The Annually Budget Planner Excel Template for Nonprofits is designed to streamline financial management by providing a clear structure for tracking income and expenses throughout the year. It allows organizations to allocate resources effectively, forecast future budgets, and identify funding gaps with ease. Accurate budgeting using this template supports transparency and accountability, crucial for maintaining donor trust and regulatory compliance.

Annual Budget Planner with Expense Tracking for Nonprofits

An Annual Budget Planner with Expense Tracking for Nonprofits is a crucial document that helps organizations plan their yearly finances and monitor spending to ensure accountability and transparency. It typically contains detailed income sources, projected expenses, and actual expenditures throughout the year.

- Include clear categories for income and expenses to simplify tracking and reporting.

- Update the document regularly to reflect actual spending versus budgeted amounts.

- Incorporate notes on variances to explain significant differences between planned and actual figures.

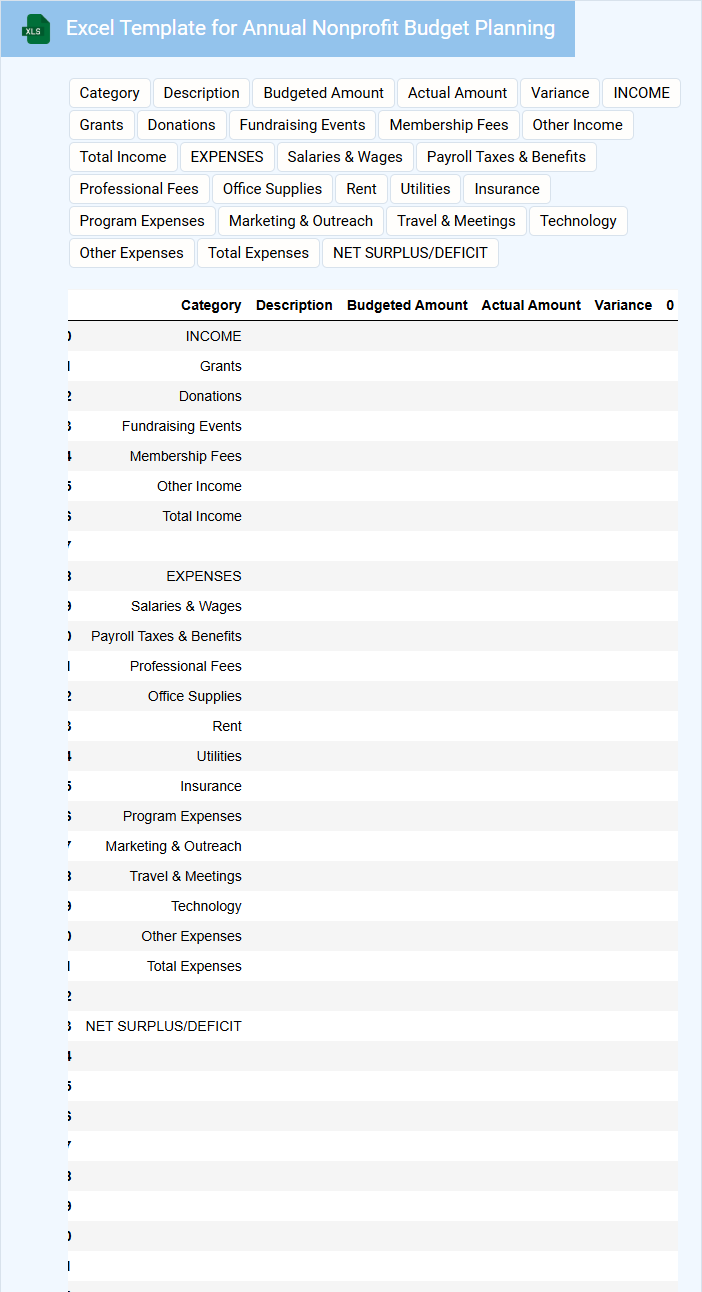

Excel Template for Annual Nonprofit Budget Planning

What is typically included in an Excel Template for Annual Nonprofit Budget Planning? This document usually contains sections for projected income, expenses, and funding sources tailored to nonprofit activities. It helps organizations allocate resources effectively and plan financial strategies for the upcoming year.

What is an important aspect to consider when using this template? Ensuring accuracy in data entry and regularly updating actual figures against projections is crucial for maintaining financial transparency and making informed decisions. Additionally, incorporating categories aligned with the nonprofit's programs enhances budget relevance and accountability.

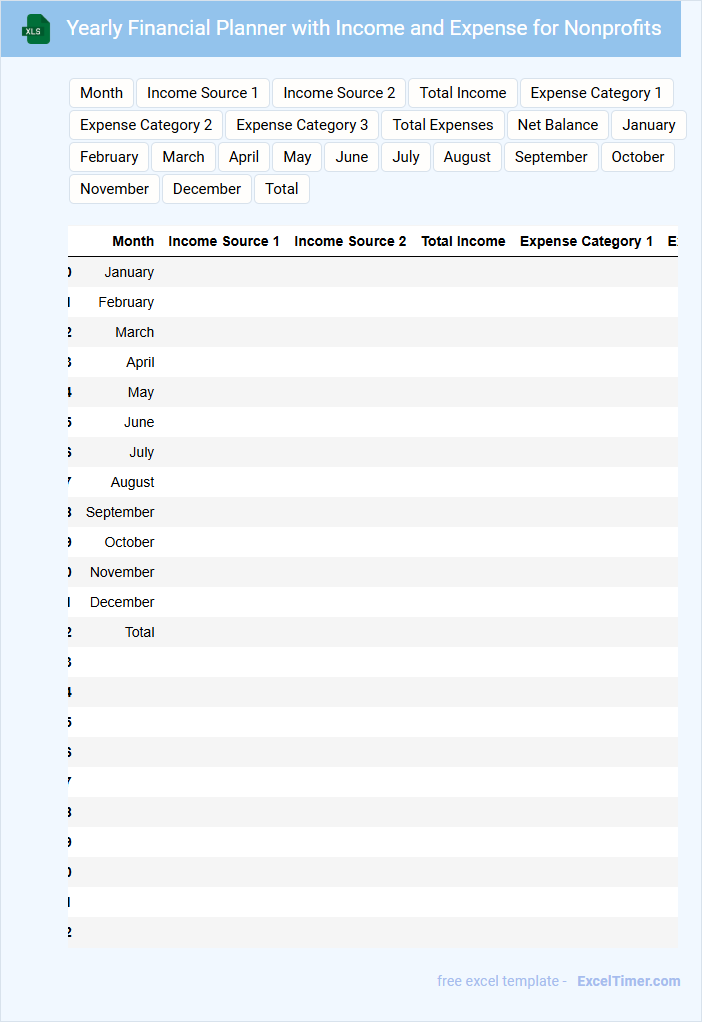

Yearly Financial Planner with Income and Expense for Nonprofits

A Yearly Financial Planner for nonprofits typically contains a detailed overview of the organization's projected income and expenses for the upcoming year. It helps track funding sources, budget allocations, and anticipated operational costs to ensure financial stability and transparency. Including clear categories for various revenue streams and expense types is essential for effective financial management.

Important elements to consider are regular updates to reflect actual income and expenses, setting realistic financial goals, and monitoring cash flow to avoid shortages. Nonprofits should also incorporate contingency plans for unexpected costs and allocate funds for program growth or emergency reserves. Ensuring all financial activities align with the organization's mission supports accountability and sustains donor trust.

Annual Grant and Donation Tracking Excel Template for Nonprofits

The Annual Grant and Donation Tracking Excel Template for nonprofits is designed to efficiently manage and monitor financial contributions throughout the year. It typically contains sections for donor details, donation amounts, dates, and grant status updates. This document helps organizations maintain transparent records and ensure compliance with reporting requirements.

For optimal use, it is important to regularly update the template with accurate data and categorize donations by source and purpose. Automating calculations and summary charts within the template can improve tracking efficiency and provide quick insights. Additionally, securing donor information and backing up the file frequently are essential to protect sensitive information.

Budget Forecasting with Variance Analysis for Nonprofit Organizations

What does a Budget Forecasting with Variance Analysis document typically contain for nonprofit organizations? This type of document usually includes projected income and expenses alongside actual financial results to assess fiscal performance. It describes deviations between expected and actual figures to help organizations manage resources effectively and improve future budgeting.

What is an important aspect to focus on in such a document? Emphasizing clear identification of key variances and their causes is crucial for nonprofits to adapt strategies and ensure alignment with mission goals. Accurate forecasting combined with detailed variance analysis supports transparency and informed decision-making.

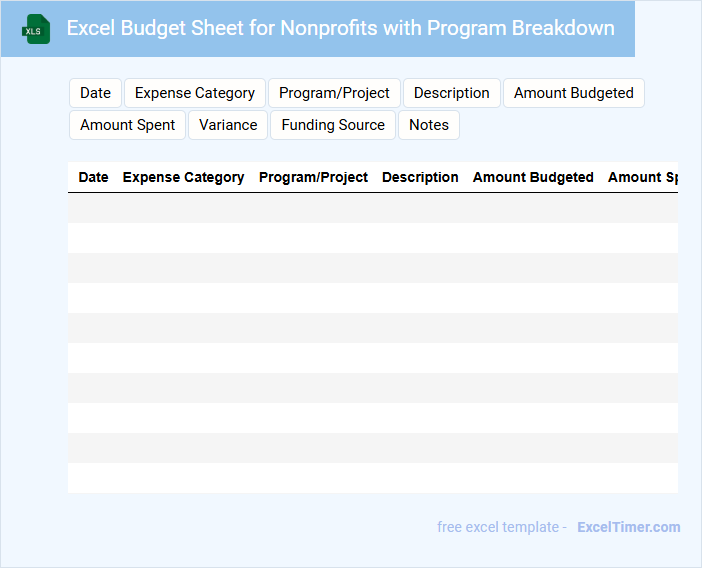

Excel Budget Sheet for Nonprofits with Program Breakdown

An Excel Budget Sheet for Nonprofits typically contains detailed financial data organized to help track income, expenses, and allocate funds effectively. It often includes sections for different revenue sources, expense categories, and breakdowns by program to ensure clear visibility into where resources are being used. This type of document is essential for maintaining transparency and supporting strategic financial planning within nonprofit organizations.

Important considerations include ensuring accurate categorization of all program costs, maintaining up-to-date records to reflect real-time financial status, and incorporating a summary section that highlights total budget allocation and variances. Additionally, using formulas to automate calculations can enhance efficiency and reduce errors. Clear labeling and detailed program breakdowns help stakeholders understand financial priorities and impact.

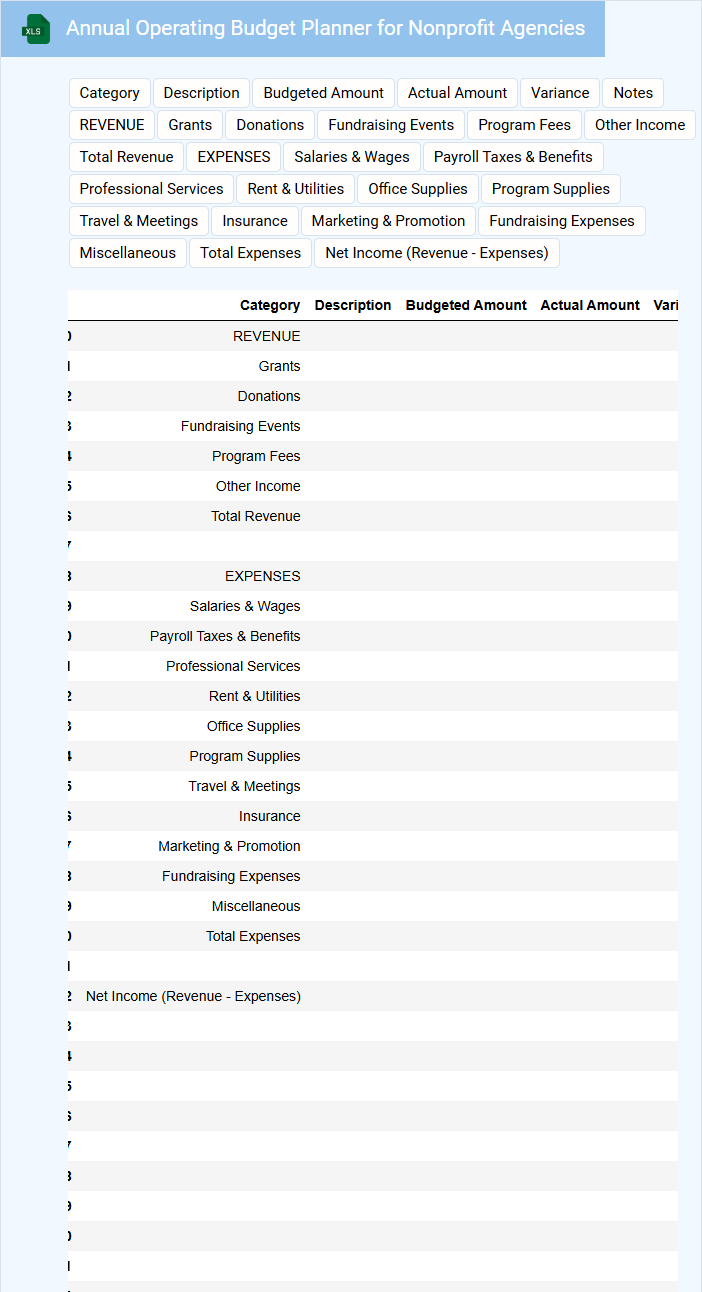

Annual Operating Budget Planner for Nonprofit Agencies

An Annual Operating Budget Planner for nonprofit agencies typically contains detailed projections of income and expenses over the fiscal year. It helps organizations allocate resources efficiently to meet their goals while ensuring financial sustainability. Key components include funding sources, program costs, and administrative expenses to provide a clear financial roadmap.

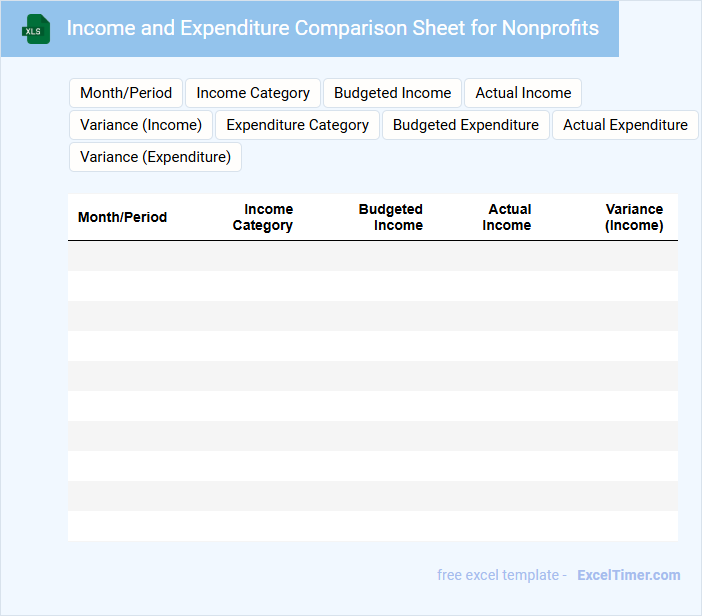

Income and Expenditure Comparison Sheet for Nonprofits

What information does an Income and Expenditure Comparison Sheet for Nonprofits usually contain?

This document typically includes detailed records of the organization's income sources and expenditure categories over a specific period. It helps nonprofits compare actual financial performance against budgeted figures to ensure transparency and accountability.

What is an important suggestion for maintaining this document effectively?

Ensure accurate and consistent data entry from all departments to provide a reliable financial overview. Regularly updating and reviewing the sheet allows nonprofits to make informed decisions and maintain financial health.

Annual Expense Tracker with Fund Source for Nonprofits

An Annual Expense Tracker for nonprofits is a crucial document that records all expenditures over the fiscal year, ensuring transparency and accountability. It typically contains detailed information about expense categories, amounts spent, and the corresponding fund sources supporting each expense. This document helps in effective budgeting, financial planning, and compliance with funding requirements.

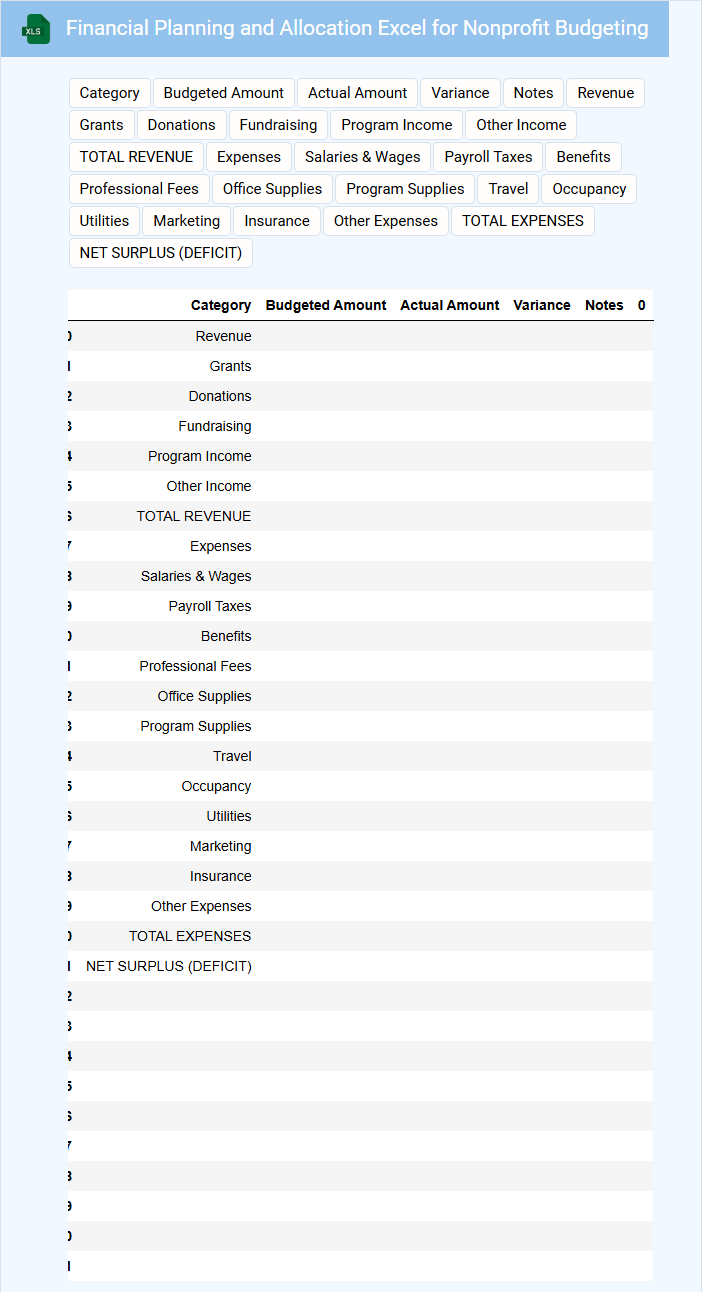

Financial Planning and Allocation Excel for Nonprofit Budgeting

A Financial Planning and Allocation Excel document is typically used by nonprofits to organize their budget, track expenses, and forecast future financial needs. It helps ensure that resources are allocated efficiently and supports transparent financial decision-making.

Such spreadsheets usually contain income sources, expense categories, funding timelines, and variance analysis. An important suggestion is to regularly update the document to maintain accuracy and support strategic planning.

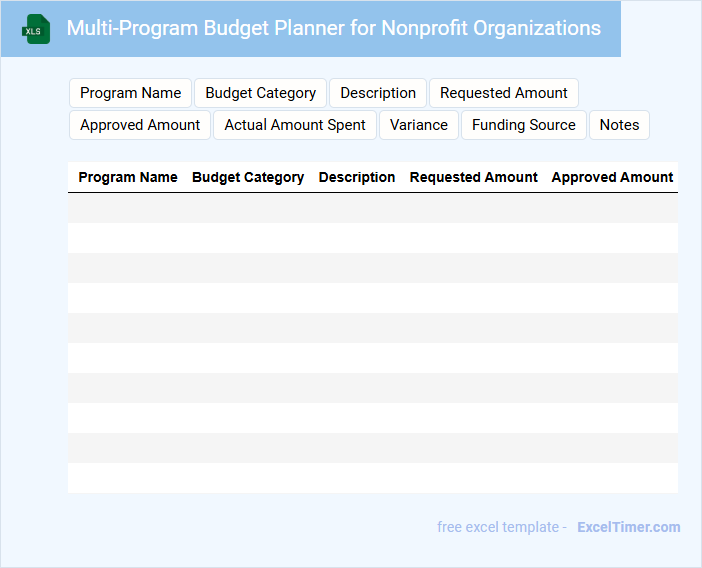

Multi-Program Budget Planner for Nonprofit Organizations

A Multi-Program Budget Planner for Nonprofit Organizations is a document that outlines the financial allocation across various programs run by a nonprofit. It helps in tracking expenses and revenues specific to each program, ensuring transparent and accountable fund management.

This document typically contains projected income sources, program-specific expenses, and overall budget summaries to support strategic planning. It is important to include clear assumptions and regularly update financial data for accuracy and effective decision-making.

Annual Budget vs Actual Tracking for Nonprofits in Excel

Annual Budget vs Actual Tracking for Nonprofits in Excel is a crucial document that helps organizations monitor their financial performance by comparing planned budgets against actual expenditures. This tracking ensures transparency and accountability, making it easier to identify variances and adjust strategies accordingly. It typically contains detailed income, expenses, and variance analysis to facilitate informed decision-making.

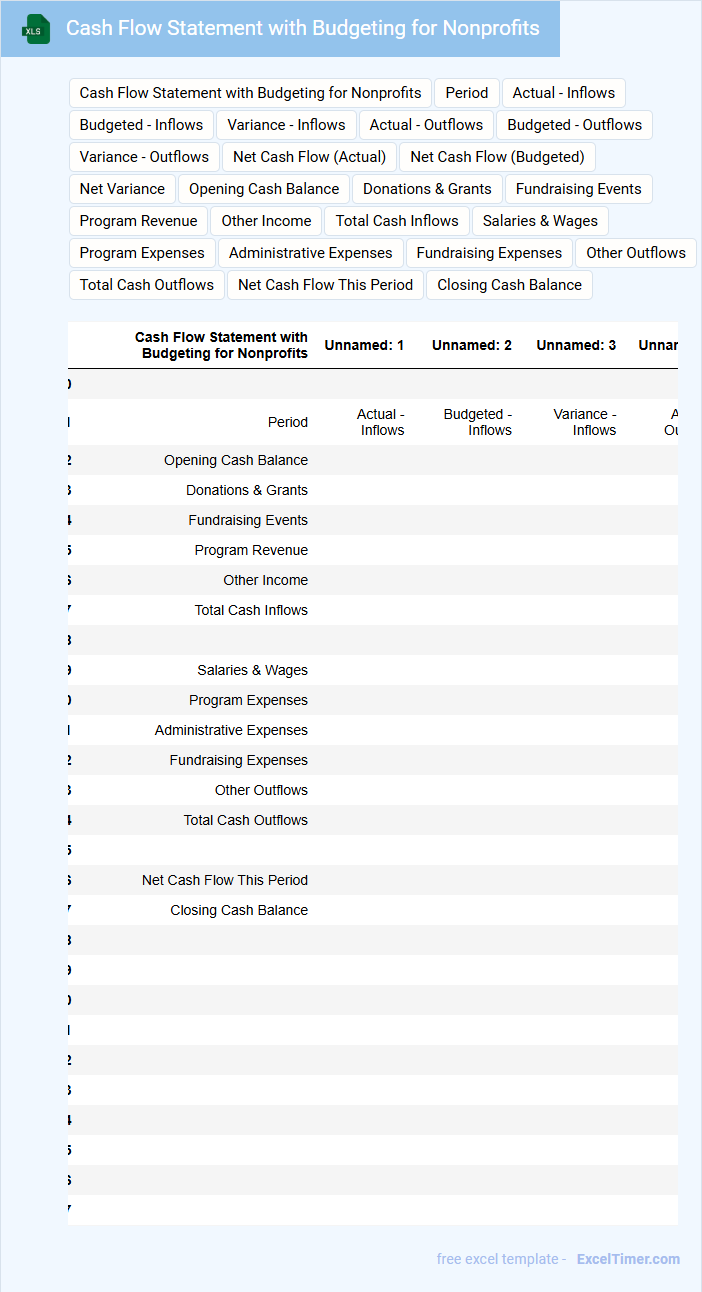

Cash Flow Statement with Budgeting for Nonprofits

The Cash Flow Statement with budgeting for nonprofits is a financial document that tracks the inflow and outflow of cash to ensure the organization maintains liquidity. It typically contains sections detailing operational, investing, and financing activities, alongside budget comparisons to monitor financial health. This statement helps nonprofits manage funds effectively to meet their mission-driven goals while ensuring accountability and transparency to stakeholders.

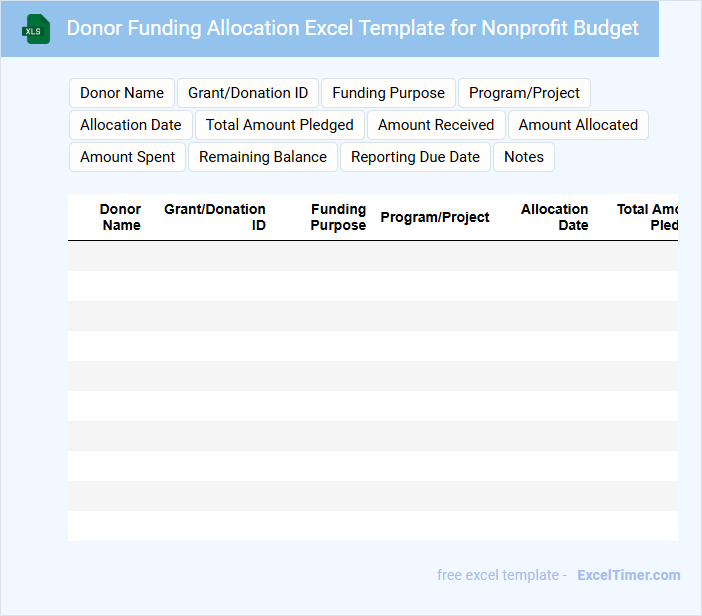

Donor Funding Allocation Excel Template for Nonprofit Budget

A Donor Funding Allocation Excel Template for Nonprofit Budget is a structured spreadsheet used to track and manage the distribution of donor funds across various nonprofit projects. It helps organizations ensure transparency and efficient use of resources.

- Clearly categorize funding sources and allocate amounts to specific programs.

- Include formulas to automatically calculate totals and remaining balances.

- Maintain detailed notes for each allocation to support accountability and reporting.

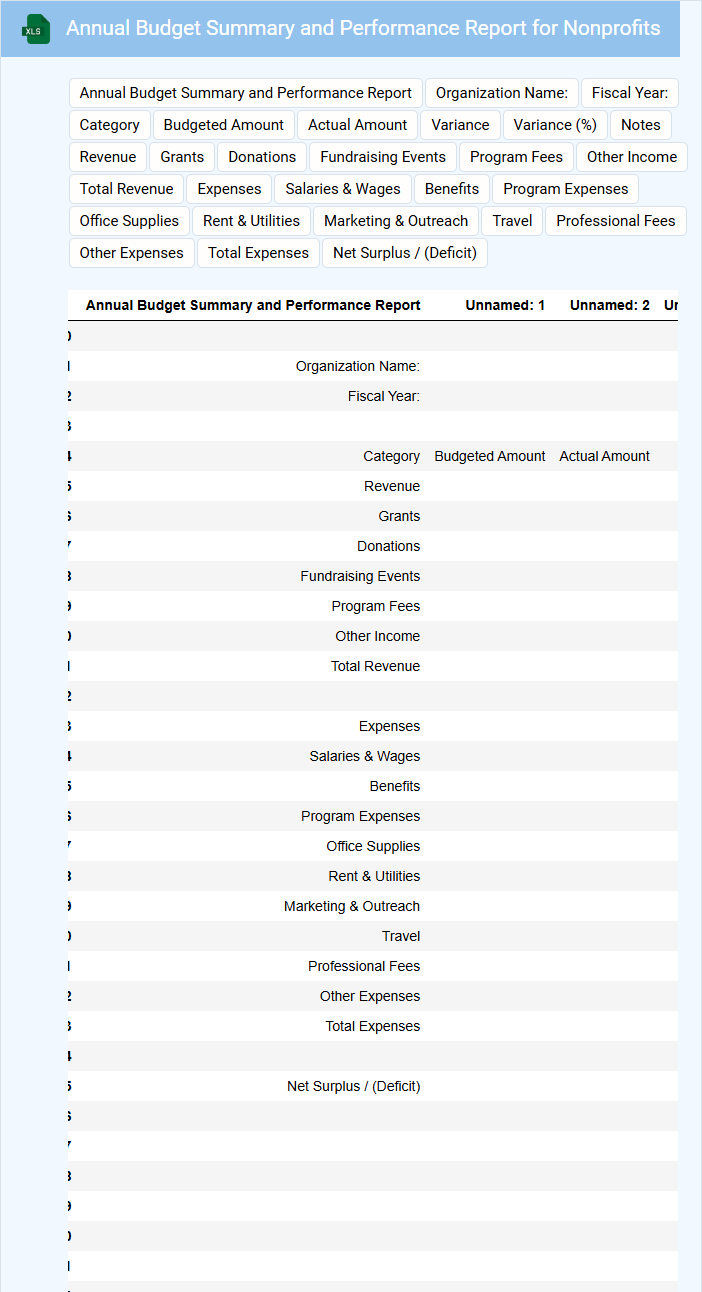

Annual Budget Summary and Performance Report for Nonprofits

An Annual Budget Summary and Performance Report for Nonprofits typically outlines the financial planning and operational outcomes of the organization over the year. It provides stakeholders with transparency about resource allocation and program effectiveness.

- Include a clear breakdown of income sources and expenditure categories.

- Highlight key performance metrics related to mission-driven activities.

- Ensure narrative explanations accompany financial figures for context.

What key expense categories should be included in an annually budget planner for nonprofits?

An annual budget planner for nonprofits should include key expense categories such as program services, administrative costs, fundraising expenses, salaries and wages, office supplies, and marketing. Accurate tracking of these categories ensures effective allocation of funds and transparency in financial reporting. Including categories for grants and operational costs supports comprehensive budget management for nonprofit sustainability.

How can nonprofits forecast annual revenue sources accurately within an Excel budget document?

Nonprofits can forecast annual revenue sources accurately within an Excel budget document by categorizing income streams such as grants, donations, and fundraising events, then applying historical data trends and growth rate assumptions. Utilizing Excel functions like SUMIFS and pivot tables enables dynamic analysis and real-time updates of revenue projections. Integrating scenario analysis tools and data validation ensures more reliable and flexible budget forecasts.

What formulas and functions are essential for tracking budget variances throughout the year?

Essential formulas for tracking budget variances in an Annual Budget Planner for Nonprofits include the SUM function to aggregate total expenses and revenues, and the IF function to flag budget overruns. The VLOOKUP or INDEX-MATCH functions enable dynamic reference of budget categories, while the VARIANCE formula (Actual Amount - Budgeted Amount) quantifies differences. Conditional formatting based on these variances visually highlights areas requiring attention, ensuring accurate financial monitoring throughout the year.

How should restricted and unrestricted funds be represented in the annually budget planner?

In the Annual Budget Planner for Nonprofits, restricted funds must be categorized separately to ensure compliance with donor-imposed limitations and accurate tracking of specific program expenditures. Unrestricted funds should be allocated to general operating expenses and flexible program costs, allowing for organizational sustainability and responsive budgeting. Clear sections or columns for both fund types enhance transparency and financial accountability in reporting.

What columns and data visualization tools in Excel help monitor budget allocation and spending trends?

Key columns such as Program Name, Budgeted Amount, Actual Spending, Variance, and Expense Category enable detailed tracking of nonprofit budgets. Excel features like PivotTables and PivotCharts efficiently summarize budget allocation and spending trends by category or period. Conditional formatting highlights variances, while line and bar charts visually represent spending patterns and budget adherence over time.