The Quarterly Profit and Loss Excel Template for Consultants offers a streamlined way to track income and expenses over each quarter, providing clear insights into financial performance. It allows consultants to monitor profitability, manage budgets, and plan strategically with customizable categories and automated calculations. Using this template enhances financial accuracy and supports informed decision-making for sustainable business growth.

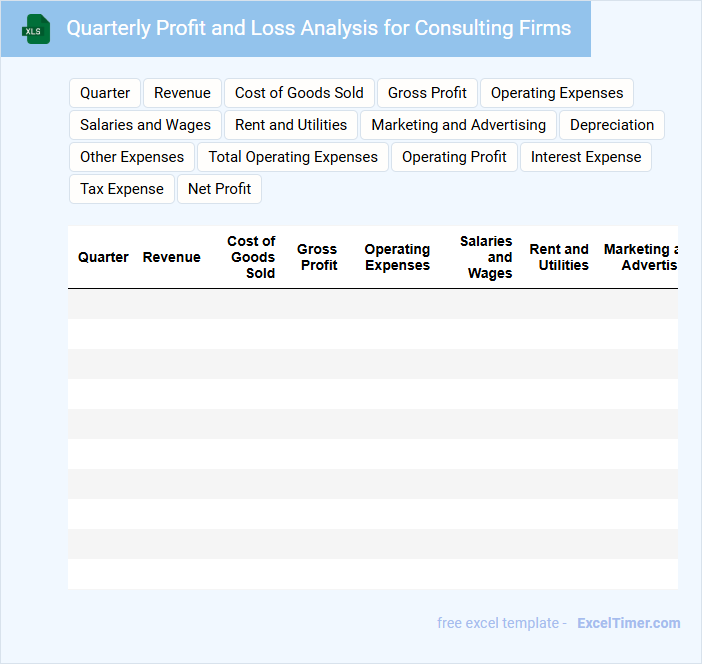

Quarterly Profit and Loss Analysis for Consulting Firms

What information does a Quarterly Profit and Loss Analysis for Consulting Firms typically contain? This type of document usually includes detailed revenue streams, cost breakdowns, and the resulting net profit or loss of the firm over the quarter. It provides insights into financial performance, operational efficiency, and highlights areas for improvement or growth.

What important factors should be considered when preparing this report? Key considerations include accurate categorization of consulting fees, overhead expenses, and project-specific costs to ensure clarity. Additionally, incorporating comparative analysis with previous quarters helps in identifying trends and making strategic decisions.

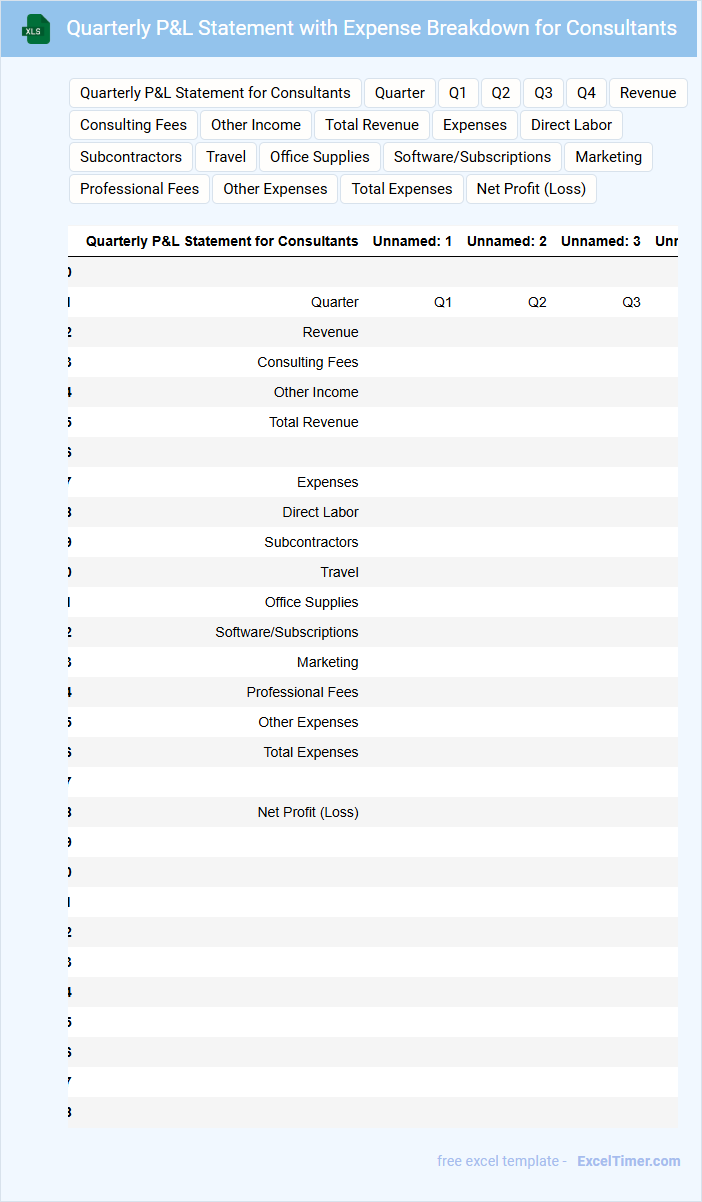

Quarterly P&L Statement with Expense Breakdown for Consultants

A Quarterly P&L Statement with Expense Breakdown for Consultants summarizes the financial performance of consulting activities over a three-month period. It highlights revenues, costs, and detailed expenses related to consulting projects.

- Include revenue streams from different consulting contracts to track income sources accurately.

- Break down expenses by categories such as travel, salaries, and office supplies to identify cost drivers.

- Compare quarterly results against previous periods to monitor profitability trends and operational efficiency.

Profit and Loss Report Template with Revenue Streams for Consultants

A Profit and Loss Report template outlines the financial performance of a business, showcasing revenues, expenses, and net profit over a specific period. It typically includes detailed revenue streams, costs associated with service delivery, and operational expenses.

This template is especially useful for consultants to track income from various projects and clients, helping to analyze profitability by service type. Including clear categorization of revenue streams ensures accurate financial insights.

For optimal use, it's important to regularly update the report to reflect current earnings and expenses, allowing informed decision-making and effective financial planning.

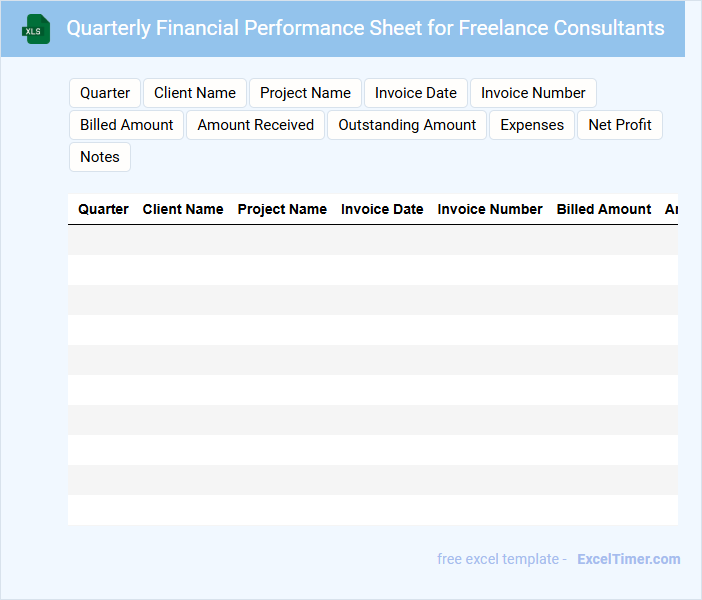

Quarterly Financial Performance Sheet for Freelance Consultants

A Quarterly Financial Performance Sheet for Freelance Consultants is a document that summarizes income, expenses, and net profit over three months. It helps track financial health and informs business decisions.

- Include detailed income streams and categorized expenses for accurate tracking.

- Regularly update the sheet to reflect all transactions and avoid discrepancies.

- Use clear charts or tables to visualize trends and performance.

Consultant Income and Expense Tracker with Quarterly Overview

What information does a Consultant Income and Expense Tracker with Quarterly Overview typically contain? This type of document usually includes detailed records of income sources and business expenses categorized by project or client, enabling accurate financial tracking throughout the year. It also provides quarterly summaries that highlight profitability trends and cash flow management, essential for strategic planning and tax preparation.

What important elements should be included to make this tracker effective? It is crucial to integrate clear categorization of income and expenses, date tracking for each transaction, and visual summaries such as charts or graphs for the quarterly overview. Regular updates and accuracy in data entry ensure the tracker supports informed decision-making and financial accountability for consultants.

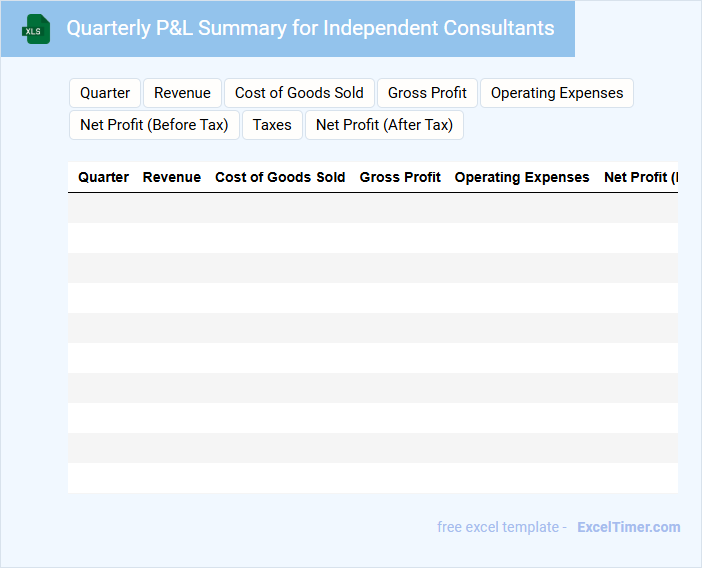

Quarterly P&L Summary for Independent Consultants

What information does a Quarterly P&L Summary for Independent Consultants typically contain? This document usually includes detailed revenue streams, expenses, and net profit or loss for the quarter, offering a clear financial snapshot to track business performance. It helps consultants assess their profitability, manage budgets effectively, and make informed decisions for future projects.

What is an important aspect to focus on in this summary? Emphasizing accurate categorization of income and expenses is crucial to avoid misinterpretation and ensure tax compliance. Additionally, highlighting trends or significant variances compared to previous quarters can provide valuable insights for strategic planning.

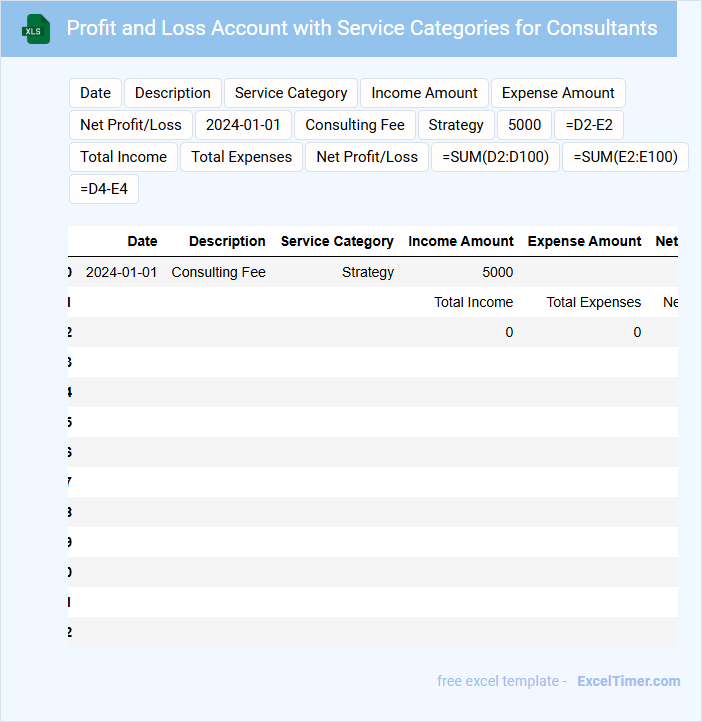

Profit and Loss Account with Service Categories for Consultants

The Profit and Loss Account for consultants typically details the revenues and expenses categorized by specific service offerings. It provides a clear overview of the financial performance related to each consulting service, aiding in strategic decision-making. This document is essential for identifying the most profitable areas and optimizing resource allocation.

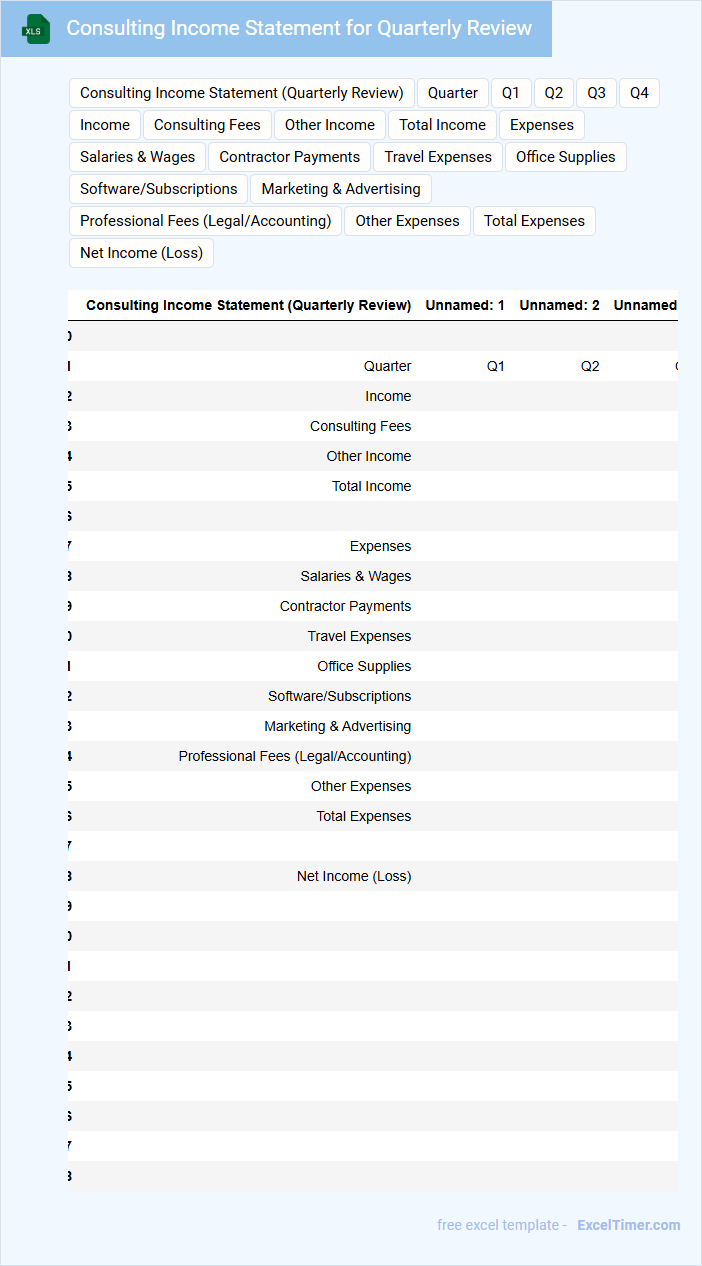

Consulting Income Statement for Quarterly Review

A Consulting Income Statement for a quarterly review typically contains detailed financial data reflecting revenues, expenses, and net profit for the consulting business during the quarter. This document helps stakeholders understand the company's financial performance and identify trends over the period. It is crucial to ensure accuracy in revenue recognition and expense categorization to present a clear picture of profitability.

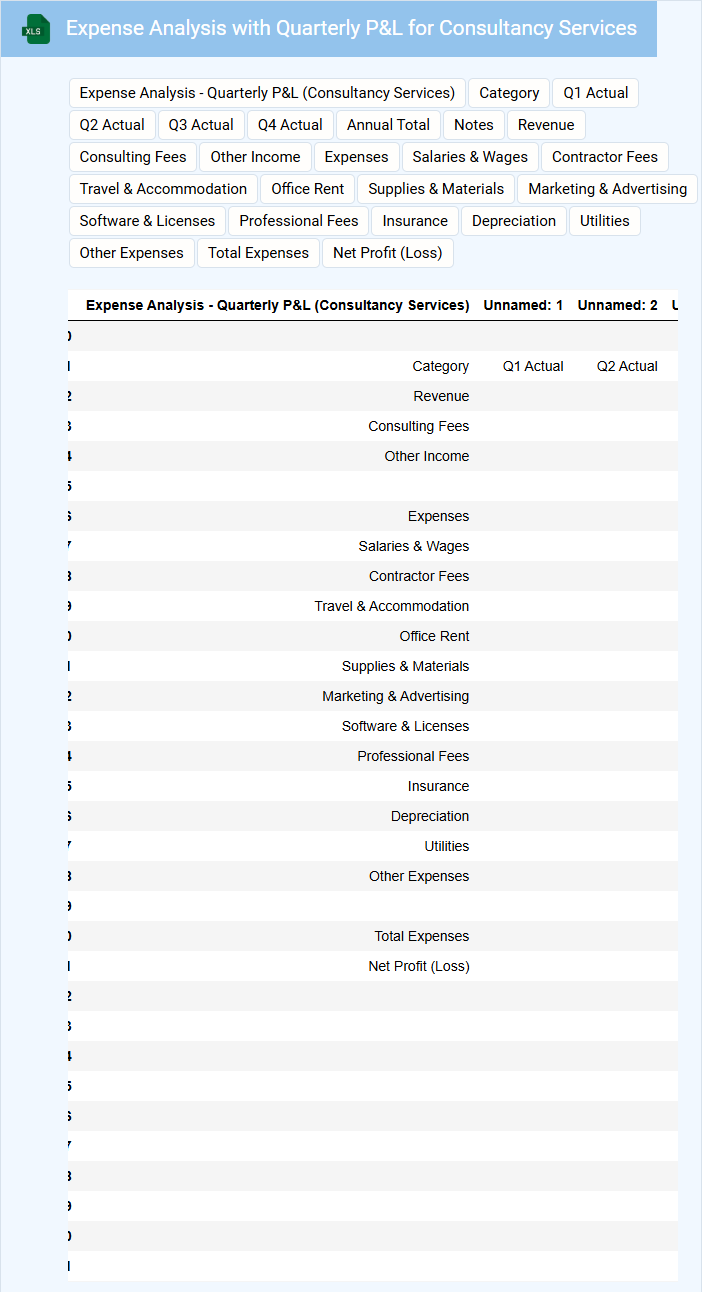

Expense Analysis with Quarterly P&L for Consultancy Services

The Expense Analysis document typically contains detailed records of costs incurred during a specific period, categorized to highlight spending patterns. It helps in identifying areas where expenses can be optimized to improve profitability.

The Quarterly P&L for Consultancy Services summarizes the revenue earned and expenses incurred within a quarter, providing insights into financial performance. Tracking these metrics regularly aids in strategic decision-making.

Ensure accurate data entry and consistent categorization to maintain the reliability of financial reports.

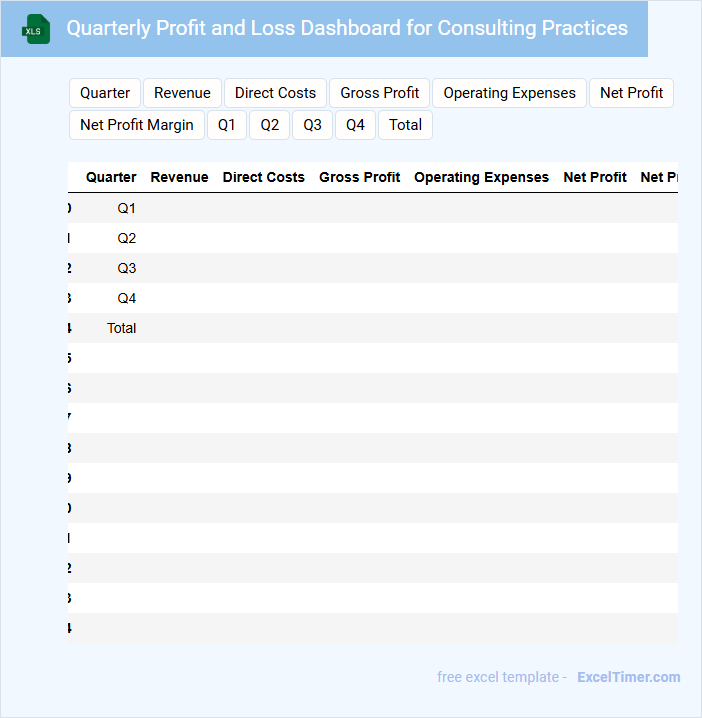

Quarterly Profit and Loss Dashboard for Consulting Practices

A Quarterly Profit and Loss Dashboard for Consulting Practices typically contains concise financial metrics and visual summaries aimed at monitoring business performance over a three-month period.

- Revenue Breakdown: Displays income sources categorized by consulting projects or client engagements.

- Expense Tracking: Highlights operational costs including manpower, tools, and administrative expenses.

- Profit Margins: Illustrates net profitability trends and key financial ratios for strategic decision-making.

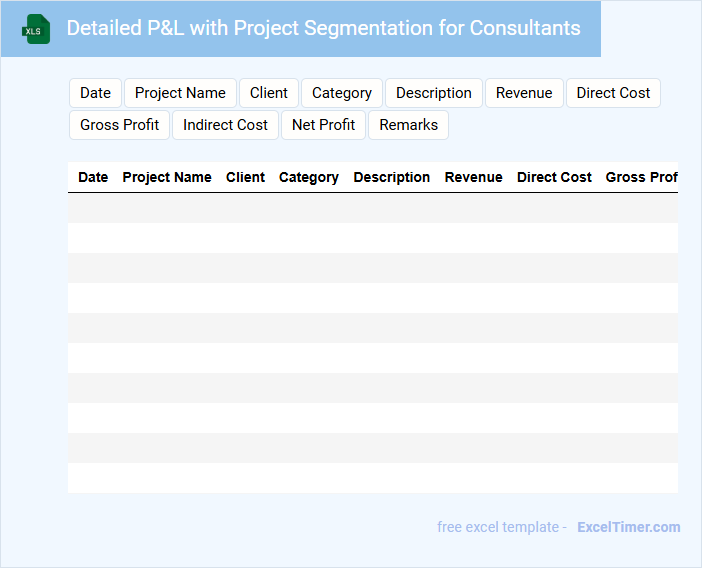

Detailed P&L with Project Segmentation for Consultants

A Detailed P&L with Project Segmentation for consultants typically contains comprehensive financial data segmented by individual projects, including revenues, expenses, and profitability. It enables precise tracking of project performance and resource allocation, ensuring consultants understand each project's contribution to overall financial health. Key elements often include direct costs, indirect expenses, billable hours, and variances between budgeted and actual figures.

For maximizing its value, ensure clear categorization of projects, consistent cost allocation methods, and integration with time-tracking systems. Highlighting key performance indicators (KPIs) such as gross margin per project enhances decision-making. Regularly updating and reviewing the document improves financial accuracy and supports strategic planning for consultancy firms.

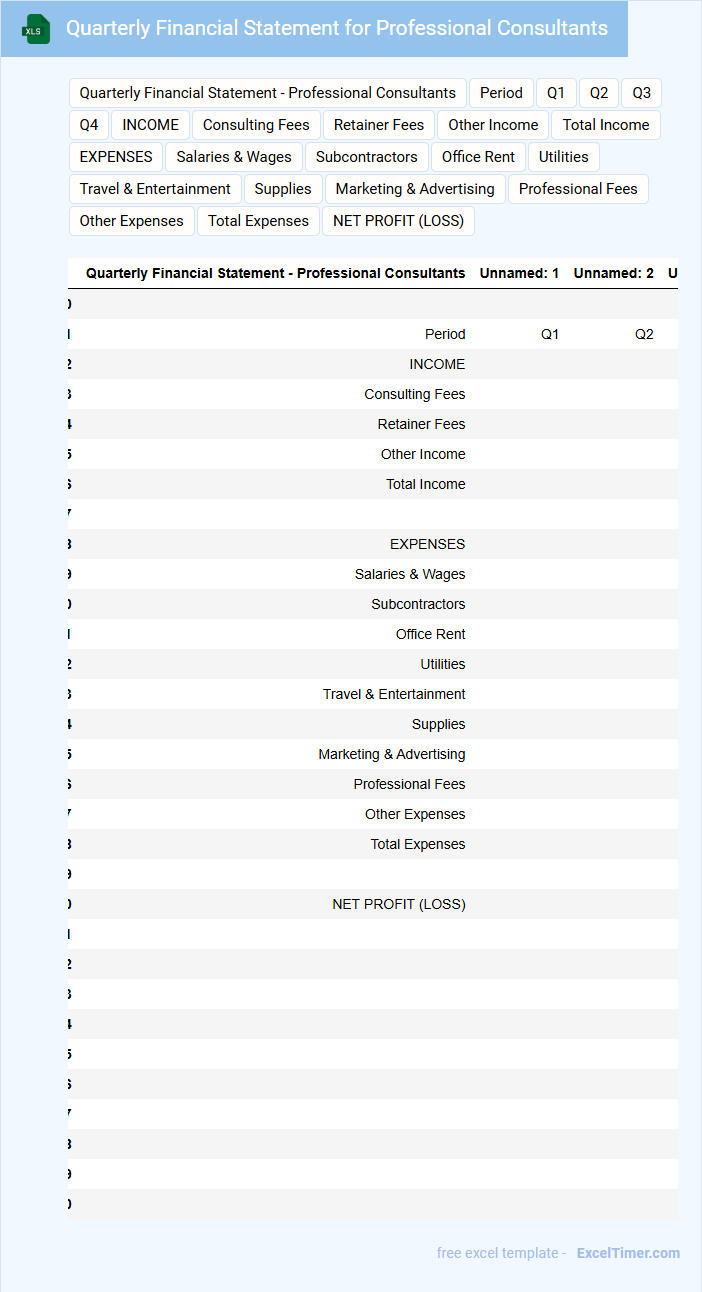

Quarterly Financial Statement for Professional Consultants

A Quarterly Financial Statement for Professional Consultants is a document that summarizes the financial performance and position of a consulting business over a three-month period. It provides insights into revenue, expenses, and profitability to help consultants make informed decisions.

- Include a detailed breakdown of income sources and consulting fees received.

- Highlight the major operating expenses and investments made during the quarter.

- Present key financial ratios and analyses to evaluate business health and growth.

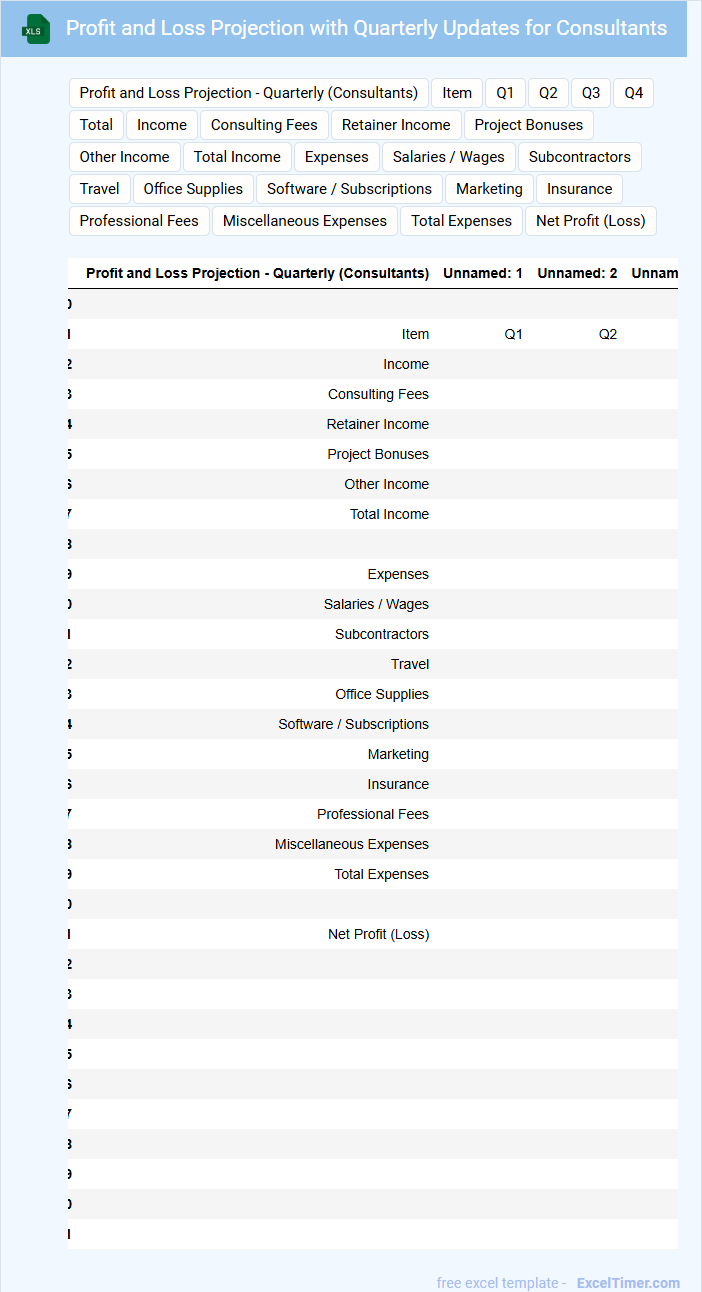

Profit and Loss Projection with Quarterly Updates for Consultants

A Profit and Loss Projection document typically contains estimated revenues, expenses, and net income over a specific period, allowing consultants to anticipate financial performance. It is crucial for identifying trends and making informed strategic decisions. Quarterly updates ensure the projection remains accurate and aligns with actual business activities and market conditions.

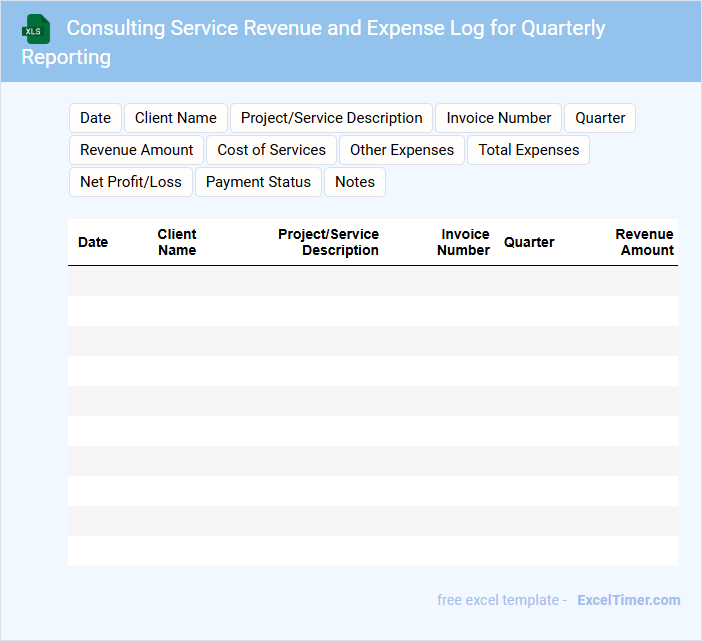

Consulting Service Revenue and Expense Log for Quarterly Reporting

The Consulting Service Revenue and Expense Log typically contains detailed records of income earned and expenses incurred during consulting activities within a quarter. It serves as a crucial financial document for tracking profitability and budget adherence. Maintaining accuracy and timeliness in this log ensures effective quarterly reporting and informed decision-making.

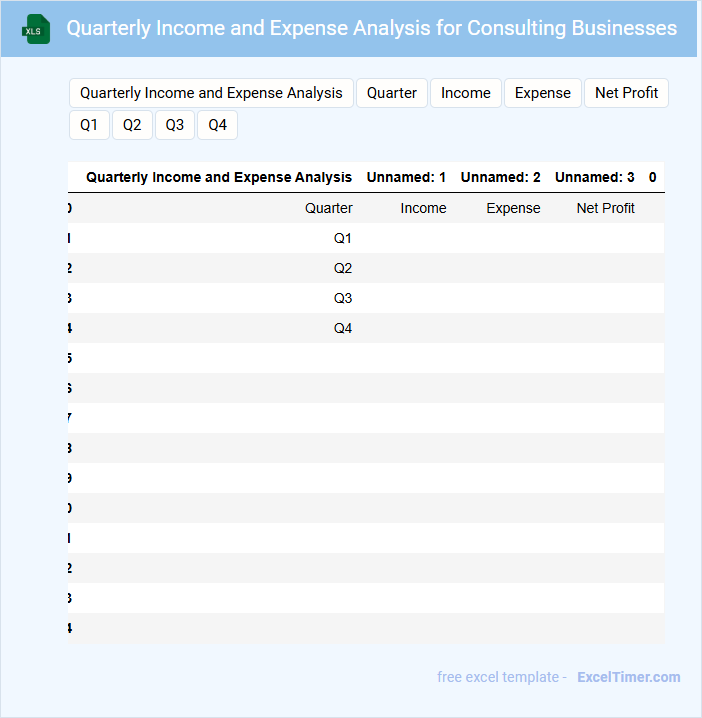

Quarterly Income and Expense Analysis for Consulting Businesses

What information is typically included in a Quarterly Income and Expense Analysis for Consulting Businesses? This document usually contains detailed records of income earned and expenses incurred during the quarter. It provides a comprehensive overview of financial performance, helping identify profit trends and cost-saving opportunities.

Why is it important to track quarterly income and expenses for consulting businesses? Regular analysis ensures accurate financial monitoring, aiding strategic decision-making and budgeting. It also helps detect irregularities early, promoting better cash flow management and business growth.

What are the key revenue streams typically recorded in a consultant's quarterly profit and loss Excel document?

Your quarterly profit and loss Excel document for consultants typically records key revenue streams such as billable consulting hours, project-based fees, and retainer agreements. Other important income sources include performance bonuses and reimbursable expenses. Tracking these revenues accurately helps you analyze profitability and make informed business decisions.

How should direct and indirect expenses be categorized and tracked for accurate quarterly P&L analysis?

Direct expenses should be categorized as costs directly tied to client projects, such as consultant fees and project materials. Indirect expenses include overhead costs like office rent, utilities, and administrative salaries. You must track both separately in your Excel document to ensure an accurate quarterly profit and loss analysis.

What quarterly financial metrics can be used to assess consultant profitability in the Excel report?

Key quarterly financial metrics to assess consultant profitability in the Excel report include gross profit margin, operating profit margin, and net profit margin. Tracking billable hours, revenue per consultant, and utilization rate provides insights into productivity and efficiency. Analyzing these metrics helps identify profitability trends and optimize resource allocation.

How can Excel formulas automate the calculation of gross profit and net profit for each quarter?

Excel formulas can automate quarterly gross profit by subtracting total costs from total revenue using =Revenue - Costs. Net profit is calculated by deducting expenses such as taxes and operating costs from the gross profit with =GrossProfit - Expenses. Linking these formulas to data cells updates profit calculations instantly when quarterly figures change.

Which data visualization tools in Excel best highlight trends and variances in quarterly profit and loss for consultants?

Excel's PivotCharts and Line Charts effectively highlight trends in your quarterly profit and loss data for consultants by visually representing fluctuations over time. Waterfall Charts clearly demonstrate variances between quarters, making it easier to analyze profit increases or losses. Combining these tools in your Excel document enhances data interpretation and supports informed decision-making.