![]()

The Weekly Expense Tracker Excel Template for Solo Entrepreneurs offers a simple, organized way to monitor weekly spending and manage budgets effectively. This template helps solo entrepreneurs save time by automating expense calculations and categorizing costs for better financial insight. Maintaining accurate expense records aids in optimizing cash flow and preparing for tax season efficiently.

Weekly Expense Tracker with Category Breakdown

What information does a Weekly Expense Tracker with Category Breakdown typically contain? This document usually records daily expenses categorized by type, such as food, transportation, and entertainment. It helps individuals monitor spending patterns and manage budgets effectively by providing a clear overview of where money is allocated each week.

What important elements should be included for optimal use? Including date, expense description, category labels, and amount spent ensures detailed tracking. Additionally, summary sections for total spending and category-wise breakdowns support better financial analysis and decision-making.

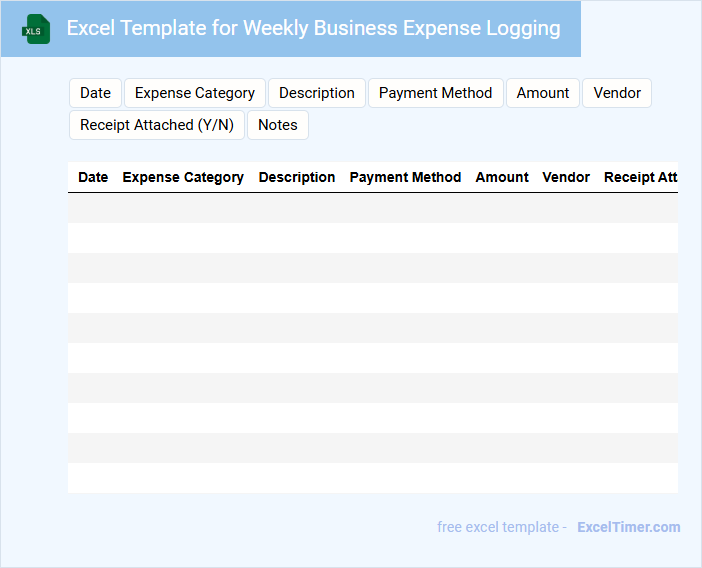

Excel Template for Weekly Business Expense Logging

An Excel Template for Weekly Business Expense Logging typically contains structured fields to record daily expenditures, categorize costs, and summarize total weekly expenses for efficient financial tracking.

- Expense Categories: Clearly defined categories help organize expenses for better analysis and reporting.

- Date Entries: Accurate date logging ensures proper chronological tracking of all expenses.

- Summary Calculations: Automatic totals and subtotals provide quick insights into weekly spending patterns.

Weekly Expense Report for Solo Entrepreneurs

A Weekly Expense Report for solo entrepreneurs typically contains detailed records of all financial transactions made throughout the week. It helps in tracking expenditures, categorizing costs, and managing budget efficiently.

Including income streams along with expenses provides a clear picture of financial health. Regularly updating this report is crucial to maintain accurate financial oversight and plan future investments.

Weekly Expense Tracking with Automated Summaries

Weekly Expense Tracking documents are designed to record and monitor all financial transactions within a specified week. They help individuals or businesses maintain a clear overview of their spending habits and control budgets effectively.

These documents often include detailed itemized lists, categorized expenses, and periodic summaries, enhancing clarity and decision-making. It is important to integrate an automated summary feature to quickly highlight key spending trends and discrepancies.

For optimal use, ensure accuracy in data entry and regularly review summaries to adjust financial strategies as needed.

Expense Tracker for Weekly Entrepreneurial Budgets

An Expense Tracker is a vital document used by entrepreneurs to monitor and manage their weekly budgets effectively. It typically contains detailed records of income, expenditures, and financial goals to ensure accurate tracking. For optimal results, it's important to categorize expenses clearly and review the tracker regularly to adjust spending habits and improve profitability.

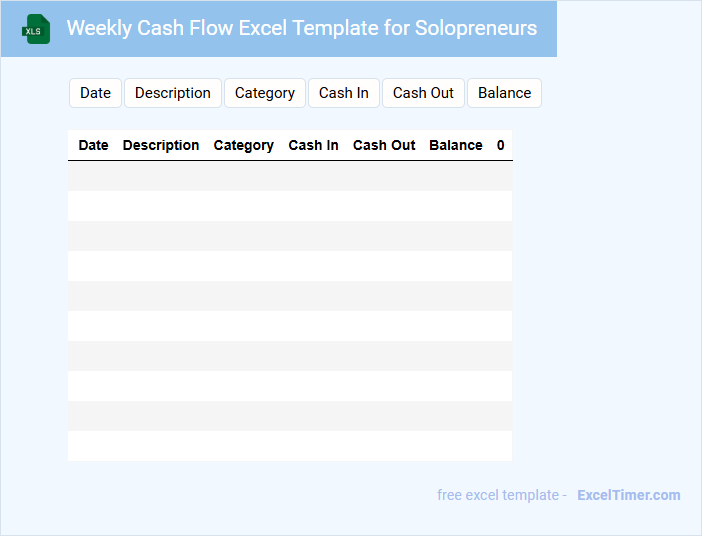

Weekly Cash Flow Excel Template for Solopreneurs

What information does a Weekly Cash Flow Excel Template for Solopreneurs typically contain? This document usually includes sections for tracking weekly income, expenses, and net cash flow, helping solopreneurs monitor their financial health in real time. It often features categorized entries to clearly differentiate between sales revenue, operational costs, and other cash movements.

What is an important consideration when using this template for solopreneurs? Accuracy in recording all cash inflows and outflows is essential to maintain a realistic financial overview, ensuring effective budgeting and forecasting. Additionally, regularly updating the template can help identify trends and manage cash flow challenges proactively.

Personal Expense Sheet with Weekly Overview

A Personal Expense Sheet with Weekly Overview typically contains detailed records of individual spending organized by week to help track and manage finances efficiently.

- Income tracking: Record all sources of income to maintain a clear understanding of available funds.

- Expense categorization: Group expenses into categories like food, transportation, and entertainment to identify spending patterns.

- Weekly summary: Include a weekly overview to easily compare spending against budget and adjust accordingly.

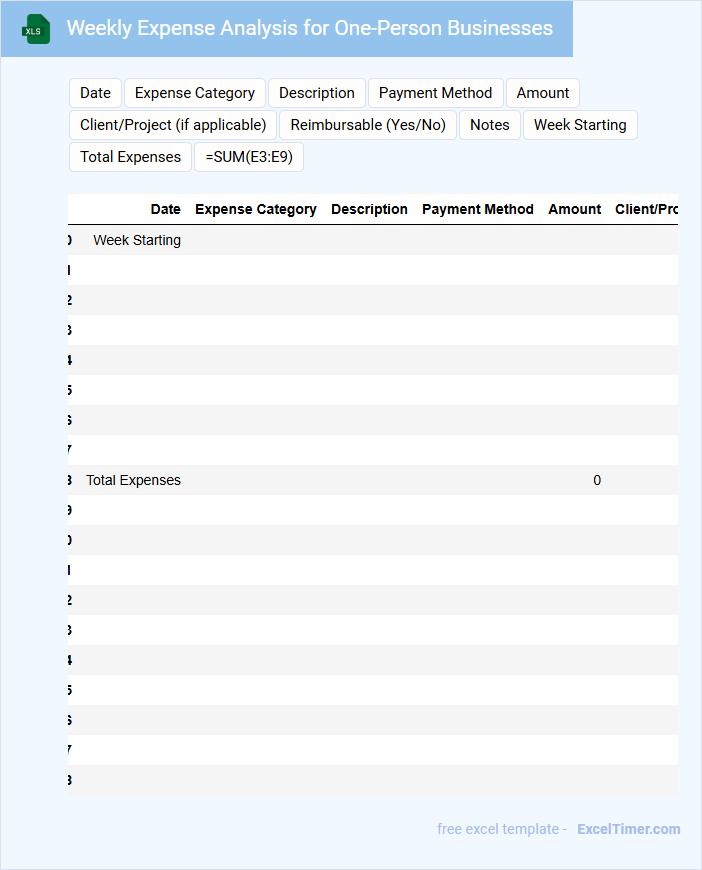

Weekly Expense Analysis for One-Person Businesses

A Weekly Expense Analysis document for one-person businesses typically contains a detailed record of all expenditures made during the week. It helps in tracking spending patterns and identifying areas where costs can be minimized. Key components include expense categories, amounts, dates, and notes for better financial clarity.

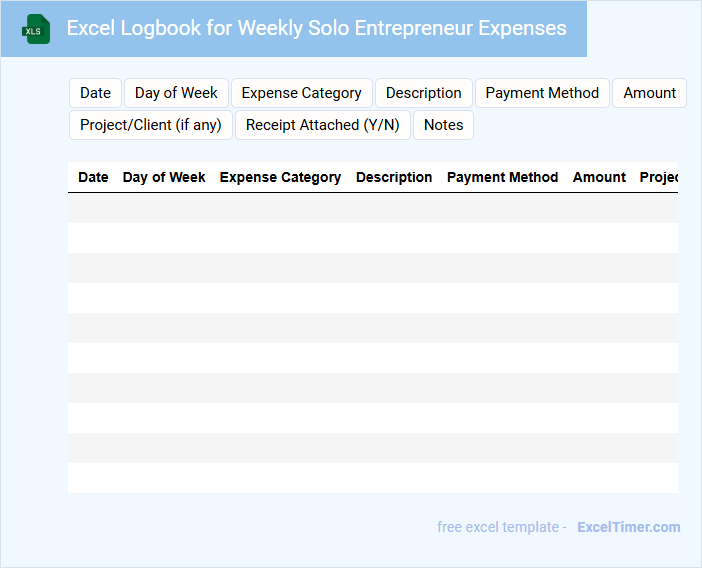

Excel Logbook for Weekly Solo Entrepreneur Expenses

An Excel Logbook for Weekly Solo Entrepreneur Expenses is a structured document used to track and manage all financial transactions on a weekly basis. It typically contains categories for income, operational costs, and miscellaneous expenditures, ensuring accurate cash flow monitoring. Maintaining this logbook helps solo entrepreneurs stay organized, monitor spending habits, and make informed budget decisions.

Weekly Budget and Expense Tracker for Self-Employed

A Weekly Budget and Expense Tracker for self-employed individuals is a document designed to monitor income and expenses on a weekly basis. It helps in maintaining financial discipline and ensuring cash flow is managed efficiently.

This type of document usually contains sections for recording earnings, categorizing expenses, and comparing actual spending against the budgeted amounts. Accurate tracking allows for better tax preparation and informed financial decisions.

It is important to regularly update the tracker and review it to identify spending patterns and opportunities for savings.

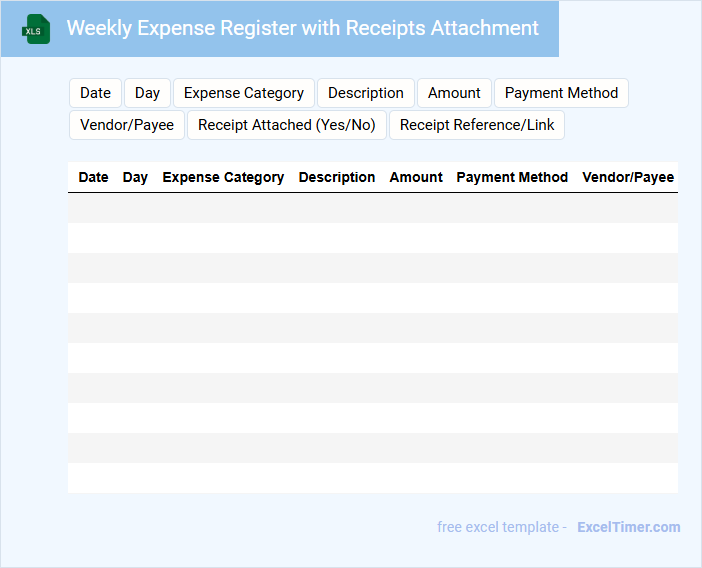

Weekly Expense Register with Receipts Attachment

A Weekly Expense Register is a document used to track and record all expenses incurred during the week. It typically includes dates, descriptions, amounts, and categories of expenses.

The inclusion of Receipts Attachment is essential for validating these expenses and maintaining accurate financial records. Organizing receipts by date and expense type helps in quick verification and auditing processes.

Ensure to update the register consistently and attach clear, legible copies of all receipts for effective expense management.

Excel Tracker for Weekly Startup Costs

An Excel Tracker for Weekly Startup Costs is a document designed to help entrepreneurs monitor and manage their expenses during the early stages of their business. It provides a structured and organized way to keep track of financial outflows on a weekly basis.

- Include categories for all types of expenses such as equipment, marketing, and utilities.

- Update the tracker weekly to maintain accurate and timely financial data.

- Use formulas to automatically calculate totals and remaining budgets for better financial oversight.

Weekly Expense Dashboard for Entrepreneurs

A Weekly Expense Dashboard for entrepreneurs typically includes a detailed overview of all expenditures made within the week, categorized by type such as marketing, operations, and utilities. It helps in tracking cash flow efficiently, ensuring that the business stays within budget. Regular monitoring through this dashboard is essential for making informed financial decisions and optimizing resource allocation.

Weekly Financial Tracker with Expense Categories

A Weekly Financial Tracker is a document designed to monitor and record income and expenses on a weekly basis. It typically includes various expense categories such as groceries, utilities, transportation, and entertainment to help organize spending. This type of tracker is essential for budgeting effectively and identifying spending patterns.

Important elements to include are clear category labels, date fields, and columns for both planned and actual expenses to facilitate accurate tracking. Using visual aids like color-coding or charts can enhance readability and quick analysis. Regularly updating and reviewing the tracker is crucial for maintaining financial discipline and achieving savings goals.

Weekly Expense Planner for Independent Business Owners

What does a Weekly Expense Planner for Independent Business Owners typically contain? This document usually includes detailed categories of business expenses, such as supplies, utilities, and marketing costs, along with spaces to record amounts and dates of each transaction. It helps owners track spending patterns and manage cash flow effectively over the course of a week.

Why is it important to customize expense categories? Tailoring categories to fit specific business needs ensures all relevant costs are captured, providing a clearer financial picture. Regularly updating and reviewing this planner can improve budgeting accuracy and support better financial decision-making.

What are the key categories to include in a Weekly Expense Tracker for solo entrepreneurs?

Key categories in a Weekly Expense Tracker for solo entrepreneurs include Office Supplies, Marketing and Advertising, Travel and Transportation, Software and Subscriptions, Meals and Entertainment, Utilities, and Professional Services. Tracking these categories helps you monitor spending patterns and optimize budget allocation effectively. Accurate categorization enables detailed financial analysis and improves expense management.

How can you automate calculation of weekly totals and category-wise spending in Excel?

Automate weekly totals and category-wise spending in your Excel Weekly Expense Tracker by using SUMIF and SUM functions to dynamically aggregate expenses based on dates and categories. Implement Excel tables with structured references for easier data management and create PivotTables for detailed weekly and category analysis. Utilize formulas combined with named ranges to enhance clarity and accuracy in your financial tracking.

Which essential columns should be included to optimize data analysis for expenses?

Your Weekly Expense Tracker for Solo Entrepreneurs should include essential columns such as Date, Expense Category, Payment Method, Vendor/Payee, Description, Amount, and Receipt Status. These columns optimize data analysis by enabling clear categorization, tracking payment types, and verifying transactions. Including a Notes column can provide additional context for each expense, enhancing financial insights.

How do you set up conditional formatting to highlight overspending in your Excel tracker?

Set up conditional formatting in your Weekly Expense Tracker by selecting the expense cells, then choosing "New Rule" and using a formula to highlight amounts exceeding your budget limits. Use a formula like =B2>BudgetCell to flag overspending and apply a red fill for easy visibility. This visual alert helps you manage your expenses and maintain financial control efficiently.

What formula can track and compare week-over-week expense trends effectively?

Use the formula =SUMIFS(ExpensesRange, WeekRange, CurrentWeek) to total weekly expenses and =SUMIFS(ExpensesRange, WeekRange, PreviousWeek) for the prior week. Apply =(CurrentWeekTotal - PreviousWeekTotal)/PreviousWeekTotal to calculate week-over-week expense changes as a percentage. Your Weekly Expense Tracker will efficiently highlight expense trends and support informed financial decisions.