The Annually Donation Record Excel Template for Churches streamlines the tracking of yearly contributions, ensuring accurate and organized financial records. It helps church administrators monitor donor activities, generate reports, and maintain transparency for audit purposes. This template supports budgeting and fundraising efforts by providing clear insights into donation patterns over time.

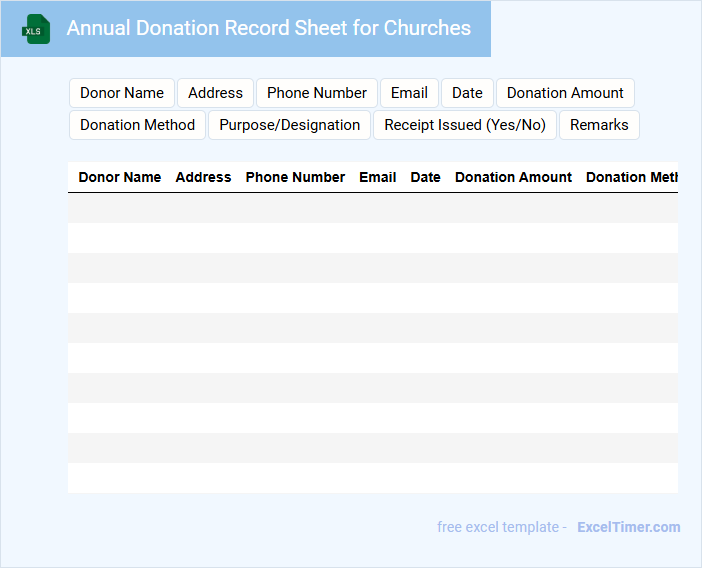

Annual Donation Record Sheet for Churches

What information is typically included in an Annual Donation Record Sheet for Churches? This document usually contains detailed records of donations made by members throughout the year, including donor names, dates, amounts, and types of contributions. It helps churches maintain transparency, track financial support, and prepare accurate reports for accounting and tax purposes.

What important considerations should be kept in mind when maintaining this record? Ensuring data accuracy and confidentiality is crucial to respect donor privacy and comply with legal requirements. Additionally, regularly updating the sheet and backing it up can prevent data loss and facilitate smooth year-end financial reviews.

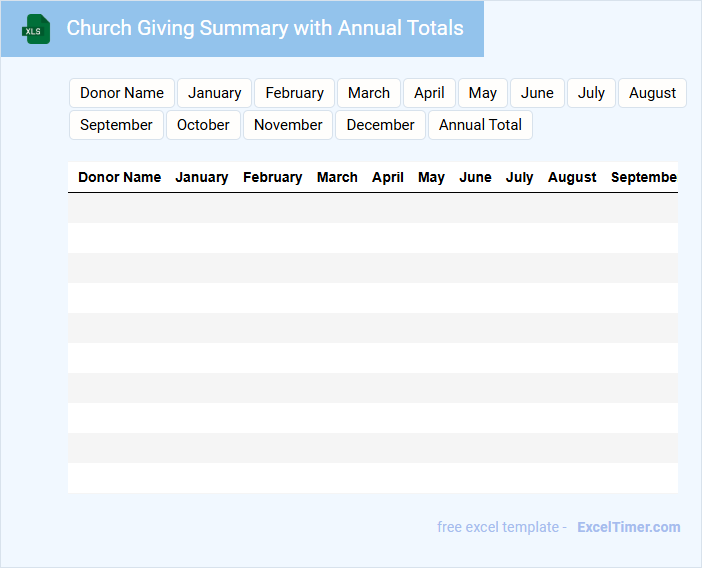

Church Giving Summary with Annual Totals

A Church Giving Summary with Annual Totals typically contains detailed records of donations and financial contributions made by members throughout the year.

- Donor Information: Includes names and contact details for accurate tracking and communication.

- Donation Records: Lists each contribution with dates and amounts for transparency and accountability.

- Annual Totals: Summarizes yearly giving to help in budgeting and financial planning.

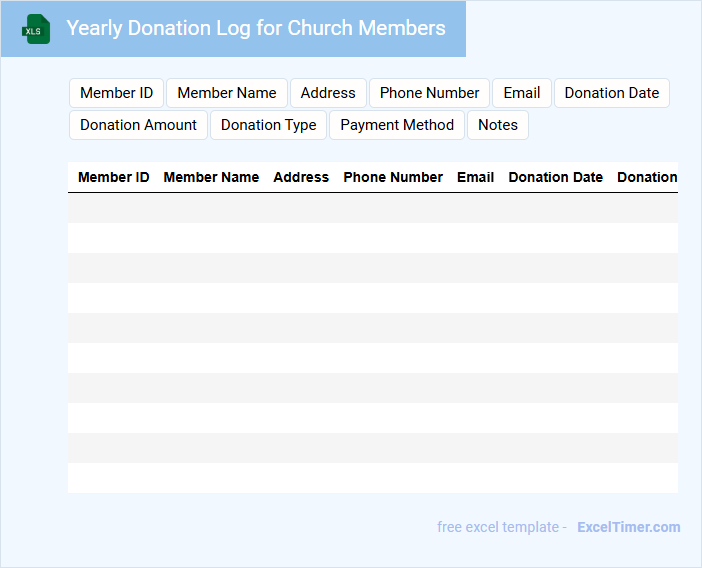

Yearly Donation Log for Church Members

A Yearly Donation Log for church members typically contains detailed records of all contributions made by individuals throughout the year. This document includes names, dates, amounts donated, and the purpose of each donation, ensuring transparency and accountability. Maintaining an accurate log helps the church manage finances effectively and provides donors with official acknowledgment for tax purposes.

Annual Contribution Tracker for Church Finances

The Annual Contribution Tracker is a crucial document used to monitor and record all financial contributions made to a church throughout the year. It typically includes details such as donor names, donation dates, amounts, and designated fund categories. Maintaining accurate records ensures transparency and aids in financial planning and accountability for the church community.

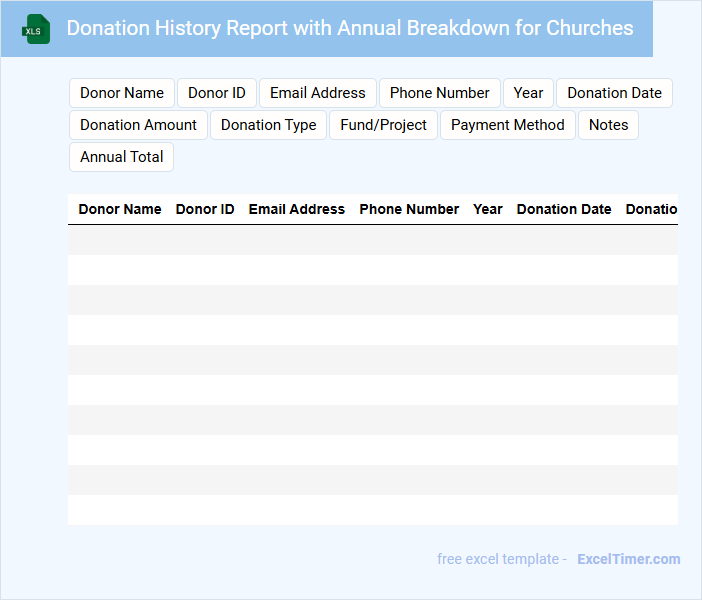

Donation History Report with Annual Breakdown for Churches

The Donation History Report for churches provides a detailed record of contributions received over a specified period, often broken down annually for clarity. This document typically includes donor names, dates of donations, amounts, and designated purposes to aid in transparent financial tracking. Ensuring accuracy and completeness in this report is essential for maintaining trust and facilitating yearly financial planning within the church community.

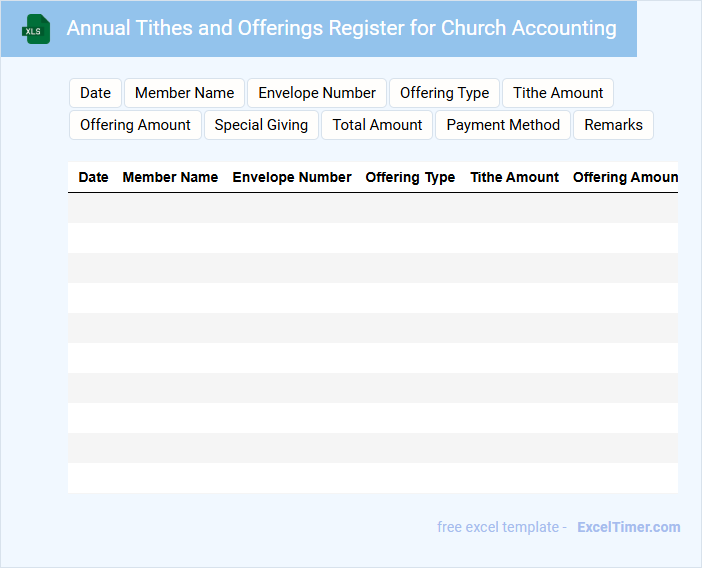

Annual Tithes and Offerings Register for Church Accounting

The Annual Tithes and Offerings Register is a vital document for church accounting that records all financial contributions received throughout the year. It ensures transparency and accountability in managing church funds.

This register typically contains detailed entries of donors, dates, amounts, and types of donations, such as tithes and offerings. Regular updates and accurate record-keeping are essential for effective financial oversight.

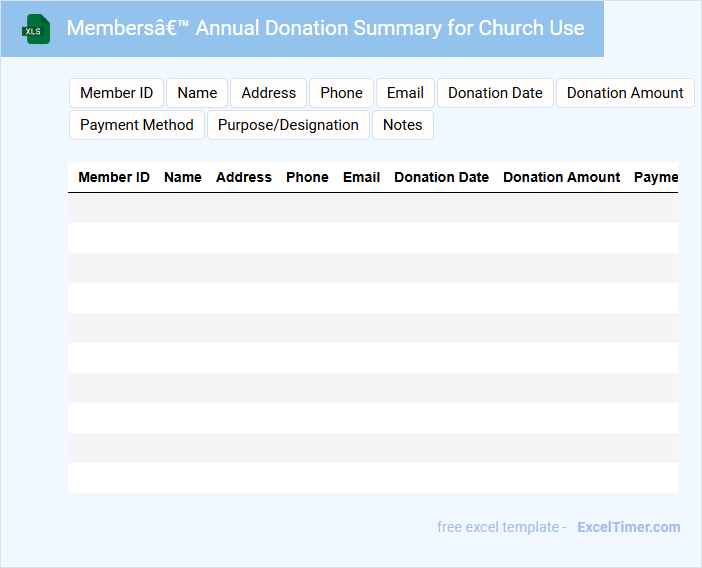

Members’ Annual Donation Summary for Church Use

The Members' Annual Donation Summary is a document that details the total contributions made by each member over the course of a year. It typically includes names, dates, and donation amounts to provide a clear financial record.

This summary is essential for transparency and accountability within the church's financial management. Ensuring accurate and up-to-date information helps in maintaining trust and supporting future fundraising efforts.

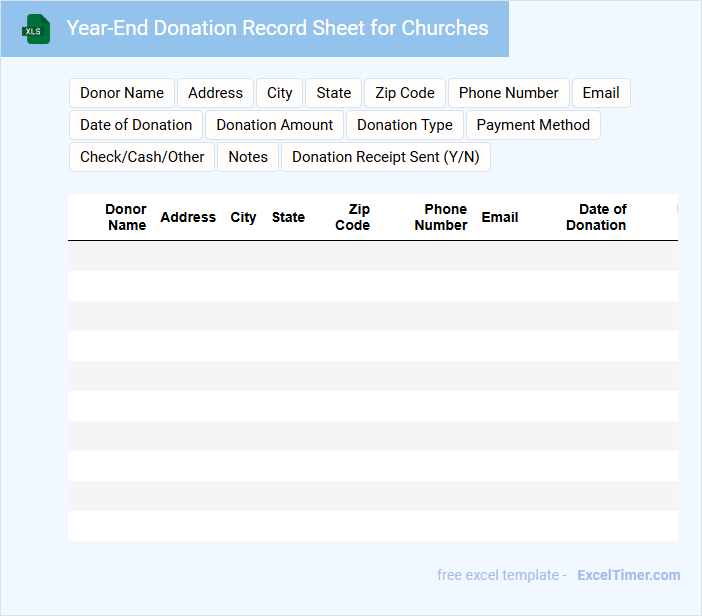

Year-End Donation Record Sheet for Churches

The Year-End Donation Record Sheet is a crucial document for churches, summarizing all the donations received throughout the year. It includes donor names, donation amounts, dates, and payment methods for accurate record-keeping.

Maintaining this sheet ensures transparency and aids in preparing tax receipts for contributors. An important suggestion is to keep the data secure and organized for easy reference during audits and annual reporting.

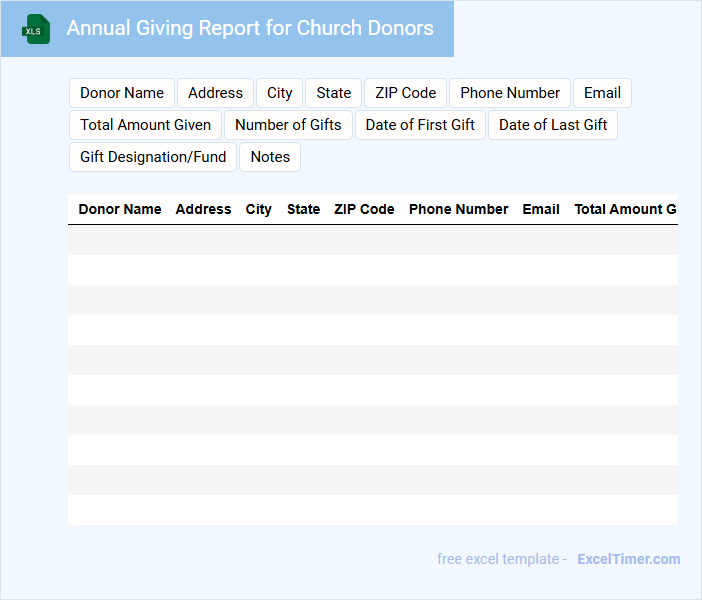

Annual Giving Report for Church Donors

What information is typically included in an Annual Giving Report for Church Donors? This type of document usually contains a summary of the total contributions received throughout the year, along with detailed acknowledgments of individual donor generosity. It also highlights the financial impact on church programs and community outreach initiatives to demonstrate transparency and gratitude.

What important elements should be included to make the report effective? Key components include a clear breakdown of donation categories, stories of how contributions have positively affected the church community, and a heartfelt thank-you message to encourage ongoing support. Visual aids such as charts or infographics can also enhance donor engagement and understanding.

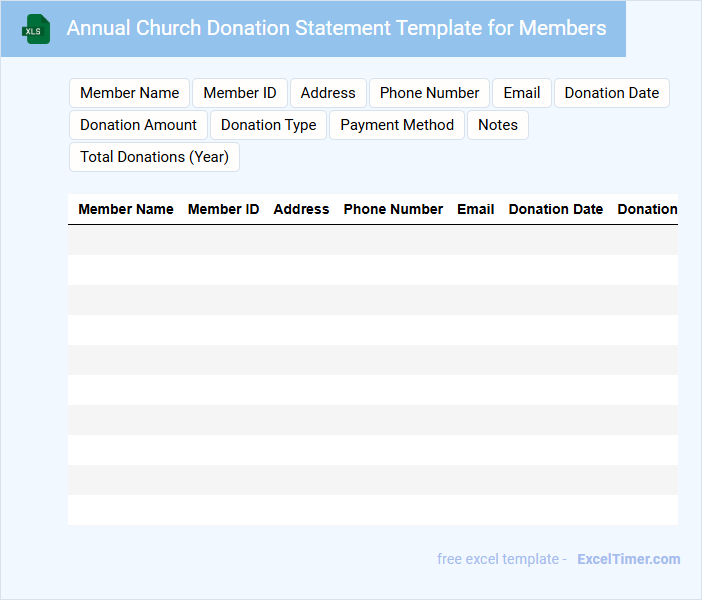

Annual Church Donation Statement Template for Members

What information is typically included in an Annual Church Donation Statement for members? This document usually contains a summary of all the donations and contributions a member has made throughout the year, including dates and amounts. It is designed to help members keep accurate records for tax purposes and to encourage continued generosity.

What important elements should be highlighted in this template? The template should clearly display the church's name and contact information, a detailed list of donations by date, total amount donated, and a statement confirming that no goods or services were provided in exchange for the donations, ensuring it meets IRS guidelines for charitable contributions.

Contribution Tracking Sheet with Annual Overview for Churches

What information does a Contribution Tracking Sheet with Annual Overview for Churches typically contain? This type of document usually includes detailed records of individual contributions, dates, and amounts given throughout the year. It also summarizes total contributions annually, helping church administration maintain transparent financial records and recognize donor support efficiently.

What is an important consideration when maintaining this sheet? Ensuring accuracy and regular updates is crucial to provide reliable data for budgeting, reporting, and acknowledging contributions, while respecting donor confidentiality and compliance with tax regulations.

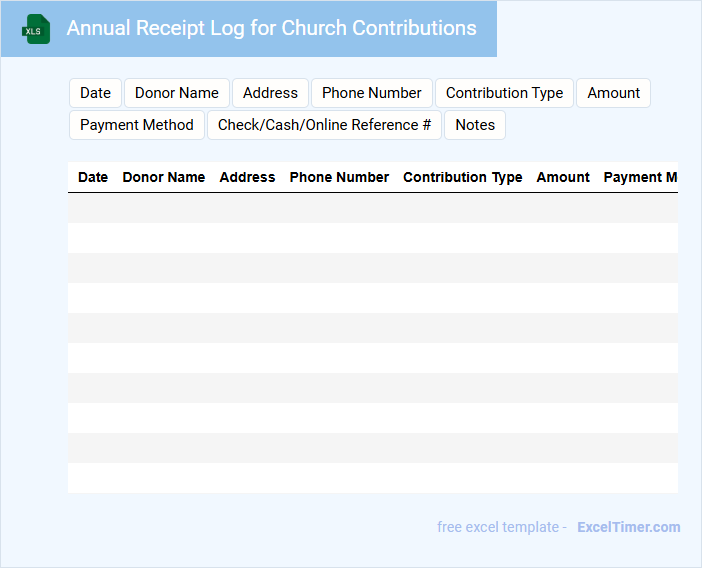

Annual Receipt Log for Church Contributions

Annual Receipt Logs for Church Contributions typically document all donations received throughout the year, ensuring transparency and proper financial tracking. This record helps maintain accurate accounting and donor acknowledgment.

- Include the donor's name, date of contribution, and amount given.

- Record the method of payment for each donation.

- Ensure timely issuance of receipts to comply with legal and tax requirements.

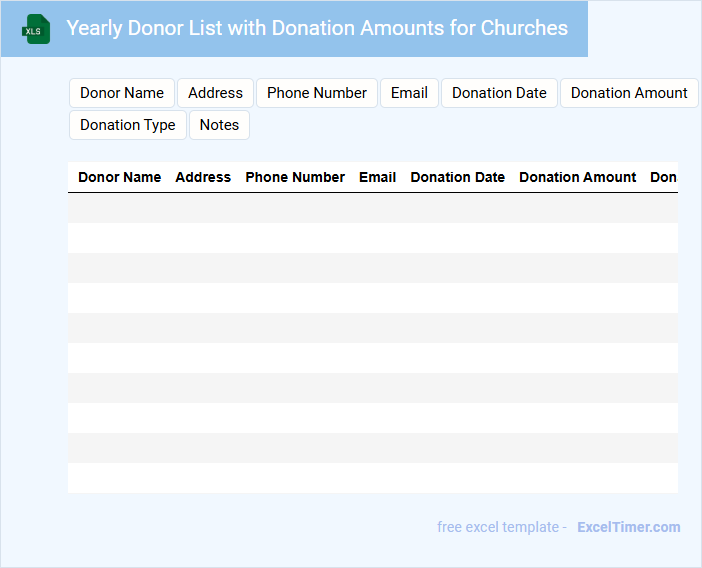

Yearly Donor List with Donation Amounts for Churches

Yearly Donor Lists are essential documents that record the names of individuals and organizations who have contributed to the church financially throughout the year. These lists typically include details such as the donor's name, donation amounts, and dates of contributions.

Including a transparent breakdown of donations helps maintain trust and encourages continued support from the congregation and community. It is important to ensure accuracy and privacy when compiling these lists to respect donors' confidentiality and comply with legal regulations.

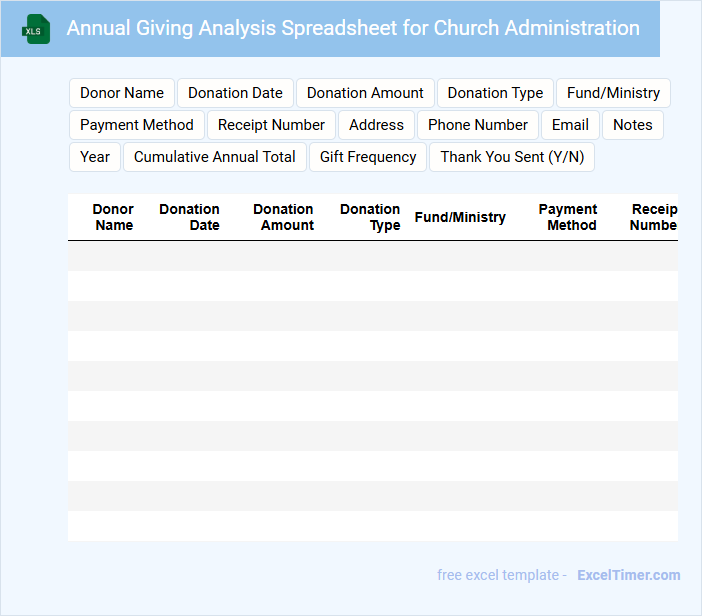

Annual Giving Analysis Spreadsheet for Church Administration

An Annual Giving Analysis Spreadsheet for church administration typically contains detailed records of all donations made throughout the year, categorized by donor type and giving frequency. It also tracks trends in contributions to help understand financial support patterns.

This document is essential for budgeting, forecasting, and recognizing major donors. Maintaining accurate and updated data is crucial for effective stewardship and transparency in church finances.

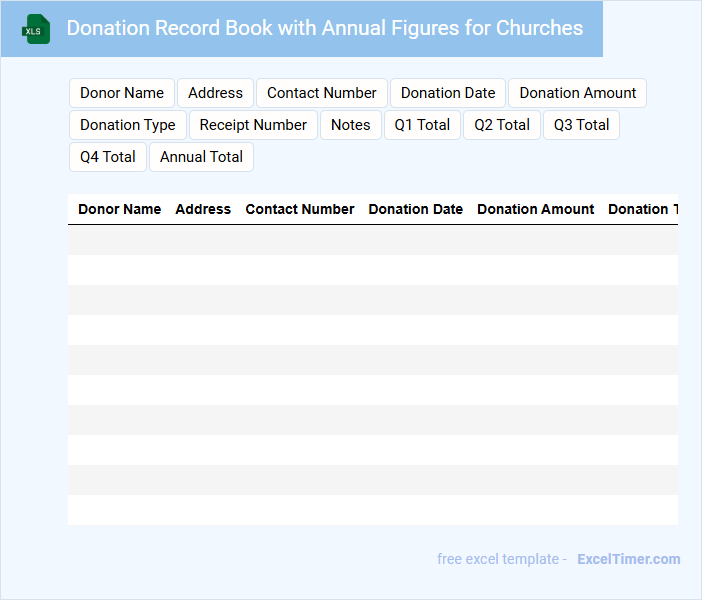

Donation Record Book with Annual Figures for Churches

The Donation Record Book for churches is typically used to document contributions made by parishioners throughout the year. It includes annual figures that help track the financial support received, ensuring transparency and accountability. This record is essential for managing church finances and planning future activities.

It should contain donor names, dates, amounts donated, and the purpose of each donation to provide a comprehensive overview. Regular updates and accurate entries are crucial to maintain trust and facilitate easy auditing. Organizing data by month or event can also improve clarity and accessibility.

To optimize the usefulness of the book, including a summary of annual totals and a section for notes or acknowledgments is recommended. Ensuring secure storage and limited access helps protect sensitive information. Utilizing both digital and physical copies can safeguard against data loss.

What are the essential fields to include in an annually donation record for church members?

Essential fields in an annual donation record for church members include Donor Name, Donation Date, Donation Amount, Donation Type (e.g., Tithes, Offering, Special Gifts), Payment Method, and Fund Designation. Additional fields such as Contact Information, Receipt Number, and Notes on Donation Purpose enhance tracking and reporting accuracy. Including a Year-to-Date Total Donation field supports annual giving summaries and tax documentation.

How can you use Excel formulas to automatically calculate total annual donations per donor?

Use the SUMIF formula to automatically calculate total annual donations per donor by summing all donation amounts that match each donor's name in the records. For example, =SUMIF(DonorRange, DonorName, DonationAmountRange) adds donations from a specific donor. Organize donor names and donation amounts in separate columns to ensure accurate aggregation.

What steps ensure donor privacy when managing annual donation records in Excel?

Encrypting the Excel file and restricting access with strong passwords protect donor privacy in annual donation records. Implementing data masking techniques on sensitive information like donor names and contact details minimizes exposure risks. Regular backups combined with audit trails track changes and prevent unauthorized data access.

How do you create a summary report of yearly donations for church leadership using Excel?

To create a summary report of yearly donations for church leadership using Excel, organize your donation data by donor name, date, and amount within a structured spreadsheet. Use PivotTables to aggregate total donations per donor and filter by year, enabling clear insight into yearly giving patterns. You can customize the report layout, add charts, and apply conditional formatting to highlight key trends in Your church's donation records.

What methods help track and flag missing or inconsistent donation entries in the annual record?

Your annual donation record for churches can be efficiently tracked using data validation rules and conditional formatting in Excel to flag missing or inconsistent entries. Implementing pivot tables and formulas like COUNTIF or IFERROR helps identify irregularities and ensure accurate reporting. Utilizing these methods enhances the integrity and completeness of your donation data.