The Weekly Budget Excel Template for Freelancers is designed to help independent professionals track income and expenses efficiently on a weekly basis. It includes customizable categories, automatic calculations, and visual summaries to ensure accurate financial management. This template is essential for maintaining cash flow awareness and preparing for tax season.

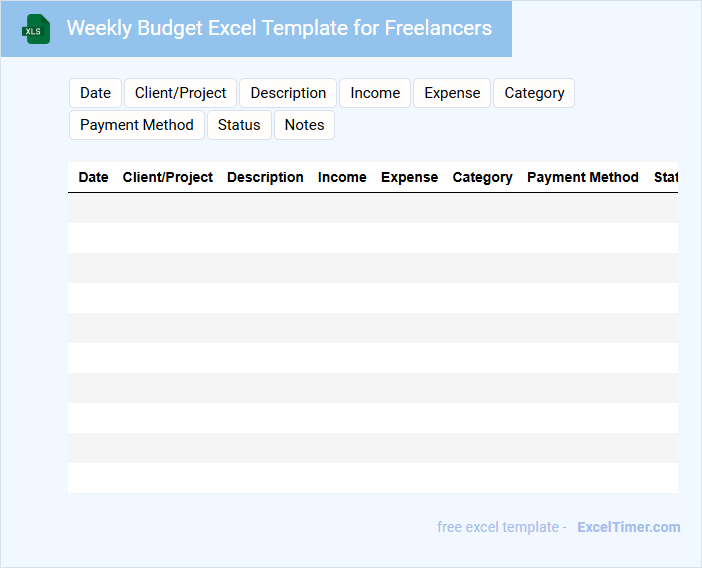

Weekly Budget Excel Template for Freelancers

A Weekly Budget Excel Template for Freelancers typically contains sections for tracking income, expenses, and savings on a weekly basis. It helps freelancers monitor cash flow, categorize spending, and plan for upcoming bills efficiently. This type of document is essential for maintaining financial discipline and ensuring profitability.

Income Tracker with Weekly Budget for Freelancers

What information does an Income Tracker with Weekly Budget for Freelancers typically contain? This document usually includes detailed records of weekly earnings, expenses, and allocated budgets to help manage personal and business finances effectively. It provides a clear overview of income streams, helping freelancers maintain financial stability and plan for future expenses.

What is an important consideration when using this type of document? Ensuring accurate and consistent data entry is crucial for reliable tracking and budgeting. Additionally, freelancers should regularly review their spending patterns to adjust budgets and optimize their financial goals.

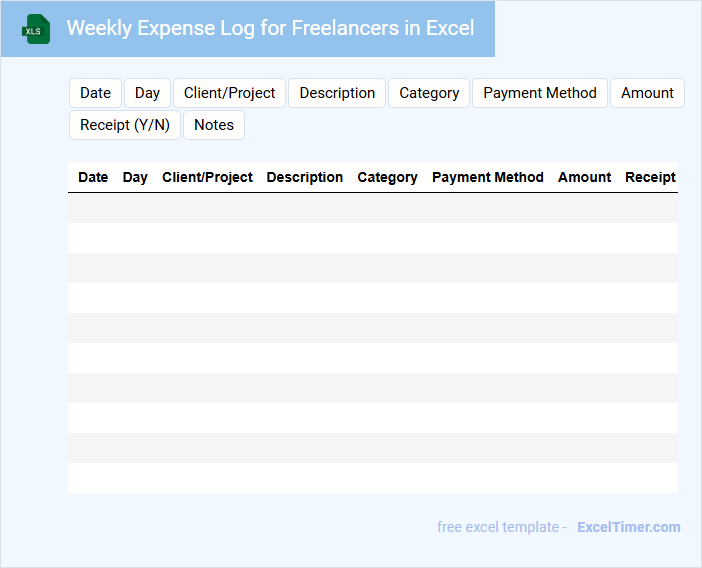

Weekly Expense Log for Freelancers in Excel

A Weekly Expense Log for freelancers in Excel is a structured document that tracks income and expenditures on a weekly basis. It typically contains columns for date, description, category, amount, and payment method to ensure detailed financial monitoring. Maintaining this log helps freelancers stay organized, manage their budgets effectively, and prepare for tax season.

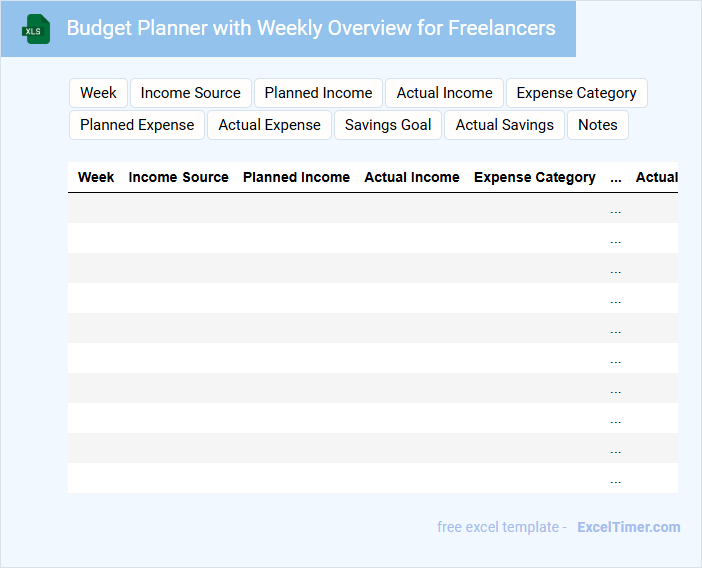

Budget Planner with Weekly Overview for Freelancers

A Budget Planner with Weekly Overview for Freelancers is a document designed to track income and expenses on a weekly basis, helping freelancers manage their cash flow efficiently. It usually contains sections for categorizing expenses, recording payments received, and estimating upcoming costs.

Important elements include detailed expense tracking and clear summaries of weekly earnings to provide a snapshot of financial health. Consistently updating the planner ensures better financial planning and avoids overspending.

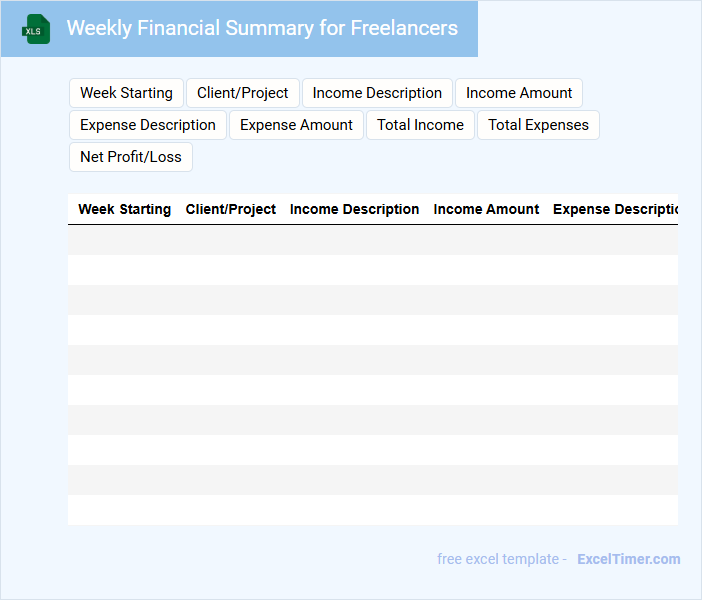

Weekly Financial Summary for Freelancers

A Weekly Financial Summary for Freelancers typically contains an overview of income, expenses, and cash flow for the week. It helps freelancers track their financial health and make informed business decisions.

- Include detailed records of all invoices issued and payments received during the week.

- Summarize all business-related expenses to monitor spending and identify deductions.

- Highlight any outstanding payments or financial goals for the upcoming week.

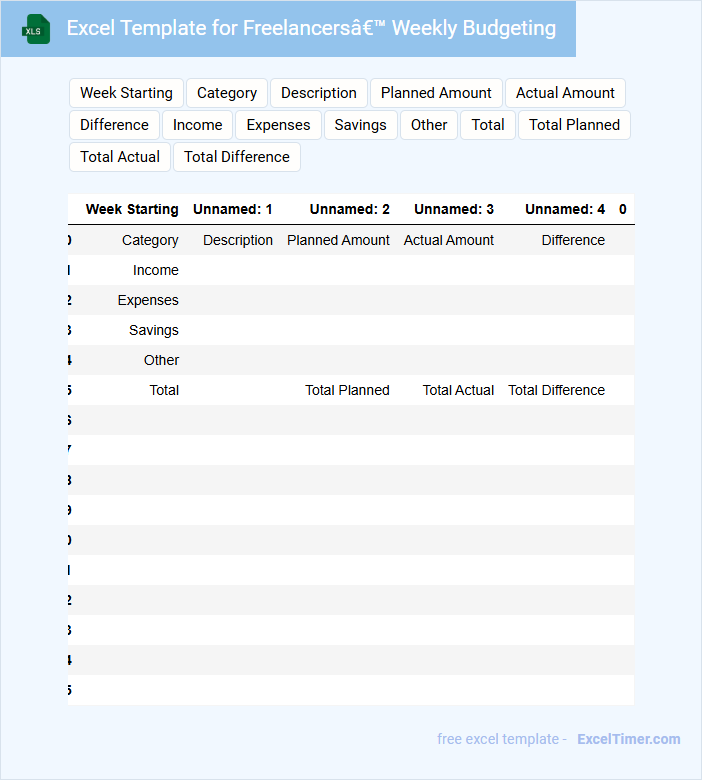

Excel Template for Freelancers’ Weekly Budgeting

This document typically contains a structured layout to help freelancers track and manage their weekly income and expenses efficiently.

- Income Sources: Clearly listing all potential revenue streams to monitor cash flow.

- Expense Categories: Categorizing all weekly costs to identify spending patterns.

- Summary Section: Providing a concise overview of profits and budget adjustments.

Weekly Cash Flow Tracker for Freelancers

A Weekly Cash Flow Tracker for freelancers is a document designed to monitor income and expenses on a weekly basis. It typically contains sections for recording payments received, bills paid, and any outstanding balances. This tracker helps freelancers maintain financial stability by providing a clear overview of their cash flow.

Important elements to include are accurate date entries, categorized income sources, and detailed expense descriptions. Regular updates and reconciliation with bank statements ensure data accuracy. Additionally, including notes for irregular payments or upcoming financial obligations can improve forecasting and budgeting efforts.

Project Budget Tracking for Freelancers (Weekly)

A Project Budget Tracking document for freelancers is a crucial tool that outlines weekly expenses and income related to specific projects. It typically contains detailed records of hours worked, rates applied, and costs incurred, helping maintain financial transparency. Staying consistent with updates ensures accurate monitoring and better financial planning.

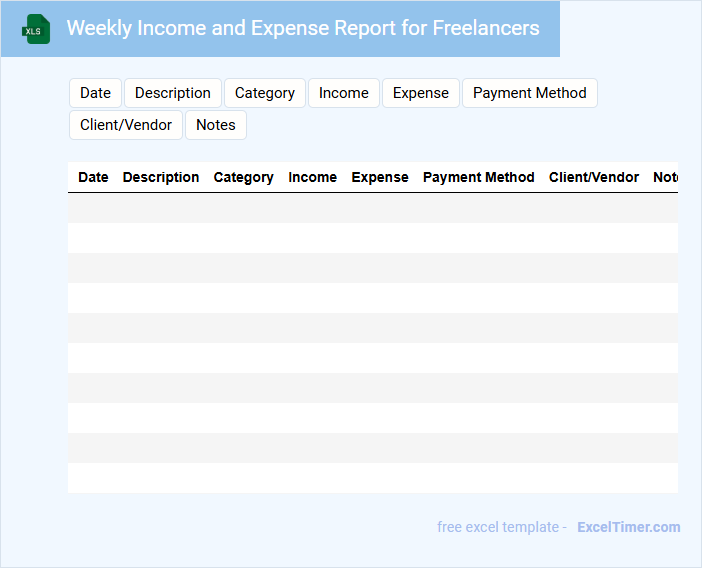

Weekly Income and Expense Report for Freelancers

A Weekly Income and Expense Report for freelancers typically contains detailed records of all earnings and expenditures within a given week. This document helps track financial performance and manage budgeting effectively. Including accurate dates and categorizing expenses ensures clarity and better financial insights.

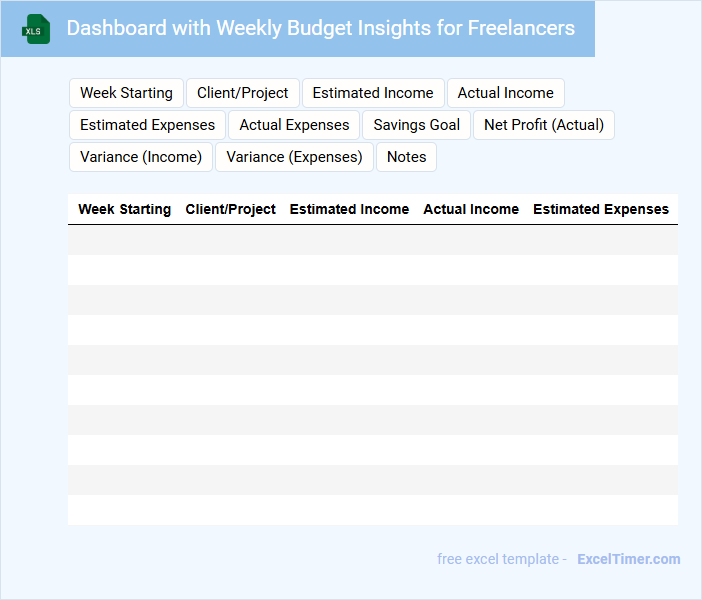

Dashboard with Weekly Budget Insights for Freelancers

This document typically contains a comprehensive visualization of weekly financial data tailored for freelancers to manage their budgets effectively.

- Income Tracking: It highlights all sources of freelance income within the week to monitor earnings accurately.

- Expense Categorization: It categorizes and tracks expenses to help freelancers identify areas for cost reduction.

- Budget Alerts: It includes alerts or notifications to prevent overspending and maintain financial discipline throughout the week.

Weekly Savings Tracker for Freelancers in Excel

A Weekly Savings Tracker for Freelancers in Excel is a document used to monitor income and expenses to ensure consistent savings over time.

- Income Monitoring: Track all sources of freelance income to accurately calculate weekly earnings.

- Expense Categorization: Organize expenses by type to identify spending patterns and areas for savings.

- Goal Setting: Set realistic weekly savings targets to stay motivated and achieve financial goals.

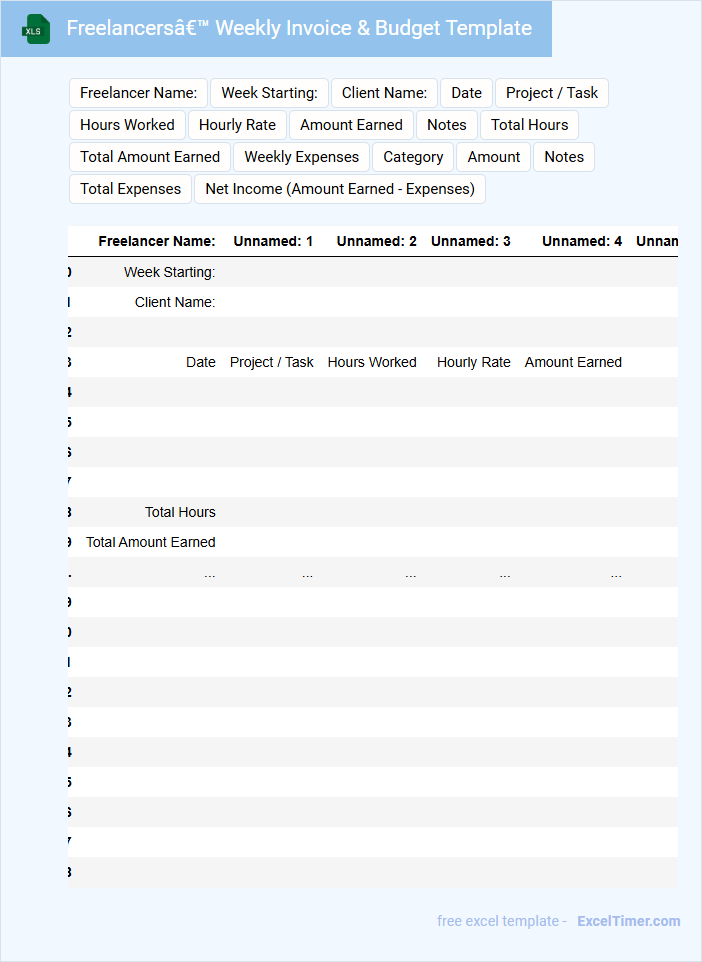

Freelancers’ Weekly Invoice & Budget Template

A Freelancers' Weekly Invoice & Budget Template typically contains detailed records of hours worked, services rendered, and payment tracking for each project. It helps freelancers organize their financial transactions and monitor their weekly income against their budget. Using this template ensures clear communication with clients and effective management of cash flow.

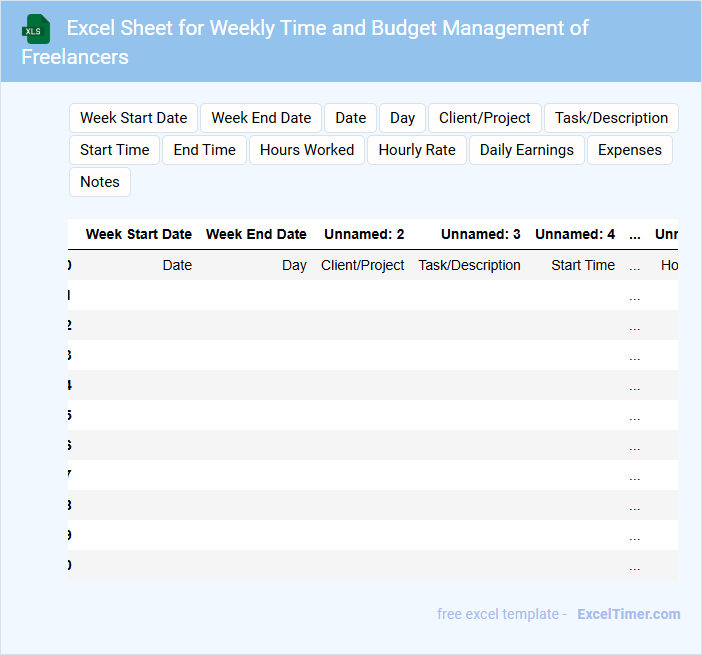

Excel Sheet for Weekly Time and Budget Management of Freelancers

This document typically contains detailed records of hours worked and budget allocations for freelancers on a weekly basis, helping track productivity and expenses efficiently. It ensures clear financial oversight and time management for project planning and payroll purposes.

- Include columns for date, task description, hours worked, hourly rate, and total cost.

- Provide a summary section for total hours and budget spent each week.

- Incorporate dropdown menus or data validation to maintain data consistency.

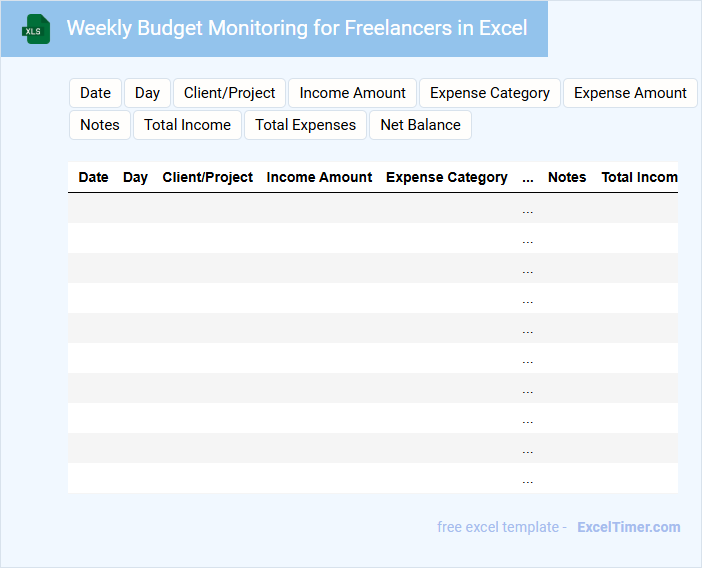

Weekly Budget Monitoring for Freelancers in Excel

What information is typically included in a Weekly Budget Monitoring document for Freelancers in Excel? This type of document usually contains detailed records of income, expenses, and budget allocations for each week to help freelancers track their financial progress. It often includes categories such as project earnings, recurring bills, variable expenses, and savings goals, providing a clear overview of cash flow.

What are important elements to consider when creating a Weekly Budget Monitoring sheet for freelancers? It is essential to include accurate date tracking, categorize expenses clearly, and update income regularly to maintain real-time budget accuracy. Additionally, incorporating visual aids like charts or conditional formatting can help freelancers easily identify overspending and optimize financial decisions.

Goal Planner with Weekly Budget for Freelancers

A Goal Planner with Weekly Budget for freelancers is a structured document designed to help individuals manage their objectives and finances efficiently. It typically contains sections for setting specific goals, tracking progress, and allocating weekly income and expenses. This tool aids freelancers in maintaining focus, budgeting wisely, and achieving both short-term and long-term success.

What key income sources should be included in a freelancer's weekly budget Excel document?

Include key income sources such as project fees, hourly consulting rates, retainer payments, royalty earnings, and affiliate commissions in a freelancer's weekly budget Excel document. Track income by client name, payment date, and amount to ensure accurate financial management. Incorporate any recurring payments or milestone bonuses for comprehensive budget planning.

How can expense categories be effectively organized in an Excel budget sheet for freelancers?

Organize expense categories in your Excel budget sheet by grouping them into fixed, variable, and occasional expenses to track spending patterns clearly. Use separate columns for category names, budgeted amounts, and actual expenses to monitor fluctuations efficiently. Incorporate dropdown lists and conditional formatting to streamline data entry and highlight budget variances automatically.

What formulas or Excel functions help track weekly savings or deficits for freelancers?

Excel functions like SUM, IF, and SUMIF help track your weekly savings or deficits by calculating total income versus expenses and highlighting shortfalls. The formula =SUM(income_range) - SUM(expense_range) shows net savings or deficits each week. Using conditional formatting with these formulas provides a visual alert for weeks with budget overruns.

How can freelancers use Excel to monitor and forecast irregular income patterns weekly?

Freelancers can use Excel to track weekly income and expenses by creating customizable budget templates that accommodate variable payment dates and amounts. Your sheet can include formulas to calculate totals, averages, and forecast future cash flow based on historical irregular patterns. Visual charts in Excel help identify trends, enabling better financial planning and stability despite fluctuating earnings.

Which visual tools in Excel (charts, conditional formatting) improve understanding of weekly budget trends?

Excel's line charts and bar graphs effectively visualize weekly income and expense trends, highlighting fluctuations and patterns. Conditional formatting uses color scales and data bars to instantly identify overspending or budget surpluses in Your weekly budget. Pivot tables offer dynamic summaries, enabling quick comparisons across different categories and weeks.