The Monthly Rental Income Excel Template for Landlords is designed to help landlords efficiently track rental payments, expenses, and net income on a monthly basis. It simplifies financial management by providing clear, organized data that aids in budgeting and tax preparation. Accurate record-keeping ensures landlords can monitor cash flow and maintain a profitable rental business.

Monthly Rental Income Tracker for Landlords

A Monthly Rental Income Tracker for landlords is a document that helps monitor the monthly rental payments received from tenants. It typically contains details such as tenant names, rent amounts, payment dates, and any outstanding balances.

An important aspect of this document is ensuring accuracy in tracking payment status to avoid discrepancies. Including sections for notes on maintenance requests or lease renewals can also enhance its usefulness.

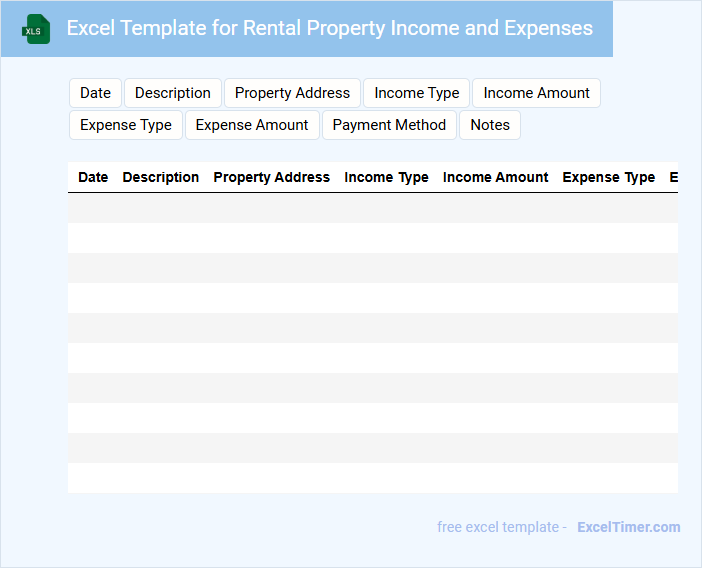

Excel Template for Rental Property Income and Expenses

What information does an Excel template for rental property income and expenses usually contain? Typically, this document includes detailed sections for tracking rental income, various expenses such as maintenance, utilities, and taxes, and summary calculations for net profit or loss. It helps landlords efficiently manage their finances and monitor the profitability of their rental properties.

What is an important suggestion when using this type of template? It is crucial to regularly update the data and categorize expenses accurately to ensure precise financial analysis and tax reporting. Consistent use of the template will provide clear insights into income trends and cost management.

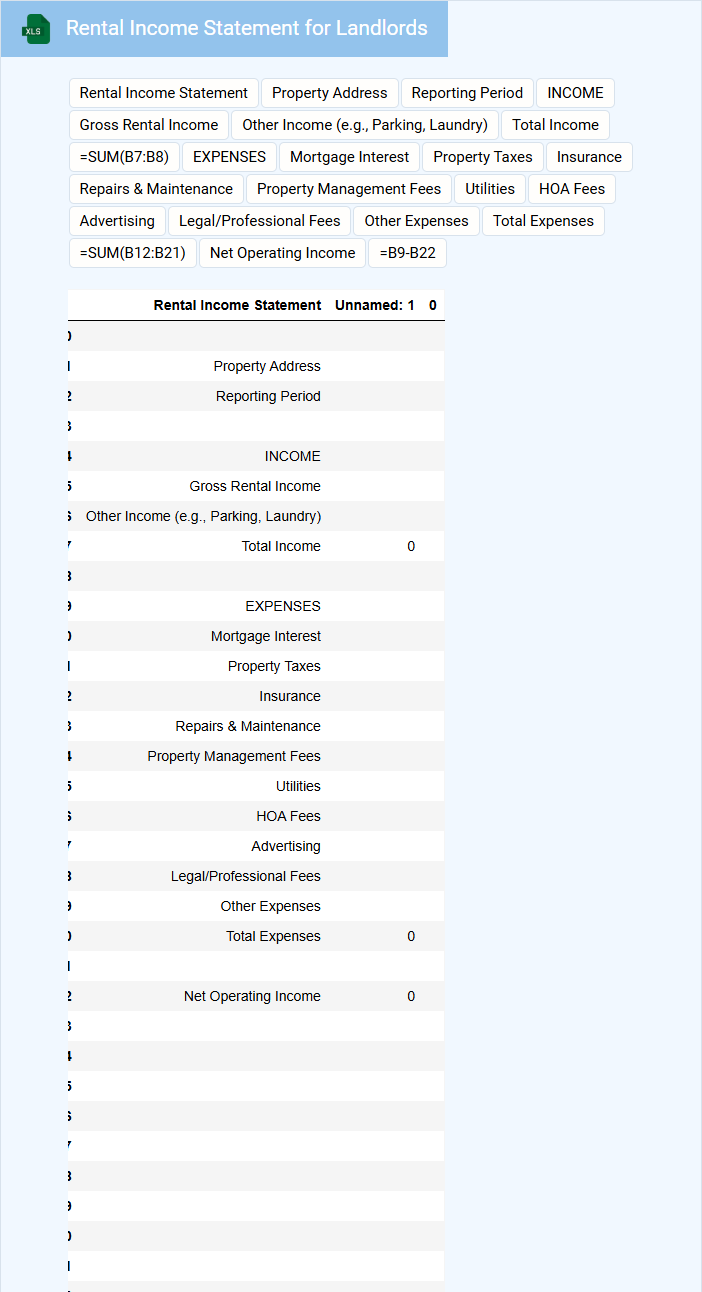

Rental Income Statement for Landlords

A Rental Income Statement for landlords is a financial document detailing the income generated from rental properties. It typically includes rental payments received, expenses incurred, and net income. Landlords use this statement to track profitability and manage property finances effectively.

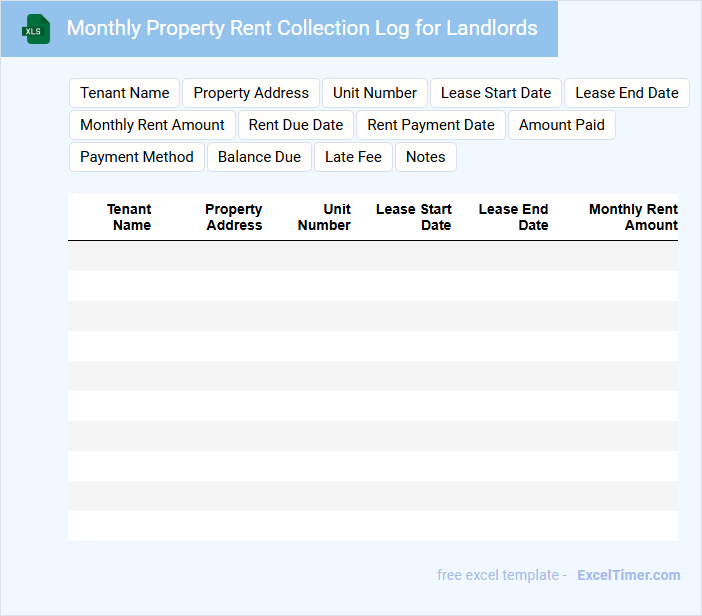

Monthly Property Rent Collection Log for Landlords

A Monthly Property Rent Collection Log for Landlords typically contains detailed records of rent payments received from tenants each month.

- Tenant Information: includes the tenant's name and property address for accurate identification.

- Payment Details: records the payment amount, date received, and method of payment to track rent collection.

- Outstanding Balances: notes any late or missed payments along with reminders or actions taken.

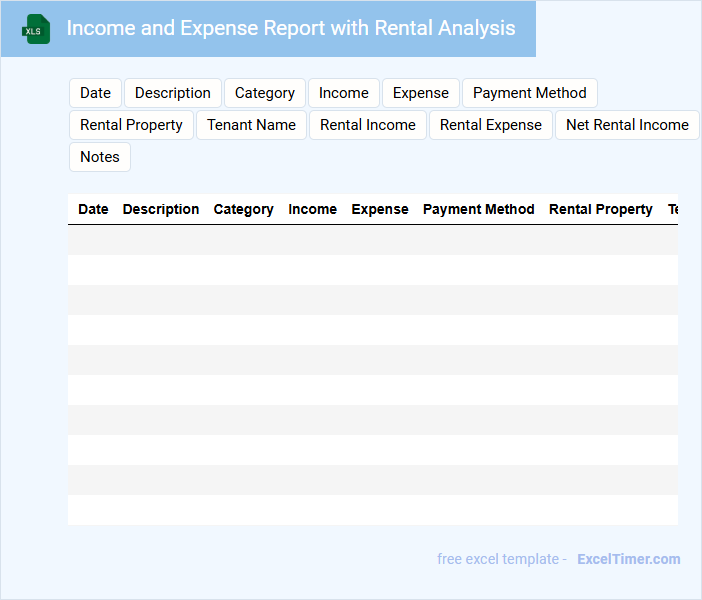

Income and Expense Report with Rental Analysis

An Income and Expense Report with Rental Analysis provides a detailed financial overview of rental properties, summarizing income generated and expenses incurred. It helps landlords and investors assess profitability and make informed decisions.

- Include all rental income sources and categorize expenses clearly.

- Highlight vacancy rates and rental trends to gauge property performance.

- Provide a comparison of actual expenses versus budgeted amounts for accuracy.

Apartment Rental Income Spreadsheet for Owners

An Apartment Rental Income Spreadsheet for owners typically contains detailed records of monthly rent payments, tenant information, and expense tracking. It helps landlords monitor income flow and manage property-related finances efficiently. Keeping accurate data in such a spreadsheet is crucial for tax reporting and financial planning.

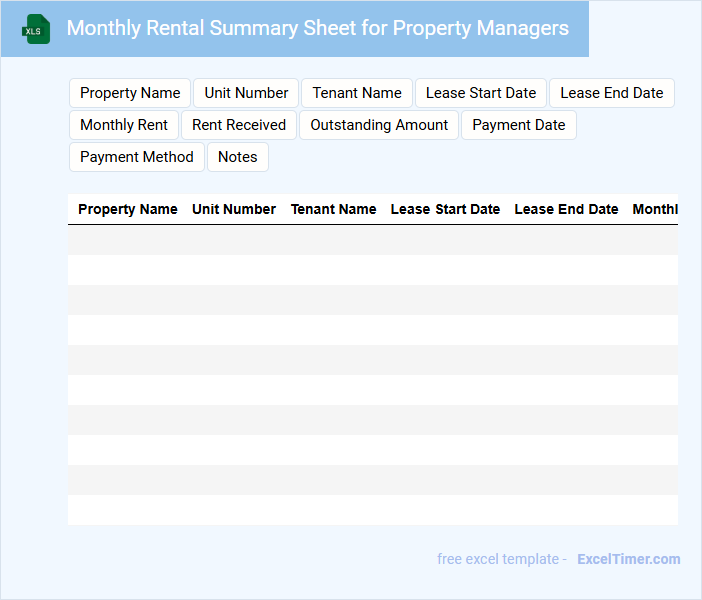

Monthly Rental Summary Sheet for Property Managers

What information is typically included in a Monthly Rental Summary Sheet for Property Managers? This document usually contains detailed records of rental income, tenant payment status, and any outstanding balances. It also summarizes maintenance requests, leasing activity, and expense reports to provide a comprehensive overview of the property's financial health each month.

Why is it important to maintain accurate and up-to-date Monthly Rental Summary Sheets? Keeping precise records helps property managers track cash flow, identify late payments promptly, and ensure transparency with property owners. Regularly updating this sheet supports efficient decision-making and fosters better communication among stakeholders.

Cash Flow Statement with Rental Income Tracking

What information does a Cash Flow Statement with Rental Income Tracking typically include and why is it important? This document records the inflows and outflows of cash specifically related to rental properties, highlighting rental income received and expenses paid. It provides a clear overview of the net cash generated from rental activities, helping landlords manage finances effectively and plan for future investments.

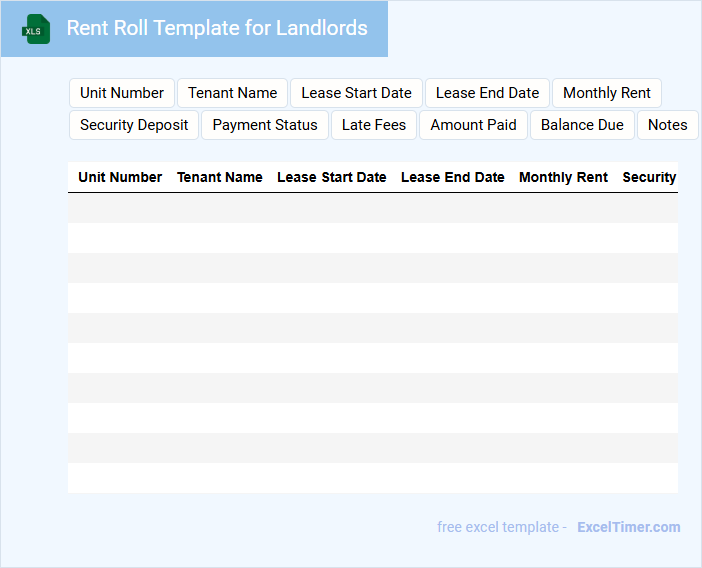

Rent Roll Template for Landlords

A Rent Roll Template for Landlords is a document that typically contains detailed information about rental properties, tenants, and lease agreements.

- Tenant Information: Includes names, contact details, and lease start and end dates.

- Rental Amounts: Tracks monthly rent payments and any additional charges or fees.

- Property Details: Lists unit numbers, addresses, and property types for easy reference.

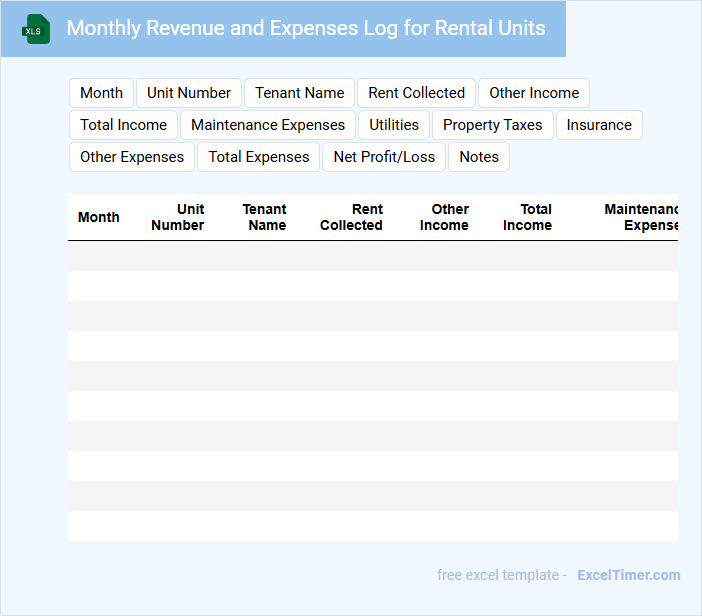

Monthly Revenue and Expenses Log for Rental Units

The Monthly Revenue and Expenses Log for rental units is a critical document used to track income and outflows related to property management. It typically contains detailed records of rental income, maintenance costs, utilities, and other operational expenses. This log helps landlords monitor financial performance and make informed budgeting decisions.

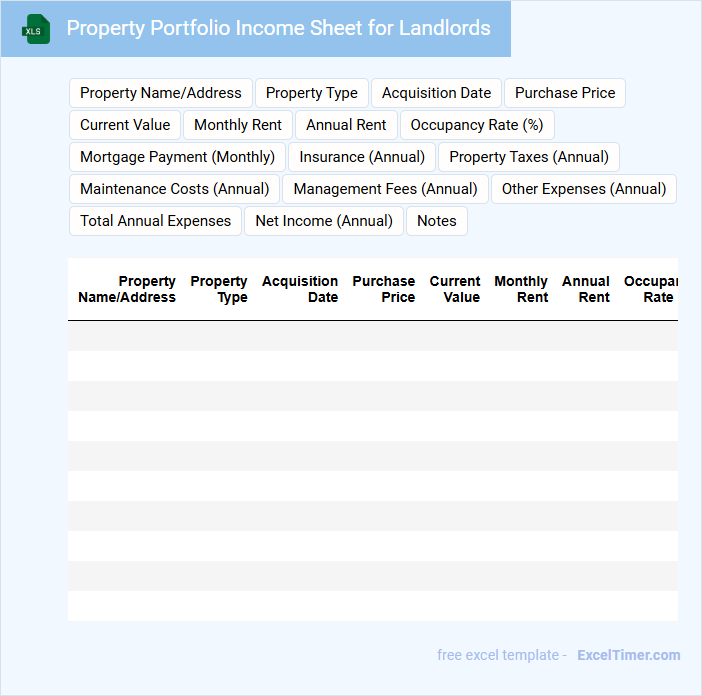

Property Portfolio Income Sheet for Landlords

A Property Portfolio Income Sheet is a financial document used by landlords to track the income generated from multiple rental properties. It typically contains details such as rental income, expenses, and net profit for each property. This sheet helps landlords monitor cash flow and make informed management decisions.

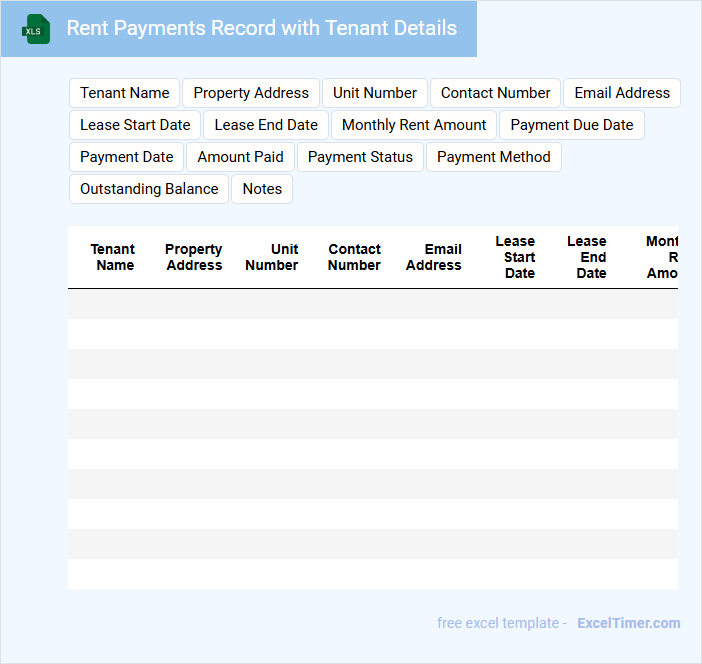

Rent Payments Record with Tenant Details

What information is typically found in a Rent Payments Record with Tenant Details? This document usually contains essential data such as tenant names, payment dates, amounts paid, and outstanding balances. It serves as a comprehensive ledger to track rent transactions, ensuring clear communication and financial accountability between landlords and tenants.

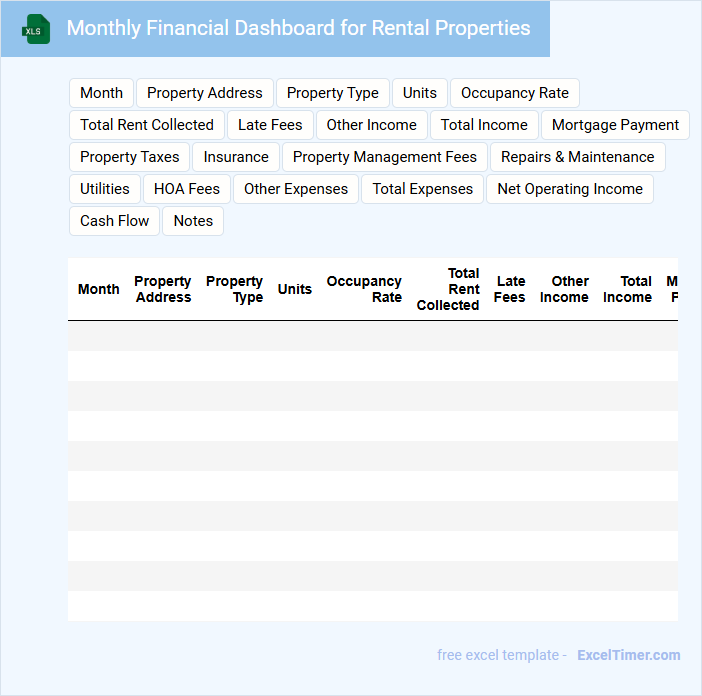

Monthly Financial Dashboard for Rental Properties

A Monthly Financial Dashboard for Rental Properties typically contains a comprehensive overview of income, expenses, and key performance indicators related to rental units. It is designed to help property managers and landlords track financial health and make informed decisions.

- Summarize rental income, including rent payments and additional fees collected monthly.

- Detail recurring and one-time expenses such as maintenance, utilities, and management fees.

- Highlight key metrics like occupancy rates, net operating income, and cash flow trends.

Income Overview Spreadsheet for Multiple Rentals

An Income Overview Spreadsheet for multiple rentals is typically designed to track and summarize rental income from various properties in one organized document. It contains detailed entries such as monthly rent received, payment status, and comparisons across different units. This helps landlords efficiently monitor their cash flow and financial performance over time.

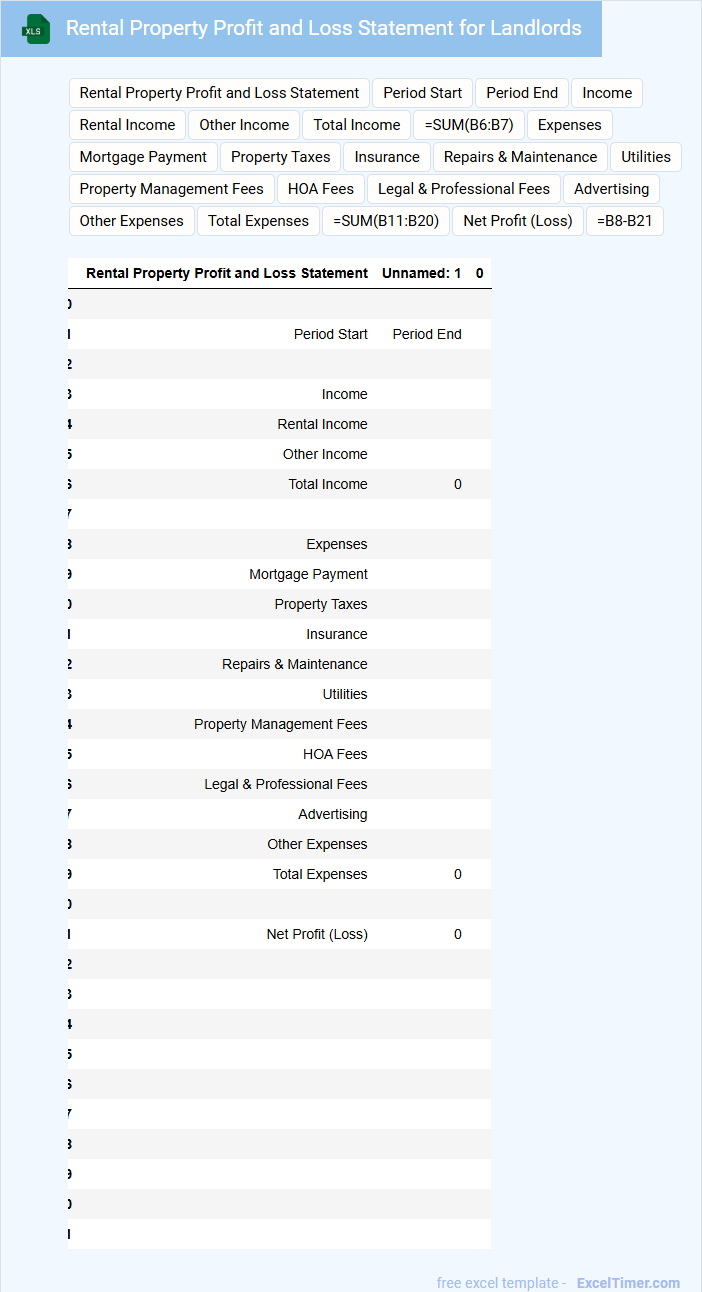

Rental Property Profit and Loss Statement for Landlords

A Rental Property Profit and Loss Statement for Landlords is a financial document that summarizes the income and expenses related to a rental property over a specific period.

- Income Sources: Clearly list all rental income and additional revenue generated from the property.

- Expense Categories: Include all operating expenses such as maintenance, property management fees, and utilities.

- Net Profit Calculation: Accurately calculate the net profit or loss by subtracting total expenses from total income.

What is the total monthly rental income received from all tenants?

The total monthly rental income received from all tenants is the sum of individual rents listed in the Excel document. This figure provides landlords with a clear overview of their consistent cash flow. Accurate aggregation ensures effective financial planning and property management.

Are there any late or unpaid rents affecting this month's income?

The Monthly Rental Income report highlights any late or unpaid rents impacting this month's cash flow. Landlords can quickly identify tenants with outstanding payments to address delinquencies. Accurate tracking ensures effective income management and timely follow-up on arrears.

How do monthly operating expenses compare to total rental income?

Monthly operating expenses typically account for 30-50% of the total rental income for landlords. These expenses include property maintenance, utilities, insurance, and property management fees. Monitoring this ratio helps landlords assess profitability and cash flow stability.

Is the monthly rental income consistent with lease agreements?

Monthly rental income data is meticulously compared against lease agreements to ensure accuracy and consistency. Discrepancies between recorded income and contractual terms are flagged for prompt review. This verification supports reliable financial tracking and landlord revenue management.

Are rent increases or adjustments reflected in the monthly income reported?

Your Monthly Rental Income report accurately reflects any rent increases or adjustments, ensuring precise tracking of rental cash flow. This Excel document updates income figures to incorporate all changes in lease agreements. Landlords benefit from clear visibility into current and projected rental earnings.