheet helps maintain organized financial records and ensures accurate billing cycles. Including a clear summary of outstanding payments is an important feature to track timely collections.

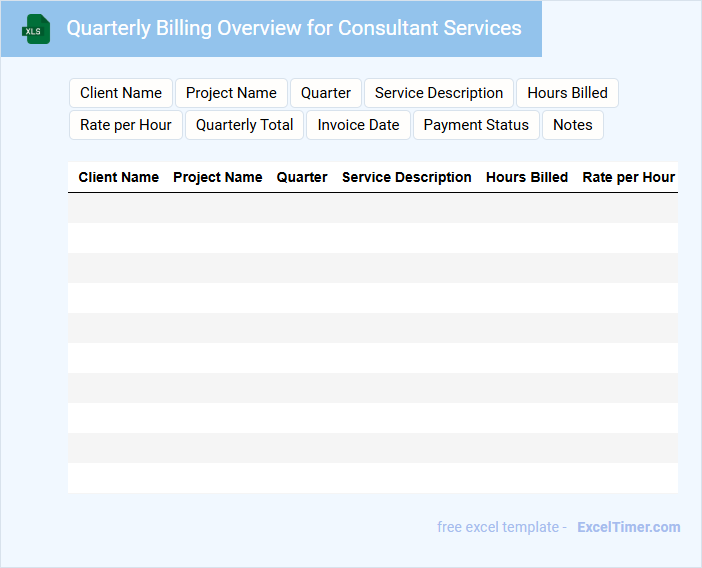

Quarterly Billing Overview for Consultant Services

The Quarterly Billing Overview document typically contains a summary of invoices issued during the quarter, detailing the services rendered and amounts billed. It highlights payment statuses, including any outstanding balances and due dates. This ensures transparent financial tracking between consultants and clients.

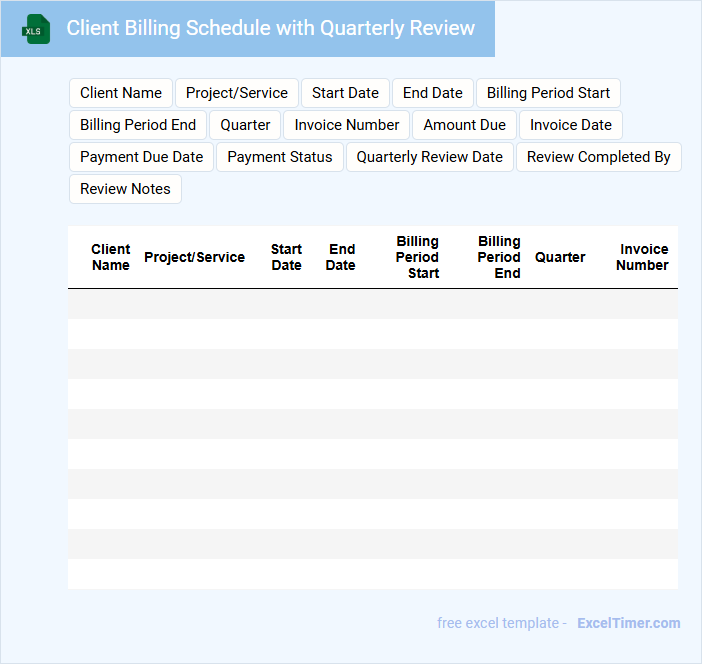

Client Billing Schedule with Quarterly Review

What information is typically included in a Client Billing Schedule with Quarterly Review? This document usually contains a detailed timeline of billing dates, payment amounts, and terms agreed upon with the client. It also outlines the key dates for quarterly reviews to assess project progress, address concerns, and adjust billing as necessary to ensure transparency and accuracy.

Why is it important to include a quarterly review in the billing schedule? Including regular reviews allows both parties to reconcile payments and services rendered, minimizing disputes. It also provides an opportunity to discuss any changes in scope, update budget forecasts, and reinforce clear communication between the client and service provider.

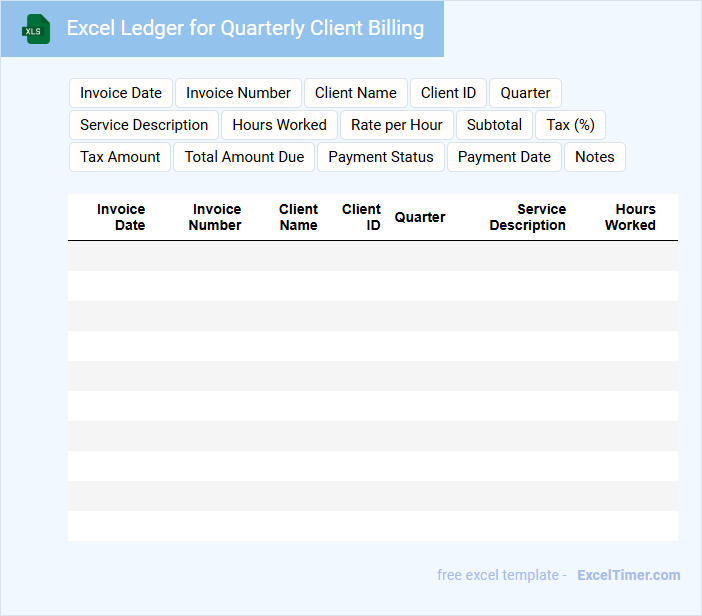

Excel Ledger for Quarterly Client Billing

An Excel Ledger for Quarterly Client Billing is a financial document used to track and summarize client payments and outstanding balances over a three-month period. It ensures accurate billing and helps maintain transparent financial records.

This document typically contains detailed transaction entries, client information, and payment status to facilitate efficient billing cycles.

- Include client names, invoice numbers, and billing dates for clear tracking.

- Maintain a running balance to monitor outstanding payments and credits.

- Use consistent formatting and formulas to automate calculations and minimize errors.

Quarterly Revenue Report with Client Breakdown

The Quarterly Revenue Report provides a detailed overview of a company's financial performance over a three-month period. It typically includes total revenue figures, trends, and comparisons with previous quarters to assess growth.

Including a Client Breakdown highlights revenue generated from key clients or segments, helping identify top contributors and areas needing attention. This information supports strategic decision-making and resource allocation.

Ensure accuracy and clarity by using consistent data sources and visual aids like charts for better comprehension.

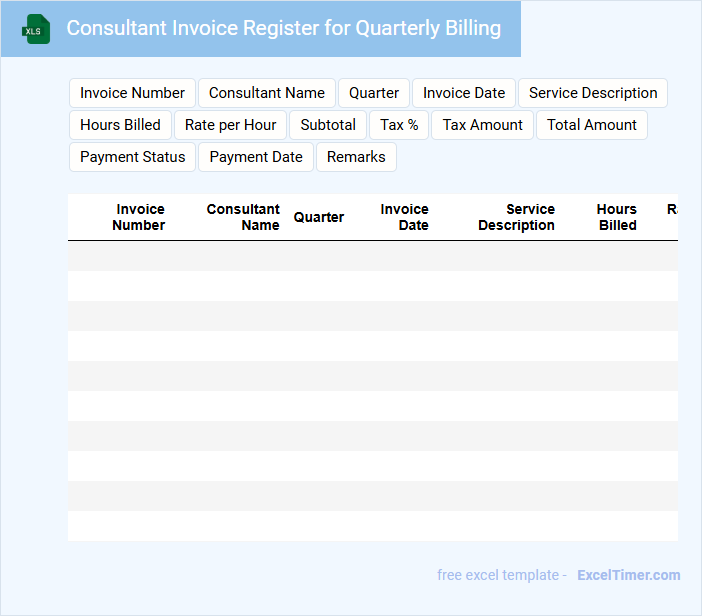

Consultant Invoice Register for Quarterly Billing

The Consultant Invoice Register is a crucial document that records all invoices issued by consultants during a specific billing period, typically quarterly. It provides a detailed summary of services rendered, invoice dates, and payment statuses, ensuring accurate financial tracking.

For effective quarterly billing, it's important to maintain meticulous records of invoice numbers, amounts, and due dates to avoid discrepancies. Consistent review and reconciliation help streamline the payment process and enhance transparency with consultants.

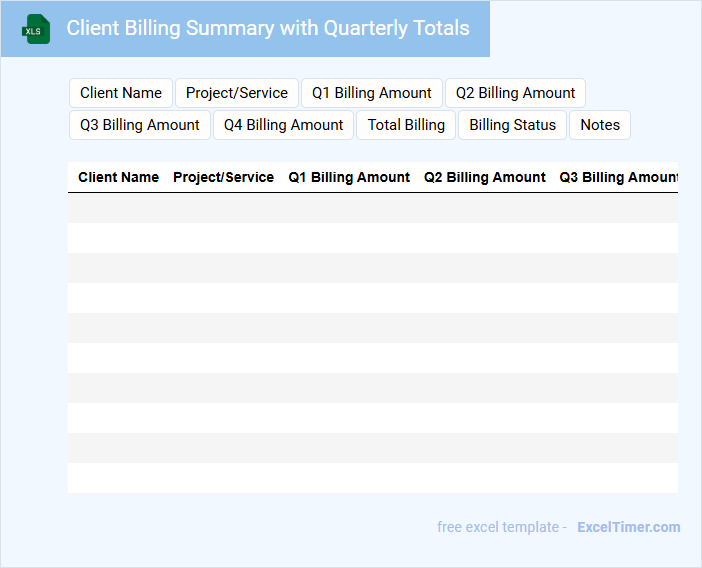

Client Billing Summary with Quarterly Totals

The Client Billing Summary is a financial document that outlines all invoices and payments made by a client over a specified period. It typically includes detailed billing entries, dates, and amounts to provide a clear record of transactions. For quarterly totals, this summary consolidates data to reflect overall client charges within each fiscal quarter.

Important elements to include are accurate invoice numbers, payment statuses, and clear dates for each billing entry. Consistency in formatting and clarity in subtotal and total amounts help ensure the summary is easy to review and verify. Including contact information for billing inquiries enhances communication and resolution efficiency.

Payment Due Tracker for Quarterly Consulting Clients

What information does a Payment Due Tracker for Quarterly Consulting Clients typically contain? This document usually includes client names, invoice numbers, payment due dates, and outstanding amounts to keep track of all pending payments efficiently. It helps consultants ensure timely payments and manage cash flow effectively by having a clear overview of all quarterly dues.

What are important elements to consider when creating this tracker? It is crucial to maintain accurate and up-to-date client details, clearly specify payment deadlines, and highlight overdue payments to prioritize follow-ups. Additionally, including notes or comments sections can help record communication and payment reminders, improving client relationship management.

Quarterly Client Statement with Billing Details

A Quarterly Client Statement with billing details typically summarizes all transactions, payments, and outstanding balances for a client over a three-month period. It provides a clear overview of invoiced services or products and any adjustments made during the quarter. Including detailed billing information ensures transparency and helps clients verify charges accurately.

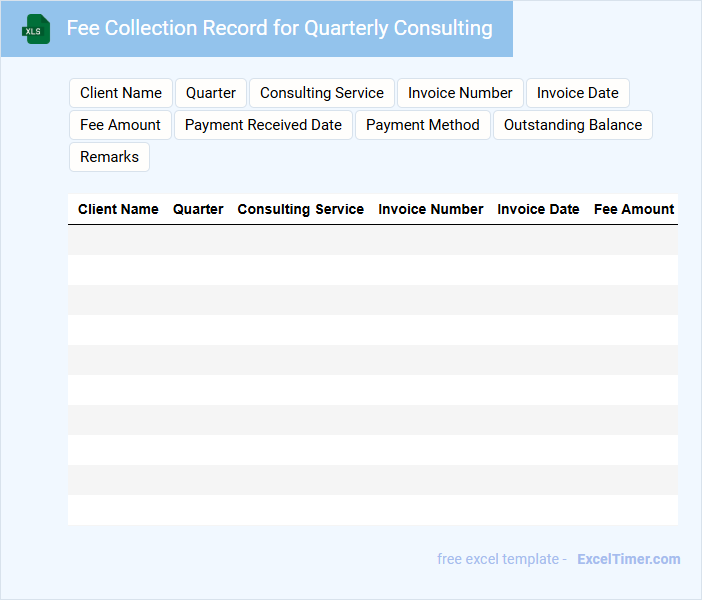

Fee Collection Record for Quarterly Consulting

A Fee Collection Record for Quarterly Consulting is a financial document used to track payments received from clients over a three-month period. It typically contains details such as client names, payment amounts, dates, and outstanding balances. This record ensures accurate monitoring of income and helps maintain transparent financial management for consulting services. An important suggestion is to include clear payment terms and schedules to avoid confusion and delays. Additionally, regularly updating the record and reconciling it with bank statements can improve accuracy and accountability. Another key aspect is to ensure the document is securely stored and backed up to prevent data loss.

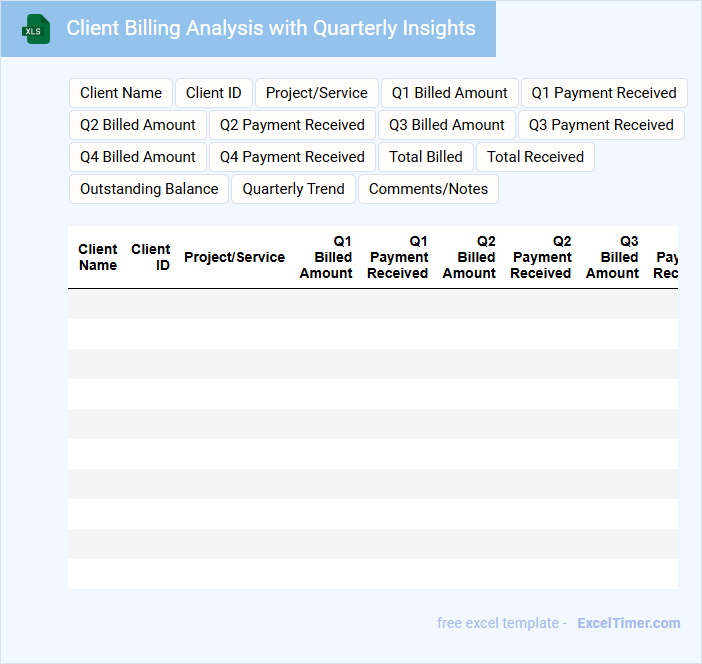

Client Billing Analysis with Quarterly Insights

The Client Billing Analysis document typically contains detailed records of client transactions, invoice summaries, and payment patterns. It provides insights into billing trends over specific periods, often segmented quarterly for effective financial tracking. Key elements include client payment history, outstanding balances, and revenue forecasting.

What are the essential data fields required in an Excel document for Quarterly Client Billing for consultants?

Your Excel document for Quarterly Client Billing should include essential data fields such as Client Name, Consultant Name, Project Code, Billing Period, Hours Worked, Hourly Rate, and Total Amount Billed. Capture Invoice Number, Payment Status, and Due Date to streamline tracking and payment management. Accurate inclusion of these fields ensures efficient billing and clear financial records.

How can you automate invoice generation and tracking within the Excel document for quarterly billings?

Automate invoice generation in Excel by using VBA macros to pull client data, billing rates, and hours logged into pre-designed invoice templates. Implement dynamic formulas and PivotTables to track quarterly payments, calculate outstanding balances, and summarize billing status per consultant. Integrate data validation and conditional formatting to ensure invoice accuracy and highlight overdue payments automatically.

What formulas are necessary to accurately calculate totals, taxes, and outstanding balances on a quarterly basis?

Use the SUM formula to calculate total billing amounts per quarter for each client. Apply the formula =TotalAmount * TaxRate to compute taxes accurately based on applicable rates. Calculate outstanding balances by subtracting payments received using =TotalBilling + Taxes - PaymentsReceived to maintain precise quarterly financial records.

How should you structure the Excel document to categorize billings for multiple clients and projects efficiently?

Structure your Excel document with separate columns for Client Name, Project Name, Billing Quarter, Hours Worked, Hourly Rate, and Total Amount. Use pivot tables to summarize billings by client, project, and quarter for quick insights. Incorporate drop-down lists for consistent data entry and conditional formatting to highlight overdue or unusual billing patterns.

What methods can be implemented in Excel to ensure data accuracy and reduce billing errors each quarter?

To ensure data accuracy and reduce billing errors each quarter in your Excel document, implement data validation rules to restrict input values and use formulas like VLOOKUP and SUMIFS for automatic calculations. Set up conditional formatting to highlight discrepancies or missing data, and utilize pivot tables to organize and verify billing information efficiently. Protect your worksheets to prevent unauthorized changes, ensuring the integrity of your quarterly client billing records.