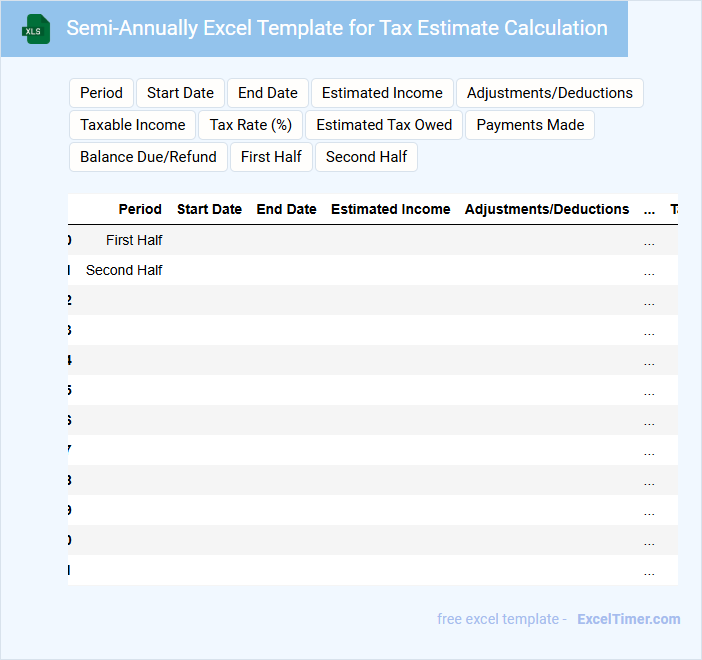

The Semi-annually Excel Template for Tax Estimate Calculation simplifies the process of forecasting tax liabilities every six months, ensuring timely and accurate financial planning. Users can input income and deductions to automatically calculate estimated taxes, reducing errors and saving time during tax season. This template is essential for individuals and businesses aiming to maintain compliance and avoid underpayment penalties.

Semi-Annually Excel Template for Tax Estimate Calculation

This document typically contains structured data and formulas to estimate tax liabilities semi-annually.

- Income and Expense Inputs: Users enter their earnings and deductible expenses for precise calculation.

- Estimated Tax Calculation: Automated formulas compute tax estimates based on current tax rates and inputs.

- Summary and Comparison: A summarized report helps users compare estimated taxes with previous periods for effective planning.

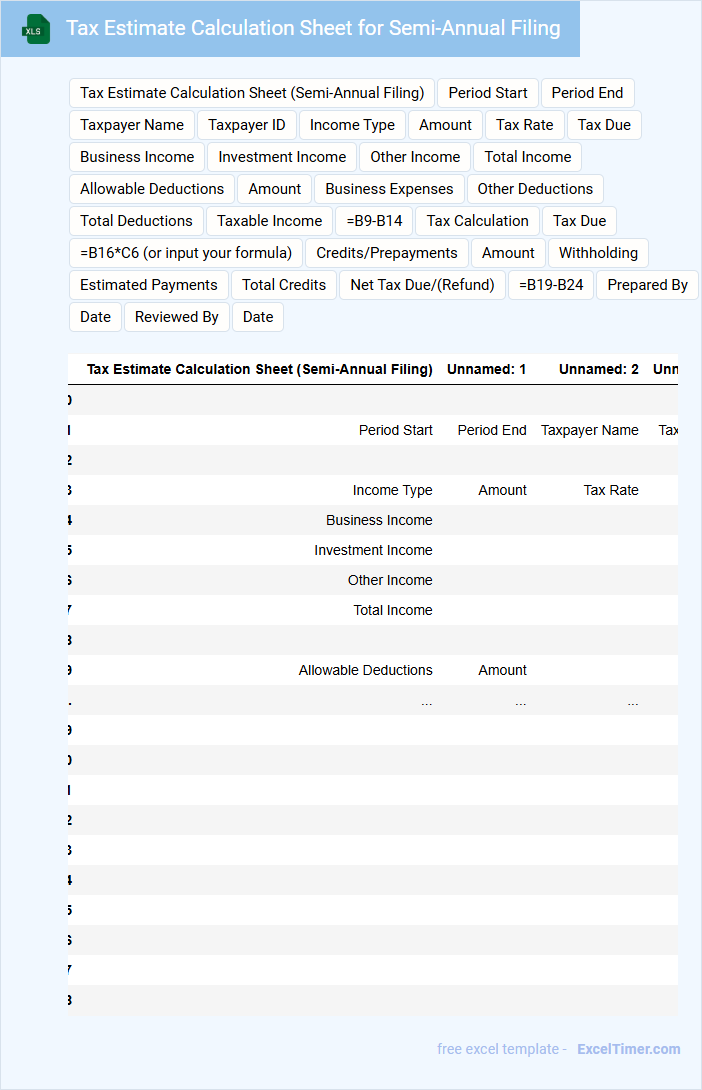

Tax Estimate Calculation Sheet for Semi-Annual Filing

This Tax Estimate Calculation Sheet is a document used to project the tax liability for semi-annual filings. It typically includes income details, deductions, and estimated tax payments made during the period. Accurate estimates help avoid underpayment penalties.

For a Semi-Annual Filing, this sheet ensures compliance with tax deadlines and smooth financial planning. It's important to update all financial data regularly and verify tax rates. Maintaining organized records will streamline the filing process.

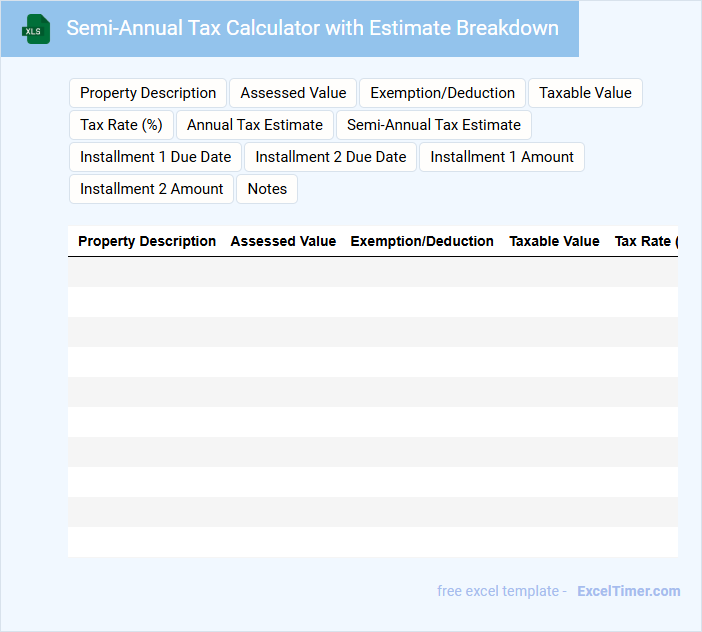

Semi-Annual Tax Calculator with Estimate Breakdown

A Semi-Annual Tax Calculator typically contains detailed inputs of income sources and deductible expenses to provide an accurate tax estimate. This type of document breaks down the estimated tax liabilities over two main periods within the year to help taxpayers plan effectively. It is important to ensure all income streams and applicable credits are included for the most precise breakdown and projection.

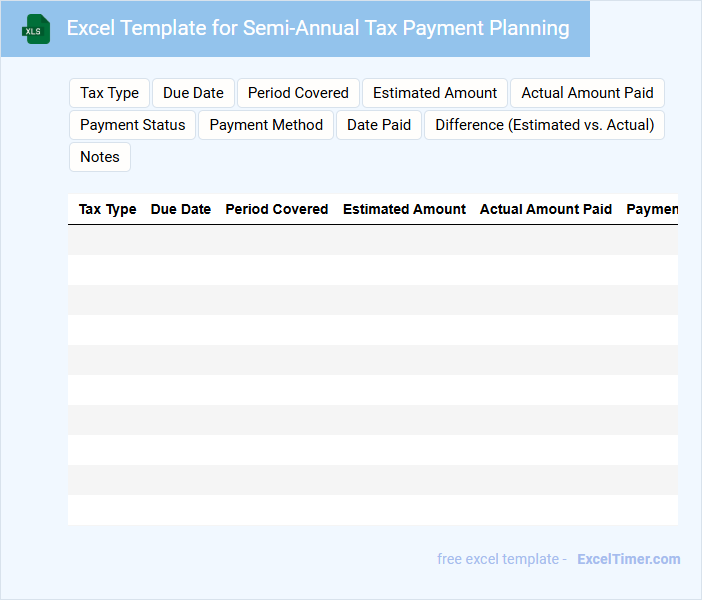

Excel Template for Semi-Annual Tax Payment Planning

What information is typically included in an Excel template for semi-annual tax payment planning? This type of document usually contains fields for income tracking, estimated tax calculations, and payment schedules to help organize and forecast tax liabilities. It assists individuals or businesses in managing tax obligations efficiently by providing clear deadlines and payment amounts.

What important elements should be considered when using such a template? It is crucial to ensure accurate and up-to-date income data, include sections for deductions and credits, and incorporate reminders for payment deadlines. Additionally, customizable formulas and summaries can enhance usability and ensure precise tax planning.

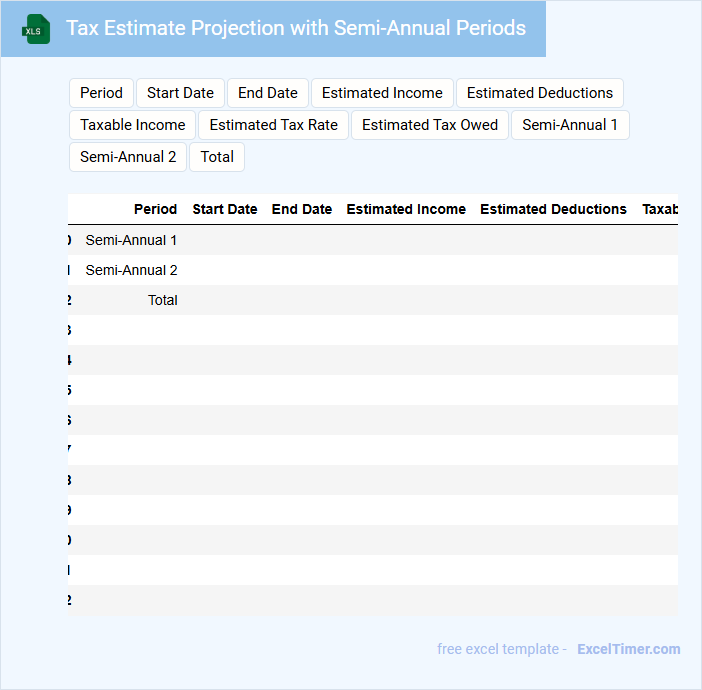

Tax Estimate Projection with Semi-Annual Periods

What information is typically included in a Tax Estimate Projection with Semi-Annual Periods? This type of document usually contains projected taxable income, estimated tax liabilities for each semi-annual period, and any applicable credits or deductions. It helps taxpayers plan their payments and avoid underpayment penalties by providing clear financial expectations over the course of the year.

What important factors should be considered when preparing a Tax Estimate Projection with Semi-Annual Periods? It is essential to use accurate and updated income data, consider seasonal income variations that affect tax liability, and account for changes in tax laws or rates. Proper timing of payments and keeping detailed records ensure compliance and accurate financial forecasting.

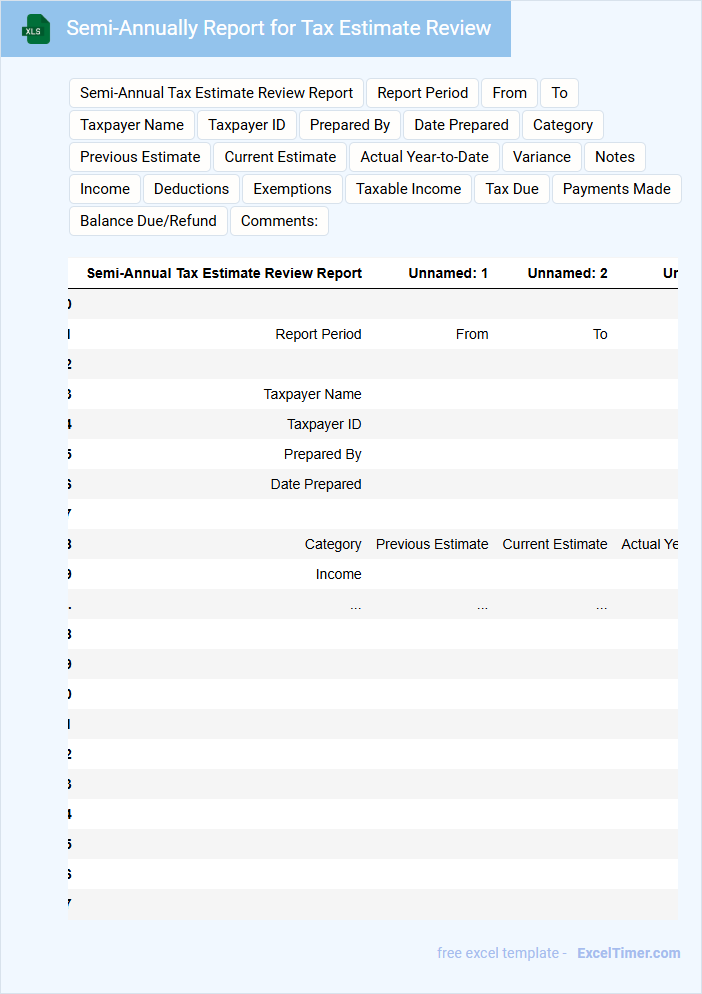

Semi-Annually Report for Tax Estimate Review

A Semi-Annual Report for Tax Estimate Review typically contains a detailed analysis of financial performance, tax liabilities, and projections for the upcoming tax periods.

- Financial Summary: A concise overview of income, expenses, and net profit relevant to tax calculations.

- Tax Liability Breakdown: An itemized report highlighting estimated taxes owed and payments made to date.

- Projection & Adjustments: Recommendations for adjusting estimated tax payments based on current fiscal data.

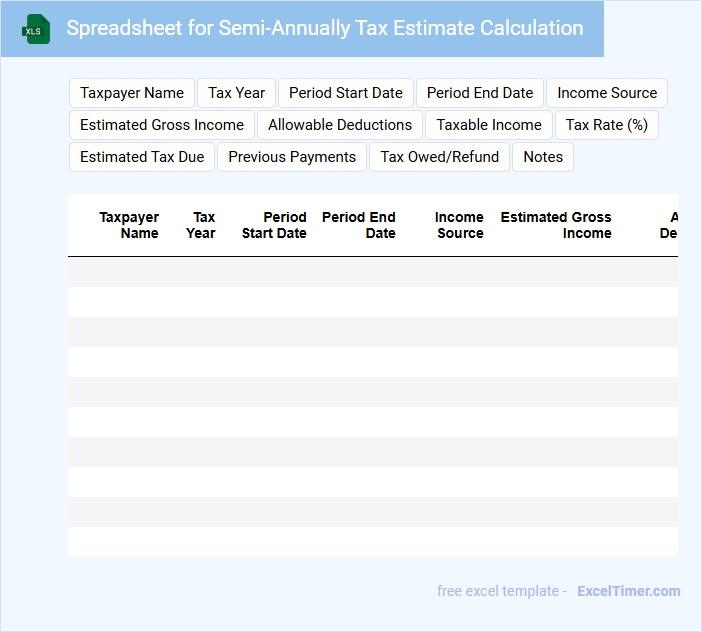

Spreadsheet for Semi-Annually Tax Estimate Calculation

A spreadsheet for semi-annually tax estimate calculation typically contains detailed financial data and tax formulas to help individuals or businesses estimate their tax liabilities every six months. It serves as a planning tool to ensure timely payments and avoid penalties.

- Include accurate income and expense entries for precise tax calculations.

- Incorporate applicable tax rates and deduction rules for the relevant tax period.

- Provide summary sections that highlight estimated tax owed and payment deadlines.

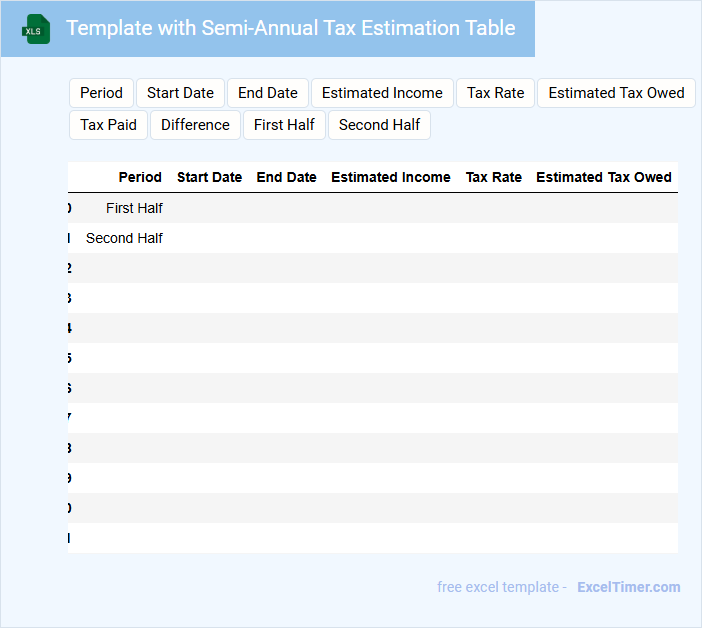

Template with Semi-Annual Tax Estimation Table

What information is typically included in a Template with Semi-Annual Tax Estimation Table? This type of document usually contains detailed columns for income, estimated tax payments, deductions, and projected tax liabilities for each half of the year. It allows individuals or businesses to plan and track their tax obligations efficiently.

What is an important consideration when using this template? Accuracy in inputting financial data and regularly updating the table with actual income and payment figures is essential to avoid underpayment penalties and ensure precise tax planning.

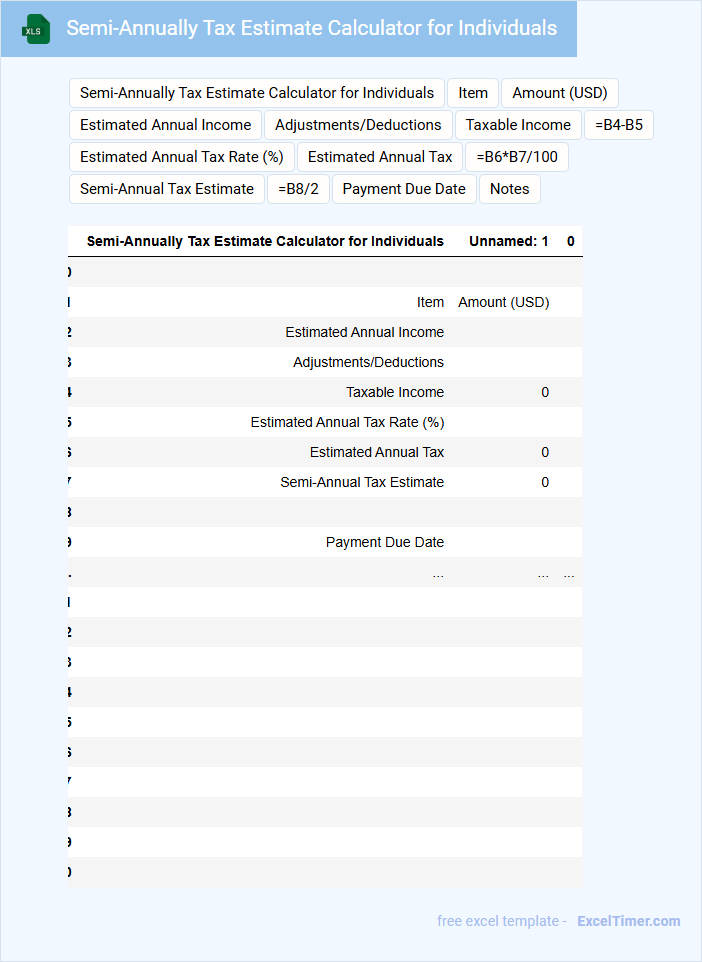

Semi-Annually Tax Estimate Calculator for Individuals

What information is typically included in a Semi-Annually Tax Estimate Calculator for Individuals? This type of document usually contains fields for income details, deductions, and tax credits relevant to the individual taxpayer, organized to calculate estimated tax payments twice a year. It provides a structured way to estimate tax liabilities to avoid underpayment penalties and manage finances efficiently.

What important factors should be considered when using this calculator? Users should ensure they input accurate income sources, including salaries, investments, and business income, and consider applicable deductions such as retirement contributions or mortgage interest. Additionally, it is important to regularly update the calculator with any changes in financial circumstances or tax laws to obtain precise estimates.

Excel Report for Semi-Annual Tax Estimate Tracking

An Excel Report for Semi-Annual Tax Estimate Tracking typically contains detailed financial data and projected tax payments to ensure accurate tax compliance.

- Financial Summary: Provides an overview of income, expenses, and estimated tax obligations for the period.

- Payment Schedule: Lists due dates and amounts for estimated tax payments to avoid penalties.

- Variance Analysis: Compares estimated versus actual payments to identify discrepancies and adjust future estimates.

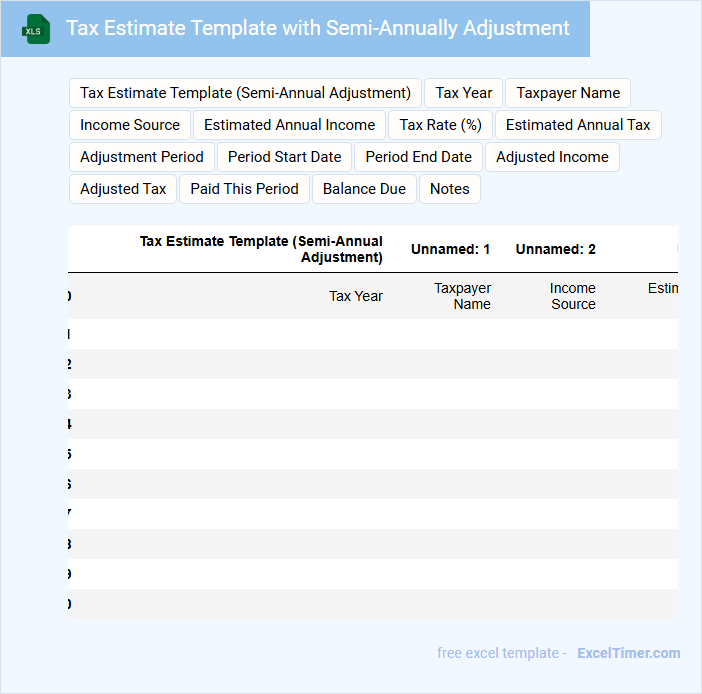

Tax Estimate Template with Semi-Annually Adjustment

A Tax Estimate Template with Semi-Annually Adjustment typically contains projected income, estimated tax liabilities, and payment schedules adjusted twice a year. This document helps taxpayers and accountants plan for tax obligations more accurately.

Important elements include clear income projections, applicable tax rates, and adjustment periods to reflect changes in financial status. Ensuring compliance with current tax laws and timely updates is critical for accuracy and effective tax planning.

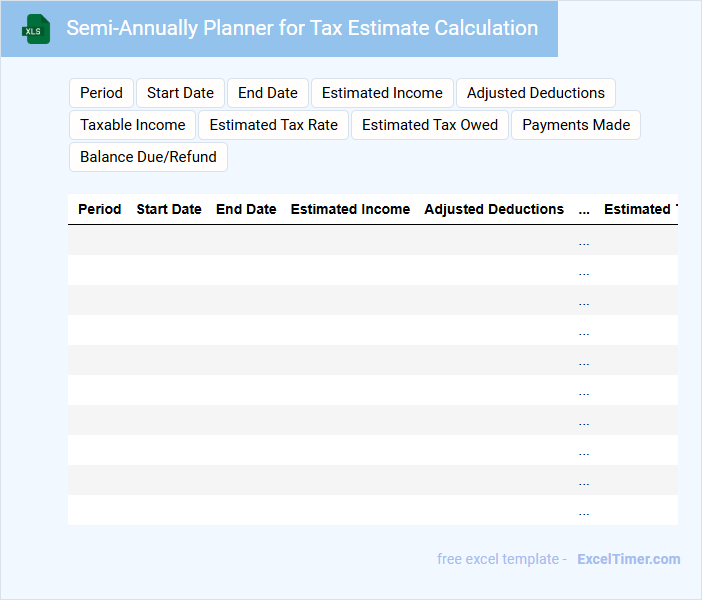

Semi-Annually Planner for Tax Estimate Calculation

A Semi-Annually Planner for Tax Estimate Calculation helps individuals or businesses organize their finances and anticipate tax liabilities twice a year. It typically contains income summaries, deductible expenses, and estimated tax payments to ensure compliance and avoid penalties.

It is important to regularly update this planner with accurate financial data and review changes in tax laws. Keeping detailed records and setting aside funds for tax payments significantly reduces year-end surprises and enhances financial planning.

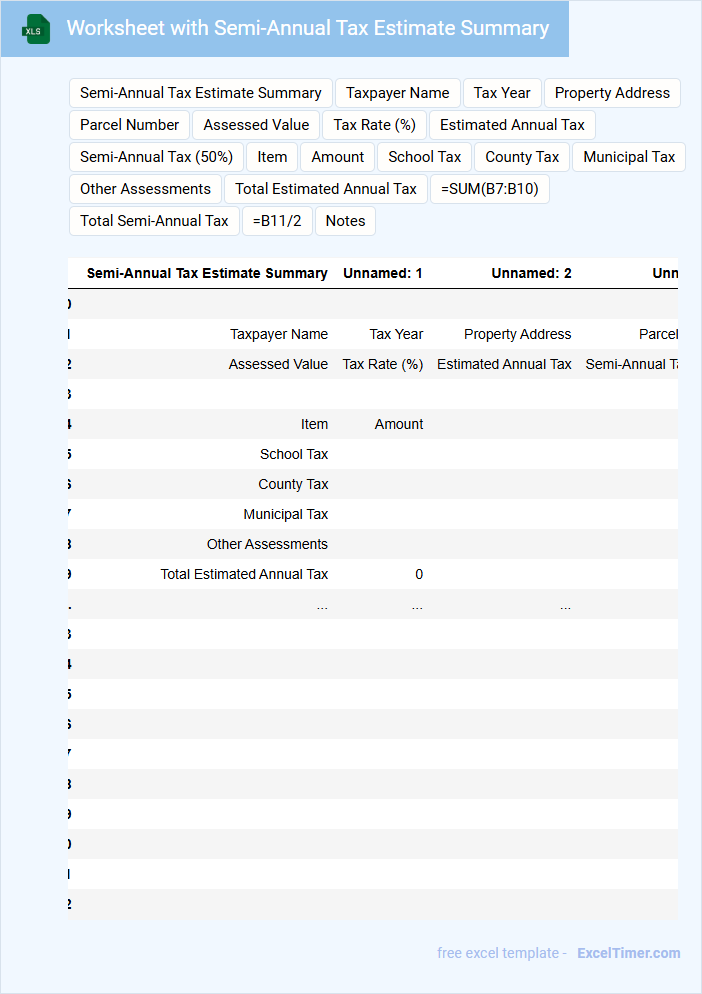

Worksheet with Semi-Annual Tax Estimate Summary

What does a Worksheet with Semi-Annual Tax Estimate Summary typically include? This document usually contains detailed calculations of estimated taxes owed for each half of the fiscal year, summarizing income, deductions, and credits. It serves as a crucial tool for taxpayers and accountants to ensure accurate tax planning and timely payments.

Why is it important to maintain accuracy in this worksheet? Accurate entries prevent underpayment penalties and help manage cash flow effectively by providing a clear overview of tax liabilities. It is recommended to keep all supporting documents and update the worksheet regularly with any income or tax law changes.

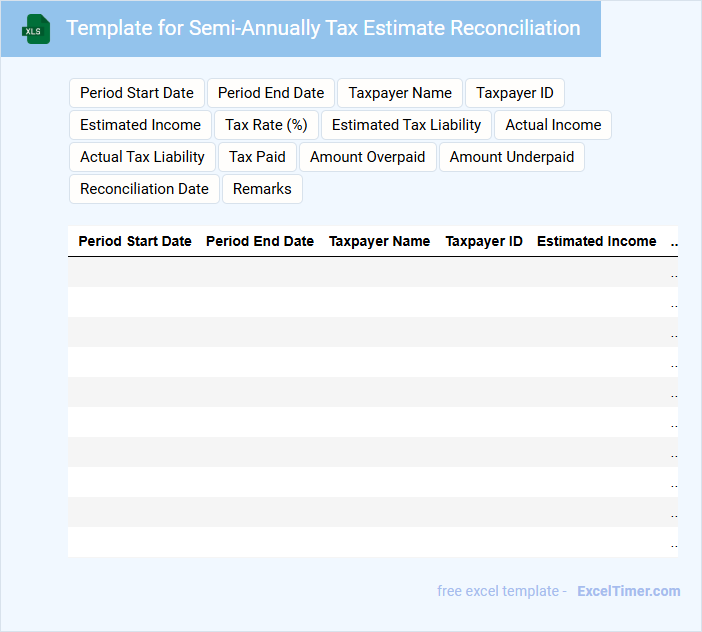

Template for Semi-Annually Tax Estimate Reconciliation

What information is typically included in a Template for Semi-Annually Tax Estimate Reconciliation? This document usually contains detailed records of estimated tax payments made biannually, including dates, amounts, and corresponding tax periods. It also reconciles these payments against the actual tax liability to identify any discrepancies and ensure accurate tax reporting.

What important elements should be considered when preparing this template? Key elements include clear tracking of payment deadlines, precise calculation of estimated taxes based on current earnings, and documentation of adjustments or credits. Ensuring accuracy and transparency helps prevent penalties and facilitates smooth communication with tax authorities.

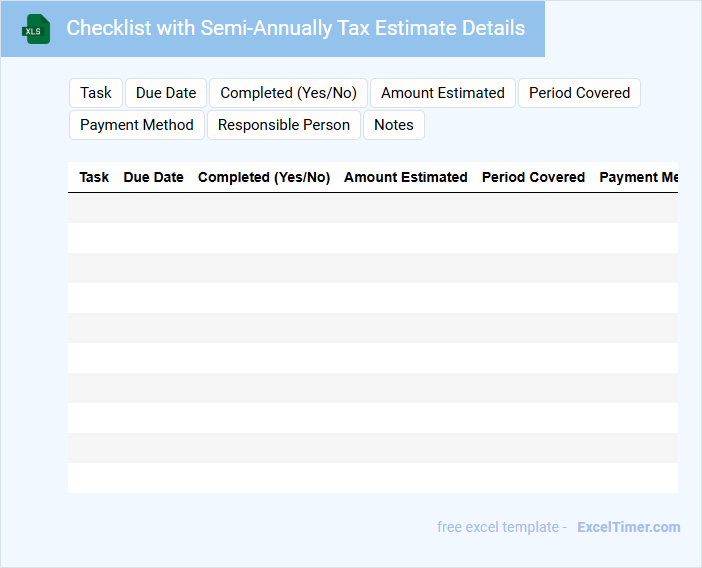

Checklist with Semi-Annually Tax Estimate Details

A Checklist with Semi-Annually Tax Estimate Details typically contains a comprehensive list of items to review and complete before submitting tax payments twice a year. It includes estimated income, deductions, and payment deadlines to ensure accuracy and compliance. This document is essential for maintaining organized tax records and avoiding penalties.

How does selecting "semi-annually" as a frequency impact the calculation of tax estimates in Excel?

Selecting "semi-annually" as a frequency in Excel divides the annual tax liability into two equal installments, affecting the timing and amount of each tax estimate payment. This choice updates the formula to calculate tax owed every six months, ensuring the estimated tax reflects a biannual payment schedule. The semi-annual frequency helps align tax estimates with IRS payment deadlines, reducing penalties for underpayment.

Which Excel functions can automate semi-annual period calculations for estimated taxes?

Excel functions like EDATE and IF can automate semi-annual period calculations for tax estimates by calculating due dates every six months. The DATE function combined with MOD can identify the relevant semi-annual period based on the payment month. Using these functions streamlines the creation of tax schedules and ensures accurate deadline tracking for semi-annual estimated tax payments.

What date logic should be applied in Excel to accurately split annual tax estimates into semi-annual amounts?

Apply a date logic that divides the fiscal year into two equal six-month periods, typically January-June and July-December. Use Excel functions like EDATE to calculate the start and end dates of each period dynamically, ensuring accurate allocation of tax amounts. Incorporate IF statements to assign tax estimates proportionally based on the specific semi-annual period in the fiscal year.

How can Excel formulas help track payment deadlines and amounts when taxes are estimated semi-annually?

Excel formulas automate tracking of semi-annual tax payment deadlines by calculating due dates based on initial payment dates and intervals. Your spreadsheet can use functions like EDATE to forecast payment schedules and SUM to aggregate estimated amounts for accurate financial planning. This ensures timely reminders and precise tax estimate calculations without manual errors.

What cell structure best supports dynamic adjustments if the semi-annual tax estimation period changes?

A dynamic Excel cell structure for semi-annually tax estimate calculation uses date functions like EDATE or DATE to automatically adjust periods based on your specified start date. Implementing named ranges and structured references in tables enhances clarity and ease of updates. This approach ensures your tax estimates adapt seamlessly to changes in the semi-annual calculation period.