The Quarterly Profit and Loss Excel Template for E-commerce Stores streamlines financial tracking by organizing revenue, expenses, and profit margins each quarter. This template provides clear insights into sales trends and cost management, helping online retailers make data-driven decisions. Its customizable format ensures accurate forecasting and simplifies tax reporting for e-commerce businesses.

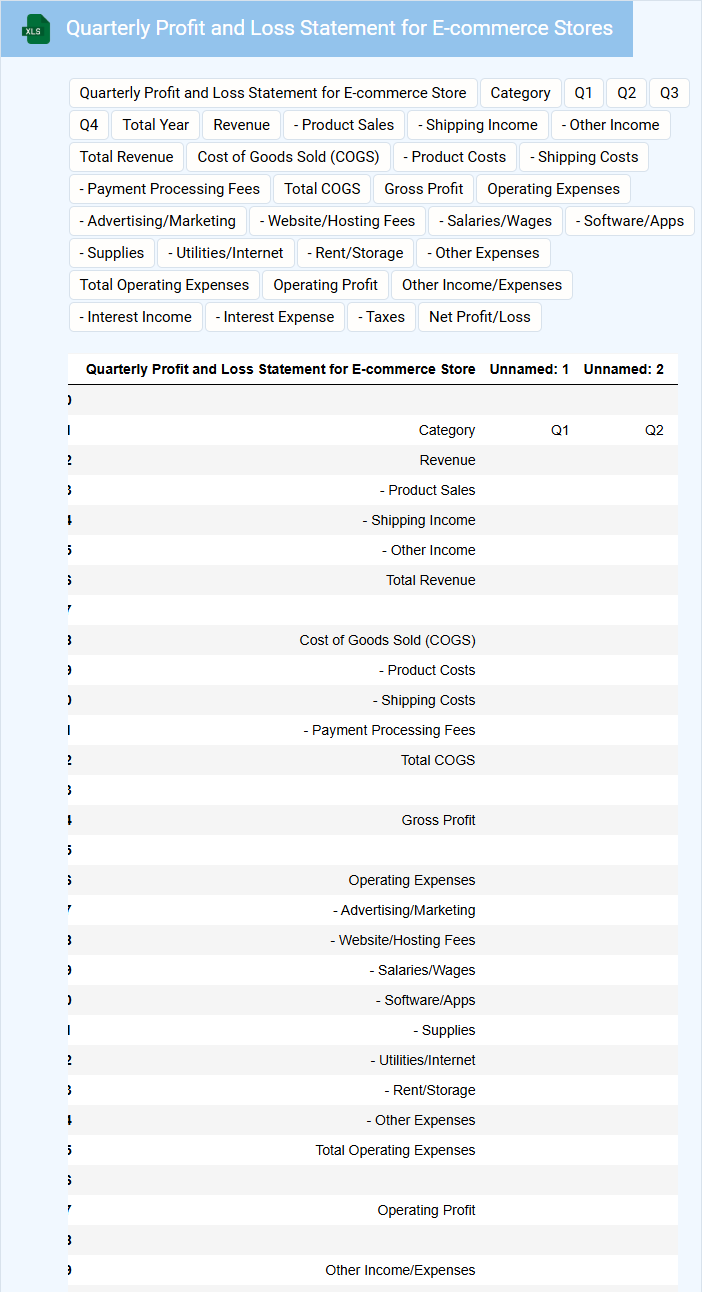

Quarterly Profit and Loss Statement for E-commerce Stores

The Quarterly Profit and Loss Statement for e-commerce stores typically contains detailed records of revenue, costs, and expenses incurred over a three-month period. It helps track the financial performance and profitability of the business during each quarter. This document is essential for analyzing sales trends, cost management, and overall business health.

Important elements to include are sales revenue breakdown, cost of goods sold, operating expenses, and net profit or loss figures. Accurate categorization and timely updates ensure stakeholders make informed financial decisions. Regular review of this statement supports strategic planning and business growth.

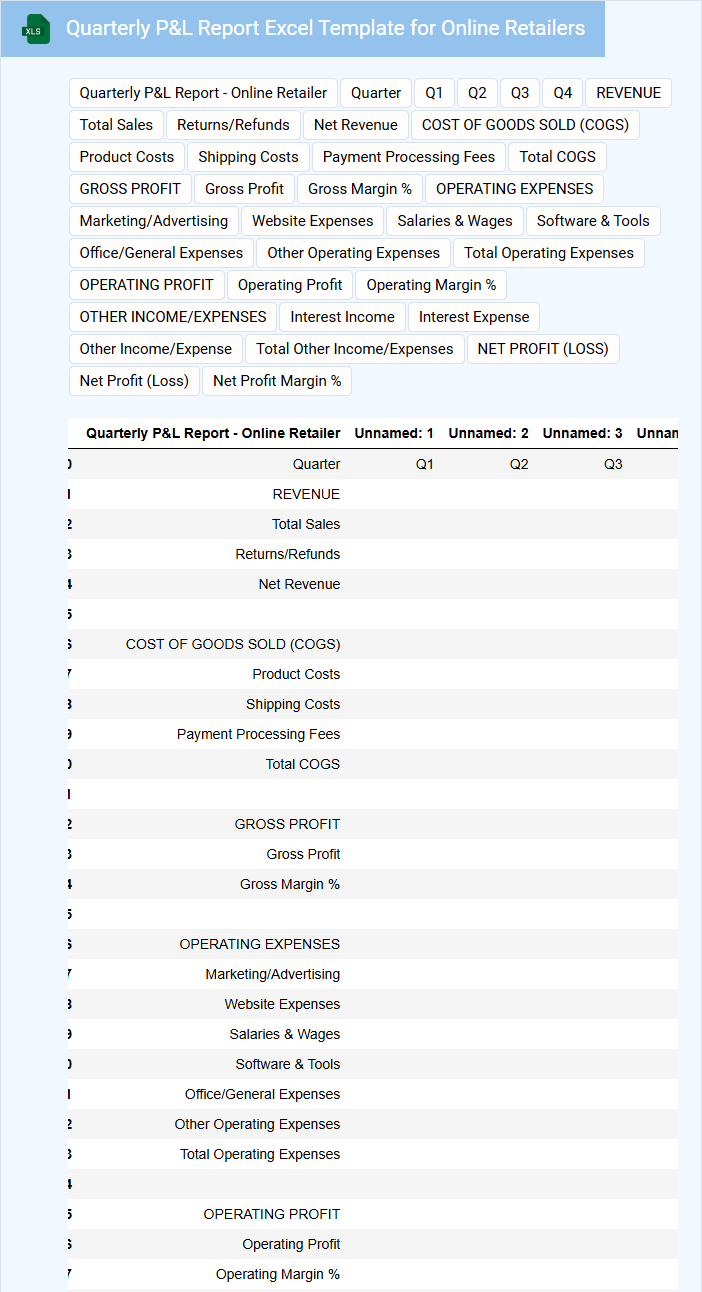

Quarterly P&L Report Excel Template for Online Retailers

The Quarterly P&L Report Excel Template for online retailers is designed to summarize the financial performance over a specific quarter, highlighting revenues, costs, and net profit. It typically includes detailed sections for sales, expenses, gross profit, and operating income for clear financial analysis.

This document is essential for tracking business profitability, identifying trends, and making informed decisions regarding budget adjustments. Including accurate sales data and categorizing expenses precisely are crucial for maintaining reliable financial insights.

Profit and Loss Analysis with Quarterly Breakdown for Online Shops

A Profit and Loss Analysis document typically contains detailed financial data that shows the revenues, costs, and expenses incurred by a business over a specific period. It helps in understanding the net profit or loss to assess financial health and operational efficiency.

When including a Quarterly Breakdown for online shops, it is essential to highlight sales trends, seasonal fluctuations, and cost variations across each quarter. This segmentation aids in better forecasting and strategic planning.

Ensure to include key metrics such as gross profit margin, operating expenses, and net income for each quarter to provide a comprehensive financial overview.

E-commerce Store Quarterly Income and Expense Tracker

What information does an E-commerce Store Quarterly Income and Expense Tracker typically contain? This document generally includes detailed records of all income generated and expenses incurred by the e-commerce store throughout the quarter. It helps business owners monitor financial performance, manage budgets, and identify trends for better decision-making.

What is an important consideration when using this tracker? Ensuring accuracy and consistency in recording transaction data is crucial. Additionally, categorizing expenses and income correctly allows for clearer financial analysis and strategic planning.

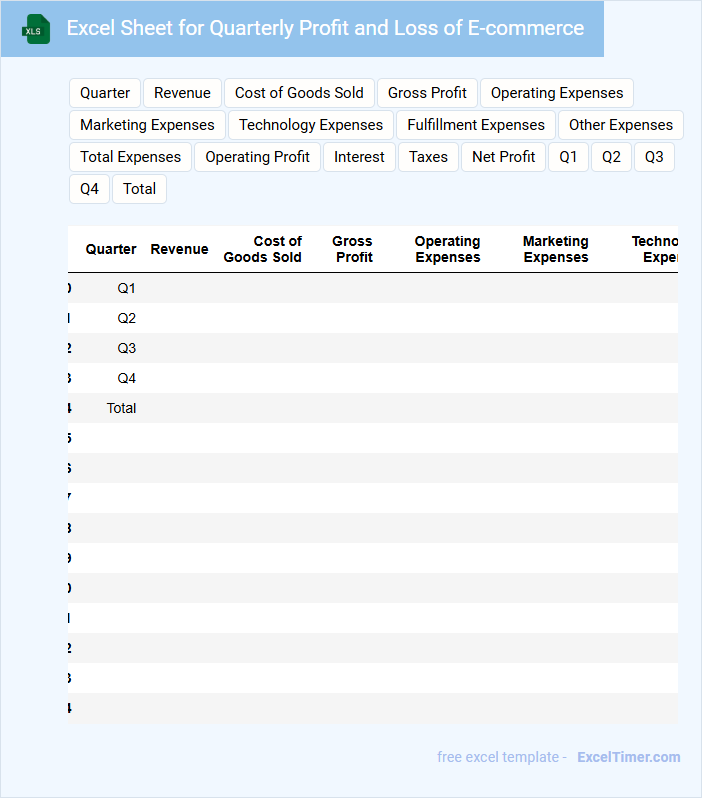

Excel Sheet for Quarterly Profit and Loss of E-commerce

An Excel sheet for Quarterly Profit and Loss in E-commerce typically contains detailed financial data organized by revenue, expenses, and net profit or loss for each quarter. It includes categories such as sales income, cost of goods sold, operational expenses, and taxes, enabling clear visibility of the company's financial health. Accurate record-keeping and timely updates are essential to support strategic decisions and track business performance over time.

Sales and Expenses Tracker with Quarterly Profit Summary

This type of document is primarily used to track sales figures and associated expenses over specific periods, enabling businesses to monitor financial performance accurately. It typically contains detailed records of income, costs, and categorized expenditures. The document also includes a quarterly profit summary to provide insights into overall profitability and trends.

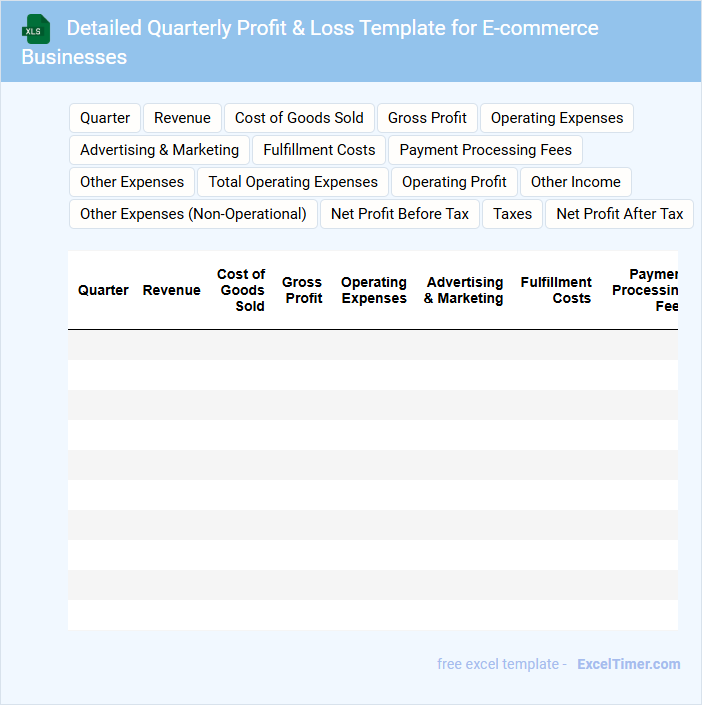

Detailed Quarterly Profit & Loss Template for E-commerce Businesses

What does a Detailed Quarterly Profit & Loss Template for E-commerce Businesses usually contain? This document typically includes comprehensive revenue streams, cost of goods sold, operating expenses, and net profit breakdowns organized by quarter for clear financial tracking. It helps e-commerce businesses analyze profitability trends, manage expenses, and make informed decisions for growth.

What is an important aspect to consider when using this template? Accuracy in capturing all sources of income and expenses is crucial to ensure reliable profit and loss calculations. Additionally, regularly updating the template with real-time data allows businesses to identify issues early and optimize financial performance.

E-commerce Financial Statement Template with Quarterly P&L

What information does an E-commerce Financial Statement Template with Quarterly P&L typically contain? This document usually includes detailed revenue, cost of goods sold, operating expenses, and net profit figures broken down by each quarter. It helps e-commerce businesses track financial performance, identify trends, and make informed decisions for growth.

Why is it important to focus on accuracy and consistency when using this template? Accurate data entry ensures reliable financial analysis, while consistency in reporting periods allows for meaningful comparison across quarters. Additionally, including clear notes on assumptions and variances can improve transparency and help stakeholders better understand the financial health of the business.

Quarterly P&L Overview for Digital Commerce Stores

The Quarterly P&L Overview provides a concise summary of the financial performance for digital commerce stores over a three-month period. It highlights key revenue streams, cost of goods sold, and operational expenses to determine net profit or loss.

This document typically contains detailed income statements, variance analysis, and trend insights essential for strategic decision-making. It is important to focus on accurate data collection and clear visualization to ensure actionable insights.

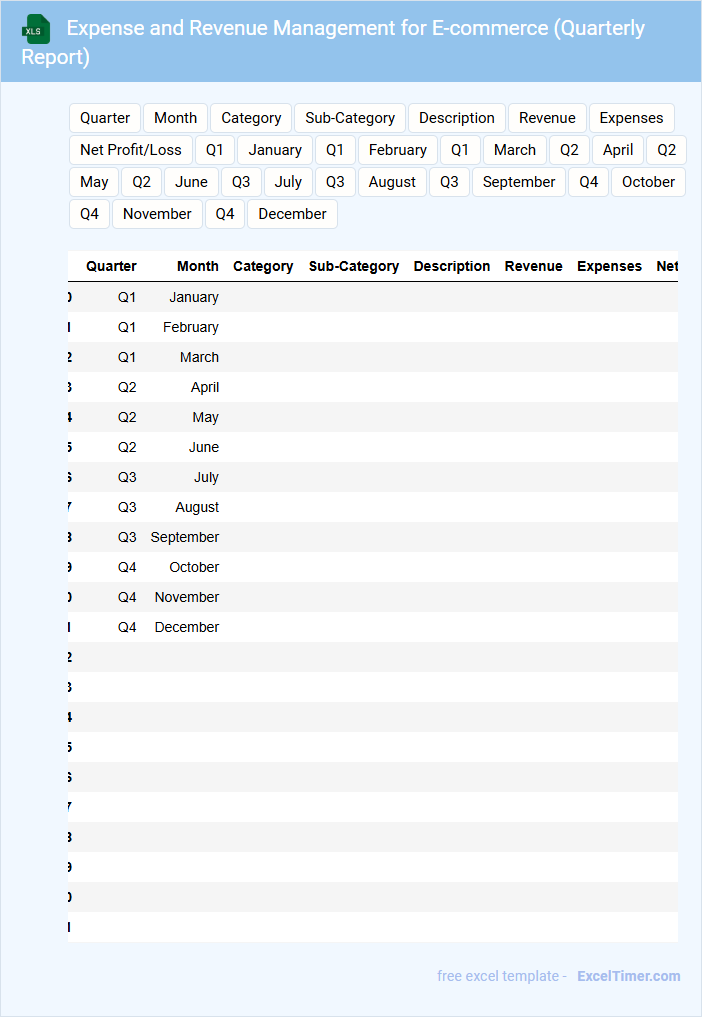

Expense and Revenue Management for E-commerce (Quarterly Report)

This type of document typically contains detailed financial data related to the expenses and revenues generated by an e-commerce business over a specific quarter. It helps stakeholders analyze financial performance and make informed decisions.

- Include a clear summary of total revenue, costs, and net profit for the quarter.

- Highlight key expense categories such as marketing, operations, and logistics.

- Provide comparative analysis against previous quarters or budgeted figures for trend insights.

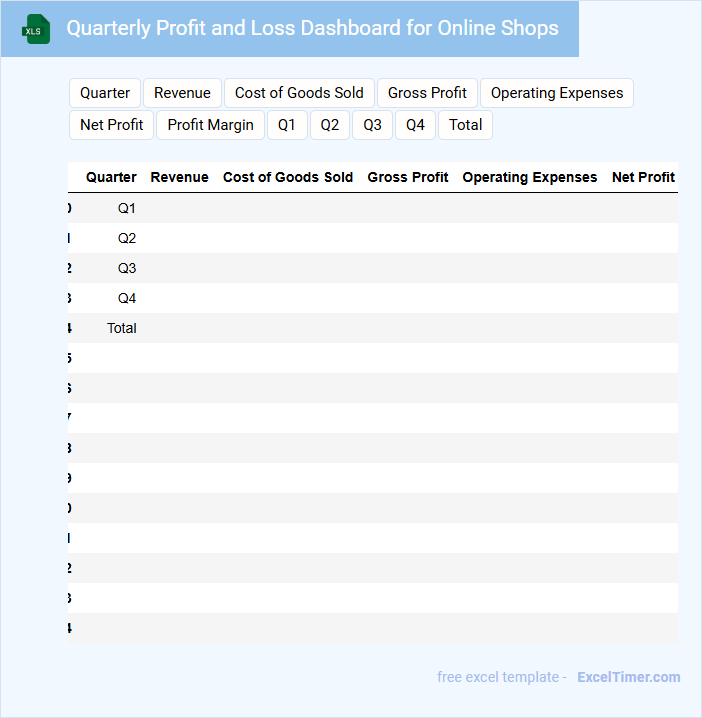

Quarterly Profit and Loss Dashboard for Online Shops

The Quarterly Profit and Loss Dashboard for Online Shops provides a comprehensive overview of the financial performance over a three-month period. It helps stakeholders quickly assess revenue streams, expenses, and net profit to make informed business decisions.

- Include clear visualizations of key financial metrics such as sales, costs, and profit margins.

- Incorporate filters for different product categories or time frames to enhance analysis.

- Ensure data accuracy and update regularly to reflect the latest financial statuses.

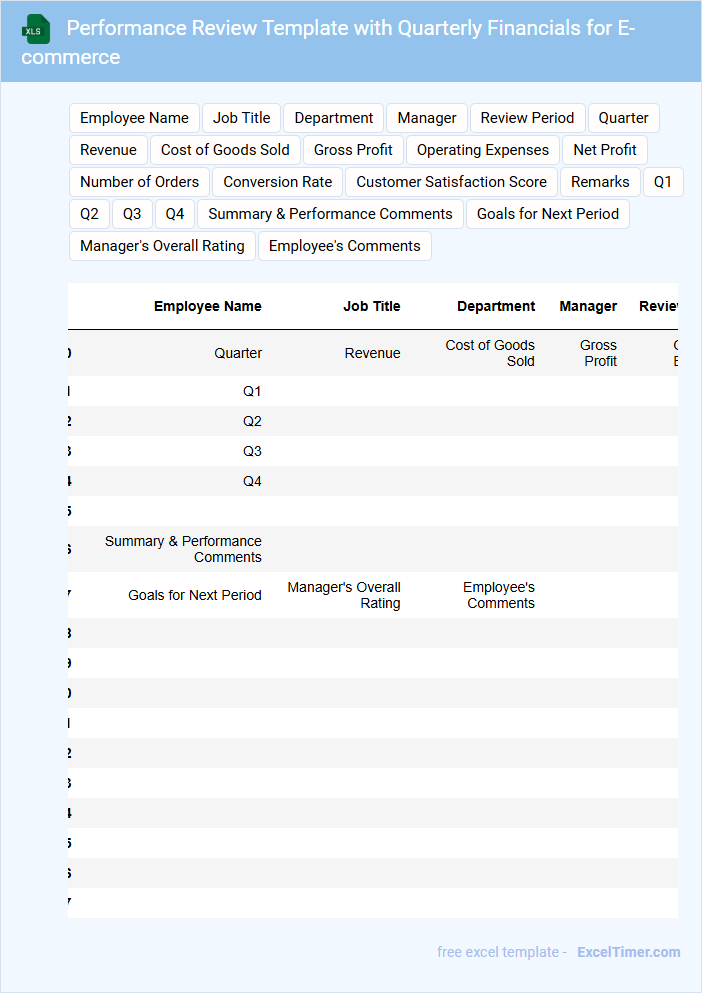

Performance Review Template with Quarterly Financials for E-commerce

What content does a Performance Review Template with Quarterly Financials for E-commerce typically include? This document usually contains evaluations of employee performance alongside detailed financial metrics such as sales, revenue, and profit margins for each quarter. It combines qualitative feedback with quantitative data to provide a comprehensive overview of both personnel contributions and business outcomes.

What important elements should be considered to optimize this type of document? Ensuring clarity and consistency in financial reporting, linking performance indicators directly to business goals, and including actionable insights for improvement are key. These elements help align employee assessment with company objectives and drive informed decision-making.

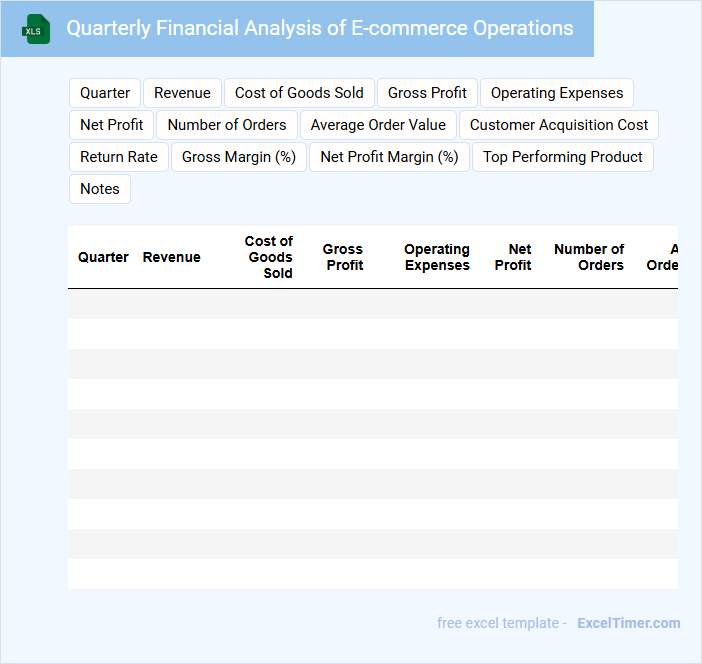

Quarterly Financial Analysis of E-commerce Operations

What key information does a Quarterly Financial Analysis of E-commerce Operations typically include? This document usually contains detailed revenue reports, cost breakdowns, and profitability metrics related to e-commerce activities. It also highlights trends, compares performance against previous quarters, and identifies areas for financial optimization.

Why is it important to focus on customer acquisition costs and average order value in this analysis? Monitoring these metrics helps assess marketing efficiency and overall sales health, enabling better budget allocation. Additionally, tracking these factors can inform strategies to increase customer lifetime value and improve profitability.

Income Statement with Quarterly Sections for E-commerce Retail

An Income Statement with Quarterly Sections for E-commerce Retail typically contains detailed revenue, expense, and profit information broken down by each quarter to analyze financial performance over time.

- Revenue breakdown: Displays sales figures divided quarterly to assess seasonality and growth trends.

- Expense categorization: Lists operational costs by quarter to monitor expenditure and cost control.

- Profit analysis: Highlights net income each quarter to evaluate profitability and financial health.

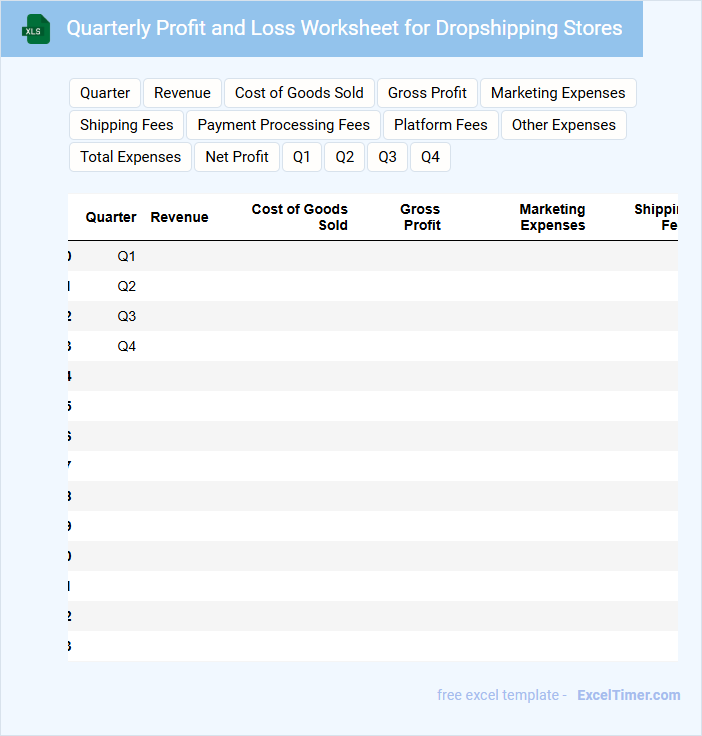

Quarterly Profit and Loss Worksheet for Dropshipping Stores

A Quarterly Profit and Loss Worksheet for dropshipping stores typically contains detailed records of revenues, costs, and expenses incurred over a three-month period. It helps to evaluate the financial performance and profitability of the store by summarizing income streams and deducting relevant expenditures. Key components often include sales data, cost of goods sold, advertising expenses, and operational costs. Important suggestions for this document include regularly updating all entries for accuracy, categorizing expenses clearly for better analysis, and reviewing profit margins to identify areas for improvement.

What key revenue streams should be tracked quarterly for an e-commerce store?

Key revenue streams to track quarterly for an e-commerce store include product sales, subscription services, and affiliate marketing income. Monitoring revenue from digital downloads and advertising partnerships provides additional insight into overall profitability. Tracking these revenue streams enables accurate financial analysis and strategic growth planning.

Which expense categories most impact quarterly profit and loss statements for online retailers?

Marketing and advertising expenses significantly impact quarterly profit and loss statements for e-commerce stores, often accounting for a large portion of operating costs. Cost of goods sold (COGS), including product sourcing and shipping fees, directly affects gross profit margins. Fulfillment expenses and platform transaction fees also play crucial roles in determining overall profitability.

How do you calculate gross profit and net profit in an e-commerce P&L Excel document?

Calculate gross profit in an e-commerce P&L Excel document by subtracting Cost of Goods Sold (COGS) from Total Revenue. Determine net profit by deducting Operating Expenses, Taxes, and Interest from the gross profit. Use formulas like "=Revenue-COGS" for gross profit and "=GrossProfit-OperatingExpenses-Taxes-Interest" for net profit to automate calculations.

What are the essential columns and data points to include in a quarterly e-commerce P&L template?

A quarterly e-commerce profit and loss template should include essential columns like Revenue, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses (marketing, shipping, salaries), and Net Profit. Track data points such as sales volume, average order value, return rates, and tax expenses to analyze profitability accurately. Your focus on these metrics ensures precise financial insights to optimize store performance and growth strategies.

Which metrics reveal trends and actionable insights from quarterly e-commerce P&L data?

Key metrics such as gross profit margin, operating expenses, and net profit reveal trends and actionable insights in your quarterly e-commerce P&L data. Tracking revenue growth and customer acquisition costs helps identify profitability patterns and efficiency. Analyzing return rates and average order value supports strategic decisions to optimize overall performance.