The Weekly Budget Planner Excel Template for College Students helps track income, expenses, and savings efficiently, promoting better financial management during college years. It includes customizable categories tailored to student needs, such as tuition, groceries, and entertainment, ensuring accurate budgeting. Using this template fosters disciplined spending habits, reducing financial stress and enhancing money management skills.

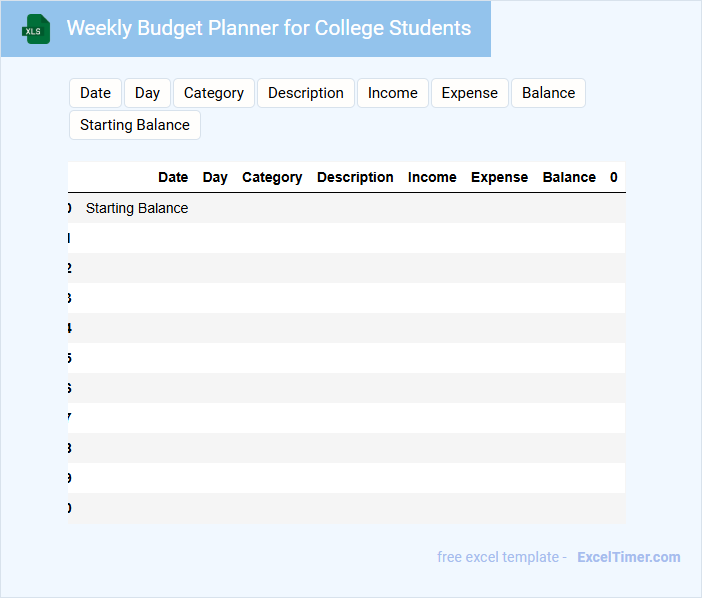

Weekly Budget Planner for College Students

A Weekly Budget Planner for college students typically contains income sources, expense categories, and savings goals. It helps in tracking daily spending and managing finances effectively.

Important elements include setting a realistic budget limit and prioritizing essential expenses over discretionary ones. Regularly updating the planner ensures better financial discipline and awareness.

Simple Weekly Budget Tracker with Expense Categories

A Simple Weekly Budget Tracker document typically contains sections for income, categorized expenses, and savings goals. It helps users monitor their spending habits on a weekly basis by breaking down expenses into clear, manageable categories. An important suggestion is to consistently update the tracker and review categories to identify areas for financial improvement.

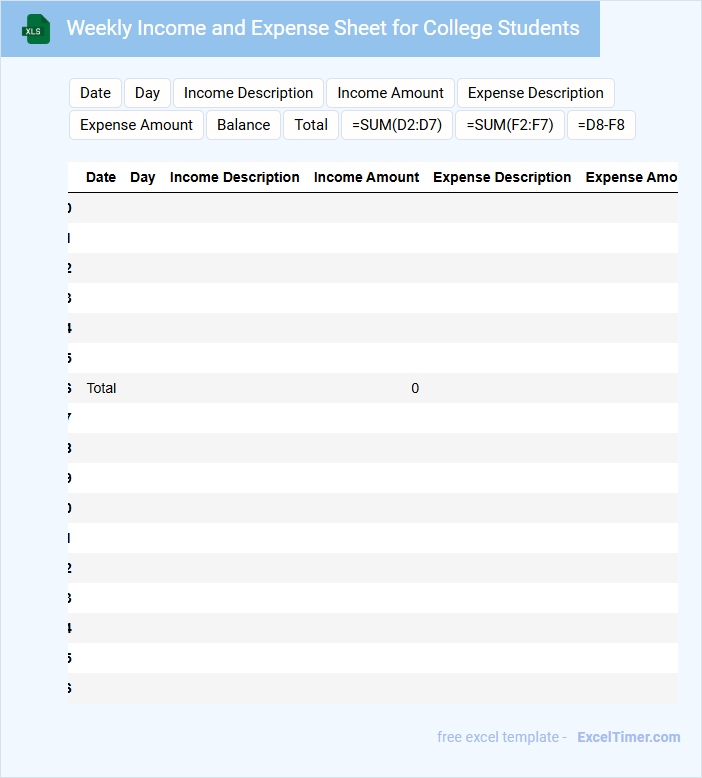

Weekly Income and Expense Sheet for College Students

A Weekly Income and Expense Sheet for College Students is a financial document designed to track and manage weekly earnings and spending habits efficiently.

- Income sources: Include scholarships, part-time jobs, and allowances to have a clear view of weekly earnings.

- Expense categories: Track essentials such as food, transportation, and supplies to monitor spending patterns.

- Balance calculation: Regularly update the remaining funds to maintain a healthy budget and avoid overspending.

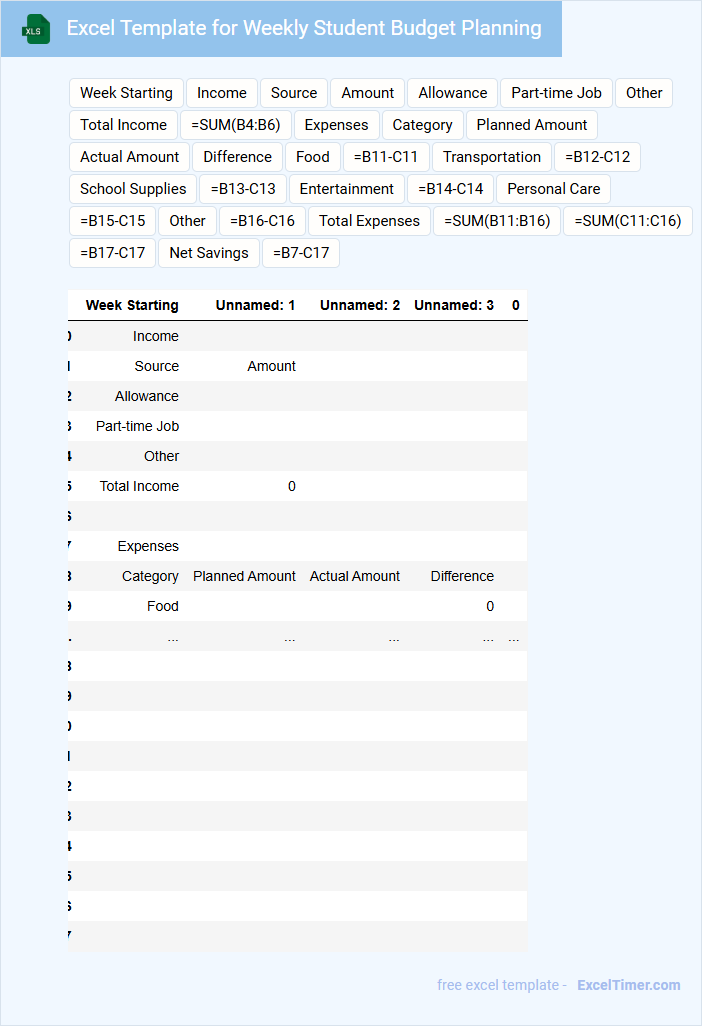

Excel Template for Weekly Student Budget Planning

This document is an Excel Template designed for organizing and managing a student's weekly budget effectively. It typically contains sections for income, expenses, and savings goals to provide a clear financial overview. Important elements include categorized expense tracking, automatic calculations, and visual charts for better budget insights.

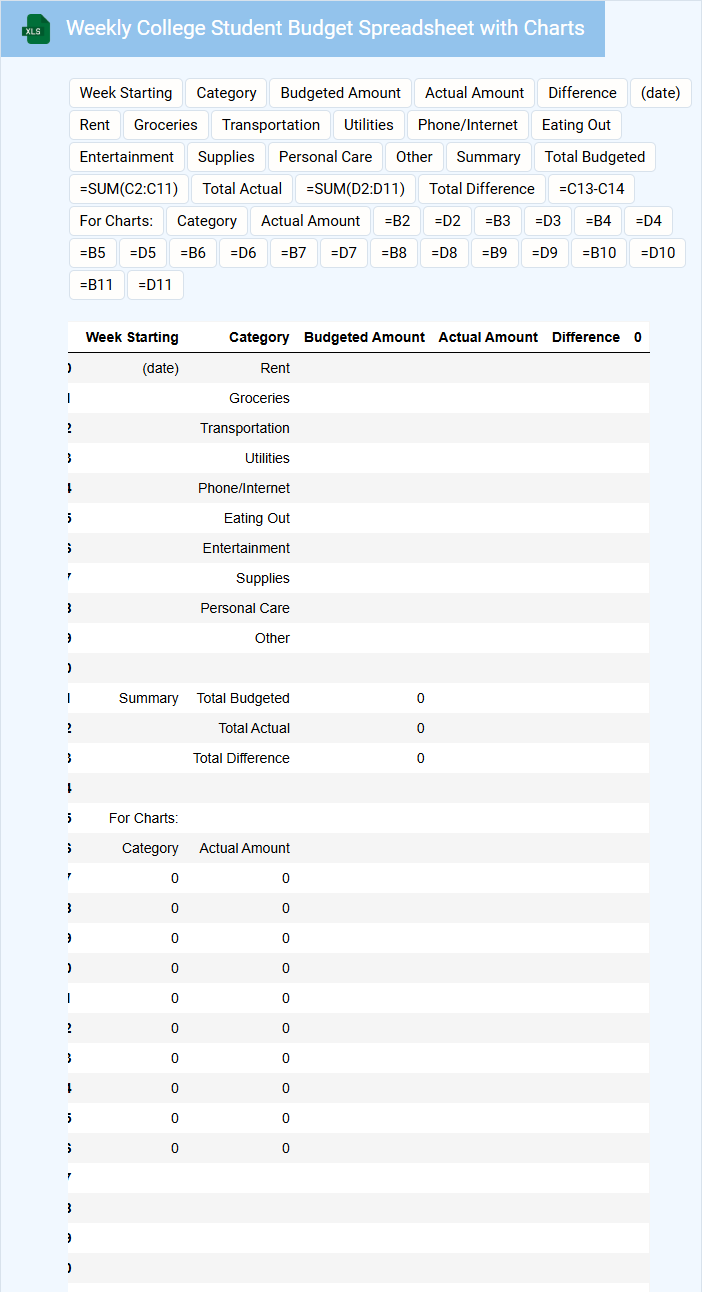

Weekly College Student Budget Spreadsheet with Charts

What information is typically included in a weekly college student budget spreadsheet with charts? This type of document generally contains categorized income and expense entries such as tuition fees, groceries, transportation, and entertainment. It uses charts to visually represent spending patterns and help students manage their finances effectively.

Why is it important to track weekly expenses visually for college students? Visual charts provide quick insights into where money is being spent excessively, enabling better budgeting decisions. Consistently updating the spreadsheet ensures financial discipline and helps avoid unnecessary debt.

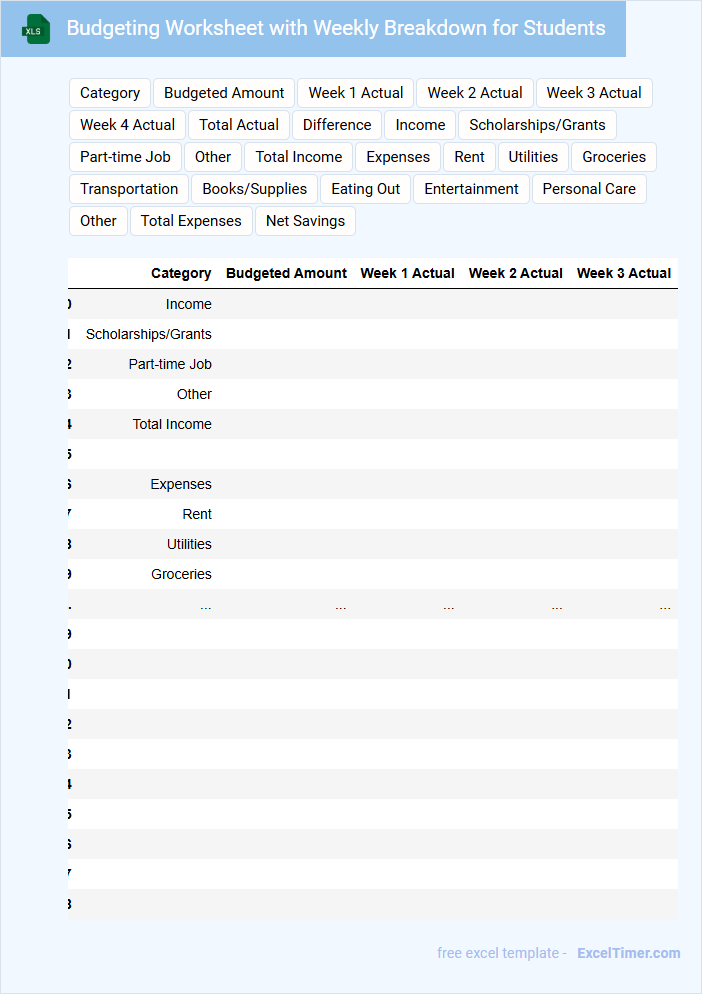

Budgeting Worksheet with Weekly Breakdown for Students

What information does a Budgeting Worksheet with Weekly Breakdown for Students typically contain? It usually includes sections for tracking weekly income, expenses, and savings goals, helping students manage their finances effectively. This document allows students to visualize their spending habits and plan their budget on a granular weekly basis.

Why is it important for students to use this type of worksheet? Using a detailed weekly breakdown encourages consistent financial awareness and discipline, making it easier for students to avoid overspending. It is also important to include categories for fixed and variable expenses to capture all potential costs accurately.

Personal Financial Plan with Weekly Tracking for College

A Personal Financial Plan with Weekly Tracking for College is a structured document that helps students manage their income, expenses, and savings on a weekly basis. It is essential for maintaining financial discipline and achieving budgeting goals throughout the semester.

- Include a clear breakdown of all sources of income such as allowances, part-time jobs, and scholarships.

- Track weekly expenses meticulously, categorizing them into essentials, non-essentials, and savings.

- Set realistic financial goals and review progress regularly to adjust the plan accordingly.

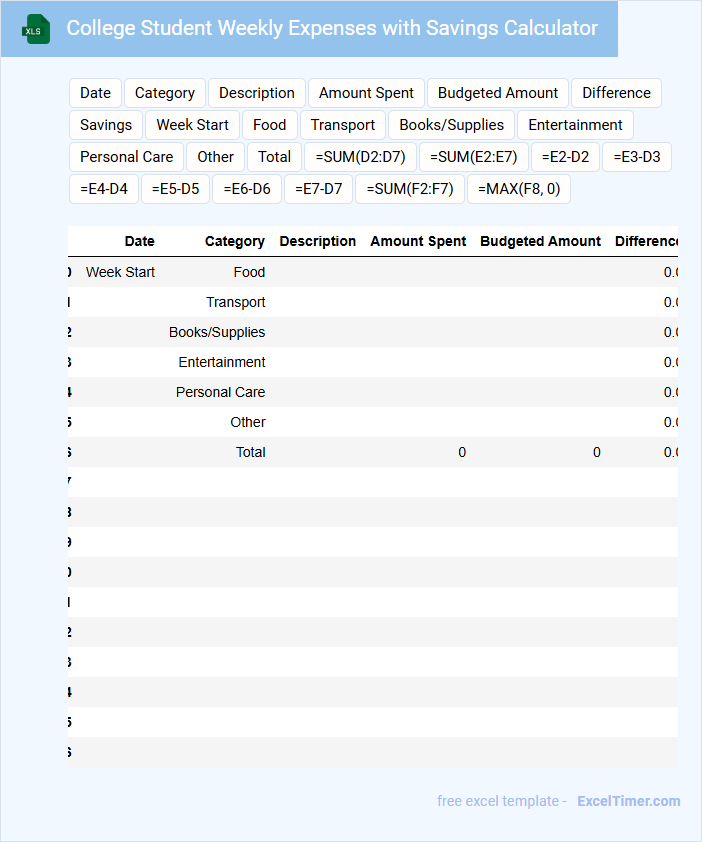

College Student Weekly Expenses with Savings Calculator

This document typically contains an overview of a college student's weekly spending patterns alongside a tool to calculate their potential savings. It helps students manage their finances effectively by tracking expenses and optimizing savings.

- Include categories such as food, transportation, entertainment, and study materials.

- Provide input fields for weekly income and variable expenses.

- Incorporate a dynamic savings calculator to project saved amounts over time.

Weekly Budget Overview for Students with Graphs

Weekly Budget Overview for Students with Graphs typically contains a summary of income, expenses, and savings visualized through graphical representations for easy tracking.

- Income Sources: Details of all weekly income such as allowances, part-time job earnings, or scholarships.

- Expense Categories: Breakdown of spending on essentials, leisure, and unexpected costs.

- Visual Representation: Graphs that highlight budget distribution and trends for better financial management.

Expense Tracker with Weekly Budget Summary for Students

What information does an Expense Tracker with Weekly Budget Summary for Students typically contain? This document usually includes detailed records of daily expenses categorized by type, such as food, transportation, and entertainment, along with a weekly summary that highlights total spending and remaining budget. It helps students monitor their financial habits and adjust their spending to stay within their budget.

What important elements should be included to make it effective? An effective tracker should feature clear categories for expenses, an easy-to-read weekly summary, and budget limits for each category. Additionally, incorporating visual aids like charts or graphs can help students quickly understand their spending patterns and plan accordingly.

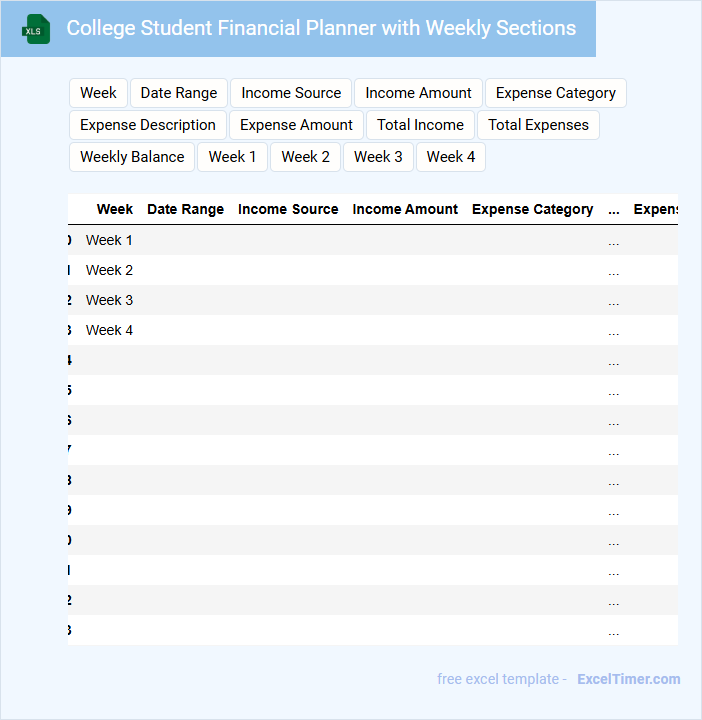

College Student Financial Planner with Weekly Sections

A College Student Financial Planner with Weekly Sections is designed to help students manage their finances effectively throughout the semester. It breaks down income, expenses, and savings goals into manageable weekly segments to promote consistent budgeting habits.

- Track weekly income sources such as part-time jobs or allowances to stay aware of cash flow.

- Record and categorize weekly expenses to identify spending patterns and reduce unnecessary costs.

- Set short-term savings goals for essentials like books, supplies, or emergency funds each week.

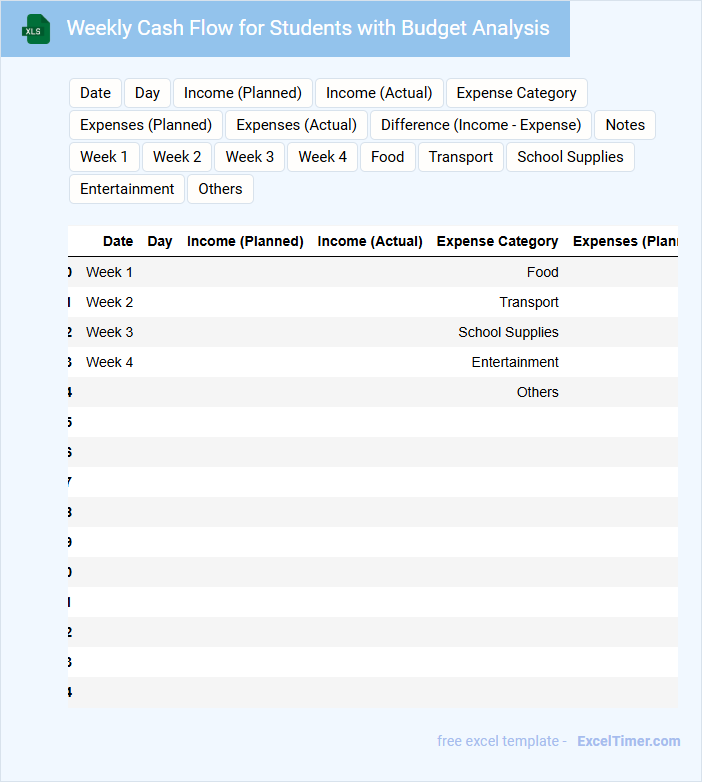

Weekly Cash Flow for Students with Budget Analysis

The Weekly Cash Flow document for students typically contains detailed records of income and expenditures over a week, helping to track financial activities. It often includes categories such as tuition fees, groceries, entertainment, and transportation expenses. This document is essential for managing finances and avoiding overspending.

For an effective analysis, it's important to include clear budget categories, regularly update transactions, and compare actual spending against planned budgets. Highlighting discrepancies helps students adjust their habits to stay within financial limits. Visual aids like charts can also enhance understanding and motivation.

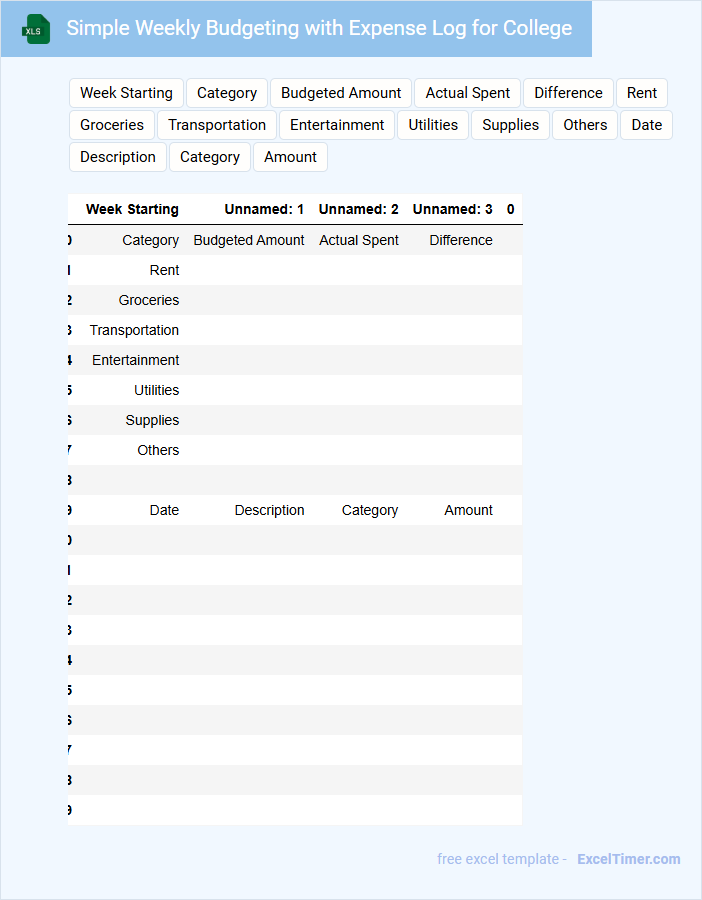

Simple Weekly Budgeting with Expense Log for College

This document typically contains a straightforward layout for tracking weekly income and expenses, helping college students manage their finances effectively.

- Income Sources: Clearly list all possible weekly income streams such as part-time jobs, allowances, or scholarships.

- Expense Categories: Organize expenses into categories like food, transportation, and entertainment for easy monitoring.

- Budget Goals: Set realistic spending limits and track actual expenses against these goals to ensure financial discipline.

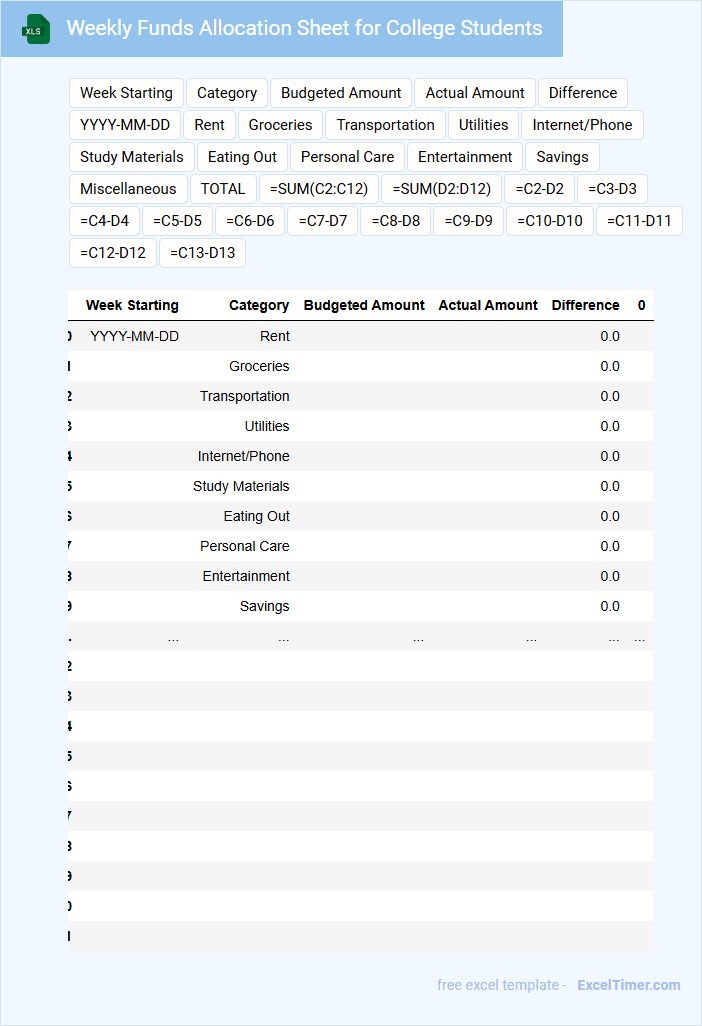

Weekly Funds Allocation Sheet for College Students

A Weekly Funds Allocation Sheet for College Students typically contains an organized breakdown of income and expenses to help manage weekly budgets effectively.

- Income Sources: Clearly list all sources of weekly income such as allowances, part-time job earnings, or scholarships.

- Expense Categories: Detail regular and variable expenses like food, transportation, study materials, and entertainment.

- Savings Goals: Set and prioritize weekly savings targets to ensure financial discipline and emergency preparedness.

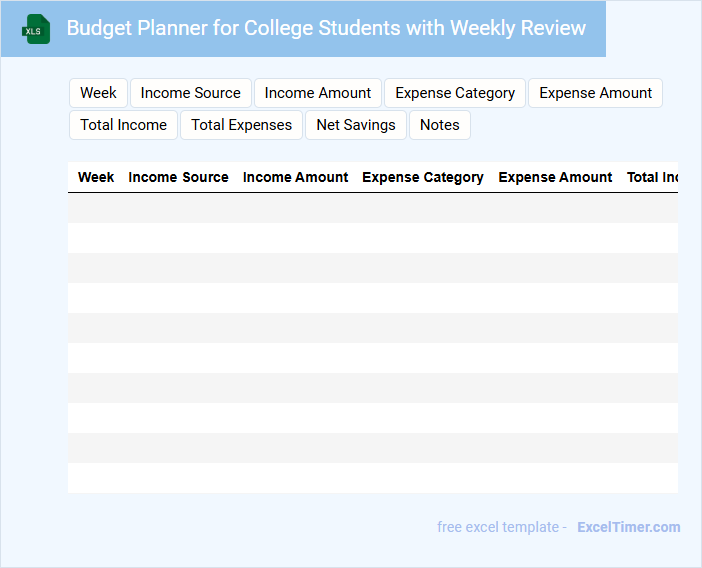

Budget Planner for College Students with Weekly Review

What does a Budget Planner for College Students with Weekly Review typically contain and what important features should it include? This document usually contains sections for tracking income, expenses, savings goals, and weekly financial reviews to help students manage their money effectively. Key features to include are categorized expense tracking, reminders for bill payments, and a weekly summary to assess spending habits and adjust budgets accordingly.

What essential expense categories should be included in a college student's weekly budget planner?

A college student's weekly budget planner should include essential expense categories such as tuition and fees, textbooks and supplies, groceries, transportation, housing, utilities, and personal expenses. Allocating funds for entertainment, dining out, and emergency savings is also important to maintain financial balance. Tracking these categories helps students manage their finances effectively and avoid overspending.

How can you utilize Excel formulas to automatically calculate weekly spending totals?

Use the SUM formula to add up all expenses listed in the weekly budget columns, providing a dynamic total that updates as you enter new data. Apply the SUMIF function to categorize and total specific expense types like food, transportation, or entertainment within your weekly spending. Implement cell references and absolute references to ensure formulas accurately calculate across multiple weeks without manual adjustments.

What methods can track variable versus fixed expenses in a weekly budget Excel sheet?

Use categorized expense columns to separate variable costs like groceries and entertainment from fixed expenses such as rent and subscriptions in the Excel sheet. Apply formulas to sum each category weekly, enabling clear tracking of spending patterns. Conditional formatting highlights overspending in variable categories to maintain budget control.

How can conditional formatting highlight overspending in specific budget categories?

Conditional formatting in your Weekly Budget Planner can highlight overspending by automatically changing the color of cells where expenses exceed the set budget limits. This visual cue helps you quickly identify specific budget categories that require attention. Using color scales or custom rules enhances your ability to manage finances effectively during college.

Which Excel features help visualize spending trends for easier budgeting decisions?

Excel features such as conditional formatting, sparklines, and pivot charts help visualize spending trends effectively. These tools allow you to highlight overspending, track expense patterns weekly, and generate interactive charts for clearer budgeting insights. Utilizing these features enhances your ability to make informed financial decisions throughout the semester.