The Semi-annually Excel Template for Client Invoicing streamlines billing processes by allowing businesses to generate invoices every six months with ease. It includes pre-built formulas and customizable fields to ensure accurate calculations and professional presentation. This template is essential for maintaining consistent cash flow and improving client payment tracking on a semi-annual basis.

Semi-Annual Client Invoicing Tracker for Excel

This document typically contains detailed records of invoices sent to clients over a six-month period, including amounts, dates, and payment statuses. It helps businesses monitor and manage their semi-annual billing cycles efficiently.

- Ensure all client details and invoice numbers are accurately recorded to avoid discrepancies.

- Regularly update payment statuses to reflect completed and pending transactions.

- Include summary totals for easy financial review and reporting.

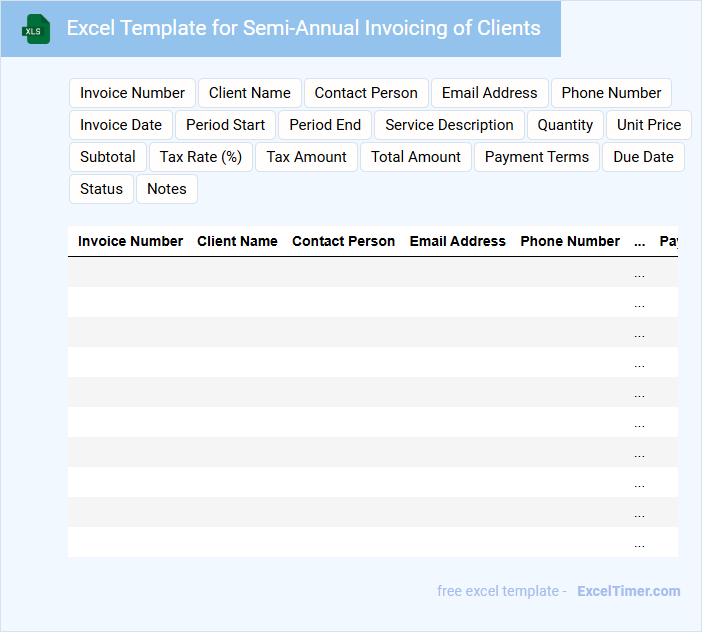

Excel Template for Semi-Annual Invoicing of Clients

What does an Excel Template for Semi-Annual Invoicing of Clients typically contain?

This type of document usually includes client details, invoice dates, services or products provided, and payment amounts organized in a clear, tabular format. It helps streamline billing processes by enabling easy calculation and tracking of payments due every six months. Key components often include invoice numbers, due dates, and payment status for efficient financial management.

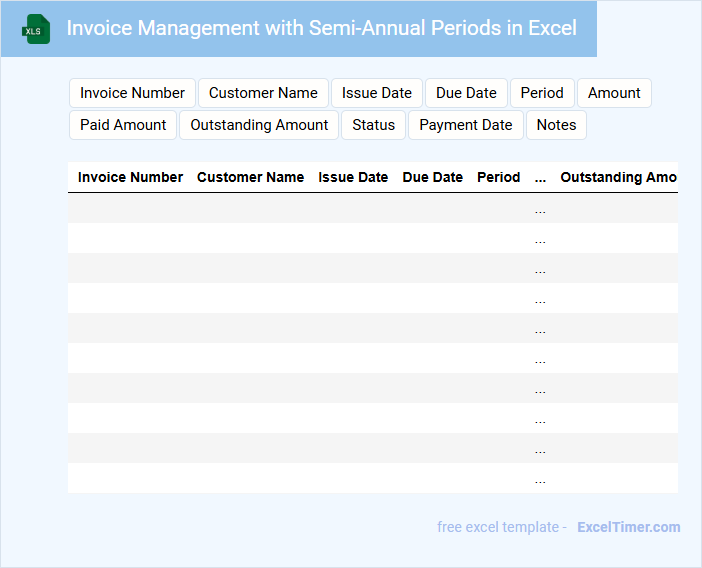

Invoice Management with Semi-Annual Periods in Excel

Invoices in Excel for Invoice Management with semi-annual periods typically contain details such as client information, invoice date, due date, and a breakdown of charges. This format allows businesses to track payments and manage billing cycles efficiently every six months.

Key elements include automated calculations for totals and due reminders to avoid late payments. Using clear labeling and consistent formatting enhances accuracy and ease of use over extended billing periods.

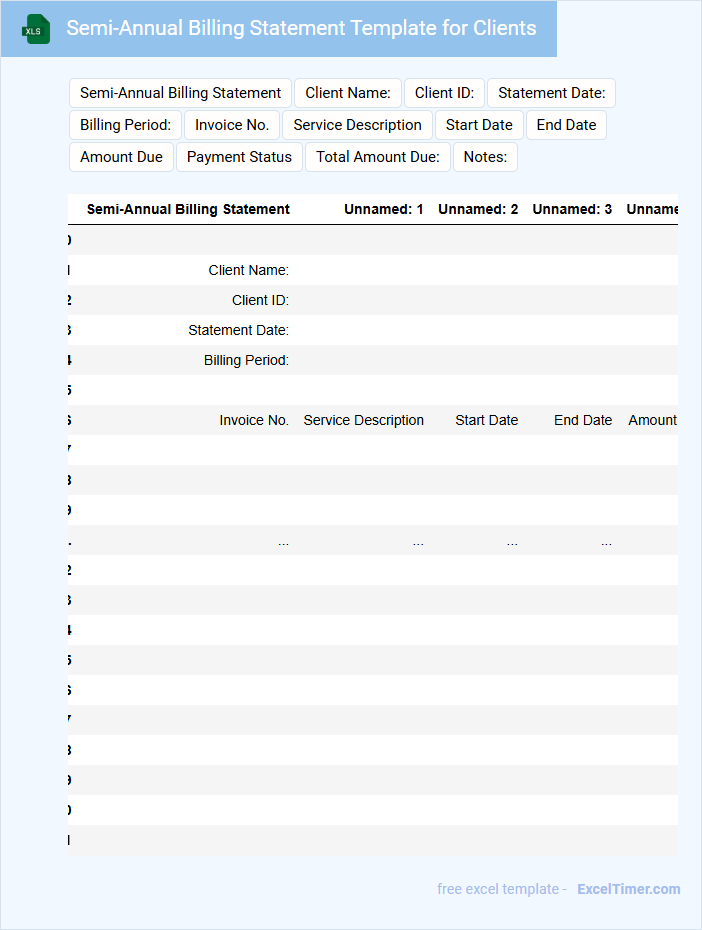

Semi-Annual Billing Statement Template for Clients

A Semi-Annual Billing Statement is a document that summarizes all transactions, payments, and charges over a six-month period for a client. It typically includes detailed invoices, payment history, and account balances to ensure transparency and clarity. For effective client communication, it is important to highlight any outstanding balances and provide clear payment instructions.

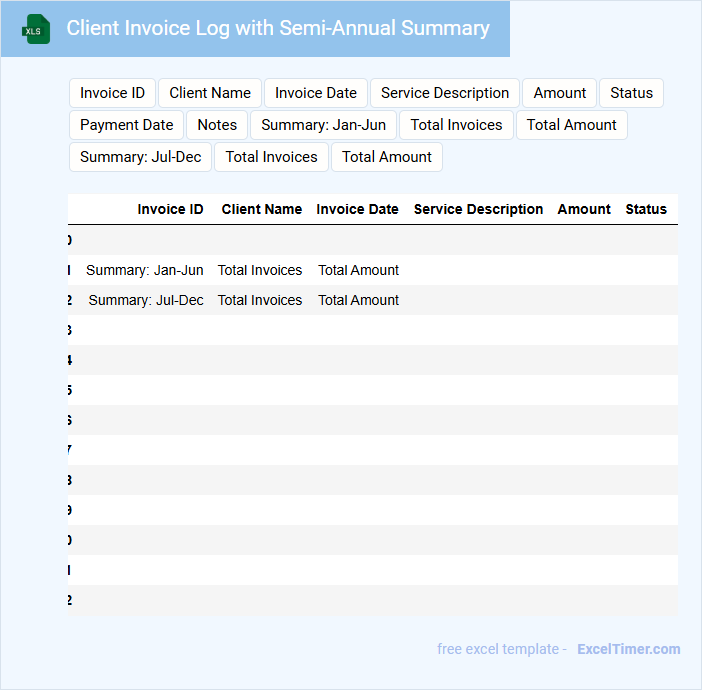

Client Invoice Log with Semi-Annual Summary

A Client Invoice Log with Semi-Annual Summary typically contains detailed records of client invoices and a summarized financial overview for a six-month period.

- Invoice Details: Logs individual invoice numbers, dates, amounts, and client names.

- Semi-Annual Summary: Provides aggregated totals and trends for better financial analysis over six months.

- Payment Status: Tracks the status of each invoice to manage outstanding payments effectively.

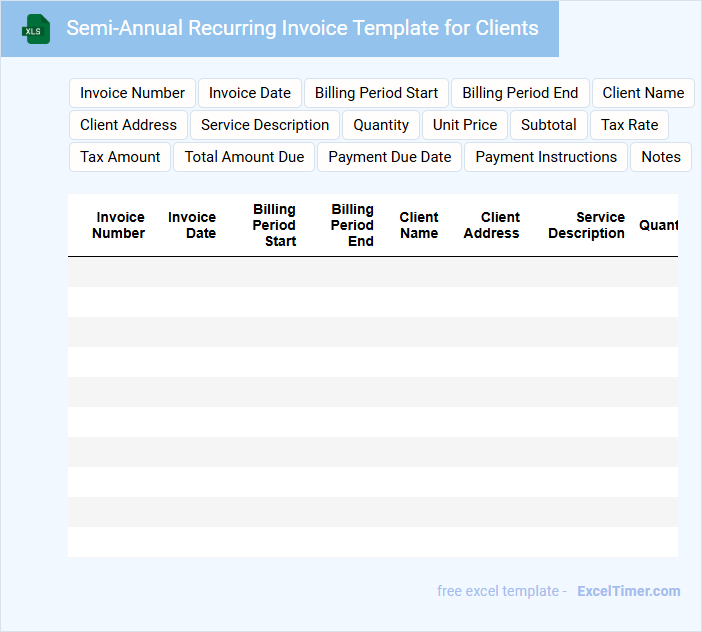

Semi-Annual Recurring Invoice Template for Clients

A Semi-Annual Recurring Invoice Template for Clients typically contains detailed billing information that recurs every six months, ensuring consistent payment tracking. It helps businesses manage and streamline semi-annual payment cycles efficiently.

- Include clear payment terms and due dates to avoid confusion.

- List all billed services or products with corresponding prices and totals.

- Incorporate client contact information and unique invoice numbers for easy reference.

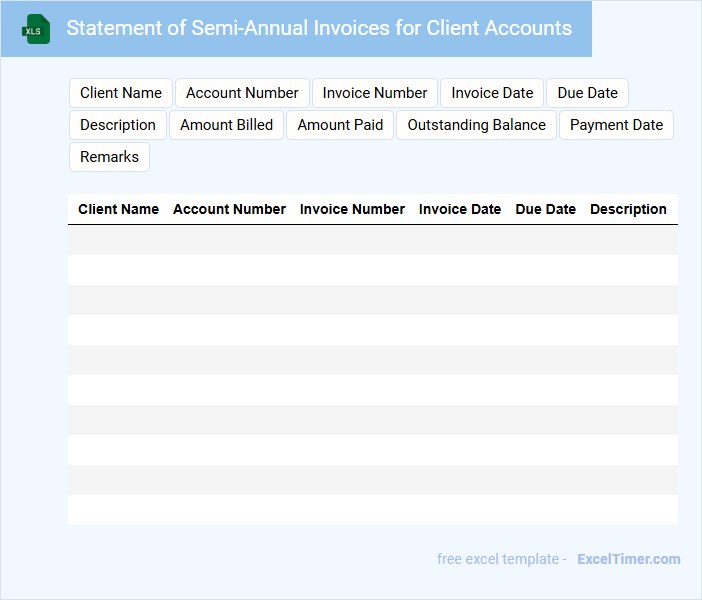

Statement of Semi-Annual Invoices for Client Accounts

A Statement of Semi-Annual Invoices typically contains a detailed summary of all invoices issued to client accounts over a six-month period. It includes invoice numbers, dates, amounts, and outstanding balances to provide a clear financial overview.

This document is important for maintaining accurate client billing records and ensuring timely payments. Always verify the accuracy of invoice details and highlight any discrepancies to facilitate smooth account reconciliation.

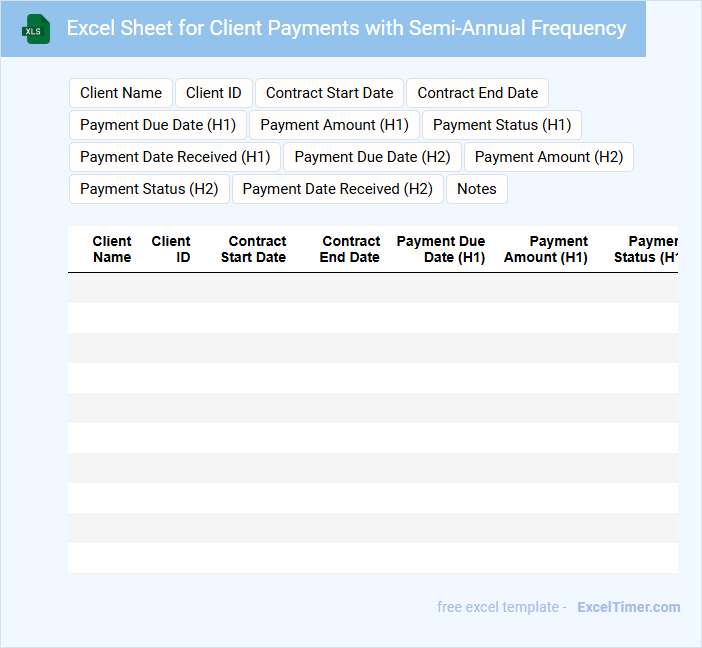

Excel Sheet for Client Payments with Semi-Annual Frequency

An Excel Sheet for Client Payments with semi-annual frequency typically contains client names, payment amounts, and due dates scheduled every six months. It helps businesses track regular income and manage cash flow efficiently. Ensuring accurate data entry and timely updates is crucial for maintaining reliable financial records.

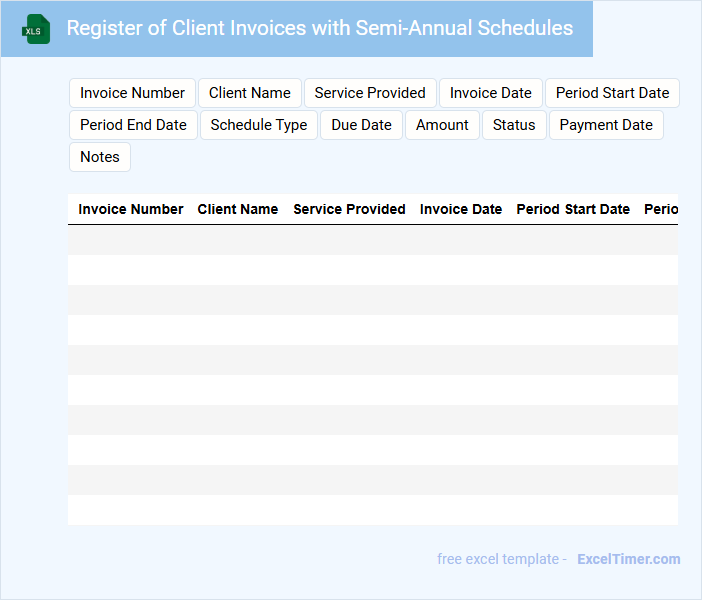

Register of Client Invoices with Semi-Annual Schedules

What information is typically included in a Register of Client Invoices with Semi-Annual Schedules? This document usually contains a detailed list of all invoices issued to clients, organized by date, amount, and payment status over a six-month period. It helps track revenue, manage accounts receivable, and ensures timely follow-up on outstanding payments for better financial control.

An important suggestion for maintaining this register is to regularly update it to reflect payments and any discrepancies, which ensures accurate financial reporting. Additionally, including client contact details and invoice reference numbers aids in efficient communication and dispute resolution.

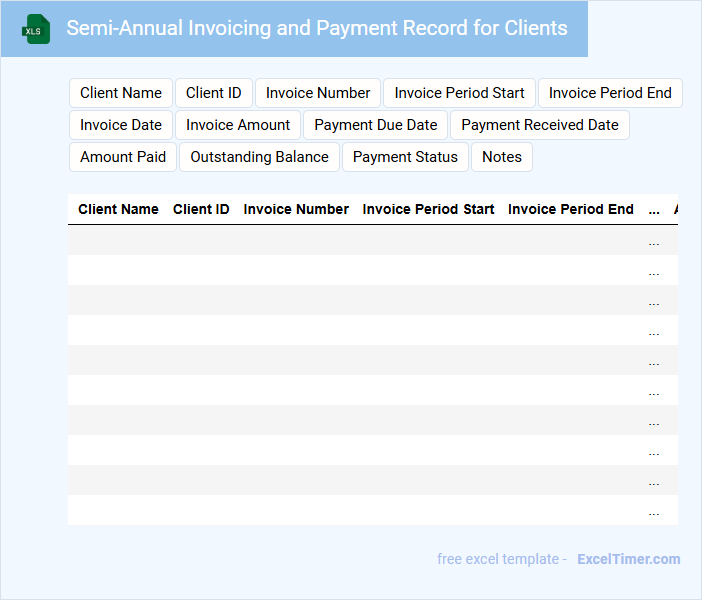

Semi-Annual Invoicing and Payment Record for Clients

The Semi-Annual Invoicing document typically contains a detailed summary of all transactions, payments, and outstanding balances for clients over a six-month period. It helps businesses track revenue and ensures clear communication of financial obligations.

Important features include accurate client information, invoice dates, payment status, and total amounts due. Ensuring timely updates and proper record-keeping is crucial for effective financial management and client trust.

Excel Tracker for Semi-Annual Client Billing Cycles

An Excel Tracker for Semi-Annual Client Billing Cycles is a specialized spreadsheet designed to organize and monitor billing activities occurring every six months. It typically contains client details, billing dates, payments received, and outstanding amounts to ensure accurate financial tracking. Maintaining this document helps streamline invoicing processes and improves cash flow management.

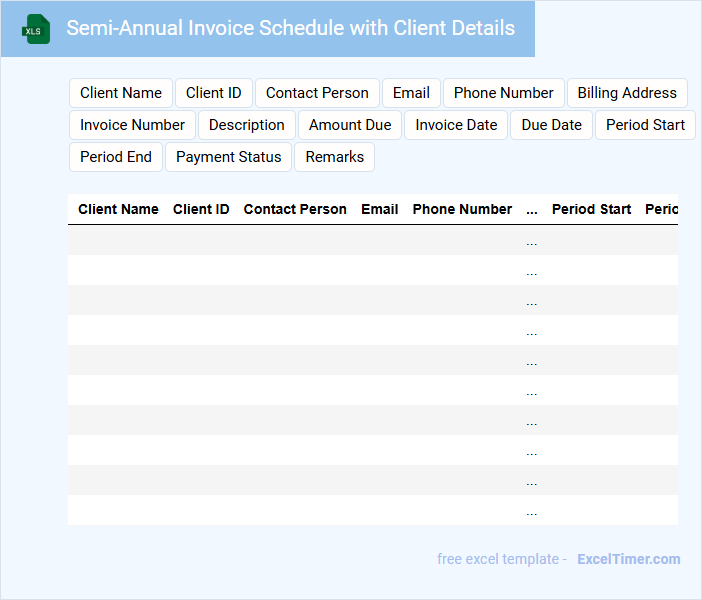

Semi-Annual Invoice Schedule with Client Details

A Semi-Annual Invoice Schedule typically contains detailed billing timelines and payment deadlines spanning six months. It organizes financial transactions to ensure clarity and timely payments.

Including Client Details like contact information and account numbers is essential for accurate invoicing and communication. This document supports transparency and efficient financial management between parties.

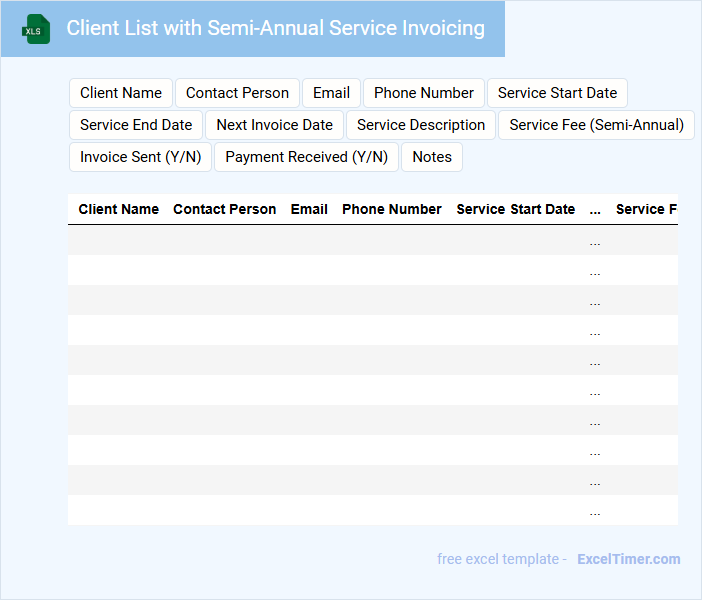

Client List with Semi-Annual Service Invoicing

What information is typically included in a Client List with Semi-Annual Service Invoicing? This document usually contains detailed client contact information, a list of services provided, and a schedule of invoicing dates occurring twice a year. It helps businesses track billing cycles and manage accounts receivable efficiently.

What is an important consideration when maintaining this document? Ensuring accurate and up-to-date client data and invoicing schedules is crucial for timely billing and maintaining strong client relationships. Regularly reviewing the list for changes in service agreements or payment terms enhances financial management and customer satisfaction.

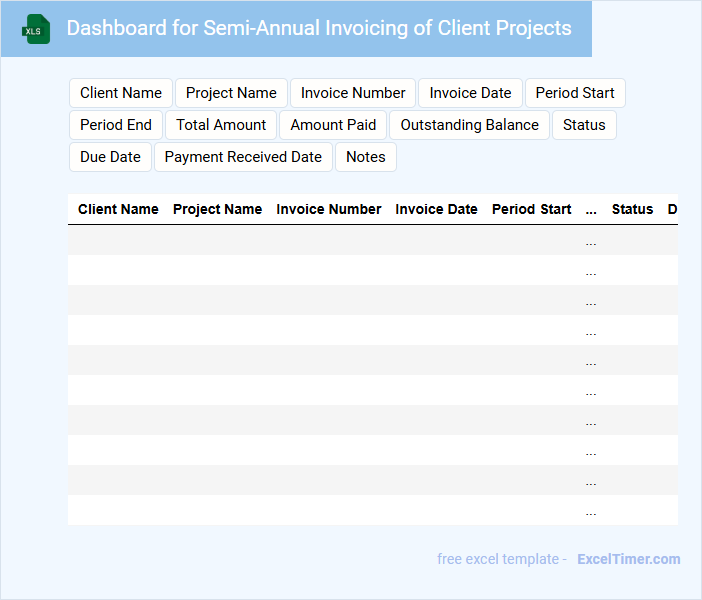

Dashboard for Semi-Annual Invoicing of Client Projects

This type of document typically contains an overview of billing cycles and detailed financial data related to client projects. It summarizes invoicing periods, payment statuses, and outstanding balances for efficient tracking.

Such dashboards are important for monitoring client payments and managing project budgets effectively. Including clear visual indicators like charts or graphs enhances quick decision-making and ensures accuracy.

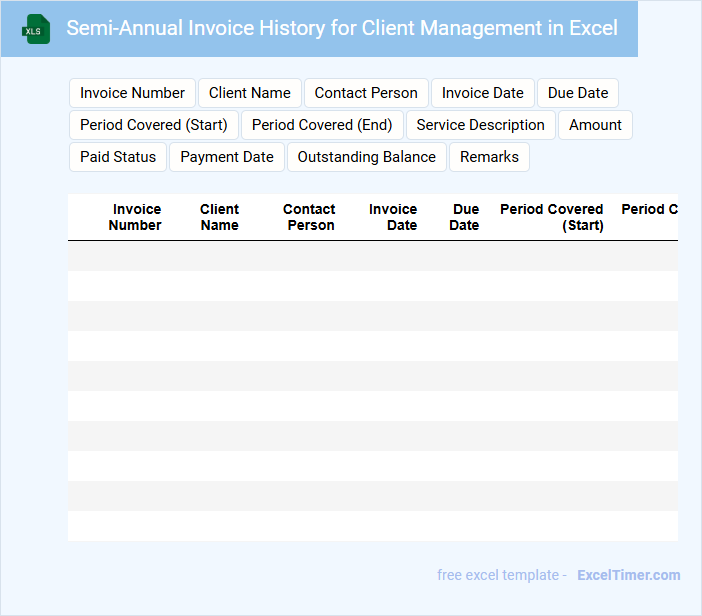

Semi-Annual Invoice History for Client Management in Excel

This document typically contains detailed records of all invoices issued over a six-month period, including dates, amounts, and payment statuses. It serves as a critical tool for tracking financial transactions and client billing history. For effective client management, it is important to regularly update the data and reconcile it with actual payments to ensure accuracy. Organizing the information clearly helps in quick reference and better financial analysis.

How does setting invoicing to "semi-annually" affect payment schedules in Excel tracking systems?

Setting invoicing to "semi-annually" in Excel tracking systems schedules client payments every six months, ensuring two invoice entries per year. This adjustment updates payment due dates automatically, streamlining financial forecasting and cash flow management. Semi-annual invoicing reduces administrative tasks by consolidating billing cycles compared to monthly or quarterly setups.

What formulas best calculate total amounts due for semi-annual client invoices?

To calculate total amounts due for semi-annual client invoices, use the SUMIFS formula to sum invoice amounts based on date ranges within each six-month period. Combine DATE and EDATE functions to define the semi-annual intervals precisely. Your Excel sheet can efficiently track and total dues by applying these formulas to client invoice records.

How can Excel automate reminders for upcoming semi-annual invoice dates?

Excel can automate reminders for semi-annual invoice dates by using formulas like EDATE to calculate the next invoice date based on the last invoicing date. Conditional formatting highlights upcoming invoice dates within a specified range to alert users visually. Integrating Excel with Outlook through VBA scripts enables automatic email reminders for timely client invoicing.

How do you structure columns to track multiple clients' semi-annual invoicing periods?

Structure columns by listing Client Name, Invoice Date, Due Date, Amount, and Payment Status for each semi-annual period. Use separate sets of these columns for each six-month interval to clearly track invoicing cycles. Your Excel sheet will efficiently organize and monitor multiple clients' invoicing schedules and payments.

How is revenue forecasting influenced by semi-annual invoicing cycles in Excel reports?

Revenue forecasting in Excel for semi-annual invoicing cycles accounts for biannual payment schedules, enabling accurate timing of cash flow projections and aligning revenue recognition with invoicing periods. Structured data tables and formulas reflect these cycles, improving the precision of period-specific forecasts and financial planning. This approach helps identify revenue trends and manage client payment patterns effectively over each six-month interval.