![]()

The Monthly Expense Tracker Excel Template for Homeowners helps efficiently manage and organize household expenses, providing clear insights into spending patterns. It includes customizable categories for utilities, mortgage payments, maintenance, and other essential costs, making budgeting simpler. Ensuring consistent tracking with this template promotes financial discipline and helps homeowners avoid overspending.

Monthly Expense Tracker Excel Template for Homeowners

A Monthly Expense Tracker Excel Template for homeowners is a tool designed to help individuals monitor and manage their monthly household expenses efficiently. It typically contains categorized expense fields such as utilities, mortgage payments, maintenance costs, and other regular bills. This document helps homeowners maintain financial awareness and make informed budgeting decisions.

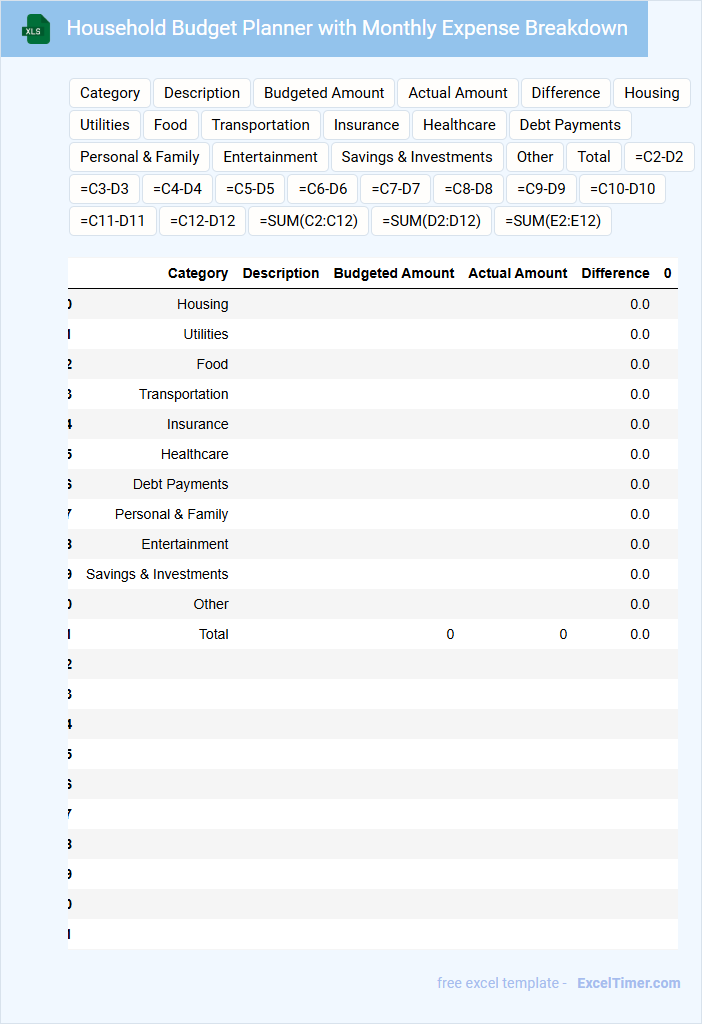

Household Budget Planner with Monthly Expense Breakdown

A Household Budget Planner is a document designed to help individuals or families track their income and expenses systematically. It usually contains categorized sections for monthly income sources, fixed and variable expenses, and savings goals. By organizing these details, the planner enables better financial management and informed spending decisions.

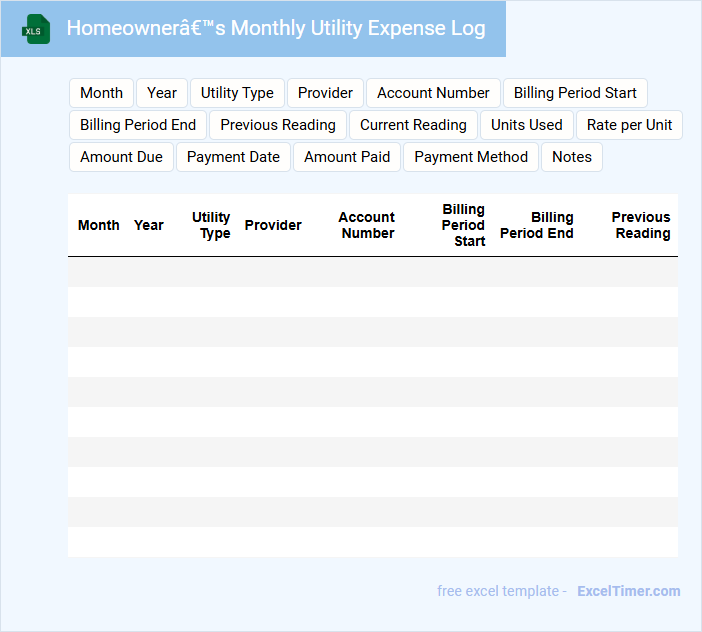

Homeowner’s Monthly Utility Expense Log

A Homeowner's Monthly Utility Expense Log typically contains detailed records of monthly utility bills such as electricity, water, gas, and waste services. This document helps homeowners track spending patterns and identify ways to reduce costs.

It is important to include accurate billing dates, amounts, and payment statuses to maintain an effective log. Keeping this log regularly updated ensures better financial management and can assist in budgeting for future expenses.

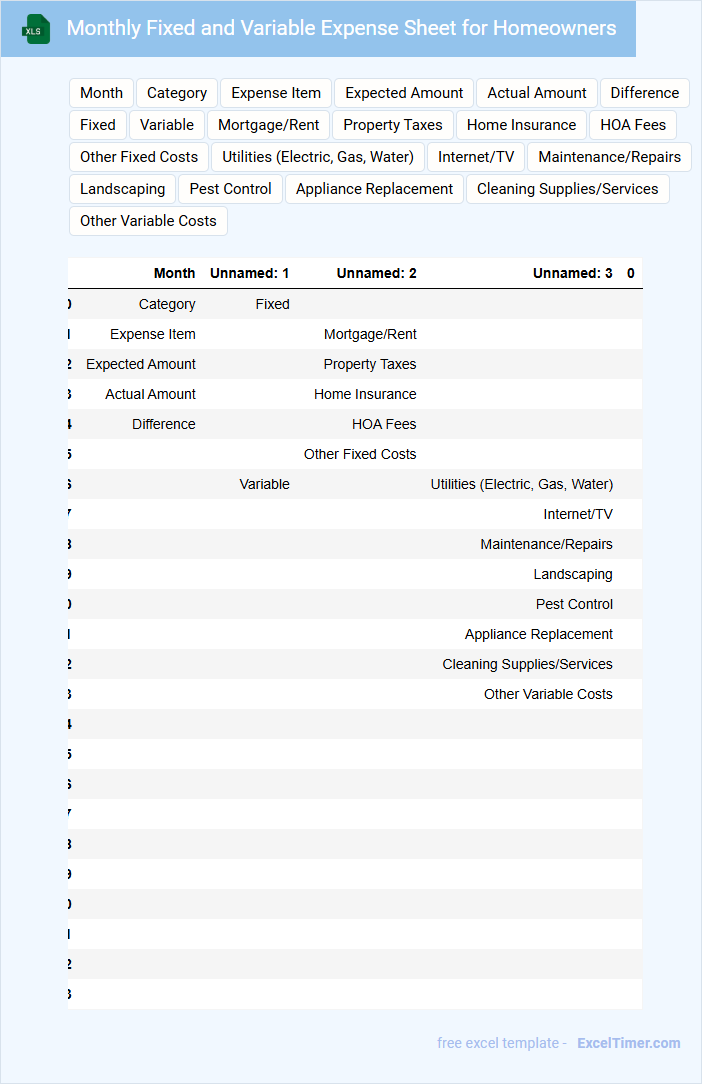

Monthly Fixed and Variable Expense Sheet for Homeowners

This document typically contains detailed records of all monthly fixed and variable expenses incurred by homeowners. It helps in budgeting and financial planning to manage household expenses efficiently.

- Include all recurring fixed expenses such as mortgage, insurance, and property taxes.

- Track variable expenses like utilities, maintenance, and groceries accurately each month.

- Regularly update the sheet to monitor spending patterns and identify areas for savings.

Home Maintenance Costs Tracker with Monthly Summary

A Home Maintenance Costs Tracker is a document designed to record and monitor all expenses related to the upkeep of a property. It typically contains detailed entries for repair costs, service dates, and contractor information, organized by month. This allows homeowners to budget effectively and identify recurring expenses over time for better financial planning.

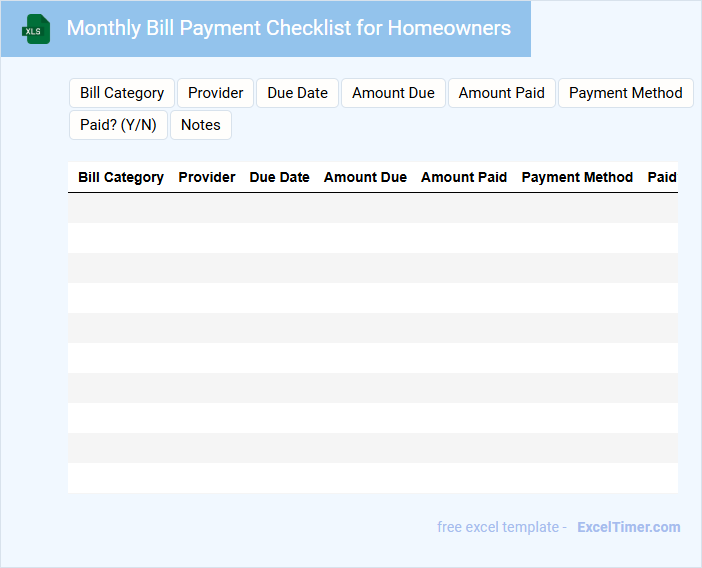

Monthly Bill Payment Checklist for Homeowners

A Monthly Bill Payment Checklist for homeowners is a crucial document that helps track and organize all recurring financial obligations related to maintaining a home. It typically contains a list of bills such as mortgage payments, utilities, insurance, and property taxes, ensuring nothing is overlooked each month. Homeowners benefit by avoiding late fees and managing their budget effectively.

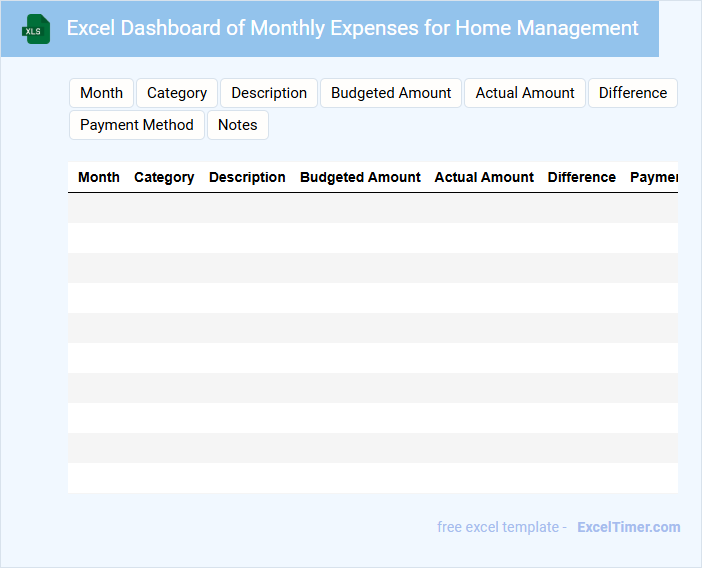

Excel Dashboard of Monthly Expenses for Home Management

What information is typically included in an Excel Dashboard of Monthly Expenses for Home Management? This type of document usually contains categorized expense data, such as utilities, groceries, and maintenance costs, displayed through various charts and graphs for easy analysis. It helps users track their spending patterns and identify areas to optimize their household budget effectively.

What key elements should be included to make the dashboard effective? Important features include clear visualizations like pie charts or bar graphs, dynamic filters to view different time periods, and concise summaries highlighting total expenses and budget variances for informed decision-making.

Family Expense Tracker with Homeownership Focus

A Family Expense Tracker with Homeownership Focus is a financial document designed to monitor household spending while emphasizing costs related to owning a home. It helps families manage budgets, track payments, and plan savings for home maintenance and improvements.

- Include categories for mortgage, utilities, and home repairs to capture all home-related expenses.

- Track recurring and unexpected expenses separately to better anticipate future costs.

- Incorporate notes or reminders for due dates and insurance payments to avoid penalties.

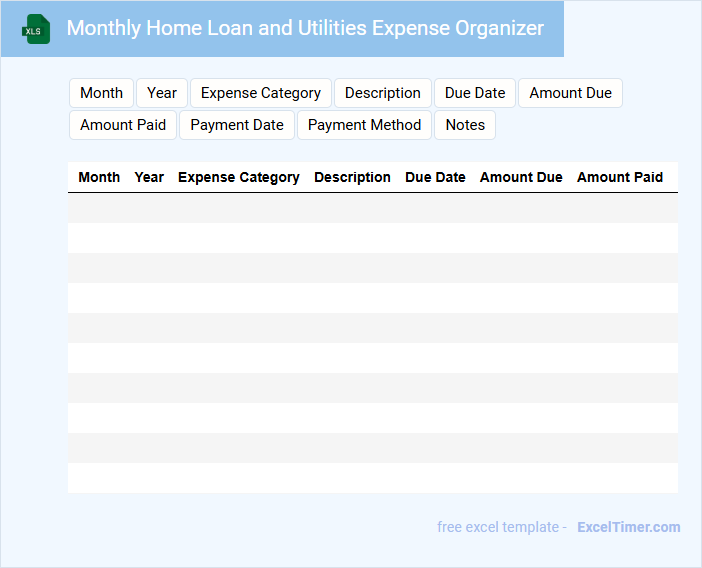

Monthly Home Loan and Utilities Expense Organizer

A Monthly Home Loan and Utilities Expense Organizer typically contains detailed records of monthly payments related to home loans, including the principal and interest amounts. It also tracks utility expenses such as electricity, water, and gas bills to provide a comprehensive overview of household financial obligations.

This document helps homeowners budget effectively by consolidating all related expenses in one place, enabling easy monitoring and timely payments. Regular updates and accurate information entry are important to maintain its usefulness and prevent missed payments.

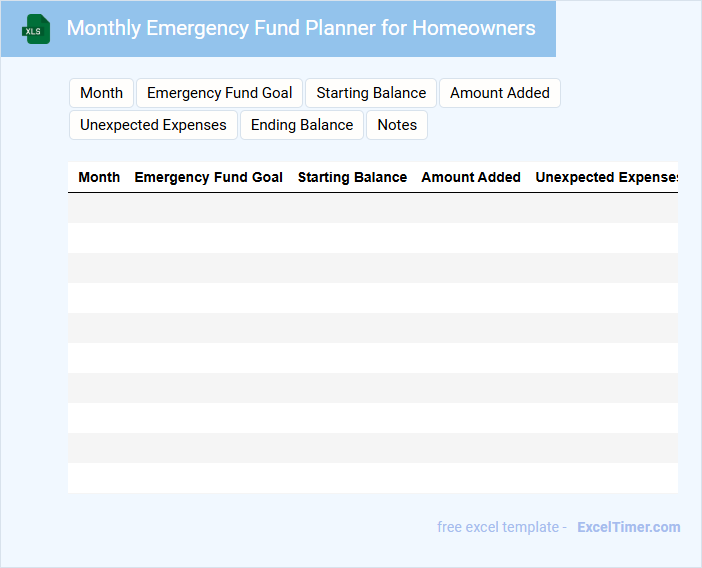

Monthly Emergency Fund Planner for Homeowners

The Monthly Emergency Fund Planner is a crucial document for homeowners to systematically manage unexpected expenses. It typically contains sections for income, monthly expenses, and a target savings goal to cover emergencies. This planner helps prioritize financial stability by tracking savings progress and forecasting potential emergencies.

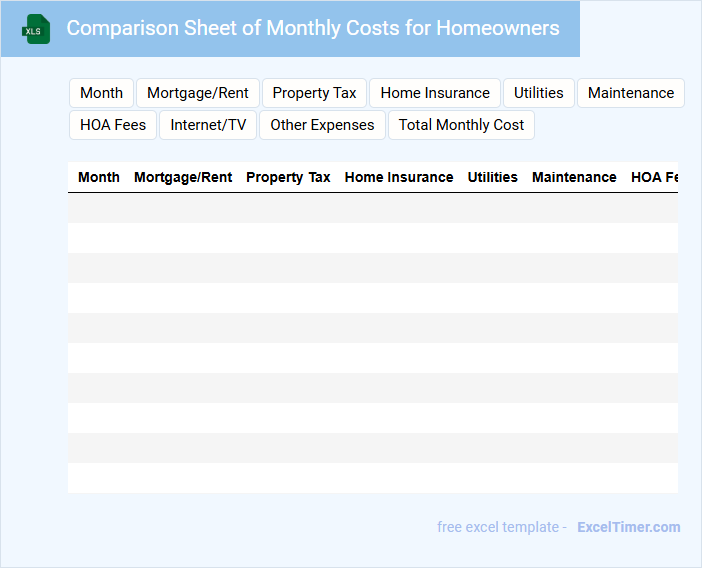

Comparison Sheet of Monthly Costs for Homeowners

A Comparison Sheet of Monthly Costs for Homeowners is a detailed document that outlines and contrasts the various expenses incurred by homeowners each month. It typically includes categories such as mortgage payments, utilities, maintenance, insurance, and property taxes.

This sheet helps homeowners make informed financial decisions by clearly presenting all recurring costs side by side. To maximize its usefulness, ensure accuracy in data entry and regularly update the sheet to reflect any changes in expenses.

Monthly Utility and Maintenance Expense Tracker for Homeowners

The Monthly Utility and Maintenance Expense Tracker is a document that helps homeowners monitor and control their monthly spending on utilities and home repairs. It usually contains detailed records of all utility bills and maintenance costs incurred each month to give a clear financial overview.

This type of tracker is essential for budgeting and identifying areas where expenses can be reduced to save money. To maximize its effectiveness, it is important to update the document regularly and categorize expenses for easy analysis.

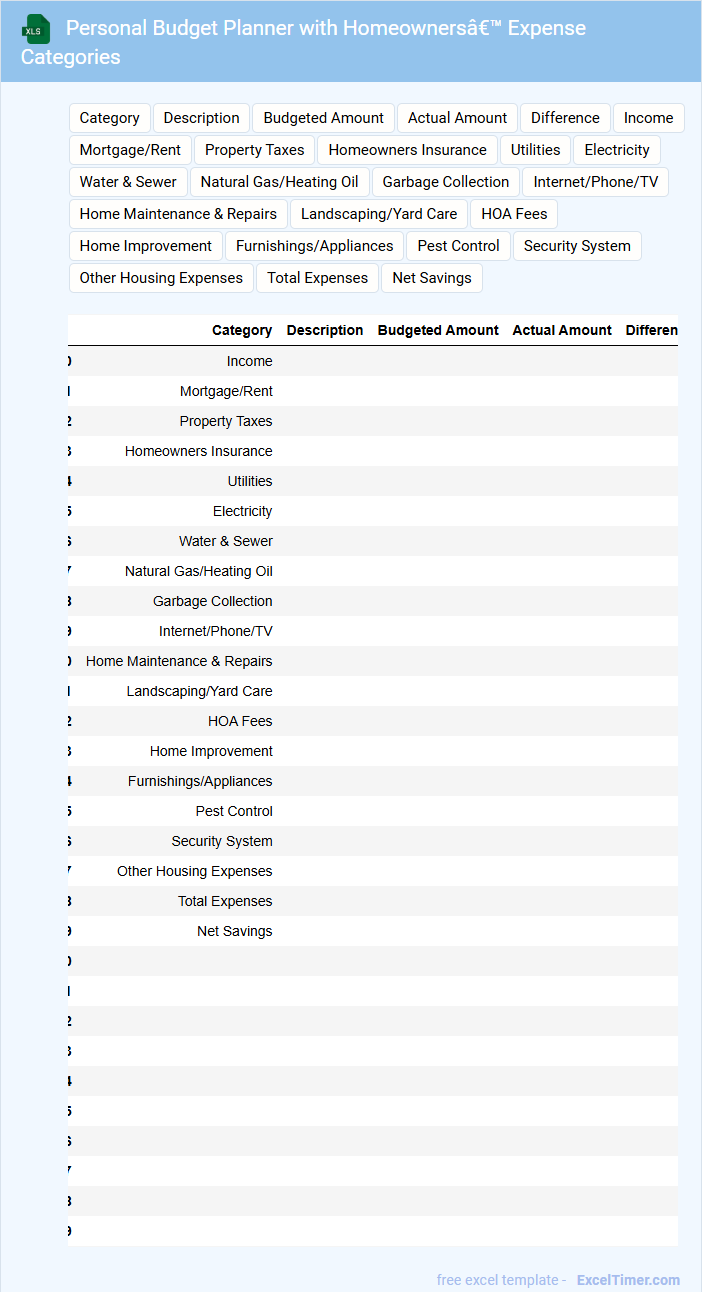

Personal Budget Planner with Homeowners’ Expense Categories

What key information does a Personal Budget Planner with Homeowners' Expense Categories typically contain? This type of document includes income details, monthly expenses broken down into categories such as mortgage or rent, utilities, maintenance, and insurance. It helps homeowners track spending, plan savings, and manage financial goals effectively by providing a clear overview of home-related costs.

What important factors should be considered when using this planner? Accurate categorization of all homeowner expenses and regular updates ensure realistic budgeting. Including unexpected costs like emergency repairs is crucial to build a resilient and practical financial plan.

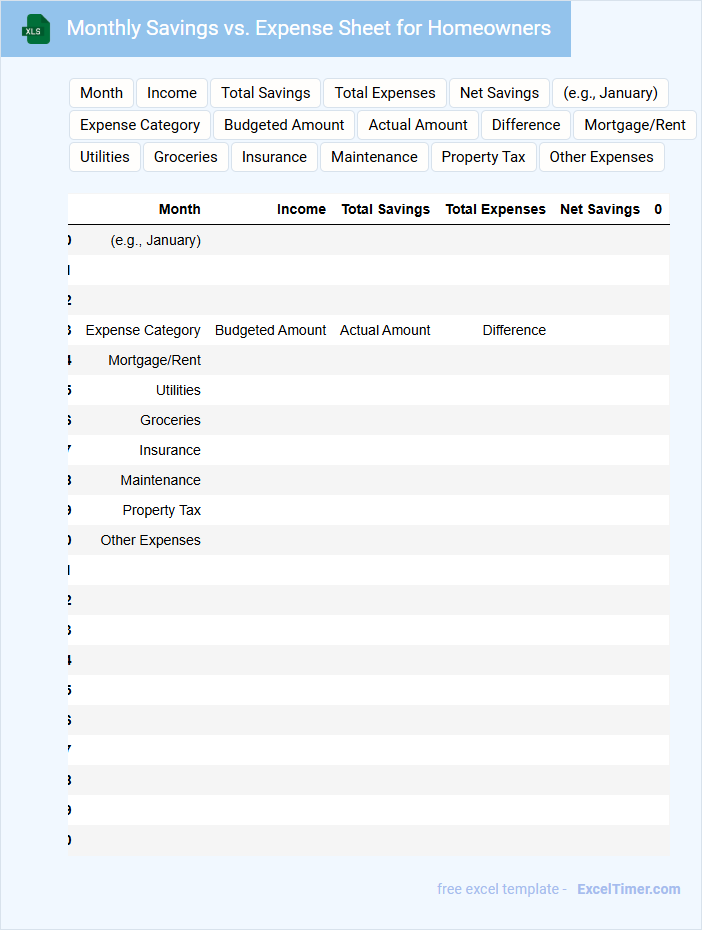

Monthly Savings vs. Expense Sheet for Homeowners

What information is typically included in a Monthly Savings vs. Expense Sheet for Homeowners? This document usually contains detailed records of all income sources, monthly savings, and various expenses such as mortgage payments, utilities, and maintenance costs. It helps homeowners track their financial health by comparing savings against expenditures to ensure effective budgeting and financial planning.

Why is it important to regularly update a Monthly Savings vs. Expense Sheet? Regular updates provide an accurate snapshot of your financial situation, allowing you to identify spending patterns and adjust your budget accordingly. Including categories like emergency funds and unexpected repairs can enhance the usefulness of the sheet for long-term financial stability.

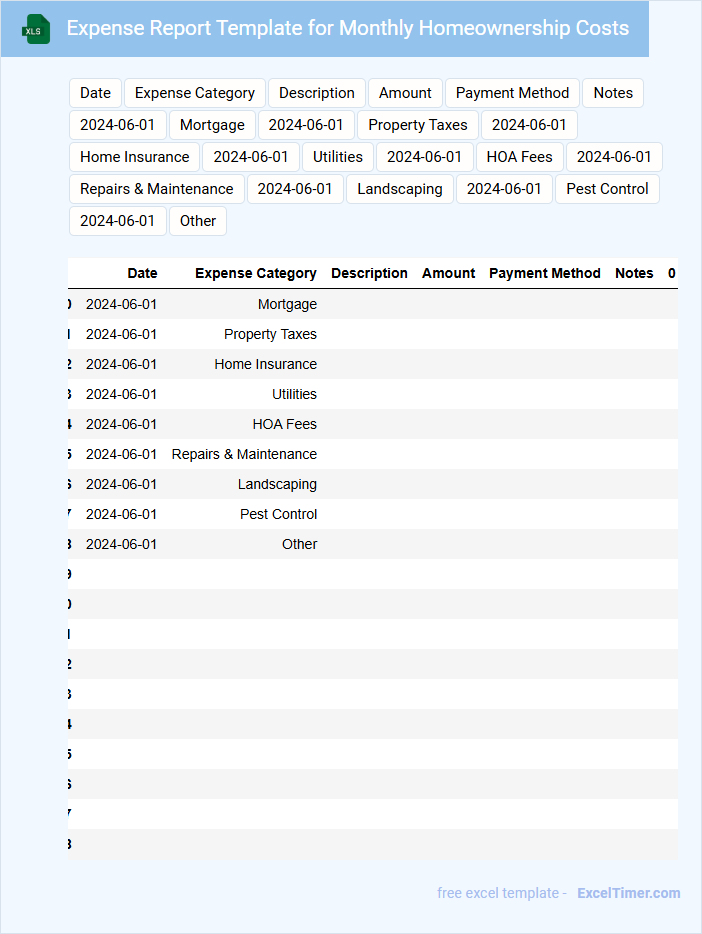

Expense Report Template for Monthly Homeownership Costs

An Expense Report Template for Monthly Homeownership Costs typically contains detailed entries of various home-related expenses such as mortgage payments, utilities, maintenance, and insurance. It helps homeowners track spending and budget effectively each month. Including clear categories and regular updates is essential for accurate financial management.

What key categories should homeowners include in a monthly expense tracker to cover all recurring and unexpected costs?

Homeowners should include key categories such as mortgage or rent payments, utilities (electricity, water, gas), property taxes, and insurance in a monthly expense tracker. Maintenance and repairs, landscaping, and HOA fees are essential for covering recurring and unexpected home-related costs. Adding a contingency fund category ensures preparedness for emergency expenses and unforeseen repairs.

How can Excel formulas automate the calculation of total expenses and identify overspending areas?

Excel formulas like SUM automatically calculate total monthly expenses by aggregating cost entries across categories. Conditional formatting combined with IF statements highlights overspending by comparing expenses against predefined budget limits. This automation enables homeowners to monitor spending patterns and make data-driven financial decisions efficiently.

What methods can be used in Excel to visualize monthly spending trends for homeowners?

Excel offers several methods to visualize monthly spending trends for homeowners, including line charts to track expense patterns over time and pie charts to display spending categories as proportions of the total. Conditional formatting highlights significant changes or overspending by using color scales or data bars within expense tables. PivotTables combined with charts provide dynamic summaries and detailed breakdowns of monthly expenses by category or payment type.

How can you set up alerts or notifications in Excel when expenses surpass budgeted amounts?

To set up alerts in your Monthly Expense Tracker, use Excel's conditional formatting feature to highlight expenses exceeding budgeted amounts. Create rules based on your budget thresholds, so cells automatically change color when limits are surpassed. This visual notification helps you quickly identify and manage overspending.

Which Excel features are most effective for tracking and comparing utility costs month-over-month?

Excel features such as PivotTables, conditional formatting, and charts are most effective for tracking and comparing utility costs month-over-month in your Monthly Expense Tracker for Homeowners. PivotTables summarize utility expenses efficiently while conditional formatting highlights cost fluctuations automatically. Visual charts provide clear comparisons, helping you identify trends and manage your household budget accurately.