The Annually Tax Preparation Excel Template for Self-Employed simplifies tracking income, expenses, and deductions throughout the year, ensuring accurate tax filing. This template helps organize financial data efficiently, reducing errors and saving time during tax season. It is essential for self-employed individuals looking to maximize deductions and stay compliant with tax regulations.

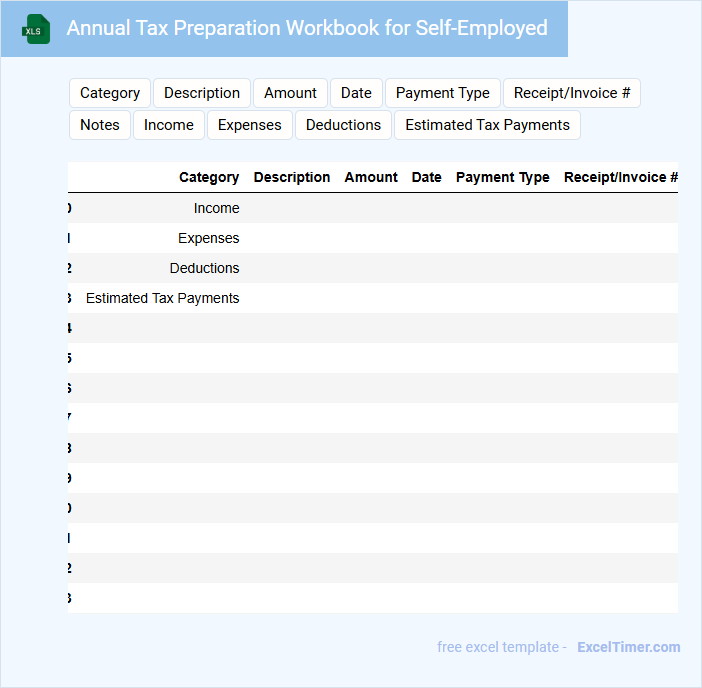

Annual Tax Preparation Workbook for Self-Employed

What information is typically included in an Annual Tax Preparation Workbook for the Self-Employed? This document generally contains sections for recording income, expenses, deductions, and tax credits specifically relevant to self-employed individuals. It helps organize financial data throughout the year to ensure accurate and efficient tax filing.

What important advice should self-employed individuals consider when using this workbook? It is crucial to keep detailed records of all business-related transactions and categorize expenses appropriately to maximize deductible items. Additionally, regularly updating the workbook can prevent last-minute stress and potential errors during tax season.

Income and Expense Tracker for Self-Employed Tax Filing

An Income and Expense Tracker for Self-Employed Tax Filing is a document used to record all earnings and expenditures related to freelance or self-employment activities. It helps in organizing financial data crucial for accurate tax reporting and maximizing deductions.

- Include detailed entries of all income sources with dates and amounts.

- Track all business-related expenses, categorizing them clearly.

- Maintain copies of receipts and invoices for proof during audits.

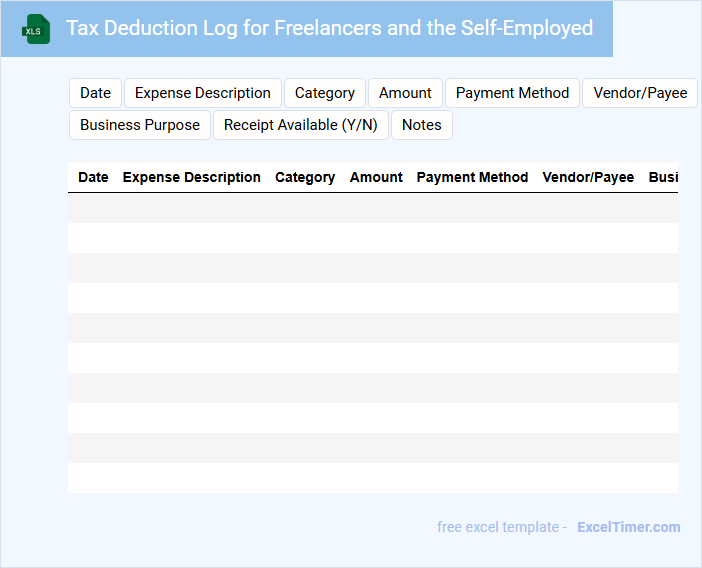

Tax Deduction Log for Freelancers and the Self-Employed

A Tax Deduction Log for freelancers and the self-employed is a crucial document that helps track all deductible expenses throughout the fiscal year. It ensures accurate record-keeping for tax filing and maximizes potential savings by documenting every eligible deduction.

This type of log typically contains details such as date, expense description, amount, and category of the deduction. Maintaining consistency and organizing receipts are important to support claims in case of an audit.

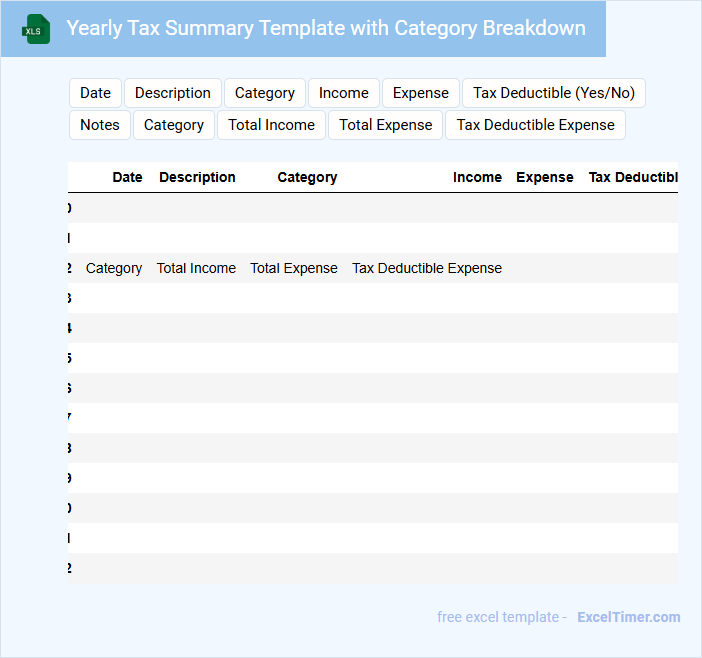

Yearly Tax Summary Template with Category Breakdown

Yearly Tax Summary Template with Category Breakdown typically contains an overview of annual income, detailed categorization of expenses, and total tax liabilities for clear financial analysis.

- Income Summary: A comprehensive list of all sources of income received during the year.

- Expense Categories: Organized breakdown of deductible expenses to accurately calculate taxable income.

- Tax Calculation: Total tax owed or refunded based on the summarized income and expenses.

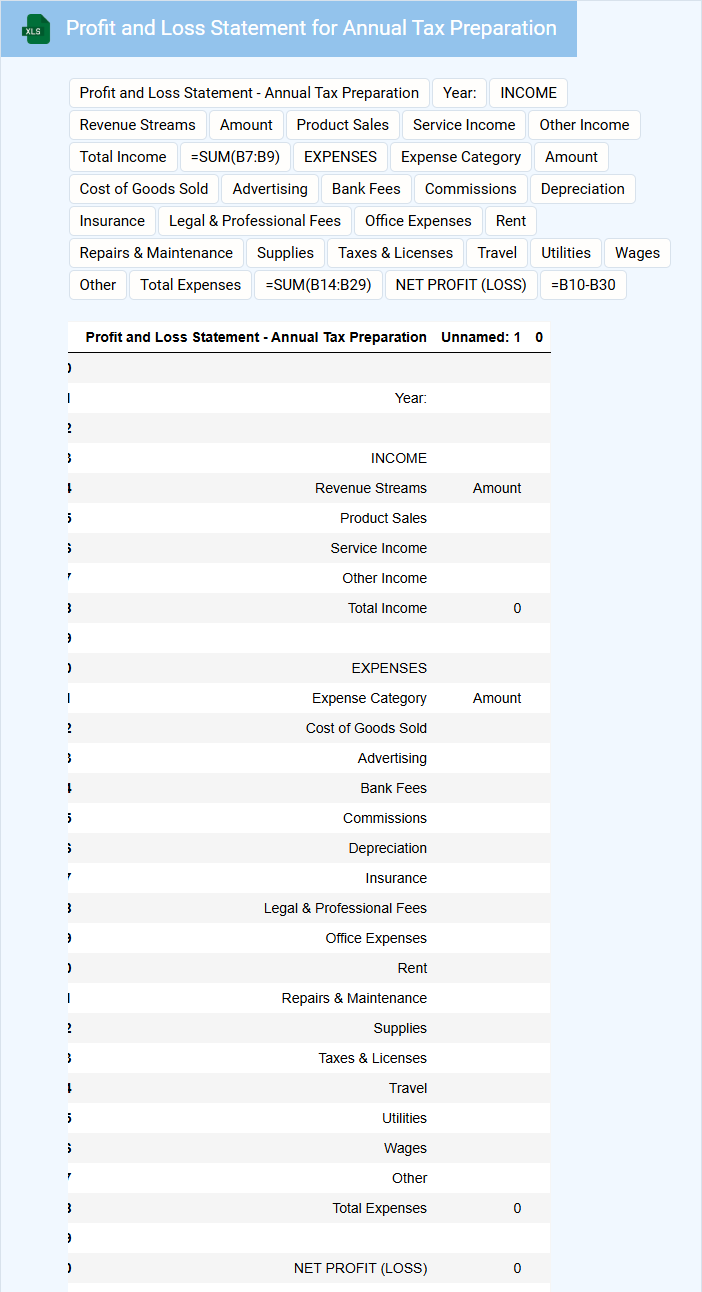

Profit and Loss Statement for Annual Tax Preparation

What information is typically found in a Profit and Loss Statement for Annual Tax Preparation?

A Profit and Loss Statement usually contains detailed records of revenues, costs, and expenses over a specific period, showing the net profit or loss. It is essential for accurately reporting income and deductible expenses to tax authorities to ensure compliance and optimize tax obligations.

Invoice Tracker with Tax Calculation for Self-Employed

An Invoice Tracker with Tax Calculation is essential for managing financial records. It helps self-employed individuals keep track of payments and outstanding invoices efficiently.

Including accurate tax calculations ensures compliance with tax regulations and simplifies tax filing. Important features include automated tax rate updates and clear summary reports.

Mileage Log for Annual Tax Reporting

A Mileage Log for annual tax reporting is a document that records the distance traveled for business purposes throughout the year. It typically includes details such as dates, starting and ending locations, trip purposes, and total miles driven. Maintaining an accurate mileage log is crucial for claiming tax deductions and ensuring compliance with tax regulations.

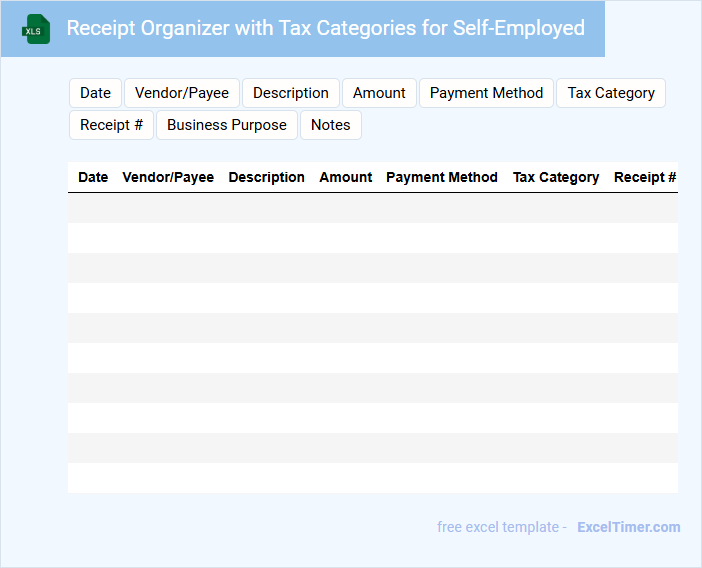

Receipt Organizer with Tax Categories for Self-Employed

What information does a Receipt Organizer with Tax Categories for Self-Employed typically contain? This document usually includes categorized receipts organized by expense type such as travel, office supplies, and meals, helping to streamline tax filing and expense tracking. It also features sections for dates, amounts, vendor details, and notes to ensure accurate record-keeping and maximize tax deductions.

What are important aspects to consider when using this organizer? It is crucial to regularly update the organizer with every business expense to avoid missing deductions and maintain compliance. Additionally, grouping receipts by tax categories simplifies the preparation of financial statements and supports clearer communication with accountants or tax professionals.

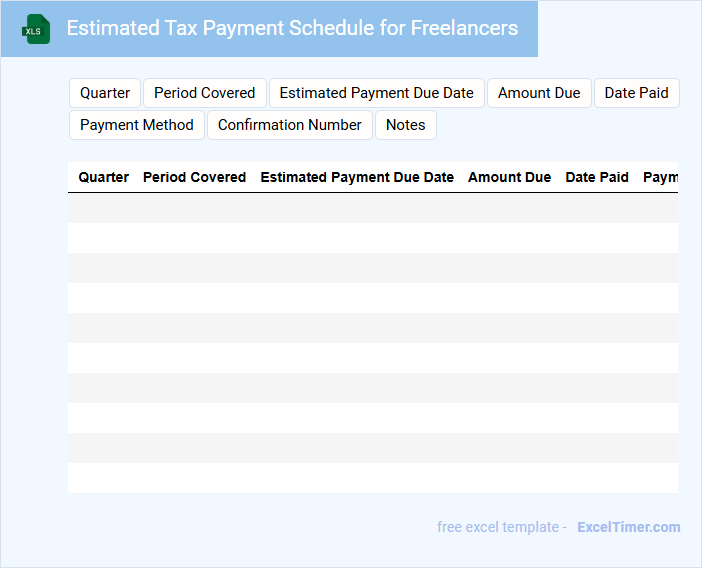

Estimated Tax Payment Schedule for Freelancers

An Estimated Tax Payment Schedule for Freelancers outlines the deadlines and amounts for quarterly tax payments to avoid penalties.

- Quarterly Deadlines: Key dates when estimated taxes must be paid to the IRS.

- Payment Amounts: Recommended amounts based on projected income to cover tax liability.

- Record Keeping: Importance of tracking income and payments for accurate filing and audit protection.

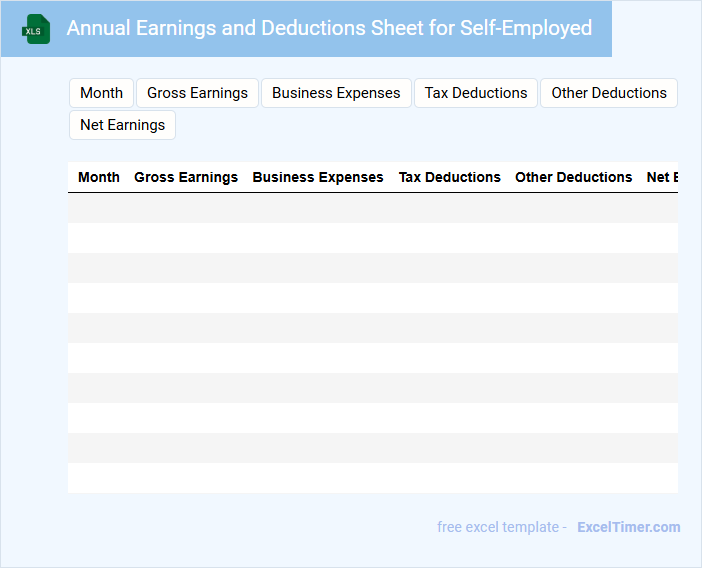

Annual Earnings and Deductions Sheet for Self-Employed

An Annual Earnings and Deductions Sheet for Self-Employed typically contains detailed records of income and expenses to accurately report taxable earnings.

- Comprehensive Income Tracking: Document all sources of revenue including sales, services, and miscellaneous earnings.

- Detailed Expense Records: Keep a precise log of deductible business expenses to reduce taxable income.

- Accurate Tax Deductions: Note applicable tax deductions such as home office, equipment, and travel expenses.

Home Office Expense Tracker for Tax Preparation

A Home Office Expense Tracker is a crucial document that records all costs related to maintaining a home office, such as utilities, rent, and office supplies. It helps individuals accurately calculate deductible expenses for tax preparation. Keeping detailed and organized records ensures compliance with tax regulations and maximizes potential deductions.

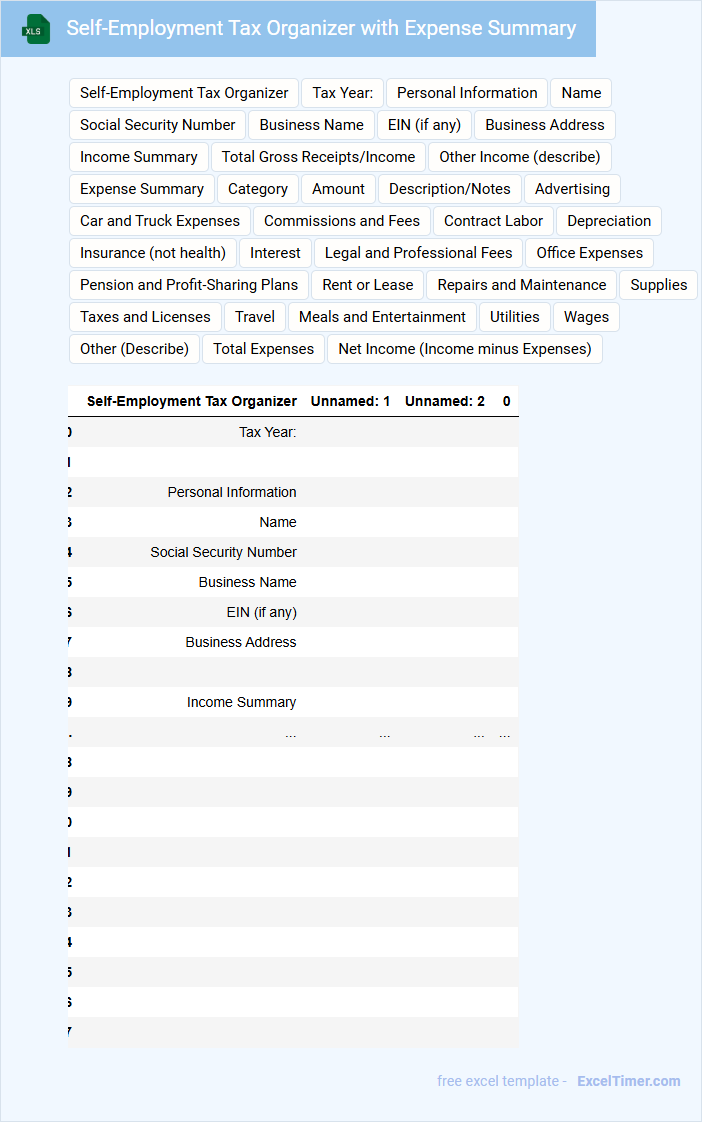

Self-Employment Tax Organizer with Expense Summary

A Self-Employment Tax Organizer with Expense Summary is a document used to compile and organize financial information for self-employed individuals in preparation for tax filing. It helps ensure all income and deductible expenses are accurately reported.

- Include detailed records of all income sources related to self-employment.

- Summarize business expenses by category to maximize deductions and simplify tax calculations.

- Provide supporting documentation such as receipts and invoices for verification.

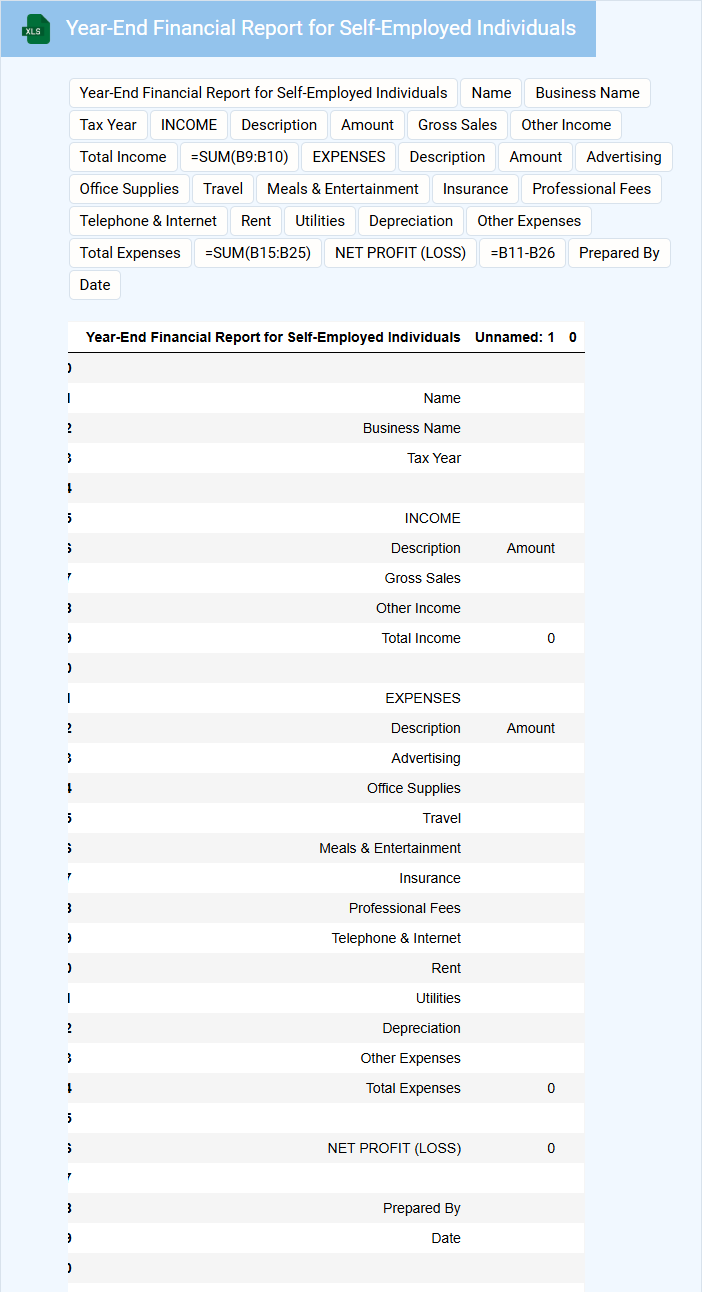

Year-End Financial Report for Self-Employed Individuals

What information is typically included in a Year-End Financial Report for Self-Employed Individuals? This document usually contains a detailed summary of income, expenses, and overall financial performance throughout the year. It helps self-employed individuals assess their financial health and prepare for tax filings accurately.

What important elements should be emphasized in this report? Key aspects include tracking all sources of income, categorizing deductible expenses clearly, and maintaining accurate records of invoices and receipts. Including a cash flow analysis and estimated tax payments can also provide valuable insights for future financial planning.

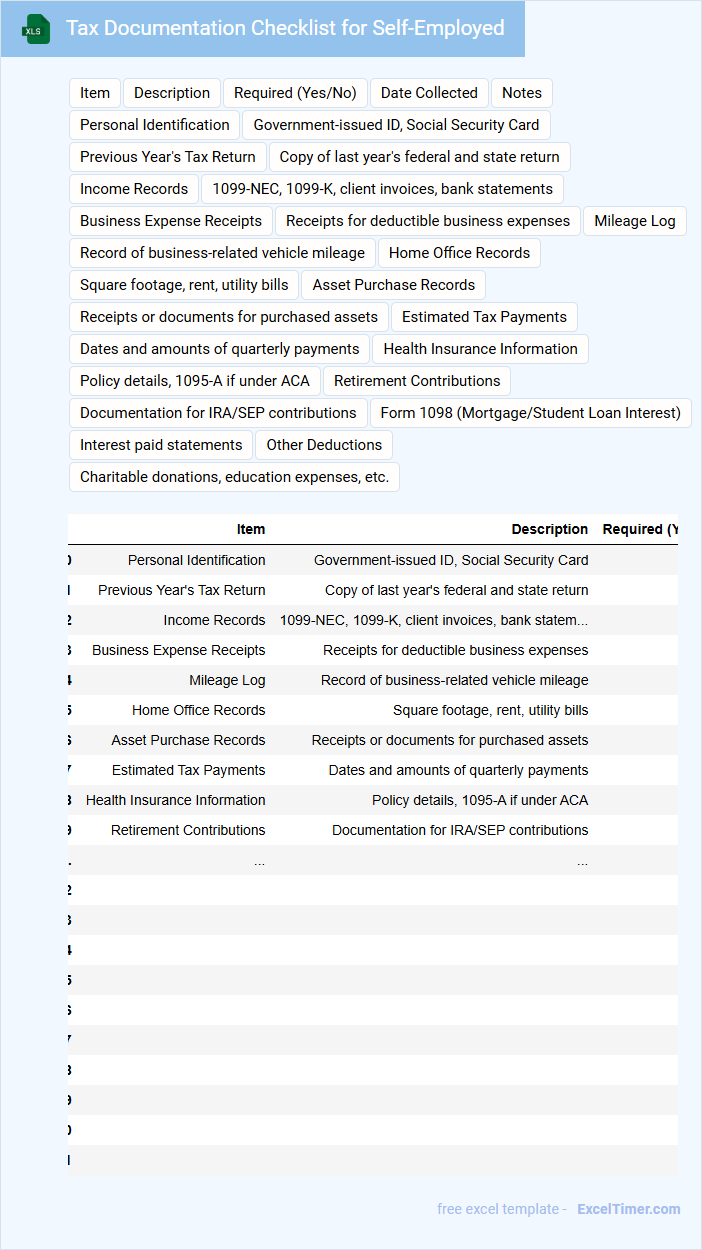

Tax Documentation Checklist for Self-Employed

Tax Documentation Checklist for Self-Employed typically includes income records, expense receipts, and proof of tax payments essential for accurate filing. Maintaining detailed records helps in maximizing deductions and avoiding audits.

Important components often cover invoices, bank statements, and tax forms like 1099 or Schedule C. Organizing these documents consistently ensures compliance and smoother tax preparation.

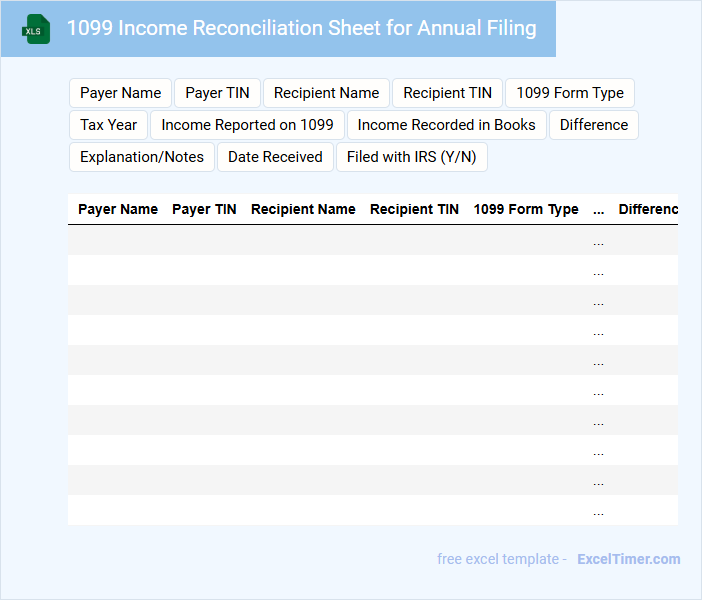

1099 Income Reconciliation Sheet for Annual Filing

The 1099 Income Reconciliation Sheet is a document used to verify income reported on 1099 forms against internal records. It helps identify discrepancies and ensure accurate annual tax reporting.

Typically, it contains payer details, payment amounts, and recipient information to reconcile all income sources. It is important to review and update this sheet regularly before annual filing to avoid errors or penalties.

What are the key income and expense categories a self-employed individual should track in Excel for annual tax preparation?

Track key income categories such as sales revenue, freelance payments, and rental income in your Excel sheet. Record expense categories including office supplies, travel costs, utilities, and professional services to maximize deductions. Accurate categorization ensures efficient annual tax preparation and compliance.

How can Excel formulas automate calculations for quarterly estimated tax payments and deductions?

Excel formulas automate quarterly estimated tax payments and deductions by calculating income, expenses, and tax rates with precision, ensuring accurate tax liability estimations. You can use functions like SUM, IF, and PMT to track payments and project upcoming tax obligations. This automation reduces errors and saves time during annual tax preparation for self-employed individuals.

Which tax forms and schedules should be referenced when structuring an Excel document for self-employed tax reporting?

When structuring an Excel document for annual tax preparation for the self-employed, include references to IRS Form 1040, Schedule C for profit or loss from business, Schedule SE for self-employment tax, and Form 1099-NEC for nonemployee compensation. Incorporate sections for income tracking, deductible expenses, and estimated tax payments to ensure comprehensive reporting. Use these forms as a framework to organize data that aligns with IRS requirements for accurate tax filing.

What method can be used in Excel to distinguish between business and personal transactions for accurate tax filing?

Using Excel's "Categorize" feature with custom tags allows you to label and separate business and personal transactions efficiently. Implementing filters or pivot tables further organizes these categories for clear, accurate tax preparation. This method ensures your annual self-employed tax filing reflects precise income and expense tracking.

How can Excel help track and apply eligible tax credits and deductions specific to self-employment?

Excel helps track and apply eligible tax credits and deductions specific to self-employment by organizing income, expenses, and relevant tax categories in customizable spreadsheets. Your annual tax preparation benefits from Excel's formulas and pivot tables, which calculate totals and identify deductible items such as home office expenses, health insurance, and business-related purchases. This streamlined approach ensures accurate reporting and maximizes tax savings for self-employed individuals.