The Quarterly Budget Excel Template for Personal Finance helps users track income and expenses over three months, providing clear insights into spending habits and savings goals. It features customizable categories and automatic calculations to simplify financial planning and improve money management. Regular updates with this template empower better decision-making and long-term fiscal responsibility.

Quarterly Budget Tracker for Personal Finance

A Quarterly Budget Tracker for Personal Finance is a document that helps individuals monitor and manage their income, expenses, and savings over a three-month period.

- Income Monitoring: It is crucial to accurately record all sources of income to understand your financial inflow.

- Expense Categorization: Categorizing expenses into necessities, wants, and savings aids in identifying spending patterns.

- Periodic Review: Regularly reviewing the budget each quarter ensures financial goals are met and adjustments can be made.

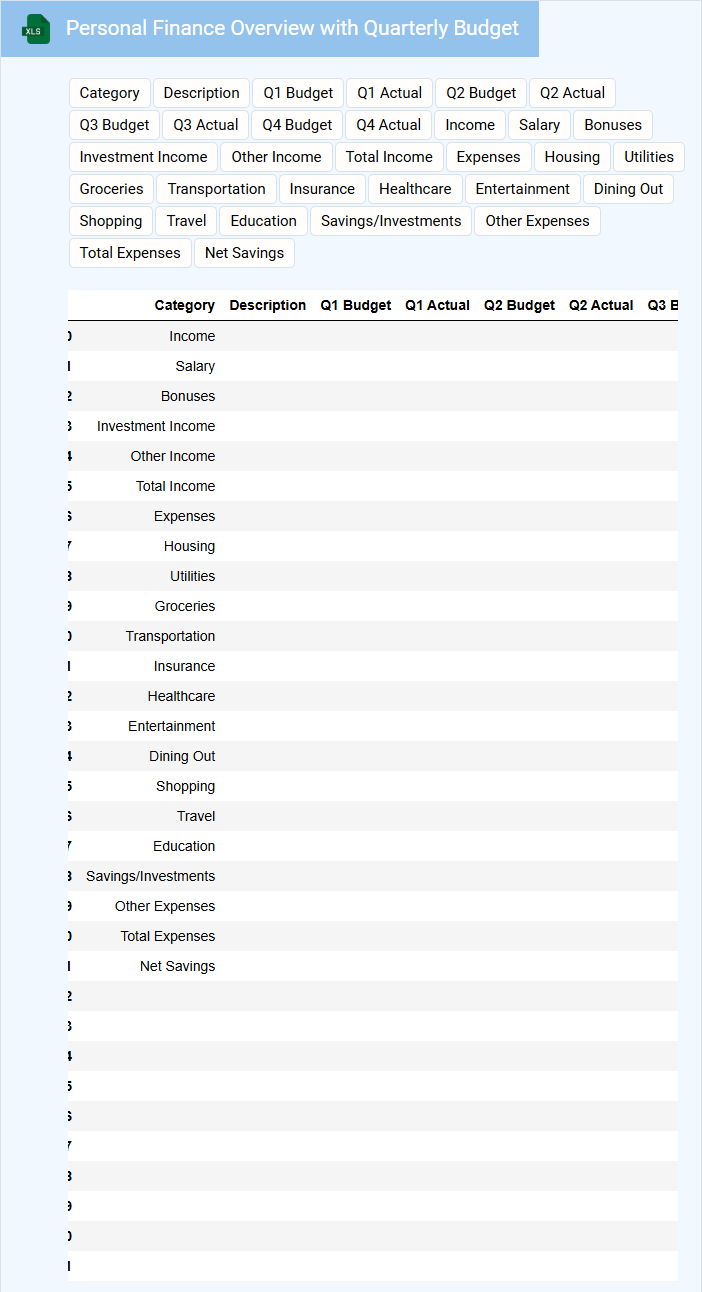

Personal Finance Overview with Quarterly Budget

A Personal Finance Overview typically outlines an individual's income, expenses, savings, and investments, providing a clear picture of their financial health. It allows for tracking progress toward financial goals and identifying areas for improvement.

A Quarterly Budget breaks down anticipated income and expenditures over three months, enabling better money management and adjustment to seasonal financial changes. Consistently updating this document ensures accuracy and effective planning.

Including emergency funds and tracking debt payments are important aspects to enhance financial stability and long-term success.

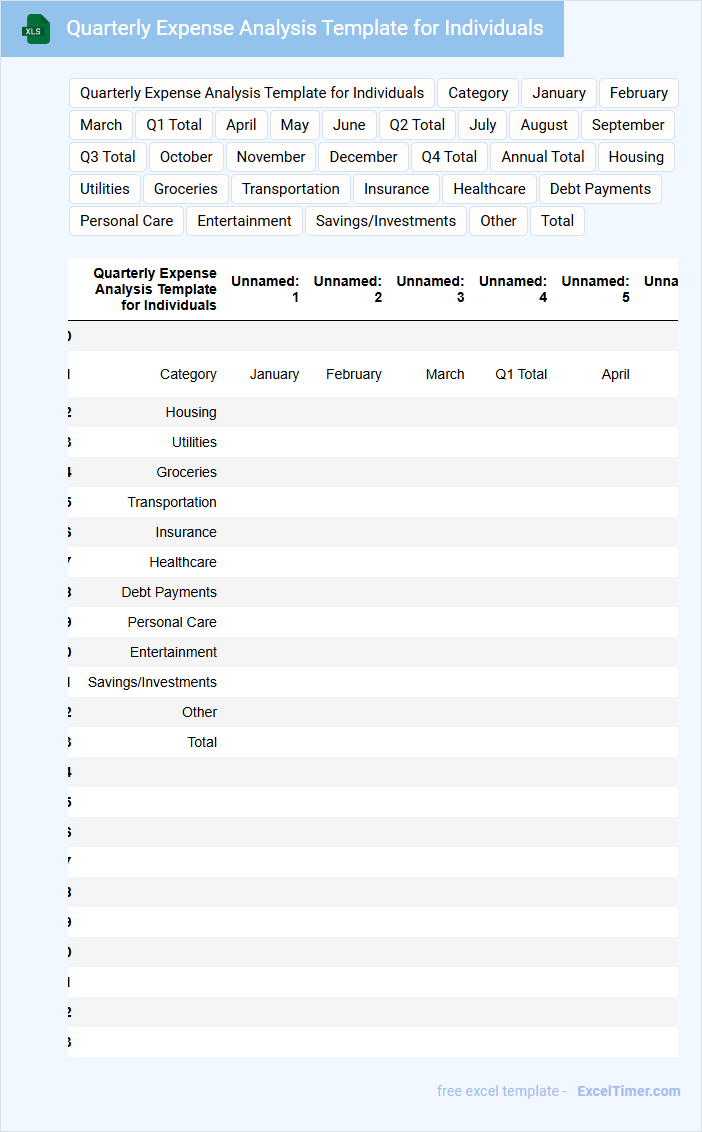

Quarterly Expense Analysis Template for Individuals

A Quarterly Expense Analysis Template for individuals is typically a detailed document that helps in tracking and categorizing personal expenditures over a three-month period. It usually contains sections for income, fixed and variable expenses, and savings or investments, providing a clear financial overview. This template assists in identifying spending patterns and areas where budget adjustments can be made for better financial planning.

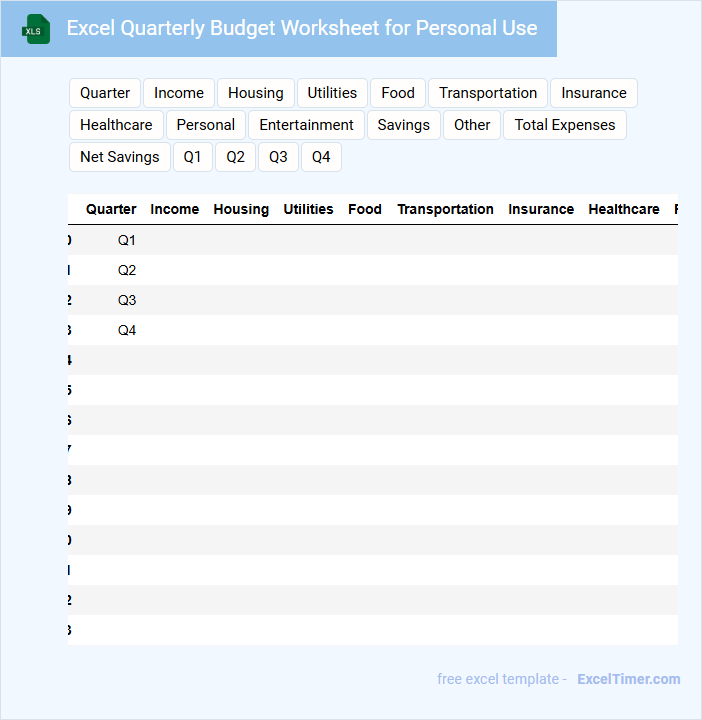

Excel Quarterly Budget Worksheet for Personal Use

An Excel Quarterly Budget Worksheet for personal use typically contains detailed income sources, categorized expenses, and savings goals organized by quarter. It helps users track financial performance and plan for upcoming periods efficiently.

Important elements include clearly defined categories, formulas for automatic calculations, and visual charts for quick analysis. Ensuring the worksheet is user-friendly and updated regularly improves financial decision-making.

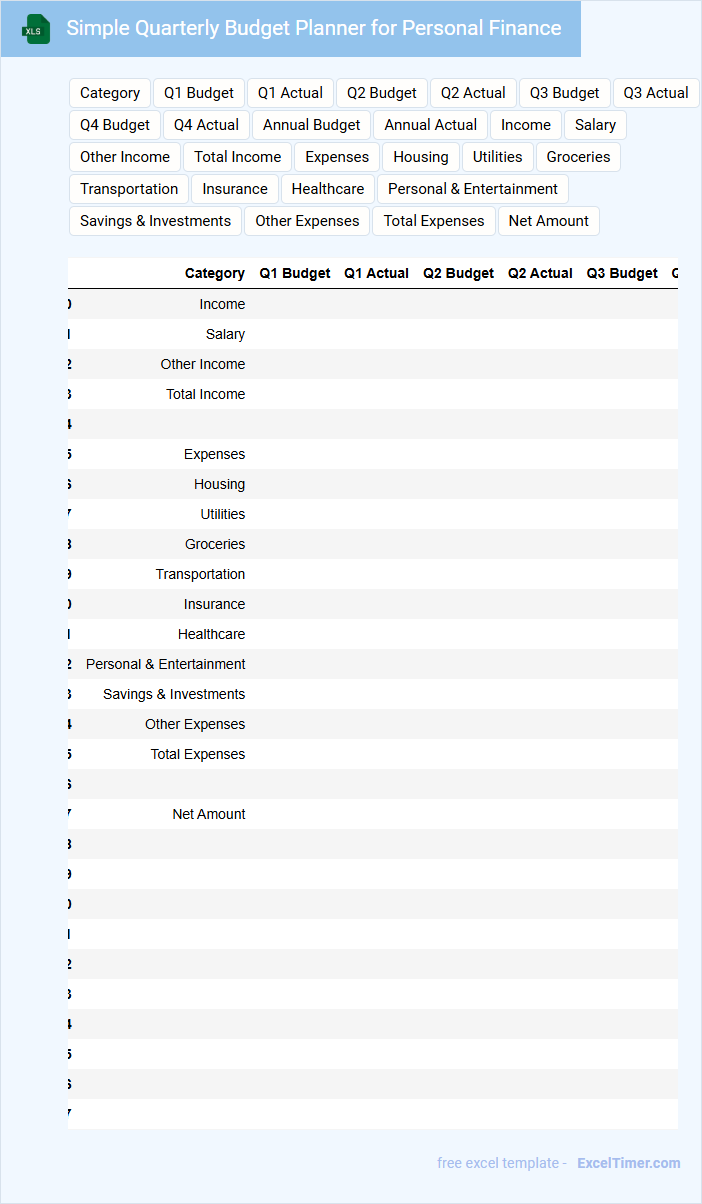

Simple Quarterly Budget Planner for Personal Finance

A Simple Quarterly Budget Planner for Personal Finance is a document used to track income, expenses, and savings over a three-month period. It helps individuals manage their finances effectively and plan for future financial goals.

- Include clear categories for income, fixed expenses, and variable expenses to maintain organization.

- Track spending regularly to identify patterns and areas where adjustments can be made.

- Set realistic savings goals each quarter to encourage financial discipline and growth.

Quarterly Financial Goals Tracker for Personal Budgeting

The Quarterly Financial Goals Tracker is a document used to monitor and evaluate progress toward achieving set financial targets within a three-month period. It typically includes income, expenses, savings, and investment tracking to provide a clear financial overview.

This type of tracker helps individuals maintain discipline and make informed adjustments to their personal budget. Including a summary of achievements and challenges each quarter can enhance its effectiveness.

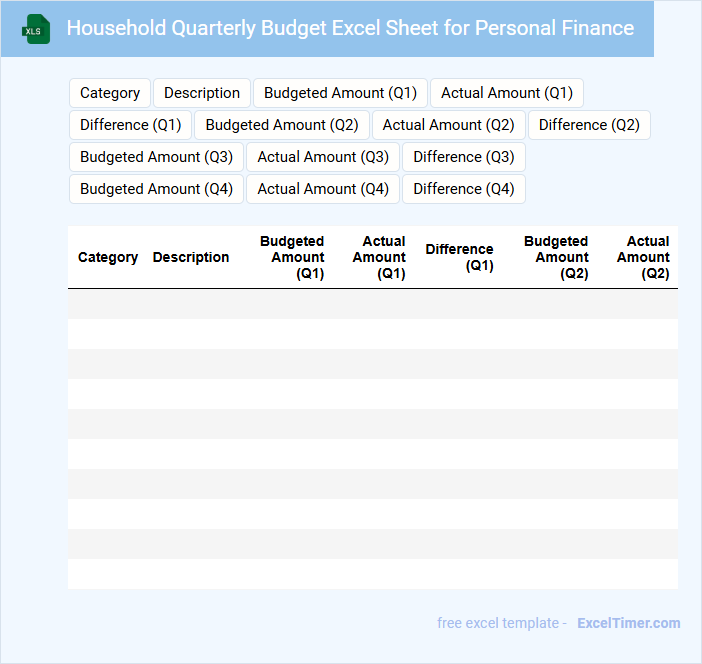

Household Quarterly Budget Excel Sheet for Personal Finance

A Household Quarterly Budget Excel Sheet is a structured document that helps individuals track income and expenses over a three-month period. It typically contains categories such as utilities, groceries, transportation, and savings to provide a clear financial overview. This type of document is essential for identifying spending patterns and planning future financial goals effectively.

Quarterly Income and Expense Tracker for Individuals

A Quarterly Income and Expense Tracker for individuals is a financial document used to monitor earnings and expenditures over three months. It helps in identifying spending patterns and managing budgets effectively. Regularly updating this tracker ensures better financial planning and savings growth.

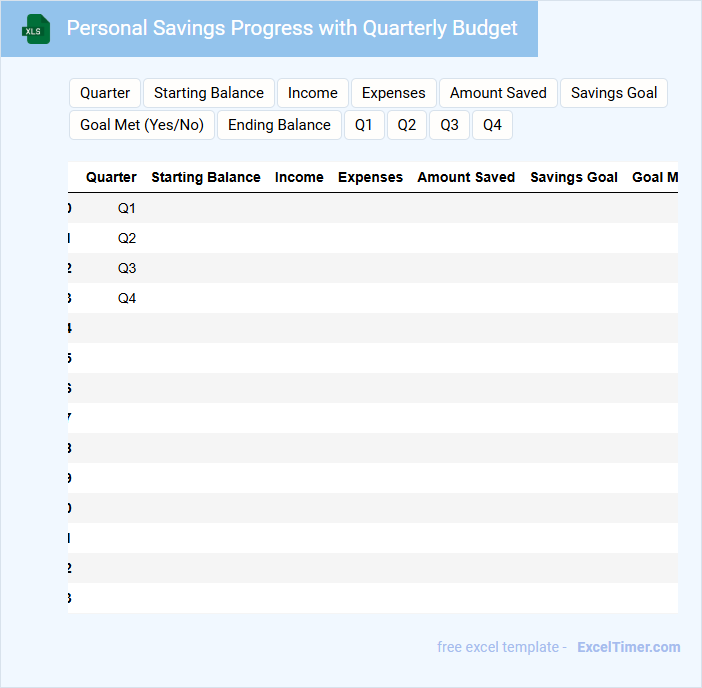

Personal Savings Progress with Quarterly Budget

This document typically outlines an individual's savings growth over time relative to their planned budget each quarter. It helps track financial discipline and adjust spending habits as needed.

- Record your initial savings amount and set realistic quarterly targets.

- Compare actual savings against the budgeted amounts to identify discrepancies.

- Review and adjust your budget quarterly based on progress and financial changes.

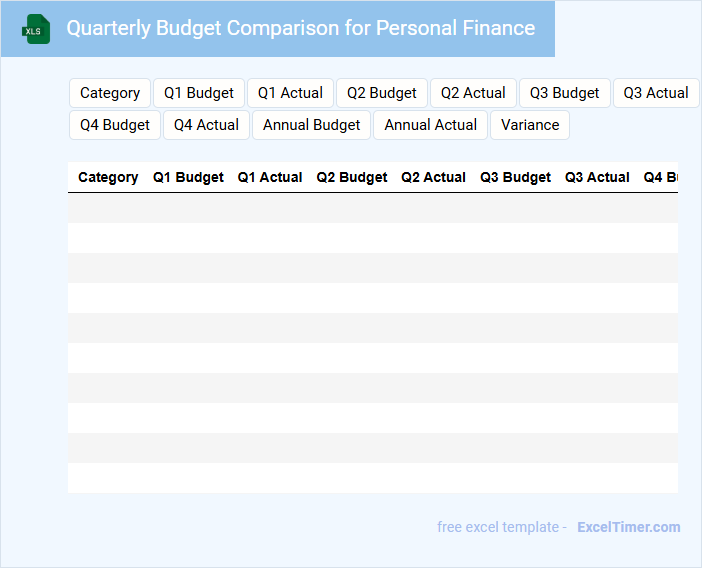

Quarterly Budget Comparison for Personal Finance

What information is typically included in a Quarterly Budget Comparison for Personal Finance? This type of document usually outlines planned versus actual income and expenses over a three-month period, helping to identify spending patterns and areas for adjustment. It is essential for tracking financial progress, managing cash flow, and making informed decisions to achieve personal financial goals.

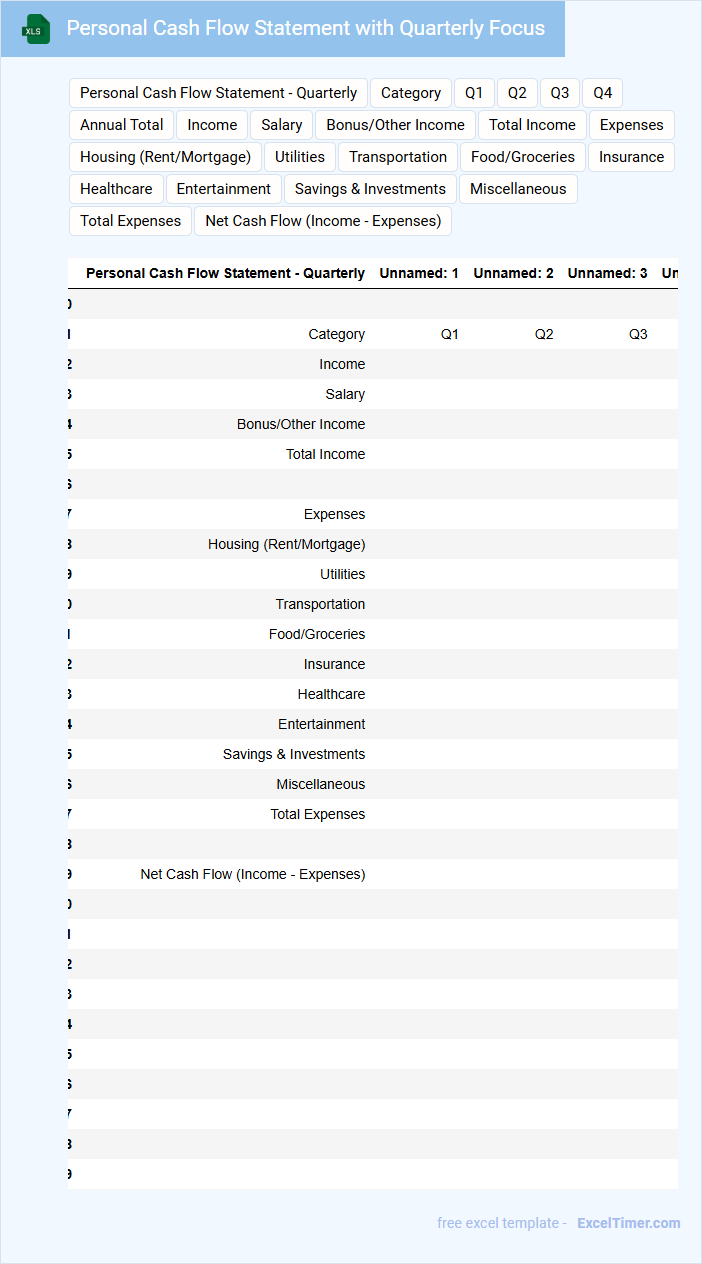

Personal Cash Flow Statement with Quarterly Focus

What does a Personal Cash Flow Statement with Quarterly Focus usually contain? This type of document typically includes detailed records of income, expenses, and savings tracked over each quarter to provide a clear overview of financial health. It helps individuals identify spending patterns and plan budgets effectively for upcoming months.

What is an important suggestion for preparing this document? It is crucial to categorize income and expenses accurately and update the statement regularly to maintain precise financial tracking. Consistent quarterly reviews allow for timely adjustments to improve savings and reduce unnecessary expenditures.

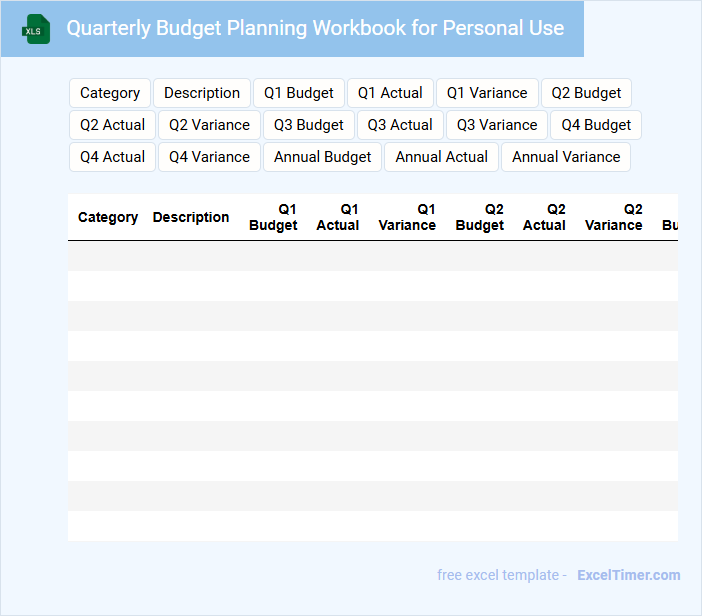

Quarterly Budget Planning Workbook for Personal Use

The Quarterly Budget Planning Workbook for personal use typically contains detailed income and expense tracking sections, savings goals, and investment planning sheets. It helps individuals organize their finances over a three-month period to better manage cash flow and plan for upcoming expenses. Including categories for unexpected costs and review checkpoints improves accuracy and financial discipline.

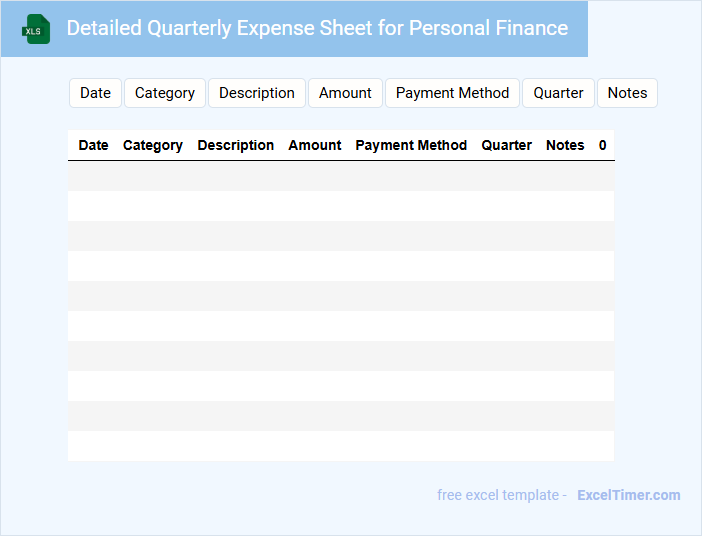

Detailed Quarterly Expense Sheet for Personal Finance

What information does a Detailed Quarterly Expense Sheet for Personal Finance usually contain? This document typically includes categorized records of all expenses incurred over the quarter, such as housing, utilities, groceries, transportation, and entertainment. It helps track spending habits, identify areas for budgeting improvements, and manage overall financial health effectively.

What important aspects should be considered when creating this document? Accuracy and consistency in recording all transactions are crucial, along with categorizing expenses clearly to gain meaningful insights. Additionally, including notes on irregular or one-time expenses can provide better context for evaluating financial decisions and planning future budgets.

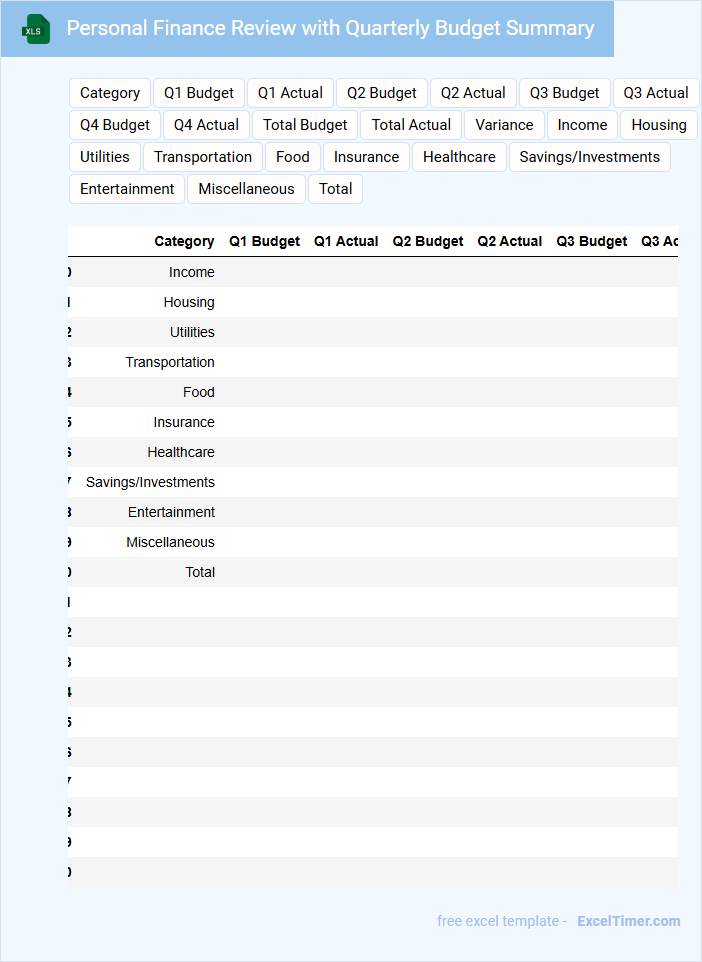

Personal Finance Review with Quarterly Budget Summary

A Personal Finance Review with a Quarterly Budget Summary typically contains an overview of income, expenses, and savings over a three-month period. It highlights key financial trends and identifies areas for improvement to ensure better money management. This document helps individuals track progress toward financial goals and adjust their budgets accordingly.

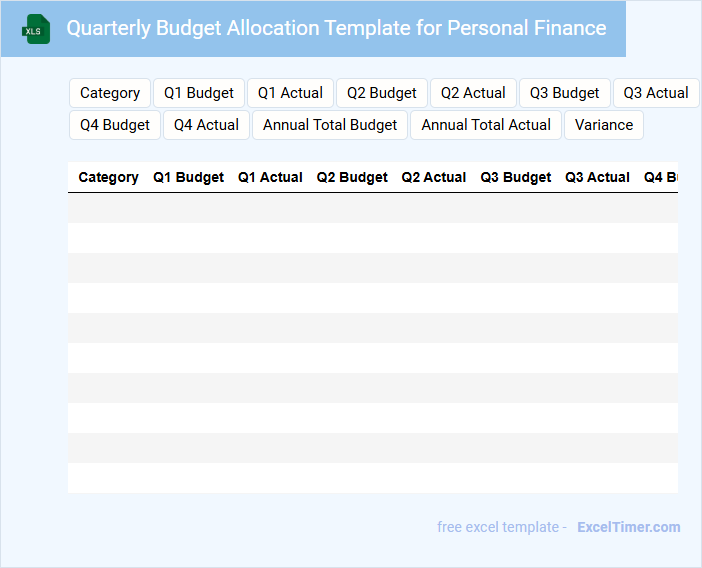

Quarterly Budget Allocation Template for Personal Finance

A Quarterly Budget Allocation Template for Personal Finance is a structured document designed to plan and monitor income and expenses over a three-month period to ensure financial stability and goal achievement.

- Income Tracking: Accurately record all sources of income to create a reliable budget foundation.

- Expense Categorization: Divide expenses into fixed and variable to identify saving opportunities and unnecessary costs.

- Goal Setting: Define clear financial objectives for the quarter to guide spending and savings decisions.

What are the key income sources included in the quarterly budget for personal finance?

Key income sources in a quarterly budget for personal finance typically include salary or wages, freelance or contract earnings, investment dividends, rental income, and any government benefits or tax refunds. Tracking these income streams helps in accurate financial planning and cash flow management. Detailed categorization of income ensures comprehensive budgeting and more effective savings strategies.

How are fixed and variable expenses categorized and tracked over the quarter?

Your quarterly budget Excel document categorizes fixed expenses as consistent monthly costs like rent and utilities, while variable expenses include fluctuating costs such as groceries and entertainment. The spreadsheet tracks these expenses by allocating each transaction to its category and summarizing totals for each month and the entire quarter. This method allows you to analyze spending patterns and adjust your budget accordingly.

What method is used to compare budgeted versus actual spending in each category?

The Quarterly Budget for Personal Finance uses variance analysis to compare budgeted versus actual spending in each category. This method highlights differences by calculating the variance amount or percentage, helping you identify overspending or savings. Tracking these variances enables better financial decision-making and budget adjustments.

How does the quarterly budget account for irregular or one-time expenses?

The quarterly budget includes a dedicated category for irregular and one-time expenses, allowing for accurate forecasting and financial planning. This category tracks unexpected costs such as repairs, medical bills, or major purchases, ensuring they do not disrupt monthly allocations. Regular updates to the budget help maintain a clear overview of available funds and adjust savings goals accordingly.

What visual tools (charts, graphs) are provided in the Excel document to analyze financial trends?

The Excel document offers line charts to track quarterly income and expenses, highlighting financial trends over time. Bar charts compare budgeted versus actual spending across categories each quarter. Pie charts visualize the proportion of expenses by category, aiding in identifying major cost areas.