The Weekly Payroll Excel Template for Restaurant Staff streamlines employee wage calculations, tracking hours, tips, and deductions efficiently. This template ensures accurate payment management, reducing errors and saving time for restaurant managers. Customizable fields allow easy adaptation to various payroll policies and labor regulations.

Weekly Payroll Excel Template for Restaurant Staff

What information does a Weekly Payroll Excel Template for Restaurant Staff typically contain? This document usually includes employee details, hours worked, pay rates, and total wages for each staff member, ensuring accurate weekly compensation. It also tracks tips, deductions, and overtime, helping restaurant managers maintain clear and organized payroll records efficiently.

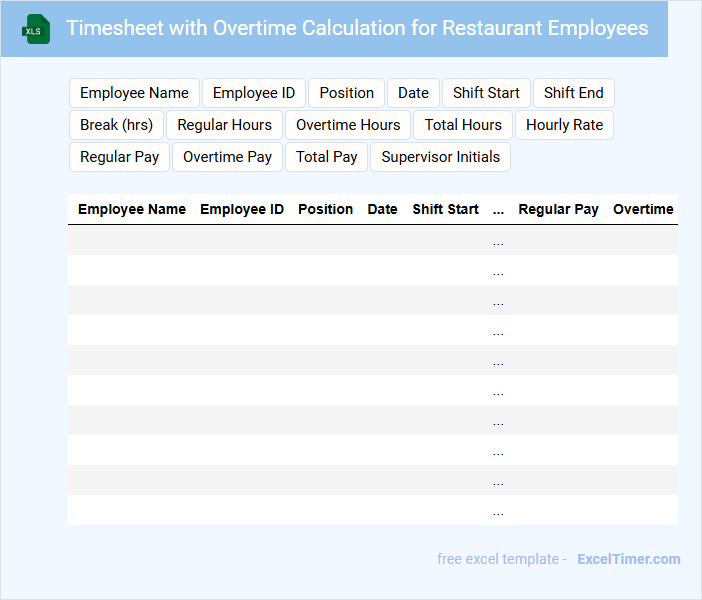

Timesheet with Overtime Calculation for Restaurant Employees

A Timesheet with Overtime Calculation for Restaurant Employees records working hours, including regular and extra hours. It helps track employee attendance and ensure accurate payroll.

Accurate overtime calculation is crucial for fair compensation and labor law compliance. Clear documentation supports dispute resolution and efficient workforce management.

Payroll Summary Sheet for Restaurant Staff

The Payroll Summary Sheet for restaurant staff typically contains detailed information about employees' working hours, wages, tips, and deductions for a specific pay period. It helps in ensuring accurate and timely salary payments while maintaining compliance with labor laws.

Key data such as overtime, bonuses, and taxes are also included to provide a clear financial overview for both the employer and employees. Maintaining confidentiality and regularly updating employee details are essential for an effective payroll system.

Weekly Wage Report for Restaurant Workers

The Weekly Wage Report for restaurant workers typically contains detailed information about the hours worked, hourly rates, and total earnings for each employee. It also includes deductions, tips received, and any overtime payments made during the week.

Ensuring accuracy and timely submission of the report is crucial for payroll processing and compliance with labor laws. Including clear employee identification and work period dates helps maintain transparency and avoid discrepancies.

Employee Attendance and Payroll Tracker for Restaurants

This document typically contains detailed records of employee attendance including clock-in and clock-out times, absences, and leave balances. It also incorporates payroll information such as hours worked, overtime, and salary calculations.

Tracking these elements helps ensure accurate and timely payment processing while maintaining compliance with labor laws. Implementing automated time tracking tools is highly recommended to minimize errors and improve efficiency.

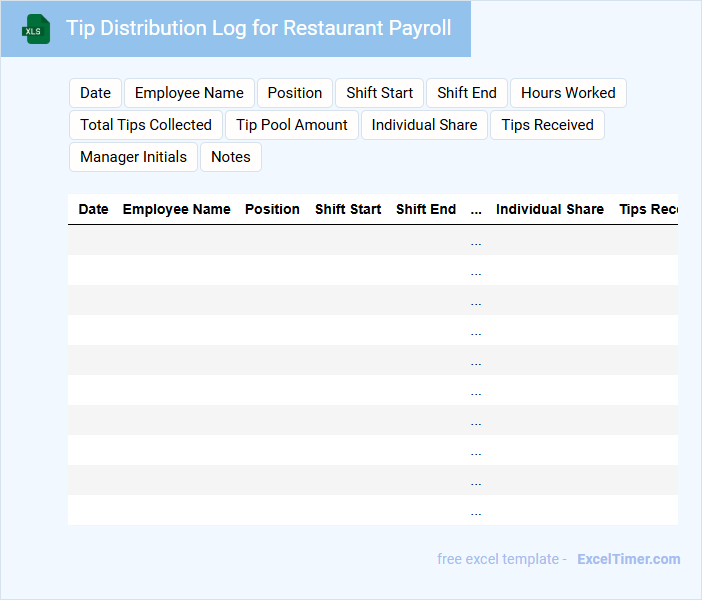

Tip Distribution Log for Restaurant Payroll

A Tip Distribution Log for restaurant payroll is a crucial document that records the allocation of tips among staff members. It typically contains detailed entries including date, employee names, hours worked, and amounts of tips distributed. Maintaining this log ensures transparency and compliance with labor laws.

Important considerations include accurately tracking daily tips, verifying employee hours, and regularly reviewing the log for discrepancies. Automated systems or digital records can improve accuracy and reduce errors. Always ensure the log is accessible for audits and payroll processing.

Work Hours Calculation Sheet for Restaurant Staff

A Work Hours Calculation Sheet for restaurant staff typically contains detailed records of employee clock-in and clock-out times, total hours worked, and any overtime accumulated. It is essential for accurate payroll processing and ensuring compliance with labor laws.

Such documents often include sections for breaks, shift differentials, and leave deductions to maintain fairness and transparency. Regularly updating and securely storing this sheet is crucial to prevent discrepancies and manage staffing efficiently.

Payroll Register Template for Restaurant Employees

A Payroll Register Template for Restaurant Employees is a document used to record and track employee wages, hours worked, and deductions. It ensures accurate payroll processing and compliance with labor laws.

- Include employee details such as name, ID, and position.

- Record hours worked, overtime, and pay rates clearly.

- List deductions like taxes, benefits, and tips separately.

Weekly Pay Slip Generator for Restaurant Staff

A Weekly Pay Slip Generator for restaurant staff typically contains detailed information about employees' hours worked, hourly rates, and total earnings for the week. It also includes deductions such as taxes and any applicable benefits or bonuses. Ensuring accuracy and clarity in these documents helps maintain transparency and trust between the restaurant management and employees.

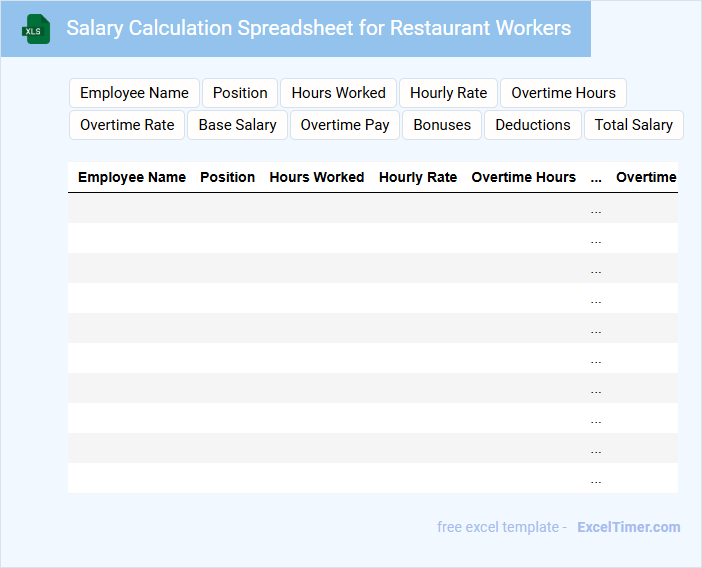

Salary Calculation Spreadsheet for Restaurant Workers

What information does a Salary Calculation Spreadsheet for Restaurant Workers typically contain? This type of document usually includes employee details, hours worked, hourly rates, and additional earnings like tips or bonuses. It helps in calculating gross and net salaries efficiently while keeping track of deductions and taxes.

What is an important aspect to consider when creating this spreadsheet? Accuracy in data entry and clear categorization of pay components are essential to avoid payment errors and ensure compliance with labor laws. Additionally, incorporating formulas for automatic calculations can save time and reduce mistakes.

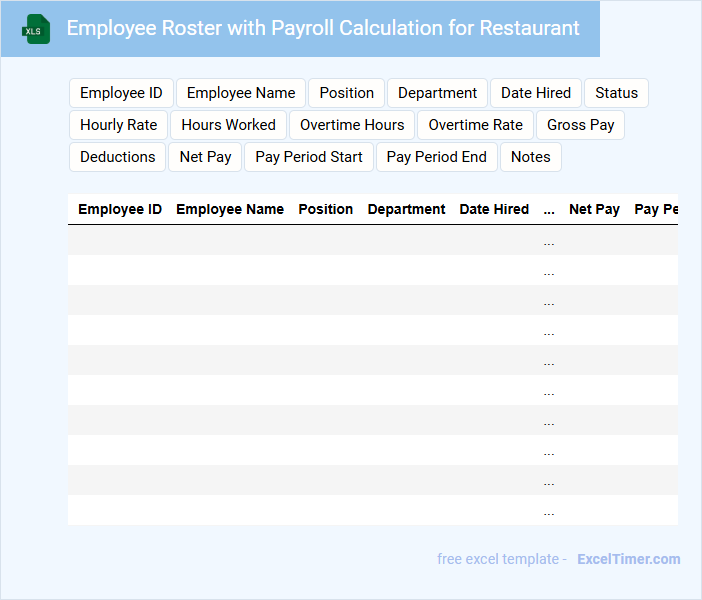

Employee Roster with Payroll Calculation for Restaurant

An Employee Roster with Payroll Calculation for a restaurant typically includes a detailed list of staff members, their scheduled working hours, and wage rates. This document integrates hours worked to accurately calculate total payroll expenses, considering factors such as overtime and tips. Ensuring accuracy in this roster helps maintain transparent payroll management and compliance with labor laws.

Shift and Payroll Planner for Restaurant Staff

The Shift and Payroll Planner for restaurant staff is a crucial document that outlines employee work schedules and corresponding compensation details. It ensures efficient management of staff shifts while accurately tracking payroll information.

This planner typically contains shift timings, break periods, employee roles, hourly wages, and overtime calculations. Including clear attendance records and compliance with labor laws is essential for maintaining transparency and fairness.

Staff Payment Tracker for Restaurant Payroll

A Staff Payment Tracker for restaurant payroll is a crucial document that records employee wages, hours worked, and payment schedules. It typically includes detailed information such as employee names, job roles, hourly rates, and total earnings for each pay period. This tracker helps ensure accurate and timely payments, maintaining transparency and compliance with labor laws.

For effective management, it is important to regularly update the tracker with overtime hours, tips, and deductions to reflect true compensation. Implementing automated calculations reduces human errors and speeds up payroll processing. Keeping clear records also aids in resolving disputes and preparing for audits.

Overtime and Deductions Sheet for Restaurant Employees

An Overtime and Deductions Sheet for restaurant employees typically contains detailed records of extra hours worked beyond standard shifts, along with any applicable deductions such as taxes or meal costs. This document helps employers ensure accurate payroll processing and compliance with labor laws. Including clear, itemized entries for each employee promotes transparency and minimizes disputes.

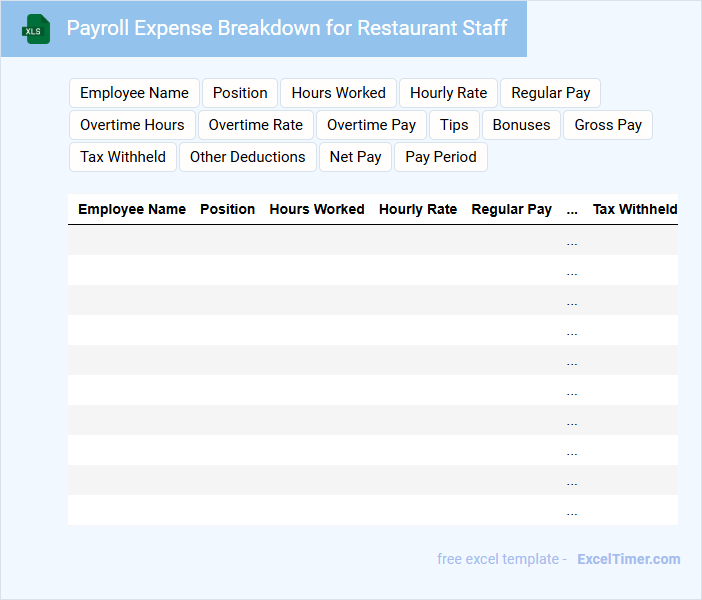

Payroll Expense Breakdown for Restaurant Staff

What information is typically included in a Payroll Expense Breakdown for Restaurant Staff? This document usually details all salary components, including wages, overtime, bonuses, and applicable taxes for each employee. It provides a clear financial overview to help manage labor costs effectively and ensure compliance with payroll regulations.

What are the essential columns needed to accurately track weekly payroll for restaurant staff in an Excel document?

Essential columns for accurately tracking weekly payroll in a restaurant staff Excel document include Employee Name, Position, Hours Worked, Hourly Rate, Overtime Hours, Overtime Rate, Gross Pay, Deductions (taxes, benefits), and Net Pay. Including Employee ID and Pay Period ensures organized data management and clear payroll timelines. These columns enable precise calculation and verification of employee earnings and payroll compliance.

How can Excel formulas be used to automatically calculate total weekly wages, including overtime?

Excel formulas can calculate total weekly wages by multiplying hourly rates by regular hours and adding overtime pay based on hours worked beyond standard thresholds. You can use the IF function to apply overtime rates for hours exceeding 40 per week, ensuring accurate wage computation. This automation streamlines payroll processing and minimizes manual errors for your restaurant staff.

What methods ensure proper documentation of different pay rates for various restaurant roles (e.g., cooks, servers, bartenders)?

Use separate columns for role-specific hourly rates within the payroll sheet to capture varied pay scales for cooks, servers, and bartenders accurately. Implement data validation lists to standardize role entries and link roles to predefined pay rates through lookup functions like VLOOKUP or INDEX-MATCH. Maintain a role-rate reference table to ensure consistency and ease of updates across weekly payroll calculations.

How can s help track staff attendance, shift schedules, and hours worked for payroll processing?

Excel templates streamline tracking staff attendance, shift schedules, and hours worked by organizing data into clear, customizable spreadsheets. Your payroll processing benefits from automated calculations and easy updating of employee hours, reducing errors and saving time. This structured approach ensures accurate weekly payroll for restaurant staff, enhancing overall efficiency.

What features in Excel enhance data security and privacy of sensitive payroll information for restaurant employees?

Excel enhances data security for restaurant payroll through password protection, which restricts unauthorized access to sensitive employee information. It also offers sheet and workbook encryption using AES 256-bit encryption, ensuring confidential payroll data remains private. Additionally, Excel supports hiding formulas and locking cells to prevent tampering with payroll calculations.