The Quarterly Tax Preparation Excel Template for Sole Proprietors streamlines tracking income, expenses, and estimated tax payments, ensuring accurate quarterly filings. This user-friendly template helps sole proprietors stay organized and avoid penalties by calculating tax obligations based on real-time data. Customizable categories and built-in formulas save time and enhance financial management throughout the fiscal year.

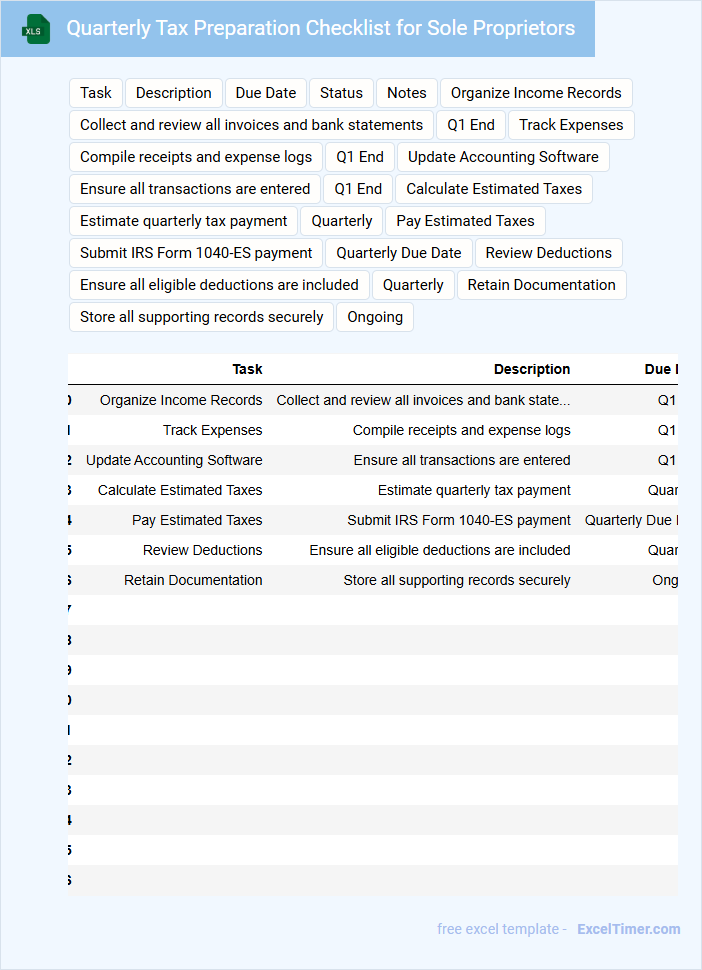

Quarterly Tax Preparation Checklist for Sole Proprietors

The Quarterly Tax Preparation Checklist for sole proprietors is a vital document that organizes essential financial tasks to ensure timely tax compliance. It typically contains income records, expense receipts, and estimated tax payment schedules. This checklist helps sole proprietors systematically track their financial activities and avoid penalties.

Income Tracking Spreadsheet for Sole Proprietors (Quarterly)

An Income Tracking Spreadsheet for sole proprietors is a vital tool for organizing and monitoring all sources of income on a quarterly basis. It typically includes columns for date, client name, service provided, amount received, and payment status to ensure accurate financial records. This document helps in managing cash flow efficiently and preparing tax returns accurately.

Key elements to include are clear categorization of income types, timely updates for each transaction, and a summary section that calculates total income per quarter. Utilizing spreadsheet software with built-in formulas can automate calculations and reduce errors. Regularly reviewing the spreadsheet enables sole proprietors to identify trends and make informed business decisions.

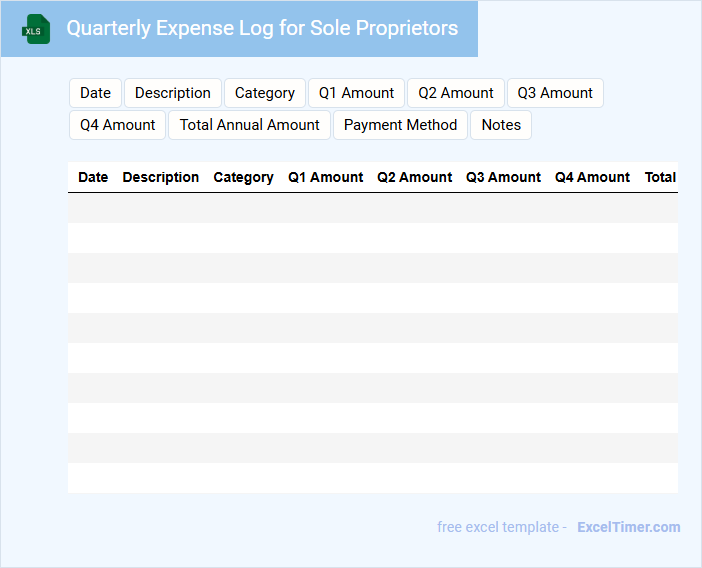

Quarterly Expense Log for Sole Proprietors

A Quarterly Expense Log for sole proprietors typically contains detailed records of all business-related expenditures within a three-month period. It includes categories such as office supplies, travel costs, utilities, and other operational expenses.

This document helps in tracking cash flow, preparing for tax filings, and analyzing spending patterns. Maintaining accurate and organized entries is crucial for financial clarity and tax compliance.

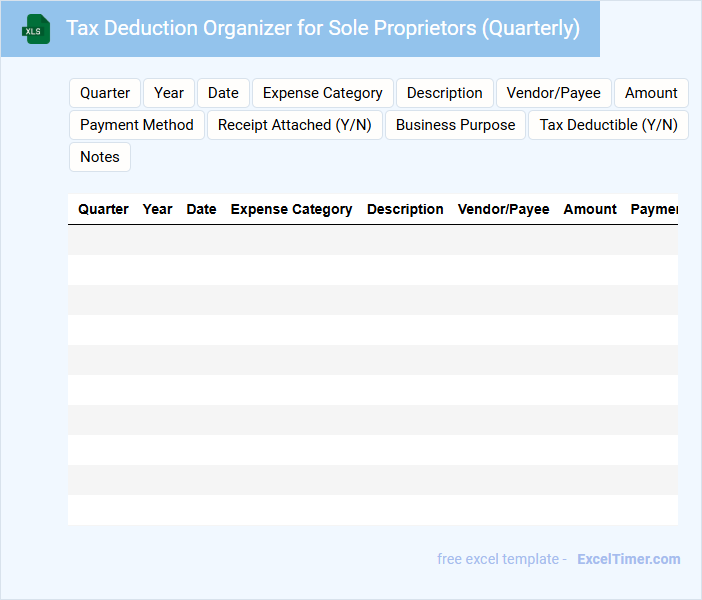

Tax Deduction Organizer for Sole Proprietors (Quarterly)

A Tax Deduction Organizer for Sole Proprietors (Quarterly) typically contains detailed records of income and expenses relevant to business operations. It includes categorized sections for deductible expenses such as office supplies, travel, and meals to simplify tax filing. This document helps ensure accuracy and maximizes potential tax savings by organizing quarterly financial data systematically.

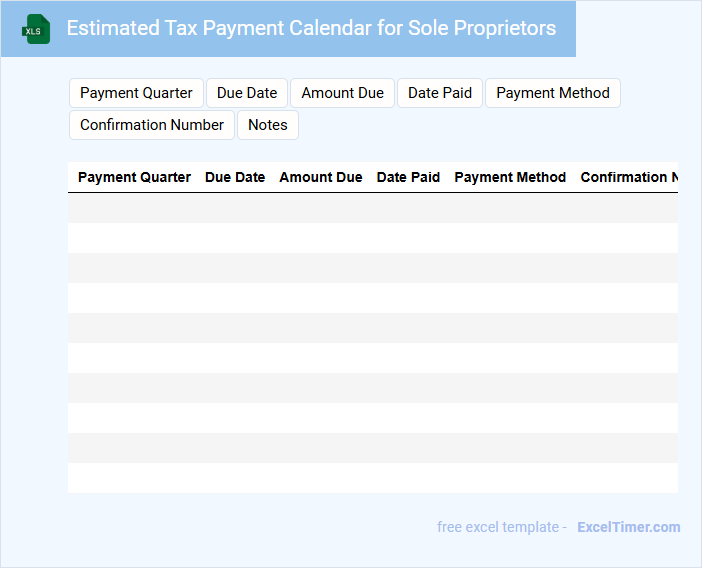

Estimated Tax Payment Calendar for Sole Proprietors

The Estimated Tax Payment Calendar for Sole Proprietors is a crucial financial document that outlines the specific dates when quarterly tax payments are due to the IRS. It helps sole proprietors plan their cash flow effectively by anticipating tax obligations throughout the year. Staying organized with this calendar ensures compliance and avoids penalties for late payments.

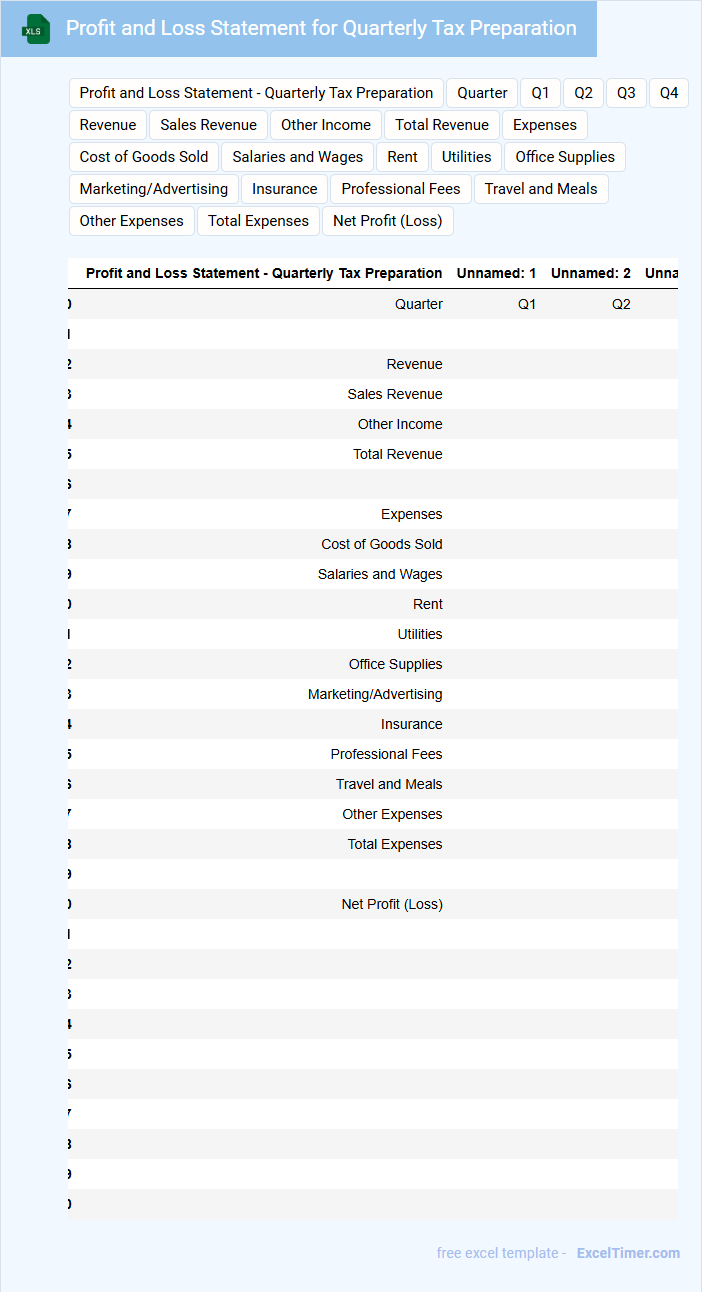

Profit and Loss Statement for Quarterly Tax Preparation

A Profit and Loss Statement is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period. It helps in understanding the company's profitability over that quarter.

This document is crucial for Quarterly Tax Preparation as it provides the necessary details to accurately calculate taxable income. Ensuring that all income and deductible expenses are correctly reported is important for compliance and minimizing tax liability.

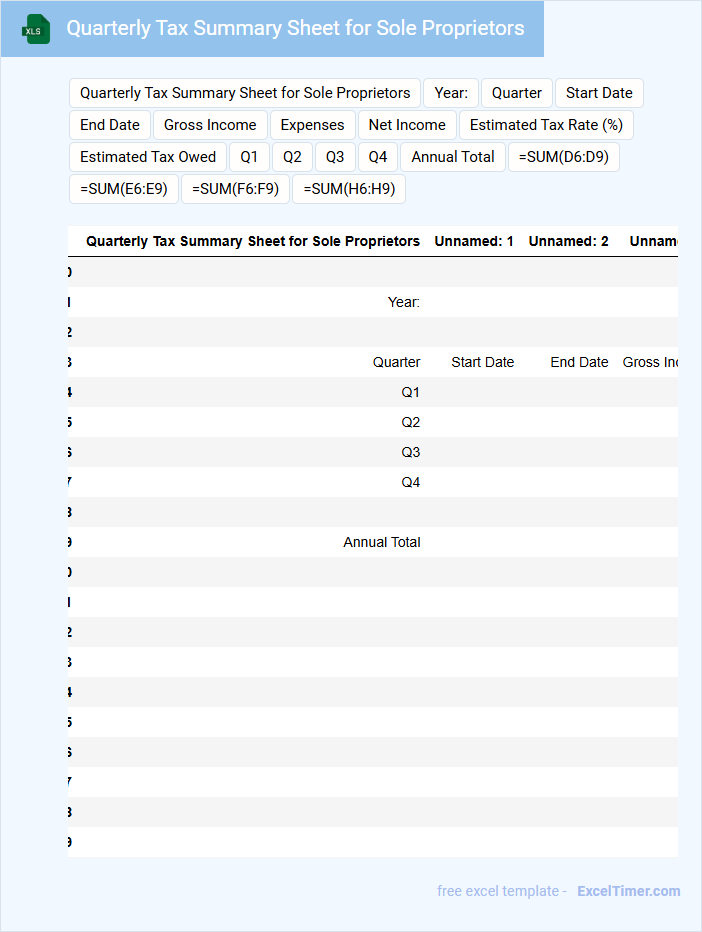

Quarterly Tax Summary Sheet for Sole Proprietors

A Quarterly Tax Summary Sheet for sole proprietors typically contains detailed records of income, expenses, and estimated tax payments made throughout the quarter. This document helps track financial activities and ensures accurate tax reporting.

It is important to include all sources of revenue and relevant deductions to avoid discrepancies during tax filing. Maintaining organized and up-to-date records on this sheet is essential for efficient tax management and compliance.

Receipts and Invoices Tracker for Quarterly Tax Filing

Receipts and invoices are essential financial documents that record transactions between a buyer and a seller. These documents help businesses track their expenses and revenues accurately throughout the fiscal quarter.

Maintaining an organized tracker for these documents simplifies the quarterly tax filing process and ensures compliance with tax regulations. It is important to consistently update the tracker and categorize the entries correctly for easy reference during audits.

Asset Depreciation Schedule for Sole Proprietors (Quarterly)

An Asset Depreciation Schedule for Sole Proprietors (Quarterly) typically outlines the depreciation of business assets over time to accurately reflect their reducing value. It is essential for calculating tax deductions and maintaining precise financial records.

- Include detailed descriptions of each asset along with purchase dates and costs.

- Record depreciation methods and quarterly depreciation amounts for transparency.

- Regularly update the schedule to reflect asset disposals or acquisitions.

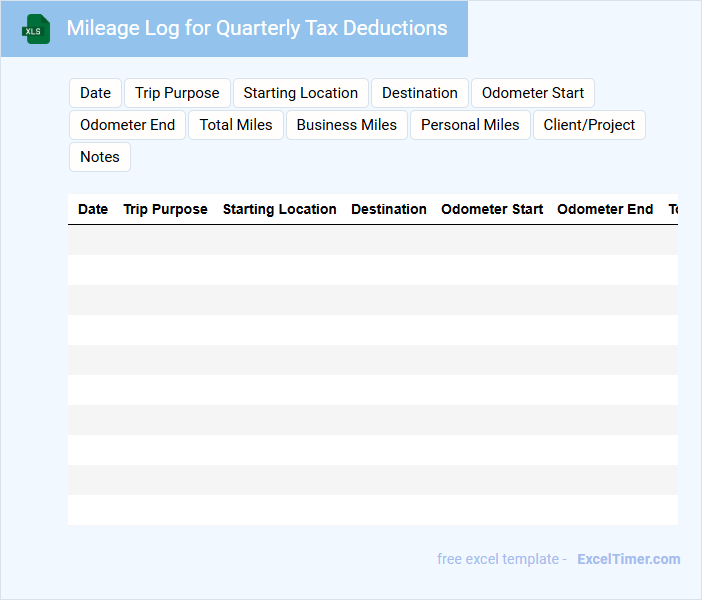

Mileage Log for Quarterly Tax Deductions

What information is typically contained in a Mileage Log for Quarterly Tax Deductions? This document usually records the dates, starting and ending locations, purpose of the trip, and miles driven for business purposes. Maintaining detailed and accurate entries in the log is crucial for substantiating tax deductions and ensuring compliance with IRS regulations.

Why is it important to keep a Mileage Log updated regularly? Consistently updating the log helps prevent loss of valuable deduction opportunities and minimizes errors during tax filing. It is also advisable to use a reliable method, such as a dedicated app or a physical notebook, to ensure the log's accuracy and accessibility when needed.

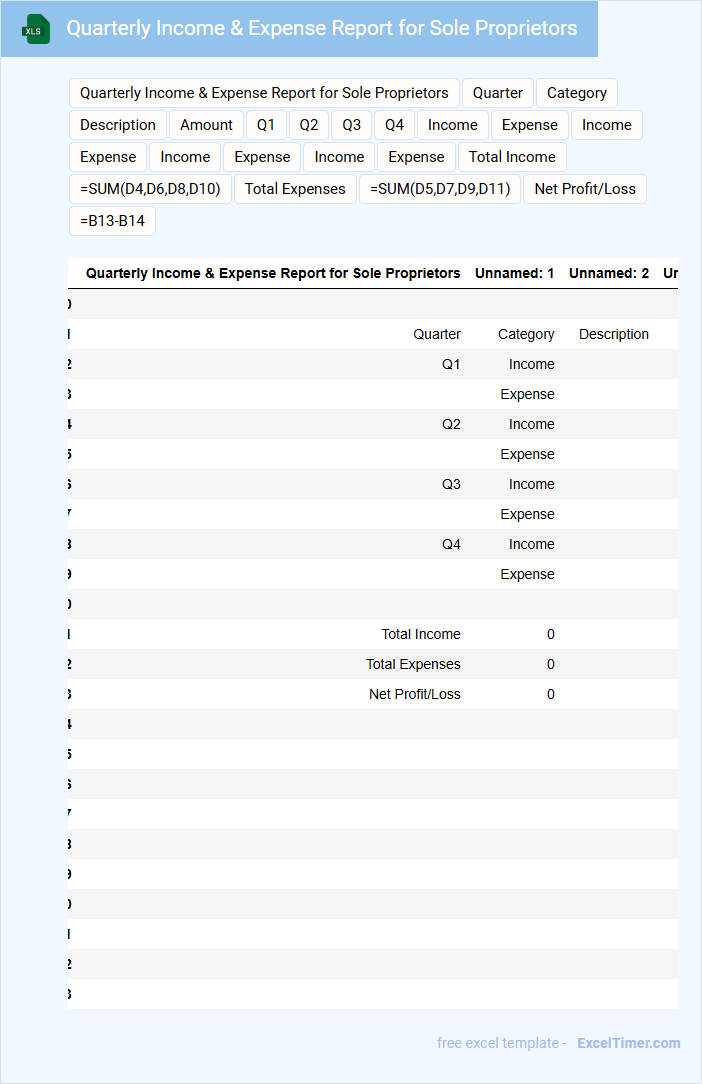

Quarterly Income & Expense Report for Sole Proprietors

A Quarterly Income & Expense Report for Sole Proprietors typically contains detailed records of all income earned and expenses incurred during a three-month period. This document helps track financial performance and prepare for tax filings accurately.

- Include all sources of income and categorize expenses for better analysis.

- Ensure timely recording to avoid missing transactions.

- Keep receipts and supporting documents organized for verification and audits.

Tax Document Checklist for Quarterly Filing

What does a Tax Document Checklist for Quarterly Filing usually contain? This type of document typically includes a detailed list of financial records and receipts necessary for accurate quarterly tax reporting. It helps taxpayers organize income statements, expense records, and any relevant tax forms required by tax authorities.

Why is it important to maintain this checklist? Keeping an updated checklist ensures timely and precise filing, reducing the risk of errors or missed deductions. It is crucial to review deadlines, verify document accuracy, and keep copies of all submitted paperwork for future reference.

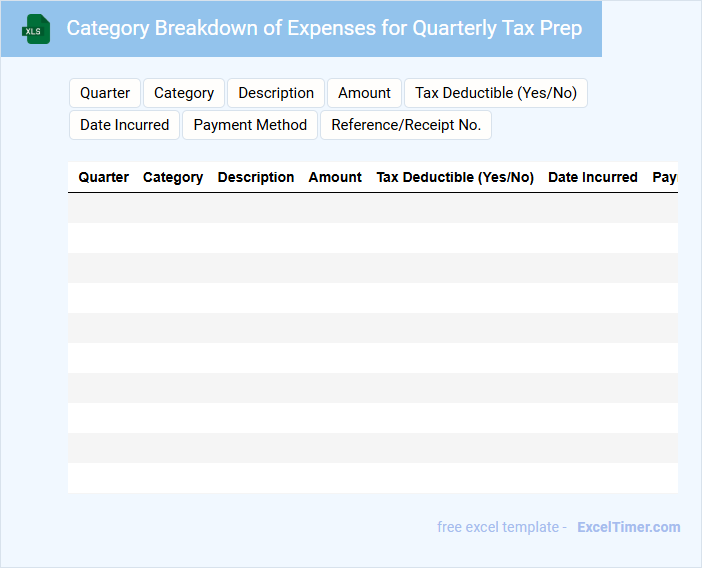

Category Breakdown of Expenses for Quarterly Tax Prep

The Category Breakdown of Expenses is a crucial document for organizing all business costs by type, aiding in accurate quarterly tax preparation. It typically includes expenses such as office supplies, travel, salaries, and utilities, systematically grouped to streamline tax filing. Maintaining detailed and well-categorized records ensures compliance and can maximize deductions.

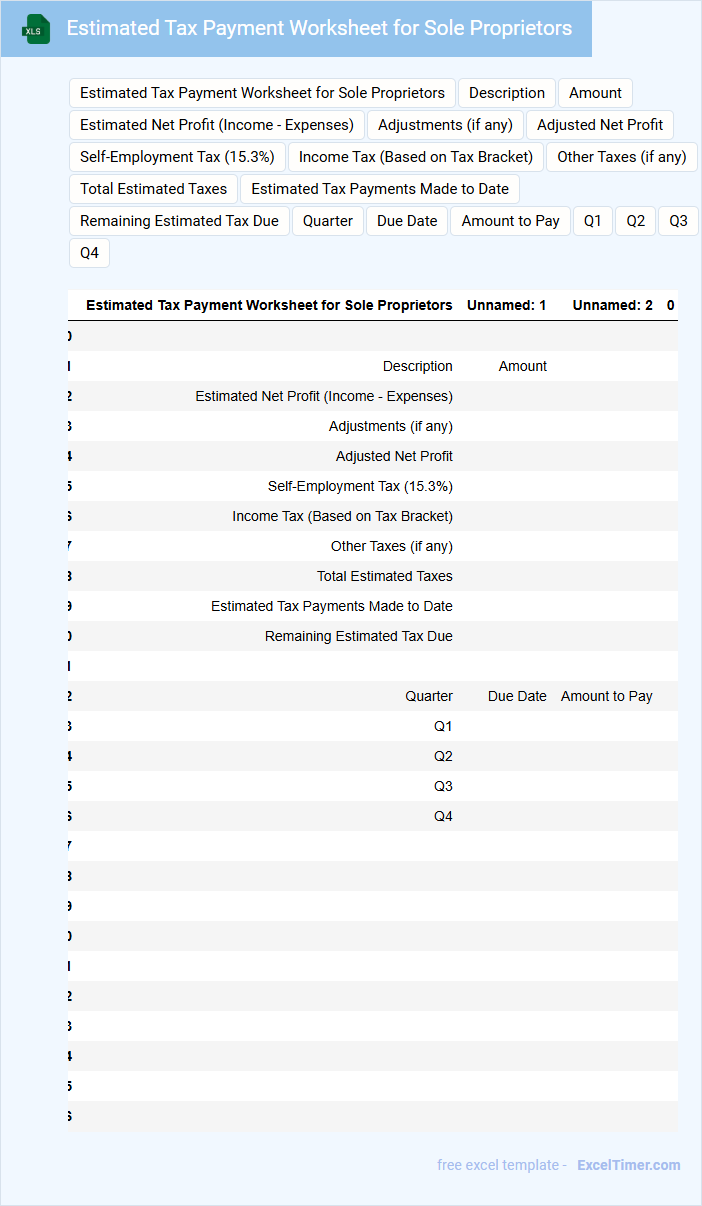

Estimated Tax Payment Worksheet for Sole Proprietors

What is usually contained in an Estimated Tax Payment Worksheet for Sole Proprietors? This document typically includes a detailed calculation of your expected taxable income, tax liability, and allowable deductions to help you estimate quarterly tax payments. It serves as a practical guide for sole proprietors to avoid underpayment penalties by accurately forecasting and submitting their tax obligations throughout the year.

What is an important consideration when using this worksheet? It is crucial to regularly update your income and expenses to reflect your current financial situation, as inaccuracies can lead to overpayment or underpayment of taxes. Additionally, keeping thorough records and consulting tax guidelines ensures precise estimates and compliance with tax regulations.

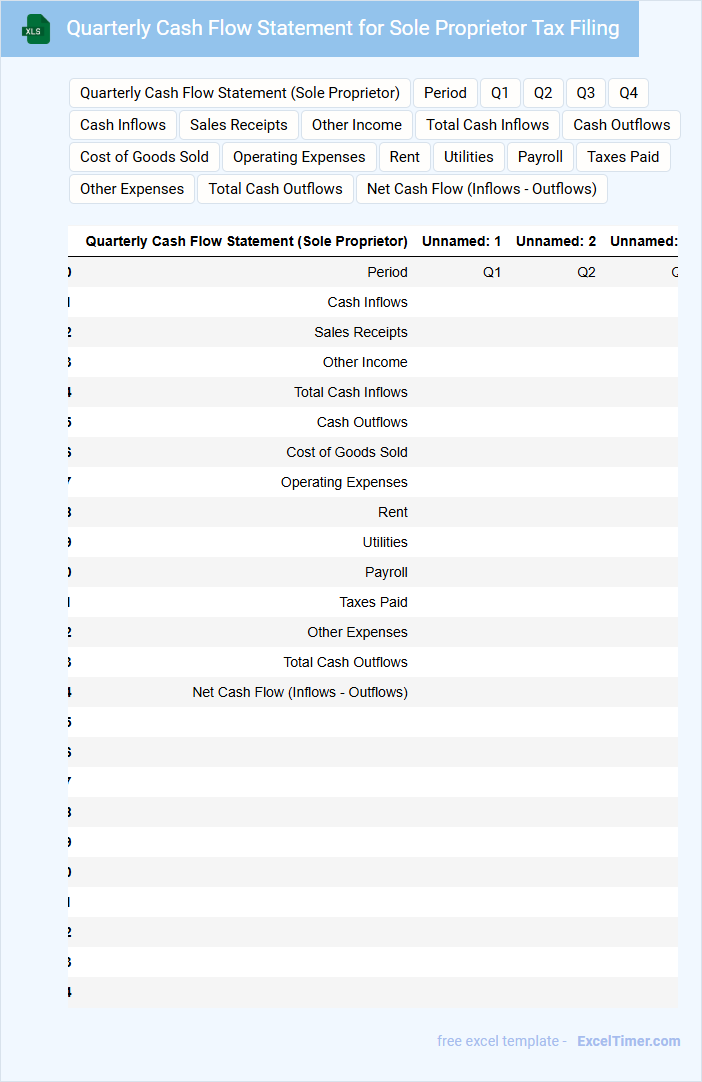

Quarterly Cash Flow Statement for Sole Proprietor Tax Filing

A Quarterly Cash Flow Statement for Sole Proprietor Tax Filing is a financial document that tracks cash inflows and outflows over a three-month period to assess liquidity. It helps sole proprietors manage their finances and prepare accurate tax returns.

- Include all sources of income and categorize expenses clearly for accurate reporting.

- Reconcile beginning and ending cash balances to ensure accuracy.

- Keep detailed records of all transactions to support tax deductions and credits.

What key information should be included in an Excel document for tracking quarterly income and expenses for tax purposes?

An Excel document for tracking quarterly tax preparation for sole proprietors should include columns for date, income source, income amount, expense category, expense amount, and payment method. It should also feature quarterly totals for income, expenses, and estimated tax payments to monitor tax liabilities accurately. Including columns for notes or receipts helps ensure thorough documentation and audit readiness.

How can Excel formulas be used to automatically calculate quarterly estimated tax payments for a sole proprietor?

Excel formulas can automatically calculate quarterly estimated tax payments for a sole proprietor by using functions like SUM, IF, and PRODUCT to total income, deduct expenses, and apply the appropriate tax rate. You can create a worksheet that tracks quarterly income and expenses, then use formulas to estimate tax liability based on current tax brackets. This streamlines your quarterly tax preparation by providing accurate, real-time calculations.

What essential expense categories should be listed in an Excel sheet to maximize allowable deductions for a sole proprietorship?

Include essential expense categories such as Office Supplies, Business Travel, Meals and Entertainment, Vehicle Expenses, Home Office Deduction, and Professional Services in your Excel sheet. Tracking these categories accurately helps maximize allowable deductions for your sole proprietorship. Ensure each entry has corresponding dates, amounts, and descriptions to support tax preparation.

How can Excel pivot tables help analyze revenue and expense trends across different quarters for improved tax planning?

Excel pivot tables allow you to efficiently summarize and analyze quarterly revenue and expense data by categorizing transactions for sole proprietors. This dynamic tool identifies patterns and trends across different quarters, enabling more accurate forecasting and tax planning. Your ability to quickly visualize financial performance supports better decision-making for minimizing tax liabilities.

What s or tools can streamline record-keeping and reporting required for quarterly tax filings as a sole proprietor?

Excel templates like Profit and Loss Statement, Expense Tracker, and Income Tracker simplify record-keeping for quarterly tax preparation. Tools with built-in formulas for tax calculations and summary dashboards help generate accurate quarterly tax reports efficiently. Using customizable templates designed for sole proprietors ensures organized data management and meets IRS reporting requirements.